Transcription

PRINCIPAL FUNDS, INC. (“PFI”)Class A SharesClass P SharesInstitutional Class SharesClass R-6 SharesThe date of this Prospectus is June 28, 2016The ticker symbols for series and share classes are on the next page.The Securities and Exchange Commission and the Commodity Futures Trading Commission have not approved ordisapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary isa criminal offense.

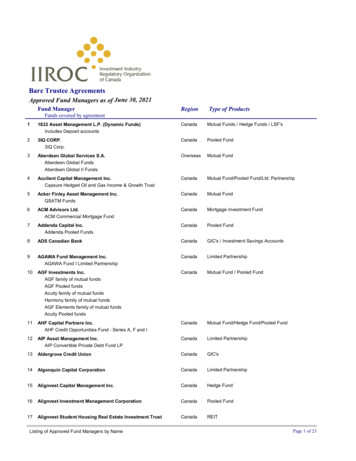

Ticker Symbols by Share ClassFundAPFinisterre Unconstrained Emerging Markets BondPFUEXPFUBXPrincipal LifeTime Hybrid IncomePrincipal LifeTime Hybrid 2015Principal LifeTime Hybrid 2020Principal LifeTime Hybrid 2025Principal LifeTime Hybrid 2030Principal LifeTime Hybrid 2035Principal LifeTime Hybrid 2040Principal LifeTime Hybrid 2045Principal LifeTime Hybrid 2050Principal LifeTime Hybrid 2055Principal LifeTime Hybrid TXPLMTXPLNTXPLJTXPLHTXPLKTX

Principal Funds, Inc.Supplement dated January 30, 2017to the Statutory Prospectus dated June 28, 2016(as supplemented July 29, 2016, December 16, 2016, and December 22, 2016)This supplement updates information currently in the Statutory Prospectus. Please retain thissupplement for future reference.PURCHASE OF FUND SHARESIn the Payment section, under Class A Shares, delete the third paragraph and replace with the following:You may reinvest your redemption proceeds, dividend payment or capital gain distribution without an initialsales charge or contingent deferred sales charge, in the same share class of any other Fund of PrincipalFunds within 90 days of the date of the redemption. To purchase the shares without a sales charge (initial orcontingent deferred) as described in this section, the shareholder must notify Principal Funds at the time ofreinvestment that the shareholder is reinvesting proceeds within 90 days of the date of redemption. Theoriginal redemption will be considered a sale for federal (and state) income tax purposes even if the proceedsare reinvested within 90 days. If a loss is realized on the sale, the reinvestment may be subject to the “washsale” rules resulting in the postponement of the recognition of the loss for tax purposes.CHOOSING A SHARE CLASS AND THE COSTS OF INVESTINGIn the One-Time Fee - Initial Sales Charge section, under Initial Sales Charge Waiver, delete the secondbulleted item, and replace with the following: You may reinvest the Funds’ Class A share redemption proceeds without a sales charge within 90 days ofthe redemption, if you previously paid a sales charge. Shares invested directly within the Class A MoneyMarket Fund are not eligible for this waiver; however, shares in the Money Market Fund that were obtainedby exchange of another Fund that imposed an initial sales charge are eligible.1FV822A3S-03

Principal Funds, Inc.Supplement dated December 22, 2016to the Statutory Prospectus dated June 28, 2016(as supplemented July 29, 2016 and December 16, 2016)This supplement updates information currently in the Statutory Prospectus. Please retain this supplementfor future reference.SUMMARY FOR FINISTERRE UNCONSTRAINED EMERGING MARKETS BOND FUNDDelete the fourth and fifth paragraphs under Principal Investment Strategies, and replace with the following:The Fund may invest, without limitation, in high yield securities (also known as “junk bonds”) rated at the time ofpurchase Ba1 or lower by Moody’s Investors Services, Inc., and BB or lower by S&P Global Ratings ("S&PGlobal") (if the security has been rated by only one of these agencies, that rating will determine whether the securityis below investment grade; if the security has not been rated by either of those agencies, the Sub-Advisor willdetermine whether the security is of a quality comparable to those rated below investment grade). Holdings mayrange in maturity from overnight to 30 years or more and will not be subject to any minimum credit rating standard.The Fund also utilizes derivatives to enhance return, hedge the value of its assets against adverse movements, andmanage certain investment risks. A derivative is a financial arrangement, the value of which is derived from, orbased on, a traditional security, asset, or market index. Specifically, the Fund expects to use forward contracts,futures, options, and swaps. The Fund holds cash to support certain of these investments.The Fund is considered non-diversified, which means it can invest a higher percentage of assets in securities ofindividual issuers than a diversified fund.Emerging market debt markets are particularly sensitive to adverse or unstable market, economic, political and/orother conditions. During such periods of uncertainty in these markets, the Fund is likely to take a temporarydefensive position and invest a significant portion of its assets in cash and cash equivalents.Under Principal Risks, add the following in alphabetical order within Emerging Markets Risk: Temporary Defensive Strategy Risk. In taking a large cash position, the Fund’s performance may beadversely affected as the Fund may not be able to benefit from an upswing in the market. Further, the Fundmay be unable to pursue or achieve its investment objective when employing such a defensive strategy.FV822A3S-021

Principal Funds, Inc.Supplement dated December 16, 2016to the Statutory Prospectus dated June 28, 2016(as supplemented on July 29, 2016)This supplement updates information currently in the Statutory Prospectus. Please retain thissupplement for future reference.SUMMARY FOR PRINCIPAL LIFETIME HYBRID 2060 FUNDIn the Average Annual Total Returns table, change “S&P Target Date 2055 Index” to “S&P Target Date2055 Index”.Effective December 31, 2016, insert a row above “S&P Target Date 2055 Index”, and add the following:Average Annual Total ReturnsFor the periods ended December 31, 20151 YearLife of FundS&P Target Date 2060 Index (reflects no deduction for fees, expenses, or taxes)(0.66)%1.11Effective December 31, 2016, add the following after the paragraph that begins, “After-tax returns arecalculated . . .”:Effective December 31, 2016, the Fund’s primary benchmark changed from S&P Target Date 2055 Index to theS&P Target Date 2060 Index because of the recent availability of the index which more closely aligns with theinvestment approach of the Fund.CHOOSING A SHARE CLASS AND THE COSTS OF INVESTINGUnder One-Time Fee - Initial Sales Charge, in the Initial Sales Charge Reduction section, delete the secondparagraph and replace with the following:(2)Statement of Intent (SOI). Qualified Purchasers may obtain reduced sales charges by signing an SOI.The SOI is a nonbinding obligation on the Qualified Purchaser to purchase the full amount indicated inthe SOI. Purchases made by you, your spouse or domestic partner, or the children of you, your spouseor domestic partner up to and including the age of 25 and/or a trust created by or primarily for thebenefit of such persons (together “a Qualified Purchaser”) will be combined along with the value ofexisting Classes A, C, and J shares of Principal Funds owned by such persons. Purchases of Class Ashares of Money Market Fund are not included. The sales charge is based on the total amount to beinvested in a 13-month period. If the intended investment is not made (or shares are sold during the13-month period), sufficient shares will be sold to pay the additional sales charge due. If a shareholderwho signs an SOI dies within the 13-month period, no additional front-end sales charge will berequired and the SOI will be considered met. An SOI is not available for 401(a) plan purchases.1FV822A3S-01

Principal Funds, Inc.Supplement dated July 29, 2016to the Statutory Prospectus dated June 28, 2016This supplement updates information currently in the Statutory Prospectus. Please retain this supplementfor future reference.DIVIDENDS AND DISTRIBUTIONSReplace the fourth paragraph with the following:Dividend and capital gains distributions will be reinvested, without a sales charge, in shares of the Fund from whichthe distribution is paid; however, you may authorize (on your application or at a later time) the distribution to be: invested in shares of another of the Principal Funds without a sales charge (distributions of a Fund may bedirected only to one receiving Fund); or paid in cash, if the amount is 10 or more.FV822A3S-0

TABLE OF CONTENTSFUND SUMMARIESFINISTERRE UNCONSTRAINED EMERGING MARKETS BOND FUNDPRINCIPAL LIFETIME HYBRID INCOME FUNDPRINCIPAL LIFETIME HYBRID 2015 FUNDPRINCIPAL LIFETIME HYBRID 2020 FUNDPRINCIPAL LIFETIME HYBRID 2025 FUNDPRINCIPAL LIFETIME HYBRID 2030 FUNDPRINCIPAL LIFETIME HYBRID 2035 FUNDPRINCIPAL LIFETIME HYBRID 2040 FUNDPRINCIPAL LIFETIME HYBRID 2045 FUNDPRINCIPAL LIFETIME HYBRID 2050 FUNDPRINCIPAL LIFETIME HYBRID 2055 FUNDPRINCIPAL LIFETIME HYBRID 2060 FUNDADDITIONAL INFORMATION ABOUT INVESTMENT STRATEGIES AND RISKSPORTFOLIO HOLDINGS INFORMATIONMANAGEMENT OF THE FUNDSPRICING OF FUND SHARESCONTACT PRINCIPAL FUNDS, INC.PURCHASE OF FUND SHARESREDEMPTION OF FUND SHARESEXCHANGE OF FUND SHARESDIVIDENDS AND DISTRIBUTIONSFREQUENT PURCHASES AND REDEMPTIONSTAX CONSIDERATIONSCHOOSING A SHARE CLASS AND THE COSTS OF INVESTINGDISTRIBUTION PLANS AND INTERMEDIARY COMPENSATIONFUND ACCOUNT INFORMATIONAPPENDIX A - DESCRIPTION OF BOND RATINGSADDITIONAL 9100101102103107109117123

FINISTERRE UNCONSTRAINED EMERGING MARKETS BOND FUNDObjective:The Fund seeks to generate total returns from current income and capital appreciation.Fees and Expenses of the FundThis table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You mayqualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least 100,000 inClass A Shares of Principal Funds, Inc. More information about these and other discounts is available from yourfinancial professional and in “Choosing a Share Class and The Costs of Investing” beginning on page 103 of theFund’s prospectus and “Multiple Class Structure” beginning on page 6 of the Fund’s Statement of AdditionalInformation.Shareholder Fees (fees paid directly from your investment)Share ClassAPInst.Maximum Sales Charge (Load) Imposed on Purchases (as a percentage ofoffering price)3.75%NoneNoneMaximum Deferred Sales Charge (Load) (as a percentage of the offering priceor NAV when Sales Load is paid, whichever is less)1.00%NoneNoneAnnual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment)Share ClassAPInst.Management Fees1.02%1.02%1.02%Distribution and/or Service (12b-1) Fees0.25%N/AN/AOther Expenses (1)0.60%0.43%0.43%Total Annual Fund Operating ExpensesExpense Reimbursement (2)Total Annual Fund Operating Expenses after Expense .47%1.15%1.12%(1)Based on estimated expenses for the current fiscal year.(2)Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund’s expenses bypaying, if necessary, expenses normally payable by the Fund, (excluding interest expense, expenses related to fund investments,acquired fund fees and expenses, and other extraordinary expenses) to maintain a total level of operating expenses (expressed as apercent of average net assets on an annualized basis) not to exceed 1.47% for Class A, 1.15% for Class P and 1.12% for InstitutionalClass shares. It is expected that the expense limits will continue through the period ending February 28, 2018; however, PrincipalFunds, Inc. and Principal, the parties to the agreement, may mutually agree to terminate the expense limits prior to the end of theperiod.ExampleThis Example is intended to help you compare the cost of investing in the Fund with the cost of investing in othermutual funds.The Example assumes that you invest 10,000 in the Fund for the time periods indicated. TheExample assumes that your investment has a 5% return each year and that the Fund’s operatingexpenses remain the same. Although your actual costs may be higher or lower, based on theseassumptions your costs would be:1 year3 yearsClass A 519 877Class P117408Institutional Class1144034

Portfolio TurnoverThe Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” itsportfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes whenFund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expensesor in the example, affect the Fund’s performance. This is a new fund and does not yet have a portfolio turnover rateto disclose.Principal Investment StrategiesUnder normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investmentpurposes, in bonds, debt securities and other fixed-income securities, and in derivatives on such investments, thatare issued by emerging market countries. A security is issued by an emerging market country if it is issued by theemerging market country’s government, is issued by a corporate entity that has its principal place of business orprincipal office in an emerging market country, or whose principal securities trading market is in an emerging marketcountry. Emerging market countries include frontier market countries. The Fund actively trades portfolio securities.The Fund follows an investment process that focuses primarily on market level analysis of global markets andpolitical developments and their impact on individual countries and companies in emerging markets. The portfolioconstruction process for the Fund will follow a top-down process, blending both fundamental and technicalconsiderations. The unconstrained nature of the investment strategy provides greater flexibility to identifyopportunities across asset classes, capital structures, maturities, and currencies.The types of fixed-income securities that the Fund can invest in include bonds, asset-backed securities (securitizedproducts), convertible bonds, contingent convertible securities (hybrid bonds that will, when the issuers capital ratiofalls below a predetermined trigger level, be converted into an equity security), credit and index linked securities, andnon-registered or restricted securities (including those issued in reliance on Rule 144A and Regulation S). Thesetypes of securities may be issued by stressed, distressed and bankrupt issuers.The Fund may invest, without limitation, in high yield securities (also known as “junk bonds”) rated at the time ofpurchase Ba1 or lower by Moody’s Investors Services, Inc., and BB or lower by Standard & Poor’s Rating Services(if the security has been rated by only one of these agencies, that rating will determine whether the security is belowinvestment grade; if the security has not been rated by either of those agencies, the Sub-Advisor will determinewhether the security is of a quality comparable to those rated below investment grade). Holdings may range inmaturity from overnight to 30 years or more and will not be subject to any minimum credit rating standard. The Fundalso utilizes derivatives to enhance return, hedge the value of its assets against adverse movements, and managecertain investment risks. A derivative is a financial arrangement, the value of which is derived from, or based on, atraditional security, asset, or market index. Specifically, the Fund expects to use forward contracts, futures, options,and swaps.The Fund is considered non-diversified, which means it can invest a higher percentage of assets in securities ofindividual issuers than a diversified fund.Principal RisksThe value of your investment in the Fund changes with the value of the Fund's investments. Many factors affect thatvalue, and it is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit of a bankand is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Theprincipal risks of investing in the Fund, in alphabetical order, are:Convertible Securities Risk. Convertible securities are bonds, notes, debentures, preferred stock or othersecurities which are convertible into common stock. Convertible securities are subject to credit and interest rate risksassociated with fixed income securities and to stock market risk associated with equity securities.Counterparty Risk. Counterparty risk is the risk that the counterparty to a contract or other obligation will be unableor unwilling to honor its obligations.Derivatives Risk. Derivatives may not move in the direction anticipated by the portfolio manager. Transactions inderivatives may increase volatility, cause the liquidation of portfolio positions when not advantageous to do so andresult in disproportionate losses that may be substantially greater than a fund's initial investment. Credit Default Swaps. Credit default swap agreements involve specific risks because they may be difficultto value, are highly susceptible to liquidity and credit risk, and generally pay a return to the party that haspaid the premium only in the event of an actual default by the issuer of the underlying obligation (as opposedto a credit downgrade or other indication of financial difficulty). Credit default swaps can increase credit riskbecause the fund has exposure to both the issuer of the referenced obligation and the counterparty to thecredit default swap.5

Currency Contracts. Derivatives related to currency contracts involve the specific risk of government actionthrough exchange controls that would restrict the ability of the fund to deliver or receive currency. Forward Contracts, Futures and Swaps. Forward contracts, futures, and swaps involve specific risks,including: the imperfect correlation between the change in market value of the instruments held by the fundand the price of the forward contract, future or swap; possible lack of a liquid secondary market for a forwardcontract, future or swap and the resulting inability to close a forward contract, future or swap when desired;counterparty risk; and if the fund has insufficient cash, it may have to sell securities from its portfolio to meetdaily variation margin requirements. Options. Options involve specific risks, including: imperfect correlation between the change in market valueof the instruments held by the fund and the price of the options, counterparty risk, difference in trading hoursfor the options markets and the markets for the underlying securities (rate movements can take place in theunderlying markets that cannot be reflected in the options markets), and an insufficient liquid secondarymarket for particular options.Distressed Investments Risk. A fund’s investment in instruments involving loans, loan participations, bonds, notes,non-performing and sub-performing mortgage loans, many of which are not publicly traded, may involve a substantialdegree of risk for the following reasons. These instruments may become illiquid and the prices of such instrumentsmay be extremely volatile. Valuing such instruments may be difficult and a fund may lose all of its investment, or itmay be required to accept cash or securities with a value less than the fund’s original investment. Issuers ofdistressed securities are typically in a weak financial condition and may default, in which case the fund may lose itsentire investment.Emerging Markets Risk. Investments in emerging market countries may have more risk than those in developedmarket countries because the emerging markets are less developed and more illiquid. Emerging market countriescan also be subject to increased social, economic, regulatory, and political uncertainties and can be extremelyvolatile. Frontier Markets Risk. Frontier market countries are emerging market countries, but generally have smalleconomies or less mature capital markets than more developed emerging markets, and, as a result, the risksof investing in emerging market countries are magnified in frontier countries. The markets of frontiercountries typically have low trading volumes and the potential for extreme price volatility and illiquidity.Fixed-Income Securities Risk. Fixed-income securities are subject to interest rate risk and credit quality risk. Themarket value of fixed-income securities generally declines when interest rates rise, and an issuer of fixed-incomesecurities could default on its payment obligations.Foreign Currency Risk. Risks of investing in securities denominated in, or that trade in, foreign (non-U.S.)currencies include changes in foreign exchange rates and foreign exchange restrictions.Foreign Securities Risk. The risks of foreign securities include loss of value as a result of: political or economicinstability; nationalization, expropriation or confiscatory taxation; settlement delays; and limited governmentregulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S.companies).Hedging Risk. A fund that implements a hedging strategy using derivatives and/or securities could expose the fundto the risk that can arise when a change in the value of a hedge does not match a change in the value of the asset ithedges. In other words, the change in value of the hedge could move in a direction that does not match the changein value of the underlying asset, resulting in a risk of loss to the fund.High Yield Securities Risk. High yield fixed-income securities (commonly referred to as "junk bonds") are subject togreater credit quality risk than higher rated fixed-income securities and should be considered speculative.Leverage Risk. Leverage created by borrowing or certain types of transactions or investments may impair the fund’sliquidity, cause it to liquidate positions at an unfavorable time, increase volatility of the fund’s net asset value, ordiminish the fund’s performance.Non-Diversification Risk. A non-diversified fund may invest a high percentage of its assets in the securities of asmall number of issuers and is more likely than diversified funds to be significantly affected by a specific security’spoor performance.Portfolio Duration Risk. Portfolio duration is a measure of the expected life of a fixed-income security and itssensitivity to changes in interest rates. The longer a fund's average portfolio duration, the more sensitive the fund willbe to changes in interest rates.6

Portfolio Turnover (Active Trading) Risk. A fund that has a portfolio turnover rate over 100% is considered activelytraded. Actively trading portfolio securities may accelerate realization of taxable gains and losses, lower fundperformance and may result in high portfolio turnover rates and increased brokerage costs.Securitized Products Risk. Investments in securitized products are subject to risks similar to traditional fixedincome securities, such as credit, interest rate, liquidity, prepayment, extension, and default risk, as well as additionalrisks associated with the nature of the assets and the servicing of those assets. Unscheduled prepayments onsecuritized products may have to be reinvested at lower rates. A reduction in prepayments may increase the effectivematurities of these securities, exposing them to the risk of decline in market value over time (extension risk).PerformanceNo performance information is shown below because the Fund has not yet had a calendar year of performance.The Fund's performance is benchmarked against the JPM CEMBI Diversified Index. Performance informationprovides an indication of the risks of investing in the Fund. Past performance (before and after taxes) is notnecessarily an indication of how the fund will perform in the future. You may get updated performance information bycalling 1-800-222-5852 or online at: For Class A and P - www.principalfunds.com. For Institutional Class - www.principal.com.ManagementInvestment Advisor:Principal Management CorporationSub-Advisor and Portfolio Managers:Finisterre Capital LLP Damien Buchet, Portfolio Manager (since 2016) Arthur Duchon-Doris, Assistant Portfolio Manager (since 2016) Christopher Watson, Portfolio Manager (since 2016)Purchase and Sale of Fund SharesPurchase MinimumPer Fund 1,000(1)Share ClassInvestment TypeAInitial InvestmentAInitial Investment for accounts with an Automatic Investment Plan (AIP)ASubsequent InvestmentsP and InstitutionalThere are no minimum initial or subsequent investment requirements foreligible purchasers. 100 100(1)(2)N/A(1)Some exceptions apply; see "Purchase of Fund Shares - Minimum Investments" for more information.(2)For accounts with an AIP, the subsequent automatic investments must total 1,200 annually if the initial 1,000 minimum has not been met.You may purchase or redeem shares on any business day (normally any day when the New York Stock Exchange isopen for regular trading), through your plan, intermediary, or Financial Professional; by sending a written request toPrincipal Funds at P.O. Box 8024, Boston, MA 02266-8024 (regular mail) or 30 Dan Road, Canton, MA 02021-2809(overnight mail); calling us at 1-800-222-5852; or accessing our website (www.principalfunds.com).Tax InformationThe Fund’s distributions you receive are generally subject to federal income tax as ordinary income or capital gainand may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-deferred in whichcase your distributions would be taxed when withdrawn from the tax-deferred account.Payments to Broker-Dealers and Other Financial IntermediariesIf you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank, insurancecompany, investment adviser, etc.), the Fund and its related companies may pay the intermediary for the sale ofFund shares and related services. These payments may create a conflict of interest by influencing the broker-dealeror other intermediary and your salesperson to recommend the Fund over another investment, or to recommend oneshare class of the Fund over another share class. Ask your salesperson or visit your financial intermediary's websitefor more information.7

PRINCIPAL LIFETIME HYBRID INCOME FUNDObjective:The Fund seeks current income, and as a secondary objective, capital appreciation.Fees and Expenses of the FundThis table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.Shareholder Fees (fees paid directly from your investment): NoneAnnual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment)Share ClassInst.R-60.00%0.00%Management Fees (1)N/AN/A(2)34.60%16.28%Acquired Fund Fees and ribution and/or Service (12b-1) FeesOther ExpensesTotal Annual Fund Operating ExpensesExpense Reimbursement (3)Total Annual Fund Operating Expenses After Expense Reimbursement0.53%0.50%Management Fees in the table have been restated to reflect current fees. Effective March 1, 2016, the Management Fees were reduced.(1)(2)(3)Based on estimated amounts for the current fiscal year (Class R-6).Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund’s expenses by paying, ifnecessary, expenses normally payable by the Fund, (excluding interest expense, expenses related to fund investments, acquired fund feesand expenses, and other extraordinary expenses) to maintain a total level of operating expenses (expressed as a percent of average netassets on an annualized basis) not to exceed 0.05% for Institutional and 0.02% for R-6 shares. It is expected that the expense limits willcontinue through the period ending February 28, 2018; however, Principal Funds, Inc. and Principal, the parties to the agreement, maymutually agree to terminate the expense limits prior to the end of the period.ExampleThis Example is intended to help you compare the cost of investing in the Fund with the cost of investing in othermutual funds.The Example assumes that you invest 10,000 in the Fund for the time periods indicated. TheExample also assumes that your investment has a 5% return each year and that the Fund’s operatingexpenses remain the same. Although your actual costs may be higher or lower, based on theseassumptions your costs would be:Institutional ClassClass R-61 year 54513 years 4,1652,3015 years 7,6025,01410 years 10,3409,451Portfolio TurnoverAs a fund of funds, the Fund does not pay transaction costs, such as commissions, when it buys and sells shares ofunderlying funds (or “turns over” its portfolio). An underlying fund does pay transaction costs when it buys and sellsportfolio securities, and a higher portfolio turnover may indicate higher transaction costs. These costs, which are notreflected in annual fund operating expenses or in the examples, affect the performance of the underlying fund andthe Fund. During its most recent fiscal year, the Fund's portfolio turnover rate was 116.2% of the average value of itsportfolio.Principal Investment StrategiesThe Fund invests according to an asset allocation strategy designed for investors primarily seeking current incomeand secondarily capital appreciation. The Fund's asset allocation is designed for investors who are approximately 15years beyond the normal retirement age of 65. The Fund is a fund of funds that invests in Institutional Class sharesof Principal Funds, Inc. (“PFI”), with a majority of the Fund's assets invested in index funds. Its underlying fundsconsist of domestic and foreign equity funds, fixed-income funds, real asset funds, and other funds that aim to offerdiversification beyond traditional equity and fixed-income securities. The Fund actively trades portfolio securities. TheFund is managed by Principal Management Corporation (“Principal”).8

Principal develops, implements and monitors the Fund's str

Fund A P Inst. R-6 Finisterre Unconstrained Emerging Markets Bond PFUEX PFUBX PFUMX Principal LifeTime Hybrid Income PHTFX PLTYX Principal LifeTime Hybrid 2015 PHTMX PLRRX Principal LifeTime Hybrid 2020 PHTTX PLTTX Principal LifeTime Hybrid 2025 PHTQX PLFTX Principal LifeTime Hybrid 2030 PHTNX PLZTX Principal LifeTime Hybrid 2035 PHTJX PLRTX