Transcription

How to Structure YourPartnership AgreementJuly 21, 2016Terrence Putney, CPA, CEOTransition Advisors

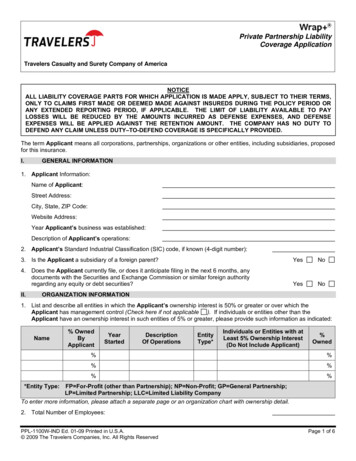

NASBA CPE Earned Credit GuidelinesTransition Advisors, LLC is a sponsor on the NationalRegistry of CPA Sponsors per the National Association of State Boardsof Accountancy (NASBA).In order to receive your one CPE credit – You must complete tworequirements:1) Participate in three of the four polling questions during thepresentation.2) Complete an online evaluation after the webinar.

Attendee Control PanelTake a moment to familiarize yourself with your Go To Webinarcontrol panel on the right hand side of your screen.The orange arrow on the top of the control panel is to minimizethe control panel.All participants are muted during the presentation, but you cancommunicate with us using the question box towards the bottomof your control panel.Just type your question in the box and click send.The presenter will answer all your questions during ourpresentation and we welcome your participation.

Upcoming WebinarsTransition Advisors, LLC offers FREE monthly CPE coursesUpcoming Webinars:August 4 – Growing Your Firm Through New Practice NichesAugust 18 - Preparing Your Firm for an Upstream MergerSeptember 7 – Succession Planning: Alternative Deal StructuresVisit transitionadvisors.com/upcoming-courses.php for more information.

Transition AdvisorsNational Consulting Firm working exclusively withaccounting firms on issues related to ownership transition

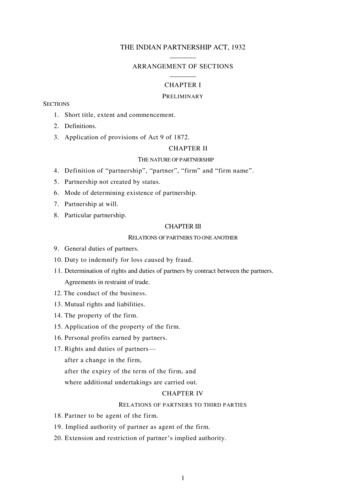

Objectives Governing the operation of the firm Managing the transition and buyout of retiringowners Addressing and controlling unexpected andsudden terminations of owners Admitting new owners Use in M & A

Polling QuestionHow many equity partners do you have in yourfirm?1) 12) 2 to 43) 5 to 94) 10 to 195) 20

Equity: What Does It Mean? CompensationDecision makingAllocating tangible valueAllocating intangible valueAllocations can be different inall four areas

Equity-What Does It Mean Be aware of the consequences of too muchequity owned by one partner when equityused to allocate value– Affect on succession planning– Affect on internal transfers of ownership– Affect on mergers & sales– Interrelationship of compensation and value

GovernanceBy way of example Managing Partner Normal hiring and operations Simply majority Expenses in excess of certain amount Super majority Admission of new partner Unanimous Dissolution or sale

GovernancePros and Cons of Unanimous DecisionRequirements

Value Issues Maintaining value through proper transitionAffordabilityMethods for determining valueTrends

Principles of ValueTwo Pools of AssetsIntangible AssetsTangible Assets

Principles of ValueWhat creates intangible value for your practiceThe intangible value of your firm is primarily made upof relationships. Value is created based on your abilityand that of a successor/buyer to successfully transferclient relationships from a retiring owner/ seller to a thesuccessor/buyerIn most firms if the clients can’t be retained, the firmhas no intangible value

Principles of ValueKeys to maintaining intangible value whenpartners retire/terminate Right successors to transition to Enough time to execute the transition plan Proper execution of the planYou need a strong transition business plan andto tie into the owner agreement

Principles of ValueTying transition to your owner agreement Adequate notice period for termination– 2 years is normal Execution of written transition plan Penalties for failure to comply Dealing with death, disability, involuntarytermination

Polling QuestionHow many partners in your firm will likely slow downover the next five years?1) None2) All3) Most4) Some

AffordabilityBackwards ValuationReward your retiringpartners fairly for theiryears of sweat equityBUTDon’t expect yourremaining partners toborrow or take a step backin compensation to do it.

Right Financial ArrangementAvailable capital is the retired partner’s foregonecompensation.Three uses for that capital: Pay the retiring partner off. Cost of replacing that partner. Some upside for the remaining partners forassuming the obligation and the extra work.

Right Financial ArrangementExample:Retiring partner comp and benefits 300kReplacement resources 120kRemaining capital 180kYou need to decide how much can be used forbuyout and how much should be left behind.

Example Firm volume 1.9 millionRetiring partner equity45%Retiring partner comp & ben 275,000Capital account 175,000Payout retirement over 5 years(works out to 171,000 per year) Cost of replacement resources 125,000

Example Year 1 net cash flow: 275,000 less 125,000 equals 150,000of available capital 150,000 less 175,000 (cap acct) less 171,000 (retirement) equals 146,000 of negative cash flow Years 2 thru 5 net cash flow: 150,000 less 171,000 equals 21,000 of negative cash flow

ExampleAlternative plan: Pay capital over 5 years Pay retirement over 10 years

Example Years 1 thru 5 net cash flow: 275,000 less 125,000 equals 150,000of available capital 150,000 less 35,000 (cap acct) less 85,500 (retirement) equals29,500 of positive cash flow Years 6 thru 10 net cash flow: 150,000 less 85,500 equals 64,500 of positive cash flow

Polling QuestionI believe our approach to valuing our owner’s interestin the firm is1) Fair and affordable2) Fair, but I’m not sure we can afford the buyouts3) Not fair, too high4) Not fair, too low5) N/A, we don’t have an agreement

Internal Valuation MethodsValuation methodology-for those w agmntOf those responding to recent AICPA survey*37% use a multiple of equity16% use managed book of business22% use a multiple of compensation25% use something else*2012 PCPS Succession Survey

Internal Valuation Benchmarks Average valuation of intangibles to revenue– Firms over 20M– 10M to 20M– 2M to 10M– Under 2MPer 2015 Rosenberg Survey68.5%77.8%80.6%85.0%

Internal Valuation BenchmarksValuation methodologyof those usingcompensation Almost 40% use three times About 15% use two and onehalf times Between 15% and 20% usetwo times

Internal v External Valuations Generally internal less based on revenuemultiple– Put option– Lack of retention adjustment-rely on transition– Legacy discount

Mandatory retirement ageShould your agreement include one?If so what should it be?66% of all firms have mandatory age*29% over 6559% @ 655% @ 622% under 62Trend is increasing age*2015 Inside Public Accounting

New Partner Buy-insBetween 103,000 and 151,000 for allsize firms*10% promote 8-10 yrs**27% promote 10-12 yrs38% promote 12-15 yrs23% promote 15 yrs*2015 Rosenberg Survey**2015 IPA Survey

New Partner Buy-ins For comp multiple systems-control valueallocation with vesting For equity based systems-use smaller initialequity and vesting Address parity in equity long term Use of unit system for equity allocation

AAV/Unit Method Determination and use of AAV units Example Redistribution-retirements and terminations

AAV/Unit MethodUse for new partner admission Admission date– Ptnr A: 1,200,000 units– 5 other ptnrs: 1,000,000 units each– New ptnr: 0 units

AAV/Unit MethodUse for new partner admission 5 years later– Ptnr A: 1,400,000 units– 5 other ptnrs: 1,200,000 units each– New ptnr: 200,000 units Ptnr A retires-10 year payout– 140,000 units redistributed annually to remainingpartners

AAV/Unit MethodBenefits Doesn’t require new partners to buy intangible valueFlexible allocationRewards sweat equityBuilt in vestingFlexibility of comp based combined with ownershipof equity based

VestingWhen is it appropriate?How long should it be?TenureAgeMerged in partners

Polling QuestionDoes your firm have an owner agreement?1) Yes, and it is signed by all owners2) Yes, but not all owners have signed it3) No, but we need one4) No, and we aren’t sure we need one

Tax Consequences Corps v Partnerships Personal Goodwill Sec 736– (a) retirement– (b) partnership interest 409A

Your Owner Agreement-M&A Your agreement defines seller’s value Your agreement likely to be less valuable Uncertainty in sellers’ minds

Your Owner Agreement-M&A Example of equity based versus comp based out ofbalance– Senior partner 60% of equity, 25% of comp– Four other partners avg 10% of equity, 18% of comp Buyout of senior partner isn’t affordable Significant eventual overvaluation of firm if a mix ofcomp based and equity buyout Good example of AAV benefit

Suggested Additional InfoThe following webinars are available on our website: www.transitionadvisors.com/archives.phpArt of Your Deal July 7, 2016Preparing Your Firm to Grow Through M & AJune 23, 2016Valuing Small Accounting Firms May 19, 2016How Tax Season Impacts M & A January 14, 2016Seven Step Roadmap for Your Merger, Acquisition or SaleOctober 21, 2015

ArticlesCPA Firm Succession SeriesJuly, 2013 thru June, .phpCPA Firm Valuation SeriesOctober, 2014 thru December, firm.phpHow To Admit New Partners-A Fresh ApproachDecember, .php

For More InformationVisit the AICPA Succession Planning Resource es/default.aspx

Gary Adamson, Adamson AdvisoryBonnie Buol Ruszczyk, bbr marketingSarah Dobek, Inovautus ConsultingAngie Grissom, The RainmakerCompaniesDustin Hostetler, Boomer ConsultingRita Keller, Keller AdvisorsRoman Kepczyk, Xcentric Tamera Loerzel,ConvergenceCoachingTerry Putney, Transition AdvisorsCarrie Steffen, The Whetstone GroupSandra Wiley, Boomer ConsultingJennifer ce.com#SuperConf15

Bridging the Gap: Strengthening the ConnectionBetween Current and Emerging Leaders in theCPA ProfessionAmazon.com 49.97

Free White Papers on Industry Trends CPA Firm Leadership: Communication Drives NewPossibilities Measuring Happiness at Work: How Firms Can WinWith a Happy Culture Top CPA Firms Succession ChallengesDownload at: www.cpaconsultantsalliance.com

For More InformationPlease visit our website for resources includingFREE reports, whitepapers and case 50www.TransitionAdvisors.com

Of those responding to recent AICPA survey* 37% use a multiple of equity 16% use managed book of business . Address parity in equity long term Use of unit system for equity allocation. AAV/Unit Method Determination and use of AAV units . How long should it be? Tenure Age Merged in partners. Polling Question