Transcription

MANAGING RISK THRU PREDICTIVE ANALITYCSPRACTICAL ASPECTSAleksandar Knezevic, director Audit & Advisory14th CFO Conference, Belgrade 2015 2012 Deloitte Czech Republic

MANAGING RISK THRU PREDICTIVE ANALITYCS2 2012 Deloitte Czech Republic

Hihger uncertainty – „New normal“ environment3Source: 2015 CFO survey - Deloitte CFO survey Serbia / Central Europe 2012 Deloitte Czech Republic Deloitte 2015

CFO Confidence /-4 2012 Deloitte Czech Republic Deloitte 2015

CFO Confidence /-5 2012 Deloitte Czech Republic Deloitte 2015

Business remodeling /-6 2012 Deloitte Czech Republic

Value creation Enablers & Drivers7

Practical application - Financial sector “booster”8 2012 Deloitte Czech Republic

Propensity model9

Practical application - Manufacturing10Basis for statisticalmodeling

Dynamic forecast application-11Goal seekPortfolio structureMedia ROI5 p.points

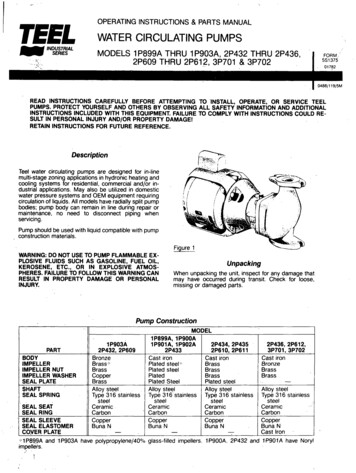

Dynamic forecast applicationKey assumptions1 Revenue2 Gross Margin3 Percent under forecasting4 Percent over forecasting5Under Forecast6 Under forecasting error rate7 % of lost sales89 Increase in production cost10 Increase in shipment cost120,000,00030.00%30.00%70.00%DataEstimated by customerEstimated by customerEstimated by customerAverage Accuracy estimated by customer 70%Estimated by customerEstimated by customerEstimated by customerOver Forecast11 Over forecasting error rate12 % of wrong products produced13 % sold at a discount14 % discount15 % transshipment cost16 Scrap due to obsolescence17 Investment cost (interest rate)18 Inventory turnsAverage Accuracy estimated by customer 70%Estimation to be confirmedEstimated by customerDataEstimated by customerEstimated by customerActual cost of moneyEstimated (Assumption)ROI Assumptions19 Growth rate20 Reduction in forecasting error (year 1)21 Annual improvement in error reductionYearly growth rate estimated by customerForecast accurracy increase estimation agreed by Customer and SASYearly forecast accurracy increase estimation agreed by Customer and SAS12

Dynamic forecast applicationKey assumptions1 Revenue2 Gross Margin3 Percent under forecasting4 Percent over forecasting5Under Forecast6 Under forecasting error rate7 % of lost sales89 Increase in production cost10 Increase in shipment .30%DataEstimated by customerEstimated by customerEstimated by customerAverage Accuracy estimated by customer 70%Estimated by customerEstimated by customerEstimated by customerOver Forecast11 Over forecasting error rate12 % of wrong products produced13 % sold at a discount14 % discount15 % transshipment cost16 Scrap due to obsolescence17 Investment cost (interest rate)18 Inventory turnsAverage Accuracy estimated by customer 70%Estimation to be confirmedEstimated by customerDataEstimated by customerEstimated by customerActual cost of moneyEstimated (Assumption)ROI Assumptions19 Growth rate20 Reduction in forecasting error (year 1)21 Annual improvement in error reductionYearly growth rate estimated by customerForecast accurracy increase estimation agreed by Customer and SASYearly forecast accurracy increase estimation agreed by Customer and SAS13

Dynamic forecast applicationKey assumptions1 Revenue2 Gross Margin3 Percent under forecasting4 Percent over forecasting5Under Forecast6 Under forecasting error rate7 % of lost sales89 Increase in production cost10 Increase in shipment .30%DataEstimated by customerEstimated by customerEstimated by customerAverage Accuracy estimated by customer 70%Estimated by customerEstimated by customerEstimated by customerOver Forecast11 Over forecasting error rate12 % of wrong products produced13 % sold at a discount14 % discount15 % transshipment cost16 Scrap due to obsolescence17 Investment cost (interest rate)18 Inventory age Accuracy estimated by customer 70%Estimation to be confirmedEstimated by customerDataEstimated by customerEstimated by customerActual cost of moneyEstimated (Assumption)ROI Assumptions19 Growth rate20 Reduction in forecasting error (year 1)21 Annual improvement in error reduction5.00%20.00%5.00%Yearly growth rate estimated by customerForecast accurracy increase estimation agreed by Customer and SASYearly forecast accurracy increase estimation agreed by Customer and SAS14

Dynamic forecast applicationUNDER FORECASTTotal SalesUnder forecast amountLost salesLost gross profitLost companion salesGross profit of lost companion salesIncrease in production costIncrease in shipment costLost gross profit from under forecastingOVER FORECASTTotal SalesOver forecasted amountWrong products producedDiscounted sales (% sold at a discount)Lost revenue due to discountingTransshipment costProduct costsCost of disposing obsolete product (scrap)Investment cost (interest rate)Inventory turnsInvestment in inventoryLost gross profit from over forecastingCurrent StateDrivers36,000,000 30%1%10,800,000 108,000 0%0 32,400 0 37,422 32,076 101,898 1%0%Current State84,000,000 30%5%4%40%2%58,800,000 1.0%7%4.0DriversTotal net benefit15Financial Impact25,200,000 1,260,000 1,008,000 403,200 352,800 588,000 955,500 2,299,500 IMPACT OF FORECASTING ERRORSCost of under forecastingCost of over forecastingTotal impact of forecasting errorsImpact relative to gross profitCOST / BENEFIT TOTALSImpact of forecasting errorsImpacrt relative to revenuesReduction in Forecasting ErrorGross Profit Impact Before Solution InvestmentsTotal cost of solutionFinancial Impact101,898 2,299,500 2,401,398 6.67%YEAR 0YEAR 1 2,401,398.002.00%20.0% 480,279.60 480,279.60YEAR 3TOTAL 2,521,467.90 2,647,541.302.10%2.21%21.0%22.1% 529,508.26 583,782.86YEAR 2 7,570,407.20- 529,508.26 583,782.86 1,593,570.71 0.00 1,593,570.71

Operating cash management application-16complex tomanageoptimum gearing0 cost funding

“On call” Real time sensitivity analysis-17„Management favorite“

Aleksandar Knezevic, CPADirector audit & advisory 381 65 222 3460aknezevic@deloittece.comDeloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UKprivate company limited by guarantee, and its network of member firms, eachof which is a legally separate and independent entity. Please seewww.deloitte.com/cz/about for a detailed description of the legal structure ofDeloitte Touche Tohmatsu Limited and its member firms. 2015 Deloitte Serbia

MANAGING RISK THRU PREDICTIVE ANALITYCS PRACTICAL ASPECTS . modeling. Dynamic forecast application 11 - Goal seek - Portfolio structure - Media ROI - 5 p.points. 12 . Forecast accurracy increase estimation agreed by Customer and SAS Yearly forecast accurracy increase estimation agreed by Customer and SAS