Transcription

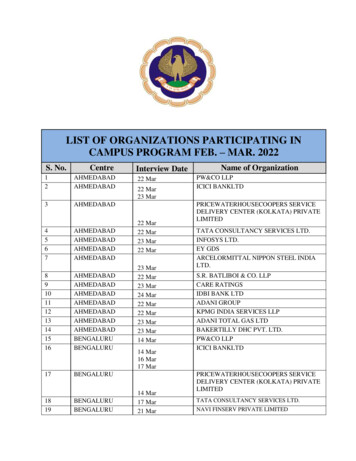

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039Number 039 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Saturday 08-02-2014News reports received from readers and Internet News articles copied from various news sites.The Dockwise semi-submersible heavy load transport ships MIGHTY SERVANT 3 (left)and FJELL moored at Drydocks World in Batam (Indonesia)Photo : Piet Sinke (c) CLICK on the photo to view the High Resolution version !Distribution : daily to 28400 active addresses08-02-2014Page 1

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039Your feedback is important to me so please drop me an email if you have any photos orarticles that may be of interest to the maritime interested people at sea and ashorePLEASE SEND ALL PHOTOS / ARTICLES TO :newsclippings@gmail.comIf you don't like to receive this bulletin anymore :To unsubscribe click here (English version) or visit the subscription page on our en.aspx?lan en-USEVENTS, INCIDENTS & OPERATIONSSee PRONOMAR latest movie at : http://www.youtube.com/watch?v R1dxKALwv7w this latest movie isshowing the PRONOMAR drying systems installed onboard the Fred. Olsen Windcarrier "BOLD TERN" andonboard the HGO InfraSea Solutions owned "INNOVATION" please CLICK on the link to view to movie !Jan de Nul’s TSHD JUAN SEBASTIAN DE ELCANOanchored off Batam Island, a trailing suction hopperdredger is mostly used for dredging loose material suchas sand, clay or gravel. To this end, one or two suctiontubes equipped with a drag head that is trailed over the ground are lowered. Througha pump system the sand/water mixture is sucked in and stored in the ‘hopper’ or wellof the vessel. Once fully loaded, the vessel sails to the unloading site where thematerial can be offloaded through its bottom doors or be reclaimed using the‘rainbowing’ technique. The on-site pumping of the sand using a floating pipeline isanother frequently used unloading technique. The JUAN SEBASTIAN ELCANO(callsign LXDD) is built in 2002 at IZAR Construcciones Navales SA - Sestao YardDistribution : daily to 28400 active addresses08-02-2014Page 2

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039under hull No.: 322 and is having a hoppercapacity of 16.500 m3 the 26.650 DWTdredger is having a length of 157.5 mtr anda width of 27.8 mtr and when loaded a draftof 11.1 mtr. For dredging is installed 2 x2250 Kw (pump power – trailing) and fordischarging 9500 Kw pump power isavailable, for the propulsion of the dredger 2x 8400 kW MAN 8L48/60 engines areinstalled which giving the dredger a servicespeedof15.7knots,onboardisaccommodation for 42 person.CLICK HERE to view theworking principlesoftheTrailingSuctionHopper Dredger. JanDe Nul Group is afamily-ownedBelgiancompany,withthefinancial headquarters inLuxembourg,thatprovides services relating to the construction and maintenance ofmaritime infrastructure on an international basis. Its main focus isdredging (including other forms of marine engineering), which accountsfor 85% of the turnover. Other areas include civil engineering andenvironmental technology. Originally founded in 1938, in Hofstade nearAalst, Belgium, Jan De Nul started as a construction companyspecialised in civil works and maritime construction. It was only in 1951that the company entered into the dredging business.At the end of2008, Jan DeNul had 4985employeesand a yearly turnover of 1.882 billion euroIt is one of the four largest dredgingcompanies in the world, together with Dutchcompanies Royal Boskalis Westminster and Van Oord, and fellow Belgians DEME. Jan De Nul has a fleet of over80 ships, including 14 cutter suction dredgers, 26 trailing suction hopper dredgers, 20 split barges, 5 backhoe dredgersand 17 rock transport barges This includes the Cristobal Colon, when launched in 2008 the world's largest dredgerwith a capacity of 46,000 m³. It can dredge to a water depth of 155m. Joined by her near-sister ship Leiv Eirikssonin 2010, Jan De Nul has one the world's largest, if not the largest, fleets of hopper dredgers. All photo’s : PietSinke CLICK on the photos to view and / or download the High Resolution version !Distribution : daily to 28400 active addresses08-02-2014Page 3

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039Shipping industry sees an end to fiveyear downturnBy Keith WallisThe SCARLET ISLAND was launched February 5th fromthe Tsuneishi ship yard in Cebu. This vessel is No 4 of 9to be built for K line. Photo’s : Captain EdwardFitzek The shipping industry is poised to emerge from itslongest downturn in three decades, buoyed by an end toyears of overcapacity that have depressed freight ratessince the end of a shipping boom in 2008. Dry cargoships are likely to see the strongest recovery, say ownersand analysts, as growth in bulk commodity cargoes suchas iron ore and coal outpaces supply of new tonnage forthe first time in seven years. But tanker rates will alsorise as fleet growth is slowing, while strategic oil reserveprojects in China and India should boost already solidAsian demand. The recovery will bring some respite toshipping firms that have endured years of losses asfreight rates failed to cover costs. Global shipper TMTGroup filed for bankruptcy protection last June, shortlyafter South Korea's STX Pan Ocean filed for courtreceivership, while Indonesian shipper PT Berlian LajuTanker narrowly avoided bankruptcy."While there will be potholes, here and there, as always,the worst is over based on the market fundamentals,"said Ong Choo Kiat, president of U-Ming MarineTransport one of Taiwan's largest listed shipping companies. Prices of new and secondhand ships started to rise lastyear on expectations of a recovery, though experts warn some shippers will still only break even this year and anyrecovery may fade after 2016 when overcapacity could again dampen freight rates. Key drivers of the pick-up will beChina's continued urbanisation and falling iron ore prices, experts say, which should support import growth eventhough the commodities super-cycle that drove a 2003-2008 boom in shipping markets is over. The global dry bulkDistribution : daily to 28400 active addresses08-02-2014Page 4

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039seaborne trade is forecast to grow 5.8 percent in 2014 to 4.37 billion tonnes, according to Barclays Research,outpacing a 5.3 percent rise in the global merchant fleet to 753 million deadweight tonnes. This is the first time growthin demand for shipping of iron ore, coal, grain and minor bulks such as fertilizer, logs and soya beans has been greaterthan dry bulk fleet growth since 2007, Barclays said, as the industry finally shakes off a surge in new ship orders in thewake of the boom. However, ship owners who paid high prices for new tonnage at the peak of the market would stillonly break even this year, said Jayendu Krishna, senior manager at shipping consultancy Drewry Maritime Research,Buyers who paid up to around 100 million for a 180,000 dwt Capesize ore carrier at the top of the market would needa daily charter rate of 44,000- 45,000 to break even, still well above current rates. The price of a similar Capesizeship has since eased to around 56 million, according to Clarkson Research.The Baltic dry index compiled from a basket of dry bulk freight rates and which traditionally falls in the run up to thelunar new year holiday in China, has halved in the past month to 1,086 points on Feb. 5. Dry bulk rates are expectedto bounce back in February and March as chartering activity rises, said Khalid Hashim, managing director of Thai drybulk ship owner Precious Shipping. "Our reading of the market is that the up-cycle will continue till the early or middlepart of 2016 before starting to slip," Hashim told Reuters, although that would depend on the number of new dry bulkships delivered. Analysts from Barclays and Jefferies forecast the Baltic dry index would average between 1,400-1,600points this year, compared with 1,060 last year. The index topped 11,500 in mid-2008. For the tanker market, rates forvery large crude carriers (VLCCs) on routes to Asia had climbed since October to their highest level in 18 months, saidPeter Sand, chief shipping analyst at industry lobby group Bimco. At the same time, growth in the VLCC market slowedto 1.9 percent year-on-year in December compared with expected import growth in China of around 4 percent, whichshould help boost freight rates. "I believe we are about to go from bad to better in the very large crude carriermarket," Sand said, adding that rates for VLCCs on routes to Asia had climbed since October to their highest level in18 months. Demand should be boosted by China's moves to fill part of its strategic petroleum reserve and India's planto launch underground storage facilities later this year. This could include more than 50 million barrels in China andnearly 40 million in India, said shipbroker ACM Shippng in Singapore. "[China's] stockbuilding has some way to go,"said Henry Curra, ACM's head of research.Moves by China to diversify its crude oil supplies to West Africa andSouth America would also lead to longer sea voyages and higher rates for tanker owners, Sand said. Source :ReutersDestruction By Fire Not A MechanicalBreakdown Under A Laytime ExclusionClauseThis was a dispute as to whether destruction by fire was a “mechanical breakdown” underClause 28 (laytime exclusion clause) of the charter. The Tribunal and the Commercial Courtapplied a narrow construction of the laytime exclusion clause and concluded that fireDistribution : daily to 28400 active addresses08-02-2014Page 5

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039was not “mechanical breakdown”. The Court of Appeal upheld both the Tribunal's award and the Commercial Court'sdecision and, once again, ruled in favour of the Owners and found that they were entitled to demurrage.The background factsThe Ladytramp was chartered on the Sugar Charter Party 1999 form for the carriage of bulk sugar from “1-2 safeberth(s), 1 safe port (intention Santos) but not south of Paranagua to the Black Sea (intention Odessa)”. On 9 June2010, the day of the fixture, the Charterers declared Paranagua as the loading port. On 14 June 2010, a week beforethe vessel arrived at the load port, the parties were informed that a fire had occurred at the terminal where they hadinitially scheduled the vessel to load the cargo. The fire had destroyed the conveyor belt system linking the terminal tothe warehouse.On 20 June, the vessel arrived at Paranagua and tendered notice of readiness. In the absence of an available berth,the vessel remained off the port until 14 July, when she entered the inner roads of the port awaiting berthinginstructions. Loading commenced on 18 July and was completed at 1300 hours on 20 July. The vessel subsequentlysailed for the discharge port in the Black Sea.The Owners claimed demurrage and contended that time began to count at 1400 hours on 21 June 2010 and thatlaytime expired at 2353 hours on 25 June. Thereafter, the vessel was on demurrage continuously up to the time ofcompletion at 1300 hours on 20 July. The Charterers disputed the claim, relying upon the laytime exclusion clause(Clause 28) of the charterparty, which provided:“In the event that whilst at or off the loading place . the loading .of the vessel is prevented or delayed by mechanical breakdowns at mechanical loading plants, government interferences time so lost shall not count aslaytime”The Charterers sought to rely upon Clause 28 on the basis that the loading of the vessel was prevented by“mechanical breakdown” (caused by the destruction of the conveyor belt system by fire) and also by “governmentinterference” (resulting from the local port authority's refusal to allow loading by reason of the fire).The arbitration awardThe arbitrators found that the Owners were entitled to demurrage and made the following rulings:1. The safe berth point: When the terminal intended to be used by Charterers became unusable as a result of the fire,the Charterers were still under an obligation to nominate “1-2 safe berths”. The Charterers could have discharged theirobligation to nominate a safe berth by nominating an alternative berth.2. The fire and mechanical breakdown point: The inoperability of the conveyor belt was the result of the physicaldamage due to the fire rather than any mechanical breakdown.3. The government interference point: The refusal of the port authority of Paranagua to permit vessels to load at theterminal in the light of the fire was not “governmental interference”. The meaning of governmental interference inClause 28 related to such things as embargoes and export bans rather than administrative decisions.The Commercial Court decisionThe Charterers appealed to the Commercial Court on the basis that the Tribunal had erred on all three points.In relation to the “safe berth” point, Mr Justice Eder held that the Tribunal had asked the wrong question, i.e. whetherthe Charterers had a relevant legal obligation to nominate an alternative loading berth when the intended loadingterminal became unusable by fire. This was not a case about berth nomination. It was about whether there wasprevention or delay in loading caused by an excepted peril. There was no reason in principle nor in the charterpartywording that required the Charterers to nominate a berth as a precondition to the operation of Clause 28.Most of the Commercial Court's judgment was focused on the mechanical breakdown point. The Judge upheld theTribunal's decision. The Charterers argued that the Tribunal's finding was contrary to the Court of Appeal decision inthe Afrapearl where it was held that the cause of the breakdown is immaterial and that there is a breakdown if theequipment does not function or if it malfunctions. The Court rejected this argument and held that as a matter ofordinary language and common sense, the destruction of an item was not within the scope of the term “breakdown”,still less within the term “mechanical breakdown” (the Thanassis A (unreported) 22 March 1982, referred to in theAfrapearl). The inclusion of the word “mechanical” had the effect of restricting the scope of the “breakdown”. Whatwas required was a breakdown of a mechanical nature.The “government interference” point was also upheld by the Judge. The Judge held that there was no finding that theport authority in Paranagua was a government entity or that the permission to berth at the intended terminal wassuspended by the port authority. The Judge also agreed with the Tribunal that, as a matter of construction, theDistribution : daily to 28400 active addresses08-02-2014Page 6

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039wording “government interference” requires more than an ordinary administrative act performed by a port authority aspart of the day-to-day management operations.The Charterers' appeal was dismissed but they continued with a fresh appeal to the Court of Appeal.The Court of Appeal decisionThe point of law before the Court of Appeal was whether the delay in loading the vessel at Paranagua was caused by“mechanical breakdown”. The Charterers submitted that the Afrapearl led to the conclusion that there was a“mechanical breakdown” of the conveyor belt system, simply because as a result of the fire the machinery no longerfunctioned as a conveyor belt system. The Court of Appeal dismissed the appeal.Lord Justice Tomlinson held that the clause under consideration in the Afrapearl (and in the Thanassis A) wasconcerned simply with “breakdown of machinery or equipment in or about the plant of the charterer, supplier, shipperor consignee of the cargo”. In the present case, the clause under consideration was concerned with “mechanicalbreakdown at mechanical loading plants”. It was not sufficient that the mechanical loading plant no longer functioned,or malfunctioned. The nature of malfunction had to be mechanical in the sense that it was the mechanism of themechanical loading plant which ceased to function, or malfunctioned and caused the prevention of or delay to loadingand the consequent loss of time. This connotes an inherent mechanical problem. Destruction of machinery by fire didnot amount to a mechanical breakdown as “fire” was not an excepted peril under Clause 28.This case demonstrates the degree of scrutiny that the English courts are prepared to exercise when looking atexception clauses. Just because clauses are similarly drafted does not necessarily mean that they will be similarlyinterpreted. The Court of Appeal judgment in the Ladytramp emphasises this approach. Here, focus was placed uponthe word “mechanical” to conclude that the nature of the breakdown is relevant. In addition, the cause of any delaymust be capable of being brought within the ordinary meaning of the charterparty clause without any need to extendthe meaning or imply additional wording. However, if the wording is ambiguous, the courts will apply the contraproferentem principle and will construe the clause against the party seeking to rely upon it. Source: INCE&CoThe PATANI approaching the Ijmuiden locks enroute Amsterdam – Photo : Simon Wolf (c)Hijacking of KERALALiberia continues its active investigation of the hijacking of the Liberian-flagged product tanker, KERALA, (IMO No.:9390927), at Luanda, Angola on18 January 2014.Liberia, in co-operation with the vessel owners, requested the attendance in Tema, Ghana, of an INTERPOL-ledmultinational Incident Response Team. These authorities, supported and helped by the Ghanaian authorities,undertook a crime scene investigation on board the vessel. A representative of the Liberian Flag Administration alsoDistribution : daily to 28400 active addresses08-02-2014Page 7

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039attended onboard in Tema to observe the collection of forensic evidence by the authorities. All parties were given fullaccess to the vessel's documents, officers and crew.Although the investigation is still ongoing, the evidence gathered thus far by the INTERPOL Incident Response Teamhas allowed the Liberian Registry to conclude that the vessel was hijacked by pirates. During the hijacking, the piratesdisabled the vessel’s AIS and other communication equipment so that the vessel could not be tracked from shore orsatellite. During this period, the pirates painted over the identifying features of the vessel, including funnel, name andIMO number and undertook three separate ship-to-ship transfers of cargo amounting to the theft of approximately12,271.5mt of cargo.The owners of the KERALA regained contact with the vessel on 26 January 2014, shortly after the pirates haddisembarked. The vessel immediately set a course for the safety of the port of Tema, Ghana, as a port of refuge.All crew members received immediate medical treatment on arrival at Tema. During the hijacking, one crew memberwas stabbed by the pirates and others were beaten. Liberia will continue working with the authorities in Ghana,Nigeria and Angola and elsewhere in the region in order to bring to justice the perpetrators of this crime to justice.Liberia remains committed to fighting piracy in all of its forms wherever it may occur in the world.The SAGA PEARL II arriving in Cape Town – Photo : Ian Shiffman LPG Shipping Surge Seen ExtendedAmid Signs of Panama DelayDelays to the 5.25 billion expansion of the Panama Canal may extend a surge in rates for vessels hauling liquefiedpetroleum gas to Asia from the U.S., a shipping company and industry analysts said.“We have been basing our plans on using Panama, so if there are delays then that’s going to tighten the supply ofships,” Christian Andersen, president of Avance Gas Holding Ltd said by phone today. The company is the fifth largestvessel owner specializing in LPG, according to data from Clarkson Plc, the world’s biggest shipbroker. The expansionworks were suspended yesterday after negotiations broke down between the Panama Canal Authority and a group ofDistribution : daily to 28400 active addresses08-02-2014Page 8

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039construction firms undertaking the enlargement, according to the head of the authority. A spokeswoman for Sacyr SA(SCYR), which is leading the works, said they were slowed rather than halted.The enlarged waterway will curb demand for LPG carriers to transport the fuel because the link shaves about 17,000miles off round-voyages between Tokyo and Houston, requiring fewer tankers for the same amount of cargo. The U.S.,which is producing the most crude in 25 years, is accelerating shipments of LPGs including propane and butanebecause they are byproducts from extracting crude and gas.Demand for the largest ships hauling LPG, used for cooking and heating, is surging as the U.S. boosts exports. Thecountry has among the world’s cheapest supplies of the fuel, which is also a feedstock for the petrochemicals industry.Market ImpactThe widening of the Panama Canal will reduce the number of ships required to haul 1 million tons a year of LPG toAsia from Houston to four vessels from six, according to Andersen. The the delayed start will prolong a rally in freightcosts.“As long as the Panama Canal remains unfit for taking VLGCs, that’s going to have a positive impact on the freightmarket,” Erik Nikolai Stavseth, a shipping analyst at Arctic Securities ASA, said by phone today. “Assuming exportscontinue as normal, volumes will continue to be shipped.”Rates for VLGCs, the industry’s biggest ships, will rise to 45,000 a day in 2015 from 30,400 in 2012 and then drop to 37,500 after the completion of the Panama Canal expansion cuts voyage durations, Arctic estimates show.Avance Gas, which is owned by Stolt-Nielsen Gas, Sungas Holdings Ltd and Transpetrol Shipping Ltd, has six VLGCs onthe water and another eight under order. The total fleet of such vessels is about 160 vessels.“The volumes will continue to move, it’s just that they will move longer-haul, rather than through Panama,” said NicolaWilliams, an analyst at Clarkson Plc, the world’s biggest shipbroker. “We see a continuation of longer-haul movementsfor a longer time than we’d originally anticipated.” Source: BloombergThe WIND SURF anchored off St Lucia – Photo : Leo Verhoog Gas warning after two found deadBOAT owners are being warned of the lethal implications of not carrying a carbon monoxide alarm on board, after twomen were found dead in their bunks. A 26-year-old skipper and 21-year-old crewman were found dead on board thescallop-dredger Eshcol near Whitby, North Yorkshire, on January 15. The boat, which was registered in Milford Haven,Distribution : daily to 28400 active addresses08-02-2014Page 9

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039had been taken out overnight by the two men. When they were not seen as expected the next day, fishermen moorednearby went on board and found the vessel’s butane gas cooker lit, and the wheelhouse full of fumes.Initial findings by the Marine Accident Investigation Branch (MAIB) indicate the men were poisoned by carbonmonoxide. It is thought that, before going to bed, the men lit the gas cooker in order to warm both the wheelhouseand the adjacent sleeping area. The Eshcol was not fitted with a carbon monoxide alarm.In a statement, MAIB said: “Gas cookers are designed for cooking, not domestic heating.”It added that, in a poorly ventilated artea, carbon monoxide can “quickly build up to lethal levels”, and with no smell,taste or colour, is extremely difficult to detect. “Carbon monoxide alarms are not expensive and should be fitted,” itadded. Source : Milford & West Wales MercuryConcerns on fuel leak as Spanish shiphits French dykeA Spanish cargo ship slammed into a dyke and split in two near the French port of Bayonne on Wednesday, injuring atleast one sailor andraising concerns of afuel leak. The localmayor’s office said theboat,carrying11sailors, had run intothe dyke amid heavyseas near the town ofAnglet after leavingBayonneinsouthwestern France.The prefecture for thePyrenees-Atlantiquesregionsaideffortswere underway to recover the sailors by helicopter but the rescue operation was being hampered by winds of up to110 kilometres per hour (70 miles per hour).Officials said a fuel leak had been detected and an emergency plan known as Polmar had been activated to deal withmaritime pollution. The prefecture said one of the sailors was injured but provided no details on the extent of injuries.Click here : o-ship-in-half-video/It said the LUNO cargo ship, 100 metres (330 feet) long, had been empty. Source : AFP / New Straits TimesALSO INTERESTED IN THIS FREE MARITIME NEWSCLIPPINGS ?PLEASE VISIT THE WEBSITE :WWW.MAASMONDMARITIME.COMAND REGISTER FOR FREE !Distribution : daily to 28400 active addresses08-02-2014Page 10

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039The MSC RAVENNA entering the Suez Canal on the south side during the early morning enroute Port SaidPhoto : Piero Carnival cruise ship passenger headingto Charleston airlifted by Coast GuardA Coast Guard helicopter airlifted a passenger from a Carnival Cruise ship heading toward Charleston Wednesdayafternoon. The ship's crew called for medical help after the 27-year-old man complained of severe abdominal pain,according to the Coast Guard. A crew from Air Station Miami took the man and a nurse off the cruise ship Fantasyabout 80 miles northeast of Cape Canaveral, Fla., about noon and flew them to Cape Canaveral Hospital in CocoaBeach, Fla. The Fantasy was on its way back to Charleston after a five-day cruise in the Bahamas.An update on the man's condition was not available. Source : The Post & CourierNEW TSHD STRANDWAY PASSING BOSKALISHEADQUARTERSBoskalis latest trailing suction hopper dredge STRANDWAY passing the Boskalis headquarters in Papendrecht onthe way to De Boer Shipyard for the final outfitting, to finish and complete the vessel so she will be fit for duty soon- Photo : Dirk van Uitert Euronav to buy five ships worth 255mln from OSG - SEC filingBelgian crude oil shipping group Euronav has agreed to buy three very large crude carriers and two aframax tankersfor 255 million from U.S. company Overseas Shipholding Group (OSG), an SEC filing showed. Euronav will buythe ships in a joint venture with GSO Capital Partners, though the deal is subject to the approval of a bankruptcycourt, as OSG in November filed for a Chapter 11 reorganisation, the statement said. Euronav was not immediatelyDistribution : daily to 28400 active addresses08-02-2014Page 11

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039available for comment. In January, Euronav said it would buy 15 very large crude carriers for 980 million fromDenmark's Maersk, citing an improved outlook for the crude shipping market. Source : ReutersBig cruise mutiny over singlesightseeing missDozens of protesting passengers on a luxury cruise ship angry over a canceled stop in Vietnam last night ended theiroccupation of the vessel after a 17-hour standoff. Just 40 passengers remained of the original group of 400 who hadoccupied the Costa Victoria soon after it docked at Ocean Terminal in Tsim Sha Tsui at 6am yesterday. Theydemanded compensation for the disrupted holiday cruise.By about 11pm, the final 40 quit the ship too and went to a hotel. Costa Victoria had been due to leave Hong Kongfor a new trip to Hainan and Vietnam at 3pm yesterday, picking up 1,000 new passengers, but its departure was heldup as the protesters remained on board.The COSTA VICTORIA in Hong Kong – Photo : Dieter Jaenicke - www.vikingrecruitment.com The ship finally sailed at about 11.30pm. A new round of negotiations between the protesting passengers - who aredemanding 30 percent of the cost of their package tour as compensation and Miramar Travel and Costa Cruise - will beheld todayThe passengers - with Democratic Alliance for the Betterment and Progress of Hong Kong lawmaker Ann Chiang Laiwan and Travel Industry Council officials acting as mediators - demanded that Miramar return one third of their moneyand make an apology. Chiang was a passenger on the cruise.About 2,000 passengers from Hong Kong, Macau and Taiwan left on Saturday for the six-day trip from Hong Kong toSanya and then on to Da Nang and Halong Bay in Vietnam. Half of the 2,000 are Miramar customers.The voyage was uneventful until they reached Halong Bay on Tuesday when the Costa Victoria was unable to dockbecause of a sunken ship. A spokeswoman for Costa Cruises said the port and channel at Halong Bay were closed byauthorities and Costa Victoria put back to sea. "The decision was made solely in the interests of passenger safety,"Distribution : daily to 28400 active addresses08-02-2014Page 12

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2014 – 039she said. Last night, the 40 defiant passengers had sought a refund of at least 30 percent of the cost of their package.They had earlier demanded 70 percent. They said they had paid Miramar HK 8,000 to HK 18,000, depending on theiraccommodation.Miramar had offered to pay each passenger about HK 340 and Costa Cruises would pay US 50 for each shared room.Among the 1,000 passengers were 100 from Guangzhou. Alex Lee Chun-ting, general manager of Miramar Travel, saidthe compensation demanded by the protesting passengers was unacceptable."They have been on board and enjoying the facilities throughout the voyage. The only thing is that the ship could notdock in Halong Bay and they missed a four-hour tour there. Would that justify a big refund? "It is impossible for us toaccept that." Travel Industry Council executive director Joseph Tung Yiu-chung said the council's representatives willmeet Miramar Travel managers today.Source : Hong Kong StandardThe CMA CGM COLUMBA arriving in Rottredam-Europoort – Photo : Harry van den Berg Asia Tankers-V

Jan De Nul has a fleet of over 80 ships, including 14 cutter suction dredgers, 26 trailing suction hopper dredgers, 20 split barges, 5 backhoe dredgers and 17 rock transport barges This includes the Cristobal Colon, when launched in 2008 the world's largest dredger with a capacity of 46,000 m³. It can dredge to a water depth of 155m.