Transcription

PAYCHECK PROTECTION PROGRAM STANDARDYour Guide to Applyingfor Loan ForgivenessMEMBER FDIC

We’re here to help!This How-To Apply Guide will take you through all the steps you need to take to apply for PPP Loan Forgiveness.What You Need to KnowHelpful Tips and RequirementsWhen to apply The Enter and Save feature allows you toBased on the rollout schedule, you will be “port enabled”enter your information, save it and return later.and receive an email notification that you are able toapply for Forgiveness with a link to access the portal.Adding additional UsersIf you need to add an additional person to assistin the completion of the Application, contact yourForgiveness Rep. If you’re unable to advance screens whenselecting Next, check for required fields. After entering data into a field, click Tab toadvance off the last field entered. The portal works best when launched in aGoogle Chrome browser.Important Reminders There are two applications available: 3508 EZ and 3508. You will be routed to the appropriate application basedon your answers to qualifying questions. Once you submit the application, you cannot go back in andedit until the Northern Bank Credit Analyst. re-enables you.How-To Apply Guide: PPP Forgiveness Standard Application2

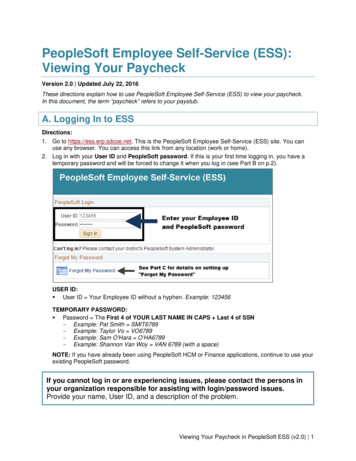

Login and Dashboard1Login2You will be routed to the Dashboard3Select Marketplace from left side of Dashboard4Click ApplyHow-To Apply Guide: PPP Forgiveness Standard Application3

Review Business and OwnershipInformation and Confirm1Review the information displayedNote: If multiple entities are tiedto you, all will be displayed2Click Apply with this Business3Tell Us About Yourself —review information on business owner4Click NextHow-To Apply Guide: PPP Forgiveness Standard Application4

Covered Period and Payroll FrequencyIn this section, you’ll be required to indicate the Covered Period or Alternative Covered Period and Payroll Frequency.Note: The side panel will provide informational text to define terms.1Select either the 8-week or 24-week period:IF THEN You received the PPPYou can elect to useLoan before June 5th8 weeks or 24 weeksYou received the PPPYou must electLoan after June 5th24 weeks2Select their Payroll Frequency1If you have a bi-weekly or more frequent period,Alternative Covered Periodyou can elect to use the Alternative CoveredPeriod, which starts the first day of the payperiod following the Disbursement Date.IF THEN You do notSelect Nowish to usethe AlternativePayroll CoveredPeriodYou elect toSelect Yesuse theEnter the AlternativeAlternativePeriod Begin DatePayroll CoveredPeriod2Click NextHow-To Apply Guide: PPP Forgiveness Standard Application5

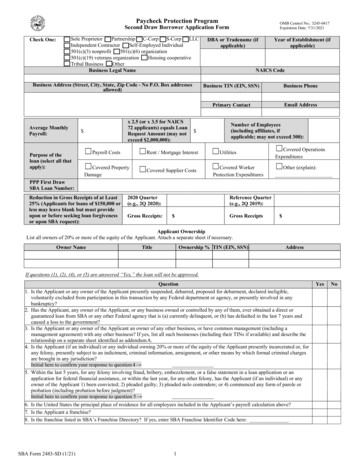

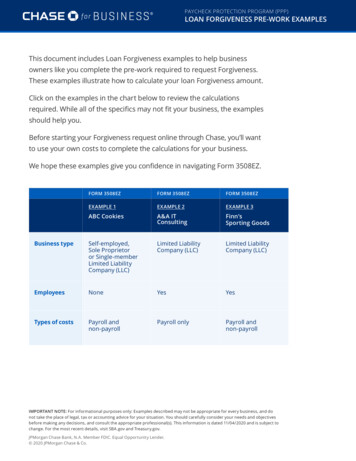

Application Types: Form 3508 or 3508EZIn this section, it will be determined whether or not you are eligible to complete the EZ Form or the Standard Form.1Review the Qualification QuestionsIF THEN You are a self-employed individual, independentQualification Option 1 applies; select Yescontractor or sole proprietor who had noemployees at the time of the Loan ApplicationQualification Option 1 doesn’t applySelect NoYou did not reduce salary/wages of any employeeQualification Option 2 applies; select Yesby more than 25% and did not reduce the numberof employeesNote: Ignore reductions in hours if you offered hoursand employee refusedQualification Option 2 doesn’t applySelect NoYou did not reduce salary/wages of any employeeQualification Option 2 applies; select Yesby more than 25% and you were unable to operateduring the Covered Period at the same level ofbusiness activity as before 2-15-2020Qualification Option 3 doesn’t applySelect No2If you do not qualify for the EZ Application, you will select No on all three (3) Qualification Options.4Click NextHow-To Apply Guide: PPP Forgiveness Standard Application7

Payroll CostsIn this section, we’ll cover the process of entering in the Payroll related costs.Note: All fields are required. Enter “0” (Zero) for anything not applicable.1Eligible Payroll Costs — You should enter the following information based on the Covered Periodor Alternative Covered Period:n2Total Cash Compensation paidnTotal Cash Compensation paid for employees earning greater than 100,000nTotal Amount Paid for Employee Health InsurancenTotal Amount Paid for Employee Retirement PlansnTotal Amount Paid for Employer State and Local TaxesCompensation to Owners — You should then enter the total compensation paid to any owners.Note: The owner compensation is limited; refer to the text for information.3Number of Owners — You should enter the total number of owners.4Click NextHow-To Apply Guide: PPP Forgiveness Standard Application8

Headcount and Salary InformationIn this step, you’ll be prompted to enter information about employee headcount and salaries.Headcount and Salary Information1Employees at Time of Loan Applicationn the Bank has the information on file from the Loan Application, the number will pre-fill.IfIf the Bank does not have the information, you should enter the Number of Employees at time of Loan Application2Employees at Time of Forgiveness ApplicationYou should enter the number of Employees at time of Forgiveness ApplicationPPP Forgiveness Calculation Specific Headcount DetailsYou will be prompted to answer Yes or No in Step 1.1Was there a reduction in the number of employees or average paidhours between January 1, 2020 and the end of the Covered Period?IF THEN YesSelect YesNote: FTE Reduction Safe Harbor Questions will displayNoSelect No2Enter the average weekly number of FTE’s during your chosen reference period3Enter the average number FTEs during the chosen reference period4Enter the average number of FTEs during the Covered Period orAlternative Payroll Covered Period with compensation 100k5Enter the average number of FTEs during the Covered Period orAlternative Payroll Covered Period with compensation 100kHow-To Apply Guide: PPP Forgiveness Standard Application9

FTE Reduction Safe HarborTwo separate safe harbors exempt certain borrowers from any loan forgiveness reduction based on a reductionin FTE employee levels: FTE Reduction Safe Harbor 1 and FTE Reduction Safe Harbor 2.Note: Refer to the SBA Forgiveness Program Overview document for more information.You need to select which FTE Reduction Safe Harbor is applicable, if any.Salary Details1You will be prompted to answer Yes or No to:Did you reduce salary or hourly wages during the Covered Period or the Alternative Covered Period?IF THEN YesSelect YesNote: An additional question appears.No2Select NoClick NextHow-To Apply Guide: PPP Forgiveness Standard Application8

Non-Payroll CostsIn this section, you’ll be prompted to enter the Non-Payroll related expenses.1Enter the amount used on Mortgage Interest2Enter the amount used on Rent/Lease3Enter the amount used on Utilities4Click NextHow-To Apply Guide: PPP Forgiveness Standard Application10

Additional DetailsYou’ll be prompted to answer additional questions:nnIs the PPP loan in excess of 2 Million?Did you receive any EIDL funds?1Did you receive PPP loans in excess of 2 Million?Select Yes or No2If you received funds via the Economic Injury Disaster Loan (EIDL),enter the EIDL Loan Number and amount; if not continue to Step 33Click NextHow-To Apply Guide: PPP Forgiveness Standard Application11

Estimated Forgiveness Calculation1Based on the information entered on previousscreens, the system will calculate the EstimatedForgiveness Amount.Note: In this example, the amount of the Loan isgreater than the Forgiveness Amount, thereforethe customer has some potential loan exposure.2Click NextPPP Schedule ASummary of information enteredHow-To Apply Guide: PPP Forgiveness Standard Application12

Certification1The Certification page ensures that youare supplying true and accurate information;you must certify each section2Click Next1You can consent to electronic signature:E-Consent Electronic SignatureJust enter name and initials to authorizethe use of the electronic signature2Click Next1You are then routed to the BorrowerBorrower Demographics: OptionalDemographic screen, which is optional2Click NextHow-To Apply Guide: PPP Forgiveness Standard Application13

Review and Submit1The “Does Everything Look Right” page gives you one final opportunity to review the information you entered.nYou may edit information by clicking on the Edit button for each section displayednIf the information is correct, you can advance to submitting the applicationNote: Once the application is submitted, you cannot make any changes.(Only Northern Bank’s Credit Analyst can make a change.)2Click Submit ApplicationYour Application Was Submitted1Click Go to DashboardHow-To Apply Guide: PPP Forgiveness Standard Application14

Uploading Documentation1You’ll be directed to the Dashboard toupload the supporting documentation2You should click on the “ ” to expand thelist of placeholders for the documentsHow-To Apply Guide: PPP Forgiveness Standard Application15

PlaceholdersThe following are the placeholder categories:I RS Form 1040 Schedule C — For Sole ProprietorsH ealth Benefits InformationM ortgage Interest InformationP PP Schedule A WorksheetP ayroll InformationR ent or Lease Information 1R ent or Lease Information 2R etirement InformationU tility Payment Information 1U tility Payment Information 2Drag and Drop or UploadYou can Drag and Drop files into the Placeholdersor click browse to search and upload files.Files supported include Excel and Word documents,PDF and JPEG.We’re here to helpwhenever you need us!If you have questions or need help with the portal,contact your Forgiveness Rep.How-To Apply Guide: PPP Forgiveness Standard Application16

Qualification Option 2 applies; select Yes Qualification Option 2 doesn't apply Select No You did not reduce salary/wages of any employee by more than 25% and you were unable to operate during the Covered Period at the same level of business activity as before 2-15-2020 Qualification Option 2 applies; select Yes