Transcription

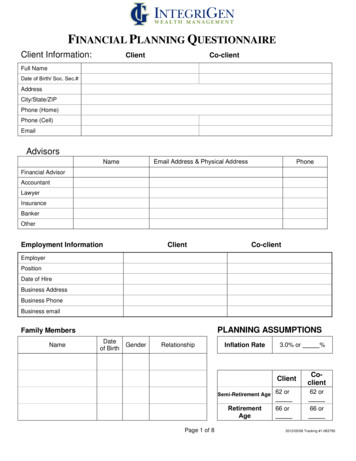

FINANCIAL PLANNING QUESTIONNAIREClient Information:ClientCo-clientFull NameDate of Birth/ Soc. Sec.#AddressCity/State/ZIPPhone (Home)Phone (Cell)EmailAdvisorsEmail Address & Physical AddressNamePhoneFinancial ent InformationClientCo-clientEmployerPositionDate of HireBusiness AddressBusiness PhoneBusiness emailPLANNING ASSUMPTIONSFamily MembersNameDateof BirthGenderRelationshipInflation Rate3.0% orClientSemi-Retirement Age 62 orRetirementAgePage 1 of 866 or%Coclient62 or66 or2012/05/08 Tracking #1-063795

DOCUMENTS NEEDED FOR NEXT MEETINGThe following documents will be needed for study and analysis as we work together to create a financial strategy foryou. It is understood that this material will be treated confidentially and returned when the plan is completed, orearlier if requested.Most Recent Payroll StubsInsurance Policies and/or StatementsLifeCash Flow WorksheetMedicalDisabilityIncome Tax ReturnsLong-term CareAuto and HomeInvestments/Retirement StatementsLiabilityPension/Profit SharingGroup InsuranceSEP/SIMPLE401k/ TSA/ PEDCWills and TrustsIRA/ Roth529Business DocumentsSecurities AccountsBuy-Sell AgreementsSavings and investmentsDeferred Compensation AgreementsAnnuitiesSplit Dollar AgreementsWage Continuation AgreementsLiabilitiesEmployee/ConsultingMortgage StatementsGroup Benefit ProgramsCredit CardsOther Employer Paid Benefits/Employee Benefit BookletsStudent LoansAuto LoansSocial Security Retirement Income Stmts(may obtain online at: https://www.ssa.gov/myaccount/ )Other:Page 2 of 82012/05/08 Tracking #1-063795

ASSETS / LIABILITIESHouse / Property(including Investment Real Estate)Property 1Property 2Property 3DescriptionOwnership (*i.e. joint/individual/trust, etc).Real Estate/Property Tax (annual)MORTGAGE INFORMATION:Loan Start DateOriginal Loan AmountInterest RateLoan DurationMonthly Payment (principal interest ONLY)Current Market Value of PropertyOutstanding Loan BalanceRental Income (if applicable)Rental Expenses (if applicable)Other Liabilities (auto loans, credit cards, lines of credit, education loans)Liability 1Liability 2Liability 3Liability 4DescriptionOwnershipLoan Start DateOriginal Loan AmountInterest Rate (Fixed or Var.?)Loan DurationPayment AmountOutstanding LoanBalanceNon-Qualified Assets* (Bank accounts, investments and non-qualified annuities)NameOwnershipMarket ValueTotalCost Savings / MM / CDsPage 3 of 82012/05/08 Tracking #1-063795

Qualified Assets* (Qualified retirement plans, IRAs, qualified annuities)Institution/Account ontributions*Please also provide account statements with asset allocation information.Monthly Income* PLEASE list GROSS amounts (before taxes)ClientCo-ClientTax BracketsMarginalTax RateJointWages, salary, tipsFederalCash dividendsStateEffectiveTax RateInterest receivedSocial Security incomePension incomeRents, royaltiesAnnuitiesBusiness incomeOther incomeSub-total 0 0 0Total Monthly Income 0*Please be sure to complete separate living expenses worksheet with itemized expenses.Do you expect a significant change in your income during the next two years?Do you want or expect to make changes to your current spending &savings strategies?Personal Use Assets (e.g. Autos, homes, furnishings, jewelry, collectibles, etc.)NameOwnershipPage 4 of 8Market Value2012/05/08 Tracking #1-063795

Education Funds (529 Plans or UTMAs)NameOwnerDonorBeneficiaryBusiness Entities (attach separate sheet if multiple)Market ValueAnnualContributionsStock Options (attach statement with vesting schedule)Name:Grant #1Type (LLC, Partnership, S Corp, C Corp)Purchase DateUnderlying StockISO or NonQualifiedOwnerPurchase AmountExercise PriceMarket ValueGrant DateLiabilityExpiration DateGrowth Rate# SharesOwnershipBuy/Sell AgreementYesGrant #2Grant #3NoEDUCATION GOALS-Please indicate what your funding goal is as well (i.e. all 4 years, 1st two years, etc.StudentStart AgeNumber ofYearsAnnual CostCostIncrease(%)Existing AssetsMAJOR PURCHASES/EXPENSES (Wedding, new cars, vacations, 2nd home, remodel, newHVAC/roof, etc.)DescriptionStart YearNumber ofYearsAmountNeededPage 5 of 8How often will thisexpense re-occur?(if applicable)2012/05/08 Tracking #1-063795

RETIREMENT PLANNING DETAILSHow do you envision your retirement? Are you still living in this area in your current home?How might your spending in retirement change (travel, downsize, health care)?What is your greatest retirement concern?Social Security Retirement BenefitsYesNoInclude Monthly Retirement Benefits?Monthly AmountAgeEffective DateIndex (COLA) rate for monthly benefits%Age0% or2% or%Co-ClientClient Use default formulaUse benefit estimate Age2% orDefined Benefit and/or PensionsMonthly or Lump Sum AmountYesNoUse default formulaUse benefit estimate Start DateIndex (COLA) rate for Social SecurityCo-ClientClient Age%0% or%Do any of your retirement income(s) allow for survivorship options (i.e. 50% or 75% to surviving spouse?Please provide details if so.Retirement Incomes (including annuity income or expected inheritance)Index orType ofClient orAmountFrequency COLA rate Start AgeIncomeCo-client(if any)Page 6 of 8End Age2012/05/08 Tracking #1-063795

INSURANCE/ESTATE PLANNINGWhat is your primary goal for your life insurance policies?Life InsurancePolicy 1Policy 2Policy 3Policy 4Policy 5CompanyType (e.g. term,universal)Effective DateInsuredPolicy OwnerBeneficiaryContingentBeneficiaryDeath BenefitAnnual PremiumCash SurrenderValueLoanStatement Attached?Has anyone in your family experienced a long term care need?Do you anticipate the possibility of needing to financially support aging parents? Please explain.Has anyone in a generation above you lived past age 90? If so, how many?Disability InsurancePolicy 1Policy 2Policy 3Description (group LTD, group STD, individual DI)Effective DateInsuredMonthly BenefitTaxable (yes / no)Index Rate for Benefit AmountElimination PeriodBenefit PeriodAnnual PremiumPage 7 of 82012/05/08 Tracking #1-063795

Long-Term Care InsurancePolicy 1Policy 2Policy 3DescriptionInsuredDaily BenefitIndex for InflationWaiting PeriodBenefit PeriodAnnual PremiumESTATE PLANNING*ClientCo-clientDo you have a will?Do you have advance directives? (living will, health carepower of attorney, durable power of attorney)When were the will / advance directives last updated?Trust Details (indicate date of last o-clientTrustee(s)Gifting: Current StrategiesGift 1Gift 2Gift 3DescriptionGifting Strategy (i.e. Cash Gift, Asset Gift)AmountApplicable PeriodBeneficiary Name*Please provide copies of all estate documents.What asset(s) or amount(s) would you like to leave (or not leave) to heirs upon your passing? (i.e. 100k to each kid or would you like to spend your last dime?)(If there are children) What would you like to see happen at your death (receive assets immediately,receive assets at set times, receive income at set times, use assets for set purposes, etc.)?Does your current estate plan reflect all of your wishes for what you want to happen when you passaway?Page 8 of 82012/05/08 Tracking #1-063795Securities offered through LPL Financial. Member FINRA/SIPC. Investment advice offered through Maryland Financial Group, aregistered investment advisor. Maryland Financial Group and IntegriGen Wealth Management are separate entities from LPL Financial.

Financial Advisor Accountant Lawyer Insurance Banker Other . Employment Information Client Co-client . Employer Position Date of Hire Business Address Business Phone Business email . Family Members . PLANNING ASSUMPTIONS . Name Date of Birth Gender Relationship . Inflation Rate. 3.0% or % Client Co-client . Semi-Retirement Age. 62 or 62 or .