Transcription

General Instructions to Complete the Municipal Budget Workbooka)b)c)d)e)f)g)h)i)j)k)l)This workbook shall be used for completing the Municipal Introduced and Adopted Budgets.It is designed to automatically calculate amounts linked from various data entry points.The individual tabs containing formulas are locked to protect the formulas.Fill in only the gray sections of the worksheet.Begin by navigating to the "Key Inputs" tab.Select the Municipality and County by clicking the dropdown menu. This will populate the Municipality,County, and dates throughout the workbook. Continue to complete each of the fields in order to populatethroughout the workbook. Enter the exact number of utilities and the utility types. Do not skip sets ofutility pages.In all applicable signature lines, insert the email address of the applicable official.The completed Budget document must be saved as a Macro‐Enabled Workbook.Once approved by the Governing Body, the completed Introduced Budget must be submitted to the Divisionvia the FAST "Introduced Budget" record portal and it must be named as: municode introbudget 20xx(all 4 digits municode must be included).Once approved by the Governing Body, the completed Adopted Budget must be submitted to the Division viathe FAST "Adopted Budget" record portal and it must be named as: municode adoptbudget 20xx (all 4digits municode must be included).Only the Chief Financial Officer has access to the "Submit for Review" tab within the FAST portal.If copying data from a prior workbook, copy and use Paste Values to preserve formatting.On the Key Inputs tab, users can select "Standard" or "Expanded" for a variety of sections to reduce thenumber of unused pages throughout the document. The following sheets can be adjusted: Grant Revenues(9), Other Special Items of Revenue (10), General Appropriations (15), Grant Appropriations (24), andm)Capital Budget (40b, 40c, and 40d). All sections are preset to "Standard" and should only be switched to"Expanded" if more pages are needed.n) Please review the additional instructions "Quick Guide for completing the Municipal Budget" link dget Document Instructions.pdf

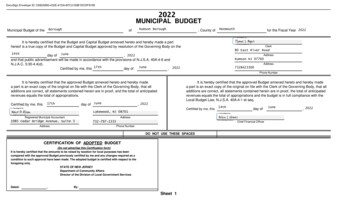

Information Required forMunicipal Budget Document:Municipal Budget Version 2022.2Responses and DataName and County of MunicipalityFull Name of MunicipalityCounty of MunicipalityName of MunicipalityTypeGoverning Body TypeLocationAddressAddressPhoneFax58TOWNSHIP OF BRIDGEWATERSOMERSETBRIDGEWATERTOWNSHIPCOUNCIL MEMBERSMunicipal Complex100 Commons WayBridgwater, NJ 08807908-722-4977ClerkTax CollectorChief Financial OfficerRegistered Municipal AccountantMunicipal AttorneyLinda DoyleDarrow MurdockAnthony ManninoRobert SwisherChristopher CorsiniCert #C-1329T-1429N-1777439Date of Original Appt.8/4/2003Calendar YearCalendar or State FiscalNewspaperDay161723Date of IntroductionDate of AdvertisementDate of Public HearingTime of Public Hearing7:30Net Valuation Taxable CurrentNet Valuation Taxable PriorBudget Year2022Municipal CodeHow many utilities does municipality have?Utility #Utility 1Utility 2Utility 3Utility 600Budget Year Type:18061Utility TypeSewerSelect "0" if you do not have any utilities.Capital Improvement Program# of YearsBeginning YearEnding Year620222027

Utility 5Utility 6Utility Assessment (Tab 37)Utility Assessment (Tab 38)

2022 Municipal Budgetof theTOWNSHIPof BRIDGEWATERSOMERSETfor the fiscal year 2022.County ofRevenue and Appropriations SummariesSummary of RevenuesAnticipated20221.2.3.4.SurplusTotal Miscellaneous RevenuesReceipts from Delinquent Taxesa) Local Tax for Municipal Purposesb) Addition to Local School District Taxc) Minimum Library TaxTot Amt to be Rsd by Taxes for Sup of Muni BndTotal General RevenuesSummary of .7946,908,773.472022 BudgetFinal 2021 0.006,986,512.352,800,000.0047,736,817.181. Operating 0,000.0023,220,841.54Salaries & WagesOther ExpensesDeferred Charges & Other AppropriationsCapital ImprovementsDebt Service (Include for School Purposes)Reserve for Uncollected TaxesTotal General otal Number of Employees2022 DedicatedSewerUtility BudgetSummary of RevenuesAnticipated20221. Surplus2. Miscellaneous Revenues3. Deficit (General Budget)Total RevenuesSummary of Appropriations1. Operating Expenses:2.3.4.5.Salaries & WagesOther ExpensesCapital ImprovementsDebt ServiceDeferred Charges & Other AppropriationsSurplus (General Budget)Total .9010,084,150.0011,006,150.0011,135,713.902022 BudgetFinal 2021 Total Number of EmployeesInterestPrincipalOutstanding BalanceBalance of Outstanding .478,860,682.8884,159,817.2210,419,264.13Notice is hereby given that the budget and tax resolution was approved by theTOWNSHIPBRIDGEWATERofof theSOMERSETMay 16on, 2022.COUNCIL MEMBERS, County ofTownship Hall (and Zoom)A hearing on the budget and tax resolution will be held atJune 23rd7 o'clock PM at which time and place, 2022 atobjections to the Budget and Tax Resolution for the year 2022 may be presented by taxpayers orother interested parties.Copies of the budget are available in the office ofBridgewaterthe Municipal Building,during the hours of100 Commons WayBridgewater TownshipNew Jersey,to5:00pm9:00am, onat.

TOWNSHIP OF BRIDGEWATERSUMMARY OF 2022 BUDGETTotal Budget47,736,817.18Employee Costs:Salaries & WagesSheet 17Sheet .00%16,121,488.51Social SecuritySheet 19Pensions etc.Sheet 19Sheet 19Sheet 19Sheet 20InsuranceSheet 14Direct Employee Costs20,921,538.1643.8%General Liability InsuranceSheet ,137,292.35106.00%6,986,512.3514.6%Reserve for Uncollected Taxes:Sheet 292,800,000.005.9%Capital Funds:Sheet 26a575,000.001.2%Deferred Charges:Sheet 52.9016,321,991.9516,648,431.79Projected Budget 5,253.8640,170,795.86202220232025202631.6%TOWNSHIP OF BRIDGEWATER2022 BUDGET FUNDINGRatablesTax 2.00%105.00%0.1%Budget Funding:Fund BalanceLocal RevenuesState AidGrantsDelinquent TaxLocal Purpose 00.0043,000.00All Other Departmental OE's:Various Line ,899.002,458,150.65-Debt Service:Sheet 27Grants:Sheet 25 (less Salaries & Wages above)Future Budget Projections20252024Project Tax 0.3970.0079,784,315,9000.4030.007CAP 000.0018,000.0039,708,658.93Over / (Under) CAP12,950,032.63LEVY CAP CALPrior Year2%Debt Service & HealthRatables 08)

COMPARISON OF REVENUES & calState AidState & Federal GrantsDelinquent TaxLocal Purpose TaxMinimum Library TaxSchool Tax (Debt Service)Arts and Cultural TOTAL REVENUE47,736,817.1846,908,773.47CHANGELOCAL TAX LEVY AND ASSESSED VALUES1,135,404.0018.02%(1,536,392.20) IV/0!#DIV/0!#DIV/0!828,043.71BUDGETYEAR%Local Purpose Tax Levy (only)Local Tax Rate23,220,841.540.2383Assessed 010,161.82) 9%#DIV/0!0.00%698,046.71 0.01484895,505.750.0000375,749,600CAP@ 0.5%CAP Base from Prior YearRate AppliedAllowable CAPAdditions:See Sheet 3bOtherTotal CAP AllowableBudget Expenditures Sheet 19Remaining or 003.50%35,559,421.52AvailableUsed to Fund BudgetRemaining 17.4935,205,035.772,185,981.7223,672,841.16 MAX23,220,841.54 ACTUAL(451,999.61) OR ( )Must be zero or ( ) toIntroduce Budget% OF TAX COLLECTIONPRIORYEAR4.01%2% LEVY CAPCAPCOLACONDITION OF SURPLUSBUDGETYEAR%STATUS OF "CAPS"1.77%SPENDING CAPAPPROPRIATIONSSalaries & WagesOther ExpensesStatutory & Deferred ChargesState & Federal GrantsCapital (without grants)Debt ServiceSchool Debt ServiceReserve for Uncollected TaxesTOTAL APPROPRIATIONSAdopted EmergenciesCHANGEActual Percentage of CollectionUsed for Reserve for 8.59%0.74%CHANGE0.05%0.03%0.02%

TOWNSHIP OF BRIDGEWATERSUMMARY OF TAX RATESEstimated2022Levy AmountCOUNTY:County Tax (General)County LibraryCounty HealthCounty Open SpaceTotal All County LeviesSCHOOLS:Local SchoolRegional SchoolRegional High SchoolAdditional Local SchoolSchool Debt ServiceSPECIAL DISTRICTS:Special District TaxLOCAL PURPOSE TAXMunicipal LibraryMunicipal Open SpaceArts and CulturalTOTAL ALL LEVIESNET VALUATION TAXABLE31,123,656.114,541,983.30Actual2021RateLevy 819,744,315,900LEVY CHANGE PER VARIOUS ASSESSED 08.551,787.2620811.40409 2383.01403426014.25512 0.010.010.010.010.01

COMPUTATION OF APPROPRIATION:RESERVE FOR UNCOLLECTED TAXES ANDAMOUNT TO BE RAISED BY TAXATIONIN 2022 MUNICIPAL BUDGETYEAR 20221Total General Appropriations for 2022 Municipal Budget Statement Item8(L) (Exclusive of Reserve for Uncollected Taxes)2 Local District School Tax3 Regional School District Tax4 Regional High School Tax5 County Tax6 Special District Tax7 Municipal Open Space8 Municipal Arts and .66equals Amount to be Raised by Taxation (Percentage used must notexceed the applicable percentage shown by Item 13, Sheet 22)202,982,158.66Analysis of Item 12:138,151,682.23Regional High School Tax (Line 4 Above)38,798,894.94County Tax (Line 5 Above)2,810,739.95Special District Tax (Line 6 Above)Municipal Open Space Tax (Line 7 Above)Municipal Arts and Culture Tax (Line 8 Above)Tax in Local Municipal Budget23,220,841.54Total Amount (Line 12)202,982,158.66Appropriation: Reserve for Uncollected Taxes (Budget13Statement, Item 8(M) (Item 12, Less Item 11)Computation of "Tax in Local Municipal Budget"Item 1 - Total General AppropriationsItem 13 - Appropriation: Reserve for Uncollected TaxesSubtotalLess: Item 10 - Total Anticipated RevenuesAmount to Be Raised by Taxation in Municipal BudgetLocal Tax for Municipal PurposeAddition to Local District School TaxMinimum Library TaxXXXXXXXXXXXXXXXXXXXXXX9 Total General Appropriations & Other Taxes10 Less: Total Anticipated Revenues from 2022 inMunicipal Budget (Item 5)11 Cash Required from 2022 to Support LocalMunicipal Budget and Other Taxes98.62%12 Amount of Item 11 divided byLocal School District Tax (Line 2 Above)Regional School District Tax (Line 3 Above)YEAR 0.0047,736,817.1824,515,975.6423,220,841.54

2022 MUNICIPAL DATA SHEETCAP(MUST ACCOMPANY 2022 BUDGET)MUNICIPALITY: TOWNSHIP OF BRIDGEWATERCOUNTY:SOMERSETGoverning Body MembersMatthew C. MoenchDecember 31, 2023Term ExpiresMayor's NameNameMunicipal OfficialsLinda DoyleMunicipal Clerk{Darrow MurdockTax CollectorAnthony ManninoChief Financial OfficerRobert SwisherRegistered Municipal Accountant8/4/2003Date of Orig. Appt.C-1329Cert. No.T-1429Cert. No.N-1777Cert. No.439Lic. No.Christopher CorsiniMunicipal AttorneyOfficial Mailing Address of MunicipalityMunicipal Complex100 Commons WayBridgwater, NJ 08807Fax #:Sheet ATerm ExpiresAllen Kurdyla12/31/2024Fillipe Pedroso12/31/2024Howard Norgalis12/31/2024Tim Ring12/31/2023Michael Kirsh12/31/2023

2022MUNICIPAL BUDGETTOWNSHIPMunicipal Budget of theBRIDGEWATERof, County ofSOMERSETIt is hereby certified that the Budget and Capital Budget annexed hereto and hereby made a parthereof is a true copy of the Budget and Capital Budget approved by resolution of the Governing Body on thefor the Fiscal Year 2022.Linda DoyleClerk100 Commons Wayday of, 202216Mayand that public advertisement will be made in accordance with the provisions of N.J.S.A. 40A:4-6 andN.J.A.C. 5:30-4.4(d).Certified by me, this16day of, 2022MayAddressBridgwater, NJ 08807Address908-722-4977Phone NumberIt is hereby certified that the approved Budget annexed hereto and hereby madea part is an exact copy of the original on file with the Clerk of the Governing Body, that alladditions are correct, all statements contained herein are in proof, and the total of anticipatedrevenues equals the total of appropriations.Certified by me, thisday of16It is hereby certified that the approved Budget annexed hereto and hereby madea part is an exact copy of the original on file with the Clerk of the Governing Body, that alladditions are correct, all statements contained herein are in proof, the total of anticipatedrevenues equals the total of appropriations and the budget is in full compliance with theLocal Budget Law, N.J.S.A. 40A:4-1 et seq., 2022MayCertified by me, thisRobert Swisherday ofRegistered Municipal AccountantAddressAnthony ManninoWestfield, NJ 07090(908) 789 - 9300Chief Financial OfficerAddressPhone NumberDO NOT USE THESE SPACESCERTIFICATION OF ADOPTED BUDGET(Do not advertise this Certification form)It is hereby certified that the amounts to be raised by taxation for local purposes has beencompared with the approved Budget previously certified by me and any changes required as acondition to such approval have been made. The adopted budget is certified with respect to theforegoing only.STATE OF NEW JERSEYDepartment of Community AffairsDirector of the Division of Local Government ServicesDated:16308 East Broad Street, 2022By:Sheet 1May, 2022

MUNICIPAL BUDGET NOTICESection 1.Municipal Budget of theTOWNSHIPof, County ofBRIDGEWATERSOMERSETfor the Fiscal Year 2022Be it Resolved, that the following statements of revenues and appropriations shall constitute the Municipal Budget for the year 2022;Be it Further Resolved, that said Budget be published in thein the issue ofMayThe Governing Body of the23, 2022TOWNSHIPBRIDGEWATERofRECORDED VOTEdoes hereby approve the following as the Budget for the year 2022:KurdylaAbstained(Insert Last Name)PedrosoNorgalisAyesRingNaysKirshAbsentNotice is hereby given that the Budget and Tax Resolution was approved by theofBRIDGEWATER, County ofA Hearing on the Budget and Tax Resolution will be held at7:30o'clockSOMERSETof theCOUNCIL MEMBERS, onMunicipal Complex16May, onTOWNSHIP, 2022.June#REF!at which time and place objections to said Budget and Tax Resolution for the year 2022 may be presented by taxpayers or otherinterested persons.Sheet 2, 2022 at

EXPLANATORY STATEMENTSUMMARY OF CURRENT FUND SECTION OF APPROVED BUDGETYEAR 2022General Appropriations For: (Reference to item and sheet number should be omitted in advertised budget)XXXXXXXXXXXX1. Appropriations within "CAPS" -XXXXXXXXXXXX(a) Municipal Purposes {(Item H-1, Sheet 19)(N.J.S.A. 40A:4-45.2)}35,205,035.772. Appropriations excluded from "CAPS" -XXXXXXXXXXXX(a) Municipal Purposes {(Item H-2, Sheet 28)(N.J.S.A. 40A:4-53.3 as amended)}9,731,781.41(b) Local District School Purposes in Municipal Budget (Item K, Sheet 29)-Total General Appropriations excluded from "CAPS" (Item O, Sheet 29)3. Reserve for Uncollected Taxes (Item M, Sheet 29) Based on Estimated98.62%4. Total General Appropriations (Item 9, Sheet 29)9,731,781.41Percent of Tax CollectionsBuilding Aid Allowance2022 - for Schools-State Aid2021 - 5. Less: Anticipated Revenues Other Than Current Property Tax (Item 5, Sheet 11) (i.e. Surplus, Miscellaneous Revenues and Receipts from Delinquent Taxes)6. Difference: Amount to be Raised by Taxes for Support of Municipal Budget (as follows)(a) Local Tax for Municipal Purposes Including Reserve for Uncollected Taxes (Item 6(a), Sheet XXX23,220,841.54(b) Addition to Local District School Tax (Item 6(b), Sheet 11)-(c) Minimum Library Tax-Sheet 3

EXPLANATORY STATEMENT - (Continued)SUMMARY OF 2021 APPROPRIATIONS EXPENDED AND CANCELEDGeneralSewerBudgetBudget Appropriations - Adopted BudgetBudget Appropriations Added by N.J.S.A. 40A:4-87Emergency AppropriationsTotal AppropriationsExpenditures:Paid or Charged (Including Reserve forUncollected Taxes)ReservedUnexpended Balances CanceledTotal Expenditures and UnexpendedBalances CanceledOverexpenditures et 3a

EXPLANATORY STATEMENT - (Continued)BUDGET MESSAGECAP CALCULATIONTotal General Appropriations for 2021Cap Base Adjustment:SubtotalExceptions Less:Total Other OperationsTotal Uniform Construction CodeTotal Interlocal Service AgreementTotal Additional AppropriationsTotal Capital ImprovementsTotal Debt ServiceTransferred to Board of EducationType I School DebtTotal Public & Private ProgramsJudgementsTotal Deferred ChargesCash DeficitReserve for Uncollected TaxesTotal ExceptionsCAP CALCULATION46,899,469.00Allowable Operating Appropriations beforeAdditional Exceptions per (N.J.S.A. 176.00Additions:New Construction (Assessor Certification)2020 Cap Bank Utilized2021 Cap Bank Utilized1,638,408.83Total .001,086,612.00Maximum Appropriations within "CAPS" Sheet 19 @2.5%37,047,448.20884,675.00Additional Increase to COLA rate.Amount of Increase .00Amount on Which CAP is Applied2.5% CAP34,356,929.00858,923.23Allowable Operating Appropriations beforeAdditional Exceptions per (N.J.S.A. 40A:4-45.3)35,215,852.23Maximum Appropriations within "CAPS" Sheet 19 @Total General Appropriations for Municipal Purposes3.5%37,391,017.4935,205,035.77(Sheet 19, H-1)Over or (Under) Appropriations CapNOTE:Sheet 3bMANDATORY MINIMUM BUDGET MESSAGE MUST INCLUDE A SUMMARY OF:1. HOW THE "CAP" WAS CALCULATED. (Explain in words what the "CAPS" mean and show the figures2. A SUMMARY BY FUNCTION OF THE APPROPRIATIONS THAT ARE SPREAD AMONG MORE THAN ONE OFFICIAL LINE ITEM(e.g. if Police S & W appears in the regular section and also under "Operation Excluded from "CAPS" section, combine thfigures for purposes of citizen understanding.)(2,185,981.72)

EXPLANATORY STATEMENT - (Continued)BUDGET MESSAGERECAP OF GROUP INSURANCE APPROPRIATIONFollowing is a recap of the Municipality's Employee Group InsuranceEstimated Group Insurance Costs - 2022 7,842,489.45Estimated Amounts to be Contributed by Employees:Contribution from all eligible emp.977,489.456,865,000.00Budgeted Group Insurance - Inside CAPBudgeted Group Insurance - UtilitiesBudgeted Group Insurance - Outside CAPTOTAL6,865,000.006,865,000.00Instead of receiving Health Benefits,20 employeeshave elected an opt-out for 2022. This opt-out amountis budgeted separately.Health Benefits WaiverSalaries and Wages 75,605.00Sheet 3b (2)

EXPLANATORY STATEMENT - (Continued)BUDGET MESSAGENEW JERSEY 2010 LOCAL UNIT LEVY CAP LAWP.L. 2007, c. 62, was amended by P.L. 2008 c. 6 and P.L. 2010 c. 44 (S-29 R1).The last amendment reduces the 4% to 2% and modifies some of the exceptions andexclusions. It also removes the LFB waiver. The voter referendum now requires a vote inexcess of only 50% which is reduced from the original 60% in P.L. 2007, c. 62.ADJUSTED TAX LEVY PRIOR TO EXCLUSIONSExclusions:Allowable Shared Service Agreements IncreaseAllowable Health Insurance Costs IncreaseAllowable Pension Obligations IncreasesAllowable LOSAP IncreaseAllowable Capital Improvements IncreaseAllowable Debt Service and Capital Leases Inc.Recycling Tax appropriationDeferred Charge to Future Taxation UnfundedCurrent Year Deferred Charges: EmergenciesAdd Total ExclusionsLess Cancelled or Unexpended WaiversLess Cancelled or Unexpended .00230,000.001,350,565.0032,385.00SUMMARY LEVY CAP CALCULATIONLEVY CAP CALCULATIONPrior Year Amount to be Raised by TaxationLess:Less: Prior Year Deferred Charges to Future Taxation UnfundedLess: Prior Year Deferred Charges: EmergenciesLess: Prior Year Recycling TaxLess:Less:Net Prior Year Tax Levy for Municipal Purpose Tax for CAP CalculationPlus 2% CAP IncreaseADJUSTED TAX LEVYPlus: Assumption of Service/FunctionADJUSTED TAX LEVY PRIOR TO 660.79420,813.2221,461,474.01ADJUSTED TAX LEVYAdditions:New Ratables - Increase for new constructionPrior Year's Local Purpose Tax Rate (per 100)New Ratable Adjustment to LevyAmounts approved by ReferendumLevy CAP Bank 00.00MAXIMUM ALLOWABLE AMOUNT TO BE RAISED BY TAXATION23,672,841.16AMOUNT TO BE RAISED BY TAXATION FOR MUNICIPAL PURPOSES23,220,841.5421,461,474.01Sheet 3 - Levy CAPOVER OR (UNDER) 2% LEVY CAP(must be equal or under for Introduction)(451,999.61)

EXPLANATORY STATEMENT - (Continued)BUDGET MESSAGE"2010" LEVY CAP BANKS:2019Maximum Allowable Amount to be Raised by TaxationAmount to be Raised by Taxation for Municipal PurposeAvailable for Banking (CY 2022)Amount Used in CY 2022Balance to Expire-Maximum Allowable Amount to be Raised by TaxationAmount to be Raised by Taxation for Municipal PurposeAvailable for Banking (CY 2022 - CY 2023)Amount Used in CY 2022Balance to Carry Forward (CY 2023)-20202021Maximum Allowable Amount to be Raised by TaxationAmount to be Raised by Taxation for Municipal PurposeAvailable for Banking (CY 2022 - CY 2024)Amount Used in CY 2022Balance to Carry Forward (CY 2023 - CY2024)-2022Maximum Allowable Amount to be Raised by TaxationAmount to be Raised by Taxation for Municipal PurposeAvailable for Banking (CY 2023 - CY 2025)Total Levy CAP Bank23,672,84123,220,842452,000452,000Sheet 3d

CURRENT FUND - ANTICIPATED REVENUESFCOAGENERAL REVENUES1. Surplus Anticipated08-1012. Surplus Anticipated with Prior Written Consent of Director of Local Government Services08-102Total Surplus Anticipated08-1003. Miscellaneous Revenues - Section A: Local 435,404.006,300,000.006,300,000.00Realized inCash in XXXXXXXXAlcoholic .0039,000.0048,540.10Fees and Permits08-105457,000.00350,000.00457,636.80Fines and Costs:XXXXXXXMunicipal Court08-110Other08-109Interest and Costs on Taxes08-112Interest and Costs on Assessments08-115Parking Meters08-111Interest on Investments and Deposits08-113Anticipated Utility Operating Surplus08-114Recreation Fees08-229Sheet .00120,649.56

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUES3. Miscellaneous Revenues - Section A: Local Revenues (continued)Sheet 4aAnticipated20222021Realized inCash in 2021

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUES3. Miscellaneous Revenues - Section A: Local Revenues (continued)Sheet 4bAnticipated20222021Realized inCash in 2021

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUESAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section A: Local Revenues (continued)Total Section A: Local Revenue08-001Sheet 4c1,323,000.001,384,000.001,471,702.72

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUESAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section B: State Aid Without Offsetting AppropriationsTransitional Aid09-212Consolidated Municipal Property Tax Relief Aid09-200Energy Receipts Tax (P.L. 1997, Chapters 162 & en State .005,904,261.005,906,465.00Total Section B: State Aid Without Offsetting AppropriationsSheet 5

CURRENT FUND - ANTICIPATED REVENUES - (Continued)GENERAL REVENUESFCOAAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section C: Dedicated Uniform Construction Code FeesOffset with Appropriations (N.J.S.A. 40A:4-36 and N.J.A.C. 5:23-4.17)XXXXXXXUniform Construction Code FeesSpecial Item of General Revenue Anticipated with Prior WrittenConsent of Director of Local Government Services:Additional Dedicated Uniform Construction Code Fees Offset with Appropriations(N.J.S.A. 40A:4-45.3h and N.J.A.C. XXXXXXXXXXXXXXXUniform Construction Code Fees08-160Total Section C: Dedicated Uniform Construction Code Fees Offset with AppropriationsSheet 608-0021,250,000.001,250,000.001,280,713.00

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUESAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section D: Special Items of General Revenue AnticipatedWith Prior Written Consent of the Director of Local Government ServicesShared Service Agreements Offset With XXXXXShared Municipal Court11-108270,000.00210,009.35Class III Special BOE11-11070,000.0065,000.00Shared Resource Officer BOE11-110127,000.00110,000.00116,548.55Joint Services with County Library11-119123,500.00115,166.37112,030.61Sheet 7212,244.36

CURRENT FUND - ANTICIPATED REVENUES - (Continued)FCOAGENERAL REVENUESAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section D: Special Items of General Revenue AnticipatedWith Prior Written Consent of the Director of Local Government ServicesShared Service Agreements Offset With Appropriations:XXXXXXXSheet 7aXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

CURRENT FUND - ANTICIPATED REVENUES - (Continued)GENERAL REVENUESFCOAAnticipated20222021Realized inCash in 20213. Miscellaneous Revenues - Section D: Special Items of General Revenue AnticipatedWith Prior Written Consent of the Director of Local Government ServicesShared Service Agreements Offset With Appropriations:Total Section D: Shared Service Agreements Offset With AppropriationsSheet ,175.72XXXXXXXXXXX440,823.52

CURRENT FUND - ANTICIPATED REVENUES - (Continued)GENERAL REVENUESFCOAAnticipated20222021Realized inCash in 20213. Mi

STATE OF NEW JERSEY Department of Community Affairs Director of the Division of Local Government Services Dated: , 2022 By: 2022 TOWNSHIP BRIDGEWATER SOMERSET 16 Linda Doyle 100 Commons Way Bridgwater, NJ 08807 MUNICIPAL BUDGET May Phone Number Registered Municipal Accountant 16 May May 16 Robert Swisher May 308 East Broad Street Address Sheet 1