Transcription

Annual report 2015

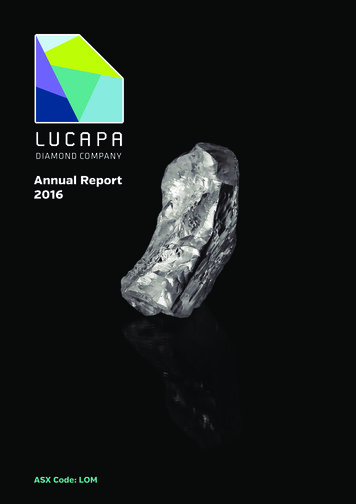

From rough toresplendentWith a warm, molten glow, the Golden Empress diamond hastravelled a long way from the Group’s Letšeng mine in Lesotho.The journey from its recovery in December 2014 to its finalresplendent state in 2015 as a magnificent 132.55 carat fancyintense yellow cushion cut diamond (together with eightsatellite diamonds) is as unique as the gem itself.Achieving the maximum revenue for our diamonds is a strategicimperative, and therefore, after careful analysis, using the Group’sadvanced mapping and analysis technology, a partnershiparrangement was undertaken with Safdico, a subsidiary of GraffDiamonds, the world-renowned luxury jeweller.The Golden Empress received a colour grading of fancy intense yellow by the GemologicalInstitute of America (GIA) – further adding to its rarity – as only one in 10 000 diamonds are classifiedas fancy coloured. Colour diamonds refract and reflect light differently to white diamonds, andSafdico’s skilled artisans undertook to meticulously study and understand this remarkable andrare diamond and ensure the jewel’s individual saturation, tone and hue were optimised.The result was the masterpiece that is the Golden Empress; a 132.55 carat fancy intense yellowcushion cut diamond. In addition, eight more polished yellow diamonds – the largest being a21.34 carat fancy yellow pear-shaped diamond – stemmed from the rough diamond. The GoldenEmpress, adorned by 30 other cushion-cut yellow diamonds, now forms the centrepiece of ascintillating Graff signature necklace, taking its place as one of the world's most breathtaking andunique polished diamonds.

Strategic reportBusiness overviewStrategic reportManagement reviewStrategic reportOperating reviewGem Diamonds is a leading producer ofhigh-value diamonds with diamond miningoperations in Lesotho and Botswana, head officesand technical offices in the United Kingdomand South Africa; and sales, marketing andmanufacturing capabilities in Belgium.Strategic report: Business overviewStrategic report: Management reviewGem Diamonds Annual Report 2015Gem Diamonds Sustainable Development Report 2015This document has beencompiled in accordance withG4 Core Compliance andGlobal Reporting Initiative(GRI) , and Gem Diamondsinternal reporting guidelines,with consideration of theUN Global Compact. Referto legal compliance in thedocument.1Contents applicableSustainable DevelopmentReport 2015Sustainable Development Report 2015Gem DiamondsAnnual Report 2015The Annual Report has beenprepared in accordance with:Englishcompany law; the regulations and bestpractice as advised by theFinancial ReportingCouncil and theDepartment of Business,Innovation and Skills; and International FinancialReporting Standards.Enhancing efficiencies.Achieving excellenceFinancialstatementsAbout Gem DiamondsFamous Letšeng diamonds2015 highlightsChairman’s statementOur strategyKey performance indicatorsPrincipal risks and uncertaintiesViability statementMarket review 2015Annual Report 2015Annual Report 2015GovernanceChief executive’s reportGroup financial performance246810121621222630Strategic report: Operating reviewLetšengGhaghooMineral resource managementSales, marketing and manufacturingSustainable development reviewSign off of our strategic s overview of corporate governanceUK corporate governance code complianceAudit, Nominations, HSSE CommitteesAnnual Statement on Directors’ remunerationDirectors’ remuneration policyThe Annual Report on RemunerationDirectors’ Report5860627077788696Financial statementsIndicates additional informationavailable on the Group’s websitewww.gemdiamonds.com.Refers the reader to further informationavailable in the Group’s 2015 SustainableDevelopment Report which can be viewedon the Group’s website.Download this QR code on your smart device to gainquick access to our website.The Strategic Report is set out on pages 2 to 55.The Directors’ Report is set out on pages 96 to 99.Directors’ responsibility statementIndependent Auditor’s ReportAnnual financial statementsAbbreviations and definitionsContact details and advisers102103110163IBC

2Gem DiamondsAnnual Report 2015About Gem DiamondsGem Diamonds is a leading producer of high-value diamonds. The Group ownsthe Letšeng mine in Lesotho and the Ghaghoo mine in Botswana. The Letšengmine is renowned for its regular production of large, top colour, exceptionalwhite diamonds, making it the highest average dollar per carat kimberlitediamond mine in the world. Since Gem Diamonds acquired the mine in 2006,Letšeng has produced four of the 20 largest white gem quality diamondsever recovered.MINESLetšeng DiamondsOwnershipAcquired70%Gem Diamonds Limited30%Government of the KingdomJuly 2006Gem Diamonds BotswanaOwnership100%AcquiredMay 2007Gem Diamonds Limitedof LesothoDescription of operationThe Group’s open pit mining operation in Lesotho focuses on: Mining and processing ore efficiently and safely from its twokimberlite pipes (Main and Satellite pipe) Optimising expansion projects to reduce diamond damage,diamond theft and to improve diamond liberationDescription of operationGhaghoo, the Group’s underground development in Botswana, isfocused on: Developing the mine safely Managing future production in line with the commodity cycle Implementing life of mine (LoM) extensionsTotal resource5.0 million carats(as at 1 January 2015)In-situ valueUS 10.3 billion(as at 1 January 2015)Total resource20.5 million carats(as at 1 January 2014)In-situ valueUS 4.9 billion(as at 1 January 2014)TECHNICAL AND ADMINISTRATIVE SERVICESAfricaGem DiamondsBotswanaGhaghoo DiamondMine (Botswana)Gem DiamondsMarketingBotswana(Botswana)Gem DiamondsTechnical Services(RSA)LetšengDiamondsLetšeng DiamondMine (Lesotho)

Strategic reportBusiness overviewStrategic reportManagement reviewStrategic reportOperating reviewGovernanceFinancialstatementsGem DiamondsAnnual Report 20153Gem Diamonds has an organic growth strategy based on enhancing theoperating efficiencies of the Letšeng mine and bringing the Ghaghoo mine intofull production. Our primary focus is to achieve operational excellence andenhance current production through continued cost reduction initiatives.Additional value is generated through the Group’s expanded sales, marketingand manufacturing capabilities.sales and marketingmanufacturingGem Diamonds Marketing ServicesBaobab ctober 2010Gem Diamonds LimitedESTABLISHEDApril 2012Gem Diamonds LimitedDescription of operationGem Diamonds Marketing BotswanaOwnershipThe Group’s high-tech diamond analysis and manufacturing operationis tasked with:ESTABLISHED100% Investing in state-of-the-art diamond analysis technology Understanding the value of exceptional rough diamonds throughAugust 2015mapping and analysis Manufacturing selected diamonds for final polished saleGem Diamonds LimitedDescription of operationSThe Group’s diamond sorting, sales and marketing operations in Belgiumand Botswana focus on: Maximising the revenue achieved on diamond sales Developing the Gem Diamonds brand in the market Enhancing customer relationshipsEuropeBaobabTechnologies(Belgium)Gem DiamondsMarketing Services(Belgium)Gem DiamondsLimitedCompanyheadquartersin the UnitedKingdom

4Gem DiamondsAnnual Report 2015Famous Letšeng diamondsThe Letšeng mine in Lesotho is renowned for its recovery of some of the world’smost valuable diamonds, achieving the highest US dollar per carat of anykimberlite diamond mine in the world. Letšeng regularly produces diamondsof exceptional size and colour.The 357 carat“ Letšeng Dynasty”The 314 carat“ Letšeng Destiny”The 299 carat yellowdiamond (unnamed)The Letšeng Dynasty wasrecovered in July 2015 and soldfor US 19.3 million in September2015, achieving the highestvalue ever for a single Letšengdiamond. The name given wasto symbolise the succession ofdiamonds from the same family.This diamond is in the process ofbeing manufactured.The Letšeng Destiny wasrecovered in May 2015 andsold into a partnershiparrangement in June 2015.The name was given to signifya hidden power believed tocontrol future events.The Letšeng Destiny hasyielded a main polished fancyshape diamond of over 100carats D colour flawless and12 smaller diamonds of Dcolour, totalling a polishedweight of 164 carats.This diamond was recovered in December2014. In line with the Group’s strategic goalto maximise the revenue achieved fromremarkable diamonds, a partnershiparrangement was undertaken with Safdico, asubsidiary of Graff Diamonds in January 2015.Unmasking its true radiance, the gem was cutand polished by expert artisans with coloureddiamond expertise, which resulted in amagnificent 132.55 carat fancy intense yellowcushion shaped polished diamond, along witheight other yellow diamonds, the largest beinga 21.34 carat fancy yellow pear shape. The132.55 carat gem, aptly named The GoldenEmpress, was set into a breathtaking Graffsignature necklace, adorned with 30 othercushion cut yellow diamonds.The 12 carat blue diamond (unnamed)This rare 12.47 carat blue diamond was recovered at Letšeng inSeptember 2013. It was sold a month later on tender in Antwerp for arecord price of US 603 047 per carat (US 7.5 million), the highest US percarat for any Letšeng rough diamond sold to date.

Strategic reportBusiness overviewStrategic reportManagement reviewStrategic reportOperating reviewGovernanceFinancialstatementsGem DiamondsAnnual Report 20155In 2015, a further two remarkably large white diamonds (314 carat and 357 carat)were recovered, adding to the list of Letšeng’s very special diamonds.The 550 carat “Letšeng Star”The 550 carat Letšeng Star was recovered in August 2011 and was so named to signify the growing number of “stars” in Letšeng’sconstellation of large diamonds recovered. The Letšeng Star is also ranked in the top 20 largestwhite rough diamonds on record and the second largest white diamond to be recovered atLetšeng. This diamond yielded 12 pairs of pear shaped diamonds, as well as a main polishedstone of 33.11 carats, also a pear shape, to form a unique collection of over 165 carats ofD flawless and internally flawless polished gems stemming from this single rough diamond.The 478 carat “Leseli La Letšeng”The “Leseli La Letšeng”, which translates to “Light of Letšeng”, reflectingthe diamond’s remarkable colour and clarity, was recovered inSeptember 2008 and is also ranked in the top 20 largest roughwhite diamonds recorded. This diamond was the third significantrecovery from the Letšeng mine in as many years and was sold inNovember 2008 for US 18.4 million (during the height of the globalfinancial crisis).The fame of this diamond extends furtherin that it revealed a 102.79 carat roundshaped, D colour internally flawlessdiamond, making it the largest roundshaped polished diamond ever to begraded D colour internally flawless bythe GIA. A further 10 exquisite polisheddiamonds were also revealed.The 493 carat “Letšeng Legacy”The Letšeng Legacy is also ranked in the top 20 largest rough whitediamonds recorded and its name highlighted the growinglegacy that the Letšeng mine in Lesothowas creating as a producer of significantlarge white diamonds. Thisdiamond was recovered inSeptember 2007 and wassold for US 10.4 million inNovember 2007.The 603 carat“Lesotho Promise”The 603 carat Lesotho Promise was recovered inAugust 2006 and together with being ranked in thetop 20 of the world’s largest white diamonds onrecord, is also the largest diamond to emerge fromthe Letšeng mine to date. The Lesotho Promise wassold for US 12.4 million in October 2006 and wassubsequently polished into 26 D flawless andinternally flawless diamonds, the largestof which was a 76.4 carat pear shapeddiamond.All 26 polished diamondswere fashioned into asingle necklace by Graff.

6Gem DiamondsAnnual Report 20152015 highlightsFinancial highlightsUS millionFY2015FY2014RevenueCorporate expensesUnderlying EBITDAProfit for the year (before exceptional items)Profit for the year (after exceptional items)Basic earnings per share (EPS) (before exceptional items) (cents)Basic EPS (after exceptional items) (cents)Cash and short-term depositsBank loans .4106.060.457.925.824.0110.737.1%changeê8ê6ê2é 12é 34é 17é 57ê 23ê 18Refer to Note 3, Operating profit, for definition of non-GAAP measures.Operational highlightsHSSE highlightsWaste tonnes mined (millions)24.0252019.117.419.9 5 star rating for Letšengmanagement of HSSE13.715105020112012201320142015Production tonnes treated (millions)86.86.66.266.57.0 4 star rating for Ghaghoomanagement of HSSEZero42020112012201320142015Carats produced (thousands)200200Letšeng achieves 142015474920142015Capital expenditure (US million)6052504030Lost time injury-free andfatality-free year292520100201120122013ISO 14001 andOHSAS 18001certification

Strategic reportBusiness overviewStrategic reportManagement reviewLetšengStrategic reportOperating reviewGovernanceGhaghoo Eleven 100 caratsrecovered during the year,making this a new recordfor the mine 89 107 carats soldduring the year achievingUS 14.4 million and US 162average US per carat The largest diamondrecovered during the year,a 357 carat Type IIdiamond, sold forUS 19.3 million, obtainingthe highest US valueever achieved for a singleLetšeng diamond Largest diamond recoveredduring the year was48 carats Plant 2 Phase 1 upgradecompleted in March, onschedule and within budgetincreasing capacity by250 000 tonnes per annum Optimised life ofmine plan approved andimplemented in Maysignificantly enhancing themine’s net present valuethrough optimised wastestripping and highergrade, higher-valueSatellite pipe ore beingmined Coarse Recovery Plantconstruction completedon schedule and withinbudget. The unit recovereda high-quality 52 caratType II diamond on itsfirst day of operation US 65 226 per carat wasthe highest US per caratachieved during the yearfrom a 108 carat Type IIdiamond Achieved 430 consecutivelost time injury (LTI) andfatality-free days Gem Diamonds sharesplatform with LesothoPrime Minister atCommonwealth Conferencein Malta to promoteinvestment in Lesotho Recovered two bluediamonds of 2.19 and1.49 carats, being thelargest blue diamondsrecovered to date Achieved 418 consecutiveLTI and fatality-free days The water fissure wassuccessfully sealed Recovered gradeexceeded reserve gradeFinancialstatementsGem DiamondsAnnual Report 20157Group Michael Lynch-Bell, anexperienced mining andmetals non-ExecutiveDirector, appointed asnon-Executive Directorand Audit CommitteeChairman Maiden dividend of5 US cents per share paidto shareholders, amountingto US 6.9 million Refinanced US 41 millionworth of facilities forextended periods The Diamond ProducersAssociation was formed,with Gem Diamonds asa founding memberalong with industry peers– De Beers, Alrosa andRio Tinto Corporate costs reduced by24% since 2011

8Gem DiamondsAnnual Report 2015Chairman’s statementA strong set of resultsDear shareholder,It is my pleasure to present theGem Diamonds’ 2015 Annual Report.I believe this report offers a fair andbalanced account of the business, itsperformance over the last year and itsprospects going forward.Strategic focusStrategic clarityInvesting in low-cost, high-return innovativeprojectsRobust corporate governanceDividend paying policyAlthough 2015 was a challenging yearfor the diamond mining industry, it ispleasing to report that the Group hasdelivered a strong set of results, bothoperationally and financially. Despitecontinued downward pressure on bothrough and polished diamond pricesduring the period, particularly in thecommercial diamonds, robust priceswere achieved for the Group’s high-endLetšeng diamonds. These strong resultsare the outcome of the strategic planadopted by the Board two years agowhereby the focus was placed onmaximising revenue from core assetsthrough enhancing operationalefficiencies and investing in low-costand high-return innovative projects.This strategic focus has positionedGem Diamonds well for sustainablegrowth and, following another strong setof results during 2015, notwithstandingchallenging market conditions, theGroup ended the year with net cash ofUS 55.3 million. Moreover, the Groupachieved a remarkable milestone withno lost time injuries recorded at anyGem Diamonds’ operations during 2015.This achievement is a hallmark of strongoperational management.Roger DavisThe Group continued to demonstratecapital discipline and, at Letšeng, wehave successfully completed various lowcapital incremental growth projects ontime and on budget. The addition of thePlant 2 upgrade to the treatment plantand the new Coarse Recovery Plant hasresulted in a rise in the recoveries of theimportant 100 carat diamonds from anaverage of six per year to 11 in 2015. Inaddition, the revised optimised life ofmine plan for Letšeng which wasimplemented during the year hassignificantly enhanced the value ofthe mine.

Strategic reportBusiness overviewStrategic reportManagement reviewAt Ghaghoo, it is pleasing that theinitial key objectives set out for thedevelopment of Phase 1 of this assetwere achieved and are all the morenoteworthy due to the challengingunderground conditions encountered.The depressed market has impactedthe prices achieved for our Ghaghooproduction. Consequently, in the currentclimate, and after reviewing variousoptions, it was considered prudent todownsize the operation for 2016 toreduce cash consumed during its finaldevelopment. It is important to notethat Ghaghoo remains a key futureoption for the Group and its expansionopportunities, when diamond pricesimprove, will further deliver on theBoard’s strategic plan.Gem Diamonds continues to seekopportunities to maximise revenue fromthe sale of its rough diamonds througha combination of channels, includingtenders, auctions, off-take arrangementsand partnerships. The Group’s multichannel marketing strategy is effectivelymanaged by the Gem Diamonds salesand marketing team in Antwerp andcontinues to develop relationships withnew and existing clients.DividendA maiden dividend of US 6.9 million(5 US cents per share) was paid toshareholders in June 2015 in respect ofthe 2014 year. This was a significantmilestone for the Company. Followingthe positive results achieved in 2015and in applying the dividend policyimplemented in the prior year, the Boardis pleased to recommend the payment ofan ordinary cash dividend of 5 US centsper share (US 6.9 million) which will beproposed at the 2016 Annual GeneralMeeting. In addition, a special dividendof 3.5 US cents per share (US 4.8 million)will also be proposed representing thecash saving arising from the settlementof a previous tax assessment. The Groupwill continue to adopt a prudent capitalmanagement strategy and stringent costcontrols at the operations in order toremain in a position to recommenddividend payments to shareholders.Strategic reportOperating reviewGovernanceFinancialstatementsStriving for zero harm andpositive contributionsGem Diamonds strives to mine itsdiamonds in such a way that promotessocially and environmentally desirableoutcomes. It is therefore pleasing toreport that in addition to having anLTI-free year during 2015, no major orsignificant environmental or stakeholderincidents were recorded.The Group is dedicated to creating andmaintaining stakeholder relationshipsthat forge shared value and leave apositive legacy in its project affectedcommunities. Focused engagement atall levels of the business ensures thatcommunity projects are relevant andfeedback is incorporated into strategiesgoing forward. In addition, robustinternational best practice guidelines areimplemented across the Group to ensureoptimal governance.Ensuring high levels ofcorporate governanceThe Board is committed to the higheststandards of corporate governanceand believes that strong corporategovernance is key to the Group’s abilityto create sustainable returns for allstakeholders. The Board thereforecontinues to support the principlesencompassed in the revised UKCorporate Governance Code.During the year, the Board welcomedMichael Lynch-Bell as an independentnon-Executive Director and the AuditCommittee Chairman. Mr Lynch-Bell waspreviously a senior resources partnerat Ernst & Young (EY) for over 27 years.His wealth of experience through hisnon-executive directorships at threeother mining and mineral companies willcomplement the skill set of the Board.Gem DiamondsAnnual Report 20159After eight years of service as ChiefOperating Officer and Executive Director,Alan Ashworth has announced hisintention to retire in June 2016. The Boardwould like to express its appreciation toAlan for his significant contribution to theGroup over the years.OutlookAlthough 2016 has seen a positive startwith improved rough diamond pricesbeing reported across the industry,significant global economic uncertaintyremains. Nevertheless, throughdisciplined execution of its core strategy,I believe that the Group is well positionedto further maximise shareholder returns.I would like to take this opportunity toacknowledge the hard work of thepeople who have made the successesof the 2015 year possible. I would liketo give my heartfelt thanks to my fellowBoard members for their insightfulleadership and express my appreciationto the Gem Diamonds managementteam. I would also like to thank our hostgovernments of Lesotho and Botswanaand, of course, our shareholders for theircontinued confidence and support.Finally, I would like to thank allGem Diamonds employees for theirdedication and hard work throughoutthe year.Roger DavisNon-Executive Chairman14 March 2016

10Gem DiamondsAnnual Report 2015Our strategyGem Diamonds’ strategy is based on three broad pillars – growth, value creationand sustainability.We believe this offers us the flexibility to generate maximum returns for our shareholders in a sustainable manner. Our focus isprimarily on extracting diamonds through mining. To complement our main focus of mining, we have expanded our attention furtheralong the diamond value chain through our strategic sales, marketing and manufacturing activities. Our overarching objective is todeliver sustainable returns for our investors while optimising the benefit for our communities and minimising our impacton the environment.StrategyGrowthValue creationSustainabilityOrganic growthOptimising the Letšeng mine anddeveloping the Ghaghoo mine usingavailable capital to deliver increasedreturns to shareholders.Operational excellenceFocusing on cost reductions andenhancing current production efficiency.Stakeholders and communitiesBuilding long term, transparent andmutually beneficial relationships with allstakeholder groups.External growthAssessing external opportunities againststrict investment criteria.Value accretive opportunitiesGenerating additional value throughsales and marketing capabilities,incorporating manufacturing anddownstream initiatives.Optimising returnsImproving the quality of our assetsthrough life of mine extensions.Strengthening the capital structure.Optimising revenue achieved fordiamond production through reductionsin diamond damage and theft.Health, safety and environmentPromoting a culture of zero harm andresponsible care as our workforce is ourmost valued asset.Delivering sustainable returns for ourinvestors while optimising the benefit forour communities and minimising ourimpact on the environment.Value createdKPIKPIKPIRevenue: US 249 millionCapital expenditure: US 49 millionLost time injury frequency rate: 0.00Underlying EBITDA: US 104 millionProduction tonnes treated: 7.0 millionAll injury frequency rate: 2.87Return on average capital employed:20%Carats produced: 200 078Zero fatalitiesWaste tonnes mined: 24.0 millionZero major or significant communityand environmental incidentsBasic EPS (before exceptional item):30.2 US centsFree cash generated: US 14 millionZero major or significant incidentsof HSSE legal non-complianceCorporate social investment (CSI)spend: US 0.6 million

Strategic reportBusiness overviewStrategic reportManagement reviewStrategic reportOperating reviewGovernanceFinancialstatementsGem DiamondsAnnual Report 201511How we differentiate ourselvesOur assetsLetšeng, our core asset, produces thehighest US per carat diamonds in theworld. We implement innovativesolutions to further enhance this value.The full development of Ghaghoo offersan opportunity to further enhance theGem Diamonds investment proposition.Strong balance sheet managementWe focus on maximising revenue fromour core assets through enhancingoperational efficiencies and investing inlow capital, quick payback projects. Thiscash generation and capital disciplinehas positioned us well for sustainablegrowth into the long term.Shareholder returnWe are committed to sustainingshareholder value through theimplementation of appropriate dividendpolicies and we aim to pay dividendsannually.Corporate responsibilityMaintaining safe operations andminimising social and environmentalimpact safeguards our social licenceto operate and further promotes ourcorporate brand.ingI deginet Analysing and mapping ourexceptional diamonds to understandand achieve highest rough valuethrough multiple selling channels.Manufacturing of select high-valuerough diamonds, unlockingadditional value throughpolished sales.Identifying, evaluating anddeveloping diamond depositsthat are potentially valuable.ssingecoPrWhat weWhatwe dodouIdentifying the valuable,economical and technicallyfeasible part of theResource to be minedeservesMining in both open-pitand underground minesefficiently and productivelyas safe as possibleMiningResoPlanning and developingRIncreasing recoveries andimprove finished productquality through initiativesof reducing diamonddamage and theft andincreasing liberation ofdiamondsntifyingercSal es,markdmanractufuanRobust corporate governanceWe are committed to the pursuit of bestpractice in governance principles. Wehold to the fact that effective corporategovernance is essential to securing theGroup’s long-term success and viability.Focused risk management is a coreelement of our business. Our Board hasoverall accountability for ensuring thatrisk is effectively managed, reviewed andcontinually assessed across the Group.

12Gem DiamondsAnnual Report 2015Key performance indicatorsKey performance indicators are used to assess the performance of the Groupagainst its strategy. These indicators are monitored continuously to effectivelyevaluate the performance of the Group over the short, medium and long term.GrowthUnderlying EBITDA (US million)/Underlying EBITDA margin (%)Revenue (US 01320142492015180160140120100806040200Return on average capital employed(ROACE) 22013DefinitionDefinitionDefinitionRevenue represents the value of goodssold during the year (both rough andpolished) and measures the level ofoperating activity and growth of thebusiness. Revenue for the year is asreported in the consolidated incomestatement and excludes revenue achievedby Ghaghoo on the basis that themine had not reached full commercialproduction by the end of the year.Underlying EBITDA means earningsbefore interest, tax, depreciation andamortisation. It excludes share-basedpayments, other income, foreignexchange differences and exceptionalitems.Underlying EBITDA margin is calculatedas underlying EBITDA as a percentage ofrevenue. Both these indicators provide ameasure of the operating profitability ofthe business. Refer to Note 3, Operatingprofit, in the financial statements for thecalculation of underlying EBITDA.ROACE is a pre-tax measure of theefficiency with which the Groupgenerates operating profits from itscapital. ROACE is calculated as underlyingEBITDA (as per Note 3, Operatingprofit, in the financial statements) lessdepreciation and amortisation (EBIT)divided by average capital employed(being total equity and non-currentliabilities per the consolidated statementof financial position).CommentaryCommentaryCommentaryThe Group is committed to maximisingthe value achieved on rough andpolished diamond sales. In a year ofadverse global market conditions, Grouprevenue decreased by 8% compared to2014 driven by a lower volume of roughcarat sales of 6% and a lower overallUS per carat achieved of 9% fromLetšeng’s production. Ghaghoo held itsfirst sale during February 2015, and intotal completed three sales during theyear, generating US 14.4 million whichis not included in Group revenue. Totalsales for the year was US 263.9 millionincluding these sales.Underlying EBITDA has remained inline with that achieved in the prioryear, with underlying EBITDA marginat 42% outperforming the prior year’smargin. This reflects the continuedcost management and the focus onoperational efficiency during the year,notwithstanding the lower revenueachieved. Underlying EBITDA does notinclude any results from Ghaghoo dueto the mine not having reached fullcommercial production.The weakening of the Lesotho loti(pegged to the South African rand) andthe British pound has had a positiveimpact on the translation of the localcosts into US dollars.Pre-tax ROACE achieved 20%, in line withthe prior year, based on similar levelsof underlying EBITDA. Prior years’ ROACEis as reported at that point in time andincludes all operations in existence inthose relevant years.The key performance indicators exclude the impact of any discontinued or disposed operations in the prior years unless otherwise stated.

Strategic reportBusiness overviewStrategic reportManagement reviewStrategic reportOperating reviewFinancialstatementsGovernanceGem DiamondsAnnual Report 201513KPIs that are used as a measure in the incentive arrangements for the remuneration of executi

2 Gem Diamonds Annual Report 2015 About Gem Diamonds Gem Diamonds is a leading producer of high-value diamonds. The Group owns the Letšeng mine in Lesotho and the Ghaghoo mine in Botswana. The Letšeng mine is renowned for its regular production of large, top colour, exceptional white diamonds, making it the highest average dollar per carat .