Transcription

REFINANCE REPORTFirst Quarter 2019

FHFA Refinance ReportFirst Quarter 2019 Highlights Total refinance volume increased in March 2019 as mortgage ratesfell in previous months. Mortgage rates decreased in March: theaverage interest rate on a 30‐year fixed rate mortgage fell to 4.27percent from 4.37 percent in February.In the First Quarter of 2019: Borrowers completed 901 refinances through HARP, bringingtotal refinances from the inception of the program to3,495,296. HARP volume represented 0.4 percent of total refinancevolume. Borrowers who refinanced through HARP had a lower delinquencyrate compared to borrowers eligible for HARP who did not refinancethrough the program.First Quarter 2019Overview and Eligibility of the HomeAffordable Refinance Program (HARP)HARP OverviewHARP was established in 2009 to assist homeowners unable to access arefinance due to a decline in their home value. The inception date of theprogram was April 1, 2009.The program is designed to provide these borrowers with an opportunity torefinance by permitting the transfer of existing mortgage insurance to theirnewly refinanced loan, or by allowing those without mortgage insurance ontheir previous loan to refinance without obtaining new coverage.HARP enhancements took effect in 2012 to increase access to the programfor responsible borrowers. The program was scheduled to expire onDecember 31, 2013, and was extended to expire on December 31, 2015.On May 8, 2015, HARP was extended again to expire on December 31,2016. On August 25, 2016, HARP was extended once more to expire onSeptember 30, 2017. On August 17, 2017, HARP was extended once moreto expire on December 31, 2018.HARP loans must have been started by December 31, 2018 and must becompleted by September 30, 2019 to be included in the program.HARP EligibilityBelow are the basic HARP eligibility criteria: Loan must be owned or guaranteed by Fannie Mae or Freddie Mac. Loan must have been originated on or before May 31, 2009. Current loan‐to‐value ratio ‐‐ LTV ‐‐ (outstanding mortgagebalance/home value) must be greater than 80 percent. There is no LTVceiling. Borrower must be current on their mortgage payments at the time of therefinance. Payment history – borrower is allowed one late payment in the past 12months, as long as it did not occur in the 6 months prior to the refinance.Page 1

FHFA Refinance ReportOverview of the Enterprises' High LTV RefinanceOptions to Replace HARPAs a replacement for HARP, Fannie Mae and Freddie Mac havecreated options for refinancing mortgages with a high loan‐to‐value(LTV) ratio: The Fannie Mae option is called the high loan‐to‐valuerefinance option. The Freddie Mac option is called the Enhanced ReliefRefinance Mortgage Program.Deliveries were eligible beginning January 1, 2019.FHFA will report on the Enterprises' high LTV refinance volumesunder these options as they develop. Currently no loans havebeen transacted under these options.First Quarter 2019Eligibility Criteria for the Enterprises' High LTVRefinance OptionsBelow are the basic eligibility criteria: Loans must be owned or guaranteed by Fannie Mae or Freddie Mac. Loans must have been originated on or after October 1, 2017 and paidfor at least 15 months. LTV ratios must be greater than the following percentages:Number Fannie FreddieOccupancyof UnitsMaeMacPrincipal Residence19797285853-47580Second Home19090Investment Property175852-47575 Borrowers must benefit in at least one of the following ways: Reduced monthly principal and interest payment Lower interest rate Shorter amortization term Moving from an adjustable‐rate mortgage to a fixed‐ratemortgage Borrowers must be current on their mortgage payments at the time ofthe refinance. Payment history ‐ borrower is allowed one late payment in the past 12months, as long as it did not occur in the 6 months prior to the refinance.Page 2

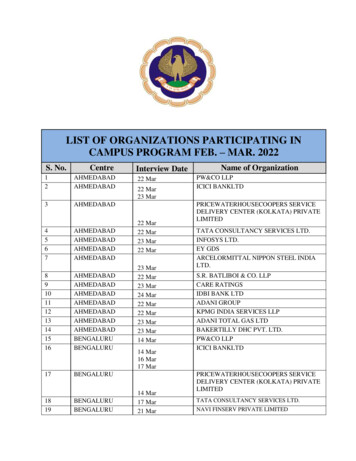

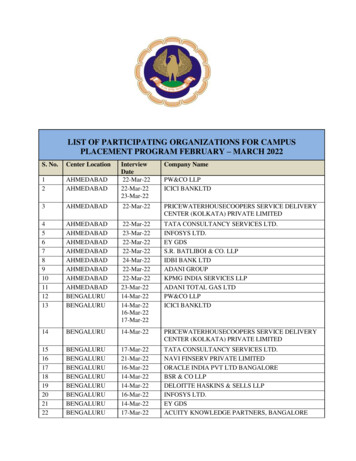

FHFA Refinance ReportFirst Quarter 2019Total refinance volume increased in March 2019 as mortgage rates fell in previous months. Mortgage ratesdecreased in March: the average interest rate on a 30‐year fixed rate mortgage fell to 4.27 percent from 4.37percent in February.Mortgage Rates vs Refinance VolumeA BCEDG H IFJK LMNOPAverage InterestRate on a 30-Year5.42Mortgage6.045.064.97 4.714.634.844.644.494.465.294.444.074.204.374.16 3.983.964.20 35 4.513.474.163.963.89 3.69 3.46 3.90 3.953.68 3.356.48600,000500,000400,000300,000200,000Number of MortgagesRefinanced by FannieMae and Freddie Mac100,0000* Mortgage rates are from the Freddie Mac Primary Mortgage Market Survey, monthly average, from the Freddie Mac website.2008200920102011Source: FHFA (Fannie Mae and Freddie Mac)A ‐ Highest rate in 2008 for a 30‐year mortgage.B ‐ GSEs placed into conservatorship on 09/06/08.C ‐ Fed announces MBS purchase program on 11/25/08.D ‐ Treasury rates sharply rose and reached a 2009 highon a better than expected June unemploymentreport.E ‐ 30‐year mortgage rates reached 4.17 percent inearly November, marking the lowest level observedsince Freddie Mac began tracking rates in 1971.F ‐ Treasury rates fell amid ongoing concerns of agrowing debt crisis in Europe.G ‐ 30‐year mortgage rates reached new historic lowsin November 2012.201220132014201520162017Mar19H ‐ Mortgage rates rose after Federal Reserve ChairmanN ‐ Mortgage rates rose in November and DecemberBernanke stated in late May that the central bank was2016 amid expectations of a rate hike by the Federalconsidering slowing its 85 billion per month bondReserve. The Federal Reserve raised the targetbuying program known as quantitative easing.federal funds rate to 0.75% on 12/14/16 in responseI ‐ Highest rate for a 30‐year mortgage since July 2011.to a strengthening economy.J ‐ 30‐year mortgage rates reached a monthly average of 3.67 O ‐ Mortgage rates fell from the beginning to the end ofpercent in January, the lowest level seen since mid 2013.2017 as the target Federal Funds rate was raised to 1%on March 16th, 1.25% on June 15, and 1.5% onK ‐ 30‐year mortgage rates reached a monthly average of 4.05December 14, with the Federal Reserve following apercent in 6/2015, the highest level observed since 9/2014,steady path to normalize its benchmark rate.amid expectations of a rate hike by the Federal Reserve.P ‐ Mortgage rates rose from the beginning to theL ‐ The Federal Reserve raised the target federal funds rateend of 2018, as the target Federal Funds rate wasfrom 0.25% to 0.5% on 12/16/15 in response to aincrementally raised quarterly to 1.75%, 2%, 2.25%strengthening economy.and 2.5%, with the Federal ReserveM‐ Treasury rates fell, amid a global flight to the safety ofPage 3projecting a continued steadygovernment debt, in response to the U.K. Brexit vote togrowthoftheUSeconomyin2018.leave the European Union.

FHFA Refinance ReportFirst Quarter 2019In the first quarter of 2019, 901 refinances were completed through HARP, bringing total refinances through HARPfrom the inception1 of the program to 3,495,296.Refinances Through March 2019Total RefinancesFannie MaeFreddie MacTotalTotal HARPFannie MaeFreddie MacTotalHARP LTV 80% -105%Fannie MaeFreddie MacTotalHARP LTV 105% -125%Fannie MaeFreddie MacTotal20182017Inceptionto 9HARP LTV 125%Fannie MaeFreddie MacTotalAll Other Streamlined RefisFannie MaeFreddie MacTotal1 Inception- April 1, 2009Source: FHFA (Fannie Mae and Freddie Mac)Page 4

FHFA Refinance ReportFirst Quarter 2019In the first quarter of 2019, 901 loans were refinanced through HARP, representing 0.4 percent of total refinancevolume during the month.HARP Refinance, Quarterly Volume(Number of loans in 002972942801501392047485115197185182169 43 7740475039401494140130 30 543244 3710932 322621 163177 7421 20 18 16721562615813 13 105613 1353 5614 48 46478 8 7 6 5 5 10 7 6 4 3 2 133 28 22119 19 15 13 12 11 10 8 817105 1067210110266949688780.4 0.3 0.12Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 19Jan Feb Mar19 19 192% 8% 11%14% 15% 12%11% 14% 17%16% 10% 17%27% 26% 22%21% 22% 23%23% 21% 16%11% 9% 6% 5% 5% 5% 5% 4% 2% 2% 3% 3% 2% 1% 1% 1% 1% 1% .4%.6% .4% .2%Freddie MacFannie MaePercent of Total Refinances.Source:FHFA (Fannie Mae and Freddie Mac)Page 5

FHFA Refinance ReportFirst Quarter 2019From inception1 through March 2019, 2,919,583 loans refinanced through HARP were for primary residences, 110,922were for second homes, and 464,791 were for investment properties.HARP Loans by Property TypeInception through March 2019TotalTotal HARPFannie MaeFreddie 1731,74177,158189,37596,602285,977HARP LTV 105% -125%Fannie MaeFreddie 8,9199,16018,07956,54535,66692,211HARP LTV 125%Fannie MaeFreddie 352435,549333,26115,68586,603HARP LTV 80% -105%Fannie MaeFreddie MacTotalTotalSource: FHFA (Fannie Mae and Freddie Mac)1Inception- April 1, 2009Page 6

First Quarter 2019FHFA Refinance ReportBorrowers who refinanced through HARP had a lower delinquency rate compared to borrowers eligiblefor HARP who did not refinance through the program.Ever 90 Days Delinquency Rate1: Fannie Mae and Freddie MacRefinance orEligibility MonthJune 2009June 2010June 2011June 2012June 2013June 2014June 2015June 2016June 2017CategoryLoans Refinanced through HARP2Loans Eligible for HARP3Loans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARPLoans Refinanced through HARPLoans Eligible for HARP .3%7.1%3.5%6.7%3.4%5.6%3.0%3.9% 1.2%6.0%10.2%4.9%8.3%4.0%5.5% %8.7%6.1%8.6%4.2%7.8%3.8%6.3%3.5%4.3%Source: FHFA (Fannie Mae and Freddie Mac)Notes1. This measures the cumulative percentage of loans that have become 90 or more days delinquent in any of the months after June 2009, 2010, 2011 , 2012, 2013, 2014, 2015, 2016 or 2017 (the refinanceor eligibility date) through December 2018 for loans refinanced through HARP or eligible for HARP.2. This measures the ever 90 day delinquency percentage for loans refinanced through HARP during the month of June 2009, 2010, 2011, 2012 , 2013, 2014, 2015, 2016 or 2017.3. This measures the ever 90 day delinquency percentage for loans that were eligible for refinancing through HARP but were not refinanced through the program as of the end of the reporting month of June2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 or 2017. LTVs as of the eligibility date for loans are estimated using internal Fannie Mae and Freddie Mac house price indices at a zip code level. Thismeasure may be understated because some loans may have later been paid off or refinanced through HARP.Fannie Mae defines a HARP eligible loan as being current on payments for the last 6 months with at most a single missed payment in the last 12 months for both HARP 1 and HARP 2 eligibility; Freddie Macdefines a HARP eligible loan as being current on payments for the last 12 months for HARP 1 (2009-2011) eligibility, or current on payments for the last 6 months with at most a single missed payment in thelast 12 months for HARP 2 (2012 onward) eligibility.Other eligibility rules specific to Fannie Mae and Freddie Mac may also apply.Page 7

First Quarter 2019FHFA Refinance ReportBorrowers who refinanced through HARP had a lower delinquency rate compared to borrowerseligible for HARP who did not refinance through the program.14%12%10%8%6%4%2%0%Ever 90 Days Delinquency Rate1Fannie Mae and Freddie MacJun 09 Jun 10 Jun 11 Jun 12 Jun 13 Jun 14 Jun 15 Jun 16 Jun 17 Jun 18Loans eligible for but notrefinanced through HARP2June 2009June 2010June 2011June 2012June 2013June 2014June 2015June 2016June 2017NotesLoans refinancedthrough HARP3LTV 80%-105%LTV 80%-105%; 105%-125%LTV 80%-105%; 105%-125%LTV 80%-105%; 105%-125%; 125%LTV 80%-105%; 105%-125%; 125%LTV 80%-105%; 105%-125%; 125%LTV 80%-105%; 105%-125%; 125%LTV 80%-105%; 105%-125%; 125%LTV 80%-105%; 105%-125%; 125%Source: FHFA (Fannie Mae and Freddie Mac)1. This measures the cumulative percentage of loans that have become 90 or more days delinquent in any of the months after June 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 or 2017 (the refinance oreligibility date) through December 2018 for loans refinanced through HARP or eligible for HARP.2. This measures the ever 90 day delinquency percentage for loans that were eligible for refinancing through HARP but were not refinanced through the program as of the end of the reporting month of June2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 or 2017. LTVs as of the eligibility date for loans are estimated using internal Fannie Mae and Freddie Mac house price indices at a zip code level. Thismeasure may be understated because some loans may have later been paid off or refinanced through HARP.3. This measures the ever 90 day delinquency percentage for loans refinanced through HARP during the month of June 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 or 2017.Fannie Mae defines a HARP eligible loan as being current on payments for the last 6 months with at most a single missed payment in the last 12 months for both HARP 1 and HARP 2 eligibility; Freddie Macdefines a HARP eligible loan as being current on payments for the last 12 months for HARP 1 (2009 to 2011) eligibility, or current on payments for the last 6 months with at most a single missed payment inthe last 12 months for HARP 2 (2012 onward) eligibility.Other eligibility rules specific to Fannie Mae and Freddie Mac may also apply.Page 8

FHFA Refinance ReportFirst Quarter 2019Appendix: Data TablesFannie Mae and Freddie Mac - Quarterly Refinance Volume (# of 76245,619126,847107,869234,716Total HARPFannie MaeFreddie 2,0139602,9731,2885771,8659354551,390599302901HARP LTV 80% -105%Fannie MaeFreddie 7377732,5101,0924551,5478043651,169500231731HARP LTV 105% -125%Fannie MaeFreddie 3267752901594492021313331396520488651537051121HARP LTV 125%Fannie MaeFreddie 0267,4704,5081,7806,2883,2931,4984,791Total RefinancesFannie MaeFreddie MacTotalAll Other Streamlined RefisFannie MaeFreddie MacTotalNotes:Initially HARP Refinance Loans were defined as Fannie Mae to Fannie Mae and Freddie Mac to Freddie Mac first-lien refinance loans with limited and no cash out that have loan-to-value ratios over 80 percent up to 125percent.HARP Enhancements: On October 24, 2011, FHFA, Fannie Mae and Freddie Mac announced HARP changes to reach more borrowers. Effective December 1, 2011, existing Enterprise borrowers who are current on theirmortgage payments can refinance and reduce their monthly mortgage payments at loan-to-value ratios above 80 percent without any maximum loan-to-value limit.Starting with the November 2012 Refinance Report, the definition of HARP for Fannie Mae has been expanded to include second home and investment property refinances with LTVs greater than 80 percent, which isconsistent with the definition of HARP for Freddie Mac since the inception of the program.All Other Streamlined Refis are streamlined refinances that do not qualify as HARP refinances. Fannie Mae implements streamlined refinances through the Refi Plus product for manual underwriting and DU Refi Plus productfor loans underwritten through Desktop Underwriter. The product is available for refinances of existing Fannie Mae loans only. Freddie Mac implements streamlined refinances through the Relief Refinance Mortgage product.Loans may be originated by any Freddie Mac approved servicer.Page 9

FHFA Refinance ReportFirst Quarter 2019Appendix: Data TablesFannie Mae - Loan Count by LTV and Product (Mortgage 36,770159,729151,575116,847114,932102,37191,346FRM 25,83416,91713,10810,5658,839FRM 5450,55941,08729,43727,25024,666Total RefinancesFRM 30 (incl FRM 25 & 40)HARP 80-105 LTVFRM 30 (incl FRM 25 & 6665477285FRM FRM 61,2541,161917741770529367318172145856447FRM 2019717815911612798636349342699FRM 431841308845341922HARP 105-125 LTVFRM 30 (incl FRM 25 & 40)HARP 125 LTVFRM 30 (incl FRM 25 & 40)FRM 20745849344919321817910143FRM 15130126617466256228172013104All Other Streamlined 4,3833,5442,4612,1481,483FRM 29916777640FRM 9831,9631,5431,138FRM 30 (incl FRM 25 & 40)Page 10

FHFA Refinance ReportFirst Quarter 2019Appendix: Data TablesFreddie Mac - Loan Count by LTV and Product (Mortgage ,181120,81079,78082,89664,97676,92380,049FRM ,6859,3026,5365,8575,258FRM 34,23626,64220,22419,58219,359Total RefinancesFRM 30 (incl FRM 25 & 40)HARP 80-105 16232152FRM 20881801892699742434350326203118595038FRM 626508591436259213112107464632FRM 30 (incl FRM 25 & 40)HARP 105-125 LTVFRM 30 (incl FRM 25 & 40)FRM 2094117908069852730101211147FRM 261205732341715HARP 125 LTVFRM 30 (incl FRM 25 & 40)FRM 20416539222318821141062-FRM 151001028258376532418141765FRM 30 (incl FRM 25 & 6101,093894707FRM 4225254FRM 94651657528All Other Streamlined RefisPage 11

First Quarter 2019FHFA Refinance ReportAppendix: State Level DataEnterprises Refinance Activity by State - March 31, 2019March AVTWAWIWVWYOther 2TotalOtherTotalHARP LTVStreamlinedRefinances 80% 231031131187311115267812111413100Inception to Date1Year to Date 2019HARP LTV 105% 125%1375212111125HARP LTV 31115142140HARP LTVOtherTotalHARP LTV 105% StreamlinedRefinances 80% 2321612148211119115212110211121TotalHARP LTVTotal HARPRefinances 2062,60627,884,589HARP LTVOtherHARP LTV 105% Streamlined 80% - 1596,362HARP LTVTotal HARP 2134,08266,3456,7362,9725,5593,495,296Inception to Date - Since April 1, 2009, the inception of HARP.of Guam, Puerto Rico, Virgin Islands and other loans for which data are not available.2 ConsistsPage 12

First Quarter 2019FHFA Refinance ReportAppendix: State Level DataFannie Mae Refinance Activity by State - March 31, 2019March AVTWAWIWVWYOther 2TotalOtherTotalHARP LTVStreamlinedRefinances 80% 4648411235116174211122557211211651Year to Date 2019HARP LTV 105% 125%1132111111HARP LTV 4Inception to DateHARP LTVOtherTotalHARP LTV 105% StreamlinedRefinances 80% 2344315001321128110511161122111611170TotalHARP LTVTotal HARPRefinances HARP LTVStreamlined 80% 401,8092,8481,479,169HARP LTV 105% ,5699,59911113,6094,061607165801332,690HARP LTVTotal HARP ,070,664Inception to Date - Since April 1, 2009, the inception of HARP.of Guam, Puerto Rico, Virgin Islands and other loans for which data are not available.2 ConsistsPage 13

First Quarter 2019FHFA Refinance ReportAppendix: State Level DataFreddie Mac Refinance Activity by State - March 31, 2019March AVTWAWIWVWYOther ,587HARP LTVOtherHARP LTVHARP LTV 105% Streamlined 125% 80% 326351471Year to Date 771,87136519261107,8691Inception to DateHARP LTVOtherHARP LTVOtherHARP LTVTotalHARP LTVHARP LTVHARP LTVTotal HARP 105% StreamlinedTotal HARP 105% Streamlined 125%Refinances 125% 80% -105% 80% 4,469984,216263,672176,744 1,424,632Inception to Date - Since April 1, 2009, the incep

On May 8, 2015, HARP was extended again to expire on December 31, 2016. On August 25, 2016, HARP was extended once more to expire on September 30, 2017. On August 17, 2017, HARP was extended once more to expire on December 31, 2018. HARP loans must have been started by December 31, 2018 and must be