Transcription

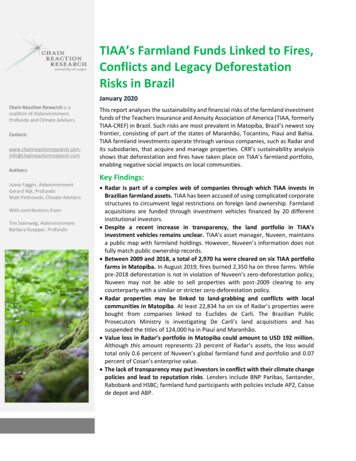

MERCER UNIVERSITY1400 COLEMAN AVEMACON, GA 312070003December 22, 2021SECTION1Re: Important information about your retirement planThe enclosed information is being provided to help you make informed decisions when managing your account andplanning your financials goals for retirement.While no action is required at this time, please review the notice as it contains important informationregarding the fees and expenses associated with your retirement plan and its investment options. To helpfacilitate your review, the notice is divided into two sections:Section I: Summary of Plan Services and Costs which provides information about administrative fees,individual transaction expenses, and your right to direct how your contributions are investedSection II: Investment Options Comparative Chart that provides information about your plan's availableinvestment options including their respective performance and expensesSECTION2You can access the Plan and Investment Notice, as well as up-to-date investment performance, at TIAA.org.Simply log in to your TIAA account and follow these steps:1. Go to "Resources"2. Select "Retirement investments" within the "Research, performance & news" section3. Select your plan name and your Plan and Investment Notice will appear under "Helpful Links Specific To ThisProduct"If you prefer to receive future notices and other communications electronically, update your eDeliverypreferences under "Actions". Select "Update your profile" and then "Communication preferences"to make changes. For this notice, click on "email" next to "Plan Sponsor disclosures and notices".If you do not have a TIAA account, you can access the notice online at TIAA.org/performance and enter yourPlan ID, 101581. You'll be directed to the current information.More information about retirement plan fees and expenses is available at TIAA.org/fees, or by calling TIAA at800-842-2252, weekdays, 8 a.m. to 10 p.m. (ET).TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC,Members FINRA and SIPC, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance andAnnuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY. 2021 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF). 730 Third Avenue,New York, NY 10017.Fee Disclosure - (2/2021)

Plan and Investment NoticeMERCER UNIVERSITY DEFINED CONTRIBUTION RETIREMENT PLANDecember 22, 2021Your participation in your employer's retirement plan is the first step to ensuring adequate retirement income. The purpose of this Plan and InvestmentNotice is to help you make informed decisions when managing your retirement account. It contains important information regarding your plan's services,investments and expenses. While no action is required at this time, please review the notice and file it with your other retirement plan documents forfuture reference.Section I: Summary of Plan Services and CostsSection II: Investment Options Comparative ChartThis section provides important information to assist you in making decisions related toyour participation in your employer's plan. It outlines the services available under thisplan, explains your right to select the investments for your account, and any fees andplan restrictions that may apply.This section is designed to make it easier for you to compare investments that align with yourretirement goals. It provides detailed information about your plan's investment options,including long-term performance and expenses.1

SECTION ISummary of Plan Services and CostsMultiple providers have been selected to offer retirement services and investment options to employees in the plan. There are costs associated with theseservices and investments, some of which may be paid by you. In addition to explaining how to direct your investments, this section details theadministrative and individual expenses associated with your plan.The information is sorted by service provider to make it easier to compare. Your plan offers a range of investment options and services from the followingproviders :TIAAAXAFidelityGuideStoneLincoln Financial GroupVALICVanguardTIAAHOW TIAA RECORDKEEPS YOUR PLANTIAA provides recordkeeping services for your employer's plan which includes: MERCER UNIVERSITY DEFINED CONTRIBUTION RETIREMENT PLAN – PlanID 101581MERCER UNIVERSITY TAX-DEFERRED ANNUITY PLAN – Plan ID 101582Each of the above plans may offer different services and investments and may assessdifferent fees. If you currently have a TIAA account, your quarterly statement lists the plan(s) that you have. If you do not have an account, please contact your employer to determinewhich plans apply to you.RIGHT TO DIRECT INVESTMENTSYou may specify how your future contributions to the retirement plan are invested or makechanges to existing investments in your plan as described in the Summary Plan Document.These changes can be made:1.Online by visiting TIAA.org2.By phone at 800 842-2252, weekdays, 8 a.m. to 10 p.m. (ET)RESTRICTIONSChanges to existing investments usually take place at the close of the business day if achange is requested prior to 4:00 p.m. (ET). Refer to Section ll: Investment OptionsComparative Chart for investment-specific restrictions.ADDITIONAL RIGHTS AND PRIVILEGESCertain investments that you may hold may give you the opportunity to vote on proposals. Ifand when such opportunities arise, you will receive a notice with the instructions on how totake advantage of what is being offered.INVESTMENT OPTIONSA variety of investment options are available in the plan. Please refer to Section II:Investment Options Comparative Chart for a current list of investment options available toyou. Additional information, as well as up-to-date investment performance, is availableonline at www.TIAA.org/planinvestmentoptions. After entering a plan ID, 101581, 101582,you'll be directed to plan and investment information.RETIREMENT PLAN PORTFOLIO MANAGER PROGRAMRetirement Plan Portfolio Manager Program (the Program) is a discretionary fee-basedasset allocation advisory program provided exclusively by the TIAA-CREF Trust Companyusing investment advice obtained through an independent third-party advisor.The Program is a fee-based service that can provide you with an ongoing customized assetallocation and access to the following features:- Automatic quarterly rebalancing based on your birthday- Reallocation of your portfolios based on TIAA's industry-recognized advice- Quarterly portfolio reviews based on your birthday, to help you know if they are on track forretirement goals2

- Calendar quarter reports containing a description of activity with respect to yourRetirement Plan Portfolio Manager assets during the preceding quarter.The annual asset-based Program Fee of 00.30% will be charged quarterly, generally withinfive business days after the end of each calendar quarter. This fee is a direct fee paid fromyour account(s). The Program Fee will be charged in arrears based on the average dailybalance of your Retirement Assets enrolled in the Program during the quarter. Available inall plans.COST OF PLAN SERVICESThere are three categories of services provided to your plan:1. GENERAL ADMINISTRATIVE SERVICESGeneral administrative services include recordkeeping, legal, accounting, consulting,investment advisory and other plan administration services. Some of the expenses forgeneral administrative services are fixed and other expenses such as legal or accountingmay vary from year to year. These costs are allocated to each participant in a uniform way.In addition to investment expenses you pay, there is a Plan Servicing Fee charged tospecific investments which is used to pay for your Plan's record keeping and other planservices. For more details, please refer to the "Shareholder Fees & Restrictions" column ofTable 1 in Section II: Investment Options Comparative Chart. Applies to all plans.2. SPECIFIC INVESTMENT SERVICESEach investment offered within the plan charges a fee for managing the investment and forassociated services. This is referred to as the expense ratio and is paid by all participants inthat investment in proportion to the amount of their investment. The specific expense ratiofor each plan designated investment option is listed in Section II: Investment OptionsComparative Chart.3. PERSONALIZED SERVICESPersonalized services provide access to a number of plan features and investments thatyou pay for, only if you use them. The personalized services used most often are:Ret. Plan Portfolio Mgr. FeeRetirement Plan Loan - Origination FeeCollateralized LoansQualified Domestic Relations Orders(QDRO)Sales Charges, Purchase, WithdrawalAnd Redemption Fees For CertainInvestments0.30% annually. This applies to plan(s):101581 101582 75.00 per loan initiated for general purpose, 125 for a residential loan. This applies to plan(s): 101581 101582The cost to you based upon the differencebetween what you earn on collateral and whatyou pay in interest. This applies to plan(s):101582No chargeCertain charges may apply. See Section II:Investment Options Comparative Chart or theprospectus for applicable charges.AXAINVESTMENT OPTIONSSeparate Account Annual Expenses: We deduct a charge for mortality and ex pense risksand other expenses. This asset-based charge is deductedfrom assets in each VariableInvestment Option to compensate us for mortality and expense risks, including the deathbenefit provided under the Contract, as well as for administrative and financial accountingservices under the Contract.EQUI-VEST offers a series of Variable Investment Options through the securities portfoliosoffered by the EQ Advisors Trust ("EQAT"), AXA Premier VIP Trust ("VIP Trust")(collectively, the "Affiliated Trusts") and portfolios of Unaffiliated Trusts ("Trusts"). Theattached Portfolio Expense Sheet shows the total operating expense of each of theAffiliated Trusts and Unaffiliated Trusts. The following describes services provided andcompensation received by AXA Equitable and its affiliates from theAffiliated Trusts and the Unaffiliated Trusts and provides some additional information aboutthe total operating expenses of each of the Affiliated Trustsand Unaffiliated Trusts.Affiliated Trusts - AXA Equitable's affiliate, AXA Equitable Funds ManagementGroup, LLC("Funds Management Group"), acts as the investment advisor to the securities portfoliosoffered through theEQAT and the VIP Trust. As investment advisor, the Funds Management Group providesservices including the selection, ongoing oversight and replacement of investment subadvisors for each portfolio. For some portfolios, AXA Equitable's affiliate, Alliance BernsteinHolding, LP ("Alliance Bernstein"), acts as sub-advisor. Other portfoliosare sub-advised bythird-parties not affiliated with AXA Equitable.Funds Management Group receives an advisory fee from each of the Affiliated Trusts forthese advisory services, which is reflected in the total operating expense stated for eachportfolio on the Portfolio Expense Sheet. If Alliance Bernstein is engaged as a sub-advisorto a portfolio, it receives a portion of the advisory fee received by the FundsManagementGroup.The Affiliated Trusts have adopted a distribution or servicing plan that provides for thepayment of Rule 12b-1 fees. These fees are included in the total operating expense of eachof the Affiliated Trusts and are not an additional fee assessed by AXA Equitable. AXAEquitable's affiliates, AXA Advisors, LLC ("AXA Advisors") and AXA Distributors , LLC("AXA Distributors"), receive these RUle 12b-1 fees for providing distribution andshareholder support services to the Affiliated Trusts, and AXA Advisors and/or AXADistributors may pay a portion of these fees to AXA Equitable as compensation fordistribution and administrative services including recordkeeping services provided for assetsinvested in the AffiliatedTrusts. (See Distribution Arrangements, below).3

The total operating expenses of the Affiliated Trusts include other operating expenses (suchas trustees' fees, expenses of independent auditors and legal counsel, bank and custodiancharges and liabilityinsurance). AXA Equitable or an affiliate may receive a portion of these other operatingexpenses as reimbursement for costs incurred in providing fund level administration andother services to the Affiliated Trusts.Unaffiliated Trusts - The Unaffiliated Trusts are advised by third-parties, which are notaffiliated to AXA Equitable. However, we receive "revenue sharing" payments from theUnaffiliated Trusts, generally in the form of 12b-1 fees charged to the assets of theUnaffiliated Trust. We may receive a subtransfer agency or other fee in addition to or in lieuof the 12b-1 fee. These payments compensate us for administrative services, monthlydistribution and other services provided to the Unaffiliated Trusts and recordkeeping ofassets invested in the Unaffiliated Trusts. 12b-1 fees are disclosed on the Portfolio ExpenseSheet. Revenue sharing payments may be made under a distribution or shareholderservicing or other agreement made directly betweeCOST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESThe charge is deducted on each Contract date anniversary. A pro rataportion of the charge is deducted if the contract is surrendered, an annuity payout option iselected, or the participant dies during the Contract year.This charge compensates us for providing administrative and financial accounting servicesunder the Contract. These administrative and financial accounting services include contractadministration services, such as receiving and allocating contributions, processingwithdrawals, loans and other transactions pursuant to the Contract, recordkeepingparticipant accounts, quarterly participant account statements and other reporting,telephone and on-line account access to account information and to provide instruction, andadministration of other Contract features (such as dollar cost averaging and accountrebalancing).The applicable Annual Administrative Charge is equal to 30 or, if less, 2% of eachparticipant's current account value plus any amount previously withdrawn during thecontract year. We deduct this charge if the participant's account value on the last businessday of this contract year is less than 25,000. If the participant's account value is 25,000 ormore, we do not deduct the charge for that contract year.COST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESPortfolio Expenses - Additional Information The following is an additional explanation of theseparate charges that comprise the total operatingexpenses of each of the Affiliated Trusts and Unaffiliated Trusts that are shown on theattached Portfolio Expense Sheet.Management Fees These fees are for the investmentmanagement of the portfolios. ForAffiliated Trusts, these fees are paid to the Funds Management Group, which may in turnpay fees to sub-advisors(including to AXA Equitable's affiliate, Alliance Bernstein). The Unaffiliated Trusts pay thisfee to the entity providing management services to the Unaffiliated Trust, which is notaffiliated to or related to AXA Equitable.12b-1 Fees - These fees are paid for the distribution, sales and marketing of the portfolio.AXA Equitable and its affiliates receive 12b-1 fees paid from the both of the Affiliated Trustsand Unaffiliated Trusts.Other Expenses - These expenses include custodian, transfer agency and administrationfees, certain payments to financial services agents for non-distribution expenses, and othercustomary mutual fund expenses.For the Affiliated Trusts, these expenses and fees may be received by AXA Equitable orone of its affiliates.Acquired Portfolio Fees and Expenses (Underlying Portfolios) - Those expenses incurredindirectly by the Variable Investment Options as a result of investments in shares of one ormore investment companies (or "acquired portfolios"). Some of the Variable InvestmentOptions invest in acquired portfolios managed by the Funds Management Group or AllianceBernstein and, in that event, the Funds Management Group or Alliance Bernstein receivesfees for services to the acquired funds. Please see the Prospectus for more details.Total Annual Expense (Before Expense Limitation) - This is the total of the fees listed abovebefore any fee waivers or expense limitations are applied.Fee Waivers and/or Expense Reimbursements - The Funds Management Group, theinvestment manager of the Affiliated Trusts, has entered into expense limitation agreementswith respect to certain Variable Investment Options. Under these agreements, the FundsManagement Group has agreed to waive or limit its fees and assume other expenses ofcertain Variable InvestmentOptions, in an amount that limits each affected VariableInvestment Option's Total Annual Expenses to not more thanthe amounts specified in the agreements. Each Variable Investment Option may at a laterdate make a reimbursement to the Funds Management Group for any of the managementfees waived or limited andother expenses assumed and paid by the Funds Management Group pursuant to theexpense limitation agreement provided that the Variable Investment Option's current annualoperating expenses do notexceed the operating expense limit determinedfor such Variable InvestmentOption.Net Annual Expenses (After expense limitations) The Total Annual Expense (BeforeExpense limitation) minus the FeeWaivers and/or Expense Reimbursements.COST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESEstimated Cost of RecordkeepingBecause certain indirect compensation received by AXA Equitable through InvestmentOptions (see the Variable Investment Option and Other Investment Options sections,below) may be taken into account indetermining the fees for administration services in connection with the Contract, we arerequired to provide an estimate of the cost to your Plan of recordkeeping services. We4

estimate the annual cost of providing recordkeeping services to your Plan in connection withthe Contract (without reduction or any adjustment for the receipt of indirect compensation)to be approximately 122 per participant. For this purpose, we considered the following tobe "recordkeeping services" -- receiving and allocating contributions, processingwithdrawals, loans and other transactions, recordkeeping plan and participant accountrecords, quarterly participant account statements and other reporting, telephone and on-lineaccount access to account information and to provide instructions, and administration ofcertain other contract features (such as dollar cost averaging and account rebalancing). Wedetermined this costestimate by dividing the annual cost AXA Equitable incurs to provide these services toclients by the average number of plan participants AXA Equitable services on itsrecordkeeping system for the year plus an associated profit assumption for the business.The estimate is based on 2011 data and has been calculated across all plans for whichAXA Equitable provides recordkeeping services, and does not account for the specificservice arrangements being provided on a plan by plan basis, which may increase ordecrease the actual cost for any specific plan.Third Party Administrative Charges: You may instructAXA Equitable to withdraw a planoperating expense charge from the participant's account value to be used to pay a thirdparty administration firm ("TPA") or other third-party for administrative and record-keepingservices provided to your Plan in connection with the Contract. The charge is determinedbetween you and the TPA or other third-party. We will remit the amount withdrawn to you orto your TPA or other third party. please refer to the Contract for more information.COST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESFIDELITYA withdrawal charge may apply in three circumstances: (1) One or more withdrawals aremade during a Contract year; (2) the Contract Withdrawal Charge: IS surrendered, or (3) weterminate the Contract. The withdrawal charge equals a percentage of the amountwithdrawn. The percentage that applies depends on the contract year in which thewithdrawal is made according to the following schedule: 6% for the contract year 1 thru 5,5% for the contract year 6 thru 8, 4% for the 9th contract year, 3% for the 10th contractyear, 2% for the 11th contract year, 1% for the 12th contract year and 0% for the contractyear 13 or later. If the participant was age 60 or over when the contract was issued, thepercentage that applies depends on thecontract year in which the withdrawal is made according to the following schedule: 6% forthe contract year 1 thru 4, 5% for contract year 5, and reduced by 1% each year thereafteruntil the end of the 12th contract year.Annuity Payout Option: If a variable immediateannuity is chosen as the payout option underthe Contract, there will be a one-time charge of 350 that will be deducted from theparticipant's account value at the time of annuitization. This charge is for issuing andadministering the payout option.Charges for State Premium and Other Applicable Taxes:We may deduct a charge designedto approximate certain taxes in the participant's state. Generally, we deduct the charge fromthe amount applied to provide an annuity payout option. The current tax charge that mightbe imposed varies by jurisdiction and ranges from 0% to 1%.Market Value Adjustment on the Fixed Maturity Options, if available:Please see thesubsection titled "Fiixed Maturity Options" within the "Other Investment Options" section foradditional information regardingthe Market Value Adjustment on the Fixed Maturity Options. There are additional chargesthat apply in connection with participant transaction activity in your Plan, as describedbelow.New Loan Cost: We charge intereston loans under the Contract, but also credit interest onthe loan reserve account. The net loan charge is determined by the excess between theinterest rate we charge over the interest rate we credit, but may not exceed 2%.Special Services Charges: We charge fees to compensate us for certain special services.These charges compensate us for the expense of processing the special service.Wire Transfer charge. We charge 90 for outgoing wire transfers.Express mail charge. We charge 35 for sending participants a check by express mail.RIGHT TO DIRECT INVESTMENTSYou have the right to direct your account balance, and any future contributions, among thePlans investment options, subject to any restrictions. Your rights under the Plan, and anyrestrictions, are subject to the terms of the Plan.RESTRICTIONSAny frequent trading restrictions imposed by the Plan and/or by the Plans investmentoptions are listed in Section 3 of this brochure. Keep in mind, restrictions are subject tochange.ADDITIONAL RIGHTS AND PRIVILEGESYou have the right to exercise voting, tender, and similar rights related to the followinginvestments you may have in your Plan account:-Mutual FundsINVESTMENT OPTIONSThe plan offers a choice of investment options that allow you to create a diversified portfolioto help you meet your individual needs. The Plans investment options, along with certaininformation about each of them, are listed in section 3 of this brochure.COST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESPlan administrative fees may include legal, accounting, trustee, recordkeeping, and otheradministrative fees and expenses associated with maintaining the Plan. In some instances,they may be deducted from individual accounts in the Plan.5

Based on the information and direction Fidelity had on file at the time this brochure wasprepared, the plan administrative fees listed below may be deducted from Plan accounts.As you review this information, please keep in mind that fees are subject to change and thatcertain plan administrative fees may not be deducted from accounts in some circumstances.Type of Plan Administrative Fee:Recordkeeping Fee - 24.00 per yearexpenses in connection with transactions associated with your Plans investment options.Please see Section 3 for details regarding the specific fees that may apply to the investmentoptions available under the Plan.If any individual fees are actually deducted from your account, they will be reflected on yourPlan account statement.If any plan administrative fees are actually deducted from your account, they will bereflected on your Plan account statement.GUIDESTONECOST OF PLAN SERVICES - SPECIFIC INVESTMENT SERVICESRIGHT TO DIRECT INVESTMENTSAsset Based Fees:Asset-based fees reflect an investment options total annual operating expenses and includemanagement and other fees. They are often the largest component of retirement plan costsand are paid by all shareholders of the investment option.You may direct the investment of all funds held in your individual participant account,subject to any restrictions and procedures described below. You have the opportunity tomake an investment election on your enrollment application when you first enroll in thePlan. If you do not make an investment election, all contributions made on your behalf willbe placed in a default fund, which is the MyDestination Fund with the date closest to theyear you will attain age 65. You may request fund exchanges, reallocations, automaticreallocations, or future contribution allocation changes at any time. There are variousmethods you may use to make such changes. These include:Typically, asset-based fees are reflected as a percentage of assets invested in the optionand often are referred to as an expense ratio. You may multiply the expense ratio by yourbalance in the investment option to estimate the annual expenses associated with yourholdings. Refer to Section 3 of this brochure for information about the Plans investmentoptions, including their expense ratios (where applicable).Asset-based fees are deducted from an investment options assets, thereby reducing itsinvestment return. Fee levels can vary widely among investment options, depending in parton the type of investment option, its management (including whether it is active or passive),and the risks and complexities of the options strategy. There is not necessarily a correlationbetween fees and investment performance, and fees are just one component to considerwhen determining which investment options are right for you.MyGuideStone through www.MyGuideStone.org. If this is your first time logging in to www.MyGuideStone.org, you will need to register and set up a username and password toaccess your individual participant account.Call 1-888-98-GUIDE (1-888-984-8433) to speak with a customer relations specialistbetween 7 a.m. and 6 p.m. CST Monday through Friday.Fax to (214) 720-2105; Attn: Customer Service Center.Email to info@GuideStone.org.COST OF PLAN SERVICES - PERSONALIZED SERVICESIndividual fees and expenses include those associated with a service or transaction that anindividual may select. In some instances, they may be deducted from the accounts of thoseindividuals who utilize the service or engage in the transaction.If you have an account in the Plan and you select or execute the following service(s) ortransaction(s), the fee(s) outlined below may be deducted from your account based on theinformation and direction Fidelity had on file at the time this brochure was prepared. As youreview this information, please keep in mind that fees are subject to change and that certainindividual fees may not be deducted in some circumstances.Type of Individual Fee:Participant Hired Advisory (Adv) Fee - varies based on advisorOvernight Mailing Fee - 25.00 per transactionMail to GuideStone Financial Resources, 2401 Cedar Springs Road, Dallas, TX 752011498.Note: GuideStone cannot guarantee trade dates for written requests sent by mail or fax;however, such requests will be processed on a timely basis when received in good order.GuideStone will not beresponsible for undelivered mail or faxes.You may give investment instructions on any day the New York Stock Exchange is open forbusiness. You may change your investment elections, or reallocate your account amongyour existing investment elections at any time. Requests must be received at GuideStoneby 3 p.m. CST on a business day to be bought or sold at that days Net Asset Value or NAV.If GuideStone receives instructions after 3 p.m. CST, GuideStone processes the purchaseor sale using the next business days NAV.ADDITIONAL RIGHTS AND PRIVILEGESAlso please note that you may incur short-term redemption fees, commissions, and similar6

The Plan does not pass through voting rights associated with your investment options. ThePlan Trustee exercises voting rights associated with the designated investment options.-Death certificate fee (cost to obtain a death certificate if at your death your individualparticipant account is unclaimed): Cost recovery (cost varies by state).COST OF PLAN SERVICES - GENERAL ADMINISTRATIVE SERVICESThe Plan pays for general Plan administrative services, such as accounting andrecordkeeping services, by reducing each designated investment alternatives investmentreturn before earnings are posted to your account. This amount is shown as Net AnnualOperating Expenses disclosed in Section 2. Fees and Expenses Information of theComparative Chart. The Sponsoring Employer may elect, at its own discretion, to pay someor all of the Plan administrative expenses including expenses for additional services such asretirement plan nondiscrimination testing and certain extra legal expenses that may beincurred. The expenses may also be charged against forfeitures, reimbursed by a thirdparty, or in the case of certain additional services, charged as a per participant fee.See definition of accounting and recordkeeping services in glossary for a list of some ofthese services.COST OF PLAN SERVICES - SPECIFIC INVESTMENT SERVICESThe Plan imposes certain charges against individual participants

GuideStone Lincoln Financial Group VALIC Vanguard TIAA 2 HOW TIAA RECORDKEEPS YOUR PLAN TIAA provides recordkeeping services for your employer's plan which includes: MERCER UNIVERSITY DEFINED CONTRIBUTION RETIREMENT PLAN - Plan ID 101581 MERCER UNIVERSITY TAX-DEFERRED ANNUITY PLAN - Plan ID 101582