Transcription

MARYLAND EMPLOYERWITHHOLDING GUIDEThis guide is effective January 2020 and includes local income tax rates. Theserates were current at the time this guide was developed. The MarylandLegislature may change this tax rate when in session. During this time, pleasecheck our Web site at www.marylandtaxes.gov for any changes.Updated August 2019Comptroller of Maryland110 Carroll StreetAnnapolis, MD 21411Call 410-260-7980 from Central Maryland, or,800-638-2937 from elsewheregreenWmarylandwww.marylandtaxes.govPeter FranchotComptroller

How to use this Employer Withholding GuideThe instructions in this guide will provide you with theinformation you need to comply with the requirements forwithholding Maryland income tax as required by law.These instructions include the percentage formulas todetermine the amount of income tax to withhold fromemployees’ wages.The withholding tables are not located in this guide. Theycan be found at www.marylandtaxes.gov or if you donot have access to the Internet, please call the forms lineat 410-260-7951.We hope this guide will provide you with all the informationyou need. However, if you need additional assistance,please feel free to contact us:Comptroller of MarylandRevenue Administration Division110 Carroll StreetAnnapolis, Maryland s.govMaryland Employer Withholding FormsMW506Employer’s Return of Income Tax WithheldMW507PMW506AEmployer’s Return of Income Tax Withheld AmendedAnnuity, Sick Pay and Retirement DistributionRequest for Maryland Income Tax WithholdingMW508Annual Employer Withholding ReconciliationReturnMW508AAnnual Employer Withholding ReconciliationReturn - AmendedMW506AM Employer's Return of Income Tax Withheld forAccelerated Filers - AmendedMW506MEmployer's Return of Income Tax Withheld forAccelerated FilersMW507Employee's Maryland Withholding ExemptionCertificateMW507MExemption from Maryland Withholding Tax fora Qualified Civilian Spouse of a U.S. ArmedForces ServicememberMW508CR Business Income Tax Credits - To be used bynon-profit 501(c)(3) organizations only.548PLimited Power of Attorney and MarylandReporting Agents Authorization - to be used byreporting agents to secure information aboutwithholding and sales & use tax returns orpayments sent to the Comptroller of Maryland.It is used in place of the federal Form 8655.Reminders The standard deduction rates have changed per newlegislation enacted in the 2018 Legislative Session. For the purpose of the percentage method calculation theStandard Deduction amounts are now minimum 1550 andmaximum 2300. Employers are responsible for ensuring that tax returnsare filed and deposits and payments are made, even if theemployer contracts with a third party to perform theseacts. The employer remains responsible if the third partyfails to perform any required action. If the third partyfails to make the tax payments, the Comptroller mayassess penalties and interest on the employer’s account.The employer is liable for all taxes, penalties and interestdue. The employer may also be held personally liablefor certain unpaid taxes. To verify that the appropriatereturns have been filed and payments have been made,you may contact the Comptroller’s Office at1-800-638-2937 or from Central Maryland 410-260-7980. Quarterly withholding tax returns are due on the 15th dayof the month that follows the calendar quarter in whichthat income tax was withheld. Withholding tax rates forgambling winnings have changed. See page 5 for details. Year End Annual Reconciliation of withholding tax usingform MW508 are due on January 31st of each yeareffective July 1st, 2016. See page 7 for details.that may be either uploaded through bFile, or copied to aCD and sent to the Revenue Administration Division. A PDFor Excel spreadsheet is not acceptable. Another acceptableelectronic option is to use the bFile website and manuallykey in each W-2. See page 8 for details. We do not automatically send paper withholding taxcoupons to businesses that have not filed electronically inthe past. We strongly encourage all businesses to file theirwithholding tax returns and payments and their annualMW508 reconciliation electronically whenever possible, byusing our free bFile online service. bFile is safe and secureand provides an acknowledgement of filing. You may file and pay your withholding return via thefollowing three electronic methods:– bFile - File Withholding Returns (MW506) – You may fileand pay your employer withholding tax using electronicfunds withdrawal (direct debit) as well as file your zero(0) balance withholding tax returns. bFile is located atwww.marylandtaxes.gov under Online Services.– Electronic Funds Transfer (EFT) - Call 410-260-7980to register.– Credit Card - For alternative methods of payment,such as a credit card, visit our website at www.marylandtaxes.gov.NOTE - If you use any of these filing options, DO NOT filea paper return. A spouse whose wages are exempt from Maryland incometax under the Military Spouses Residency Relief Act mayclaim an exemption from Maryland withholding tax. Seepage 6 for details. Be sure your Central Registration Number and phonenumber appear on all forms and correspondence. Employers or payors of payments subject to Marylandwithholding taxes are required to submit their W-2/MW508data electronically if they have 25 or more employees. Theelectronic file must be a modified EFW2 format text fileFor questions concerning the withholding of Maryland and localtaxes, please e-mail your questions to taxhelp@comp.state.md.us or call one of our Taxpayer Service Division at 1-800638-2937 or from Central Maryland 410-260-7980.MARYLAND EMPLOYER WITHHOLDING2

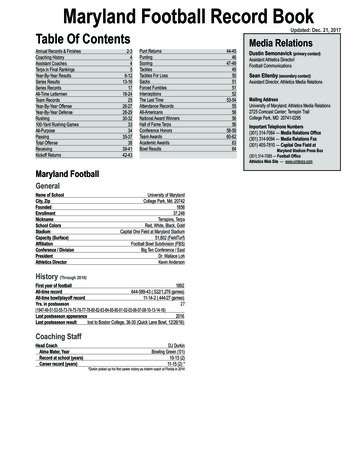

TABLE OF CONTENTSPage1. INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42. HOW THE LAW APPLIESEmployers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4All Employers Register with Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Employees' Social Security numbers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Records to Keep . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Penalties for Failing to Comply . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Civil and Criminal Penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43. PAYMENTS SUBJECT TO WITHHOLDINGTaxable Wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5Nonresident Employees Subject to Withholding . . . . . . . . . . . . . . . . . . . . . . . . . . 5Lottery & Gambling Winnings Subject to Withholding . . . . . . . . . . . . . . . . . . . . . . 5Exemption Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5Withholding for Annuity, Sick Pay and Retirement Distributions . . . . . . . . . . . . . . . 6Mandatory Withholding on Retirement Distributions . . . . . . . . . . . . . . . . . . . . . . . 6Tax-exempt organizations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64. DETERMINING THE AMOUNT TO BE WITHHELDHow to Use the Percentage Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65. HOW TO FILEbFile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Year End Reconciliation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Magnetic Media Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Names, Address and Federal Employer Identification Number Changes and FinalReturns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Amendments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8MW506A, MW506AM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8MW508A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Where Amended Returns are to be Sent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8SPECIAL WITHHOLDING INFORMATION FOR SINGLESAND STUDENTS ONLY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8IN THE EVENT OF A DISASTER OR EMERGENCY . . . . . . . . . . . . . . . . . . . . . . . . . . . 9PERCENTAGE INCOME TAX WITHHOLDING RATESMaryland Resident Employees who work in Delaware . . . . . . . . . . . . . . . . . . . . . 102.25 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122.40 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142.50 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 162.60 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182.65 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 202.80 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 222.85 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 242.90 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263.00 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 283.05 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 303.10 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 323.15 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 343.20 Percent Local Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36*****MARYLAND EMPLOYER WITHHOLDING3

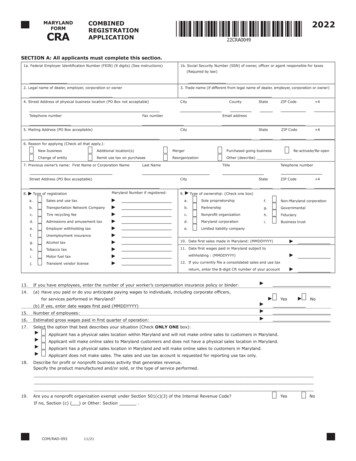

1. INTRODUCTIONThe withholding of Maryland income tax is a part of thestate’s “pay-as-you-go” plan of income tax collectionadopted by the 1955 session of the Maryland GeneralAssembly. The provisions are set forth in the Tax-GeneralArticle of the Annotated Code of Maryland.The law aids in the proper collection of taxes required to bereported by individuals with taxable income.Generally speaking, the state’s system resembles the federalwithholding plans. The distinctive differences between thestate and federal systems are explained in this guide.Withholding tax is not an additional tax, but merely acollection device. Its purpose is to collect tax at the source,as the wages are earned, instead of collecting the tax a yearafter the wages were earned.Under the law, the sums withheld must be recorded by theemployer or payor in a ledger account to clearly indicatethe amount of tax withheld and that the tax withheld is theproperty of the State of Maryland.Funds set aside by the employer or payor from taxeswithheld are deemed by law to be held in trust for the useand benefit of the State of Maryland. Any employer or payorwho negligently fails to either withhold the required tax orto pay it to the Comptroller, or both, is held personally andindividually liable for all monies involved.If the employer is a corporate entity, the personal liabilityextends and is applicable to the officer or agent of thecorporation whose duty it is to withhold the tax andtransmit it to the Comptroller as required by law.To help keep accurate employer records, every employersubject to the withholding provisions of the Maryland lawis assigned a Central Registration Number (CRN) (this isyour eight-digit Maryland tax account number). The FederalEmployer Identification Number (FEIN) assigned to you bythe IRS for federal purposes also is used for record-keepingpurposes. If you do not have a FEIN when you apply fora Maryland account, we will assign you a CRN. When youreceive your FEIN, you should notify us immediately.2. HOW THE LAW APPLIESEmployersGenerally, an employer is a person or organization, subjectto the jurisdiction of Maryland, for whom an individualperforms a service as an employee.An employer who is not required by law to withhold Marylandincome tax may withhold Maryland income tax througha voluntary arrangement with the employees or payees,provided that the employer registers with the RevenueAdministration Division. This arrangement must conform tothe Maryland withholding and payment requirements.All employers must register with MarylandAll employers are required to register with the RevenueAdministration Division by filing a Combined RegistrationApplication Form CRA. You also can register online atwww.marylandtaxes.gov. The employer will be assigneda CRN that will be used for employer income tax withholdingas well as most other Maryland business taxes.Do not wait until withholding payments are due to register asan employer. Contact the Revenue Administration Division,Annapolis, Maryland 21411 (410-260-7980) as soon as youknow you will be paying wages and withholding taxes.You should have only one CRN for withholding purposes. Ifyou have more than one, notify the Revenue AdministrationDivision.If you acquire another employer’s business, do not usethe number assigned to that business. Request aCombined Registration Application Form CRA from theRevenue Administration Division or register online at www.marylandtaxes.gov. You must include your CRN and FEIN,if available, on all forms, attachments and correspondenceyou send to the Revenue Administration Division.For withholding purposes “employee” means: An individual, whether a resident or nonresident ofMaryland, who performs any service in Maryland forwages. A resident of Maryland who performs any service outsidethis state for wages. An officer, employee, or elected official of the UnitedStates, Maryland, or any other state or territory, or anypolitical subdivision thereof, or the District of Columbia,or any agency or instrumentality of any of the above. An officer of a corporation.Employees' Social Security numbersYou must record the name and address of each employeeor payee exactly as it appears on the Social Security card.If a new employee does not have a Social Security card,have the employee obtain one at any Social SecurityAdministration office.Records to keepYou are required to keep all records pertaining to thepayment of wages and the deduction and withholding ofMaryland income tax. These records must be availablefor inspection by the Revenue Administration Division andinclude: The amounts and dates of all wage payments to eachemployee. The amounts and dates for all Maryland income taxeswithheld from wage payments to each employee. The name, address, Social Security Number, and periodof employment for each employee. Each employee’s exemption certificate. Your identification number, the amount of Marylandincome tax withheld and paid to the Comptroller ofMaryland, and the dates payments were made.All records should be retained for a period of at least threeyears after the date the tax to which they relate becamedue or the date the tax was paid, whichever is later.Penalties for failing to complyAny employer who fails to file returns or remit amountscollected as required is subject to a penalty not to exceed25% of the unpaid tax.If an employer pays tax, interest or penalty by check (orother instrument) that is not honored by the bank on whichit is drawn, the employer shall be assessed a service chargeof 30.Remember! The money you withhold from youremployees is held in trust for the State of Maryland.Civil and Criminal PenaltiesCivil Penalties» Suspension or revocation of all business licenses issuedby the State to the employer for willful failure to withholdor pay income tax to the Comptroller.» Imposition of a 50 penalty for each violation forwillful failure to provide an income tax statement or forproviding a false withholding statement.Also, for willful non-compliance with a wage lien, theemployer will be personally liable for excess wages paidto an employee subject to the lien. In addition, all unpaidwithholding tax, interest and penalties, constitute a lien infavor of the State of Maryland, extending to all real andMARYLAND EMPLOYER WITHHOLDING4

personal property belonging to the employer.Criminal Penalties (Upon Conviction)» Not to exceed ten thousand dollars ( 10,000) orimprisonment not exceeding five years or both, for: Willful failure to file a return. Willful failure to withhold the required tax. Willful failure to pay the tax withheld to the Comptroller.» Not to exceed five-hundred dollars ( 500) orimprisonment not exceeding six months or both, for: Willful failure to provide a copy of withholding taxstatement. Providing a false or fraudulent withholding taxstatement. Failure to provide information on a withholdingcertificate or for filing a false certificate. Willful failure to pay to the Comptroller salary wagesor compensation subject to a salary lien.3. PAYMENTS SUBJECT TO WITHHOLDINGTaxable wagesFor withholding purposes, “wages” mean all compensationfor services performed by an employee, including thecash value of all remuneration paid in any medium otherthan cash. (Exceptions are listed later in this section.)These exceptions are similar to the exclusions for federalwithholding purposes, so that in most instances wagessubject to federal withholding also will be subject toMaryland withholding.Taxable “wages” include all employee compensation, such assalaries, fees, bonuses, commissions, vacation allowances,back pay and retroactive increases.Wages paid in any form other than money are measuredby their fair market value. These include lodging, meals,property or other considerations for personal services.Agricultural wages subject to Social Security (FICA) tax aresubject to Maryland withholding tax. Tips and gratuitiespaid to an employee by a customer also are subject towithholding tax in the same manner as reported for federalpurposes.Withholding is not required for the following: Domestic service in a private home, local college club orlocal chapter of a college fraternity or sorority. Services performed by a duly ordained, commissionedor licensed minister of a church in the exercise of hisministry or by a member of a religious order in theexercise of duties required by such order. Nonresident individuals employed as seamen uponvessels engaged in oceanic and foreign trade orcommerce while such vessels are within any of the portsof Maryland. Single and student employees whose total incomewill be less than the minimum filing requirement.(See page 8.) Employees paid at a rate of less than 5,000annually.Nonresident employees subject to withholdingA nonresident is not subject to tax if: His income consists entirely of wages or othercompensation for personal services performed inMaryland; and The state of residence has agreed in writing to allow areciprocal exemption from tax and withholding for eachother’s residents.As a result of this provision, the residents of a number ofstates are exempt and no withholding of Maryland tax isto be made by the employer. Under such circumstances,it is necessary that Maryland Form MW507, EmployeeMaryland Withholding Exemption Certificate, be filed withthe employer in which the employee certifies that he resideswithin one of the reciprocal states listed on the form.Nonresidents from states that have no income tax law orhave no written reciprocal income tax agreement with thisstate are subject to Maryland tax and withholding must bemade from salaries and wages for services performed inMaryland.Withholding is also required in a sale or exchange of realproperty and associated tangible personal property ownedby a nonresident or nonresident entity.Lottery & gambling winnings subject to withholdingLottery and other gambling winnings in excess of 5,000are subject to withholding at a rate of 8.95% for Marylandresidents or 8% for nonresidents. Pari-mutuel (horseracing) winnings in excess of 5,000 and at least 300 timesas large as the original wager are subject to the samewithholding rates.Exemption certificateAt the time of or before hiring a new employee, theemployer must obtain a certificate of exemption, MarylandForm MW507, from the employee. This certificate authorizesthe employer to withhold Maryland income tax from theemployee's salary, based on the number of withholdingexemptions claimed on Form MW507. Often, the number ofwithholding exemptions will correspond with the number ofpersonal exemptions allowed the employee in computing histax on his Maryland income tax return.However, if the employee expects that his federal adjustedgross income will exceed 100,000 (or 150,000 if filing a jointincome tax return) he must use the worksheet to recalculatethe number of withholding exemptions to which he is entitled.The value of personal exemptions will be reduced at thisincome level on the Maryland income tax return. (To see thereduction in exemptions, at the various income levels, go topage two of Maryland Form MW507 which can be obtainedat www.marylandtaxes.gov.)Also, if the employee expects that the amount of Marylandincome tax withheld will not equal the Maryland tax liability,he must use the worksheet to recalculate the number ofexemptions to which he is entitled. The employee also mayenter into an agreement with the employer to have anadditional amount of tax withheld. As long as the numberof withholding exemptions claimed by the employee doesnot exceed the number he is entitled under the law, thetotal withholding exemptions shown on the Maryland FormMW507 do not have to agree with the total shown on thefederal Form W-4.When a new employee files a certificate, the employermust make it effective with the first payment of wages.A certificate, once filed with the employer, will remain ineffect until a new certificate is filed.If an employee fails to furnish a certificate, the employer isrequired to withhold the tax as if the employee had claimedone withholding exemption.An employer is required to submit a copy of the exemptioncertificate received by the Compliance Division if:1. The employer has any reason to believe this certificateis incorrect.2.The employee claims more than ten (10) exemptions.3. The employee claims exemption from withholding on thebasis of nonresidence.4. The employee claims exemption from withholdingbecause he/she has no tax liability this year, and theMARYLAND EMPLOYER WITHHOLDING5

wages are expected to exceed 200 a week.5. The employee claims an exemption from withholdingunder the Military Spouses Residency Relief Act. (In thiscase, Form MW507M must be completed and attached toForm MW507.)When the exemption certificate is received, the ComplianceDivision will make a determination and will notify theemployer if a change is required.Withholding for annuity, sick pay and retirementdistributionsA payee of an annuity, sick pay or retirement distributionmay request the payor to withhold tax with respect topayments of annuities, sick or retirement distributionpayments. If such a request is made, the payor must deductand withhold the tax as required. The amount requestedto be withheld from each sick pay, annuity payment orretirement distribution must be a whole dollar amountof at least 5 per month for annuities and retirementdistributions, and at least 2 per daily payment in the caseof sick pay.Mandatory withholding on retirement distributionsWhen a rollover distribution is subject to a mandatory federalwithholding, the eligible rollover distribution of Marylandresidents is subject to a mandatory state withholding of7.75%. Otherwise, such withholding should not takeplace unless requested by the payee.Tax-exempt organizationsEntities which are tax-exempt organizations under IRC501(c)(3), and that are eligible to claim the MarylandDisability Employment Tax Credit or the Commuter TaxCredit against their withholding taxes, will use FormMW508CR to claim the amount of credit.The paperversion of Form 500CR has been discontinued. MW508CRis attached to MW508 for employers submitting fewer than25 Forms W-2 or 1099. MW508CR is attached to FormMW508A for those employers required to file electronically.See Administrative Release 344. DETERMINING THE AMOUNT TO BE WITHHELDMaryland law provides that the Comptroller developwithholding tax schedules to approximate the tax on wages,without considering the tax rates in effect that are less than4.75%.In this guide, you will find the appropriate percentage forthe computation of the amount of Maryland income tax tobe withheld. Apply the applicable percentage to the taxableincome. Note: there are two different rates explainedbelow.The SINGLE rate is used by single employees; employeeswho are dependents on another person's tax return, oremployees who are Married planning to file separately. TheJOINT rate is used by Married taxpayers who plan to filejoint returns, employees who qualify for Head of Householdstatus on their tax return, or for employees who qualify asWidow or Widower with a dependent child.For employees who are residents of Maryland, use the ratecorresponding to the area where the employee lives. Sinceeach county sets its local income tax rate, there is thepossibility of having 24 different local income tax rates.To reduce the number of local income tax rates, we haveestablished 14 local income tax rates. Use the rate thatequals or slightly exceeds the actual local income tax rateto ensure that sufficient tax is withheld.For employees who are not residents of Maryland, use theNonresident rate, which includes no local tax; but doesinclude the Special 2.25% Nonresident rate.For employees who are residents of Maryland and areworking and paying withholding taxes in Delaware or anyother nonreciprocal state, use the Delaware/Nonreciprocalstate rate, which includes local tax and credit for taxes paidto another state or locality.Withholding is a combination of the state income tax rateand local taxes. When using the percentage method ofwithholding, the employer must follow these four steps:1. Subtract an allowance for Standard Deduction (15percent of wages for the payroll period with a minimumand maximum as set forth for the particular payroll)from the employee’s wages.2.Multiply the amount of one withholding exemption forthe payroll period by the number of exemptions claimedon the employee’s Form MW507.3. Subtract the amount determined in Step 2 from theemployee’s wages.4. Apply the appropriate percentage rate table to theresulting figure to determine the amount of withholding,based on the employee’s county of residence. If theemployee is a resident of a nonreciprocal state, use thespecial nonresident tax rate.Visit www.marylandtaxes.govwithholding calculator.touseouronline5. HOW TO FILEFor filing purposes, employers will fall into one of five typesof filing categories: Accelerated – those employers who were required towithhold 15,000 or more for the preceding calendar yearand who have 700 or more of accumulated withholdingare required to remit the withholding payment withinthree business days following that payroll (pay date).You may request a waiver allowing monthly returns.A renewal of the waiver also is available if eligibilityto file federal withholding tax returns on a monthlybasis is unchanged. Pay date is defined as the date thepaychecks are made available to employees. Quarterly – those employers with less than 700 ofwithholding per quarter who are required to remit thetax withheld on a quarterly basis. Monthly – those employers with more than 700 ofwithholding in any one quarter who are required to remitthe tax withheld on a monthly basis. Seasonal – those employers who operate only duringcertain months. You must obtain prior approval to fileon a seasonal basis. If approval is granted, you wouldonly be required to file reports during the period yourbusiness is in operation. Annual – those employers with less than 250withholding per calendar year are required to remitthe tax withheld on an annual basis. The due date forfiling an annual Form MW506 is the last day of Januaryfollowing the year to which such withholding applies. Inaddition, annual filers must file the Annual ReconciliationForm MW508 with the Form W-2 for each employee.bFileThis online service is used to file and pay Employer’s Returnof Income Tax Withheld (MW506). A valid FEIN or SSN andMaryland CRN (this is your eight-digit Maryland tax accountnumber) are required. If you have not registered to fileMaryland business taxes or do not have a CRN, you mayregister on our Web site at www.marylandtaxes.gov.You may be asked to provide a bank routing and transitnumber (RTN) and a depositor’s account number (DAN) tomake payments of business taxes. The funds automaticallywill be withdrawn from your bank account on the datespecified.Do not send a paper return when using bFile, thisMARYLAND EMPLOYER WITHHOLDING6

online service supports the current year and two previousyears. If your return is for a prior period, you may requestthese forms by calling Taxpayer Service Division 410-2607980, or e-mail taxhelp@comp.state.md.us.The Revenue Administration Division has sent postcards towithholding filers advising them we no longer send papercoupon books unless the postcard was returned or ane-mail was received requesting them. This is an effort toreduce and/or eliminate paper processing and to encourageemployers to use the online service which has manybenefits to offer:Fast – Enter your business and bank information once.The information will be filled in each time you file a return,using auto-fill.Accurate – The automatic fill-in feature e

data electronically if they have 25 or more employees. The electronic file must be a modified EFW2 format text file that may be either uploaded through bFile, or copied to a CD and sent to the Revenue Administration Division. A PDF or Excel spreadsheet is not acceptable. Another acceptable electronic option is to use the bFile website and manually