Transcription

FASB's new lease standard: Accountingand implementation insights2017 Engineering and Construction Conference

AgendaModule/TopicIdentifying a leaseKey ingredients of the leases modelOverview of the core accounting modelsOther provisions, effective date, and transitionTax implicationsAreas of potential challengeComponents of implementation effortImplementation toolsQ&ACopyright 2017 Deloitte Development LLC. All rights reserved.2

Understanding the journey2005SEC targets off-balance-sheet financing2006FASB and IASB initiate joint project on leases2009FASB and IASB issue Leases: Preliminary Views (March)2010FASB and IASB issue the first lease standard exposure draft (August)2013FASB and IASB issue the second lease standard exposure draft (May)2016IASB issues its final standard IFRS 16, Leases (January 13)FASB issues its final standard ASU 2016-02, Leases (February 25)After more than 10 years in the making Let’s discuss how to navigate the new leasing standardCopyright 2017 Deloitte Development LLC. All rights reserved.3

Overview4

The “Big Picture”Key takeaways from this presentationMost leases on balance sheet for lesseesClassification will drive expense profileLessor model largely unchangedMost changes result from alignment with ASC 606Separate lease & non-lease components and disclosuresFASB tried to make things easyClassification, reassessment, transitionEffective 2019 (2020 nonpublic), but don’t wait to assess impactProcess and systems changes may be requiredPotential impact on debt covenantsCopyright 2017 Deloitte Development LLC. All rights reserved.5

Understanding the implicationsIndividuals throughout an entire organization will need tounderstand the new lease accounting rules under ASC 842because it represents a wholesale change when compared tothe current guidanceLease characterization for tax purposes has not changed as aresult of the new standard. However, since ASC 842 resultsin the recognition of more assets and liabilities, entities maybe required to record new or adjust existing DTAs and DTLsIdentification of the lease population, data abstraction, anddeveloping a platform for ongoing reporting are all key stepsin implementing the new standardCopyright 2017 Deloitte Development LLC. All rights reserved.6

Identifying a lease7

Introducing the new standard1What’s in and what’s out?Scope Applies to leases of property, plant, and equipment Does not apply to:– Leases of intangible assets– Leases to explore for or use nonregenerative resources– Leases of biological assets– Leases of inventory– Leases of assets under construction1Refers to Accounting Standards Codification Topic 842, Leases (ASC 842, the new leases standard)Copyright 2017 Deloitte Development LLC. All rights reserved.8

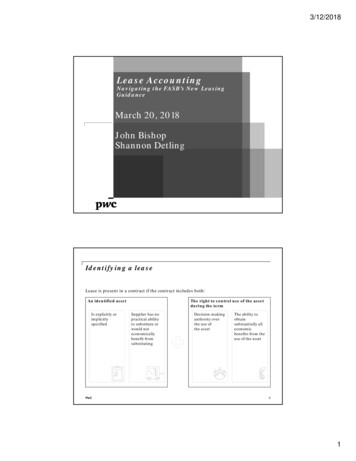

Definition of a leaseWhat does the new definition look like under ASC 842?A lease is a contract, or part of a contract, that conveys the rightto control the use of identified property, plant, or equipment for aperiod of time in exchange for considerationControl the use of anidentified assetLessorLesseeConsiderationCopyright 2017 Deloitte Development LLC. All rights reserved.9

Definition of a lease (cont.)For a contract to be, orcontain a lease, it must:Depend on the use of anidentified asset, andConvey the right to controlthe useRight to obtainsubstantially all of theeconomic benefits fromthe asset useandRight to direct the use ofthe asset over lease termCopyright 2017 Deloitte Development LLC. All rights reserved.10

Identified assetUnderstanding the criteria under ASC 842Contract must depend on use ofidentified assetRight of substitutionWarranty or upgradeconsiderations Asset must be explicitly or implicitlyidentified Would result in the asset not beingdeemed a specified asset Physically distinct portion of a largerasset may be an identified asset Substitution would be consideredsubstantive if: Supplier’s right or obligation tosubstitute an alternative asset due tooperational failure does not mean theasset is not an identified asset Capacity portion of a larger asset isgenerally not an identified asset Lessor has the practical ability tosubstitute the asset Lessor would benefit fromexercising its right of substitutionCopyright 2017 Deloitte Development LLC. All rights reserved. Supplier’s right or obligation toupgrade the asset similarly does notmean the asset is not an identifiedasset11

Definition of a lease (cont.)For a contract to be, orcontain a lease, it must:Depend on the use of anidentified asset, andConvey the right to controlthe useRight to obtainsubstantially all of theeconomic benefits fromthe asset useandRight to direct the use ofthe asset over lease termCopyright 2017 Deloitte Development LLC. All rights reserved.12

Right to control the useObtain substantially all of the economic benefits from useRight to obtain substantially all of the economic benefits from useCan obtain economic benefits from the use of an asset directly orindirectly in many waysEconomic benefits from the use of an asset include itsprimary output and by-products, including potential cashflows derived from these itemsBenefits related to the ownership of an asset should not be included in the assessment of whether anarrangement contains a leaseCopyright 2017 Deloitte Development LLC. All rights reserved.13

Right to control the use (cont.)Right to direct the useRight to direct the use of the asset Right to direct “how and for what purpose” the asset is used throughout the period of use; or Relevant decisions about “how and for what purpose” asset is used are predetermined before theperiod of use, and:– Customer has the right to operate asset without supplier having the right to change operatinginstructions; or– Customer designed the asset in a way that predetermines the most relevant decisions about howand for what purposeProtective rights, while defining the scope of the asset use, generally do not, in isolation, prevent thecustomer from being able to direct the use of the assetCopyright 2017 Deloitte Development LLC. All rights reserved.14

Right to control the use (cont.)Decision treeDoes the customer have the right to obtainsubstantially all of the economic benefits fromuse?NoYesCustomerWho has the right to direct how and for whatpurpose the asset is used?SupplierNeitherYesDoes the customer have the right to operatethe asset?NoNoDid the customer design the asset?YesContract contains a leaseCopyright 2017 Deloitte Development LLC. All rights reserved.Contract does not contain a lease15

Right to control the use (cont.)Illustrative exampleContract for the use of a crane—FactsCustomer A enters into a contract with Supplier B for theuse of a specific crane for a two-year period Supplier B is not permitted to substitute the crane duringthe contract term During the lease term, Customer A is required to providea properly trained operator for the crane Customer A decides what and when the crane will liftduring the contract period, subject to certain limitations Customer A is prohibited from moving the crane or usingit unsafely (e.g. lifting anything in excess of 20 tons) During the contract period, Supplier B is required tomaintain the craneCopyright 2017 Deloitte Development LLC. All rights reserved.16

Right to control the use (cont.)Illustrative exampleContract for the use of a crane—analysisIn this scenario, Customer A has the right to control the useof the crane throughout the two-year contract period Customer A has the right to obtain substantially all of theeconomic benefits from the use of the crane during thecontract period through its exclusive use of the crane Customer A has the right to direct activities related to theuse of the crane because it decides where and what thecrane will lift While there are contractual restrictions about moving thecrane or using it unsafely, these are protective rights anddo not prevent Customer A from having the right to directthe use of the asset Since Customer A has an identified asset (crane) and theright to control the use of the crane, this contract wouldmeet the definition of a lease since Customer has an identified asset and the right tocontrol the use of the crane, it would meet the definitionof lease.Copyright 2017 Deloitte Development LLC. All rights reserved.17

Identifying a leaseDecision treeIs there an identified asset?NoYesDoes the customer have the right to obtain substantially all of the economicbenefits from use?NoYesCustomerYesWho has the right to direct how and for what purpose the asset isused?SupplierNeitherDoes the customer have the right to operate the asset?NoDid the customer design the asset?NoYesContract contains aleaseCopyright 2017 Deloitte Development LLC. All rights reserved.Contract does notcontain a lease18

Contracts with multiple components19

Contracts that contain multiple componentsSeparating lease and nonlease componentsContracts with multiple lease componentsfor different underlying assetsAn asset will be considered a separate leasecomponent if: Lessee can benefit from the use of theunderlying asset either on its own or usingother resources that are readily available The underlying asset is not highly dependenton or highly interrelated with other assets inthe arrangementNOTE: Land and other elements evaluatedseparately unless the accounting for the landelement would not be significantly differentContracts with lease and nonleasecomponents (i.e., separate services)An activity is a nonlease component if ittransfers a good or service to the lessee: Common area maintenance (CAM) andutilities would likely be separate, nonleasecomponents Property taxes and insurance would likelynot be considered a component of thecontract, and any consideration receivedshould be allocated across the lease andnonlease components in the contractNOTE: Consideration in the contract is onlyallocated to the contract componentsStandard provides specific lessee and lessor guidance on how consideration should be allocated toeach contract componentCopyright 2017 Deloitte Development LLC. All rights reserved.20

Contracts that contain multiple componentsAllocating consideration in the contractThe basic process is similar for lessees and lessorsStep 3Step 2Determine the basis for allocationStep 1Lessees, for each component:Determine the consideration in thecontract Stand-alone price using observablestand-alone price, if readily availableLessees: If not, estimate stand-alone pricemaximizing the use of observableinformation Residual estimation may beappropriate Fixed and in-substance fixedpayments, less incentives Variable lease payments that dependon an index or rateLessors: Same as above, plus Variable consideration in accordancewith ASC 606, for which variabilitydoes not relate to the lease componentCopyright 2017 Deloitte Development LLC. All rights reserved.Allocate consideration in the contractto each componentLessees: Relative stand-alone price basisLessors: Relative stand-alone selling pricebasis, in accordance with ASC 606Lessors, for each component: Stand-alone selling price, inaccordance with ASC 60621

Example: Lessee allocation Lessee X enters into a five-year lease of equipment from Lessor Y Fixed annual lease payments are 25,000, which includes both rental payments and payment for maintenance of the equipment that aredetailed within the contract as follows:ItemsRentContractualpayment 20,000MaintenanceTotal5,000 25,000Question 1: How many components are there in the contract?Question 2: What is Lessee X’s consideration in the contract?Copyright 2017 Deloitte Development LLC. All rights reserved.22

Example: Lessee allocation (cont.)Answer 1: Two Lease component, for the right to use the equipment Nonlease component, for the maintenance servicesAnswer 2: 25,000Accordingly, Lessee X would allocate its 25,000 total consideration in the contract on the basis of stand-alone selling price (SASP) for twocomponents. Assume that the SASP for the rent of the equipment is 21,500. Further, assume that the stand-alone selling price for themaintenance services is 3,000ComponentSASPRent 21,50087.8%87.8% 25,000 21,950 3,00012.2%12.2% 25,000 3,050 24,500100.0% 25,000MaintenanceTotalCopyright 2017 Deloitte Development LLC. All rights reserved.% of Total SASPAllocation23

Key ingredients of the leases model24

Lease classificationOverview of the criteriaClassification criteriaLease would be classified as a finance lease (lessee) or a sales-type lease (lessor) when: Lease transfers ownership of the underlying asset to lessee by the end of the lease term Lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise Lease term is for a major part of the remaining economic life of the underlying asset Present value of the lease payments and any residual value guaranteed by the lessee equals or exceedssubstantially all of the fair value of the underlying asset Leased asset is so specialized in nature that it is expected to have no alternative use to the lessor at the end of thelease termThe standard states that the bright-line thresholds that exist under ASC 840 could be a reasonableapproach to evaluate whether a lease would be classified as a finance leaseCopyright 2017 Deloitte Development LLC. All rights reserved.25

Lease termInitial determination and reassessmentLease termReassessment requirementsLessees are required to reassess lease term when:Noncancelable period, plus: Renewal options that arereasonably certain to beexercised by a lessee A significant event or change in circumstances occurs that is in thecontrol of the lessee A contract term obliges the lessee to exercise (or not exercise) arenewal or termination option Termination options that arereasonably certain not to beexercised by a lessee Lessee elects to exercise or not exercise a renewal or terminationoption that was not previously deemed reasonably certain of beingor not being exercised Options to extend (or not toterminate) that are controlled bythe lessor Would reassess when there is a modification that does not result ina separate contractCopyright 2017 Deloitte Development LLC. All rights reserved.Lessors would not be required to reassess lease term, unless there isa modification that does not result in a separate contract26

Lease paymentsWhat amounts are included in lease payments?Fixed leasepayments Payments specified in the lease agreement In-substance fixed paymentsVariable payments Payments that depend on an index or a rate Excludes payments based on usage orperformance Reassessment required under certaincircumstancesResidual valueguarantees Lessees—amount that it is probable will be owedunder the RVG at the end of the lease term Lessors—the full amount at which the residualasset is guaranteed by the lessee or third partyPurchase andtermination options Treated in a manner consistent with theaccounting for renewal options Include options that a lessee is reasonablycertain to exerciseCopyright 2017 Deloitte Development LLC. All rights reserved.27

Discount rateWhat discount rate should be used? Lessee must use the rate the lessor charges in the lease if readily determinable or, alternatively, its incrementalborrowing rate Lessor would use the rate it charges the lessee, which is known as the rate implicit in the leaseReassessment requirements Would generally be updated when there is a remeasurement of the lease obligation Would reassess when there is a modification that does not result in a separate contractLesseeLessee Would reassess, in certain instances, when there is a modification that does not resultin a separate contractLessorLessorNonpublic business entities are permitted to make an accounting policy election to use the risk-freerate when measuring their lease obligationsCopyright 2017 Deloitte Development LLC. All rights reserved.28

Overview of the core accountingmodels29

Lessee accounting modelWhat does the lessee model look like?Most* leases are recorded on the balance sheet using a right-of-use asset approachInitial measurementSubsequent measurement Lease obligation—PV of lease paymentsnot yet paid Lease obligation—amortized using theeffective interest method ROU asset—lease obligation initialdirect costs lease incentives prepaidlease payments ROU asset—depends upon leaseclassification Expense recognition pattern:‒ Finance lease—front-loaded‒ Operating lease—generally straight-line* Short-term leases: A lessee can elect, by asset class, not to record on its balance sheet a lease witha lease term of 12 months or less and that does not include a purchase option that the lessee isreasonably certain to exerciseCopyright 2017 Deloitte Development LLC. All rights reserved.30

Lessee accounting modelIllustrative exampleA lessee enters into a three-year lease and agrees to make the following annual payments at the end of each year: 10,000 in year 1, 15,000 inyear 2, and 20,000 in year 3. The initial measurement of the right-of-use (ROU) asset and liability to make lease payments is 38,000 at adiscount rate of 8%.This table highlights the differences in accounting for the lease under the finance lease and operating lease models.BothmethodsOperating leaseFinance leaseInterestexpense X Amortizationexpense Y (straight-line approach)Total leaseexpense X Y Reduction inROU asset Z X YearLease liability0 38,000131,038 3,038 12,666 15,70425,334 15,000 ,51913,5193–1,48112,66714,148–15,00013,519– 7,000 38,000 45,000 45,000 38,000TotalCopyright 2017 Deloitte Development LLC. All rights reserved.ROU assetLease expense Z 38,000ROU asset 38,00031

Lessee accounting-let’s do the journal entries!Lessee enters into a three-year lease with payments of 10,000 at the end of year one, 15,000 at the end of yeartwo and 20,000 at the end of year three, for a total of 45,000. Assume an interest rate of 8%.Journal Entry at lease inception:Right of use asset 38,000 (assumes no initial direct costs)Lease liability 38,000 (PV of lease payments @8%)Copyright 2017 Deloitte Development LLC. All rights reserved.32

Lessee accounting-let’s do the journal entries!Finance lease: entry at end of year one:Amortization expense 12,667 ( 38,000/3)Interest expense 3,038 ( 38,000*.08)Lease liability 6,962 ( 10,000- 3,038)Right of use asset-accumulated amortization 12,667Cash 10,000Operating lease: entry at end of year one:Rent expense 15,000 ( 45,000/3)Lease liability 6,962 ( 10,000- 3,038)Right of use asset-accumulated amortization 11,962 (PLUG)Cash 10,000Copyright 2017 Deloitte Development LLC. All rights reserved.33

Presentation requirementsLessee modelBalance sheetFinancingleaseOperatingleaseIncome statementCash flow statementROU assetAmortization expensePrincipal (Financing)Lease liabilityInterest expenseInterest (Operating)ROU assetLease expense (single line onstraight-line basis)Lease payments(Operating)Lease liabilityLessor modelPresentation consistent with current lessor model: Balance sheet—presentation depends on lease classification Income statement—profit or loss recognized in a manner consistent with businessmodel Cash flow statement—recognized as cash inflows from operating activitiesCopyright 2017 Deloitte Development LLC. All rights reserved.34

Disclosure requirementsDisclosure objective—Enable financial statement users to assess the amount, timing, and uncertainty of cash flows arisingfrom leasesLessee disclosuresLessor disclosures Nature of its leases Nature of its leases Information about leases that have not yet commenced Significant assumptions and judgments used Related-party lease transactions Related-party leases transactions Accounting policy election regarding short-term leases Tabular disclosure of lease-related income Finance and operating lease costs Components of the net investment in a lease Short-term and variable lease costs Information on the management of risk associated withresidual asset Sublease income Gain or loss from sale-and-leaseback Maturity analysis for lease obligations Weighted-average remaining lease term Maturity analysis of operating lease payments and leasereceivable Information required by ASC 360 Weighted-average discount rateCopyright 2017 Deloitte Development LLC. All rights reserved.35

Other provisions, effective date, andtransition36

Lease modificationsLesseeAt stand-alone priceRecognize the lease modification as a new lease,separate from the original leaseNot at stand-alonepriceReassess classification and use updated lease paymentsand discount rate to remeasure the lease liability andROU assetExtends or reduceslease termWhether at standalone price or notReassess classification and use updated lease paymentsand discount rate to remeasure the lease liability andROU assetOnly changesconsiderationWhether at standalone price or notReassess classification and use updated lease paymentsand discount rate to remeasure the lease liability andROU assetFully or partiallyterminates leaseWhether at standalone price or notReassess classification, remeasure the lease liability,decrease a proportionate amount of the ROU asset, andrecognize any difference as a gain/lossGrants an additionalROULease modificationCopyright 2017 Deloitte Development LLC. All rights reserved.37

Other key provisionsLessee disclosuresRelated-party leasesLeasehold improvements Head lease and sublease accounted for astwo separate leases Accounted for on the basis of legallyenforceable terms and conditions (versussubstance) Generally capitalized and amortized overthe shorter of their useful life or remaininglease term unless: Sublease classification based on underlyingasset Offsetting generally prohibitedCopyright 2017 Deloitte Development LLC. All rights reserved. Subject to ASC Topic 850 disclosurerequirements‒ Lease transfers ownership at the end oflease term or‒ It is reasonably certain that lessee willexercise purchase option38

Effective date and transitionEffective date Public business entities—effective for calendar periods beginning on January 1, 2019 and interim periods therein All other entities—effective for calendar periods beginning on January 1, 2020, and interim periods thereafter Early adoption will be permittedTransition Lessees and lessors are required to use a modified retrospective transition method for all existing leases Would apply the new model for the earliest year presented in the financial statements Application of approach linked to current lease classification and new lease classification An entity can use hindsight when evaluating lease termTransition relief package:Lessees and lessors are not required to reassess the following upon transition: Whether any expired or existing contracts are leases or contain leases The lease classification for any expired or existing leases Initial direct costs for any existing leasesCopyright 2017 Deloitte Development LLC. All rights reserved.39

ASC 205: Retrospective reporting complianceInsight to required financial statements to be presented on the reporting date for allentitiesPublic business entities (SEC)All other entitiesBalance sheetBalance sheetFY 2018FY 2019Restate under ASC 842FY 2019*Restate under ASC 842Income statement (P&L)FY 2017FY 2018Restate under ASC 842FY 2020Income statement (P&L)FY 2019FY 2019*Restate under ASC 842FY 2020Public business entities: effective for calendar periods beginning afterDecember 15, 2018 and interim periods therein. The Q1 2019 will be thefirst publication to be presented in complianceAll other entities: effective for calendar periods beginning after December15, 2019 and interim periods thereafterSEC and ASC 250 reporting rules require earlier comparative resultsrestated (as early as 2017)Shall provide the transition disclosures required by Topic 250 on accountingchanges and error corrections, except for the requirements related to effectof changes in the statements*Topic 205 encourages a comparative presentation as ordinarilydesirable, but requirements may differEarly adoption is permittedCopyright 2017 Deloitte Development LLC. All rights reserved.40

Other key provisions and resourcesBut wait, there’s more Contract combinations Leveraged lease accounting Accounting for leases at a portfolio level Leases in a business combination Impairment considerations U.S. GAAP to IFRS comparisonCopyright 2017 Deloitte Development LLC. All rights reserved.41

Tax implications42

Overview of income tax implicationsLease characterization for federal income tax purposes has not changed (e.g., true lease vs. sale) as a result of ASC 842. For tax, thefocus remains on which party bears the benefits and burdens of ownershipASC 842 does not contain tax accounting guidance and only includes minor, conforming amendments to ASC 740,Accounting for Income Taxes, that do not change the basic requirements of current accountingASC 842 will create book/tax differences consistent with current GAAP. However, since the newstandard may result in the recognition of more assets and liabilities, ASC 842 may require entitiesto record new or adjust existing DTAs and DTLsASC 842 may also impact the computation of state and local income-basedtaxes as a result of changes to the apportionment formulaCopyright 2017 Deloitte Development LLC. All rights reserved.43

Common book/tax differencesTenant construction Tax Lessee records allowance as an incentive thatreduces the ROU asset that is recorded Resulting asset is generally amortized overthe lesser of the life of the asset or the leaseterm Lessee includes allowance into income onreceipt; depreciates property over applicablerecovery period Lessor depreciates property on a straight-linebasis over the useful life Lessor depreciates property over applicablerecovery periodCopyright 2017 Deloitte Development LLC. All rights reserved.44

Common book/tax differencesOperating lease (book)/true lease (tax)BookTaxLessee Lessee expenses rent on a straight-line basisover lease term Lessee expenses rent as payments are made(subject to section 467)Lessor Lessor depreciates property on a straight-linebasis over the useful life Lessor depreciates property over applicablerecovery periodLessee-ownedLessor-ownedCopyright 2017 Deloitte Development LLC. All rights reserved.45

Common book/tax differencesFinance lease (book)/asset sale (tax)BookLessee onlyTax Lessee expenses interest component ofpayment as payments are made Lessee expenses interest component ofpayment as payments are made Lessee uses lessor’s implicit rate, if readilydeterminable, or incremental borrowing rate Interest imputed using AFR under OID rules Lessee depreciates ROU asset on a straightline basis or using another systematic basis,if appropriate Lessee depreciates property over applicablerecovery periodCopyright 2017 Deloitte Development LLC. All rights reserved.46

Areas of potential challenges47

Operational challengesKey challenges associated with the proposed lease standard1Data housedin varioussystemsData Challenges: High volume of lease agreements across multipledecentralized locations, in different business and operating units.2IT systems: Need to store lease data and perform calculations.Consider modifying existing system or moving to new system. Giventhe long lead times of system initiatives, may need bridge system.3Timeline for adoption: It can be a challenge to anticipate the datagaps and overcome the data abstraction hurdle. A typical timelinefrom planning to implementation is 18-24 months.Lack ofresourcesNumber ofnew dataelementsInformationisn’t all inoneagreementMultiplecurrenciesMultiplelanguages /contractingpracticesHigh volumeof datafieldsNewanalytics tronicThe data being collected may be in a variety of formats, thus increasing the complexity and cost oforganizing the data.Copyright 2017 Deloitte Development LLC. All rights reserved.48

Operational challenges (cont.)The system change efforts are often given primary consideration, however you mustalso consider the vital component of data maintenance.Data Abstraction,Remediation, ValidationLong-termintegratedsolutionDuring this period, your operations do not cease. New leases are entered into and existing leases aremodified and terminated.Copyright 2017 Deloitte Development LLC. All rights reserved.49

Operational challenges (cont.)The following challenges should be considered in the transition period:Application of Judgment and EstimationApply judgment and make estimates under a number of the new lease requirements: Judgment is often required in the assessment of a lease’s term, which would affect whether the lease qualifiesfor the short-term exemption and therefore for off-balance-sheet treatment Since almost all leases will be recognized on the balance sheet, an entity’s judgment in distinguishing betweenleases and services becomes more critical under the new guidance Lease classification without bright line classification tests Determine whether the customer has the right or not to direct the use of the identified assetData Management Third-party data may be needed to ensure a high level of operational quality and efficiency Numerous lease agreements at multiple decentralized locations, lease data in spreadsheets or physicaldocuments. Consequently, collecting and abstracting may be time-consuming and resource-intensive Entities may need to gather information that may not be contained in lease agreements (e.g.: the fair value ofan asset, the asset’s estimated useful life, incremental borrowing rate, etc.) Distinct data between the new requirements and to accomplish with the transition pe

identified asset Asset must be explicitly or implicitly identified Physically distinct portion of a larger asset may be an identified asset Capacity portion of a larger asset is generally not an identified asset Warranty or upgrade considerations Supplier's right or obligation to substitute an alternative asset due to