Transcription

HENRY FORD COMMUNITY COLLEGESTUDENT REFUND PROCESSProcess Improvement PlanFall 2013

Table of ContentsProcess Improvement Team3Background4Project Statement5Glossary6Current Student Refund Process8Cause-and-Effect Diagram9Cost of Paper Check Student Refunds10MCCBOA Survey11From the Old Process to the New12New Student Refund Process13Cost Savings14Force Field15Project Time Line – Gantt Chart16Key People17Steering Committee Feedback18Ideas for Future Process Improvement Teams19Acknowledgments202

Process Improvement TeamTeam SponsorJohn Satkowski – Vice President for Financial and Auxiliary ServicesTeam MembersKevin Culler – Financial Aid Director (Team Leader)Scott Barnett – Mathematics Instructor (Team Scribe)Thomas Anderson – Adjunct History InstructorBarb Eisterhold – General Accounting ManagerSandro Silvestri – Director, Information Technology ServicesMary Szymanski – Accounting Associate, Accounts Payable3

BackgroundThe Process Improvement Team for Budgetingdetermined that the problems encountered by studentsand staff due to the current student-refund process, andthe significant costs to the College for the currentprocess, should be addressed.4

Project StatementTo improve the process for issuing refunds to studentswho have credit balances on their accounts, as measuredby the reduction in the number of paper refund checks,reduction in costs (e.g. supplies, postage, bank fees),reduction in reported refund-related cases of fraud, andreallocation of staff time.5

Glossary of TermsAccount with a Bank or Credit Union: Arranged transactions with a bank or credit union whichcould be a checking account, savings account or a deposit account.Affidavit: An affidavit is a legal document that contains sworn facts and statements.Bank Reconciliation: A bank reconciliation is a process that explains the difference betweenthe bank balance shown in an organization’s bank statement, as supplied by the bank, and thecorresponding amount shown in the organization's own accounting records at a particular pointin time.Check fraud: This refers to a category of criminal acts that involve making the unlawful use ofchecks in order to illegally acquire or borrow funds that do not exist within the account balanceor account-holder's legal ownership.Counterfeit Check: An imitation check intended to be passed off fraudulently or deceptively asgenuine.Debit Card: A plastic card that resembles a credit card but functions like a check. Debit Cardscan be used to access cash via ATM’s or can be used for paying purchases or services. Paymentis made available electronically to the bank accounts of participating retailing establishmentsdirectly from the Debit Card.EFT/E-Check/Direct Deposit: Electronic funds transfer (EFT) is the electronic exchange, transferof money from one account to another, either within a single financial institution or acrossmultiple institutions, through computer-based systems.Emergency Checks: Checks that are issued by the Cashier’s Office to process a check outside ofthe normal weekly check run.Escheat: The College is required to make annual reports to the State of Michigan for all checksthat remain un-cashed over a period of one year. The College sends a check to the State alongwith specific check information. After a check is escheated, the payee on the check (who thecheck is written to) works directly with the State to retrieve funds owed.6

Escheatment: Escheatment is a procedure in which property, in this case checks issued by theCollege, which appears to be abandoned reverts to the ownership of the government. Thegovernment enters the property into its bookkeeping, and may dispose of it as it pleases. If aclaimant to the property later appears and the claim is legitimate, the government providescompensation in accordance with the amount entered at the time of the escheatment.Financial Aid Awards: This is an aid package to help alleviate or defray out of pocket costs toattend college. Awards can be based on merit or need. Some awards, such as loans, must beeventually paid back, other awards, such as scholarships and grants do not.Paper Check: A written order, usually on a standard printed form, directing a bank to paymoney to a particular person for a certain amount.Positive Pay: This is a treasury service that banks provide to businesses that forms apartnership between the two parties to prevent check fraud. Positive Pay involves the bankmatching checks presented for payment with those issued by the company.Pressure Sealed form Check Stock: Pressure seal forms include adhesive around the edges.When pressure is applied with a pressure seal machine, tiny glue capsules burst and create asecure bond. The form is folded, sealed and ready to mail! Pressure seal is perfect forprocessing a high volume of forms. Pressure Sealed forms replaces the need for an envelope.Request for Proposal (RFP): A solicitation document used to obtain offers of price andproposed method of execution of a specific project. We use a bid or request for quotationwhen we can specifically define the item that needs to be procuredStop Payment: An order by the issuer of a check to the bank that the check is drawn on, not topay a specified check. Possible reasons include a lost check or a stolen check. HFCC is charged afee by the bank for this service.Student Refund: A refund is a reimbursement issued to a student if account payments, loans,grants (financial aid) were more than what they owed for classes owing after the add/dropperiod.Third Party Vendor: An outside company that provides services, on behalf of the College, toour employees or vendors.7

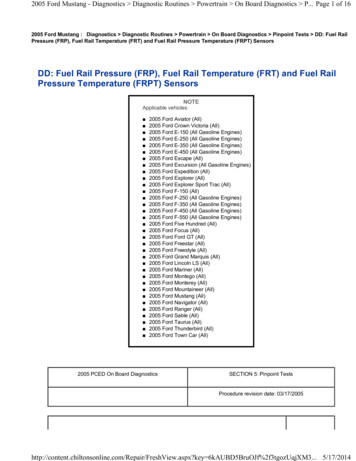

Current Student Refund Check Run ProcessStudentFinancial Aidrefunds to beissuedEPBR: Vouchersfor payment:report signedand forwarded toDFSCKSE: bothpaper &electonicrefundsauthorizedECHP: Processeselectonic checks,posts to generalledgerCreate fileto processrefundsPaper ChecksCashier'sOfficeEFTs(process isrun twice)Web Focus reportcaptures studentbalances, pulls IDs,saves list.CKPR: Print screenrequests dates forchecks, then printed incashiers vaultSLCR: Creates asaved list for prenoting checksFinancialServicesPrint ChecksARTM: Saved listused to create reportoffsetting current &past term creditbalancesCKRS: acceptscreen forproperly printedchecks, marks Y/NECPP: Pre-notesbank accountinformation toverify correctnessSLED: CreateSaved list forbatch refundingRFVR: Use createdlist to createvoucher register;no money pulled.RFVC: Moneynow pulled fromstudent accountsCKPO: Postschecks to generalledgerSCKR: Creates afile for generalaccounting; runtwice, for paperand electonicNotify Financialservices via emailRun RERG:capturescheck data toprocessFold ChecksReview forbad addressesFin. Ser. ties datato CashiersinformationReview forCanadianAddressesCopy file and charge toapprop. area to allowfile to be recognized bysystemFin. Ser. verifies# of checks, amount of runRun SNDACRCNprocess to transmitfile to ComericaVerify file acceptanceand that file processedwas completeSave returned fileMail ChecksProcess Prenote fileNotify Financialservices via emailCopy file & chargeext. to approp. areaso file can berecognized byComericaTransmit file toComericaVerify file byphoneNotify Cashier's office thatfile has been verifiedProcessRegular echeckfileNotify Financialservices via emailCopy file & chargeext. to approp. areaso file can berecognized byComericaTransmit file toComericaVerify file byphoneNotify Cashier's office thatfile has been verified8Email completedtransmitted formto ComericaNotify Cashiers thatchecks can be mailedFin. Ser. Dailybanking: prior dayruns bankingreportingClear checks in Hank & tietotals to banking report

Cause-and-Effect DiagramEnvironmentFraudLack of Financial Literacy- Lack of Bank Accounts- Understanding banking feesProcess IssuesMaterialsEscheat RegulationsFraud/counterfeitingStop-payment requestsEmergency checksCheck reissuementCost- Check stock- Postage- TonerProblem StatementProblems encounteredissuing refunds toHFCC studentsPotential cost to students- Check-cashing services- Debit card/ATM feesMeasurementPaper check vs.- Own debit card- 3rd party debit card- Bank acct- EFTMethods9PeopleLabor Cost- Cashier's office- Accounting- Responding tocalls aboutchecks

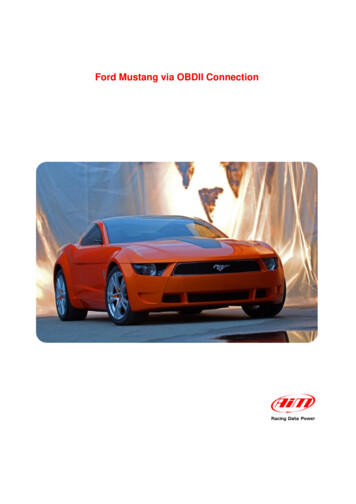

Refund Cost by Academic YearYearTotal costCost of Paper Check Student 102010/20112011/20122012/2013 160,000.00 150,000.00 140,000.00 130,000.00 120,000.00 110,000.00 100,000.00Cashier hours 90,000.00Acct hours 80,000.00 70,000.00Stop payments 60,000.00Postage 50,000.00Paper & toner 40,000.00 30,000.00 20,000.00 10,000.00 2005/2006 2006/2007 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 2012/201310 ,929.56130,776.86109,614.49

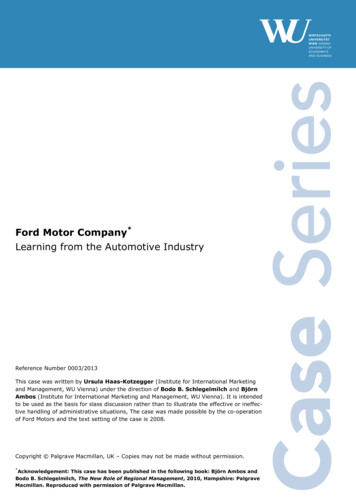

MCCBOA (Michigan Community College Business Officers Association) SURVEYIssuing Student RefundsRequested by: Barb Eisterhold Henry Ford Community College – Emailed 9/19/13 – Updated 11/8/13Community CollegeProvide options offered to students toreceive refundsAlpena Community CollegeBay De Noc Community CollegePaper ChecksDelta CollegeGlen Oaks Community CollegePaper ChecksPaper ChecksIf funds placed onDebit Card, pleaseprovide vendorCost to College for issuing Debit CardCommentsGogebic Community CollegeGrand Rapids Community CollegePaper Check, Direct Deposit, Debit CardHenry Ford Community CollegePaper Checks, Direct DepositJackson Community CollegeKalamazoo Valley Community CollegeKellogg Community CollegeDebit Card, Dir DepPaper Checks, Direct DepositKirtland Community CollegePaper Checks, Direct DepositLake Michigan CollegePaper Check, Direct DepositHigher OneHigher OneHigher One does all options. If they fail to login and make a choice, default is check.Check if requestedDirect Deposit is issued one week prior toPaper checks to encourage use.Sallie Mae- Moving toProbably NelnetHigher OneLansing Community CollegePaper Check, Direct Deposit, Debit CardMacomb Community CollegePaper Check, Direct Deposit, Debit CardHigher One for allOptionsMid Michigan Community CollegePaper Check, Direct Deposit, Debit CardPNC UniversityBankingMonroe County Community College.40 Per transaction.40 Per transaction regardless of distribution method.No cost to issue original card. Replacement card is passed on tostudentHigher one does all options. A paper check isissued by higher one after 21 days if a studentdoes not choice a refund option2.95Paper ChecksMontcalm Community CollegeMott Community CollegeMuskegon Community CollegeNorth Central Michigan CollegeNorthwestern Michigan CollegeOakland Community CollegeSchoolcraft CollegeSouthwestern Michigan CollegeSt. Clair County Community CollegeWashtenaw Community CollegeWayne County Community CollegeWest Shore Community CollegePaper ChecksPrimarily Debit Card, If money isreturned, Paper CheckPaper Check, Direct Deposit, Debit CardHigher OneHigher One for alloptionsPaper Check, Direct DepositPaper Check, Direct Deposit, CreditCards, College One CardPaper Checks, Direct DepositPaper Checks – Going to Direct DepositDirect Deposit/Paper Check.40 for each refund sent to Higher One. No cost for Card, Studentpays replacement fee.NoJust started with Higher One. They bought outSallie Mae(previous vendor)Direct Deposits processed via Touch NetUS BankHigher OnePaper Check OnlyPaper CheckWWW.Oakloandcc.edu/RaiderOneCardDirect Deposit processed via TouchNetOnly for Replacement Card- Student PaysJust moved to TouchNet Oct 2013Paper Check is DefaultWorking on another method11

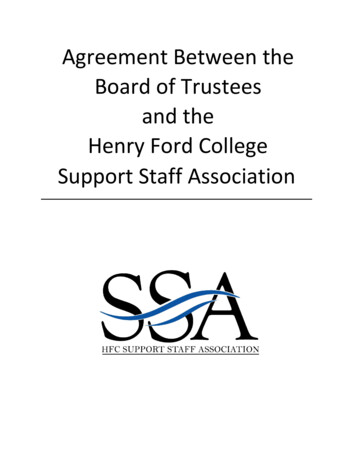

From the Old Process to the NewStudentFinancial Aidrefunds to beissuedEPBR: Vouchersfor payment:report signedand forwarded toDFSCKSE: bothpaper &electonicrefundsauthorizedECHP: Processeselectonic checks,posts to generalledgerCreate fileto processrefundsPaper ChecksCashier'sOfficeEFTs(process isrun twice)Web Focus reportcaptures studentbalances, pulls IDs,saves list.CKPR: Print screenrequests dates forchecks, then printed incashiers vaultSLCR: Creates asaved list for prenoting checksFinancialServicesPrint ChecksARTM: Saved listused to create reportoffsetting current &past term creditbalancesCKRS: acceptscreen forproperly printedchecks, marks Y/NECPP: Pre-notesbank accountinformation toverify correctnessSLED: CreateSaved list forbatch refundingRFVR: Use createdlist to createvoucher register;no money pulled.RFVC: Moneynow pulled fromstudent accountsCKPO: Postschecks to generalledgerSCKR: Creates afile for generalaccounting; runtwice, for paperand electonicNotify Financialservices via emailRun RERG:capturescheck data toprocessFold ChecksReview forbad addressesFin. Ser. ties datato CashiersinformationReview forCanadianAddressesFin. Ser. verifies# of checks, amount of runCopy file and charge toapprop. area to allowfile to be recognized bysystemRun SNDACRCNprocess to transmitfile to ComericaVerify file acceptanceand that file processedwas completeEmail completedtransmitted form toComericaSave returned fileMail ChecksProcess Prenote fileNotify Financialservices via emailCopy file & chargeext. to approp. areaso file can berecognized byComericaTransmit file toComericaVerify file byphoneNotify Cashier's office thatfile has been verifiedProcessRegular echeckfileNotify Financialservices via emailCopy file & chargeext. to approp. areaso file can berecognized byComericaTransmit file toComericaVerify file byphoneNotify Cashier's office thatfile has been verifiedFin. Ser. Dailybanking: prior dayruns bankingreportingClear checks in Hank & tietotals to banking reportSend file toOutside vendorAll of the highlighted steps would be virtuallyeliminated. The exception would be to printemergency refund checks, perhaps 1-3% of the totalnumber of currently issued checks.12Notify Cashiers thatchecks can be mailed

New Student Refund ProcessStudentFinancial Aidrefunds to beissuedEPBR: Vouchersfor payment:report signedand forwarded toDFSCKSE: bothpaper &electonicrefundsauthorizedECHP: Processeselectonic checks,Web Focus reportcaptures studentbalances, pulls IDs,saves list.CKPR: Print screenrequests dates forchecks, then printed incashiers vaultSLCR: Creates asaved list for prenoting checksARTM: Saved listused to create reportoffsetting current &past term creditbalancesCKRS: acceptscreen forproperly printedchecks, marks Y/NECPP: Pre-notesbank accountinformation toSLED: CreateSaved list forbatch refundingRFVR: Use createdlist to createvoucher register;no money pulled.CKPO: Postschecks to generalledgerSCKR: Creates afile for generalaccounting; runtwice, for paper13Send file toOutside vendorRFVC: Moneynow pulled fromstudent accounts

Cost SavingsTotal paper Outsourced& EFTtransactiontransactions costYear2010/20112011/20122012/201342541 42347 36029 Paper CheckcostCurrent Paper &EFT annual cost17,016 134,929.56 16,939 130,776.86 14,412 109,614.49 90% of Papercheck costEstimated annual Estimated annual Newtotal cost savings total cost savings estimated( )(%)annual cost136,369.43 121,436.60 132,406.81 117,699.18 111,202.05 98,653.04 105,860.07102,390.3385,829.0077.6% 30,509.3677.3% 30,016.4977.2% 25,373.05Current Cost Compared to "Historic" Outsourced Cost 150,000.00 136,369.43 132,406.81 135,000.00 120,000.00 111,202.05 105,000.00 90,000.00Current total cost 75,000.00Historic estimated cost if in place 60,000.00 45,000.00 30,509.36 30,000.00 30,016.49 25,373.05 15,000.00 2010/20112011/20122012/201314

Force FieldDesired Change: Outsource Majority of Student Refund Payments to Third Party VendorDriving ForcesRestraining Forces1. Best Practices Model2. Cost Savings - Cashiers - Labor3. Cost Savings - Accounting - Labor4. Cost Savings - Bank Charges5. Cost Savings - Postage1. Resistance to Change2. Perception of Students3. Refunding Limitations- Immediate Checks4. Refunding Limitations - Third Party Checks5. Cannot Pick Up Outside Vendor Checks6. Cost Savings - Materials6. Understanding Fee Structure and How toAvoid Them7. Increased Staff Efficiency7. Lack of Student Financial Literacy8. Chance to Help Student Improve FinancialLiteracy8. Timeliness of Refund Process using Third -PartySystems-Lead-time needed by College9. Improvement in Local Vendor Relations9. Customer Service to Students . What is Role ofCashiers Office with Outside Process?PR/Complaints/Questions10. Ensure Regulations Compliance11. Reduction in Fraud/Counterfeit Occurrences12. Reduction in Annual Escheatment Process15

Henry Ford Community CollegeFall 2013 - Continuous Process Improvement (CPI) InitiativeBusiness Services Team - Reducing Paper Checks in Student Refund ProcessProject Time Line - Gantt ChartItemActivityResponsible Party01Continuous Process Improvement (CPI) Team ReviewsStudent Refund ProcessCPI Team02CPI Team Presents Report and RecommendationCPI Team03Financial Services Staff Review Report andRecommendation and Work with PurchasingDepartment to Develop Request For Proposal (RFP)Financial Services04RFP is Issued and Financial Services Staff/PurchasingStaff meet with Possible Vendors to Discuss RFPObjectivesFinancial Services05RFP Submissions are Received and Reviewed and aVendor is SelectedFinancial Services06Optional: Informational Presentation to Board ofTrusteesFinancial Services07Contract is Signed with Vendor08Implementation Plan is Developed and FinancialServices Staff work with Vendor to Implement and Testthe New Student Refund ProcessFinancial Services09CPI Team Meets with Financial Services Staff for anInterim Six-Month (After Report andRecommendation) Status ReportCPI TeamFinancial Services10New Student Refund Process is Gradually Rolled-Out toa Selected "Pilot" Group of StudentsFinancial Services11Large Scale Communication Plan is Rolled-Out as Partof Implementation Plan to Educate HFCC StudentAbout New Student Refund Process3rd-Party VendorFinancial ServicesOfc of CommunicationsStudent Services12New Student Refund Process is Fully Implmented forAll HFCC Students3rd-Party VendorFinancial Services13CPI Team Meets with Financial Services Staff for anInterim Six-Month (After Implementation) StatusReportCPI TeamFinancial Services14CPI Team Meets with Financial Services Staff for a FinalTwelve-Month (After Implementation) Status ReportCPI TeamFinancial ServicesSept2013Oct2013Nov2013Dec2013Jan2014John 4July2014Aug2014Sept2014Oct - Feb2014 - 2015March2015Apr - Aug2015 - 2015Sept2015

Key PeopleContinuous Process Improvement Team members Barb Eisterhold,Kevin Culler, and John Satkowski, along with other Financial Servicesstaff, the Communications Department, and Student Services, will eachbe involved in the work required to adjust the student-refund process.17

Steering Committee FeedbackTeam Name:Financial Services CPI TeamDate:November 19. 2013Sponsor:John SatkowskiIdeas for Improvement#1234567IdeaSignificantly reduce time and cost associated with in-house studentrefunds.Pursue option to outsource majority of student-refund process.Develop and then release an RFP in December 2013.Outsource the student refund process with a soft implementation duringSpring/Summer 2014 and a full implementation Fall 2014.Improve student financial literacy in conjunction with the 3rd-party vendoror through an expanded HFCC-developed program.Reallocate resources assigned to student refund check creation.Review the effectiveness of the new process.Team Feedback Meeting Date:Sponsor: John SatkowskiLeader: Kevin Culler18Support

Ideas for Future Process Improvement Teams1. Create efficiencies in the refund-selection process. (Identify easily students who hadrefunds in prior terms, students with stale-dated checks, students with credit balances,etc.)2. Automatically apply prior-semester credit balances to current charges.3. Implement a comprehensive financial-literacy program at the College.4. How to gain financial stability5. Bad-debt deterrence6. Dealing with pending financial aid7. Institutional process for contract approval8. Determine why we have the number of check requests (as opposed to requisitions) thatwe do.9. How do we get the whole campus involved in the budget process, and how might aparticular department know what its budget is?10. The de-registration process19

AcknowledgmentsThe Process Improvement Team would like to thank thefollowing contributors for their work with the team indeveloping a strategy to improve the handling of studentfinancial-aid refunds at the College:David Cunningham – Financial Services DirectorDr. Stanley Jensen – PresidentRhonda Johnson – BursarTim Seguin – AccountantFred Steiner – Purchasing SupervisorThe Process Improvement Team would also like to thankits sponsor, John Satkowski.20

6 Glossary of Terms Account with a Bank or Credit Union: Arranged transactions with a bank or credit union which could be a checking account, savings account or a deposit account. Affidavit: An affidavit is a legal document that contains sworn facts and statements. Bank Reconciliation: A bank reconciliation is a process that explains the difference between