Transcription

Market PerspectiveSector SpotlightM&A and Capital Raising ActivityPublic Market PerformanceBig Data – Q4 2017IDC states worldwide revenues for Big Data and businessanalytics will grow from 130 billion in 2016 to over 203billion in 2020, at a CAGR of 12%. In addition, Forresterpredicts 70% of enterprises will implement AI over thenext 12 months (up from 40% in ‘16 and 51% in ’17). This isa huge shift but a natural evolution of Big Data!Gretchen FrarySeayCo-Founder &Managing DirectorEmail GretchenAs we put the wrap on 2017 and look to 2018, who will be thewinners in this AI/Machine Learning landscape? Companiesthat focus on specific business outcomes will be the bigwinners. Much like early Big Data days, the focus has beenon customer insights and predicting customer behavior.However, enterprises are now looking to deploy AI acrosstheir operations from supply chain to equipment maintenance.As AI use cases widen, companies seek to better understandthe complex and confusing AI solution landscape. AI solutionproviders that can address multiple business problems anduse cases and are growing revenue at 40% will commandthe attention of the most active consolidators, while startupsthat require tens of millions of dollars of funding to amasstheir first enterprise use case will struggle to exit effectively.Clearsight believes 2018 is the year for AI M&A as strategicbuyers have identified the gaps in their software and servicesofferings and are eager to find proven targets.Upcoming ConferencesMarch 5-8Strata Data ConferenceSan Jose, CAMarch 6-9Gartner Data and AnalyticsSummitGrapevine, TXApril 22-27Enterprise Data WorldSan Diego, CAMay 22-23Data SummitBoston, MAPhilo TranDirectorEmail PhiloCLEARSIGHT MONITOR Big Data Industry Q4 20171

SECTORSPOTLIGHTQ4 2017 acquisitions advance Splunk’s market-leading machine learning platformSplunk ramped its acquisition activity in 2017 helping drive its stock price up 60% for thefull year. In Q4 alone, the company completed two transactions totaling 40mm in value.The acquisitions of SignalSense and Rocana’s technology and IP assets fit into Splunk’sstrategy of enhancing their leadership position as the #1 Operational Intelligence platform.Splunk Acquires Signal SenseTargetTransaction SummaryBuyerOn October 17, Splunk announced it had acquired SignalSense, a privatelyheld technology company offering cloud-based advanced data collection andbreach detection solutions that leverage machine learning. These machinelearning technologies are applied to signal processing and make cyberintelligence practical and effective for businesses of any size. Seattle-basedSignalSense will join Splunk’s Products organization in its growing Seattleoffice. The acquisition was funded with cash from Splunk’s balance sheet.Deal AnalysisTransaction InformationAnnounced DateDeal TypeDeal SizeTarget InformationYear FoundedTarget HQ10/17/2017Acquisition 12.2 mm2013Seattle, WADeal Commentary Clearsight Perspective: The acquisition of SignalSense builds upon Spunk’s ongoingstrategy to further advance its machine learning capabilities and its market-leadingmachine data platform. SignalSense’s expertise in building modern cloud applications andapplying machine learning to data complements Splunk’s product capabilities.“Splunk is the perfect platform for our teamto make a big impact on Splunk’ssubstantial customer base”Brad LoveringChief Engineering Officer, SignalSenseSplunk Acquires Rocana AssetsTargetBuyerTransaction SummaryOn October 9, Splunk announced it had acquired select assets of Rocana, aprivately held technology company offering analytics solutions for the ITmarket. A number of technical employees from Rocana will also be joiningSplunk as part of the transaction, which was funded with cash from Splunk’sbalance sheet.Deal AnalysisTransaction InformationAnnounced DateDeal TypeDeal SizeTarget InformationYear FoundedTarget HQ10/9/2017Acquisition 30.2 mm2014San Francisco, CADeal Commentary Clearsight Perspective: The acquisition of Rocana’s technology and intellectual propertyassets comes after Splunk’s recent commitment to innovate through a build, buy, andpartner approach. Splunk will leverage Rocana’s assets to advance its machine dataplatform and machine learning capabilities. Furthermore, Rocana’s team of technicalemployees will strengthen Splunk’s IT Operations leadership.“We are thrilled to join the Splunk teamand help contribute to its vision of helpingcustomers turn data into answers”Eric SammerChief Technical Officer, RocanaOther Notable Splunk Acquisitions in 2017May 2017: Splunk acquired Drastin, a provider of conversational analytics technology intended to help nontechnical users gain critical business insights from massive amounts of data.The acquisition of Drastin expands Splunk’s search-driven analytics capabilities and enhances Splunk’sability to provide an intuitive search experience for customers.Source: Public Filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20172

FEATUREDTRANSACTIONSQ4 2017 Select Big Data / Data Analytics Software M&A TransactionsAnnouncedTargetBuyerTarget Description / Deal Rationale 12/20/2017 12/18/2017 12/5/2017 11/27/2017 11/17/2017 Innowera provides global software enabling users to more efficiently manage SAPprocesses and workflows for productivity and data managementThe acquisition, via its financial sponsor The Audax Group, expands Magnitude’sportfolio of solutions in the SAP marketplace, provides access to additional target users,and complements key solutionsNet Health’s software offers end-to-end services that include practice managementtools, clinical workflow documentation, revenue cycle management and analyticsPrivate equity firms, The Carlyle Group and Level Equity, completed the acquisition ofNet Health SystemsMadrone Software & Analytics provides portfolio, risk analytics, and market intelligencesolutions for the asset management industryFollowing the acquisition, Solovis’ clients will gain access to advanced fund analytics,detailed risk analysis, and operational and investment due diligence capabilitiesHalo Business Intelligence supplies advanced analytics and business intelligencesolutions for the supply chain marketThe acquisition will help clients move from projections to predictive and prescriptiveanalytics to increase visibility and accelerate decision-making across the supply chainViewics provides analytics software focused on laboratory business analytics, allowingefficient integration of big data from a variety of IT systemsThe transaction will provide data-driven lab business analytics and add further digitalcapabilities along the laboratory value chain11/15/2017 Alpine Data offers a cloud-based data science and social collaboration platformThe addition of Alpine Data will bolster TIBCO’s data science technology and analyticsportfolio11/9/2017 Qumram offers advanced session replay technology for mobile and web applicationsThe transaction will further expand Dynatrace’s digital experience capabilities byproviding the ability to visually replay a user session within the existing platform Zyme, a channel data management company, enables organizations to have deepvisibility into their indirect sales channelsThe combination will give global manufacturers unprecedented visibility and control oftheir manufacturing and sales operations11/6/201710/26/201710/19/2017 Logi Analytics provides embedded business intelligence and analytics software solutionsthat create engaging analytic applications Marlin Equity Partners is a global investment firm with over 6.7 billion of capital undermanagement Perspica is a developer of SaaS analytics and observability products designed to ingestand understand the high volume, velocity, and variety of big dataPerspica’s domain knowledge around machine learning and streaming data will greatlyenhance the capabilities of AppDynamics engineering teams 10/17/2017 SignalSense provides machine learning technologies for signal processing, designed tomake cyber intelligence practical and effective for businesses of any sizeThe addition of SignalSense will help expand Splunk’s product leadership and drivecustomer valueSource: Public filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20173

FEATUREDTRANSACTIONSQ4 2017 Select Big Data / Data Analytics Software M&A Transactions (Cont.)AnnouncedTargetBuyerTarget Description / Deal Rationale 10/10/2017eBureau provides custom-analytic solutions with both credit-risk and anti-fraudapplicationsThe acquisition continues to build upon TransUnion’s success as a source of versatiledata and analytics capabilities 10/6/2017Cyence offers an analytics platform designed to quantify the financial impact of cyberrisk, through data collection, machine learning, and economic / risk modelingThe 275m transaction will enable Guidewire to provide P&C insurers with cloud-baseddata listening and risk analytics solution for managing modern-day threats 10/5/2017Composite Software offers solutions that power enterprise-scale virtualization andassociated consulting and support servicesTIBCO’s analytics users will benefit from improved data agility, enhanced scalability,and better business insights Q4 2017 Select Big Data / Data Analytics Software Capital Raise TransactionsAnnouncedTargetInvestorTarget Description / Deal Rationale 12/19/2017 11/30/2017 11/29/2017 11/3/201711/2/2017 Run LiangTai Fund 10/23/2017 10/18/2017 10/7/2017 10/3/2017 10/3/2017 Anodot provides a SaaS real time analytics & automated anomaly detection systemdesigned to detect & turn outliers in time series data into valuable business insightsThe company raised 23 million of Series B venture funding in a deal led by RedlineCapital ManagementUptake offers a predictive analytics platform designed to transform data intomeasurable business valueThe company raised 117 million of Series D venture funding in a deal led by BaillieGiffordCallMiner provides a cloud based customer analytics platform designed to offer afundamental driver of positive customer experiencesThe company raised an estimated 5.5 million of Series D2 funding in a deal led byEscalate Capital PartnersDataRobot offers a machine learning automation platform designed to deploy accuratepredictive modelsThe company raised 68 million of Series C venture funding in a deal led by NewEnterprise AssociatesAyla operates as a cloud platform-as-a-service connectivity solution designed toprovide the flexibility and modularity to enable rapid changes to any type of deviceThe company raised 60 million of Series D venture funding in a deal led by RunLiang Tai Fund and Sunsea TelecommunicationsActionIQ provides a SaaS enterprise customer data platform that helps marketers withthe flow and scale of data, analytics, and marketing campaignsThe company raised 30 million of Series B venture funding in a deal led byAndreessen HorowitzMapR Technologies provides an enterprise-grade distributed data platform to storeand process Big DataThe company raised 61 million of funding in a round led by Lightspeed VenturePartnersPetuum operates as a machine learning infrastructure platform designed to makeeven the most advanced AI technology accessible and affordableThe company raised 93 million of Series B venture funding in a round led bySoftBank GroupAtScale provides a business intelligence platform designed to make businessanalytics work on Big DataThe company raised 25 million of Series C funding in a deal led by Atlantic BridgeInfinidat provides data storage management technology designed to support dataintensive enterprisesThe company raised 95 million of Series C venture funding in a deal led by GoldmanSachs Private Capital Investing GroupSource: Public filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20174

FEATUREDTRANSACTIONSQ4 2017 Select Big Data / Data Analytics Services M&A TransactionsAnnouncedTargetBuyerTarget Description / Deal Rationale 12/15/2017SQS Software Quality Systems provides software quality assurance services via softwaretesting and software certification servicesThe 335 million transaction will enhance Assystem’s products and services in softwaretesting solutions, quality assurance, and change management support 12/5/2017Alliance Life Sciences provides a range of services including contract analysis, enterprisecontract life-cycle management, clinical data review and analysis, and managed servicesThe Access Group, via its financial sponsor, Water Street Healthcare Partners, made theacquisition to build out its global life sciences’ commercialization services platform 12/1/2017CRM manager provides salesforce.com cloud application implementation, integration, andcustomization services in the United StatesThis acquisition continues Simplus’ acquisition trend, which began with the purchase ofBaldPeak in 2016 and then EDL Consulting and Basati earlier in 2017 11/28/2017 FuturTech Consulting provides quality, cost-effect IT and computing services to clientsThe companies have merged to create a full service IT cloud solutions company uniquelypositioned to take clients from their desktop to the cloud11/1/2017 Bug Insights provides market research, human capital analysis, and consulting servicesThe acquisition will help Deloitte deliver essential employee insights into total rewardsofferings AutoCont provides information and communication services including enterpriseinfrastructure, enterprise information systems, IT, and cloud servicesKKCG Investment Group became a majority shareholder owning 70% of the company10/19/2017 10/18/2017RiskVision provides integrated solutions for operational and security risk intelligence forbusinessesRiskVision’s capabilities, including threat and vulnerability management, IT risk, andvendor risk, perfectly complement Resolver’s existing market offerings 10/17/201710/10/2017 Datascope Analytics offers data science consulting and designing servicesThe acquisition expands IDEO’s core offerings, creating a new service called “Design forAugmented Intelligence” and a new discipline around data science GeoFields provides data management solutions for the data integration, analysis, andregulatory needs of the oil and gas pipeline industryThe acquisition of GeoFields helps further position Emerson as a comprehensivesolutions provider for pipeline operations management Q4 2017 Select Big Data / Data Analytics Services Capital Raise TransactionsAnnouncedTargetInvestorTarget Description / Deal Rationale 12/21/2017 10/31/2017 Catalyte leverages machine learning, proprietary algorithms, and Big Data to provideagile software development servicesThe company received 13 million of development capital from Cross Culture VenturesOnica is a technology consulting firm offering services in cloud consulting,infrastructure, security and compliance, data analytics, and managed servicesThe company raised 20 million of growth equity funding from Sunstone PartnersSource: Public filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20175

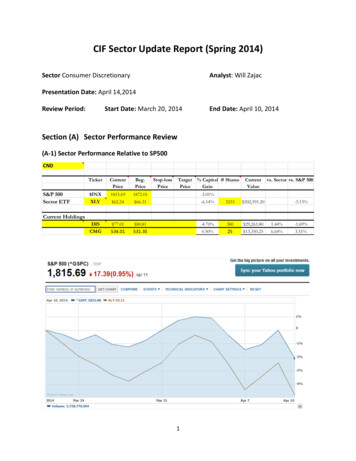

PUBLICMARKETSBig Data Comparable Companies AnalysisData Analytics / BI Software ec-2017 MedianMeanLow% of 52WeekHigh97.4 %97.684.180.270.795.886.763.880.9EquityMarketCap erpriseValue 19,48211,6665,3812,8412,4721,6551,4478281,05697.6 %84.184.163.8 16,2722,8615,2331,151 19,4822,4725,203828EV / Revenue MultiplesLTM201720189.2 x9.1 x8.5 .311.28.21.61.71.77.77.15.512.3 x7.78.01.611.2 x7.17.51.78.5 x5.76.11.7EV / EBITDA MultiplesLTM2017201819.9 x18.7 x17.3 .3 17ERevenueGrowth6.8 %30.75.155.038.939.450.2(2.4)40.219.9 x(38.0)(27.1)(82.1)46.3 %(16.9)(23.8)(110.4)55.0 %38.929.3(2.4)201813.7 x10.38.79.013.411.7LTMEBITDAMargin37.1 %38.940.521.525.27.92017ERevenueGrowth16.1 %4.74.5(1.6)21.4(7.8)13.7 x11.011.18.740.5 %31.228.57.921.4 %4.66.2(7.8)94.2 x(21.2)(19.2)(220.9)72.5 x(28.7)(132.8)(1,034.3)Diversified Analytics Software ingPrice31-Dec-2017 85.5447.2846.16153.42112.3238.46HighMedianMeanLow% of 52WeekHigh97.8 %89.096.983.993.097.8EquityMarketCap Value 606,193194,870235,126179,031135,3454,45897.8 %94.993.083.9 659,906175,066228,4204,810 606,193186,951225,8374,458EV / Revenue MultiplesLTM201720186.5 x6.0 x5.5 x5.05.04.83.83.83.72.32.32.34.94.84.52.12.12.16.5 x4.34.12.16.0 x4.34.02.15.5 x4.13.82.1EV / EBITDA MultiplesLTM201717.6 x15.2 x12.910.99.49.210.69.419.413.826.212.126.2 x15.316.09.415.2 x11.511.89.2LTM EV / Revenue Multiple Trend – 2 YearsData Analytics / BI Software Index1Diversified Analytics Software Index10.0 x2/5/2016 – Tableau share pricedropped 50% after reporting resultswith reduced full-year outlook8.0 x7.3x6.0 x4.3x4.0 x2.0 x0.0 xDec 2015Apr 2016Aug 2016Dec 2016Apr 2017Aug 2017Dec 2017Note: Cloudera went public in April of 2017.1. Excludes Alteryx, Cloudera, Hortonworks, MuleSoft, and Talend.Source: Public filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20176

PUBLICMARKETSBig Data Market Indices Performance – 1 Year150%Data Analytics / BI Software Index1S&P 500Diversified Analytics Software ec 2016Feb 2017Mar 2017May 2017Jun 2017Aug 2017Sep 2017Nov 2017Dec 2017Q4 2017 Share Price Performance – 1 lMuleSoftVerisk Microsoft TeradataIBMMicroS.SAPCloudera OracleTalent(8.2)%Tableau1. Excludes Alteryx, Cloudera, and MuleSoft because they went public in the LTM period.Source: Public filings as of 31-Dec-2017, CapitalIQCLEARSIGHT MONITOR Big Data Industry Q4 20177

has been acquired byA portfolio company ofWe would like to thank all of our clients, colleagues and friends for helping toreinforce Clearsight as the leader in advising high-end consulting firmsCONTACT USABOUT USClearsight Advisors is a premier, independent investment bank dedicated toproviding world-class M&A and capital raising solutions exclusively to growthoriented Technology and Business Services companies. Clearsight combinesdeep market insights across software, services and data. This market knowledgecombined with superior strategic and financial advice allows Clearsight to act as acatalyst, enabling entrepreneurs, private equity owners and boards of directors tosuccessfully advance their vision. Clearsight Capital Advisors, Inc., a whollyowned subsidiary, is a registered member of FINRA & SIPC. For moreinformation, please visit www.clearsightadvisors.com1650 Tysons Blvd., Suite 710McLean, Virginia 22102325 North St. Paul Street, Suite 3500Dallas, TX ightmbClearsight Advisors

Gartner Data and Analytics Summit Grapevine, TX April 22-27 Enterprise Data World San Diego, CA May 22-23 . IDC states worldwide revenues for Big Data and business analytics will grow from 130 billion in 2016 to over 203 predicts 70% of enterprises will implement AI over . AtScale provides a business intelligence platform designed to make .