Transcription

Servicer Evaluation: Freddie MacServicer Analyst:Marilyn D Cline, Farmers Branch 1 (972) 367 3339; marilyn.cline@spglobal.comSecondary Contact:Steven Altman, New York 1 (212) 438 5042; steven.altman@spglobal.comAnalytical Manager, Servicer Evaluations:Robert J Radziul, New York 1 (212) 438 1051; robert.radziul@spglobal.comTable Of ContentsRationaleProfileManagement And OrganizationLoan AdministrationFinancial PositionAppendix: Freddie Mac Multifamily Portfolios/Product TypesRelated ResearchWWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 1

Servicer Evaluation: Freddie MacRanking OverviewSubrankingsServicing category Overall rankingManagement and organization Loan administration OutlookCommercial masterABOVE AVERAGEABOVE AVERAGEABOVE AVERAGEStableFinancial positionSUFFICIENTRationaleS&P Global Ratings' ranking on Freddie Mac Multifamily Asset Management and Operations (AMO) is ABOVEAVERAGE as a commercial mortgage loan master servicer. On May 11, 2021, we affirmed the ranking (please see"Freddie Mac ABOVE AVERAGE Commercial Mortgage Loan Master Servicer Ranking Affirmed; Outlook Stable,"published May 11, 2021). The outlook for the ranking is stable.Our ranking reflects AMO's: Experienced and tenured senior management team; Effective and comprehensive employee training and development program; Continued low levels of multifamily mortgage loan delinquency rates, albeit supported by an extensive forbearanceprogram during 2020; Integrated and effective technology systems; Comprehensive subservicer (seller/servicer) oversight program; Sound audit and control environment, albeit with a longer-than-average internal audit cycle compared with those ofmost servicers; Homogenous multifamily property portfolio, with limited exposure to other commercial property types; Financial support and implicit guarantee from the U.S. government; and Continued position under the conservatorship of the Federal Housing Finance Agency (FHFA) limiting the ability tocontrol its future.Since our prior review (see "Servicer Evaluation: Freddie Mac," published Aug. 15, 2019), the following changes and/ordevelopments have occurred: In November 2020, the FHFA issued its annual Conservatorship scorecard, which provides for a multifamily lendingcap at 70 billion for Freddie Mac for 2021; at least 50.0% of that cap must include mission-driven affordablemultifamily acquisitions. In January 2021, Freddie Mac, acting through FHFA, and the U.S. Department of theTreasury entered into a letter agreement to further amend the Senior Preferred Stock Purchase Agreement andterms of the senior preferred stock. The January 2021 Letter Agreement, among other things, capped multifamilyloan purchases at 80 billion in any 52-week period, subject to annual adjustment by FHFA.WWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 2

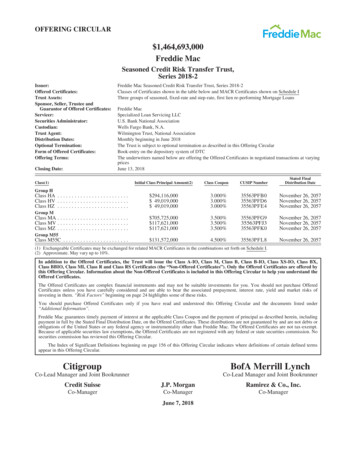

Servicer Evaluation: Freddie Mac The "serviced by others" portfolio increased to 102 billion as of Dec. 31, 2020, from 82 billion as of Dec. 31, 2018,and the traditional K-Deal (i.e., capital market execution) portfolio balance increased to approximately 295 billionas of Dec. 31, 2020, from nearly 235 billion as of Dec. 31, 2018. As of Dec. 31, 2020, AMO was the appointed master servicer on securitized transactions aggregating 42.3 billion inunpaid principal balance (UPB), including 40 nontraditional K-Deals for a total of 10.7 billion in UPB, 81small-balance deals for a total of 23.9 billion in UPB, 12 Q-Deals for a total UPB of 3.3 billion, and 10 "other"transactions for a total UPB of 4.4 billion. In November 2020, the CEO tendered his resignation and the head of investments and capital markets wasappointed interim president, while also maintaining his existing duties. The CEO departed the company in January 2021 and a board member was appointed interim CEO in March until apermanent replacement was hired. In June 2021, the newly selected CEO, with extensive industry experience, started with the company. The interimCEO then returned to his position on the board. In December 2020, the chief human resources officer/chief diversity officer resigned and an internal candidate willserve as acting officer until a permanent replacement is hired. In December 2020, a new senior vice president (SVP) was hired as chief information security officer (CISO),replacing the previous CISO who left the company in June 2020. The head of production was promoted to SVP of multifamily production and sales in November 2019. From March 1, 2020, through Sept. 30, 2020, 18 AMO employees accepted early retirement packages, which werepreviously offered, and exit dates were staggered during the year. Management states that all vacated positionshave been filled, except one based on need. The company continues to invest in its five-year digital transformation plan (which began in the fall of 2018),including increasing responsiveness, optimizing data, providing portable access, and easing the user experience. In January 2020, the company held an in-person inaugural compliance forum with representatives from eachservicer to review and discuss compliance requirements. In the summer of 2020, Freddie Mac made their multifamily seller/servicer guide available for free access, insteadof the previous paid subscription format on the All Regs website. Freddie Mac implemented its disaster recovery and business continuity plan in the spring of 2020 due to theCOVID-19 pandemic. Management reported that there were no disruptions to the company's operations or datafacilities and that they have continued normal operations with no issues.The outlook on the ranking is stable, which reflects our view that the company is expected to remain a competentmaster servicer for commercial mortgage loans. As previously noted, the company recently experienced a change inleadership at the CEO level. Freddie Mac filled the role on an interim basis with a board member. The newly selectedCEO started with Freddie Mac on June 1, 2021, and the interim CEO returned to his position on the board. Theoperational core leadership of AMO has remained stable and has extensive experience and tenure with the company.Further, although housing finance reform and the future existence and/or role of Freddie Mac has been underdiscussion internally within Freddie Mac and externally within various levels of the U.S. government under theWWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 3

Servicer Evaluation: Freddie Macprevious administration, we expect at this time, that operations will continue as usual for the foreseeable future.In addition to conducting a remote meeting with servicing management, our review includes current and historicalServicer Evaluation Analytical Methodology data through Dec. 31, 2020, as well as other supporting documentationprovided by the company.ProfileServicer ProfileServicer nameFederal Home Loan Mortgage Corp. (d/b/a Freddie Mac)Primary servicing locationMcLean, Va.Parent holding company(i)Federal Housing Financing Agency (September 2008)Loan servicing systemMultiple (see the Systems And Technology section)(i)Federal Housing Financing Agency is the conservator of Freddie Mac (not a parent holding company). d/b/a--Doing business as.Freddie Mac was chartered by the U.S. Congress in 1970 with a public mission to provide liquidity, stability, andaffordability to the U.S. housing market. Freddie Mac fulfills its mission by conducting business in the secondarymortgage market and purchasing loans through a national network of mortgage lenders; it does not make loansdirectly.Freddie Mac Multifamily's mission is to promote an ample supply of affordable rental housing by purchasingmortgages collateralized by apartment buildings with five or more units. Freddie Mac has been funding and servicingmultifamily mortgages since 1993 and, as of Dec. 31, 2020, it had cumulatively provided more than 763 billion infinancing for over 11.3 million multifamily units.Freddie Mac purchases multifamily mortgages from approved seller/servicers and targeted affordable housingcorrespondents according to Freddie Mac guidelines. The multifamily division has over 1,000 employees, and it issupported by more than 200 additional Freddie Mac employees across finance, technology, legal, enterprise riskmanagement, and human resources departments. The majority of Freddie Mac employees are typically headquarteredat the McLean, Va., campus, with additional multifamily staff located in four regional offices (Arlington, Va., Chicago,Los Angeles, and New York), along with nine field offices. However, due to concerns about the COVID-19 pandemic,the majority of Freddie Mac's staff have been working from home since March 2020.On Sept. 6, 2008, FHFA placed Freddie Mac (and Fannie Mae) in conservatorship, under which it continues to remain.The conservator assumed all powers of the board, management, and shareholders. During conservatorship, the FHFAhas made an effort to distinguish the government-sponsored enterprise's (GSE's) multifamily division from theresidential loan single-family businesses, which suffered losses during the housing crisis, whereas the multifamilybusiness weathered the crisis and continued to generate positive cash flow while providing liquidity to the multifamilymortgage industry. Freddie Mac Multifamily uses its K-Deal securitization model, which was adopted in 2009, as theprimary vehicle to transfer credit risk.In November 2020, the FHFA issued its annual Conservatorship Scorecard, which provides for a multifamily lendingcap at 70 billion for Fannie Mae for 2021; at least 50.0% of that cap must include mission-driven NE 9, 2021 4

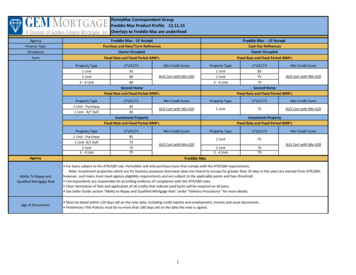

Servicer Evaluation: Freddie Macmultifamily acquisitions. In January 2021, the FHFA and Treasury Department amended the preferred stock purchaseagreement to include an 80 billion cap to be calculated in any 52-week period.Freddie Mac Multifamily sources its loans from approximately 26 approved seller/servicers (an additional 22 areapproved for servicing only or negotiated transactions), which are licensed in either conventional, small-balance,and/or affordable housing loan products. The seller/servicers must meet Freddie Mac's standards for both originationand servicing of multifamily loans, including maintaining minimum financial requirements and satisfactory annualaudit results. After Freddie Mac Multifamily purchases a loan from a seller/servicer, the servicer typically maintainsthe loan servicing and asset management duties. The servicer's roles and responsibilities are clearly defined in theFreddie Mac Multifamily Seller/Servicer Guide (SSG). In the event of a loan default, the servicer prepares an initialpackage for Freddie Mac to review; Freddie Mac then controls the resolution process.In addition to loans securitized in K-Deals, Freddie Mac Multifamily has various other product types that make upmore than 346 billion (see table 1) as of Dec. 31, 2020 (for more information about these portfolio/product types, seethe Appendix of this report). Consistent with the goal to migrate to a securitization model, the percentage of suchtransactions in the portfolio has increased since our last review (81.9% of UPB as of Dec. 31, 2020, compared with80.6% as of Dec. 31, 2018).Table 1Multifamily Portfolio(i)As of Dec. 31, 2020Product TypeLoan/bond countLoan/bond count (%)UPB (mil. )UPB (%)Participation certificates (45- and 75-day)2080.71380.0Participation certificates (55-day)6142.112,1793.5TEBS6602.26,4111.9Bond credit enhancements4531.510,7753.1Retained portfolio (for sale)1,3804.723,7896.9Retained portfolio (for tal(i)Includes loans where Freddie Mac is guarantor or the master servicer. (ii)K-Deal info also includes ML deals (securitized tax-exempt loans[TELs]). UPB--Unpaid principal balance. TEBS--Tax-exempt bond securitization.Management And OrganizationThe management and organization subranking is ABOVE AVERAGE.Organizational structure, staff, and turnoverThe multifamily division's long-tenured executive vice president (EVP) oversees a staff of over 800, includingemployees within operations, investments, strategic planning, data management initiative, and business supportWWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 5

Servicer Evaluation: Freddie Macoperations and execution. There are seven lines of business (headcounts as of Dec. 31, 2020): Production and sales (137 employees); Affordable sales and investments (27); Underwriting and credit (247); Chief Market Risk (8); Capital markets (90); Business and offerings management (33); and AMO (264).The multifamily division is further supported by in-house legal, accounting, finance, technology, enterprise riskmanagement, human resources, and communications staff.The AMO group is headed by the SVP of multifamily operations and operational risk for Freddie Mac. The SVP hasbeen with the company almost 25 years and has extensive experience in the industry. She reports directly to theaforementioned EVP of Multifamily.AMO is organized into four distinct areas with tenured executives managing each area as described below: Asset Management – headed by a vice president (VP) with almost 10 years with the company and prior industryexperience with a servicer as well as a rating agency. Her group manages and monitors borrower transactions,structured transactions, and risk ratings, and performs master servicing asset management and reporting. The unitalso oversees investor support, insurance, physical risk guidance, loan boarding, and compliance and propertyassessments collections. Multifamily Operations – headed by a VP with 21 years at the company and prior industry experience in banking.His group manages and reconciles servicer reporting and remittance, the Multifamily (MF) cash desk, monthlyoperational closing activities, retained portfolio servicing and master servicing (post securitization), and fundadministration. The unit also authorizes loan/bond purchases, performs loan sales/securitization documentactivities, handles the MF data program, and manages the document custody process. Operational Risk – headed by a VP with more than 15 years at the company and prior industry experience withanother GSE in the capital markets area. His group is the centralized governance for MF over operational risk,departmental procedures, and business continuity management. In addition, the unit is responsible for the MFcontract and vendor management process and reporting, as well as for providing management reports and analyticsfor AMO. Customer Compliance Management – headed by a senior director with 24 years with the company and priorindustry experience. Her group monitors the MF seller/servicers' eligibility and compliance, performs audits of MFseller/servicers and primary servicers, and assesses counterparty risk of seller/servicers and other non-borrowers.The unit also manages the SSG and interfaces with rating agencies for master, special, and operating advisor ratings.It is also the main channel for seller/servicer communications and relationships.As of Dec. 31, 2020, there were 202 employees in the AMO group who had roles in master servicing with the majoritybased out of the McLean, Va. office (although most are currently working from home due to the COVID-19 NE 9, 2021 6

Servicer Evaluation: Freddie MacAMO continues to utilize outsourcing for assistance when volumes are high, but it does not outsource any remitting orreporting functions.For 2020, AMO reported 20.7% overall turnover, which is slightly greater than the 17.0% for year-end 2019 and 15.0%for year-end 2018. We note that contributing to the 2020 turnover were the aforementioned retirement packagesoffered to those who qualified in 2019, with scattered departure dates throughout 2020. We believe the overallturnover is average for the industry.Table 2Years Of Industry Experience/Company Tenure(i)Senior managersMasterMiddle managersAsset 43(i)As of Dec. 31, 2020. N/A--Not applicable.We believe AMO's organizational structure provides appropriate oversight and accountability, while supporting themaster servicing duties and requirements associated with the various Freddie Mac Multifamily product portfolios.TrainingFreddie Mac provides its management and staff with a diverse array of ongoing, formal internal and external trainingprograms. Other training highlights include the following: Freddie Mac employs full-time dedicated training personnel, and employee participation hours are formally tracked. AMO utilizes a training task force to develop on-site training opportunities and provide resources for individualtraining opportunities. This includes department-specific education and preparing in-depth sessions on certain MFloan product types and the securitization process for employees. AMO recently revised their annual training target, and it is now based on the employee's commercial real estateexperience. Depending on industry experience, annual requirements range from 40 hours for those with under 5years' experience, 30 hours for individuals with 5-10 years' experience, and 20 hours for those with over 11 years inthe industry. Freddie Mac University (FMYou) is an integrated learning platform where employees can search and register fordevelopment opportunities in any of the four general knowledge centers: business expertise, managing people,personal effectiveness, and tools and technology. FMYou also offers employee performance management resources,multifamily divisional training, certification curriculums, and advanced programs. Industry training opportunities are made available to AMO employees, including from the MBA School ofMultifamily Mortgage Banking (MBA). Internal training is provided by various Multifamily groups, including CapitalMarkets and Freddie Mac Legal. Training includes web-based and instructor-led courses. Employees also have access to LinkedIn learning, over 100on-campus MBA classes, and 179 learning management Ted Talks. In 2020, the company offered two remote securitization classes and a commercial mortgage-backed securities(CMBS) credit risk course that focused on technical skills. AMO employees also received training on Excel, Tableau,and technical and business writing.WWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 7

Servicer Evaluation: Freddie Mac Overall, management reported employees averaged 36 hours of training during 2020. Management reviewsemployee progress quarterly so that employees are positioned to meet their year-end targets.Systems and technologyWe believe Freddie Mac has solid and effective technology to meet its master servicing requirement. The companyhas well-designed data backup routines and disaster recovery preparedness. According to management, they continueto make updates as necessary, including enhancements to technology systems, providing staff with effective up-to-datetools, improving and streamlining efficiencies, and helping investors access information on the K-Deals.Servicing system applicationsHighlights of AMO's systems and technology include the following: Freddie Mac uses Enterprise! v.2015.4.5 as a secure repository for loan-level master servicing and investment fundprocessing. Multifamily processing system (MPS) is an internal Freddie Mac system that processes the purchase and accountingof multifamily loans. MPS Loan Accounting is the system of record for all loans. MPS Cash Management provides accounting for funds due and received by Freddie Mac for all multifamily products(excluding CMBS, which uses an external banking application); the application interfaces with the corporatetreasury group. MultiSuite for Bonds is the system of record for active bonds; it monitors Freddie Mac credit-enhanced bonds. MultiSuite for Bonds Tax-Exempt Bond Securitization (TEBS) is the system of record for active TEBS bonds. MultiSuite for Bond Wires is used to submit trustees' draw requests; it is integrated with MPS to capture approval ofthe wire requests. Integrated Loan Servicing (ILS) provides seller/servicers with a consolidated loan servicing portfolio in asingle-platform experience. In November 2020, Multifamily Eligibility System (MES) Release 7 was deployed, which added an internal controlquestionnaire (ICQ); management noted it eliminates manual processes and increases efficiency. The Property Reporting System (PRS) is used by seller/servicers to submit annual property assessment data,including operating statements, property inspections, and borrower compliance analyses. PRS SBL 2.0, the small-balance loan enhancement, incorporates assessment collection and post-securitizationmaster servicing assessment collection into PRS. The Insurance Compliance Tool submits and tracks insurance compliance and waiver requests. Multifamily Securities Investor Access is a web-based interface that provides investor access for K-Deals, includingCommercial Real Estate Finance Council Investor Reporting Package and select deal documents. The Consent Request Tracker (CRT) is a web-based tool that tracks and monitors primary, master, and specialservicer performance on borrower requests (i.e., loan assumptions and property management changes). The Streamlined Management Analytical and Reporting Tool (SMART) is used for loan and portfolio surveillance todevelop business plans and assign loan risk ratings.WWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 8

Servicer Evaluation: Freddie Mac The Document Management System is a web-based solution that enables electronic and paperless transmitting andsharing of documents for mortgage originations, underwriting, post-closing loan activity (i.e. servicingdocumentation), and investor delivery.In the fall of 2018, the company initiated a five-year multifamily digital transformation project. This project isfacilitating a move forward with modernization and automation of processes and systems to increase responsiveness,optimize data processes, allow for portable access, and simplify the user experience. To date, per management, theproject is currently on target.Overall, we believe AMO has a solid integrated technology platform to effectively analyze, monitor, and report onloans, collateral properties, and seller/servicers.Business continuity and disaster recoveryFreddie Mac's enterprise business continuity group works with the business lines to mitigate the risk and impact ofbusiness disruptions. It is responsible for identifying recovery solutions consistent with Freddie Mac's recovery timeobjectives (RTOs). Notable features include the following: Freddie Mac performs disaster recovery testing quarterly, which is more frequently than most ranked servicers. Each Freddie Mac Multifamily department, including AMO, maintains their own business continuity plan. Writtenupdates to the plan are made at least annually and are required to comply with corporate policy. The annual full business continuity test was completed in August 2020, with no significant issues identified. Each department has a documented business impact analysis along with a systematic assessment of the potentialfinancial, reputational, and operational impacts caused by critical incidents and disruptions. The plan identifiesrecovery timeframes and requirements and helps allocate resources during an event. Updates are conducted at leastannually. Freddie Mac's RTO is two hours for cash remittance processing and investor reporting. RTO for all other servicingfunctions is three days, which is greater than other ranked servicers. Freddie Mac stores their backup data tapes in multiple locations across the US. Physical papers are stored inSterling, VA and other regional locations. The disaster recovery data has been moved to an AWS Cloud site.CybersecurityFreddie Mac maintains a formal cybersecurity protection plan. Features include the following: A stand-alone cybersecurity insurance policy is maintained and access to specialized cybersecurity legal counsel isreadily available. Employees are sent phishing emails at least quarterly to maintain cyber threat awareness. Updates are continually made to the network perimeter firewalls and intrusion detection. A layered network is usedto protect critical assets with anti-malware for incoming emails and desktops. Security risk testing is regularly performed and patches are installed to address vulnerabilities as needed. Sensitive data is encrypted and masked to ensure its protection and RECTJUNE 9, 2021 9

Servicer Evaluation: Freddie Mac A third-party vendor performs penetration testing annually to evaluate potential cybersecurity risk. The companyalso performs internal penetration testing on a quarterly basis. The last penetration test was conducted in the springof 2020, with no material issues identified. With the previously noted organizational changes in informationtechnology (IT), the penetration test planned for April 2021 is on hold until further notice.Internal controlsWe believe that Freddie Mac's risk management efforts, including its policies and procedures and audit processes,demonstrate a comprehensive and sound approach to maintaining a controlled servicing environment. Freddie Mac'sgovernance and business services group provides a range of services to support AMO. A centralized operational riskmanagement area assists AMO with crisis management, business continuity, fraud prevention, information security,risk assessment and testing, and Sarbanes-Oxley-related compliance. They also provide the EVP of multifamily and thepresident of Freddie Mac an executive summary covering the aforementioned areas. We view this level of reportingfavorably and believe it provides an additional level of control and dedication to oversight.Policies and proceduresFreddie Mac's policies and procedures are extensive, thorough, well-organized, and reviewed annually for potentialupdates or changes. The Multifamily Credit Policy department makes policy for the corporation. The business unit approves procedurechanges and updates. Credit policy governance updates are also captured and approved electronically through SharePoint Workflow. Procedures are available online to all staff via SharePoint and AllRegs software.Compliance and quality controlFreddie Mac has three lines of defense to manage its operational risk. The first line of defense includes leaders fromthe revenue-producing business units and IT. The second line includes leaders from the enterprise risk managementand compliance departments, as well as the chief risk officer, providing oversight of the first line of defense. Internalaudit (discussed below) is the third line of defense, providing independent oversight of both the other lines of defense.Internal and external auditsThe internal audit group is an independent oversight function established by Freddie Mac's board. The general auditorreports functionally to the audit committee of Freddie Mac's board and administratively to the president. A UniformSingle Attestation Program (USAP) audit is conducted annually by an external auditor. Additionally: Internal audit uses a risk-based planning approach and completes a comprehensive risk assessment of the inherentrisks related to each auditable line of business while independently evaluating how the first and second line achieverisk management and control objectives. Risk is scored based on operational, credit, and market risks, as well as strategic, reputation, regulatory, and legalissues. The resulting risk score is then used to determine the audit frequency based on a cycle between one and fouryears. Audit risk assessment opinions are expressed in one of four categories: very high, high, medium, or low, based onWWW.STANDARDANDPOORS.COM/RATINGSDIRECTJUNE 9, 2021 10

Servicer Evaluation: Freddie Macthe likelihood of a risk event occurring.Management reported that its 2020 multifamily audit universe encompassed 15 auditable entities, of which eight wererisk-rated high (two-year audit cycle), and seven were risk-rated medium (three-year audit cycle). Of the audits thatwere completed in 2020, four of them involved the AMO group in some respect, including operational risk governance,cash desk operations, data integrity and rules management, and seller/ servicer compliance management. Three of thefour audits had minimal or no findings, while the operational risk governance audit contained a major issue finding incompliance with the new corporate standard on the risk and control testing framework and the manner of escalatingissues. AMO worked to correct the issues and will be re-audited for compliance in summer 2021 to verify that all issueshave been corrected. The group will also have another full audit covering operational risk governance in 2022.The USAP audit report for year-end 2020 had no issues noted. Freddie Mac is not subject to, nor does it perform, aRegulation AB review.While the internal audit cycle of AMO is somewhat less frequent than those of similarly ranked peers, we believe theoverall audit plan is rigorous and suitable given the well-designed three lines of defense that Freddie Mac utilizes undera highly regulated regime. Further, the internal controls and compliance framework at AMO appear to be robust andeffective.Vendor managementFreddie Mac engages and monitors outsourced service providers (i.e., systems, tax administration, etc.) and third-partyvendors--which may include appraisers, property managers, and environmental engineers--in a controlled manner. All vendors are subject to a competit

Servicer Evaluation Analytical Methodology data through Dec. 31, 2020, as well as other supporting documentation provided by the company. Profile Servicer Profile Servicer name Federal Home Loan Mortgage Corp. (d/b/a Freddie Mac) Primary servicing location McLean, Va. Parent holding company(i) Federal Housing Financing Agency (September 2008)