Transcription

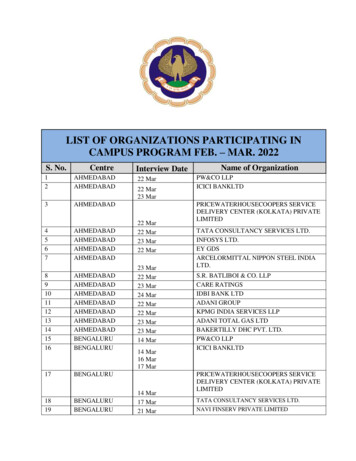

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028Number 028 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Saturday 28-01-2012News reports received from readers and Internet News articles copied from various news sites.The PACIFIC PANDA moored in Singapore Jurong – Photo : E.KnispAbove photo can also be seen in high resolution in the Maasmond Maritime Flickr photo album , just click hereDistribution : daily to 20750 active addresses28-01-2012Page 1

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028Your feedback is important to me so please drop me an email if you have any photos orarticles that may be of interest to the maritime interested people at sea and ashorePLEASE SEND ALL PHOTOS / ARTICLES TO :newsclippings@gmail.comIf you don't like to receive this bulletin anymore :To unsubscribe click here (English version) or visit the subscription page on our en.aspx?lan en-USEVENTS, INCIDENTS & OPERATIONSBoonsweg 19, 3274 LHP.O.Box 5023, 3247 ZJHeinenoord – The NetherlandsT 31 (0) 186-603333F 31 (0) 186-603619E info@tenwolde.comW www.tenwolde.comThe VOS PRODUCER (ex Rig Express) moored in Ijmuiden – Photo : Joop Marechal EU launches attempt to deliver shippingemissions trading schemeDistribution : daily to 20750 active addresses28-01-2012Page 2

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028The EU is asking for views on how best to reduce greenhouse gas emissions from shipping in a move that could pavethe way for the sector to follow aviation into the bloc's carbon trading scheme, Business Green reports. A consultationdocument published last week considers a number of options for curbing emissions, including a market-basedmechanism that would apply to ships' emissions from the port they left to any EU port, and then on to the next port ofcall. This could mean bringing shipping into the EU's emissions trading scheme, a move that would require carriers topurchase carbon allowances to cover the CO2 they produce. However, the consultation document alternativelyproposes a straight tax on bunker fuel or emissions, the levelling of carbon caps on vessels, and a "compensationfund" that would see companies make payments in line with the environmental damage the industry causes.Although an EU source told BusinessGreen there is "no preferred option," the EU has made noises about takingshipping into the emissions trading scheme (EU ETS) in the past. Shipping emissions account for approximately threeper cent of current global CO2 emissions, but are expected to more than double by 2050 if no additional measures aretaken to reduce the sector's carbon footprint. Long-running talks at the International Maritime Organisation (IMO)have come up with a series of efficiency targets, which the UN body estimates will cut emissions by a quarter over thenext 20 years.But the EU noted in a statement accompanying its consultation that "there has been only limited progress to date onthe necessary technical, operational and market-based measures for new and existing ships". European Legislationcompelled the EU to take action if no international agreement to deal with maritime emissions was in place by the endof 2011 to help meet its own target of a 20 per cent emissions cut across all sectors by 2020. While the industryrecognises the problem, it is highly unlikely to support any regional attempt to reduce emissions, arguing that any newgreen policy measures should be applicable worldwide in order to avoid trade disparities. The arguments mirror therow over the EU's attempts to shoehorn airlines into the ETS, which this year saw airlines forced into the emissionstrading scheme for the first time, despite legal and political efforts to overturn the EU's decision. The EU again appearsto be ready for a scrap with the shipping industry and other governments, and is already arguing that with theinternational community failing to act it has the right to introduce its own emissions-reduction regime. "Theintroduction of measures to cut emissions will also limit fuel consumption – reducing ships' fuel bills by many billions ofeuros each year – and hence bring down transport costs," it said in a statement. "Such action will also stimulatedemand for 'low-carbon' maritime equipment and services." A spokeswoman for the IMO said the organisation had nocomment to make on the consultation, but pointed out that "moving forward on market-based measures" was one ofthe main items on the Marine Environment Committee's agenda when it meets at the end of next month. Theconsultation is open for submissions until 12 April. Source : PortNews3800 HP TUG FOR CHARTER3800 hp (40 ton BP) TTB SALVOR is available for(prompt) charter in SingaporeIf interested please contact :Richard ( rw@ttbisso.com )OrPiet at ( ps@ttbisso.com )Salvage firms line up to recover strickencruise shipDutch, US and Danish marine salvage experts are among the firms lined up to break up or salvage the wrecked oceanliner Costa Concordia, news agency Reuters reports. A salvage expert appointed by one of the ship’s insurers saidcompanies likely to bid include Smit Salvage, an arm of Dutch group Boskalis-Westminster, Titan Salvage, owned byCrowley Maritime Corp of the US and Denmark's Svitzer, owned by Maersk. ‘The ship is definitely re-floatable, but it's aquestion of cost-benefit about whether that is worth it,’ he told the news agency.Smit has already been asked to pump the 2,300 tonnes of fuel from the ship. ‘Our involvement is limited to fuelextraction and does not pertain to the eventual removal of the vessel, but our track record shows we are also capableof doing that,’ said spokesman Martijn Schuttevaer. Smit led the salvage of the Herald of Free Enterprise ferryDistribution : daily to 20750 active addresses28-01-2012Page 3

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028which sank 25 years ago just outside the Belgian port of Zeebrugge, killing 193 passengers and crew. Smit was alsoinvolved in lifting Russian nuclear submarine Kursk from the Barents Sea in 2001. Source : DutchNewsThe BEAUMAGIC outbound from the Ijmuiden locks – Photo : Hans Blomvliet Thailand seeks to build maritime tieswith IndiaThailand Prime Minister Yingluck Shinawatra on Wednesday expressed desire to double trade with India to USD 14billion by 2014 and forge maritime partnership to develop seaport at Dawei,a strategic location on the southwesterncoast of Myanmar, PTI reports. Addressing leaders of Indian industry at the luncheon meeting hosted by Assocham,Ficci and CII here, Shinawatra said, the two countries can also have cooperation in developing the port infrastructureat Chennai."My government has decided to invest in transport and connect with our neighbours.we could set up a maritimelinkage with Chennai and Dawei seaport in Myanamar.," the visiting Prime Minister said, adding the road connectivitycan also be developed. Dawei is a strategic location for India to get access to South East Asian markets. China isinvesting heavily in the countries neighbouring India. Shinawatra said India-Thailand trade has seen a quantum jumpfrom USD one billion to USD seven billion in the last ten years, helped by 'Early Harvest' pact, limited to 82 items.Distribution : daily to 20750 active addresses28-01-2012Page 4

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028The two countries want to upgrade it to a full-fledged Comprehensive Economic Partnership Agreement (CEPA)covering not only goods but also services and investment. "We will work together to finalise FTA (CEPA) by middle ofthis year. This will cut the tariff on remaining products. This is why the two governments are setting up a goal todouble the bilateral trade to USD 14 billion in 2014," Shinawatra, who would be the Chief Guest at the Republic Daycelebrations, said.She said there is a potential to collaborate in areas like IT, manufacturing, tourism and medical services. "We hope towork together to set up a high-level forum with businessmen," she said. Stating that Thailand has expertise in themanufacturing sector, Commerce and Industry Minister Anand Sharma said, "We would like to invite your companiesand institutions to become partner in this. You have achieved a lot in construction of highways, ports and airports."In October last year, the government had cleared the National Manufacturing Policy (NMP), which seeks to set upmega industrial zones. The policy aims to raise the share of manufacturing in the country's Gross Domestic Product to25 per cent from 16 per cent at present. It is expected to create 100 million jobs in the sector. Sharma also saidThailand companies can look at investing in the Delhi-Mumbai Industrial Corridor (DMIC) project, which aims to createindustrial infrastructure covering over 1,483 km."I would request your industry to look at investing along the corridor.," he said, adding that Thailand's strength -especially in electronic software manufacturing -- could help India to complete its projects related to innovation andmanufacturing. Meanwhile, an agreement was signed between Delhi-based Indo Rama Synthetics and Bangkok'sIndorama Ventures for setting up a facility in India for polyester fibre at an investment of USD 700 million. Source :PortNewsIskes ARGUS assisting an arriving vessel in the port of IJmuiden - Photo : Willem Koper Distribution : daily to 20750 active addresses28-01-2012Page 5

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028Earlier this week during a very very grey weather with not much light the tug Wojtek came in to Dordrecht with thehull of a Shoalbuster with yardnumber 571672. Photo : R&F van der Hoek – LEKKO Cunard's Queen Elizabeth to make SanFrancisco maiden callPhoto : Arnold T. Slotboom On February 4, Cunard Line’s Queen Elizabeth will make her inaugural call to San Francisco, marking her only U.S.maiden call this year, Cruise Industry News reports. Currently sailing her 107-day World Cruise, Queen Elizabeth willdock at Pier 35 along the city’s famed Embarcadero, and is scheduled to arrive between 5:30-6:00 a.m. and depart atapproximately 9:00 p.m. “We are very pleased to introduce our newest Cunarder to Bay Area residents who havehistorically extended a gracious welcome to our fleet of Queens,” said Peter Shanks, president of Cunard Line. “Thecity’s warm hospitality, iconic landmarks, world-class dining and culture are always a highlight for our well-travelledguests.”Distribution : daily to 20750 active addresses28-01-2012Page 6

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028Named by Her Majesty The Queen in Southampton, England in October 2010, Queen Elizabeth is the second largestCunarder ever built, after flagship Queen Mary 2. Cunard’s longtime relationship with Great Britain’s Royal Family isreflected throughout the ship, including a specially-commissioned portrait of Her Majesty The Queen.While this will be Queen Elizabeth’s inaugural visit to San Francisco, the city has held historical significance forCunard ships since 1942, when the original Queen Elizabeth visited as part of her war duties, and where she alsounderwent a refit. Later, in 1978, Queen Elizabeth 2 made her maiden call to San Francisco, visiting a dozen timesmore in subsequent years. Five years ago to the day of Queen Elizabeth’s upcoming maiden call, flagship QueenMary 2 was warmly received by hundreds who came out to welcome her during her 2007 inaugural visit; and QueenVictoria was also graciously greeted by the city during her 2009 maiden call.The QUEEN MARY 2 visited Cape Town last week where the passenger liner berthed without assistance of anyharbor tugs – Photo : Ian ShiffmanCunard continues their enduring relationship with the city by the bay and is pleased to be the Preferred Cruise Partnerof the San Francisco Symphony’s 2012 Black & White Ball this June. The best locations to view the ship’s sailaway asshe departs the harbour are: Golden Gate Overlook: At Golden Gate National Recreation Area The Marina Green: Between Fort Mason and the Presidio, adjacent to San Francisco Bay Fort Mason: Located in the northern Marina District, alongside San Francisco Bay Aquatic Park: At the historic Hyde Street Pier PIER 39: Two-blocks east of Fisherman’s Wharf at Beach Street and The Embarcadero. Convenient parking isavailable across the street in the PIER 39 Garage. Treasure Island: Connected to Yerba Buena Island, which has exits and entrances into and out of the SanFrancisco – Oakland Bay Bridge (I-80) in both directions. Travel between Yerba Buena and Treasure Islands and therest of San Francisco is toll-free in both directions.From San Francisco, Queen Elizabeth will continue her World Cruise, which includes stops in Hawaii, AmericanSamoa, Fiji, New Zealand, Australia, Hong Kong, Vietnam, Malaysia, Thailand, India, United Arab Emirates, Egypt,Greece, Italy, Monaco and PortugalPLEASE MAINTAIN YOUR MAILBOX, DUE TO NEW POLICY OF THEPROVIDER, YOUR ADDRESS WILL BE “DEACTIVATED”AUTOMATICALLY IF THE MAIL IS BOUNCED BACK TO OUR SERVERIf this happens to you please send me a mail at newsclippings@gmail.com to reactivateyour address again, please do not write this in the guestbook because I am notchecking this guest book daily.Distribution : daily to 20750 active addresses28-01-2012Page 7

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028The 1978 built MHL flag semi-submersible heavy lift ship EIDE TRADER leaving Grand Harbour, Malta on Wednesday25th January, 2012 bound to Murmansk, Russia loaded with MRTS split hopper barges BD 6 and BD 7 together withbackhoe dredger SERVICE after they were loaded from Sakhalin, Russia.Photo : Cpt. Lawrence Dalli - www.maltashipphotos.com Northern RockLeading ratings agency Standard and Poor’s (S&P) has confirmed North P&I club’s ‘A’ financial strength rating andstable outlook for the eight consecutive year.The agency says its rating reflects the 150 million GT club’s continued‘very strong financial flexibility, strong capitalisation and strong competitive position’.According to S&P analysts Tufan Basarir and Peter McClean, ‘North now ranks as the second largest member of theInternational Group of P&I Clubs by owned tonnage and the third largest by total tonnage. We believe that the clubwill maintain its strong competitive position by continuing to manage the growth in its tonnage to ensure that financialstrength and member service are not weakened, nor the club’s portfolio quality diluted’.S&P sees North’s 20-year record of not having to ask members for unbudgeted supplementary funding as a significantsuccess factor. ‘The club’s avoidance of unplanned supplementary calls, in our opinion, has contributed positively tothis growth. We do not expect the club to make supplementary calls over the next two years (two-year rating horizon)because of its strong capitalisation.’ The agency also says North has a long-term track record of outperforming most ofits peers, which can be attributed to firmer underwriting of risks and a low expense base. ‘This is best illustrated byDistribution : daily to 20750 active addresses28-01-2012Page 8

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028North’s 14-year average combined ratio over 1998-2011 of 102%, compared with International Group clubs’ averageof 114% over the same period,’ say the analysts. In addition S&P believes North has clear strategic goals. ‘First andforemost is the continued development of a quality portfolio within a framework of financial strength, andcomprehensive service and support for members. The club has virtually achieved its goal of increasing its market shareof mutual business to 12.5%. This growth will yield economies of scale for operational expenses. ‘North also hasextensive operational controls in place that ensure a high level of accountability. Preparations for Solvency II haveseen enhancements made to the club’s financial reporting structures to enable automated quarterly balance sheetreporting, which supports the solvency capital calculations,’ say the analysts. Responding to S&P’s comments,chairman Pratap Shirke said, ‘I am pleased we have yet again maintained our ‘A’ (stable) rating, which is a testamentto the continuing quality, diversity and international spread of our membership portfolio as well as to our financialprudence and service quality. It also serves to demonstrate the importance of achieving the 5% general increase wehave set for premiums at next month’s renewal, both to preserve our financial strength and maintain our rating in thecurrent adverse economic climate.’North is a leading marine mutual liability insurer providing P&I, FD&D, war risks and ancillary insurance to 115 millionGT of owned tonnage and 35 million GT of chartered tonnage, with 6000 ships entered by 400 members. It is based inNewcastle upon Tyne, UK with regional offices in Hong Kong, Piraeus and Singapore. The club is a leading member ofthe International Group of P&I Clubs, with approximately 12% of the group’s owned tonnage. The 13 group clubsprovide liability cover for approximately 90% of the world’s ocean-going tonnage and, as a member of the group,North protects and promotes the interests of the international shipping industry.Leading ratings agency Standard and Poor’s (S&P) has confirmed North P&I club’s ‘A’ financial strength rating andstable outlook for the eight consecutive year. The agency says its rating reflects the 150 million GT club’s continued‘very strong financial flexibility, strong capitalisation and strong competitive position’. According to S&P analysts TufanBasarir and Peter McClean, ‘North now ranks as the second largest member of the International Group of P&I Clubs byowned tonnage and the third largest by total tonnage. We believe that the club will maintain its strong competitiveposition by continuing to manage the growth in its tonnage to ensure that financial strength and member service arenot weakened, nor the club’s portfolio quality diluted’. S&P sees North’s 20-year record of not having to ask membersfor unbudgeted supplementary funding as a significant success factor. ‘The club’s avoidance of unplannedsupplementary calls, in our opinion, has contributed positively to this growth. We do not expect the club to makesupplementary calls over the next two years (two-year rating horizon) because of its strong capitalisation.’ The agencyalso says North has a long-term track record of outperforming most of its peers, which can be attributed to firmerunderwriting of risks and a low expense base. ‘This is best illustrated by North’s 14-year average combined ratio over1998-2011 of 102%, compared with International Group clubs’ average of 114% over the same period,’ say theanalysts. In addition S&P believes North has clear strategic goals. ‘First and foremost is the continued development ofa quality portfolio within a framework of financial strength, and comprehensive service and support for members. Theclub has virtually achieved its goal of increasing its market share of mutual business to 12.5%. This growth will yieldeconomies of scale for operational expenses. ‘North also has extensive operational controls in place that ensure a highlevel of accountability. Preparations for Solvency II have seen enhancements made to the club’s financial reportingstructures to enable automated quarterly balance sheet reporting, which supports the solvency capital calculations,’say the analysts. Responding to S&P’s comments, chairman Pratap Shirke said, ‘I am pleased we have yet againmaintained our ‘A’ (stable) rating, which is a testament to the continuing quality, diversity and international spread ofour membership portfolio as well as to our financial prudence and service quality. It also serves to demonstrate theimportance of achieving the 5% general increase we have set for premiums at next month’s renewal, both to preserveour financial strength and maintain our rating in the current adverse economic climate.’ North is a leading marinemutual liability insurer providing P&I, FD&D, war risks and ancillary insurance to 115 million GT of owned tonnage and35 million GT of chartered tonnage, with 6000 ships entered by 400 members. It is based in Newcastle upon Tyne, UKwith regional offices in Hong Kong, Piraeus and Singapore. The club is a leading member of the International Group ofP&I Clubs, with approximately 12% of the group’s owned tonnage. The 13 group clubs provide liability cover forapproximately 90% of the world’s ocean-going tonnage and, as a member of the group, North protects and promotesthe interests of the international shipping industry.ALSO INTERESTED IN THIS FREE MARITIME NEWSCLIPPINGS ?PLEASE VISIT THE WEBSITE :WWW.MAASMONDMARITIME.COMAND REGISTER FOR FREE !Distribution : daily to 20750 active addresses28-01-2012Page 9

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028The BOW TONE enroute Rotterdam – Photo : Ria Maat NAVY NEWSFrank Cable Conducts Fire Drills At SeaSailors assigned to the submarine tender USSFrank Cable (AS 40) practiced hose handlingtechniques on the flight deck during a trainingevolution at sea. Frank Cable is temporarily relievedfrom conducting maintenance of submarines andservice vessels deployed in the U.S. 7th Fleet areaof operations by submarine tender USS Emory S.Land (AS 39). Photo : U.S. NavyFlight deck fire drills were scheduled for all dutysection Sailors to give them the opportunity toimprove their firefighting tactics, teamwork, andknowledge of firefighting procedures."You need to be prepared at all times,” said ChiefHull Maintenance Technician (SW) David Devoe. “Alot of people usually think a general quarter’sDistribution : daily to 20750 active addresses28-01-2012Page 10

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028situation is what will lead to a casualty, but most of the casualties you are going to have to face are in port at two inthe morning when there is a flooding in a storeroom.” The crew was prepped on Self Contained Breathing Apparatus’(SCBA) before they donned them. Frank Cable Sailors were also taught the proper hose handling techniques as theysprayed down the flight deck.Devoe said Sailors sometimes become lackadaisical, having a mindset that since they’re not going to the Gulf theydon’t need to train. He highlighted that at anytime and moment the ship could have a casualty and the crew needs toprepare for that both physically and mentally. Safety was paramount for the Damage Control Training Team and FrankCable Chiefs during the drills. “We are always looking for the safety of the crew during these drills,” said ChiefElectrician’s Mate (SW/AW) Charlie Duque. “If somebody get hurts, we can direct them to the person in charge andkeep the fire fighting team combating the causualty.”This was Yeoman 1st Class Patrice Fant’s first fire fighting drill. Fant is a reservist temporarily assigned to the FrankCable from Navy Operations Support Center (NOSC) Cincinnati. “The training was a good learning experience thatmade me think, if a real fire happened how I would anticipate and handle the real thing.” Fant added, “I believe thatevery Sailor should have to go through this training.”During Frank Cable’s underway period, the ship is going to do multiple fire fighting drills, as well as flooding drillsbefore they reach Portland, Ore. to keep the Sailors up to speed. Frank Cable is temporarily relieved from conductingmaintenance of submarines and service vessels deployed in the U.S. 7th Fleet area of operations by submarine tenderUSS Emory S. Land (AS 39) and is currently in the Pacific Ocean headed to Portland, Ore. for a regular overhauland dry-docking (ROH). Following the dry-docking maintenance, sea trials will be conducted before Frank Cablemakes her transit back to Guam.Russia's N-powered submarine to enterservice by JuneRussia's newest nuclear-powered submarine -- the Yury Dolgoruky -- will be put into operation in the second quarterof the year, the shipbuilding group said. The Borey-class Project 955 submarine will be armed with the Bulavaintercontinental ballistic missiles. But a representative from the United Shipbuilding Corporation said it was yet to bedecided when the missile will enter service.The submarine's construction began in 1996 at the Sevmash shipyard and was completed in 2008. It has a crew of130 and will be armed with 16 Bulava missiles and six SS-N-15 cruise missiles. President Dmitry Medvedev said inDecember that the flight tests of the Bulava missiles were completed and it will now be adopted for service with theRussian Navy.Russia successfully test launched two Bulava missiles on December 23. They were the 18th and 19th test launches ofthe troubled Bulava. Only 11 launches have been officially declared successful. But some analysts suggest that inreality the number of failures is considerably larger. Russian military expert Pavel Felgenhauer said that of the Bulava'sfirst 12 test launches, only one was entirely successful. Despite several previous failures, officially blamed onmanufacturing faults, the Russian military has insisted that there is no alternative to the Bulava.The Bulava (SS-NX-30), developed by the Moscow Institute of Thermal Technology, carries up to 10 MIRV warheadsand has a range of over 8,000 km. The three-stage ballistic missile is designed for deployment on Borey-class nuclearsubmarines. Source : zeenewsSubmarine purchase plan to be refloatedThe Thaise Defence Minister Sukumpol Suwanatat vowed to re-examine the navy's plan to buy submarines. On his firstday in office at the Defence Ministry, ACM Sukumpol said he would continue to push for the implementation ofincomplete plans and projects, including the submarine purchase."We will look at it. The navy must explain to the public why the submarine purchase is an appropriate project," ACMSukumpol said. The minister also told navy chief Adm Surasak Roonroengrom to clarify details of the submarineproject to the cabinet and the public. The navy had planned to buy six second-hand submarines from Germany.However, as the cabinet has not yet approved the plan, Germany has since sold two of the submarines to Colombia.The navy now hopes to buy the remaining four subs for 5.5 billion baht. "If the navy had submarines, the balance ofDistribution : daily to 20750 active addresses28-01-2012Page 11

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028military power in the region would change," a navy source said. He warned Cambodia may well obtain submarinesbefore Thailand as it can rely on its alliances with "superpowers". Source : Bangkok PostIs the Navy's newest sub worth the price?Not much of a sea-based deterrentJust when the Russian nuclear-powered Akula-II submarine joins the Indian Navy as INS Chakra on a 10-year lease ata cost of over one billion, the moot question is: does it contribute to India's sea-based nuclear deterrence?To put matters in perspective, India in 1988 had procured the Soviet Charlie I class nuclear attack submarine,renamed INS Chakra on a three-year lease. The vessel came without strategic weapons, with the sole purpose offamiliarising naval personnel on training and maintenance of nuclear-powered submarines. The rules of engagementspelt out that INS Chakra would not be used in war. The hidden part of the deal was that Soviets would help India inits indigenous Advanced Technology Vessel (ATV), both materially and intellectually. While the promised assistance tothe ATV programme which culminated in the launch of 80MW nuclear reactor S-2 vessel (to be called INS Arihant oncommissioning) by Prime Minister Manmohan Singh on 26 July 2009 came in fits and starts, the technology of the6,000 tonne vessel is between first and second generation vintage. By comparison, the U.S. has ninth generationnuclear-poweredsubs which do notrequirerefuellingthroughouttheirlifetime.The Russian Akulasub, given the samename, INS Chakracomes with similarpurpose and rules ofengagement.Likethe earlier deal, theundisclosedunderstandingthistime is that it is partoftheGorshkovpackage(INSVikramaditya) andincludesRussianhelp in the follow-onindigenous nuclear-powered vessels. While S-2 vessel began sea-trials in January (could last 12 to 18 months), Indiahas planned follow-on S-3 and S-4 vessels based on the S-2 design. As all three vessels have similar hull and nuclearpower plant, capability enhancements will be meagre. It is only when the S-5 vessel with a new design and a powerfulnuclear reactor is launched, which could be two-decades away, can India hope to have a semblance of sea-baseddeterrence against China. The S-2 and the coming S-3 and S-4 vessels will lack adequate capabilities in three keyareas of stealth, reactor design and missile range to become a deterrent ballistic missile armed nuclear-poweredDistribution : daily to 20750 active addresses28-01-2012Page 12

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 028submarine (SSBN) against China, which with its Jin class subs is at least four decades ahead. India's S-2 vessel armedwith 700km K-15 missile will have difficulty in even deterring Pakistan as, given its limitations, it would be required tobe positioned closer to hostile shore. Against this backdrop, a retired chief of naval staff had told me that the comingof Akula four years late, when the S-2 vessel is already undergoing sea-trials, serves little purpose. While still in office,he had written to the government to review the leasing of Akula programme. According to him, there is a case todispense with the S-3 and S-4 vessels which will consume enormous time and finances. India, after all, is still on thetechnology understanding curve and not ready for production. Therefore it should leap-frog to work on S-5 vesselswhich would entail imagination and initiative. Given improved relations with the U.S. and France, why cannot Indiaseek advanced reactor technology from them? Developing long range ballistic missile would have

Number 028 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Saturday 28-01-2012 . News reports received from readers and Internet News articles copied from various news sites. The PACIFIC PANDA moored in Singapore Jurong - Photo : E.Knisp . Above photo can also be seen in high resolution in the Maasmond Maritime Flickr photo album , just click