Transcription

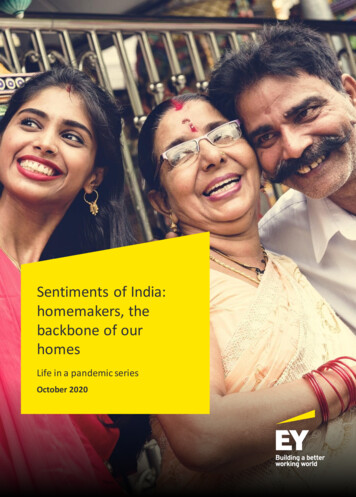

Sentiments of India:homemakers, thebackbone of ourhomesLife in a pandemic seriesOctober 2020

BackgroundHomemakers undertake most of the household work andsupport their families unconditionally. While the work maynot be included in formal economic metrics as it is seldomquantified in monetary terms, homemaking is indeed a full time job. Social developments in the recent few years havegiven recognition and respect to homemakers. However, thepandemic has led professionals and working class toexperience the life of homemakers. Family members are nowsharing responsibilities and are even more cognizant of thevalue homemakers add to their lives.The pandemic has disrupted our daily schedules. Families arespending more time together in their homes. Homes havenow evolved into more than a place of shelter and rest. Theyhave become offices, gyms, restaurants and movie theatres,all rolled into one. This transformation has had an immenseimpact on homemakers and their place of work.As important decision-makers in household purchases,homemakers have always had a huge influence on householdexpenses and consumption behavior. As the pandemic bringsabout changes in the environment at home, it also beckonschange in the way homemakers consume and driveconsumption in the family. Due to lack of external help, inmany cases, families are now playing a more active part inactivities traditionally under the ambit of the homemaker.Consequently, they are exerting a greater influence onhomemakers’ choices and lifestyle.Spouses and children are becoming influencers for digitaluptake and actively engaging in household decision-makingas well. The entire dynamics of the traditional Indian homeare getting challenged and the report tries to capture thosenuances from the lens of the homemaker. It furtherdiscussed the implications of these for brands and businessesin the near and long-term future.The ‘Sentiments of India: homemakers, the backbone of ourhomes' report looks at the impact of the pandemic on:22Sentiments of India: homemakers, the backbone of our homesReport titles Evolving role of homemakers in the household Household and family consumption patterns Evolving behavioral patterns of households and long-termimplications Adoption of digital tools and services by the homemakersand family as a unit Entrepreneurial ambitions of homemakers Sentiment towards the upcoming festive season Evolving consumer sentiment

EY collected responses from 385 homemakers from different age groups,family types and spend categories across various citiesAge distributionSample size and methodology25%1.Planning A combi nation of qualitative and quantitative researchwa s planned to understand i n depth the homemakers’needs, challenges, motivations and tri ggers. Thesefi ndings were then va lidated with a larger sample.28-37 Semi -structured questionnaires were designed fori ntervi ews Pa rti ci pants constituted of 30 homemakers spanninga cross va rious demographics to get representationsfrom di fferent s egments Length of the interview: 30-40 minutes32%23%3. Quantitative surveyMedium 385 res ponses were collected Length of questionnaire: 25 questions20%35%65% Fi ndings from detailed intervi ews and survey werecompi led a nd a nalyzed using power BI Gra phs were then further a nalyzed, a nd trends a ndi ns ights were evaluated to create the detailed report Ins ights were shared with key i ndustry experts tocrea te releva nt business i mplicationsSentiments of India: homemakers, the backbone of our homes80%JointOtherAnalysis and reporting*Spending is classified by monthly spend on groceries by household (per person)Classification for Tier 1 cities, per person spend (INR) of households on groceries – highspenders 7,500, medium spenders 7,500 and 2,500, low spenders 2,500Classification for Other cities, per person spend (INR) of households on groceries – highspenders 6,500, medium spenders 6,500 and 2,000, low spenders 2,0003Family typeCityTier 14.LowA qua ntitative survey based on emerging themes,deri ved from the semi-structured i nterviews, wasconducted after interviews to va lidate findingsA questionnaire was created on Qualtrics a nd wasfl oated online on va rious homemaker groups, residentwel fare associations (RWAs), personal contacts andnetworks to get an a dequate number of respondents48 45%High 37-48Spend distribution*Qualitative study 22%21%20-282.32%Image not to scaleNuclear

EY identified nine key themes where the pandemic has impacted thebehaviors and consumption patterns of homemakers1Health, yoga, immunity and moreUncertainty and anxiety brought about by thepandemic has resulted in a sharp focus on healthand wellbeing. As a result, homemakers arebecoming flagbearers for family health andimmunity. They are driving consumption towards thesame.60%2respondents startedconsuming herbal products139%respondents said that they considerheath and immunity boostingproperties in their purchases129%respondents said they activelypractice meditation and otheractivities for mental wellbeing1Homemakers are turning to products and channelsthat help them save time and effort. Convenienceand do-it-yourself (DIY) techniques are drivingconsumption changes52%respondents reported feelinguncertain due to circumstancessurrounding the pandemic 143%Effort minimization over price minimization28%4Homemakers are rapidly adopting digitalchannels; however, digital education remains abottleneckChallenging gender norms: paving the wayfor more gender neutral homes63%respondents reported that family membersstarted contributing to household choressince the pandemic 127%homemakers are ordering online butare dependent on others for placingorders 148%512homemakers delegate decision-makingabout brand preference when relying onother family members to place onlineorders. This means other family membersare also engaged in taking decisions relatedto brands 135%Most households have reduced frequency ofpurchases and increased basket size in order toreduce store visits. Additionally, there is anincreasing openness to try alternate brands38%Sentiments of India: homemakers, the backbone of our homesrespondents switched to onlinechannels for purchasing at least acategory of essentials1homemakers reported increase inusage of online shopping postlockdown, while 15% used onlineshopping first time duringlockdown148%respondents stated that UPI anddigital wallets as their preferredmodes of payment 127%respondents, who preferred othermodes of payments, statedsecurity is their biggest concern1FinTech adoption is mostly limited to payment andtransaction apps. Insurance, investments and otherareas of finance are the areas that homemakers areyet to adopt on a large scale1Consumer baskets are growing, withroom for experimentationEY COVID Impact Homemakers Survey, 2020EY COVID Impact Consumer Survey, 2020450%Homemaking is becoming a shared responsibility.Family members are pitching in and activelyparticipating in their consumption choicesrespondents in the high- and mediumspend category purchased conveniencegoods like standing mops, choppers,etc.1Reducing digital divide but gaps remain52%3respondents increased usage ofonline services and digitalpayments to save time1respondents stated that they have switched toalternate brands in at leastone grocery category since the pandemic1respondents said that they tried alternate brands inat least one grocery product category, but switchedback to their preferred brand when the productbecame available1

6Festivities to be smaller, more intimateand more digitalHouseholds are planning intimate festivities and areexpressing caution over spending84%50%respondents said they spendmore time watching contenton OTT platforms156%consumers stating they wouldreduce spends on nonessentials1,255%respondents stated that theyare using online channels forlearning yoga, recipes etc.1respondents said they would conducttheir festive shopping online, while 44%respondents said they would avoidshopping in large markets and crowdedplaces1respondents would prefer to couriergifts to their loved ones during theupcoming festive season 1Stay home, stay safe may not be just afadStaying indoors may indeed become a long-termpreference over going out. Homes have become theepicenter of activities with households staying hometo stay safe52%would prefer cooking exotic meals athome over going to a restaurant 151%would prefer watching OTT premiers overgoing to movie theatre 1392respondents indicated that they wouldcelebrate the festive season at homewith only members of their ownhousehold1of the homemakers are waiting forfestive promotions to make big ticketpurchases despite the fact24%1would prefer home workouts overgoing to gym 120%would prefer using on-demand serviceslike at home parlour rather than going toa parlor 135%would prefer online shopping overvisiting physical stores, wherepossible1EY COVID Impact Homemakers Survey, 2020EY COVID Impact Consumer Survey, 20205Influenced by their children, homemakers are gettingaccustomed to digital platforms for entertainmentand learning, in addition to taking up traditionaloffline hobbies like gardening and cooking12%28%87Homemakers get demanding: the rise ofover-the-top (OTT) and online platformsSentiments of India: homemakers, the backbone of our homes9Leaning in: homemakers have more tobring to the tableHomemakers are looking for suitable supportsystems to unleash their entrepreneurial spiritand have increasing aspirations to work andupskill11%19%homemakers are already engagedin part-time jobs/side business orfamily business1younger homemakers agedbetween 20-37 years are alsoturning to online educationplatforms for upskillingopportunities115%younger homemakers alreadyworking on business ideas toimplement in the near future 117%younger homemakers stated theyare looking to avail work fromhome opportunities155%In contrast, majority of thehomemakers above 48 years, donot have any such plans 1

Health, yoga, immunityand more“We have started exercising morefrequently now. I have asthma, so Iwould earlier do pranayama once aday. However, since the lockdown, Ihave been doing it twice a day andthat has benefitted me. I also soakalmonds for the entire family at nightto be consumed the next morning. A Pune-based homemaker“There is no longer any fixed timingfor anything. I have to reheat foodmultiple times as work calls oftencome in between meal times. Everymember has a different lunch timeand I need to provide as per theirschedules. A Kolkata-based homemaker

Hea lth, yoga, i mmunity a nd moreChanges in daily schedule and increased workload have led to anxiety andstress along with perdurable concerns for health and safetyHomemakers have always worked at a relentless pace throughoutthe day to ensure functioning of the household while still alsomanaging to find time to stay connected with friends and familyand upskill themselves.The adoption of practices to secure their families from thepandemic and the presence of the entire family at homethroughout the day has resulted in increased workload forhomemakers. The increased and unscheduled work hasencroached on time traditionally set aside for themselves 1 .Q. What are the feelings you associate with the nextthree months? (Select all that apply)These factors cause anxiety and stress among homemakers intheir bid to keep their family safe from the pandemic and havestimulated them to become flagbearers of health and wellbeing 1 .It has also resulted in greater use of effort minimizers (like mops,appliances), a push towards cocooning and increased contributionof other family members in tasks 1 .Q. How has your household workload changed sincethe tainity17%Remained the sameDecreasedSource: EY COVID Impact Homemakers Survey, 2020 60% homemakers reported feelings of uncertainty, 44% feltstressed and 43% felt anxious due to the pandemic.Homemakers are concerned about their health andwellbeing and that of their loved ones 1 . Many homemakers also reported disruptions in dailyschedules on account of no fixed meal timings, elongatedwork calls of other family members, children at home, etc. 1 . 1 EYStress and anxiety are also partially on account of increasedworkload. 64% homemakers reported an increase inworkload with a similar trend across age groups, familytypes and cities 1 .COVID Impact Homemakers Survey, 20207Sentiments of India: homemakers, the backbone of our homes On a positive note, around 40% respondents felt happinessand peace while at home. 31% also felt optimistic aboutthe future1 . These emotions can be attributed to increasingadoption of wellbeing practices like yoga, and comfort fromthe fact that families are living together in a safe sanctuary,i.e., their home. Feelings of uncertainty and anxiety are highest among thehigh spenders with 71% and 49% homemakers reportingthe same, respectively.

Hea lth, yoga, i mmunity a nd moreHomemakers are driving household consumption towards healthieralternatives and are encouraging their family members to adopt wellnessactivitiesQ. Select all that applies to your home for each category48%Exercising at home with no equipments43%Started consuming herbal products and health supplements39%Look for immunity boosting qualities in products29%Conscious effort at improving mental healthExercising at home with home equipments22%Learning yoga or exercise at home through online videos22%14%Started monitoring health through apps or devices4%Joined paid workout sessions0%20%40%60%Source: EY COVID Impact Homemakers Survey, 2020Further, the concern for safety and anxiety around exposure to public places also reflects in the homemakers apprehension of usingride sharing/commercial taxi services with 45% homemakers stating their preference to continue using their personal transportover the shared services 1 . Concern for safety and wellbeing of family loom large on theminds of the homemakers, motivating them towardsadopting wellness practices. 48% homemakers stated that they had started practicingsome physical exercises at home1 . 43% homemakers started consuming herbal products orhealth supplements 1 . For 39% homemakers, health and immunity boostingproperties were primary influencers for purchase decisions 1. Homemakers were also using digital means to track theirhealth. 14% of them reported that they use apps and devicesto monitor their health or fitness and 22% leverage on onlinevideo platforms to learn yoga or other forms of exercise 1 . 1 EYThere was an increasing cognizance and acknowledgementof mental health issues among homemakers. Many hadstarted meditating and making conscious efforts towardstheir mental health. 29% of them reported practicingmeditation or making a conscious effort towards mentalhealth improvement1 .COVID Impact Homemakers Survey, 20208Sentiments of India: homemakers, the backbone of our homesKey implications Product or service innovation: brands should explorecategory expansions into health and wellness or designnew products that offer health and wellness properties. Promotions and product bundles: bundling products intoimmunity packs and family baskets may help brands drivesales of a larger product and service portfolio. In addition,discounts and promotions, especially on online channelscan incentivize consumer purchases. Communication focused on health and wellness:consumers are looking for products and services thatstrengthen their immunity and protect them from thepandemic. They will also turn to brands that empathizewith these sentiments and take precautions along theirsupply chain through safety measures and communitysupport.

Effort minimization overprice minimization“We have recently purchased an air fryer asthe number of fried items getting cooked athome was increasing. We purchased an airfryer to not compromise on our health. Wehave also started vacuuming more often asmaids are not coming. A Chennai-based homemaker

Effort mi nimization over price minimizationHomemakers are turning to time-saving and effort-minimizing purchases todeal with increased household workloadOne of the major challenges that hit homes hard was the lack ofavailability of the support staff and helpers that were previouslyemployed. They served as a support system to most homemakerswho would call them for laborious tasks like cleaning, dusting andwashing utensils 1. Although, some households had a permanenthelper employed that they were able to retain as they stayed withthem, those with part-time helpers avoided calling them from thefear of exposing their homes 1 . While many house helps haveresumed their services in limited capacity, some households arecautiously doing household chores all by themselves 1 . To ease the load of work, 52% homemakers sought timesaving alternatives like making purchases and bill paymentsonline1 26% homemakers purchased convenience-driven householditems like vegetable choppers, standing mops 1 15% homemakers purchased time-saving appliances likevacuum cleaners, air fryers, steam irons 1 52%Adoption of online services for their convenience is a strongtrend amongst homemakers aged 20-28 years with 68%respondents stating that they started or increased the use ofonline services since the pandemic1Homemakers started using online servicesmore often for buying grocery andmaking bill payments to save their time28%Homemakers in the medium- and highspend categories undertook conveniencedriven purchases like standing mops,chopper, etc.18%Homemakers in the medium- and highspend categories purchased an electricalappliance for convenienceSource: EY COVID Impact Homemakers Survey, 2020Key implications1 EYCOVID Impact Homemakers Survey, 202010Sentiments of India: homemakers, the backbone of our homes Product and service innovation: homemakers arepurchasing products that help them save time and effort.Brands could leverage this consumer need by designingproducts or services articulated around the theme ofconvenience. Increasing digital presence: as more families look to goonline and increase the range of goods purchased,increasing digital presence can help brands remain in thesight of consumers. Train staff to meet consumer needs: brands can train salesstaff and backend support teams to cater to a newcustomer segment. This comprises of homemakers andolder age groups that are turning to online for faster andseamless services. Brands should ensure that staff issensitized to the needs of the new segment, willing tolearn and adaptive to their needs.

Challenging gendernorms:paving the way for more genderneutral homes“Everyone is pitching in thesedays. My husband helps mein washing utensils, doinglaundry and ordering itemsonline. The children are alsomore pro-active. They maketheir own bed and try to keepthe house as clean aspossible. I am hoping thesehabits stick. A Delhi-based homemaker

Cha l lenging gender normsFamily members are pitching in to lend a helping hand makinghomemaking a shared responsibility, challenging traditional genderstereotypesThe lockdown has given family members a chanceto get up close and personal, and experience thechallenges of being a homemaker.Nineteen percent of the homemakers in nuclear families across India (withoutchildren) reported that their spouse was helping them with household chores.This indicates that couples are moving towards a more equitable partnership1 .Load sharing is coming up as a trend with 63%homemakers reporting that they are receiving helpfrom their spouses or other family members 1 .This is a welcome social development that inches our households closer togender neutrality and blurs the boundaries between gender-based segmentationof tasks. Even children are actively supporting their mothers, makinghomemaking a more shared responsibility1 .How are you managing increased household work?63%Getting support from family52%Using online ordering and bill payment apps26%Purchased more of convenience-driven items15%Recently purchased home appliances10%Had full-time maid/help available, so no changeSource: EY COVID Impact Homemakers Survey, 2020Further, other family members are also having positive influenceson the homemakers. Many homemakers have learnt how to usemobile apps from their children and spouses 1 . Some of them had topick it up out of necessity due to social distancing1 . This hasprovided homemakers with greater independence and confidence.However, in tasks such as online bill payments or online ordering,although there has been an uptick by homemakers, many still relyon their family members to use the app1 .27%Homemakers are ordering online but rely onothers for placing the order48%Homemakers delegate decision making aboutbrand preference, in households where otherfamily members place online ordersKey implications Progressive branding and marketing strategies: brandsneed to reinvent their image as more inclusive andprogressive organizations that support sharing ofhousekeeping responsibility. New target segments: brands need to include men andother family members in their communications andadvertisements related to household and consumptiongoods. Spouses/children checking out on online ordering apps forthe homemakers: brands to also aim at increasing top ofthe mind recall (TOM) in the men’s and adolescentsegment. Evolving societal relationships: organizations and societyat large need to support and celebrate positive socialchanges coming as a result of the pandemic in theirpolicies and messaging.Source: EY COVID Impact Homemakers Survey, 2020The above indicates that as channels of purchasing are changing, and as homemaking is becoming more gender neutral, other familymembers will increasingly participate in household purchase decisions like brands and SKUs. Brands will need to include other familymembers in their targeting and not restrict their messaging to just the homemakers as the end purchaser is evolving.1 EYCOVID Impact Homemakers Survey, 202012Sentiments of India: homemakers, the backbone of our homes

Reducing digitaldivide but gaps remain““We do all our shoppingonline instead of visitingshops. I have a young babyand elderly dad whom I donot want to expose toCOVID”A Tiruchirappalli-based homemaker“I have asked my kids to teach me howto use ordering and payment appsmultiple times but they are very busy.I am sure it won’t be difficult to usebecause I use other apps. It should beeasy once I learn and get the hang of it.A Mumbai-based homemaker

Reducing digital divide but gaps remainThe pandemic has accelerated the uptake of online shopping amonghomemakers, even in the older age categoriesEncouraged by their children, there is an increasinguptake of online services amongst homemakers asthey turn to ways to help them save time andenable them to operate from the safety of theirhomes. Homemakers are shifting to onlinechannels, more prominently in the essentialscategory of purchases during the pandemic.52%15%homemakers switched toonl ine purchasing in a tl east one grocery ca tegory150%homemakers reported usingonl ine shopping apps for thefi rs t ti me s ince thel ockdown127%homemakers reported thatthei r usage of online s hoppinga pps increased during thel ockdown1of the homemakers relied onthei r s pouse or other familymembers to place orders forthem vi a online shoppinga pps 1Q. In regards to ordering online (including ordering groceries online), which of thefollowing are applicable to you? (Select all that apply)Usage increased50%Let my spouse or someone else order27%Do not use online ordering apps17%Started using for the first timeStarted using but switched to offline shopping15%11%Source: EY COVID Impact Homemakers Survey, 202042%Homemakers over 48 years old dependon their spouse or someone else toplace orders online58%Homemakers in the age group of20-37 years switched to online medium in atleast one of the categoriesKey implications Omni-channel presence: as household consumption shifts online, itis pivotal for brands to develop omni-channel capabilities to remainrelevant for consumers. Digital literacy and ease of use: homemakers in older generations(above 48 years old) are concerned about the safety of onlinetransactions and report difficulties in navigating apps. For wideradoption, brands should develop user-friendly interfaces speciallydesigned for this segment. They should also leverage marketingcampaigns and influencers from peer groups to educatehomemakers about the safety and in-built security of onlinetransactions. Train front-end sales staff and backend support teams for onlineand faceless sales: there is a need for organizations’ sales andsupport staff to develop capabilities to support homemakers andolder generation customers with technical aspects. Additionally,they should engage with this new segment and assure them of thesame quality standards as provided by the offline channels.Source: EY COVID Impact Homemakers Survey, 20201 EYCOVID Impact Homemakers Survey, 202014Sentiments of India: homemakers, the backbone of our homes

Reducing digital divide but gaps remainDifficulties while using online applications and concerns regarding productquality remain barriers for wider adoptionDigital literacy still remains a bottleneck for wider adoption ofdigital channels, especially in the older segments as homemakersreport the need for support from their family members to useonline channels. Seventeen percent of the homemakers who weresurveyed stated they were not using online ordering apps. Thereasons for that included the following:150%26%homemakers preferred the touch and feel aspect ofshopping1homemakers found it difficult to navigate onlineordering apps. A larger proportion of respondents inthe older age groups had this issue with 42%homemakers in the 48 or older age group reportingthe same117%of respondents said that they do not trust onlineordering apps for placing orders because they areafraid of product quality 117%raised concerns over return or exchange of productsas the main reasons from not making onlinepurchases 116%Key implications Marketing communication: apps and platforms can focuson addressing the concerns of consumers about onlineapps by messages, emphasizing aspects such as their easeof use and safety measures to drive adoption. Peer-to-peer learning: organizations can establish peer-topeer learning communities by leveraging kittygroups/RWAs and engaging older children as influencersto help homemakers onboard onto online platforms aspart of onboarding campaigns. Gamification: continuous engagement by reducing lapsesthrough gamification using badges, points, rewards,recognition schemes may foster healthy competitionamong homemakers and increase their digital uptake. Creating simpler alternate interfaces: creating a differentversion of interfaces which are less complex and havebasic functionality will increase the ease of use for the lesstech-savvy homemakers and consumers from oldersegments.homemakers conveyed willingness to learn using suchapps if someone were to teach them1Reasons for not using online ordering apps50%26%Prefer to physically inspectgoodsDifficult to use27%17%17%16%Do not trust themReturn or exchange processis difficultWould use if somebodyteaches ficult to useDo not trust themPrefer to physically inspectgoodsSource: EY COVID Impact Homemakers Survey, 20201 EYCOVID Impact Homemakers Survey, 20201537-4822%30%Sentiments of India: homemakers, the backbone of our homes48 or older19%28-3720-28Return or exchange process Would use if somebody canis difficultteach me

Reducing digital divide but gaps remainUPI and wallets have emerged as the most popular payment methods amonghomemakers; however, penetration of other FinTech applications is limitedThe pandemic has accelerated the adoption of digitalpayments with consumers concerned about exposure to thevirus through cash transactions. Children have played apivotal role in introducing homemakers to digital wallets 148%homemakers said UPI or digital wallets was theirpreferred payment method 171%Preference for digital payments is strongest amongyounger homemakers aged 20-37 1Q. Which of the following payment methods are preferred by you for day-to-day transactions?Percentage of homemakers who preferred UPIacross each age group71%26%67%UPI or wallet payments48%Debit Card34%Credit cards11%Cash27%16%20-2828-3737-4848 or olderSource: EY COVID Impact Homemakers Survey, 2020“I do not know much about that (investments and insurance).My husband looks after those matters. I will need to learnabout these things before I can contribute.A Bengaluru-based homemakerCurrently the uptick in fintech is limited to digital payments.However, potential for penetration of digital tools in otherareas like insurance, wealth management, budget managementremains to be seen. Managing fixed deposits (FDs) and investments was citedas the prerogative of spouse with minimal involvementfrom the homemaker 1 . Lack of awareness and confidence in handling investmentand insurance matters was cited as primary deterrents toadoption of digital tools in this space1 .1 EYCOVID Impact Homemakers Survey, 202016Sentiments of India: homemakers, the backbone of our homes

Reducing digital divide but gaps remainWhile a third of the homemakers are concerned about safety of digitaltransactions via UPI/wallets, many still express willingness to learn andadoptConcerns about security of such transactions and financial lossdue to user error (unintended transactions) remain ahinderance to higher levels of adoption. Fifty-two percent of thehomemakers showed preference for cash or card-basedpayments over UPI or payment wallets for the followingreasons 1 :35%homemakers reported that some other familymember(s) looked after bill payments 127%reported that they did not feel secure while usingthese apps 112%said were willing to use UPI/wallets if someonetaught them how to use them111%homemakers ha

3 Sentiments of India: homemakers, the backbone of our homes 21% 25% 22% 32% 20-28 28-37 37-48 48 Age distribution 32% 45% 23% High Medium Low Spend distribution*