Transcription

John Hancock InvestmentsSIMPLE IRAYour employer has just madesaving for retirement easier!All the forms you need to opena John Hancock Investments SIMPLE IRAEMPLOYEE FORMS

Save for retirement with the John Hancock SIMPLE IRAYour Employer has just made saving for your retirement easier for you by selecting the John Hancock Investments SIMPLE IRA.The SIMPLE IRA is a salary deferral retirement Plan for Employers with no more than 100 eligible Employees. As a Plan Participant, you can make pretax salarydeferrals into your SIMPLE IRA account. Your Employer also contributes to your account each year, making your savings grow even faster. The SIMPLE IRA provideseligible Employees with a convenient way to invest for retirement and reduce current taxes. Generally, you’re eligible to participate if you received 5,000 or more from\RXU (PSOR\HU LQ DQ\ WZR SUHFHGLQJ FDOHQGDU \HDUV DQG \RX¶UH H[SHFWHG WR UHFHLYH DW OHDVW GXULQJ WKH FXUUHQW \HDU 3OHDVH FRQVXOW ZLWK \RXU ¿QDQFLDO DGYLVRU WR determine if a SIMPLE IRA is right for you.Benefits of participating in the John Hancock Investments SIMPLE IRAYour salary deferral contributions reduce today’s tax billContributions to your SIMPLE IRA are deducted from your salary on a pretax basis. By deferring part of your salary, you reduce your taxable wages, which reduces yourannual tax liability. Due to the passing of the Economic Growth and Tax Relief Reconciliation Act of 2001, SIMPLE IRA contribution limits may increase each year. Thelegislation also allows for a catch-up contribution for SIMPLE IRA Plan Participants over the age of 50.Employer contributions help your savingsaccumulate fasterYour Employer can select either of the following options:Pretax saving with a SIMPLE IRA can keepmoney in your pocket.A matching contribution of up to 3% of Compensation based on the amount of yoursalary deferral orA 2% nonelective contribution to all eligible EmployeesTo be eligible for an Employer-matching contribution, you must make salary deferralcontributions. However, if your Employer chooses a nonelective contribution, you willreceive your Employer’s contribution whether or not you choose to contribute to the Plan.Each year your Employer will inform you of the Employer contribution and other Plan detailsat least 60 days before the start of the Plan Year.SIMPLE IRA contribution limitsCatch-up provision forParticipants over age 502017: 12,5002017: 3,0002018: 12,5002018: 3,000Please keep in mind that mutual funds are not insured by the FDIC, not deposits orother obligations of the institution and are not guaranteed by the institution, and aresubject to investment risks, including possible loss of the principal amount invested.SIMPLEIRATaxableaccountAnnual salary 25,000 25,000 200/monthpretax contribution 2,400N/ATaxable income 22,600 25,000Federal taxes* 3,390 3,880N/A 2,400 19,210 18,720 490 0 200/monthafter-tax contributionTake-home payTax savings* Based on a 28% tax bracket.

Establishing your SIMPLE IRA account is easy!After reading the materials in your SIMPLE IRA kit, just follow the three steps outlined below1. Determine how much you want to contributeYou may not contribute more than 12,500 for 2017 and 2018.Please note: If your Employer has chosen to make a matching contribution, you will not receive the Employer match unless you contribute to the Plan.2. Select your investmentsSelect the John Hancock Investments funds for your account. Before investing, be sure to read the prospectus included in your enrollment kit, which containscomplete information, including expenses. Your investment professional can help you select the funds best suited for your needs.3. Complete the following forms. &RPSOHWH WKH IRUPV OLVWHG EHORZ DQG UHWXUQ WKHP WR \RXU (PSOR\HU %H VXUH WR NHHS FRSLHV IRU \RXU RZQ ¿OHV 1. SIMPLE IRA Adoption Agreement (Form 1—used by John Hancock to establish your account)2. SIMPLE IRA salary reduction agreement (Form 2—for your Employer’s records)TransfersIf your Employer has decided to change providers and move your Plan to John Hancock from another provider, there are two ways to transfer your account toJohn Hancock:Direct asset transfer—By completing the John Hancock SIMPLE IRA rollover-transfer form (form 3), you instruct your current SIMPLE IRA trustee or custodian totransfer dollars directly to John Hancock Investments. There is no limit to the number of direct asset transfers you can make.SIMPLE IRA-to-SIMPLE IRA rollover—You request a check, payable to yourself, from your current SIMPLE IRA custodian for the full amount of your SIMPLE IRAassets. You then redeposit this amount in your new SIMPLE IRA no later than 60 days after you received your distribution. You can make a SIMPLE IRA rollover onlyonce every 12 months. RX FDQQRW FRPELQH RU FRPPLQJOH D GLVWULEXWLRQ IURP D TXDOL¿HG UHWLUHPHQW 3ODQ WUDGLWLRQDO ,5 RU 6(3 ,5 ZLWK \RXU 6,03/( ,5 DVVHWV &RPPLQJOLQJ ZLOO QHJDWH \RXU DELOLW\ WR WUDQVIHU DQ\ SRUWLRQ RI \RXU TXDOL¿HG 3ODQ GLVWULEXWLRQ LQWR D QHZ (PSOR\HU¶V 3ODQ RU WR WDNH DGYDQWDJH RI DQ\ IXWXUH WD[ DYHUDJLQJ RX PD\ RQO\ WUDQVIHU SIMPLE IRA assets into a SIMPLE IRA.

Tax-deferred compounding also boosts the value of your accountNot only do you save on current income taxes when you contribute to a SIMPLE IRA, but all interest, dividends, and capital gains accumulate tax deferred (free ofcurrent taxes) until you begin taking money out of your account. As you can see from the graph below, tax-deferred compounding can make a big difference in thevalue of your retirement account.Account value(Thousands) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 700 600 500 400 300 200 100 030 years 1,416,040 913,824 572,025 339,401 181,082 73,3335 years10 years15 years20 years25 yearsHypothetical tax-deferred accumulation for an investor contributing 12,500 per year, for 30 years, at an 8% annual return.The example above is hypothetical and is for illustrative purposes only. This hypothetical example does not take into account taxes, fees, charges, andH[SHQVHV ZKLFK ZRXOG UHVXOW LQ ORZHU WRWDO GROODU DPRXQWV V PDUNHW FRQGLWLRQV ÀXFWXDWH VRPH LQYHVWPHQWV PD\ IDOO RXW RI IDYRU ZLWK WKH PDUNHW DQG XQGHUSHUIRUP ,QYHVWPHQW GHFLVLRQV FRXOG DGYHUVHO\ DIIHFW UHWXUQV 3OHDVH FRQWDFW \RXU ¿QDQFLDO SURIHVVLRQDO WR GLVFXVV \RXU LQYHVWLQJ QHHGV You’re in charge of your accountYou set up your account, decide how much you want to defer (up to the IRS limit), and select the investments. Each year during the 60-day election period, you candecide whether or not to change the amount of your deferral for the coming year. You can stop contributing to your Plan at any time.Your account is always 100% vested. This means that all dollars in the account—your own contributions and your Employer’s—belong to you. Although yourSIMPLE IRA account is intended to fund your retirement, you may withdraw money at any time. There are federal penalties for withdrawing money before you reachDJH ò² GXULQJ WKH ¿UVW WZR \HDUV DIWHU \RX HVWDEOLVK \RXU DFFRXQW DQG WKHUHDIWHU 3HQDOWLHV GR QRW DSSO\ WR ZLWKGUDZDOV PDGH IRU GHDWK GLVDELOLW\ PHGLFDO H[SHQVHV KHDOWK LQVXUDQFH LI \RX EHFRPH XQHPSOR\HG HGXFDWLRQ H[SHQVHV ¿UVW WLPH KRPH EX\HUV OLIHWLPH OLPLW RU VXEVWDQWLDOO\ HTXDO SHULRGLF payments. Of course, you’ll also have to pay ordinary income tax on the full amount.Because of the complexity of the tax laws governing retirement distributions, you should always consult your legal counsel or tax advisor before taking a distribution.

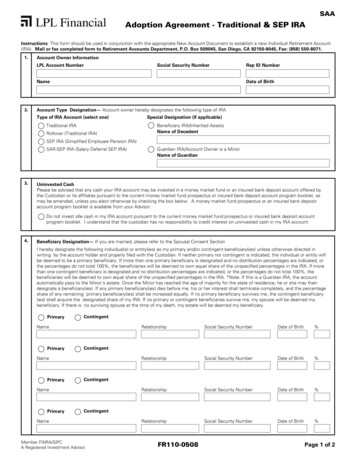

Reset FormFORM 1SIMPLE IRA adoption agreementIntroductionInstructionsUse this form for John Hancock custodial accounts. This form allows you to open a new SIMPLE IRA.Please print in all capital letters and use black ink.Questions about this form?800-432-1969Special considerationsShares of a fund generally may be sold only to U.S. citizens and U.S. residents. For the purpose ofthis policy, both the residential address and the mailing address provided must be U.S. addresses.Contact us:800-432-1969 jhinvestments.com See the end of this document forreturn instructions1. Account type (Please check only one box)New SIMPLE IRA Direct transfer from another SIMPLE IRA: (Estimated amount)(From another SIMPLE IRA only. Please attach the SIMPLE IRA transfer of assets form.) Rollover from another SIMPLE IRA, traditional IRA, or eligible Employer-sponsored retirement Plan: (Estimated amount)1DPH RI WKH SULRU WUXVWHH RU FXVWRGLDQ ,I DSSOLFDEOH 'DWH RI ¿UVW FRQWULEXWLRQ WR WKH RWKHU 6,03/( ,5 Note: If you cannot provide the date your Prior Plan was started, the date of this Plan’s start will be used to calculate possible penalties for withdrawals within two years.2. Owner informationIf you are a new Participant to an existing Plan, it is very important to indicate your Plan ID number below. Your Employer will be able to provide you with thisnumber. Your SIMPLE IRA will be registered as follows:John Hancock Life & Health Insurance Co., custodian for the SIMPLE IRA of:Plan namePlan ID number(PSOR\HH¶V ¿UVW QDPH V LW DSSHDUV RQ \RXU WD[ UHWXUQ 0, /DVW QDPHResidential address (No P.O. boxes except A.P.O. or F.P.O. boxes. Must be a U.S. address)CitySocial Security numberStatePhone numberZip codeDate of birth (MM/DD/YYYY)Mailing address (If different from above)Street address/A.P.O., F.P.O., or P.O. box/apt. # (Must be a U.S. address)CityStateZip codeEmail addresseDeliveryBy checking the box above, I consent to receiving electronic delivery of John Hancock Investments mutual fund and account documents, notices and communications, includingEXW QRW OLPLWHG WR FRQ¿UPDWLRQ DQG TXDUWHUO\ DFFRXQW VWDWHPHQWV WD[ LQIRUPDWLRQ DQG QRWLFHV DQQXDO VHPLDQQXDO UHSRUWV SURVSHFWXVHV DQG RWKH U UHTXLUHG DQG LQIRUPDWLRQDO QRWLFHV DFFRXQW GRFXPHQWV LQVWHDG RI LQ SDSHU IRUP E\ UHJXODU PDLO 0\ FRQVHQW ZLOO UHPDLQ LQ HIIHFW XQWLO UHYRNHG , XQGHUVWDQG WKDW -RKQ DQFRFN ZLOO VHQG PH DQ HPDLO ZKHQ DFFRXQW GRFXPHQWV DUH DYDLODEOH IRU YLHZLQJ GRZQORDGLQJ DQG SULQWLQJ (DFK HPDLO ZLOO SURYLGH D OLQN WR MKLQYHVWPHQWV FRP ZKLFK ZLOO DOORZ PH WR DFFHVV P\ DFFRXQW GRFXPHQWV RQOLQH FFHVVLQJ DFFRXQW GRFXPHQWV RQOLQH UHTXLUHV PLQLPXP WHFKQLFDO UHTXLUHPHQWV LQFOXGLQJ L DFFHVV WR WKH ,QWHUQHW LL D YDOLG HPDLO DGGUHVV DQGLLL LQVWDOODWLRQ RI GREH FUREDW 5HDGHU RQ P\ FRPSXWHU GREH FUREDW 5HDGHU FDQ EH GRZQORDGHG IUHH RI FKDUJH DW DGREH FRP , XQGHUVWDQG WKDW QR FRQ¿GHQWLDO GDWD ZLOO EH VHQW WKURXJK HPDLO DQG -RKQ DQFRFN GRHV QRW FKDUJH D IHH IRU SURYLGLQJ HOHFWURQLF GRFXPHQWV KRZHYHU , PD\ LQFXU ,QWHUQHW DFFHVV FKDUJHV WHOHSKRQH FKDUJHV DQG RWKHU WKLUG SDUW\ FKDUJHV ZKHQ UHFHLYLQJ HOHFWURQLF GRFXPHQWV RU GRZQORDGLQJ WKH UHTXLUHG VRIWZDUH , XQGHUVWDQG WKDW , FDQ UHFHLYH D IUHH SDSHU FRS\ RI DFFRXQW GRFXPHQWV DQG RU UHYRNH P\ FRQVHQW DW DQ\ WLPH E\ FDOOLQJ RU E\ YLVLWLQJ MKLQYHVWPHQWV FRP SIRAFM FORM 1 10/18PAGE 1 OF 4

3. Fund selectionIndicate the fund name, share class, and the percentage of future contributions to be allocated to each fund in the space provided. If a fund class is not selected,John Hancock Investments will default to Class A shares. Consult your prospectus for details.Fund nameA CTax year Investment amountPercentage to each fund % % %For direct transfers and rollovers: Total amount of checks attached: 4. Designation of beneficiary'HVLJQDWLQJ EHQH¿FLDULHV LV DQ LPSRUWDQW SDUW RI WKH HVWDWH SODQQLQJ SURFHVV 3OHDVH WDNH FDUH LQ FKRRVLQJ \RXU EHQH¿FLDULHV DQG RI FRXUVH PDNH SODQV WR SHULRGLFDOO\ UHYLHZ \RXU EHQH¿FLDULHV WR PDNH VXUH QRWKLQJ VKRXOG FKDQJH :H KDYH SURYLGHG VRPH EDVLF LQIRUPDWLRQ DERXW WKLV SURFHVV EHORZ KRZHYHU LI \RX KDYH VSHFL¿F TXHVWLRQV UHJDUGLQJ KRZ WKLV ZLOO DIIHFW \RXU HVWDWH 3ODQ ZH UHFRPPHQG WKDW \RX FRQWDFW \RXU WD[ DGYLVRU RU HVWDWH DWWRUQH\ -RKQ DQFRFN ,QYHVWPHQWV DOORZV \RX WR SODFH FHUWDLQ UHVWULFWLRQV RQ GLVWULEXWLRQV PDGH WR \RXU QDPHG EHQH¿FLDULHV ,Q RUGHU WR WDNH DGYDQWDJH RI WKLV IHDWXUH SOHDVH OHDYH WKLV VHFWLRQ EODQN DQG FRPSOHWH WKH -RKQ DQFRFN ,QYHVWPHQWV LQGLYLGXDO UHWLUHPHQW DFFRXQW ,5 UHVWULFWHG EHQH¿FLDU\ GHVLJQDWLRQ IRUP available by calling John Hancock Signature Services, Inc. at 800-225-5291 or by visiting our website at jhinvestments.com. &RPSOHWH WKH UHTXLUHG LQIRUPDWLRQ IRU HDFK EHQH¿FLDU\ QDPHG RX PD\ FKDQJH \RXU EHQH¿FLDU\ LHV DW DQ\ WLPH DIWHU WKH LQLWLDO GHVLJQDWLRQ E\ QRWLI\LQJ -RKQ DQFRFN 6LJQDWXUH 6HUYLFHV ,QF LQ ZULWLQJ , I QR EHQH¿FLDULHV DUH GHVLJQDWHG RU LI WKHUH DUH QR EHQH¿FLDULHV OLYLQJ DW WKH WLPH RI \RXU GHDWK \RXU HVWDWH ZLOO JHQHUDOO\ EH HQWLWOHG WR \RXU DFFRXQW DVVHWV 3HUFHQWDJHV IRU EHQH¿FLDULHV PXVW WRWDO IRU HDFK VHFWLRQ ,I QRW WUDQVIHUV VKDOO EH PDGH SURSRUWLRQDOO\ RQ WKH SHUFHQWDJHV VWDWHG ,I QR SHUFHQWDJHV DUH LQGLFDWHG HDFK SULPDU\ EHQH¿FLDU\ ZKR VXUYLYHV \RX ZLOO UHFHLYH HTXDO SHUFHQWDJHV RI \RXU DFFRXQW , I PXOWLSOH EHQH¿FLDULHV DUH OLVWHG DQG D EHQH¿FLDU\ GRHV QRW VXUYLYH \RX KLV RU KHU SHUFHQWDJH ZLOO EH GLYLGHG HTXDOO\ DPRQJ WKH UHPDLQLQJ EHQH¿FLDULHV unless previously stated otherwise. &RQWLQJHQW EHQH¿FLDULHV DUH HQWLWOHG WR UHFHLYH \RXU DFFRXQW RQO\ LI WKHUH DUH QR VXUYLYLQJ SULPDU\ EHQH¿FLDULHV DW WKH WLPH RI \RXU GHDWK For trusts, please list the trust name, the name(s) of the trustee(s), and the trust establishment date.Name of primary beneficiary(ies)SSN/tax ID #% shareDate of birth/trustRelationship to owner Spouse Spouse Spouse SpouseTotal:Name of contingent beneficiary(ies)SSN/tax ID #SIRAFM FORM 1 10/18 Other Other Other Other(Must add up to 100%)% shareDate of birth/trustRelationship to owner Spouse Spouse Spouse SpouseTotal:Name of custodian ifbeneficiary is a minor(Must add up to 100%)PAGE 2 OF 4 Other Other Other OtherName of custodian ifbeneficiary is a minor

4. Designation of beneficiary (continued)This section should be reviewed if the residence of the SIMPLE IRA holder is located in a community property state and the SIMPLE IRA holder is married.I am not married. , XQGHUVWDQG WKDW LI , PDUU\ LQ WKH IXWXUH , PXVW FRPSOHWH D QHZ 6,03/( ,5 GHVLJQDWLRQ RI EHQH¿FLDU\ IRUP I am married. , XQGHUVWDQG WKDW LI , FKRRVH WR GHVLJQDWH D SULPDU\ EHQH¿FLDU\ RWKHU WKDQ P\ VSRXVH P\ VSRXVH PXVW VLJQ EHORZ Spousal consent—5HTXLUHG LI \RXU VSRXVH LV QRW QDPHG DV VROH SULPDU\ EHQH¿FLDU\ DQG \RX UHVLGH LQ D FRPPXQLW\ RU PDULWDO SURSHUW\ VWDWH RX VKRXOG consult with your own legal or tax advisor to determine if spousal consent is required. , DP WKH VSRXVH IRU WKH DERYH QDPHG 6,03/( ,5 DFFRXQW RZQHU , DFNQRZOHGJH WKDW D GHVLJQDWLRQ RI D QRQVSRXVH EHQH¿FLDU\ PD\ QRW EH HIIHFWLYH LQ P\ VWDWH ZLWKRXW P\ FRQVHQW , KHUHE\ UHOLQTXLVK DQ\ LQWHUHVW WKDW , PD\ KDYH LQ WKLV 6,03/( ,5 DQG FRQVHQW WR WKH EHQH¿FLDU\ GHVLJQDWLRQ V VWDWHG DERYH , assume full responsibility for any adverse consequences that may result.SIGNHERESignature of spouseDate (MM/DD/YYYY)5. Net asset value privilegeAvailable for Class A shares to the following, as described in the Statement of Additional Information (SAI). Please check the box that applies.I am an Employee of John Hancock. , DP DQ (PSOR\HH RI WKH DI¿OLDWHG ¿UP QDPHG EHORZ ZKLFK PDLQWDLQV D VHOOLQJ DJUHHPHQW ZLWK -RKQ DQFRFN I am an investment professional and have completed Section 6.I am an immediate family member of the Employee or investment professional named below. (Investment professionals mustcomplete Section 6.) I am transferring assets from an existing account that I acquired as a result of a reorganization of the fund into John Hancock and have terminated myrelationship with the pULRU ¿QDQFLDO LQVWLWXWLRQ , DP DWWDFKLQJ D SIMPLE IRA rollover/transfer form.Employee’s or investment professional’s nameJohn Hancock department, affiliated firm name,or broker-dealer‘s nameRelationship to the Employee orinvestment professional6. Investment professional information (Must be completed by an investment professional)First nameMILast nameBroker-dealer’s nameAddressCityStateBroker-dealer’s numberBranch numberInvestment professional’s numberZip codePhone numberSIGNHERESignature of the investment professionalSIRAFM FORM 1 10/18Date (MM/DD/YYYY)PAGE 3 OF 4

7. Signature, taxpayer identification number, and certification1RWH RX PXVW VLJQ DQG HQWHU \RXU WD[SD\HU LGHQWLÀFDWLRQ QXPEHU EHORZ RXU DFFRXQW FDQQRW EH HVWDEOLVKHG ZLWKRXW WKLV UHTXLUHG LQIRUPDWLRQ I hereby adopt this SIMPLE IRA Plan, appointing John Hancock Life & Health Insurance Co. to serve as custodian and to perform the administrative services of this Plan.I have received and read the prospectus(es) for the fund(s) in which I am making my SIMPLE IRA investment. In addition, I have received and read a copy of the AdoptionAgreement, custodial agreement, and disclosure statement, and I understand the eligibility requirements for the type of IRA deposit I am making, as well as any feesto which my account(s) may be subject. I understand that I am responsible for determining my eligibility for a SIMPLE IRA each year I make a contribution, and that allcontributions I make are within the limits set forth by the tax laws. I also assume complete responsibility for the tax consequences of any contributions (including rolloverFRQWULEXWLRQV DQG GLVWULEXWLRQV WKDW , PDNH , DFNQRZOHGJH WKDW LGHQWLI\LQJ LQIRUPDWLRQ LV UHTXLUHG EHIRUH WKH DFFRXQW FDQ EH RSHQHG DQG LV VXEMHFW WR YHUL¿FDWLRQ E\ P\ ¿QDQFLDO SURIHVVLRQDO WKH IXQG RU LWV DJHQWV ,I YHUL¿FDWLRQ LV XQVXFFHVVIXO -RKQ DQFRFN PD\ FORVH P\ DFFRXQW UHGHHP P\ VKDUHV DW WKH QH[W QHW DVVHW YDOXH PLQXV DQ\ applicable sales charges, and take other steps that it deems reasonable. I understand that under certain circumstances, if no activity occurs in my account within a timeSHULRG VSHFL¿HG E\ VWDWH ODZ P\ VKDUHV PD\ EH WUDQVIHUUHG WR WKH DSSURSULDWH VWDWH Note: The rules for transferring abandoned property vary state by state, so we suggest you contact your state’s department of abandoned property if you have anyquestions regarding requirements.&HUWLILFDWLRQ UHTXLUHG RI 8 6 SHUVRQV RQO\ LQFOXGLQJ 8 6 FLWL]HQV 8 6 UHVLGHQW DOLHQV RU RWKHU 8 6 SHUVRQVUnder penalties of perjury, I certify that:1. The number shown below is my correct taxpayer identification number,2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal RevenueService (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am nolonger subject to backup withholding,3. , DP D 8 6 FLWL]HQ RU RWKHU 8 6 SHUVRQ LQFOXGLQJ D 8 6 UHVLGHQW DOLHQ DV GHILQHG LQ WKH ,56 )RUP : LQVWUXFWLRQV DQG 4. The FATCA Code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.Note: Cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report allinterest and dividends on your tax return.Please note that, by signing this form, you declare that you make the above certifications under penalties of perjury. Under penalties of perjury, I certify the above statements.7KH ,56 GRHV QRW UHTXLUH \RXU FRQVHQW WR DQ\ SURYLVLRQ RI WKLV GRFXPHQW RWKHU WKDQ WKH FHUWLILFDWLRQ UHTXLUHG WR DYRLG EDFNXS ZLWKKROGLQJ SIGNHERESignature of owner(Sign exactly as name appears in Section 2)Date (MM/DD/YYYY)Print name of ownerSocial Security number as entered in Section 25HTXLUHG WR HVWDEOLVK \RXU DFFRXQWPRINTHEREExemptions: 6HH ,56 )RUP : LQVWUXFWLRQV IRU H[HPSWLRQ UXOHV DQG H[HPSWLRQ &RGHV (QWHU &RGHV EHORZ RQO\ LI DSSOLFDEOH *HQHUDOO\ LQGLYLGXDOV DUH QRW H[HPSW IURP EDFNXS withholding. FATCA Codes apply to persons submitting this form for accounts maintained outside the United States by certain foreign financial institutions. If you are submitting thisform for an account you hold in the United States, you may leave this field blank.Exempt payee Code (if any)Exempt payee Code (if any)Exemption from FATCA reporting Code (if any)Exemption from FATCA reporting Code (if any)Acceptance byJohn Hatch—Vice PresidentJohn Hancock Life & Health Insurance Co.8. Mail0DNH D FRS\ RI WKLV GRSWLRQ JUHHPHQW IRU \RXU UHFRUGV -RKQ DQFRFN 6LJQDWXUH 6HUYLFHV ,QF ZLOO FRQ¿UP \RXU SXUFKDVH WKURXJK D FRQ¿UPDWLRQ VWDWHPHQW Follow your Employer’s directions for submitting documents to: Regular mailJohn Hancock Signature Services, Inc.P.O. Box 55913Boston, MA 02205-5913SIRAFM FORM 1 10/18 Overnight mailJohn Hancock Signature Services, Inc.Suite 5591330 Dan RoadCanton, MA 02021PAGE 4 OF 4

FORM 2SIMPLE IRA salary reduction agreementIntroductionInstructionsUse this form if you wish to reduce your Compensation and direct the proceeds to your SIMPLE IRAaccount. This agreement is between you and your Employer. This agreement, and any changes to it,VKRXOG EH ¿OHG GLUHFWO\ ZLWK \RXU (PSOR\HU 7KLV IRUP VKRXOG QRW EH VHQW WR -RKQ DQFRFN 5HDG DOO sections of this salary reduction agreement before signing. Please print in all capital letters and useblack ink.Questions about this form?800-432-1969Contact us:800-432-1969 jhinvestments.com 7KLV IRUP VKRXOG EH ÀOHG GLUHFWO\ with your Employer1. General informationEmployer and Plan informationPlan nameName of the EmployerEmployer’s addressCityStateZip codeEmployee informationFirst nameMILast nameAddressCityStateEmployee’s numberZip codeSocial Security number2. Terms of agreement (To be completed by the Employer)Limits on elective deferrals—Subject to the requirements of the Employer’s SIMPLE IRA Plan, each Employee who is eligible to enroll as a contributingParticipant may set aside a percentage of his or her pay into the Plan (elective deferrals) by signing this salary reduction agreement. This salary reductionagreement replaces any earlier salary reduction agreement and will remain in effect as long as the Employee remains an eligible Employee or until he or sheprovides the Employer with a new salary reduction agreement as permitted by the Plan. A Participant who is aged 50 or older by the end of the year may beallowed to make catch-up contributions. A contributing Participant’s elective deferrals (excluding catch-up contributions) may not exceed 12,500 for 2017 and2018 (after 2018, this amount is subject to cost-of-living adjustments).Changing this agreement—An Employee may change the percentage of pay he or she is setting aside into the Plan. Any Employee who wishes to make sucha change must complete and sign a new salary reduction agreement and give it to the Employer during the election period or any other period the EmployerVSHFL¿HV RQ WKH SDUWLFLSDWLRQ QRWLFH DQG VXPPDU\ GHVFULSWLRQ Terminating this agreement—An Employee may terminate this salary reduction agreement. After terminating this salary reduction agreement, an EmployeeFDQQRW DJDLQ HQUROO DV D FRQWULEXWLQJ 3DUWLFLSDQW XQWLO WKH ¿UVW GD\ RI WKH \HDU IROORZLQJ WKH \HDU RI WHUPLQDWLRQ RU DQ\ RWKHU GDWH WKH (PSOR\HU VSHFL¿HV RQ WKH participation notice and summary description.Effective date—This salary reduction agreement will be effective for the pay period that begins .SIRAFM FORM 2 10/18PAGE 1 OF 2#616 2018 Ascensus, Inc.

3. XWKRUL]DWLRQ DQG LQYHVWPHQW VHOHFWLRQ 7R EH FRPSOHWHG E\ WKH (PSOR\HHElective deferral agreementI, the undersigned Employee, wish to set aside, as elective deferrals, % or (which equals % of my current rate of pay) into my Employer’s SIMPLE IRA Plan by way of payroll deduction.Note: If you are eligible to defer, your SIMPLE IRA Plan permits catch-up contributions, and you have attained age 50 before the close of the Plan Year, you may makecatch-up contributions under the SIMPLE IRA Plan. Certain limits, as required by law, must be met prior to being eligible to make catch-up contributions. Your election above willpertain to elective deferrals, which may include catch-up contributions. See your Employer for additional information, including the catch-up contribution limit for the year., DJUHH WKDW P\ SD\ ZLOO EH UHGXFHG LQ WKH PDQQHU , KDYH LQGLFDWHG DERYH DQG , DI¿UPDWLYHO\ HOHFW WR KDYH WKLV DPRXQW FRQWULEXWHG WR WKH LQYHVWPHQWV OLVWHG EHORZ This salary reduction agreement will continue to be effective while I am employed, unless I change or terminate it, as explained in Section 2. I acknowledge that Ihave read this entire salary reduction agreement, I understand it, and I agree to its terms. Furthermore, I acknowledge that I have received a copy of the participationnotice and summary description.SIMPLE IRA providerJ O H NH A N C O C KF U N D S ,L L C 6 0 1C O N G R E S SS T R E E T BO S T O NM A 0 2 2 1 0 - 2 8 0 5 NameAddressCityStateZip codeInvestment optionsPlease indicate your fund selection for contributions to your SIMPLE IRA. Your selection here should match your selection on the SIMPLE IRA AdoptionAgreement (Form 1). You may only use this form to select John Hancock Investments mutual funds.Name of fundPercentage (%)Name of fundPercentage (%)Total: 100%For direct transfers and rolloversTotal amount of checks attached: (Make checks payable to John Hancock Signature Services, Inc.)SIGNHERESignature of the EmployeeDate (MM/DD/YYYY)SIGNHEREName of the Employee (Print or type)SIGNHEREAuthorized signature for the EmployerSIRAFM FORM 2 10/18Date (MM/DD/YYYY)PAGE 2 OF 2#616 2018 Ascensus, Inc.

FORM 3SIMPLE IRA rollover/transfer formIntroductionInstructionsUse this form to roll over or transfer SIMPLE IRA assets to your John Hancock custodial SIMPLE IRADFFRXQW 3OHDVH ¿OO RXW D VHSDUDWH IRUP IRU HDFK DFFRXQW UROOLQJ RYHU RU WUDQVIHUULQJ WR -RKQ DQFRFN All sections must be completed. Please print in all capital letters and use black ink.Special considerationsThe IRS only permits a single rollover in a 12-month period, regardless of the number of IRAs or typesof IRAs owned.Questions about this form?800-432-1969Contact us:800-432-1969 jhinvestments.com See the end of this document forreturn instructions1. Your transferring accountMy account is being transferred from (please complete entirely):Name of the resigning trustee/custodianAddress of the resigning trustee/custodianCityStateFund/account nameAccount numberDate of initial contribution* (MM/DD/YYYY)Phone number for the resigning trustee/custodianZip code* If you cannot tell us this date, we will use the date your John Hancock Investments SIMPLE IRA is established for calculating possible tax penalties if withdrawal occurswithin two years.2. Your new John Hancock account informationJohn Hancock Life & Health Insurance Co., custodian for the SIMPLE IRA of:First nameMILast nameAddressCityStateSocial Security numberPhone numberPlan namePlan ID numberSIRAFM FORM 3 10/18PAGE 1 OF 3Zip codeDate of birth (MM/DD/YYYY)

3. Asset transfer informationPlease authorize your current trustee or custodian to transfer your SIMPLE IRA Plan to John Hancock Investments, and indicate the date these assets are to beliquidated (immediately or at maturity).Please check one of the following I am opening a new account and have attached a SIMPLE IRA Adoption Agreement (Form 1). Please deposit the proceeds of my account transfer/rollover into my existing John Hancock SIMPLE IRA account(s) as listed below:Fund nameA CAccount number or% or% or% or% or% or% Transfer in kind (reregister) the following assets to my new or existing SIMPLE IRA currently held at John Hancock Investments:Fund nameA CAccount numberThe resigning trustee or custodianPlease liquidateall orpart ( ) of the SIMPLE IRA account(s) listed below, and transfer the proceeds to my John Hancock Investments SIMPLE IRA.If there is more than one account, please list the account numbers below:Please liquidateimmediately orat maturity. FFRXQW QXPEHU OO RU SDUW /LTXLGDWLRQ PDWXULW\ GDWH (MM/DD/YYYY) 4 VVHW WUDQVIHU DXWKRUL]DWLRQPlease sign here to authorize the transfer of your assets.SIGNHERESignature of the depositorDate (MM/DD/YYYY)Signature guaranteed by:Your resigning trustee or custodian may require that yoursignature be guaranteed. Please call them for requirements.Note: Signature guarantee should not be dated.SIRAFM FORM 3 10/18PAGE 2 OF 3

5. Acceptance by new custodian (To be completed by John Hancock Life & Health Insurance Co.):H DJUHH WR DFFHSW FXVWRGLDQVKLS DQG WKH WUDQVIHU GHVFULEHG DERYH IRU WKH -RKQ DQFRFN ,QYHVWPHQWV 6,03/( ,5 3ODQ HVWDEOLVKHG RQ EHKDOI RI WKH LQGLYLGXDO named above. John Hancock Life & Health Insurance Co. accepts its appointment as successor custodian of the above SIMPLE IRA account and requests theliquidation and transfer of assets as indicated above.Acceptance byJohn Hatch—Vice President, John Hancock Life & Health Insurance Co.Note: 7KLV 3ODQ LV QRW HIIHFWLYH XQWLO LWV UHFHLSW KDV EHHQ DFNQRZOHGJHG WKURXJK D FRQ¿UPDWLRQ VWDWHPHQW PDLOHG E\ WKH FXVWRGLDQ WR WKH GHSRVLWRU Follow your Employer’s directions for sending this form to John Hancock Investments. Be sure to include the completed SIMPLE IRA Adoption Agreement)RUP DQG DQ\ H[LVWLQJ 3ODQ FRQWUDFWV RU FHUWL¿FDWHV WWDFK D FRS\ RI WKH PRVW UHFHQW DFFRXQW VWDWHPHQW IURP \RXU UHVLJQLQJ WUXVWHH RU FXVWRGLDQ -RKQ Hancock Investments will work with your resigning trustee or custodian to facilitate this transaction.6. MailNote to resigning trustee/custodian: Be sure to return a copy of this SIMPLE IRA rollover/transfer form with your check for the account proceeds. Checks should bemade payable to John Hancock Signature Services, Inc. and sent to one of the following addresses: Regular mailJohn Hancock Signature Services, Inc.P.O. Box 55913Boston, MA 02205-5913SIRAFM FORM 3 10/18 Express mailJohn Hancock Signature Services, Inc.Suite 5591330 Dan RoadCanton, MA 02021PAGE 3 OF 3

6,03/( ,1',9,'8 / 5(7,5(0(17 &8672', / &&2817 *5((0(17(i) the remaining interest will be distributed in accordance w

SIMPLE IRA Adoption Agreement (Form 1—used by John Hancock to establish your account) 2. SIMPLE IRA salary reduction agreement (Form 2—for your Employer's records) Transfers If your Employer has decided to change providers and move your Plan to John Hancock from another provider, there are two ways t o transfer your account to