Transcription

SBA Form 1149 ReportSBAForm1149.dnaxDNAapp ID 7f021654-34cf-46af-8675-54f2b8dfe8cfFiserv Confidential: Distribution restricted to: Clients using or considering purchase of the product described in this document Fiserv associates

SBA Form 1149 ReportFiserv 2013-2021 Fiserv, Inc. or its affiliates. All rights reserved. This work is confidential and its use is strictlylimited. Use is permitted only in accordance with the terms of the agreement under which it was furnished.Any other use, duplication, or dissemination without the prior written consent of Fiserv, Inc. or its affiliatesis strictly prohibited. The information contained herein is subject to change without notice. Except asspecified by the agreement under which the materials are furnished, Fiserv, Inc. and its affiliates do notaccept any liabilities with respect to the information contained herein and is not responsible for any direct,indirect, special, consequential or exemplary damages resulting from the use of this information. Nowarranties, either express or implied, are granted or extended by this document.http://www.fiserv.comFiserv is a registered trademark of Fiserv, Inc.Other brands and their products are trademarks or registered trademarks of their respective holders andshould be noted as such.SBA Form 1149 Report6/18/20212

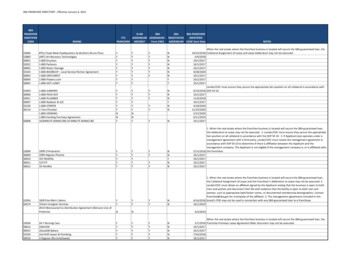

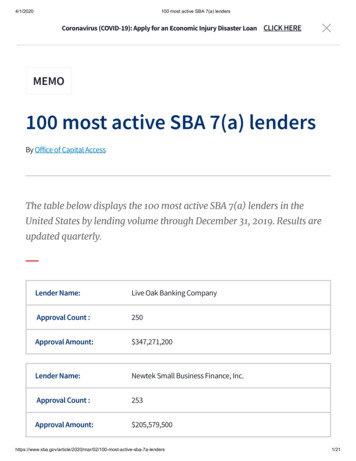

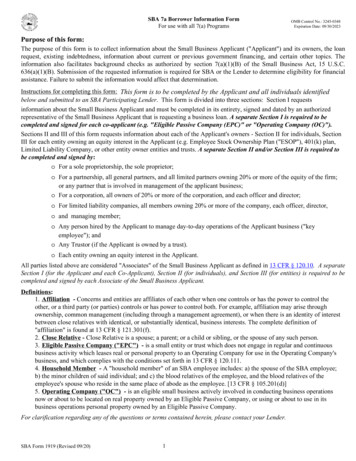

SBA Form 1149 ReportFiservOverview:Financial institutions often need to furnish information to the Small BusinessAdministration (SBA) pertaining to borrowers and their loans with SBA Form 1149. Thisform is needed when a loan is in default and all collection efforts have been exhausted.The form is submitted to SBA as claim to recover a portion of the balance due on theloan up to the coverage limit allowed. The SBA Form 1149 Report application generatesa CSV file for a given loan account number, in which the content and format comply withSBA Form 1149.Processing:Once the App is installed, the SQT should be set up to run using the normal queuesetup. To run the App, the user must provide an Account Number, Output File Path,Payment Type Codes that are comma-delimited and Disbursement Type Codes that arealso comma-delimited. It is optional for a user to provide Initial Int Paid From Date(Initial Interest Paid From Date) for calculating all interest paid periods.The report generated from this application only contains input parameters and overalloutput information. The data for SBA Form 1149 is dumped to a CSV file that isdesignated by output file path as an input parameter. If any one of input parameters isnot valid, the process will generate an error message, and it will be iredDefaultAccount NumberInitial Int PaidFrom Date9ACC9IIFYesNo Blank Blank Output File PathCOUPYes Blank Payment TypeCodes9PTPAccount numberInitial Interest Paid FromDate. The input for thisparameter cannot be laterthan the first repaidtransaction date.The location where theresultant CSV file will beoutput.Transaction type codes forloan payments.YesDisbursementType Codes9DTPTransaction type codes DSB,PDSB,XDSBReport (s):SBA Form 1149 Report6/18/20213

SBA Form 1149 ReportFiservFigure 1 Report file generated by the batch.Following figures illustrate that if the input for Account Number, Initial Int Paid FromDate, Payment Type Codes, Disbursement Type Codes and/or Output File Path is notvalid, the process will generate a corresponding error message, and no output file willbe generated.Figure 2 Report file containing error message generated with an invalid accountnumber.SBA Form 1149 Report6/18/20214

SBA Form 1149 ReportFiservFigure 3 Report file containing error message generated by invalid input Initial Int PaidFrom Date.Figure 4 Report file containing error message generated by invalid input Payment TypeCodes.SBA Form 1149 Report6/18/20215

SBA Form 1149 ReportFiservFigure 5 Report file containing error message generated by invalid input DisbursementType Codes.Figure 6 Report file containing error message generated by invalid input Output FilePath.Field Listing:FieldGenerated FileTotal RecordsSBA Form 1149 Report6/18/2021DescriptionResults in the Report FileThe full name of output CSV file. The file name is formatted with:SBAForm1149 AcctNbr acctnbr .csv, where acctnbr is theplaceholder of the account number.The number of records generated in the output file.6

SBA Form 1149 ReportFiservFile Layout(s):Output File Layout – Comma SeparatedFieldBorrower NameLoan NumberLoan AmountTransaction DateDescriptionAmount DisbursedAmount RepaidPaid To PrincipalPaid To InterestInterest RateInt. Paid From DateInt. Paid To DatePrincipal BalanceFormatDescriptionTop Lines in Output FileBorrower name, which can be an organizationname or a person name that consists of first name,middle initial if applicable and last.Account number of the loan. Only loan account isallowed for this application.The credit limit amount set for the loan.Columns in Output File, Delimited by comasMM/DD/YYYY The date of each transaction on the loan account.STRThe transaction type description.999999999v99 The amount of each loan disbursement.999999999v99 The amount of each repayment made by theborrower.999999999v99 The amount applied to principal for eachrepayment made by the borrower.999999999v99 The amount applied to interest for each repaymentmade by the borrower.9999v9999The interest rate in effect at the time the paymentwas applied on loan account.MM/DD/YYYY Interest Paid From Date.The "Interest Paid From Date" and "Interest PaidTo Date" dates used in computing the interest paidon the loan. These dates should be in consecutiveorder. This column will be empty if input for InitialInt Paid From Date is empty.MM/DD/YYYY Interest Paid To Date.The "Interest Paid From Date" and "Interest PaidTo Date" dates used in computing the interest paidon the loan. These dates should be in consecutiveorder. This column will be empty if input for InitialInt Paid From Date is empty.999999999v99 The principal balance after each transaction.SBA Form 1149 Report6/18/20217

SBA Form 1149 ReportFiservThe output file name is formatted with: SBAForm1149 AcctNbr acctnbr .csv, where acctnbr is the placeholder of the account number.Additional Requirements:Fiserv DNA 3.0.1 or later.For Pre-DNA 3.3 clients, after installing the application, the SQTFixExtension.dnaxneeds to be installed.Configuration ParametersRevisions:Date06/2021AppVersion #1.0.3.0SBA Form 1149 Report6/18/2021ChangeUser Guide document updated.8

SBA Form 1149 ReportDate08/2013AppVersion SBA Form 1149 Report6/18/2021FiservChangeDisplay interest rate even if the Initial Int Paid From Date is notprovidedIssues fixed after 2nd validationValidation ChangesApplication Created9

Financial institutions often need to furnish information to the Small Business Administration (SBA) pertaining to borrowers and their loans with SBA Form 1149. This form is needed when a loan is in default and all collection efforts have been exhausted. The form is submitted to SBA as claim to recover a portion of the balance due on the