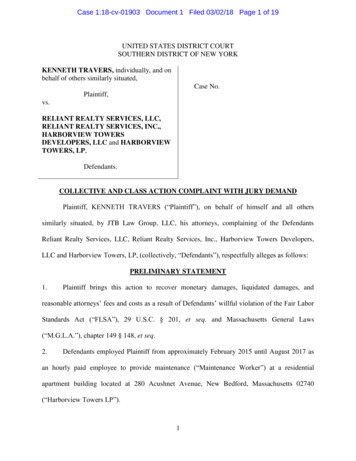

Transcription

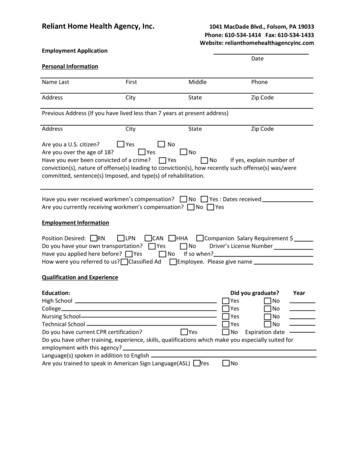

Reliant Home Health Agency, Inc.Employment Application1041 MacDade Blvd., Folsom, PA 19033Phone: 610-534-1414 Fax: 610-534-1433Website: relianthomehealthagencyinc.comDatePersonal InformationName LastFirstMiddlePhoneAddressCityStateZip CodePrevious Address (If you have lived less than 7 years at present address)AddressCityStateZip CodeAre you a U.S. citizen?YesNoAre you over the age of 18?YesNoHave you ever been convicted of a crime?YesNoIf yes, explain number ofconviction(s), nature of offense(s) leading to conviction(s), how recently such offense(s) was/werecommitted, sentence(s) Imposed, and type(s) of rehabilitation.Have you ever received workmen’s compensation?NoYes : Dates receivedAre you currently receiving workmen’s compensation?NoYesEmployment InformationPosition Desired:RNLPNCANHHACompanion Salary Requirement Do you have your own transportation?YesNoDriver’s License NumberHave you applied here before?YesNo If so when?How were you referred to us? Classified AdEmployee. Please give nameQualification and ExperienceEducation:Did you graduate?YearHigh SchoolYesNoCollegeYesNoNursing SchoolYesNoTechnical SchoolYesNoDo you have current CPR certification?YesNo Expiration dateDo you have other training, experience, skills, qualifications which make you especially suited foremployment with this agency?Language(s) spoken in addition to EnglishAre you trained to speak in American Sign Language(ASL)YesNo

Reliant Home Health Agency, Inc.1041 MacDade Blvd., Folsom, PA 19033Phone: 610-534-1414 Fax: 610-534-1433Website: relianthomehealthagencyinc.comAvailabilityCircle days and indicate time(s) you are available to work: SundayTuesdayWednesdayThursdayEmployment HistoryCurrent EmployerAddressSalaryReason for leavingSupervisor’s NamePrevious Employer:AddressSalaryReason for leavingSupervisor’s NamePrevious Employer:AddressSalaryReason for leavingSupervisor’s NameMondayFridaySaturdayPositionDate of employmentMay we contact supervisor?PhoneYesNoYesNoYesNoPositionDate of employmentMay we contact supervisor?PhonePositionDate of employmentMay we contact supervisor?PhonePersonal ReferencesPlease list the names, addresses and phone number of three persons not related to you, whom you haveknown for at least a year:NameYears AcquaintedAddressPhoneNameAddressBusinessYears AcquaintedPhoneNameAddressBusinessYears AcquaintedPhoneEmergency ContactNamePhoneRelationship to youI verify that my answers are true and complete to the best of my knowledge. In the even I am employed,I understand that false or misleading information given in my application or interview(s) may result indischarge.SignatureDate

Form W-4 (2018)Future developments. For the latestinformation about any future developmentsrelated to Form W-4, such as legislationenacted after it was published, go towww.irs.gov/FormW4.Purpose. Complete Form W-4 so that youremployer can withhold the correct federalincome tax from your pay. Considercompleting a new Form W-4 each year andwhen your personal or financial situationchanges.Exemption from withholding. You mayclaim exemption from withholding for 2018if both of the following apply. For 2017 you had a right to a refund of allfederal income tax withheld because youhad no tax liability, and For 2018 you expect a refund of allfederal income tax withheld because youexpect to have no tax liability.If you’re exempt, complete only lines 1, 2,3, 4, and 7 and sign the form to validate it.Your exemption for 2018 expires February15, 2019. See Pub. 505, Tax Withholdingand Estimated Tax, to learn more aboutwhether you qualify for exemption fromwithholding.General InstructionsIf you aren’t exempt, follow the rest ofthese instructions to determine the numberof withholding allowances you should claimfor withholding for 2018 and any additionalamount of tax to have withheld. For regularwages, withholding must be based onallowances you claimed and may not be aflat amount or percentage of wages.You can also use the calculator atwww.irs.gov/W4App to determine yourtax withholding more accurately. ConsiderSpecific Instructionsusing this calculator if you have a morecomplicated tax situation, such as if youhave a working spouse, more than one job,or a large amount of nonwage incomeoutside of your job. After your Form W-4takes effect, you can also use thiscalculator to see how the amount of taxyou’re having withheld compares to yourprojected total tax for 2018. If you use thecalculator, you don’t need to complete anyof the worksheets for Form W-4.Note that if you have too much taxwithheld, you will receive a refund when youfile your tax return. If you have too little taxwithheld, you will owe tax when you file yourtax return, and you might owe a penalty.Filers with multiple jobs or workingspouses. If you have more than one job ata time, or if you’re married and yourspouse is also working, read all of theinstructions including the instructions forthe Two-Earners/Multiple Jobs Worksheetbefore beginning.Nonwage income. If you have a largeamount of nonwage income, such asinterest or dividends, consider makingestimated tax payments using Form 1040ES, Estimated Tax for Individuals.Otherwise, you might owe additional tax.Or, you can use the Deductions,Adjustments, and Other Income Worksheeton page 3 or the calculator at www.irs.gov/W4App to make sure you have enough taxwithheld from your paycheck. If you havepension or annuity income, see Pub. 505 oruse the calculator at www.irs.gov/W4Appto find out if you should adjust yourwithholding on Form W-4 or W-4P.Nonresident alien. If you’re a nonresidentalien, see Notice 1392, Supplemental FormW-4 Instructions for Nonresident Aliens,before completing this form.Personal Allowances WorksheetComplete this worksheet on page 3 first todetermine the number of withholdingallowances to claim.Line C. Head of household please note:Generally, you can claim head ofhousehold filing status on your tax returnonly if you’re unmarried and pay more than50% of the costs of keeping up a home foryourself and a qualifying individual. SeePub. 501 for more information about filingstatus.Line E. Child tax credit. When you fileyour tax return, you might be eligible toclaim a credit for each of your qualifyingchildren. To qualify, the child must beunder age 17 as of December 31 and mustbe your dependent who lives with you formore than half the year. To learn moreabout this credit, see Pub. 972, Child TaxCredit. To reduce the tax withheld fromyour pay by taking this credit into account,follow the instructions on line E of theworksheet. On the worksheet you will beasked about your total income. For thispurpose, total income includes all of yourwages and other income, including incomeearned by a spouse, during the year.Line F. Credit for other dependents.When you file your tax return, you might beeligible to claim a credit for each of yourdependents that don’t qualify for the childtax credit, such as any dependent childrenage 17 and older. To learn more about thiscredit, see Pub. 505. To reduce the taxwithheld from your pay by taking this creditinto account, follow the instructions on lineF of the worksheet. On the worksheet, youwill be asked about your total income. Forthis purpose, total income includes all ofSeparate here and give Form W-4 to your employer. Keep the worksheet(s) for your records.FormW-4Department of the TreasuryInternal Revenue Service1Employee’s Withholding Allowance CertificateOMB No. 1545-0074Whether you’re entitled to claim a certain number of allowances or exemption from withholding issubject to review by the IRS. Your employer may be required to send a copy of this form to the IRS. Your first name and middle initial2Last nameHome address (number and street or rural route)3SingleMarried2018Your social security numberMarried, but withhold at higher Single rate.Note: If married filing separately, check “Married, but withhold at higher Single rate.”City or town, state, and ZIP code4 If your last name differs from that shown on your social security card,check here. You must call 800-772-1213 for a replacement card.567 Total number of allowances you’re claiming (from the applicable worksheet on the following pages). . .5Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . .6 I claim exemption from withholding for 2018, and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . 7Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.Employee’s signature(This form is not valid unless you sign it.) 8 Employer’s name and address (Employer: Complete boxes 8 and 10 if sending to IRS and completeboxes 8, 9, and 10 if sending to State Directory of New Hires.)For Privacy Act and Paperwork Reduction Act Notice, see page 4.Date 9 First date ofemploymentCat. No. 10220Q10 Employer identificationnumber (EIN)Form W-4 (2018)

Page 2Form W-4 (2018)your wages and other income, includingincome earned by a spouse, during the year.Line G. Other credits. You might be ableto reduce the tax withheld from yourpaycheck if you expect to claim other taxcredits, such as the earned income taxcredit and tax credits for education andchild care expenses. If you do so, yourpaycheck will be larger but the amount ofany refund that you receive when you fileyour tax return will be smaller. Follow theinstructions for Worksheet 1-6 in Pub. 505if you want to reduce your withholding totake these credits into account.Deductions, Adjustments, andAdditional Income WorksheetComplete this worksheet to determine ifyou’re able to reduce the tax withheld fromyour paycheck to account for your itemizeddeductions and other adjustments toincome such as IRA contributions. If youdo so, your refund at the end of the yearwill be smaller, but your paycheck will belarger. You’re not required to complete thisworksheet or reduce your withholding ifyou don’t wish to do so.You can also use this worksheet to figureout how much to increase the tax withheldfrom your paycheck if you have a largeamount of nonwage income, such asinterest or dividends.Another option is to take these items intoaccount and make your withholding moreaccurate by using the calculator atwww.irs.gov/W4App. If you use thecalculator, you don’t need to complete anyof the worksheets for Form W-4.Two-Earners/Multiple JobsWorksheetComplete this worksheet if you have morethan one job at a time or are married filingjointly and have a working spouse. If youdon’t complete this worksheet, you mighthave too little tax withheld. If so, you willowe tax when you file your tax return andmight be subject to a penalty.Figure the total number of allowancesyou’re entitled to claim and any additionalamount of tax to withhold on all jobs usingworksheets from only one Form W-4. Claimall allowances on the W-4 that you or yourspouse file for the highest paying job inyour family and claim zero allowances onForms W-4 filed for all other jobs. Forexample, if you earn 60,000 per year andyour spouse earns 20,000, you shouldcomplete the worksheets to determinewhat to enter on lines 5 and 6 of your FormW-4, and your spouse should enter zero(“-0-”) on lines 5 and 6 of his or her FormW-4. See Pub. 505 for details.Another option is to use the calculator atwww.irs.gov/W4App to make yourwithholding more accurate.Tip: If you have a working spouse and yourincomes are similar, you can check the“Married, but withhold at higher Singlerate” box instead of using this worksheet. Ifyou choose this option, then each spouseshould fill out the Personal AllowancesWorksheet and check the “Married, butwithhold at higher Single rate” box on FormW-4, but only one spouse should claim anyallowances for credits or fill out theDeductions, Adjustments, and AdditionalIncome Worksheet.Instructions for EmployerEmployees, do not complete box 8, 9, or10. Your employer will complete theseboxes if necessary.New hire reporting. Employers arerequired by law to report new employees toa designated State Directory of New Hires.Employers may use Form W-4, boxes 8, 9,and 10 to comply with the new hirereporting requirement for a newly hiredemployee. A newly hired employee is anemployee who hasn’t previously beenemployed by the employer, or who waspreviously employed by the employer buthas been separated from such prioremployment for at least 60 consecutivedays. Employers should contact theappropriate State Directory of New Hires tofind out how to submit a copy of thecompleted Form W-4. For information andlinks to each designated State Directory ofNew Hires (including for U.S. territories), goto www.acf.hhs.gov/programs/css/employers.If an employer is sending a copy of FormW-4 to a designated State Directory ofNew Hires to comply with the new hirereporting requirement for a newly hiredemployee, complete boxes 8, 9, and 10 asfollows.Box 8. Enter the employer’s name andaddress. If the employer is sending a copyof this form to a State Directory of NewHires, enter the address where childsupport agencies should send incomewithholding orders.Box 9. If the employer is sending a copy ofthis form to a State Directory of New Hires,enter the employee’s first date ofemployment, which is the date services forpayment were first performed by theemployee. If the employer rehired theemployee after the employee had beenseparated from the employer’s service forat least 60 days, enter the rehire date.Box 10. Enter the employer’s employeridentification number (EIN).

Page 3Form W-4 (2018)Personal Allowances Worksheet (Keep for your records.)ABCDEEnter “1” for yourself . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter “1” if you will file as married filing jointly . . . . . . . . . . . . . . . . . . . . . . .Enter “1” if you will file as head of household . . . . . . . . . . . . . . . . . . . . . . . You’re single, or married filing separately, and have only one job; or You’re married filing jointly, have only one job, and your spouse doesn’t work; orEnter “1” if: Your wages from a second job or your spouse’s wages (or the total of both) are 1,500 or less.Child tax credit. See Pub. 972, Child Tax Credit, for more information. If your total income will be less than 69,801 ( 101,401 if married filing jointly), enter “4” for each eligible child. If your total income will be from 69,801 to 175,550 ( 101,401 to 339,000 if married filing jointly), enter “2” for eacheligible child.{}ABCD If your total income will be from 175,551 to 200,000 ( 339,001 to 400,000 if married filing jointly), enter “1” foreach eligible child. If your total income will be higher than 200,000 ( 400,000 if married filing jointly), enter “-0-” .FGH.ECredit for other dependents. If your total income will be less than 69,801 ( 101,401 if married filing jointly), enter “1” for each eligible dependent. If your total income will be from 69,801 to 175,550 ( 101,401 to 339,000 if married filing jointly), enter “1” for everytwo dependents (for example, “-0-” for one dependent, “1” if you have two or three dependents, and “2” if you havefour dependents). If your total income will be higher than 175,550 ( 339,000 if married filing jointly), enter “-0-” . . . . .Other credits. If you have other credits, see Worksheet 1-6 of Pub. 505 and enter the amount from that worksheet hereAdd lines A through G and enter the total here . . . . . . . . . . . . . . . . . . . .For accuracy,complete allworksheetsthat apply.{. FGH If you plan to itemize or claim adjustments to income and want to reduce your withholding, or if youhave a large amount of nonwage income and want to increase your withholding, see the Deductions,Adjustments, and Additional Income Worksheet below. If you have more than one job at a time or are married filing jointly and you and your spouse bothwork, and the combined earnings from all jobs exceed 52,000 ( 24,000 if married filing jointly), see theTwo-Earners/Multiple Jobs Worksheet on page 4 to avoid having too little tax withheld. If neither of the above situations applies, stop here and enter the number from line H on line 5 of FormW-4 above.Deductions, Adjustments, and Additional Income WorksheetNote: Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwageincome.1234Enter an estimate of your 2018 itemized deductions. These include qualifying home mortgage interest,charitable contributions, state and local taxes (up to 10,000), and medical expenses in excess of 7.5% ofyour income. See Pub. 505 for details . . . . . . . . . . . . . . . . . . . . . .{} 24,000 if you’re married filing jointly or qualifying widow(er)Enter:. 18,000 if you’re head of household 12,000 if you’re single or married filing separatelySubtract line 2 from line 1. If zero or less, enter “-0-” . . . . . . .Enter an estimate of your 2018 adjustments to income and any additionalblindness (see Pub. 505 for information about these items) . . . . . . . . . . . . . . .standard deduction for age or. . . . . . . . . .5678Add lines 3 and 4 and enter the total . . . . . . . . . . . . . . . . . . . . . .Enter an estimate of your 2018 nonwage income (such as dividends or interest) . . . . . . . . .Subtract line 6 from line 5. If zero, enter “-0-”. If less than zero, enter the amount in parentheses. . .Divide the amount on line 7 by 4,150 and enter the result here. If a negative amount, enter in parentheses.Drop any fraction. . . . . . . . . . . . . . . . . . . . . . . . . . . .9Enter the number from the Personal Allowances Worksheet, line H above10.Add lines 8 and 9 and enter the total here. If zero or less, enter “-0-”. If you plan to use the Two-Earners/Multiple Jobs Worksheet, also enter this total on line 1, page 4. Otherwise, stop here and enter this totalon Form W-4, line 5, page 1 . . . . . . . . . . . . . . . . . . . . . . . . .1 2 3 45678910

Page 4Form W-4 (2018)Two-Earners/Multiple Jobs WorksheetNote: Use this worksheet only if the instructions under line H from the Personal Allowances Worksheet direct you here.1Enter the number from the Personal Allowances Worksheet, line H, page 3 (or, if you used theDeductions, Adjustments, and Additional Income Worksheet on page 3, the number from line 10 of thatworksheet). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if you’remarried filing jointly and wages from the highest paying job are 75,000 or less and the combined wages foryou and your spouse are 107,000 or less, don’t enter more than “3” . . . . . . . . . . . . .23If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter “-0-”)and on Form W-4, line 5, page 1. Do not use the rest of this worksheet . . . . . . . . . . . .3Note: If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4 through 9 below tofigure the additional withholding amount necessary to avoid a year-end tax bill.45678Enter the number from line 2 of this worksheet . . . . . . . . . . .4Enter the number from line 1 of this worksheet . . . . . . . . . . .5Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . .Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here . . .Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed .9Divide line 8 by the number of pay periods remaining in 2018. For example, divide by 18 if you’re paid every2 weeks and you complete this form on a date in late April when there are 18 pay periods remaining in2018. Enter the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheldfrom each paycheck. . . . . . . . . . . . . . . . . . . . . . . . . . .Table 1Married Filing JointlyIf wages from LOWESTpaying job are— 0 - 5,0005,001 9,5009,501 - 19,00019,001 - 26,50026,501 - 37,00037,001 - 43,50043,501 - 55,00055,001 - 60,00060,001 - 70,00070,001 - 75,00075,001 - 85,00085,001 - 95,00095,001 - 130,000130,001 - 150,000150,001 - 160,000160,001 - 170,000170,001 - 180,000180,001 - 190,000190,001 - 200,000200,001 and overEnter online 2 above012345678910111213141516171819Table 2All OthersIf wages from LOWESTpaying job are— 0 - 7,0007,001 - 12,50012,501 - 24,50024,501 - 31,50031,501 - 39,00039,001 - 55,00055,001 - 70,00070,001 - 85,00085,001 - 90,00090,001 - 100,000100,001 - 105,000105,001 - 115,000115,001 - 120,000120,001 - 130,000130,001 - 145,000145,001 - 155,000155,001 - 185,000185,001 and overPrivacy Act and Paperwork ReductionAct Notice. We ask for the information onthis form to carry out the Internal Revenuelaws of the United States. Internal RevenueCode sections 3402(f)(2) and 6109 andtheir regulations require you to provide thisinformation; your employer uses it todetermine your federal income taxwithholding. Failure to provide a properlycompleted form will result in your beingtreated as a single person who claims nowithholding allowances; providingfraudulent information may subject you topenalties. Routine uses of this informationinclude giving it to the Department ofJustice for civil and criminal litigation; tocities, states, the District of Columbia, and.Married Filing JointlyEnter online 2 above01234567891011121314151617If wages from HIGHESTpaying job are—U.S. commonwealths and possessions foruse in administering their tax laws; and tothe Department of Health and HumanServices for use in the National Directory ofNew Hires. We may also disclose thisinformation to other countries under a taxtreaty, to federal and state agencies toenforce federal nontax criminal laws, or tofederal law enforcement and intelligenceagencies to combat terrorism.You aren’t required to provide theinformation requested on a form that’ssubject to the Paperwork Reduction Actunless the form displays a valid OMBcontrol number. Books or records relatingto a form or its instructions must be67 8 9 All OthersEnter online 7 above 0 - 24,37524,376 - 82,72582,726 - 170,325170,326 - 320,325320,326 - 405,325405,326 - 605,325605,326 and over. 4205009101,0001,3301,4501,540If wages from HIGHESTpaying job are— 0 - 7,0007,001 - 36,17536,176 - 79,97579,976 - 154,975154,976 - 197,475197,476 - 497,475497,476 and overEnter online 7 above 4205009101,0001,3301,4501,540retained as long as their contents maybecome material in the administration ofany Internal Revenue law. Generally, taxreturns and return information areconfidential, as required by Code section6103.The average time and expenses requiredto complete and file this form will varydepending on individual circumstances.For estimated averages, see theinstructions for your income tax return.If you have suggestions for making thisform simpler, we would be happy to hearfrom you. See the instructions for yourincome tax return.

USCISForm I-9Employment Eligibility VerificationDepartment of Homeland SecurityU.S. Citizenship and Immigration ServicesOMB No. 1615-0047Expires 08/31/2019 START HERE: Read instructions carefully before completing this form. The instructions must be available, either in paper or electronically,during completion of this form. Employers are liable for errors in the completion of this form.ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work-authorized individuals. Employers CANNOT specify whichdocument(s) an employee may present to establish employment authorization and identity. The refusal to hire or continue to employan individual because the documentation presented has a future expiration date may also constitute illegal discrimination.Section 1. Employee Information and Attestation (Employees must complete and sign Section 1 of Form I-9 no laterthan the first day of employment, but not before accepting a job offer.)Last Name (Family Name)Apt. NumberAddress (Street Number and Name)Date of Birth (mm/dd/yyyy)Middle InitialFirst Name (Given Name)U.S. Social Security Number-Other Last Names Used (if any)StateCity or TownZIP CodeEmployee's Telephone NumberEmployee's E-mail Address-I am aware that federal law provides for imprisonment and/or fines for false statements or use of false documents inconnection with the completion of this form.I attest, under penalty of perjury, that I am (check one of the following boxes):1. A citizen of the United States2. A noncitizen national of the United States (See instructions)3. A lawful permanent resident(Alien Registration Number/USCIS Number):4. An alien authorized to workuntil (expiration date, if applicable, mm/dd/yyyy):Some aliens may write "N/A" in the expiration date field. (See instructions)QR Code - Section 1Do Not Write In This SpaceAliens authorized to work must provide only one of the following document numbers to complete Form I-9:An Alien Registration Number/USCIS Number OR Form I-94 Admission Number OR Foreign Passport Number.1. Alien Registration Number/USCIS Number:OR2. Form I-94 Admission Number:OR3. Foreign Passport Number:Country of Issuance:Signature of EmployeeToday's Date (mm/dd/yyyy)Preparer and/or Translator Certification (check one):I did not use a preparer or translator.A preparer(s) and/or translator(s) assisted the employee in completing Section 1.(Fields below must be completed and signed when preparers and/or translators assist an employee in completing Section 1.)I attest, under penalty of perjury, that I have assisted in the completion of Section 1 of this form and that to the best of myknowledge the information is true and correct.Today's Date (mm/dd/yyyy)Signature of Preparer or TranslatorLast Name (Family Name)Address (Street Number and Name)First Name (Given Name)City or TownStateZIP CodeEmployer Completes Next PageForm I-9 07/17/17 NPage 1 of 3

USCISForm I-9Employment Eligibility VerificationDepartment of Homeland SecurityU.S. Citizenship and Immigration ServicesOMB No. 1615-0047Expires 08/31/2019Section 2. Employer or Authorized Representative Review and Verification(Employers or their authorized representative must complete and sign Section 2 within 3 business days of the employee's first day of employment. Youmust physically examine one document from List A OR a combination of one document from List B and one document from List C as listed on the "Listsof Acceptable Documents.")Employee Info from Section 1Last Name (Family Name)List AFirst Name (Given Name)ORList BM.I.ANDList CIdentityIdentity and Employment AuthorizationCitizenship/Immigration StatusEmployment AuthorizationDocument TitleDocument TitleDocument TitleIssuing AuthorityIssuing AuthorityIssuing AuthorityDocument NumberDocument NumberDocument NumberExpiration Date (if any)(mm/dd/yyyy)Expiration Date (if any)(mm/dd/yyyy)Expiration Date (if any)(mm/dd/yyyy)Document TitleQR Code - Sections 2 & 3Do Not Write In This SpaceAdditional InformationIssuing AuthorityDocument NumberExpiration Date (if any)(mm/dd/yyyy)Document TitleIssuing AuthorityDocument NumberExpiration Date (if any)(mm/dd/yyyy)Certification: I attest, under penalty of perjury, that (1) I have examined the document(s) presented by the above-named employee,(2) the above-listed document(s) appear to be genuine and to relate to the employee named, and (3) to the best of my knowledge theemployee is authorized to work in the United States.The employee's first day of employment (mm/dd/yyyy):Signature of Employer or Authorized RepresentativeLast Name of Employer or Authorized Representative(See instructions for exemptions)Today's Date (mm/dd/yyyy)Title of Employer or Authorized RepresentativeFirst Name of Employer or Authorized RepresentativeEmployer's Business or Organization Address (Street Number and Name)City or TownEmployer's Business or Organization NameStateZIP CodeSection 3. Reverification and Rehires (To be completed and signed by employer or authorized representative.)A. New Name (if applicable)Last Name (Family Name)B. Date of Rehire (if applicable)First Name (Given Name)Middle InitialDate (mm/dd/yyyy)C. If the employee's previous grant of employment authorization has expired, provide the information for the document or receipt that establishescontinuing employment authorization in the space provided below.Document TitleDocument NumberExpiration Date (if any) (mm/dd/yyyy)I attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and ifthe employee presented document(s), the document(s) I have examined appear to be genuine and to relate to the individual.Signature of Employer or Authorized RepresentativeForm I-9 07/17/17 NToday's Date (mm/dd/yyyy)Name of Employer or Authorized RepresentativePage 2 of 3

LISTS OF ACCEPTABLE DOCUMENTSAll documents must be UNEXPIREDEmployees may present one selection from List Aor a combination of one selection from List B and one selection from List C.LIST ADocuments that EstablishBoth Identity andEmployment Authorization1. U.S. Passport or U.S. Passport Card2. Permanent Resident Card or AlienRegistration Receipt Card (Form I-551)3. Foreign passport that contains atemporary I-551 stamp or temporaryI-551 printed notation on a machinereadable immigrant visa4. Employment Authorization Documentthat contains a photograph (FormI-766)5. For a nonimmigrant alien authorizedto work for a specific employerbecause of his or her status:a. Foreign passport; andb. Form I-94 or Form I-94A that hasthe following:(1) The same name as the passport;and(2) An endorsement of the alien'snonimmigrant status as long asthat period of endorsement hasnot yet expired and theproposed employment is not inconflict with any restrictions

Reliant Home Health Agency, Inc. 1041 MacDade Blvd., Folsom, PA 19033 Phone: 610-534-1414 Fax: 610-534-1433 Website: relianthomehealthagencyinc.com . Employment Application . Date . Personal Information . Name Last First Middle Phone . Address City State Zip Code