Transcription

( /7 & 5( -2851 /MARCH / APRIL 2018 I healthcarejournallr.com I 8ofLittle RockQ&A withDoug Ross, MDCMO, CHI St. VincentHospitals: OperatingThrough alMedicineA Larger rolefor midwives

Delivering!it’s our speciality /5 March / April 2018Our MissionHealthcare Journal of Little Rockanalyzes healthcare for thepurpose of optimizing the healthof our citizens.Chief EditorSmith W. ng EditorsKaren Tatumktatum@ushealthcarejournals.comLaura Feredaylauramfereday@gmail.comWeb editorBetty butorsWilliam Marshall, MBA, JDNina MartinCharles OrnsteincorrespondentsMartin Eisele, LAcWilliam Golden, MDDavid LukasJason MillerTad Pruitt, MDNathaniel Smith, MD, MPHJoseph W. Thompson, MD, MPHJimmy Tucker, MDsponsorship directorDianne Hartleydhartley@ushealthcarejournals.comART DIRECTORCheri Bowlingcheri@ushealthcarejournals.comHJLRphotogr apherZoie ClifteNewsSubscribe t 2018 Healthcare Journal of Little RockThe information contained within has been obtained by Healthcare Journal ofLittle Rock from sources believed to be reliable. However, because of thepossibility of human or mechanical error, Healthcare Journal of Little Rock doesnot guarantee the accuracy or completeness of any information and is notresponsible for any errors or omissions or for the results obtained from use of suchinformation. The editor reserves the right to censor, revise, edit, reject or cancelany materials not meeting the standards of Healthcare Journal of Little Rock.

visit usonlineRead the Journal / Get eNews UpdatesSubscribe / Learn about sponsorshipHealthcare Journal of Little RockSponsorsArkansas UROLOGYwww.ArkansasUrology.comEvergreen co.comOrthoarkansaswww.OrthoArkansas.comDavid lukas Financialwww.DavidLukasFinancial.comstate volunteer mutual insurancewww.svmic.comThe BridgeWaywww.TheBridgeWay.comThe Doctors Companywww.TheDoctors.comSubscribeTo subscribe to the Little Rock Healthcare Journaland receive weekly eNews, please email us hcareJournalLR.comWe would love to hear from you.

ContentsMarch / April 2018IVol. 5, No. 3243022

/5 fe aturesHospitals: OperatingThrough FinancialPressures.10Doug Ross, MDCMO, CHI St. Vincent. 18Hospital InspectionsReports Secret,Feds Decide. 22International MedicineQ&A with Heidi Chumley,MD, MBA. 24A Larger Role forMidwives.30Depa rt m ent sEditor’s Desk.8Healthcare Briefs. 3318Hospital Rounds.57Ad Index. 66Corr es po nd ent sDirector’s Desk. 44Policy. 4610Mental Health. 48Orthopedics. 50Medicaid. 52Wealth Management. 54Acupuncture. 56

Editor’s DeskIt’s time forherbalism tobe magnified inour consciousdiscussions.Nature produces the herbs to significantlybenefit our health.It’s almost astounding that we really don’thave a thorough understanding of the opportunities we have to treat ourselves withregards to the impact herbalism can play inour well-being.Part of the challenge is the information.There are studies and other viable sourcesto explain the impact nature’s plants canhave on our chemical design. A larger challenge is being able to adequately prescribe an ideal herbal treatment plan. When I go to a healthfood store and look at all the herbal propositions, I’m basically overwhelmed. Does this really help? How much of this is just marketing?And, yes, all the outcomes such as better sleep, increased energy, reduced pain, stamina, better skin, better hair, better mood, etc., all soundgreat. Do I take everything? But most of the challenge seems to be thatherbalism is not significant in our modern culture.There is an opportunity in the world of health to become an expertin all things herbalism. There are experts, but surprisingly, they arerarely sought out. Much of it has to do with our culture. The concept ofnatural prevention is usually pressed towards the back of the discussion. We have a culture. We like our culture. It would be important,however, to bring a mindfulness to the possibilities of herbal health tothe forefront. Nature gives us what we need; I’m just not sure we arepaying attention.Some examples that I’m told are effective include:d Circulatory system: Hawthorne berries, Yarrow, Lime Blossom,and Arnicad Musculoskeletal system: Willow and MeadowsweetAlso, there are thousands of specific herbal treatmentmodules such as treatment for anti-inflammatory issues,for example, which include Calendula, Turmeric, Arnica,Licorice, and Wild Yam.There are literally thousands of options and treatmentpossibilities with herbs. Obviously, too many to list here,but information is available. Prior to our modern industrial revolution, cultures throughout the world becameexperts in many of these treatment techniques. Manystill use them today. It seems as if it would be a nice balance to our modern system.Not all products are as proclaimed. Being a sophisticated herbalist will take many years of practice and trialand error. There are side effects to herbs. The proper coordination of dosage and interaction is an art and science.I think our culture is almost ready. By slowing downand observing the health possibilities, we can find enhanced treatment modalities, new opportunities forfarming and business, and an awareness of life optionswe have not yet given proper mindfulness.d Respiratory system: Licorice, White Horehound, Goldenseal,and Coltsfootd Digestive system: Slippery Elm, Chamomile, Peppermint, Fennel,Agrimony, Oak Bark, and Gingerd Skin: Chickweed, Arnica, Plantain, and St. John’s WortSmith Hartleyd Urinary System: Corn Silk, Couchgrass, Bearberry, and HorsetailChief Editord Nervous System: Slippery Elm, Hops, Mugwort8MAR / APR 2018IHealthcare Journal of little rockeditor@healthcarejournallr.com

Hospitals:Operating ThroughFinancial PressuresBy William T. Marshall, CPA (Inactive), MBA, JDThis article will focus on the financial performance of generalacute care hospitals located in the Little Rock Service Area.One of these hospitals is owned by a multi-hospital organizationhaving financial difficulties that may have resulted, or may resultin having a negative impact on the Little Rock hospital it owns.Before discussing the financial performance of Little Rock generalacute care hospitals, a brief discussion of the financial decline inU.S. hospitals will give some insight as to why most of the LittleRock general acute care hospitals are having financial difficultiesin recent years.

Healthcare Journal of little rockIMAR / APR 201811

Hospital Finances“According to CHI’s Annual Report as ofthe fiscal year ended June 30, 2017, CHI’sloss from operations was approximately 585 million.”U.S. Hospital FinancialPerformanceHCAThe largest for-profit multi-hospital organization is HCA Healthcare, Inc. (HCA),which is the first company that I workedfor after completing my education in 1975in their corporate headquarters in Nashville,Tennessee. According to its Form 10-K filedthe year ended December 31, 2017, of 18,398largest Catholic healthcare systems, servingon February 23, 2018, HCA reported reve-million compared to 21,275 million for themore than four million people each year in 17nues before provision for doubtful accountsyear ended December 31, 2016. CHS reportedstates through operations and facilities thatfor the year ended, December 31, 2017, ofa net loss of 2,459 million, up from thespan the continuum of care, including103 47,653 million compared to 44,747 mil-year ended December 31, 2016, of a net losshospitals, 3 academic medical centers, andlion for the year ended December 31, 2016,of 1,721 million. CHS owns the following29 critical access facilities; physician prac-while net income for the year ended Decem-eight hospitals in Arkansas: (i) Medical Cen-tices; long-term care facilities; assisted livingber 31, 2017, decreased to 2,216 millionter of South Arkansas, El Dorado, Arkansas;and residential-living facilities; community-compared to 2,890 million for the year(ii) Northwest Medical Center, Springdale,based health services; home care, researchended December 31, 2016.Arkansas; (iii) Northwest Health Physi-and development; medical and nursing edu-cians’ Specialty Hospital, Fayetteville, Arkan-cation; reference laboratory services; virtualsas; (iv) Siloam Springs Regional Hospital,health services; managed care programs;The second largest for-profit multi-hos-Siloam Springs, Arkansas; (v) Willow Creekand clinically integrated networks. As of Sep-pital organization is Tenet Healthcare Corp.Women’s Hospital, Johnson, Arkansas; (vi)tember 15, 2017, CHI has operations with a(Tenet). According to its Form 10-K filedNorthwest Medical Center-Bentonville, Ben-service area that covers approximately 54on February 26, 2018, for the year endedtonville, Arkansas; (vii) Sparks Medical Cen-million people, or approximately 17% of theDecember 31, 2017, Tenet reported reve-ter – Van Buren, Arkansas; and (viii) SparksU.S. population.nue before doubtful accounts for the yearRegional Medical Center, Fort Smith Arkan-According to CHI’s Annual Report as ofended December 31, 2017, of 20,613 mil-sas. According to a November 14, 2017, articlethe fiscal year ended June 30, 2017, CHI’slion compared to 21,070 million for the yearwritten by Ayla Ellison for Becker Hospitalloss from operations was approximatelyended December, 31, 2016. Tenet reportedReview in August of 2017, CHS extended its 585 million. When adjusted for nonoper-a net loss for the year ended Decemberdivestiture plan. The company said it wouldating gains of 714 million, the CHI Annual31, 2017, of 704 million, up from the yearsell a group of hospitals with combined rev-Report showed an excess of revenue overended December 31, 2016, of a net loss ofenue of 1.5 billion in addition to the 30 hos-expenses of 129 million. The CHI Quarterly 192 million. In a presentation to inves-pitals already announced. After complet-Report for the three months ended Septem-tors at the J.P. Morgan Healthcare Confer-ing the its original 30-hospital divestitureber 30, 2017, showed loss from operations ofence in San Francisco in January 8, 2018,plan in November of 2017, CHS once againapproximately 78 million. When adjustedthe new CEO of Tenet, Ronald Rittenmeyer,expanded its divestiture plan and on Janu-for nonoperating gains of 213 million, thissaid 2,000 jobs would be eliminated underary 16, 2018 it announced it would sell addi-CHI Quarterly Report showed an excessthe 250 million cost-cutting plan. That istional hospitals with combined revenue ofof revenue over expenses of 135 million.up from 1,300 jobs that were initially going 2 billion.According to CHI’s Quarterly Report as ofTENETto be eliminated. Tenet no longer owns anyhospitals in Arkansas.sale of QualChoice Health, Inc.’s MedicareCatholic Health Initiatives (CHI) whichAdvantage health insurance operations hasbegan operation on July 1, 1996, is a tax-been received, with an anticipated sale inThe third largest for-profit multi-hospi-exempt Colorado corporation and has beenfiscal year 2018. This Quarterly report alsotal organization is Community Health Sys-granted an exemption from federal incomestates that although there has been a sig-tems, Inc. (CHS). According to its Form 8-K,tax under Section 501(c)(3) of the Internalnificant interest in the QualChoice Healthfiled on February 27, 2018, for the year endedRevenue Code. Colorado-based CHI is acommercial operations, the uncertainty sur-December 31, 2017, CHS reported revenuegroup of non-profit and for- profit organi-rounding the Affordable Care Act and cur-before provision for doubtful accounts forzations that comprises one of the nation’srent political environment has delayed theCHS12September 30, 2017, a letter of intent for theCHIMAR / APR 2018IHealthcare Journal of little rock

anticipated sale of this operation to a time-healthcare systems, is a 22-state networkby the Health Care and Education Recon-line outside of CHI’s control. CHI remainsof more than 9,000 physicians and otherciliation Act of 2010 (Affordable Care Act orcommitted to selling or otherwise disposingadvanced practiced clinicians and 63,000ACA). In addition, slumping Medicare mar-of the QualChoice Health commercial oper-employees. The organization was formed ingins put hospitals on precarious cliff. In theations while it continues to actively market1996 when two congregations of the SistersNovember 27, 2017, Modern Healthcare, inthese operations.of Mercy joined their 10 hospitals togetheran Article entitled “Slumping Medicare mar-At the 36th Annual J.P. Morgan Health-to form Catholic Healthcare West, whichgins put hospitals on precarious cliff”, Vir-care Conference, CHI made a presentationnow includes over 400 care centers includ-gil Dickson indicated that “[w]hile extendedwherein it described a proposed mergering hospitals, urgent and occupational care,coverage in a net positive, hospital leaderswith Dignity Health. A non-binding letterimaging centers, home health, and primarystill complain that the government paymentof intent was signed on October 24, 2016,care clinics under the name Dignity Care,programs do not cover costs. In regard toand a Definitive Agreement was signed inheadquartered in San Francisco. AccordingMedicare, hospitals received 88 cents forDecember 2017, to create a new, nonprofitto the November 15, 2017, Deloitte Indepen-every dollar spent caring for beneficiarieshealth system. The combination would bringdent Auditor’s Review Report to the Boardin 2015 and 90 cents for Medicaid patients,together two leading health systems withof Directors of Dignity Health and its Sub-according to the American Hospital Asso-facilities in 28 states. The new health sys-ordinate Corporations as of the fiscal yearciation.” According to this Modern Health-tem will include more than 700 care sitesended June 30, 2017, excess of revenuescare article , Medicare margins are in a freeand 139 hospitals, offering people and com-over expenses attributable to Dignity Healthfall. In 2015, aggregate margins hit a negativemunities access to quality care delivered bytotaled an excess of 384 million compared7.1% across hospitals. According to the Medi-approximately 159,000 employees and moreto a deficit of revenues over expenses ofcare Payment Advisory Commission, mar-than 25,000 physicians and other advanced 238 million as of the fiscal year ended Junegins are expected to sink to a negative 10%practiced clinicians. The governing board30, 2016.this year. According to the American Hospi-of the new organization-Board of Stew-Why are General Acute Care Hospitalstal Association (AHA), hospitals and healthardship Trustees-will include six membersExperiencing Financial Challenge? Thesystems in the U.S. are facing an unparal-from each legacy board and the two CEOs tohealthcare industry in general, and theleled force to change. Industry experts haveestablish its corporate headquarters in Chi-acute care hospital business in particu-projected that multiple, intersecting pres-cago and operate under a new name that willlar, are experiencing significant regulatorysures will drive the transformation of health-be chosen in the second half of 2018. Localuncertainty based, in large part, on legisla-care delivery and financing from volume-facilities will continue operating under theirtive efforts to significantly modify or repealto-value payments over the next decade. Incurrent names.and potentially replace the Patient Protec-the current regulatory and economic envi-tion and Affordable Care Act, as amendedronment, hospitals must focus their effortsDignity Health, one of the nation’s largeston performative initiatives that are essentialin the short term and that will also remaincritical for long-term success. The inaugural report of the AHA Committee on Per-“The healthcare industry in general,and the acute care hospital business inparticular, are experiencing significantregulatory uncertainty based in largepart on legislative efforts to significantlymodifyor repeal and potentially replacethe Patient Protection and AffordableCare Act, as amended by the HealthCare and Education Reconciliation Actof 2010 (Affordable Care Act or ACA).”formance Improvement details “Hospitaland Care Systems of the Future”. The teamconducted exploratory interviews and analyzed the results to identify must-do, prioritystrategies and core organizational competencies that organizations should establishto remain successful in this time of sweeping change. One of these “Must-Do” strategies to succeed in the future was improvingefficiency through productivity and financialmanagement. These 10 “Must-Do Strategiesto Succeed in the Future” are available forreview on the AHA web site. At the U.S. News& World Report’s Healthcare of TomorrowConference which took place in Washington,

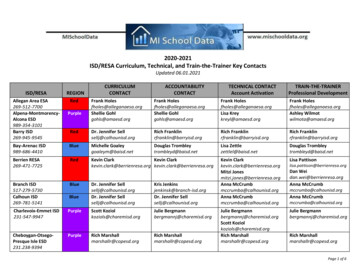

Hospital FinancesSource: MedPacD.C., on November 14-16, 2017, it was con-Privacy and security 569,471cash flow due in part to further swelling ofcluded that the healthcare of tomorrow willFraud and abuse 339,471staff and technology expenses” (Modernmove away from hospitals. At the J.P. Mor-Program integrity 337,379Healthcare, February 5, 2018) and based ongan Healthcare Conference which took placeNew models of care 121,774projections that operating cash flow willin January, it was reported that the direc-Total cost 7, 585,752contract by 2% to 4% over the next 12 to 18tion that hospitals are heading in is actu-Source: American Hospital Associationally pretty clear and consistent. One of the14months, that revenue growth will slow amid“very low” payment increases, that there willconsistent themes was that all hospitals areAccording to Navigant’s 2017 CEO Forum,be an ongoing shift in payment mix to gov-experiencing margin compression and that“Hospitals and health systems faced a tre-ernment payers, and there will be contin-hospitals must manage cost and margins.mendous uncertainty in 2017, a trend thatued shift to high-deductible health plans”.According to the American Hospital Asso-will continue throughout 2018. According(Hospital Financial Management Magazine,ciation, combined underpayments from theto Rulon F. Stacey, PhD., FACHE, ManagingFebruary 2018)government programs were 57.8 billion inDirector, Navigant Transformation Institute,Last year, a study by McKesson Corp.2015. This includes a shortfall of 41.6 bil-“I’ve seen firsthand how uncertainty canfound that only 26% of hospitals were meet-lion for Medicare and 16.2 billion for Med-affect delivery. Instead of waiting or waver-ing goals to lower healthcare costs under theicaid, the association reported. Attempts toing, providers must maintain their focus onnew pay models, and just 30% were meetingmove Medicare from a fee-for-service sys-efforts that improve safety, quality, satisfac-care-coordination goals. The slow progresstem to a value-based model poses perhapstion, eliminate disparity of care, and reduceis occurring despite significant implementa-the most serious challenge to hospitals andcost. But achieving these care delivery goalstion of cost incurred by hospitals. On aver-health systems struggling with low Medi-is increasingly proving a challenge. Accord-age, hospitals have five full-time employees,care programs.ing to a Navigant analysis of 2000 hospital,including clinical staff, tracking and report-from 2015-2017, average operating marginsing quality measures under value-basedRegulatory AreaTotal Costdropped from 5.6% to 3.6%, a 35% decrease.models, according to the American HospitalHospital condition of participation 3,108,052These trends are forecasted to continue, ifAssociation. They are also spending approx-Billing and coverage 1,641,046not worsen. Moody’s downgraded not-for-imately 709,000 annually on the admin-Meaningful use 759,689profit healthcare from stable to negative inistrative aspects of quality reporting. TheQuality reporting 708,6922018, predicting further decline in operatingAmerican Hospital Association estimatedMAR / APR 2018IHealthcare Journal of little rock

that health systems, hospitals and post-year beginning July 1, 2015, and ending JuneArkansas, a tertiary care referral center withacute providers spend 39 billion annually30, 2016, showed a negative 9,690,123, up522 acute care beds in use at June 30, 2017;complying with the regulatory mandates.from a negative 7,919,546 from prior year.(iii) regional programs, including Tele-edu-That equates 7.6 million for an average-According to CHI’s Annual Report as ofcation, Rural Hospital Program, and eightsized community hospital (161 beds).the fiscal year ended June 30, 2017, CHI’sArea Health Education Centers (AHECs)More broadly, the American Hospitalloss from operations was approximatelylocated throughout the state; (iv) the Win-Association suggested that the average com- 585,247,000. Dignity Health’s Form 990throp P. Rockefeller Cancer Center Institute;munity hospital spends 7.6 million annu-for the tax year beginning July 1, 2015, and(v) Harvey and Bernice Jones Eye Institute;ally on administrative costs to meet a subsetending June 30, 2016, showed Revenue less(vi) Donald W. Reynolds Institute on Aging;of federal mandates that cut across qualityExpenses of a positive 31,219,525, but down(vii) Myeloma Institute for Research andreporting, record-keeping and meaningfulfrom the prior year of positive 494,850,341.Therapy; (vii) Psychiatric Research Insti-use compliance.tute; (viii) Jackson T. Stephens Spine Neu-Baptist Health, Little RockLittle Rock, ArkansasGeneral-Acute Care Hospital PerformanceSt. Vincent Infirmary, Little Rockrosciences Institute and (ix) TransitionalBaptist Health, Little Rock, is not a sub-Research Institute. Therefore, its revenuesidiary of a multi-hospital organization. Itsless expenses cannot be compared to CHIForm 990 for the tax year beginning Janu-St. Vincent Infirmary, Little Rock, or Bap-ary 1, 2015 and ending December 31, 2015,tist Health.showed revenue less expenses of approxi-According to the UAMS Audited Finan-St. Vincent Infirmary Medical Center,mately positive 49 million, up from priorcial Statement the tax year beginning July 1,d/b/a CHI St. Vincent Infirmary, in Littleyear of a positive 42 million. According2016, and ending June 30, 2017, showed anRock, Arkansas, and CHI St. Vincent Northto it Medicare Cost Report, Baptist Healthoperating loss of approximately a negativeare owned by Catholic Health Initiativesshowed a positive net income of about 33 86 million, up from the operating loss in(CHI).million with 843 licensed beds and an Occu-2016 of approximately a negative 5 million.pancy Rate of 52%.After adding back nonoperating revenuesAccording to the 2005 IRS Form 990,Return of Organization Exempt fromIncome Tax (Income Tax Return), for theof State Appropriations of about 31mil-UAMS Medical Centerlion, Gifts of about 20 million, Investmenttax year beginning July 1, 2015, and endingThe UAMS is a state-assisted academicIncome of about 24 million, a deduction forJune 30, 2016, CHI St. Vincent Infirmary, Lit-health center composed of (i) the CollegesInterest on Debt of approximately 11 milliontle Rock, showed revenue less expenses ofof Medicine, Pharmacy, Nursing, Healthand Gain on Disposable Assets of 133 thou-a negative 18,088,329, up from prior yearProfessionals, Public Health, Graduatesand, the net income for the fiscal year endednegative 13,015,256. In addition, St. Vin-School, and Northwest Arkansas Satel-June 30, 2017, was approximately a negativecent Medical Group’s Form 990 for the taxlite Campus; (ii) the University Hospital of 20 million down from a positive net incomeHealthcare Journal of little rockIMAR / APR 201815

Hospital Finances16for the fiscal year ended, June 30, 2016, of aShared Savings Programs (MSSP). UAMSone-half of the fiscal year end left to makepositive 19 million. The Audited Financialand Baptist Health will share in any sav-up the 32 million gap, keep the deficit at 39Statement, which was prepared by KPMG,ings generated for the treatment of Medicaremillion and come up with a deficit-free bud-indicated while a 1.3% increase in operat-patients attributed to the ACO, but will alsoget for fiscal year, 2019, it was reported oning revenue was experienced in 2017, UAMSshare in any losses if costs exceed currentJanuary 10, 2018, that during the weekend ofincurred higher operating expenses duringbaseline amounts. Members of the Legisla-January 6, 2018, it reduced its work force bythe year. The leading increase in operatingture’s Joint Performance Review Commit-600 positions, including 258 layoffs. UAMSexpenses were compensation and benefitstee have questioned the UAMS’s contract forexpects that the job cuts will save UAMSexpenses, which increased by approxi-emergency room and orthopedic servicesbetween 26 million to 30 million this yearmately 59 million, or 6.4%. This increaseat Baptist Health Medical Center-Conway.and up to 60 million in fiscal year 2019. Inwas primarily due to the staffing requiredThe Committee wants UAMS to appear onaddition, on January 10, 2018, it has beento support higher inpatient and outpatientJanuary 25 and “answer questions aboutreported that UAMS will have new reduc-volumes. Also, supplies and other servicesthe nature of the contract,” said Represen-tions which shall come on top of the 600increased by approximately 42 million, ortative Mark Lowery, R-Maumelle, who is apositions, including the 258 layoffs. It has9.5%, largely for medical supplies, primarilyco-chair of the committee. Certain aspectsbeen reported that the 258 layoffs, includ-for surgeries, and drugs and medicines forof the UAMS/Baptist Health affiliation haveing faculty, took place on Monday, Januaryboth inpatient and outpatient care.been criticized by Conway Regional Medical8, 2018. It has also been reported on Janu-According to the Economic Outlook Sec-Center System’s President and CEO, Mat-ary 10, 2018, that more staff reductions aretion of the Audit’s Management’s Discussionthew Troup, who has said that he thoughtto come at UAMS, including tenured or ten-and Analysis, looking ahead, UAMS antic-the arrangement between UAMS and Baptisture-track faculty of as many as 45 such fac-ipates a further decline in net position ofHealth Medical Center-Conway was unfairulty members, once UAMS lawyers work out 39 million, based on fiscal year 2018 bud-competition.the terms under which they may be let go.get projections. UAMS, in collaboration withUAMS’s 2018 budget projections of a defi-These notifications could come in two-to-Baptist Health, is forming an accountablecit of 39 million was approved by the UAfour weeks and could be followed by fur-care organization (ACO) under the rulesSystem Board of Trustees, a figure that couldther reduction in work force in the new year.established by the Centers of Medicarereach approximately 72 million by the endUAMS has contracted with Huron Consult-and Medicaid Services (CMS) for Medicareof this fiscal year. Since there is only abouting of Chicago to look at such changes. nMAR / APR 2018IHealthcare Journal of little rock

Healthcare Journal of little rockIMAR / APR 201817

Q & A withDoug Ross, MDCMO, CHI ST. VINCENTCHI St. Vincent recently announced thepromotion of Dr. Doug Ross to SeniorVice President and Chief Medical Officer. Dr. Ross, of Hot Springs, previously wasvice president of medical affairs for CHI St.Vincent Hot Springs. In his new position, hewill oversee medical services throughout theCHI St. Vincent system.Ross has played a key role in helping CHISt. Vincent develop an integrated emergencymedical group covering all four CHI St. Vincent hospitals in central Arkansas and ConwayRegional Medical Center. He has also playedan essential role in quality improvements atCHI St. Vincent Hot Springs.Ross joined what was then Mercy Hot Springsin 2003 as an emergency medicine physician.He has also served as chief of staff, medicaldirector of informatics and medical director ofthe emergency department.He is board certified in emergency medicineand he completed his residency in emergencymedicine at the University of South Carolina.He is a graduate of the University of Arkansasfor Medical Sciences.

dialogueChief Editor Smith W. Hartley With such alarge system as CHI St. Vincent, what isthe role of Chief Medical Officer?Dr. Doug Ross My role as Chief Medical Offi-cer is to make sure that every patient thatenters our doors achieves the highest clinical quality and best outcomes. We want ourpatients to understand our focus on patientsafety as our number one priority. In addition, I want every patient at any of our campuses across Arkansas to feel the care andcompassion of our coworkers and physicians. I believe a Chief Medical Officer mustbe innovative and create new and efficientprocesses to accomplish these goals.Editor As the newly appointed Chief Med-ical Officer of CHI St. Vincent, what aresome of your first priorities?Dr. Ross I think my first priority as the newChief Medical Officer at CHI St. Vincent isto develop relationships. We hav

TENET The second largest for-profit multi-hos-pital organization is Tenet Healthcare Corp. (Tenet). According to its Form 10-K filed on February 26, 2018, for the year ended December 31, 2017, Tenet reported reve-nue before doubtful accounts for the year ended December 31, 2017, of 20,613 mil-lion compared to 21,070 million for the year