Transcription

We s co A i rc raft Savi ng s an d Inves tment PlanENROLL NOW TO TAKE FULL ADVANTAGEOF YOUR RETIREMENT SAVINGS PLAN BENEFITSYOUR GUIDE TO GETTING STARTED

Save for retirement through Wesco Aircraft Savings andInvestment Plan easily, regularly, and automatically.With all the responsibilities and financial priorities you might bejuggling – mortgage payments, parenthood, saving or paying forcollege, caring for parents, and more – it can be easy to overlookthe need to save for retirement. But it’s important to considersetting aside money for retirement as early and regularly as youcan, because the quality of your retirement years could very welldepend on how much you have been able to save.As you consider enrolling in Wesco Aircraft Savings and InvestmentPlan and selecting investment options for your account, pleasereview this Enrollment Guide. It contains valuable information thatmay help you better understand the basics of investing, as well ashelp you make the most of your company’s retirement savings plan.LOOK INSIDE FOR: Participating in your plan Investment Options Next Steps Rollover contribution formPlease review this information carefully.FIDELITY RESOURCES TO HELP YOU MANAGE YOURRETIREMENT SAVINGS ACCOUNT:Visit www.401k.comContact Fidelity representatives at 1-800-8355097 who are available to assist you from 8:30a.m. to 8:00 p.m. ET any business day that theNew York Stock Exchange is open.¿Habla español? Para empezar, llame anuestros representantes dedicados que hablanespañol a la línea de Beneficios de Jubilaciónde Fidelity (Fidelity Retirement Benefits Line) al800-587-5282.2

PARTICIPATING IN YOURplanThere are many benefits to participating in the Wesco Aircraft Savings and Investment Plan. One of theprimary benefits is that you will receive help reaching your financial goals for retirement. By reviewingthe important information in this guide and visiting Fidelity NetBenefits at www.401k.com, you can takeadvantage of what your company and Fidelity have to offer.When am I eligible for the Plan?You are eligible to participate in the Plan if: you complete 1 month of service you are at least 20 years old and you are not:- covered by a collective bargainingagreement (unless the agreementspecifically provides for you to becovered by the plan)- a leased employee- a nonresident alien who does not receiveany earned income from your Employer- internsHow do I enroll?To enroll, log on to Fidelity NetBenefits atwww.401k.com. You can also set up yourbeneficiary information by going to FidelityNetBenefits at www.401k.com or calling a FidelityRepresentative at 1-800-835-5097 to request aDesignation of Beneficiary Form to fill out andreturn to Fidelity.Your plan has an automatic enrollment feature.If the automatic enrollment feature applies toyou and you do not take action, you will beautomatically enrolled at 3%. If the automaticenrollment feature applies to you, you will receivea separate notification indicating when deferralswill begin to be made on your behalf. If you donot select an investment, your Plan Sponsor hasdirected Fidelity to place your contributions inthe JP Morgan target date fund that most closelyaligns with your projected retirement date basedupon your birth year.If you would prefer to elect not to participate atthis time or to specifically elect a contribution rateand/or investment options, please contact Fidelityby logging onto www.401k.com or call 1-800-8355097.When is my enrollment effective?Once you satisfy these requirements you willbecome eligible to participate in the Plan on thefirst day of the following month.How much can I contribute?Through automatic payroll deduction, you maycontribute between 1% and 60% of your eligiblepay on a pretax basis, up to the annual IRS dollarlimit (2018 18,500). You may change yourdeferral percentage as applicable on the next Planentry date (first day of each month).At certain times of the year, if you have notexceeded IRS pretax dollar contribution limits orPlan percentage limits, you may be able to makean additional deferral contribution to the Plan.You need to contact your Plan Sponsor about theproper procedure for making additional deferralcontributions.If you expect to receive bonus compensation andhave not exceeded IRS pretax dollar contributionlimits or Plan pretax contribution percentage limits,you may be able to make an additional deferralcontribution to the Plan. You need to contact yourPlan Sponsor about the procedure for making anadditional deferral contribution of up to 100% of abonus paid to you.Your company’s plan has established an AnnualIncrease Program which will automatically increaseyour contributions by 1% on . Each year on thedesignated date, your contributions will increaseby the amount your company has establishedwhich may be limited to a deferral percentagecommunicated to you by notice. If you want tocontribute more to the Annual Increase Programor if you wish to opt out of the program, follow theinstructions outlined in the notification letter.If you are age 50 or over by the end of the taxableFor more information about your plan, go to www.401k.com3

year and have reached the annual IRS limit orPlan’s maximum contribution limit for the year, youmay make additional salary deferral contributionsto the Plan up to the IRS Catch Up Provision Limit(2018 6,000).make employee pretax deferralcontributions or Roth 401(k) after taxdeferral contributions. The plan willmatch on the combined total of thesecontributions up to the matching limit.The Roth 401(k) contribution option is available toyou. A Roth 401(k) contribution to your retirementplan allows you to make after-tax contributions andtake any associated earnings completely tax free atretirement.In some Plan Years, your Employer may chooseto make an additional discretionary matchingcontribution to your account. The amount wouldbe determined at Plan Year end by a Board ofDirectors’ Resolution.Can I move qualified money from anotherretirement account into this one?You may be permitted to roll over eligiblecontributions into this Plan from a previousemployer’s retirement plan. For other eligibleaccount types, please see your Summary PlanDescription. Be sure to consider all youravailable options and the applicable fees andfeatures of each before moving your retirementassets. To complete a rollover in the Plan followthese easy steps: Contact your prior plan provider to requesta rollover distribution Rollover check issued should bemade payable to Fidelity InvestmentsInstitutional Operations Company, Inc.(FIIOC) FBO: your name and sent to you Initiate the rollover by logging intowww.401k.com (recommended) or bycompleting the rollover contribution formfound at the end of the Enrollment Guide Return both the applicable rolloverdocumentation and the check from yourprior Plan as per the rollover instructionsTo be eligible for additional discretionary matchingcontributions you are required to: make employee pretax deferralcontributions or Roth 401(k) after taxdeferral contributions. The plan willmatch on the combined total of thesecontributions up to the matching limit.Does the Company contribute to my account?Your employer will make Safe Harbor QualifiedAutomatic Contribution Arrangement matchingcontributions to your account based on yourpretax contributions. The amount will equal 100%of the first 1% of compensation you contribute tothe Plan and 50% of the next 5% of compensationyou contribute to the Plan.Certain employees are excluded from theSafe Harbor Qualified Automatic ContributionArrangement matching contribution. Please referto your employer or Summary Plan Description formore detailed information.To be eligible for matching contributions you arerequired to:4 For purposes of determining your matchingcontributions under the Plan, your pretaxcontributions will include Age 50 and over CatchUp Contributions described above.Your Employer may designate all or a portionof any matching contributions for a Plan Year as“qualified matching contributions” and allocatethem to employees to help the Plan pass one ormore annually required Internal Revenue Codenondiscrimination test(s). Any such contributionswill be allocated to those non-highly compensatedParticipants eligible to receive the Employermatching contributions described above whomade pretax contributions during the Plan Year.Participants are 100% vested in these contributionsand may not request a hardship withdrawal ofthese contributions.The Employer may make a discretionary profitsharing contribution to only those participantswho are eligible under the terms of the plan.Please refer to your employer or Summary PlanDescription for more detailed information.When am I vested?The term “vesting” refers to the portion of youraccount balance that you are entitled to under theplan’s rules.You are always 100% vested in your:- employee pretax account- rollover account- Roth 401(k) after tax deferral account

- and any earnings thereon.Employer profit sharing contributions, matchingcontributions and earnings will be vested inaccordance with the following schedule:Years of Service forVestingless than 22Percentage0100Qualified Automatic Contribution Arrangementemployer matching contributions and earningswill be vested in accordance with the followingschedule:Years of Service forVestingless than 22Percentage0100Can I take a loan from my account?Although your plan account is intended for yourretirement, you may take a loan from your account.Can I make withdrawals from my account?Withdrawals from the Plan are generally permittedin the event of termination of employment,retirement, disability, or death. You may also beeligible for a withdrawal in the case of a severefinancial hardship as defined by your Plan.How do I access my account?Through Fidelity NetBenefits at www.401k.comyou have access to your account information,retirement planning tools, and e-Learningworkshops that provide you access to self-pacedtraining on savings and investing principles.You may call the Retirement Benefits Line at 1-800835-5097 between 8:30 a.m. and 8:00 p.m. on anybusiness day when the New York Stock Exchangeis open. Fidelity Representatives can assistyou with transactions and answer many of yourquestions regarding retirement savings.How do I learn more?Through Fidelity NetBenefits at www.401k.comyou have access to your account information andretirement planning tools including:Live and self-paced learning workshops.The workshops cover a variety of topicsincluding determining your retirementsavings needs, evaluating your investmentoptions and keeping your investmentstrategy on track to help you achieve yourretirement goals.In addition, you can take advantage of localInvestor Centers by scheduling time with a FidelityRepresentative to discuss your total investmentneeds beyond your retirement savings plan. Or, ifyou prefer, call 1-800-Fidelity for a complimentaryportfolio review.How do I change my investment options?You can make changes to your investmentselections online at www.401k.com or by callingthe Retirement Benefits Line at 1-800-835-5097.Create an asset strategy that’s right for you: Visit the Library section of NetBenefits .How do I manage my account?Through Fidelity NetBenefits at www.401k.comyou may sign up to receive alerts via email whenyour retirement savings account strays from theinvestment allocation you established.To update your beneficiary information goNetBenefits and enter your beneficiaryinformation at any time.Model Portfolios. The Model PortfolioRecordkeeping Service (MPRS) is an investmentmanagement service offered under your Plan.Under MPRS, your eligible account balanceand any future contributions will be investedaccording to the asset allocation strategy of themodel portfolio in which you are invested. Modelportfolios are composed of some or all of yourplan’s investment options and are a method ofallocating your account among those investmentoptions. The asset allocation of each modelportfolio is determined by your Plan’s namedfiduciary. In addition, the asset allocation of themodel portfolio may be adjusted periodically byyour Plan’s named fiduciary. Fidelity Investmentsis not responsible for the construction ormanagement of model portfolios and is notaffiliated with your Plan’s named fiduciary. ToFor more information about your plan, go to www.401k.com5

enroll, un-enroll, or request additional information,please contact Fidelity.6

This page intentionally left blank.For more information about your plan, go to www.401k.com7

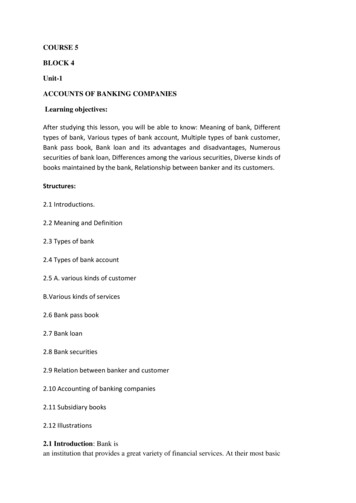

INVESTMENToptionsBefore investing in any investment option, consider the investment objectives, risks, charges, and expenses.Contact Fidelity for a mutual fund prospectus or, if available, a summary prospectus containing this information.Read it carefully.What follows is an introduction to the investment options you can choose for your plan account. You can spreadyour investments among several options to take advantage of what each has to offer and help balance differenttypes of risk. Reviewing this information can help you understand and compare your options. For more completeinformation about any of the mutual funds available through the plan, including fees and expenses, log on to FidelityNetBenefits at www.401k.com for prospectuses. Read them carefully before you invest.More ConservativeMore AggressiveCategories to the left have potentially moreinflation risk and less investment riskMoneyMarket (orShort Term)Government Fidelity GovernmentMoneyMarket FundStable ValueBondGovernment Fidelity Limited TermGovernmentFundDiversified JPMorganCore BondFund Class IInflationProtected NuveenInflationProtectedSecuritiesFund Class ICategories to the right have potentially lessinflation risk and more investment riskBalanced /HybridDomestic EquitiesInternational /Global EquityLarge Value AmericanBeaconLarge CapValue FundInstitutionalClassLarge Blend Fidelity 500Index Fund- PremiumClassLarge Growth Fidelity GrowthCompanyFund - ClassKMid Value Fidelity Low-PricedStock Fund Class K MFS Mid CapValue FundClass R4Small Value AmericanBeacon SmallCap ValueFund ClassInstitutionalMid Blend VanguardMid-Cap IndexFund AdmiralSharesMid Growth Fidelity Mid-Cap StockFund - Class KSmall BlendSmall Growth Fidelity Small CapGrowth FundSpecialtyCompanyStockDiversified InvescoInternationalGrowth FundR5 Class DelawareInternationalValue EquityFund Institutional ClassThis spectrum, with the exception of the Domestic Equity category, is based on Fidelity’s analysis of the characteristics of the general investmentcategories and not on the actual investment options and their holdings, which may change frequently. Investment options in the Domestic Equitycategory are based on the options’ Morningstar categories as of the most recent calendar quarter. Morningstar categories are based on a fund’sstyle as measured by its underlying portfolio holdings over the past three years and may change at any time. These style calculations do notrepresent the investment options’ objectives and do not predict the investment options’ future styles. Investment options are listed in alphabeticalorder within each investment category. Risk associated with the investment options may vary significantly within each particular investmentcategory, and the relative risk of categories may change under certain economic conditions. For a more complete discussion of risk associatedwith the mutual fund options, please read the prospectuses before making your investment decision. The spectrum does not represent actual orimplied performance.8

ADDITIONAL INVESTMENToptions:Target Date funds offer a blend of stocks, bonds, and short-term investments within a single fund. They are designed forinvestors who don’t want to go through the process of picking several funds from the three asset classes but who still want todiversify among stocks, bonds, and short-term investments.Categories to the left have potentially more inflation risk andless investment riskCategories to the right have potentially less inflation risk andmore investment riskJPMorgan SmartRetirement Income Fund Class R5JPMorgan SmartRetirement 2025Fund Class R5JPMorgan SmartRetirement 2040Fund Class R5JPMorgan SmartRetirement 2020Fund Class R5JPMorgan SmartRetirement 2030Fund Class R5JPMorgan SmartRetirement 2045Fund Class R5JPMorgan SmartRetirement 2035Fund Class R5JPMorgan SmartRetirement 2050Fund Class R5JPMorgan SmartRetirement 2055Fund Class R5Target date investments are generally designed for investors expecting to retire around the year indicated in eachinvestment’s name. The investments are managed to gradually become more conservative over time. The investmentrisks of each target date investment change over time as its asset allocation changes. They are subject to thevolatility of the financial markets, including equity and fixed income investments in the U.S. and abroad and maybe subject to risk associated with investing in high yield, small cap and foreign securities. Principal invested is notguaranteed at any time, including at or after their target dates.For more information about your plan, go to www.401k.com9

NEXTstepsInvesting in yourself is easy with your retirement plan. You can count on us to support you everystep of the way with our account management website, Fidelity NetBenefits . First log in towww.401k.com and we’ll show you how to get started step by step.Step 1: Enroll online today. Go to www.401k.com and click on ‘‘Register Now’’ when logging infor the first time. Follow the instructions to enroll online. Call the Retirement Benefits Line if youneed assistance at 1-800-835-5097.Step 2: Decide how much to invest and enter your contribution per pay period.Step 3: Select how you want to invest your contributions among the investment options availablein the plan. Investment performance and fund descriptions are available online or over the phone.If you are interested in additional information about investing, go to the NetBenefits Library tolearn more.Enroll today, and start saving for your retirement.10

DESCRIPTIONS OF INVESTMENToptionsMONEY MARKET FUNDSFidelity GovernmentMoney Market Fund0458Objective:Seeks as high a level of current income as is consistent with preservation ofcapital and liquidity.Strategy:The Adviser normally invests at least 99.5% of the fund’s total assets incash, U.S. Government securities and/or repurchase agreements that arecollateralized fully (i.e., collateralized by cash or government securities).Certain issuers of U.S. Government securities are sponsored or charteredby Congress but their securities are neither issued nor guaranteed by theU.S. Treasury. Investing in compliance with industry-standard regulatoryrequirements for money market funds for the quality, maturity, liquidity anddiversification of investments. The Adviser stresses maintaining a stable 1.00share price, liquidity, and income. In addition the Adviser normally invests atleast 80% of the fund’s assets in U.S. Government securities and repurchaseagreements for those securities.Risk:You could lose money by investing in the fund. Although the fund seeks topreserve the value of your investment at 1.00 per share, it cannot guaranteeit will do so. An investment in the fund is not insured or guaranteed by theFederal Deposit Insurance Corporation or any other government agency.Fidelity Investments and its affiliates, the fund’s sponsor, have no legalobligation to provide financial support to the fund, and you should not expectthat the sponsor will provide financial support to the fund at any time.} Thefund will not impose a fee upon the sale of your shares, nor temporarilysuspend your ability to sell shares if the fund’s weekly liquid assets fall below30% of its total assets because of market conditions or other factors. Interestrate increases can cause the price of a money market security to decrease.A decline in the credit quality of an issuer or a provider of credit support ora maturity-shortening structure for a security can cause the price of a moneymarket security to decrease.Short-term Redemption Fee: 0.00Who may want to invest: Someone who has a low tolerance for investment risk and who wishes tokeep the value of his or her investment relatively stable. Someone who is seeking to complement his or her bond and stock fundholdings in order to reach a particular asset allocation.Footnotes:This description is only intended to provide a brief overview of the mutualfund. Read the fund’s prospectus for more detailed information about thefund.Short-term Redemption Fee Notes:NoneBOND FUNDSFor more information about your plan, go to www.401k.com11

Fidelity Limited TermGovernment Fund0662JPMorgan Core BondFund Class IOMNW12Objective:Seeks a high level of current income in a manner consistent with preservingprincipal.Strategy:Normally investing at least 80% of assets in U.S. Government securitiesand repurchase agreements for those securities. Normally maintaining adollar-weighted average maturity between two and five years. Engaging intransactions that have a leveraging effect on the fund.Risk:Fixed income investments entail interest rate risk (as interest rates rise bondprices usually fall), the risk of issuer default, issuer credit risk and inflation risk.Leverage can increase market exposure and magnify investment risk.Short-term Redemption Fee: 0.00Who may want to invest: Someone who is seeking a fund that invests primarily in securities issuedby the U.S. government and its agencies or instrumentalities. Someone who is seeking to diversify an equity portfolio with a moreconservative investment option.Footnotes:This description is only intended to provide a brief overview of the mutualfund. Read the fund’s prospectus for more detailed information about thefund.Weighted average maturity (WAM) is the weighted average of all thematurities of the securities held in a fund. WAM for money market fundscan be used as a measure of sensitivity to interest rate changes. Generally,the longer the maturity, the greater the sensitivity. WAM for money marketfunds is based on the dollar-weighted average length of time until principalpayments must be paid, taking into account any call options exercised bythe issuer and any permissible maturity shortening devices, such as demandfeatures and interest rate resets. For bond funds, WAM can be used as ameasure of sensitivity to the markets. Generally, the longer the maturity, thegreater the sensitivity. The WAM calculation for bond funds excludes interestrate resets and only takes into account issuer call options if it is probable thatthe issuer of the instrument will take advantage of such options.Short-term Redemption Fee Notes:NoneObjective:The investment seeks maximum total return by investing primarily in adiversified portfolio of intermediate- and long-term debt securities.Strategy:The fund is designed to maximize total return by investing in a portfolio ofinvestment grade intermediate- and long-term debt securities. It will investat least 80% of its net assets plus the amount of borrowings for investmentpurposes in bonds. The fund may principally invest in corporate bonds, U.S.treasury obligations and other U.S. government and agency securities, andasset-backed, mortgage-related and mortgage-backed securities. The fund’saverage weighted maturity will ordinarily range between 4 and 12 years.

Nuveen InflationProtected SecuritiesFund Class IOLGYRisk:In general the bond market is volatile, and fixed income securities carryinterest rate risk. (As interest rates rise, bond prices usually fall, and viceversa. This effect is usually more pronounced for longer-term securities.) Fixedincome securities also carry inflation risk and credit and default risks for bothissuers and counterparties. Unlike individual bonds, most bond funds do nothave a maturity date, so avoiding losses caused by price volatility by holdingthem until maturity is not possible. Additional risk information for this productmay be found in the prospectus or other product materials, if available.Short-term Redemption Fee: 0.00Who may want to invest: Someone who is seeking potential returns primarily in the form of interestdividends rather than through an increase in share price. Someone who is seeking to diversify an equity portfolio with a moreconservative investment option.Footnotes:This description is only intended to provide a brief overview of the mutualfund. Read the fund’s prospectus for more detailed information about thefund.Weighted average maturity (WAM) is the weighted average of all thematurities of the securities held in a fund. WAM for money market fundscan be used as a measure of sensitivity to interest rate changes. Generally,the longer the maturity, the greater the sensitivity. WAM for money marketfunds is based on the dollar-weighted average length of time until principalpayments must be paid, taking into account any call options exercised bythe issuer and any permissible maturity shortening devices, such as demandfeatures and interest rate resets. For bond funds, WAM can be used as ameasure of sensitivity to the markets. Generally, the longer the maturity, thegreater the sensitivity. The WAM calculation for bond funds excludes interestrate resets and only takes into account issuer call options if it is probable thatthe issuer of the instrument will take advantage of such options.Short-term Redemption Fee Notes:NoneObjective:The investment seeks to provide investors with total return while providingprotection against inflation.Strategy:The fund normally invests at least 80% of the sum of its net assets and theamount of any borrowings for investment purposes in inflation protecteddebt securities. These securities will be issued by the U.S. and non-U.S.governments, their agencies and instrumentalities, and domestic and foreigncorporations. Up to 20% of the fund’s assets may be invested in holdings thatare not inflation protected.For more information about your plan, go to www.401k.com13

Risk:The interest payments of TIPS are variable, they generally rise with inflationand fall with deflation. In general the bond market is volatile, and fixedincome securities carry interest rate risk. (As interest rates rise, bond pricesusually fall, and vice versa. This effect is usually more pronounced for longerterm securities.) Fixed income securities also carry inflation risk and credit anddefault risks for both issuers and counterparties. Unlike individual bonds, mostbond funds do not have a maturity date, so avoiding losses caused by pricevolatility by holding them until maturity is not possible. Additional riskinformation for this product may be found in the prospectus or other productmaterials, if available.Short-term Redemption Fee: 0.00Who may want to invest: Someone who is seeking potential returns primarily in the form of interestdividends and who can tolerate more frequent changes in the size ofdividend distributions than those usually found with more conservativebond funds. Someone who is seeking to supplement his or her core fixed-incomeholdings with a bond investment that is tied to changes in inflation.Footnotes:This description is only intended to provide a brief overview of the mutualfund. Read the fund’s prospectus for more detailed information about thefund.Short-term Redemption Fee Notes:NoneDOMESTIC EQUITY FUNDSAmerican BeaconLarge Cap Value FundInstitutional ClassOSKGObjective:The investment seeks long-term capital appreciation and current income.Strategy:Under normal circumstances, at least 80% of the fund’s net assets (plus theamount of any borrowings for investment purposes) are invested in equitysecurities of large market capitalization U.S. companies. These companieshave market capitalizations within the market capitalization range of thecompanies in the Russell 1000 Index at the time of investment.Risk:Value stocks can perform differently than other types of stocks and cancontinue to be undervalued by the market for long periods of time. Stockmarkets are volatile and can decline significantly in response to adverseissuer, political, regulatory, market, economic or other developments. Theserisks may be magnified in foreign markets. Additional risk information forthis product may be found in the prospectus or other product materials, ifavailable.Short-term Redemption Fee: 0.00Who may want to invest: Someone who is seeking the potential for long-term share-priceappreciation and, secondarily, dividend income.14

Someone who is comfortable with the volatility of large-cap stocks andvalue-style investments.Footnotes:This description is only intended to provide a brief overview of the mutualfund. Read the fund’s prospectus for more detailed information about thefund.The Russell 1000 Index is an unmanaged market capitalization-weightedindex measuring the performance of the 1,000 largest companies in theRussell 3000 Index and is an appropriate index for broad-based large-capfunds.Short-term Redemption Fee Notes:NoneAmerican Beacon Small Objective:Cap Value Fund ClassThe investment seeks long-term capital appreciation and current income.InstitutionalStrategy:OSHBUnder normal circumstances, at least 80% of the fund’s net assets (plus theamount of any borrowings for investment purposes) are invested in equitysecurities of small market capitalization companies. These companies havemarket capitalizations of 5 billion or less at the time of investment. Thefund’s investments may include common stocks, real estate investmenttrusts (“REITs”), American Depositary Receipts (“ADRs”) and U.S. dollardenominated foreign stocks traded on U.S. exchanges (collectively, “stocks”).Risk:The securities of smaller, less well-known companies can be more volatilethan those of larger companies. Value stocks can perform differently thanother types of stocks and can continue to be undervalued by the market forlong periods of time. Stock m

needs beyond your retirement savings plan. Or, if you prefer, call 1-800-Fidelity for a complimentary portfolio review. How do I change my investment options? You can make changes to your investment selections online at www.401k.com or by calling the Retirement Benefits Line at 1-800-835-5097.