Transcription

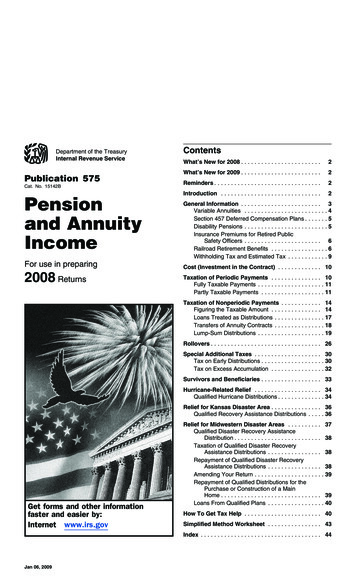

PAGER/SGMLUserid: SD 03NBB DTD tipxLeadpct: -4% Pt. size: 10Fileid: D:\Users\03nbb\documents\epicfiles\P575.XMLPage 1 of 46 of Publication 575 Draft(Init. & date) Ok to Print14:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.Department of the TreasuryInternal Revenue ServicePublication 575Cat. No. 15142BPensionand AnnuityIncomeFor use in preparing2008 ReturnsContentsWhat’s New for 2008 . . . . . . . . . . . . . . . . . . . . . . . .2What’s New for 2009 . . . . . . . . . . . . . . . . . . . . . . . .2Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2General Information . . . . . . . . . . . . . . . . . . . . . . . . 3Variable Annuities . . . . . . . . . . . . . . . . . . . . . . . . . 4Section 457 Deferred Compensation Plans . . . . . . . 5Disability Pensions . . . . . . . . . . . . . . . . . . . . . . . . . 5Insurance Premiums for Retired PublicSafety Officers . . . . . . . . . . . . . . . . . . . . . . . 6Railroad Retirement Benefits . . . . . . . . . . . . . . . . . 6Withholding Tax and Estimated Tax . . . . . . . . . . . . 9Cost (Investment in the Contract) . . . . . . . . . . . . . 10Taxation of Periodic Payments . . . . . . . . . . . . . . . 10Fully Taxable Payments . . . . . . . . . . . . . . . . . . . . 11Partly Taxable Payments . . . . . . . . . . . . . . . . . . . 11Taxation of Nonperiodic Payments . . . . . . . . . . . . 14Figuring the Taxable Amount . . . . . . . . . . . . . . . 14Loans Treated as Distributions . . . . . . . . . . . . . . . 17Transfers of Annuity Contracts . . . . . . . . . . . . . . . 18Lump-Sum Distributions . . . . . . . . . . . . . . . . . . . . 19Rollovers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26Special Additional Taxes . . . . . . . . . . . . . . . . . . . . 30Tax on Early Distributions . . . . . . . . . . . . . . . . . . . 30Tax on Excess Accumulation . . . . . . . . . . . . . . . . 32Survivors and Beneficiaries . . . . . . . . . . . . . . . . . . 33Hurricane-Related Relief . . . . . . . . . . . . . . . . . . . . 34Qualified Hurricane Distributions . . . . . . . . . . . . . . 34Relief for Kansas Disaster Area . . . . . . . . . . . . . . . 36Qualified Recovery Assistance Distributions . . . . . 36Get forms and other informationfaster and easier by:Internet www.irs.govRelief for Midwestern Disaster Areas . . . . . . . . . . 37Qualified Disaster Recovery AssistanceDistribution . . . . . . . . . . . . . . . . . . . . . . . . . . 38Taxation of Qualified Disaster RecoveryAssistance Distributions . . . . . . . . . . . . . . . . 38Repayment of Qualified Disaster RecoveryAssistance Distributions . . . . . . . . . . . . . . . . 38Amending Your Return . . . . . . . . . . . . . . . . . . . . . 39Repayment of Qualified Distributions for thePurchase or Construction of a MainHome . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39Loans From Qualified Plans . . . . . . . . . . . . . . . . . 40How To Get Tax Help . . . . . . . . . . . . . . . . . . . . . . . 40Simplified Method Worksheet . . . . . . . . . . . . . . . . 43Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44Jan 06, 2009

Page 2 of 46 of Publication 57514:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.What’s New for 2008Rollovers to Roth IRAs. Beginning in 2008, you can rollover distributions directly from a qualified retirement planto a Roth IRA if, for the tax year of the distribution, yourmodified adjusted gross income for Roth IRA purposes isnot more than 100,000, and your filing status is notmarried filing separately. See Rollovers to Roth IRAs, later,for more information.Tax relief for the Kansas disaster area. Special rulesapply to the use of retirement funds by qualified individualswho suffered an economic loss in the Kansas disaster areaas a result of the storms and tornadoes that began on May4, 2007. For more information, see Relief for Kansas Disaster Area, later.IntroductionThis publication discusses the tax treatment of distributions you receive from pension and annuity plans and alsoshows you how to report the income on your federal income tax return. How these distributions are taxed depends on whether they are periodic payments (amountsreceived as an annuity) that are paid at regular intervalsover several years or nonperiodic payments (amounts notreceived as an annuity).What is covered in this publication? Publication 575contains information that you need to understand the following topics. How to figure the tax-free part of periodic paymentsunder a pension or annuity plan, including using asimple worksheet for payments under a qualifiedplan.Tax relief for the Midwestern disaster areas. Specialrules apply to the use of retirement funds by qualifiedindividuals who suffered an economic loss in the Midwestern disaster areas as a result of severe storms, tornadoes,or flooding. For more information, see Relief for Midwestern Disaster Areas, later. How to figure the tax-free part of nonperiodic pay-Qualified settlement income. Qualified settlement income you receive in connection with the Exxon Valdezlitigation can be contributed, in whole or in part, to aqualified retirement plan. For more information, see Qualified settlement income under Rollovers, later. How to report disability payments, and how benefi-ments from qualified and nonqualified plans, andhow to use the optional methods to figure the tax onlump-sum distributions from pension, stock bonus,and profit-sharing plans. How to roll over certain distributions from a retirement plan into another retirement plan or IRA.ciaries and survivors of employees and retirees mustreport benefits paid to them. How to report railroad retirement benefits. When additional taxes on certain distributions mayapply (including the tax on early distributions and thetax on excess accumulation).What’s New for 2009Temporary waiver of required minimum distribution(RMD) rules for certain retirement plans and IRAs for2009. No RMD is required from your employer-providedqualified retirement plan or IRA for 2009. For more information, see Temporary waiver of required minimum distributions (RMDs) for 2009, under Rollovers, later.RemindersHurricane tax relief. Special rules apply to retirementfunds received by qualified individuals who suffered aneconomic loss as a result of Hurricane Katrina, Rita, orWilma. See Hurricane-Related Relief, for information onthese special rules.Photographs of missing children. The Internal Revenue Service is a proud partner with the National Center forMissing and Exploited Children. Photographs of missingchildren selected by the Center may appear in this publication on pages that would otherwise be blank. You can helpbring these children home by looking at the photographsand calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child.Page 2For additional information on how to report pension or annuity payments on your federal incometax return, be sure to review the instructions onthe back of Copies B, C, and 2 of the Form 1099-R that youreceived and the instructions for Form 1040, lines 16a and16b (Form 1040A, lines 12a and 12b or Form 1040NR,lines 17a and 17b).TIPA “corrected” Form 1099-R replaces the corresponding original Form 1099-R if the originalCAUTIONForm 1099-R contained an error. Make sure youuse the amounts shown on the corrected Form 1099-Rwhen reporting information on your tax return.!What is not covered in this publication? The followingtopics are not discussed in this publication.The General Rule. This is the method generally used todetermine the tax treatment of pension and annuity incomefrom nonqualified plans (including commercial annuities).For a qualified plan, you generally cannot use the GeneralRule unless your annuity starting date is before November19, 1996. Although this publication will help you determinewhether you can use the General Rule, it will not help youuse it to determine the tax treatment of your pension orannuity income. For more information on the General Rule,see Publication 939, General Rule for Pensions and Annuities.Publication 575 (2008)

Page 3 of 46 of Publication 57514:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.Individual retirement arrangements (IRAs). Information on the tax treatment of amounts you receive from anIRA is in Publication 590, Individual Retirement Arrangements (IRAs).Civil service retirement benefits. If you are retiredfrom the federal government (either regular or disabilityretirement) or are the survivor or beneficiary of a federalemployee or retiree who died, get Publication 721, TaxGuide to U.S. Civil Service Retirement Benefits. Publication 721 covers the tax treatment of federal retirementbenefits, primarily those paid under the Civil Service Retirement System (CSRS) or the Federal Employees’ Retirement System (FERS). It also covers benefits paid fromthe Thrift Savings Plan (TSP).Social security and equivalent tier 1 railroad retirement benefits. For information about the tax treatment ofthese benefits, see Publication 915, Social Security andEquivalent Railroad Retirement Benefits. However, thispublication (575) covers the tax treatment of the non-socialsecurity equivalent benefit portion of tier 1 railroad retirement benefits, tier 2 benefits, vested dual benefits, andsupplemental annuity benefits paid by the U.S. RailroadRetirement Board.Tax-sheltered annuity plans (403(b) plans). If youwork for a public school or certain tax-exempt organizations, you may be eligible to participate in a 403(b) retirement plan offered by your employer. Although thispublication covers the treatment of benefits under 403(b)plans, it does not cover other tax provisions that apply tothese plans. For more information on 403(b) plans, seePublication 571, Tax-Sheltered Annuity Plans (403(b)Plans) For Employees of Public Schools and CertainTax-Exempt Organizations.Comments and suggestions. We welcome your comments about this publication and your suggestions forfuture editions.You can write to us at the following address:Internal Revenue ServiceIndividual Forms and Publications BranchSE:W:CAR:MP:T:I1111 Constitution Ave. NW, IR-6526Washington, DC 20224We respond to many letters by telephone. Therefore, itwould be helpful if you would include your daytime phonenumber, including the area code, in your correspondence.You can email us at *taxforms@irs.gov. (The asteriskmust be included in the address.) Please put “PublicationsComment” on the subject line. Although we cannot respond individually to each email, we do appreciate yourfeedback and will consider your comments as we reviseour tax products.Ordering forms and publications. Visit www.irs.gov/formspubs to download forms and publications, call1-800-829-3676, or write to the address below and receivea response within 10 days after your request is received.Internal Revenue Service1201 N. Mitsubishi MotorwayBloomington, IL 61705-6613Publication 575 (2008)Tax questions. If you have a tax question, check theinformation available on www.irs.gov or call1-800-829-1040. We cannot answer tax questions sent toeither of the above addresses.Useful ItemsYou may want to see:Publication 524Credit for the Elderly or the Disabled 525Taxable and Nontaxable Income 560Retirement Plans for Small Business (SEP,SIMPLE, and Qualified Plans) 571Tax-Sheltered Annuity Plans (403(b) Plans)For Employees of Public Schools and CertainTax-Exempt Organizations 590Individual Retirement Arrangements (IRAs) 721Tax Guide to U.S. Civil Service RetirementBenefits 915Social Security and Equivalent RailroadRetirement Benefits 939General Rule for Pensions and Annuities 4492 Information for Taxpayers Affected byHurricanes Katrina, Rita, and Wilma 4492-A Information for Taxpayers Affected by theMay 4, 2007, Kansas Storms and Tornadoes 4492-B Information for Affected Taxpayers in theMidwestern Disaster AreasForm (and Instructions) W-4P Withholding Certificate for Pension or AnnuityPayments 1099-R Distributions From Pensions, Annuities,Retirement or Profit-Sharing Plans, IRAs,Insurance Contracts, etc. 4972 Tax on Lump-Sum Distributions 5329 Additional Taxes on Qualified Plans (IncludingIRAs) and Other Tax-Favored Accounts 8915 Qualified Hurricane Retirement PlanDistributions and Repayments 8930 Qualified Disaster Recovery AssistanceRetirement Plan Distributions andRepaymentsSee How To Get Tax Help near the end of this publication for information about getting publications and forms.General InformationDefinitions. Some of the terms used in this publicationare defined in the following paragraphs.Pension. A pension is generally a series of definitelydeterminable payments made to you after you retire fromwork. Pension payments are made regularly and arePage 3

Page 4 of 46 of Publication 57514:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.based on such factors as years of service and prior compensation.Annuity. An annuity is a series of payments under acontract made at regular intervals over a period of morethan one full year. They can be either fixed (under whichyou receive a definite amount) or variable (not fixed). Youcan buy the contract alone or with the help of your employer.Qualified employee plan. A qualified employee plan isan employer’s stock bonus, pension, or profit-sharing planthat is for the exclusive benefit of employees or theirbeneficiaries and that meets Internal Revenue Code requirements. It qualifies for special tax benefits, such as taxdeferral for employer contributions and capital gain treatment or the 10-year tax option for lump-sum distributions (ifparticipants qualify). To determine whether your plan is aqualified plan, check with your employer or the plan administrator.Qualified employee annuity. A qualified employee annuity is a retirement annuity purchased by an employer foran employee under a plan that meets Internal RevenueCode requirements.Designated Roth account. A designated Roth accountis a separate account created under a qualified Roth contribution program to which participants may elect to havepart or all of their elective deferrals to a 401(k) or 403(b)plan designated as Roth contributions. Elective deferralsthat are designated as Roth contributions are included inyour income. However, qualified distributions are not included in your income. You should check with your planadministrator to determine if your plan will accept designated Roth contributions.Tax-sheltered annuity plan. A tax-sheltered annuityplan (often referred to as a 403(b) plan or a tax-deferredannuity plan) is a retirement plan for employees of publicschools and certain tax-exempt organizations. Generally,a tax-sheltered annuity plan provides retirement benefitsby purchasing annuity contracts for its participants.Types of pensions and annuities. Pensions and annuities include the following types.Fixed-period annuities. You receive definite amountsat regular intervals for a specified length of time.Annuities for a single life. You receive definiteamounts at regular intervals for life. The payments end atdeath.Joint and survivor annuities. The first annuitant receives a definite amount at regular intervals for life. Afterhe or she dies, a second annuitant receives a definiteamount at regular intervals for life. The amount paid to thesecond annuitant may or may not differ from the amountpaid to the first annuitant.Variable annuities. You receive payments that mayvary in amount for a specified length of time or for life. Theamounts you receive may depend upon such variables asprofits earned by the pension or annuity funds,cost-of-living indexes, or earnings from a mutual fund.Disability pensions. You receive disability paymentsbecause you retired on disability and have not reachedminimum retirement age.Page 4More than one program. You may receive employeeplan benefits from more than one program under a singletrust or plan of your employer. If you participate in morethan one program, you may have to treat each as a separate pension or annuity contract, depending upon the factsin each case. Also, you may be considered to have received more than one pension or annuity. Your formeremployer or the plan administrator should be able to tellyou if you have more than one contract.Example. Your employer set up a noncontributoryprofit-sharing plan for its employees. The plan providesthat the amount held in the account of each participant willbe paid when that participant retires. Your employer alsoset up a contributory defined benefit pension plan for itsemployees providing for the payment of a lifetime pensionto each participant after retirement.The amount of any distribution from the profit-sharingplan depends on the contributions (including allocatedforfeitures) made for the participant and the earnings fromthose contributions. Under the pension plan, however, aformula determines the amount of the pension benefits.The amount of contributions is the amount necessary toprovide that pension.Each plan is a separate program and a separate contract. If you get benefits from these plans, you must account for each separately, even though the benefits fromboth may be included in the same check.!CAUTIONDistributions from a designated Roth account aretreated separately from other distributions fromthe plan.Qualified domestic relations order (QDRO). A QDRO isa judgment, decree, or order relating to payment of childsupport, alimony, or marital property rights to a spouse,former spouse, child, or other dependent of a participant ina retirement plan. The QDRO must contain certain specificinformation, such as the name and last known mailingaddress of the participant and each alternate payee, andthe amount or percentage of the participant’s benefits to bepaid to each alternate payee. A QDRO may not award anamount or form of benefit that is not available under theplan.A spouse or former spouse who receives part of thebenefits from a retirement plan under a QDRO reports thepayments received as if he or she were a plan participant.The spouse or former spouse is allocated a share of theparticipant’s cost (investment in the contract) equal to thecost times a fraction. The numerator of the fraction is thepresent value of the benefits payable to the spouse orformer spouse. The denominator is the present value of allbenefits payable to the participant.A distribution that is paid to a child or other dependentunder a QDRO is taxed to the plan participant.Variable AnnuitiesThe tax rules in this publication apply both to annuities thatprovide fixed payments and to annuities that provide payments that vary in amount based on investment results orother factors. For example, they apply to commercial variable annuity contracts, whether bought by an employeeretirement plan for its participants or bought directly fromPublication 575 (2008)

Page 5 of 46 of Publication 57514:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.the issuer by an individual investor. Under these contracts,the owner can generally allocate the purchase paymentsamong several types of investment portfolios or mutualfunds and the contract value is determined by the performance of those investments. The earnings are not taxeduntil distributed either in a withdrawal or in annuity payments. The taxable part of a distribution is treated asordinary income.For information on the tax treatment of a transfer orexchange of a variable annuity contract, see Transfers ofAnnuity Contracts under Taxation of Nonperiodic Payments, later.Withdrawals. If you withdraw funds before your annuitystarting date and your annuity is under a qualified retirement plan, a ratable part of the amount withdrawn is taxfree. The tax-free part is based on the ratio of your cost(investment in the contract) to your account balance underthe plan.If your annuity is under a nonqualified plan (including acontract you bought directly from the issuer), the amountwithdrawn is allocated first to earnings (the taxable part)and then to your cost (the tax-free part). However, if youbought your annuity contract before August 14, 1982, adifferent allocation applies to the investment before thatdate and the earnings on that investment. To the extent theamount withdrawn does not exceed that investment andearnings, it is allocated first to your cost (the tax-free part)and then to earnings (the taxable part).If you withdraw funds (other than as an annuity) on orafter your annuity starting date, the entire amount withdrawn is generally taxable.The amount you receive in a full surrender of yourannuity contract at any time is tax free to the extent of anycost that you have not previously recovered tax free. Therest is taxable.For more information on the tax treatment of withdrawals, see Taxation of Nonperiodic Payments, later. If youwithdraw funds from your annuity before you reach age591/2, also see Tax on Early Distributions under SpecialAdditional Taxes, later.Annuity payments. If you receive annuity paymentsunder a variable annuity plan or contract, you recover yourcost tax free under either the Simplified Method or theGeneral Rule, as explained under Taxation of PeriodicPayments, later. For a variable annuity paid under a qualified plan, you generally must use the Simplified Method.For a variable annuity paid under a nonqualified plan(including a contract you bought directly from the issuer),you must use a special computation under the GeneralRule. For more information, see Variable annuities in Publication 939 under Computation Under the General Rule.Death benefits. If you receive a single-sum distributionfrom a variable annuity contract because of the death ofthe owner or annuitant, the distribution is generally taxableonly to the extent it is more than the unrecovered cost ofthe contract. If you choose to receive an annuity, thepayments are subject to tax as described above. If thecontract provides a joint and survivor annuity and theprimary annuitant had received annuity payments beforedeath, you figure the tax-free part of annuity payments youreceive as the survivor in the same way the primary annuitant did. See Survivors and Beneficiaries, later.Publication 575 (2008)Section 457 DeferredCompensation PlansIf you work for a state or local government or for atax-exempt organization, you may be able to participate ina section 457 deferred compensation plan. If your plan isan eligible plan, you are not taxed currently on pay that isdeferred under the plan or on any earnings from the plan’sinvestment of the deferred pay. You are generally taxed onamounts deferred in an eligible state or local governmentplan only when they are distributed from the plan. You aretaxed on amounts deferred in an eligible tax-exempt organization plan when they are distributed or otherwisemade available to you.This publication covers the tax treatment of benefitsunder eligible section 457 plans, but it does not cover thetreatment of deferrals. For information on deferrals undersection 457 plans, see Retirement Plan Contributionsunder Employee Compensation in Publication 525.Is your plan eligible? To find out if your plan is an eligibleplan, check with your employer. Plans that are not eligiblesection 457 plans include the following: Bona fide vacation leave, sick leave, compensatorytime, severance pay, disability pay, or death benefitplans. Nonelective deferred compensation plans for nonemployees (independent contractors). Deferred compensation plans maintained bychurches. Length of service award plans for bona fide volun-teer firefighters and emergency medical personnel.An exception applies if the total amount paid to avolunteer exceeds 3,000 for any year of service.Disability PensionsIf you retired on disability, you generally must include inincome any disability pension you receive under a plan thatis paid for by your employer. You must report your taxabledisability payments as wages on line 7 of Form 1040 orForm 1040A or on line 8 of Form 1040NR until you reachminimum retirement age. Minimum retirement age generally is the age at which you can first receive a pension orannuity if you are not disabled.TIPYou may be entitled to a tax credit if you werepermanently and totally disabled when you retired. For information on this credit, see Publica-tion 524.Beginning on the day after you reach minimum retirement age, payments you receive are taxable as a pensionor annuity. Report the payments on Form 1040, lines 16aand 16b; Form 1040A, lines 12a and 12b; or on Form1040NR, lines 17a and 17b.Disability payments for injuries incurred as a direct result of a terrorist attack directed against theUnited States (or its allies) are not included inincome. For more information about payments to survivorsof terrorist attacks, see Publication 3920, Tax Relief forVictims of Terrorist Attacks.TIPPage 5

Page 6 of 46 of Publication 57514:28 - 6-JAN-2009The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.Insurance Premiums for RetiredPublic Safety OfficersIf you are an eligible retired public safety officer (lawenforcement officer, firefighter, chaplain, or member of arescue squad or ambulance crew), you can elect to exclude from income distributions made from your eligibleretirement plan that are used to pay the premiums foraccident or health insurance or long-term care insurance.The premiums can be for coverage for you, your spouse,or dependents. The distribution must be made directly fromthe plan to the insurance provider. You can exclude fromincome the smaller of the amount of the insurance premiums or 3,000. You can only make this election foramounts that would otherwise be included in your income.The amount excluded from your income cannot be used toclaim a medical expense deduction.An eligible retirement plan is a governmental plan thatis: a qualified trust,a section 403(a) plan,a section 403(b) annuity, ora section 457(b) plan.If you make this election, reduce the otherwise taxableamount of your pension or annuity by the amount excluded. The amount shown in box 2a of Form 1099-R doesnot reflect this exclusion. Report your total distributions onForm 1040, line 16a; Form 1040A, line 12a; or Form1040NR, line 17a. Report the taxable amount on Form1040, line 16b; Form 1040A, line 12b; or Form 1040NR,line 17b. Enter “PSO” next to the appropriate line on whichyou report the taxable amount.If you are retired on disability and reporting your disability pension on line 7 of Form 1040 or Form 1040A, or line 8of Form 1040NR, include only the taxable amount on thatline and enter “PSO” and the amount excluded on thedotted line next to the applicable line.Railroad Retirement BenefitsBenefits paid under the Railroad Retirement Act fall intotwo categories. These categories are treated differently forincome tax purposes.The first category is the amount of tier 1 railroad retirement benefits that equals the social security benefit that arailroad employee or beneficiary would have been entitledto receive under the social security system. This part of thetier 1 benefit is the social security equivalent benefit(SSEB) and you treat it for tax purposes like social securitybenefits. If you received, repaid, or had tax withheld fromthe SSEB portion of tier 1 benefits during 2008, you willreceive Form RRB-1099, Payments by the Railroad Retirement Board (or Form RRB-1042S, Statement for Nonresident Alien Recipients of Payments by the RailroadRetirement Board, if you are a nonresident alien) from theU.S. Railroad Retirement Board (RRB).For more information about the tax treatment of theSSEB portion of tier 1 benefits and Forms RRB-1099 andRRB-1042S, see Publication 915.Page 6The second category contains the rest of the tier 1railroad retirement benefits, called the non-social securityequivalent benefit (NSSEB). It also contains any tier 2benefit, vested dual benefit (VDB), and supplemental annuity benefit. Treat this category of benefits, shown onForm RRB-1099-R, as an amount received from a qualifiedemployee plan. This allows for the tax-free (nontaxable)recovery of employee contributions from the tier 2 benefitsand the NSSEB part of the tier 1 benefits. (The NSSEB andtier 2 benefits, less certain repayments, are combined intoone amount called the Contributory Amount Paid on FormRRB-1099-R.) Vested dual benefits and supplemental annuity benefits are non-contributory pensions and are fullytaxable. See Taxation of Periodic Payments, later, forinformation on how to report your benefits and how torecover the employee contributions tax free. FormRRB-1099-R is used for U.S. citizens, resident aliens, andnonresident aliens.Nonresident aliens. A nonresident alien is an individualwho is not a citizen or a resident alien of the United States.Nonresident aliens are subject to mandatory U.S. tax withholding unless exempt under a tax treaty between theUnited States and their country of legal residency. A taxtreaty exemption may reduce or eliminate tax withholdingfrom railroad retirement benefits. See Tax withholdingnext, for more information.If you are a nonresident alien and your tax withholdingrate changed or your country of legal residence changedduring the year, you may receive more than one FormRRB-1042S or Form RRB-1099-R. To determine your totalbenefits paid or repaid and total tax withheld for the year,you should add the amounts shown on all forms youreceived for that year. For information on filing requirements for aliens, see Publication 519, U.S. Tax Guide forAliens. For information on t

ern disaster areas as a result of severe storms, tornadoes, lump-sum distributions from pension, stock bonus, or flooding. For more information, see Relief for Midwest-and profit-sharing plans. ern Disaster Areas, later. How to roll over certain distributions from a retire-ment plan into another retirement plan or IRA. Qualified settlement .