Transcription

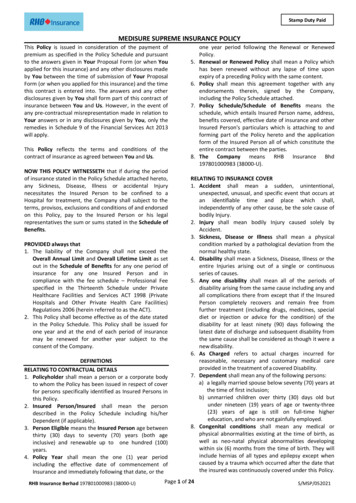

Stamp Duty PaidMEDISURE SUPREME INSURANCE POLICYThis Policy is issued in consideration of the payment ofpremium as specified in the Policy Schedule and pursuantto the answers given in Your Proposal Form (or when Youapplied for this insurance) and any other disclosures madeby You between the time of submission of Your ProposalForm (or when you applied for this insurance) and the timethis contract is entered into. The answers and any otherdisclosures given by You shall form part of this contract ofinsurance between You and Us. However, in the event ofany pre-contractual misrepresentation made in relation toYour answers or in any disclosures given by You, only theremedies in Schedule 9 of the Financial Services Act 2013will apply.This Policy reflects the terms and conditions of thecontract of insurance as agreed between You and Us.NOW THIS POLICY WITNESSETH that if during the periodof insurance stated in the Policy Schedule attached hereto,any Sickness, Disease, Illness or accidental Injurynecessitates the Insured Person to be confined to aHospital for treatment, the Company shall subject to theterms, provisos, exclusions and conditions of and endorsedon this Policy, pay to the Insured Person or his legalrepresentatives the sum or sums stated in the Schedule ofBenefits.PROVIDED always that1. The liability of the Company shall not exceed theOverall Annual Limit and Overall Lifetime Limit as setout in the Schedule of Benefits for any one period ofinsurance for any one Insured Person and incompliance with the fee schedule – Professional Feespecified in the Thirteenth Schedule under PrivateHealthcare Facilities and Services ACT 1998 (PrivateHospitals and Other Private Health Care Facilities)Regulations 2006 (herein referred to as the ACT).2. This Policy shall become effective as of the date statedin the Policy Schedule. This Policy shall be issued forone year and at the end of each period of insurancemay be renewed for another year subject to theconsent of the Company.DEFINITIONSRELATING TO CONTRACTUAL DETAILS1. Policyholder shall mean a person or a corporate bodyto whom the Policy has been issued in respect of coverfor persons specifically identified as Insured Persons inthis Policy.2. Insured Person/Insured shall mean the persondescribed in the Policy Schedule including his/herDependent (if applicable).3. Person Eligible means the Insured Person age betweenthirty (30) days to seventy (70) years (both ageinclusive) and renewable up to one hundred (100)years.4. Policy Year shall mean the one (1) year periodincluding the effective date of commencement ofInsurance and immediately following that date, or theRHB Insurance Berhad 197801000983 (38000-U)5.6.7.8.one year period following the Renewal or RenewedPolicy.Renewal or Renewed Policy shall mean a Policy whichhas been renewed without any lapse of time uponexpiry of a preceding Policy with the same content.Policy shall mean this agreement together with anyendorsements therein, signed by the Company,including the Policy Schedule attached.Policy Schedule/Schedule of Benefits means theschedule, which entails Insured Person name, address,benefits covered, effective date of insurance and otherInsured Person's particulars which is attaching to andforming part of the Policy hereto and the applicationform of the Insured Person all of which constitute theentire contract between the parties.The Company means RHB Insurance Bhd197801000983 (38000-U).RELATING TO INSURANCE COVER1. Accident shall mean a sudden, unintentional,unexpected, unusual, and specific event that occurs atan identifiable time and place which shall,independently of any other cause, be the sole cause ofbodily Injury.2. Injury shall mean bodily Injury caused solely byAccident.3. Sickness, Disease or Illness shall mean a physicalcondition marked by a pathological deviation from thenormal healthy state.4. Disability shall mean a Sickness, Disease, Illness or theentire Injuries arising out of a single or continuousseries of causes.5. Any one disability shall mean all of the periods ofdisability arising from the same cause including any andall complications there from except that if the InsuredPerson completely recovers and remain free fromfurther treatment (including drugs, medicines, specialdiet or injection or advice for the condition) of thedisability for at least ninety (90) days following thelatest date of discharge and subsequent disability fromthe same cause shall be considered as though it were anew disability.6. As Charged refers to actual charges incurred forreasonable, necessary and customary medical careprovided in the treatment of a covered Disability.7. Dependent shall mean any of the following persons:a) a legally married spouse below seventy (70) years atthe time of first inclusion;b) unmarried children over thirty (30) days old butunder nineteen (19) years of age or twenty-three(23) years of age is still on full-time highereducation, and who are not gainfully employed.8. Congenital conditions shall mean any medical orphysical abnormalities existing at the time of birth, aswell as neo-natal physical abnormalities developingwithin six (6) months from the time of birth. They willinclude hernias of all types and epilepsy except whencaused by a trauma which occurred after the date thatthe insured was continuously covered under this Policy.Page 1 of 24S/MSP/052021

9. Eligible expenses shall mean Medically Necessaryexpenses incurred due to a covered Disability but notexceeding the limits in the schedule.10. Medically Necessary shall mean a medical service whichis:a) consistent with the diagnosis and customarymedical treatment for a covered disability, andb) in accordance with standards of good medicalpractice, consistent with current standard ofprofessional medical care, and of proven medicalbenefits, andc) not for the convenience of the Insured or thePhysician, and unable to be reasonably renderedout of hospital (if admitted as an inpatient), andd) not of an experimental, investigational or researchnature, preventive or screening nature,e) for which the charges are fair and reasonable andcustomary for the disability.11. Reasonable and customary charges shall meancharges for medical care which is Medically Necessaryshall be considered reasonable and customary to theextent that it does not exceed the general level ofcharges being made by others of similar standing in thelocality where the charge is incurred, when furnishinglike or comparable treatment, services or supplies toindividual of the same sex and of comparable age for asimilar sickness, Disease or Injury and in accordancewith accepted medical standards and practice could nothave been omitted without adversely affecting theInsured Person's medical condition. In Malaysia,Reasonable and Customary Charges shall be deemed tobe those laid down in the Malaysian MedicalAssociation’s Schedule of Fees.12. Pre-Existing Illness shall mean disabilities that theInsured Person has reasonable knowledge of. AnInsured Person may be considered to have reasonableknowledge of a pre-existing condition where thecondition is one for which:a) the Insured Person had received or is receivingtreatment;b) medical advice, diagnosis, care or treatment hasbeen recommended;c) clear and district symptoms are or were evident; ord) its existence would have been apparent to areasonable person in the circumstances.13. Specified Illnesses shall mean the following disabilitiesand its related complication, occurring within the firstone hundred and twenty (120) days of Insurance of theInsured Person:a) Hypertension, diabetis mellitus and Cardiovasculardiseaseb) All tumours, cancers, cysts, nodules, polyps, stonesof the urinary system and biliary systemc) All ear nose (including sinuses) and throatconditionsd) ) EndometriosisincludingdiseaseoftheReproduction systemf) Vertebra-spinal disorders (including disc) and kneeconditions.14. Hospital Confinement shall mean the Insured Personbeing duly registered and admitted as an in-patient in aHospital for more than twelve (12) hours.15. Hospitalisation shall mean admission to a Hospital as aregistered in-patient for Medically Necessarytreatments for a covered disability uponrecommendation of a physician. A patient shall not beconsidered as an in-patient if the patient does notphysically stay in the hospital for the whole period ofHospital Confinement.16. Intensive Care Unit shall mean a section within aHospital which is designated as an Intensive Care Unitby the Hospital, and which is maintained on a twentyfour (24) hour basis solely for treatment of patients incritical condition and is equipped to provide specialnursing and medical services not available elsewhere inthe Hospital.17. Out-Patient shall mean the Insured Person isreceiving medical care or treatment without beinghospitalized and includes treatment in a Daycarecentre.18. Waiting Period shall mean the first thirty (30) daysbetween the beginning of an Insured Person'sdisability and the commencement of this Policy date/reinstatement date and is applied only when theperson is first covered. This shall not be applicableafter the first year of cover. However, if there is abreak in insurance, the Waiting Period will applyagain.19. Overall Annual LimitBenefits payable in respect of expenses incurred fortreatment provided to the Insured Person during theperiod of insurance shall be limited to Overall AnnualLimits as stated in the Schedule of Benefitsirrespective of a type/types of disability. In the eventthe Overall Annual Limit having been paid, allinsurance for the Insured Person hereunder shallimmediately cease to be payable for the remainingpolicy year.20. DeductibleThe Policyholder has the option to choose a Deductiblein return for a reduction of premium. The Deductibleshall be deducted from the eligible medical expenses,per Insured Person per disability.The Policyholder can choose to increase or decrease theDeductible Option upon annual renewal of the cover.No midterm amendment to the deductible is allowed.The liability of the Company shall commence once theselected Deductible amount has been exhausted andshall not exceed the Overall Annual Limit and OverallLifetime Limit set out In the Schedule of Benefits forany one period of insurance for any one InsuredPerson.21. Overall Lifetime Limit shall mean the totalaccumulated benefit payable from the original Policydate shall not exceed the lifetime benefit limit asstated in the Schedule of Benefits attached hereto andis the maximum limit of liability to the Insured Person.22. Emergency shall mean treatment needed in the eventwhereby immediate medical attention is requiredwithin twelve (12) hours for Injury, Illness or SymptomsPage 2 of 24

which are sudden and severe failing which theMember’s life could be threatened (e.g. accident andheart attack) or lead to significant deterioration ofhealth.23. HIV Infection Due to Blood TransfusionInfection with the Human Immunodeficiency Virus(HIV) through a blood transfusion, provided that all ofthe following conditions are met:(i) The blood transfusion was Medically Necessary orgiven as part of a medical treatment;(ii) The blood transfusion was received in Malaysia orSingapore after the commencement of the policy;(iii) The source of the infection is established to be fromthe institution that provided the blood transfusionand the institution is able to trace the origin of theHIV tainted blood;(iv) The Insured does not suffer from hemophilia; and(v) The Insured is not a member of any high risk groupsincluding but not limited to intravenous drug users.24. Home Nursing Care shall mean continued medical careor other types of skilled care furnished on a visitingbasis in the Insured Person’s home, where he/ she isrecuperating.RELATING TO MEDICAL SUPPLIERS1. Day SurgeryA patient who needs the use of a recovery facility for asurgical procedure on a pre-plan basis at the hospital/specialist clinic (but not for overnight stay).2. Hospital shall mean only an establishment dulyconstituted and registered as a hospital for the careand treatment of sick and injured persons as payingbed-patients, and which:a) has facilities for diagnosis and major surgery,b) provides twenty four (24) hour a day nursingservices by registered and graduate nursesc) is under the supervision of a Physician, andd) is not primarily a clinic; a place for alcoholics ordrug addicts; a nursing, rest or convalescent homeor a home for the aged or similar establishment.3. Malaysian Government Hospital shall mean a hospitalwhich charges of services are subject to the Fee Act1951 Fees (Medical) Order 1982 and/or its subsequentamendments if any.4. Prescribed Medicines shall mean medicines that aredispensed by a Physician, a Registered Pharmacist ora Hospital and which have been prescribed by a Physicianor Specialist in respect of treatment for a covereddisability.5. Doctor or Physician or Surgeon shall mean a registeredmedical practitioner qualified and licensed to practicewestern medicine and who, in rendering suchtreatment, is practicing within the scope of his licensingand training in the geographical area of practice, butexcluding a doctor, physician or surgeon who is theinsured himself.6. Specialist shall mean a medical or dental practitionerregistered and licensed as such in the geographicalarea of his practice where treatment takes place andwho is classified by the appropriate health authoritiesas a person with superior and special expertise inspecified fields of medicine or dentistry, but excludinga physician or surgeon who is the insured himself.7. Surgery shall mean any of the following medicalprocedures:a) To incise, excise or electrocauterize any organ orbody part, except for dental services.b) To repair, revise, or reconstruct any organ or bodypart.c) To reduce by manipulation a fracture or dislocationd) Use of endoscopy to remove a stone or object fromthe larynx, bronchus, trachea, esophagus, stomach,intestine, urinary bladder, or urether.DESCRIPTIONS OF BENEFITS1. Hospital Room and BoardReimbursement of the Reasonable and tion and meals. The amount of thebenefit shall be equal to the actual charges madeby the Hospital during the Insured Person'sconfinement, but in no event shall the benefitexceed, for any one day, the rate of Room andBoard Benefit, and the maximum number of days asset forth in the Schedule of Benefits. The InsuredPerson will only be entitled to this benefit whileconfined to a Hospital as an in-patient.2. Intensive Care UnitReimbursement of the Reasonable and CustomaryCharges Medically Necessary for actual room andboard incurred during confinement as an in-patient inthe Intensive Care Unit of the Hospital. This benefitshall be payable equal to the actual charges made bythe Hospital subject to the maximum benefit for anyone day, and maximum number of days, as set forth inthe Schedule of Benefits.No Hospital Room and Board Benefits shall be paidfor the same confinement period where the DailyIntensive Care Unit Benefits is payable.3. Hospital Supplies & ServicesReimbursement of the Reasonable and CustomaryCharges actually incurred for Medically Necessarygeneral nursing, prescribed and consumed drugsand medicines, dressings, splints, plaster casts, xray, laboratory examinations, electrocardiograms,physiotherapy, basal metabolism tests, intravenousinjections and solutions, administration of blood andblood plasma including the cost of blood and plasmawhilst the Insured Person is confined as an in-patientin a Hospital, up to the amount stated in the Scheduleof Benefits.4. Operating TheatreReimbursement of the Reasonable and CustomaryOperating Room charges incidental to the surgicalprocedure.5. Pre-Hospital Diagnostic Tests (Reimbursement only)Reimbursement of the Reasonable and CustomaryCharges for Medically Necessary ECG, X-ray andlaboratory tests which are performed for diagnosticpurposes on account of an Injury or illness when inconnection with a Disability preceding hospitalizationwithin the maximum number of days and amount asPage 3 of 24

set forth in the Schedule of Benefits in a Hospital andwhich are recommended by a qualified medicalpractitioner.This benefit will also reimburse the cost ofmedications prescribed which are MedicallyNecessary on account of an Injury or illness when inconnection with a Disability preceding Hospitalisation.Only the cost of drugs used for the Treatment of theDisability are covered excluding traditional/complementary medicines, supplementary medicines,vitamins or nutritional herbs.No payment shall be made if upon such diagnosticservices, the Insured does not result in HospitalConfinement for the treatment of the medicalcondition diagnosed. Medications and consultationcharged by the medical practitioner will not bepayable.6. Pre-Hospital Specialist Consultation (Reimbursementonly)Reimbursement of the Reasonable and CustomaryCharges for the first time consultation by a Specialistin connection with a Disability within the maximumnumber of days as set forth in the Schedule ofBenefits preceding confinement in a Hospital andprovided that such consultation is MedicallyNecessary and has been recommended in writing bythe attending general practitioner.This benefit will also reimburse the cost ofmedications prescribed which are MedicallyNecessary on account of an Injury or illness when inconnection with a Disability preceding Hospitalisation.Only the cost of drugs used for the Treatment of theDisability are covered excluding traditional /complementary medicines, supplementary medicines,vitamins or nutritional herbs.Payment will not be made for clinical treatment(including medications and subsequent consultationafter the illness is diagnosed) or where the Insureddoes not result in Hospital Confinement for thetreatment of the medical condition diagnosed.7. Second Surgical Opinion (Reimbursement only)An amount equal to actual charges to consultation ofopinion with a second Specialist within sixty (60) daysfrom the first consultation by the first Specialist todetermine whether a surgical operation is necessaryor required in view of the Insured Person’s medicalcondition, subject to the limits set forth in theSchedule of Benefits. This benefit is payable only if theInsured Person is admitted subsequently.8. Surgical FeesReimbursement of the Reasonable and CustomaryCharges for a Medically Necessary surgery by theSpecialists, including pre-surgical assessment,Specialist's visits to the Insured Person and postsurgery care up to the maximum sixty (60) days fromthe date of surgery, but within the maximumindicated in the Schedule of Benefits. If more thanone surgery is performed for Any One Disability, thetotal payments for all the surgeries performed shallnot exceed the maximum stated in the Schedule ofBenefits.9. Anasthetist FeesReimbursement of the Reasonable and CustomaryCharges by the Anaesthetist for the MedicallyNecessary administration of anaesthesia notexceeding the limits as set forth in the Schedule ofBenefits.10. In-Hospital Physician VisitReimbursement of the Reasonable and CustomaryCharges by a Physician for Medically Necessaryvisiting an in-paying patient while confined for a nonsurgical disability subject to a maximum of two (2)visits per day not exceeding maximum two hundred(200) days as set forth in the Schedule of Benefits.11. Post-Hospitalisation Treatment (Reimbursementonly)Reimbursement of the Reasonable and CustomaryCharges incurred in Medically Necessary follow-uptreatment by the same attending Physician, withinthe maximum number of days and amount as setforth in the Schedule of Benefits immediatelyfollowing discharge from Hospital for a non-surgicaldisability. This shall include medicines prescribedduring the follow-up treatment but shall not exceedthe supply needed for the maximum number of daysas set forth in the Schedule of Benefits.12. Organ TransplantReimburses Reasonable and Customary Chargesincurred on transplantation surgery for the InsuredPerson being the recipient of the transplant of akidney, heart, lung, liver or bone marrow. Payment forthis Benefit is applicable only once per lifetime whilstthe policy is in force and shall be subject to the limit asset forth in the Schedule of Benefit. The costs ofacquisition of the organs and all costs incurred by thedonors are not covered.13. Emergency Accidental Outpatient Treatment(Reimbursement only)Reimbursement of the Reasonable and CustomaryCharges incurred for up to the maximum stated in theSchedule of Benefits, as a result of a covered bodilyinjury arising from an Accident for Medical Necessarytreatment as an outpatient at any registered clinic orhospital within 24 hours of the Accident causing thecovered bodily Injury. Follow-up treatment by thesame doctor or same registered clinic or Hospital forthe same covered bodily injury will be provided up tothe maximum amount and the maximum number ofdays as set forth in the Schedule of Benefits.14. OutpatientPhysiotheraphyTreatment(Reimbursement only)Reimbursement of Reasonable and CustomaryCharges for outpatient physiotherapy treatmentreferred to in writing by a licensed specialist Physicianafter Surgery or in-Hospital treatment, within ninety(90) days from the date of hospital discharge/surgeryfor Any One Disability. However, no payment shall bemade for medication or treatment and subsequentconsultations with the same Specialist or Physician.Page 4 of 24

15. Annual Out-Patient Kidney Dialysis Treatment(Reimbursement only)If an Insured Person is diagnosed with Kidney Failureas defined below, the Company will reimburse theReasonable and Customary Charges incurred forthe Medically Necessary treatment of kidneydialysis performed at a legally registered dialysiscentre subject to the limit of this disability as specifiedin the Schedule of Benefits.Such treatment (dialysis excluding consultation,examination tests, take home drugs) must bereceived at the out-patient department of a Hospitalor a registered dialysis treatment centre immediatelyfollowing discharge from Hospital confinement orsurgery.Kidney Failure means end stage renal failurepresenting as chronic, irreversible failure of bothkidneys to function as a result of which renal dialysis isinitiated.It is a specific condition of this Benefit thatnotwithstanding the exclusion of pre-existingconditions, this Benefit will not be payable for anyInsured who has developed chronic renal diseasesand/or is receiving dialysis treatment prior to theeffective date of Insurance.16. AnnualOut-PatientCancerTreatment(Reimbursement only)If an Insured Person is diagnosed with Cancer asdefined below, the Company will reimburse theReasonable and Customary Charges incurred for theMedically Necessary treatment of cancer performedat a legally registered cancer treatment centre subjectto the limit of this disability as specified in theSchedule of Benefits.Such treatment (radiotherapy or chemotherapyexcluding consultation, examination tests, take homedrugs) must be received at the out-patientdepartment of a Hospital or a registered cancertreatment centre immediately following dischargefrom Hospital confinement or surgery.Cancer is defined as the uncontrollable growth andspread of malignant cells and the invasion anddestruction of normal tissue for which majorinterventionist treatment or surgery (excludingendoscopicproceduresalone)is considerednecessary. The cancer must be confirmed byhistological evidence of malignancy. The followingconditions are excluded:a) Carcinoma in situ including of the cervix;b) Ductal Carcinoma in situ of the breast;c) Papillary Carcinoma of the the bladder & Stage 1Prostate Cancer;d) All skin cancers except malignant;e) Stage 1 Hodgkin's disease;f) Tumours manifesting as complications of AIDSIt is a specific condition of this Benefit thatnotwithstanding the exclusion of pre-existingconditions, this Benefit will not be payable for anyInsured who had been diagnosed as a cancer patientand/or is receiving cancer treatment prior to theeffective date of Insurance.17. Prostheses and Wheelchair Benefit (Reimbursementonly)Reimbursement of the Reasonable and CustomaryCharges actually incurred for purchasing any of thefollowing medical equipment, subject to the limit ofthis disability as specified in the Schedule of Benefits:a) Wheelchair;b) Artificial arm or leg; and/orc) Crutchesin the event the Insured Person suffers PermanentDisablement due to an Accident or Illness providedthat such medical equipment is necessary to assist inthe mobility of the Insured Person and isrecommended by the attending specialist Physician orSurgeon.18. Home Nursing Care (Reimbursement only)Reimbursement of the Reasonable and CustomaryCharges for full-time services of a registered Nurse forservices rendered to the Insured Person which isMedically Necessary and prescribed by the attendingPhysician or Surgeon for the continued treatment atthe Insured Person’s home of the specific medicalcondition for which the Insured Person wasdiagnosed. Services for activities of daily living that arenot Medically Necessary will not be payable. Thebenefit will be payable if the care is provided withinseven (7) days of hospital discharge subject to aminimum of three (3) days Hospitalisation. The benefitpayable shall not exceed the limits as set forth in theSchedule of Benefits.19. Government Hospital Daily Cash AllowancePays a daily allowance for each day of confinement fora covered Disability in a Malaysian GovernmentHospital, provided that the Insured shall confine to aRoom and Board rate that does not exceed theamount shown and maximum number of days setforth in the Schedule of Benefits. No payment will bemade for any transfer to or from any Private Hospitaland Malaysian Government Hospital for the coveredDisability.20. Insured Child’s Daily Guardian BenefitReimburse (up to stipulated limits set forth on theSchedule of Benefits) the expenses for meals andlodging incurred to accompany an Insured Child (agedbelow fifteen (15) years) in the hospital up to themaximum number of days set forth in the Schedule ofBenefits.21. Ambulance Fees (Reimbursement only)Reimbursement of the Reasonable and CustomaryCharges incurred for necessary domestic ambulanceservices inclusive of attendant to and/or from theHospital of confinement. Payment will not be made ifthe Insured Person is not hospitalised and subject tothe limits set forth in the Schedule of Benefits.22. Medical Report FeesReimburses the actual fee charged for completion of amedical report by the attending Physician or surgeonin respect of each disability but not to exceed theamount as stated in the Schedule of Benefits.Page 5 of 24

23. Blood and PlasmaReimbursement of the Reasonable and CustomaryCharges actually incurred for blood and plasma duringMedically Necessary administration of blood and bloodplasma whilst the Insured Person is confined as an inpatient in a Hospital, up to the amount stated in theSchedule of Benefits.24. ID Band and Registration FeesReimburses the ID band and registration fees incurredsubject to the limit as specified in the Schedule ofBenefits.GENERAL EXCLUSIONSThis contract does not cover any hospitalisation, surgery orcharges caused directly or indirectly, wholly or partly, byany one (1) of the following occurrences:1. Pre-existing illness.2. Specified Illnesses occurring during the first onehundred and twenty (120) days of continuous cover.3. Any medical or physical conditions arising within thefirst thirty (30) days of the Insured Person's cover ordate of reinstatement whichever is latest except foraccidental injuries.4. Plastic/ Cosmetic surgery, circumcision, eyeexamination, glasses and refraction or surgicalcorrection of nearsightedness (Radial Keratotomy) andthe use or acquisition of external prosthetic appliancesor devices such as artificial limbs, hearing aids,implanted pacemakers and prescriptions thereof.5. Dental conditions including dental treatment or oralsurgery except as necessitated by Accidental Injuries tosound natural teeth occurring wholly during the Periodof Insurance6. Private nursing, rest cures or sanitaria care, illegaldrugs, intoxication, sterilization, venereal disease andits sequelae, AIDS (Acquired Immune DeficiencySyndrome) or ARC (AIDS Related Complex) and HIV(Human Immunodeficiency Virus) related diseasesexcept the infection of HIV arose as a result of bloodtransfusion, and any communicable diseases requiredquarantine by law.7. Any treatment or surgical operation for congenitalabnormalities or deformities including hereditaryconditions8. Pregnancy, child birth (including surgical delivery),miscarriage, abortion and prenatal or postnatal careand surgical, mechanical or chemical contraceptivemethods of birth control or treatment pertaining toinfertility. Erectile dysfunction and tests or treatmentrelated to impotence or sterilization.9. Hospitalisation primarily for investigatory purposes,diagnosis, X-ray examination, general physical ormedical examinations, not incidental to treatment ordiagnosis of a covered Disability or any treatmentwhich is not Medically Necessary and any preventivetreatments, preventive medicines or examinationscarried out by a Physician, and treatments specificallyfor weight reduction or gain.10. Suicide, attempted suicide or intentionally self-inflictedInjury while sane or insane.11. War or any act of war, declared or undeclared, criminalor terrorist activities, active duty in any armed forces,direct participation in strikes, riots and civil commotionor insurrection.12. Ionising radiation or contamination by radioactivityfrom any nuclear fuel or nuclear waste from process ofnuclear fission or from any nuclear weapons material.13. Expenses incurred for donation of any body organ byan Insured Person and costs of acquisition of the organincluding all costs incurred by the donor during organtransplant and its complications.14. Investigation and treat

RHB Insurance Berhad 197801000983 (38000-U) . Member's life could be threatened (e.g. accident and heart attack) or lead to significant deterioration of health. 23. HIV Infection Due to Blood Transfusion Infection with the Human Immunodeficiency Virus (HIV) through a blood transfusion, provided that all of the following conditions are met: