Transcription

In collaboration with theWharton Blockchain andDigital Asset ProjectDecentralized AutonomousOrganizations: Beyond the HypeWHITE PAPERJUNE 2022

Images: Getty ImagesContentsForeword3Executive summary4Introduction51 What is a DAO?61.1 Emergence of DAOs61.2 History of DAOs71.3 DAO strengths and weaknesses82 Practical elements102.1 Launching DAOs102.2 Managing DAOs113 Categories of DAOs123.1 Means and objectives133.2 Defining terms154 Key issues for the future of DAOs164.1 Practical challenges164.2 Legal and regulatory sclaimerThis document is published by theWorld Economic Forum as a contributionto a project, insight area or interaction.The findings, interpretations andconclusions expressed herein are a resultof a collaborative process facilitated andendorsed by the World Economic Forumbut whose results do not necessarilyrepresent the views of the World EconomicForum, nor the entirety of its Members,Partners or other stakeholders. 2022 World Economic Forum. All rightsreserved. No part of this publication maybe reproduced or transmitted in any formor by any means, including photocopyingand recording, or by any informationstorage and retrieval system.Decentralized Autonomous Organizations: Beyond the Hype2

June 2022Decentralized Autonomous Organizations:Beyond the HypeForewordAiden SlavinProject Lead, Crypto Impactand Sustainability Accelerator,World Economic Forum, USAInnovation has always driven organizationalcoordination. From the rise of the joint-stockcompany in the seventeenth century, thedevelopment of limited liability in the nineteenthand the proliferation of the internet in the twentieth,novel structures and technologies have, throughouthistory, profoundly altered the way humanityorganizes work. Today, blockchains, digital assetsand related technologies are changing humancoordination at a quicker rate than before, creatingboth opportunities and challenges.Worldwide, entrepreneurs are hitching the powerof distributed ledger technology to a new formof coordination, decentralized autonomousorganizations (DAOs), to deploy resources,coordinate activities and make decisionscommunally. By empowering members to propose,vote on and effect changes to an entity, DAOsenable communities to work collectively towardsachieving shared goals, often without top-down,hierarchal management.Although centralized governance has madepossible the creation of some of the most powerfulenterprises in history, centralization comes at acost. With a small minority in charge, centralizedentities tend to make decisions opaquely andconcentrate power at the top. The overheadsof centralized management can be significant.Moreover, centralized organizations mayoveremphasize narrow goals at the expense ofbroader societal considerations.By contrast, DAOs aspire to operate withoutconventional centralized intermediaries orinstitutional structures. DAOs may offer a way todemocratize the management of organizationsand direct effort towards a wide variety of goals,Kevin WerbachProfessor of Legal Studies andBusiness Ethics and Director,Blockchain and Digital AssetProject, Wharton School,University of Pennsylvania, USAincluding prosocial ends. Likewise, DAOs havethe potential to realize gains in transparency,accountability and more relative to traditionalorganizational structures, including corporations.Yet practical challenges of governance,cybersecurity and power concentration, combinedwith regulatory uncertainty and fragmentation,could lead to further hacks, privacy issues andinequality.Since DAO innovation is evolving rapidly and isprimarily led by the private sector, it is vital forpolicy-makers and regulators to stay engaged.Harnessing technologies for effective coordinationrequires more than just innovation. For DAOs torealize their full potential, recent innovations mustbe combined with evidence-based, fit-for-purposepolicy and governance informed by public-privatecollaboration focused on ensuring that DAOs aredeveloped and managed in a manner beneficial tosociety at large.This joint World Economic Forum and WhartonSchool of the University of Pennsylvania publicationaims to shed light on this topic, offering afoundation for policy-makers, regulators andsenior business leaders to understand the DAOecosystem. Forthcoming publications from thiscollaboration will provide policy frameworks forevaluating DAOs, principles-based approachesfor governing DAOs and reflections on earlyexperiments in leveraging DAOs for social impact.Throughout history, any tool that meaningfullyimproved organizational coordination eventuallybecame widespread, sparking dramatic economicand social changes. Only time will tell whetherDAOs will join this list. It is our hope that this reporthelps realize the benefits of this emerging form.Decentralized Autonomous Organizations: Beyond the Hype3

Executive summaryOpen-sourcesoftware, blockchaintechnology,economic incentivesand programmablesmart contractshave the potentialto offer greatertransparency,trust, adaptabilityand speed.In recent years, decentralized autonomousorganizations (DAOs), entities that use blockchains,digital assets and related technologies to directresources, coordinate activities and make decisions,have experienced explosive growth. According tothe analytics service DeepDAO, in 2021 the totalvalue of DAO treasuries surged fortyfold, from 400 million to 16 billion, and the number of DAOparticipants increased by 130 times from 13,000 to1.6 million.1 As DAO innovation has largely been ledby the private sector and DAOs are being developedfor an increasingly wide variety of purposes, it iscritical that policy-makers, regulators and seniorexecutives develop a nuanced understanding ofthese entities.DAO proponents assert that the novel organizationalform can address the limitations of centralizedgovernance, offering a way to democratizemanagement and direct efforts towards a widevariety of aims, including prosocial goals. Opensource software, blockchain technology, economicincentives and programmable smart contracts havethe potential to offer greater transparency, trust,adaptability and speed over traditional organizationalforms such as corporations. At the same time,DAOs face challenges of scalability, engagement,cybersecurity, privacy and regulatory uncertainty.Questions remain about whether DAOs fulfil theirvision of decentralized governance in practice.To equip policy-makers, regulators and businessleaders to develop nuanced, fit-for-purposeapproaches to DAOs, this report provides anoverview of the DAO landscape, explores DAOs’advantages and disadvantages compared totraditional organizational structures and offers abreakdown of some of the key risks they face.Forthcoming publications developed from thisinternational collaboration among academics, legalpractitioners, DAO entrepreneurs, technologists andcrypto experts will offer guidelines for developingDAOs, recommendations for policy responses andassessments of social impact use cases.1. The landscapeThe first functional DAO, known as “The DAO”,was created in 2016. In a matter of weeks, it raised 150 million in ether to create an organizationfor collective investment in blockchain projects.2When a bug in The DAO’s code was exploited tosiphon off a considerable amount of the committedassets, innovators doubled down on developingimproved DAO tooling and supporting infrastructure.Today, DAOs benefiting from a range of tools arebeing deployed for functions as various as grantmaking, social networking and driving social impact.Generally, the DAO landscape can be segmentedaccording to objective and means; namely, theprimary objective of the DAO and the means aDAO uses to achieve that objective. While someDAOs aim to power a network or application, otherspursue a specific communal objective. Likewise,while some DAOs manage activities, othersdeploy capital to achieve their goal. This reportoffers a novel taxonomy, breaking down the DAOecosystem into nine categories.2. Strengths and weaknessesAlthough DAOs are nascent, key strengths andweaknesses are already emerging. Relativeto traditional organizational forms such ascorporations, DAOs may offer a way to achievegreater transparency, trust, adaptability and speed.They also make possible rapid experimentationand the potential to direct activity towards amultiplicity of goals. Conversely, DAOs have manypotential weaknesses. DAOs today confrontissues of governance, voter engagement, powerconcentration, cybersecurity and more. Perhapsmost crucially, DAOs face regulatory fragmentationand uncertainty.3. Key risksSeveral practical, legal and regulatory risks affectDAOs. Like the blockchains they run on, manyDAOs face limitations and security challenges.Likewise, due to their pseudonymous nature,DAOs can create information asymmetries betweencreators and contributors. DAOs also continue toconfront a host of governance-related risks, suchas a lack of voter engagement and voter fatigue.Moreover, power concentration in DAOs presentsa challenge to the vision of decentralizationespoused by DAO practitioners. Crucially, DAOsalso face legal and regulatory risks concerninglegal status, applicable laws and regulations, andjurisdictional uncertainty.Critically, the aim of this report is not to provide acomprehensive analysis of the DAO ecosystem butto identify the key emerging benefits and risks ofDAOs. DAOs are nascent; their operations, utilityand functions are still being defined. As DAOscontinue to develop, our hope is that this report willhelp decision-makers develop informed analysesand actionable strategies.Decentralized Autonomous Organizations: Beyond the Hype4

IntroductionDecentralized autonomous organizations (DAOs)are entities that leverage blockchains, digital assetsand related technologies to deploy resources,coordinate activities and make decisions. DAOsattempt to decentralize the operation of firms andother collective entities by making functional andfinancial information transparent and empoweringtoken-holding members to propose, vote on andenact changes.3DAOs have recently experienced explosive growth.According to the analytics service DeepDAO, thetotal combined value of DAO treasuries increasedroughly fortyfold (from 380 million to 16 billion)from January to September 2021.4 DAOs are beingcreated to achieve purposes as diverse as investing,community networking, governing decentralizedapplications and driving social impact.5 Nonetheless,DAOs are still early in their development.The aim of this report is to demystify DAOs for awide range of audiences, including policy-makers,regulators and business leaders. It describesthe fundamental elements of DAOs, the DAOecosystem and key ongoing developments. Inaddition, it offers case studies that exemplify criticalemerging strengths and weaknesses of DAOsand a breakdown of potential risks. Forthcomingpublications in this collaboration between the WorldEconomic Forum and the Wharton School of theUniversity of Pennsylvania will offer guidance fordeveloping DAOs, frameworks for evaluating themand assessments of social impact use cases.6DAO is a general term covering a range oforganizational structures and applications. Weidentify nine categories of DAOs based on theirprimary objective (generative, associative or adhoc) and primary means of achieving that objective(activity, value transfer and social).7 While traditionalcorporate governance relies on management andformal legal structures, DAOs attempt to operate ina decentralized fashion, typically running on public,permissionless blockchains with rules encoded inopen-source software protocols and enforced bysmart contracts.8Like decentralized web3 technologies moregenerally, DAOs have been promoted for theirpotential to realize greater efficiency, transparencyand shared ownership. However, they have alsobeen criticized for their risks and unknowns. Therehave already been several attacks, governanceproblems and other challenges in the DAOecosystem. Thus, it is essential for the privateand public sectors alike to develop a nuancedunderstanding of the opportunities, risks andchallenges presented by DAOs.The Wharton Blockchain and Digital Asset Project (BDAP) is a research initiative at the WhartonSchool of the University of Pennsylvania focused on the evolving blockchain phenomenon. Drawing onthe world-class Wharton/Penn faculty, alumni and students, as well as relationships with officials andindustry experts from around the world, BDAP seeks to enhance understanding and bridge gaps amongstakeholder communities.The Crypto Impact and Sustainability Accelerator is a project of the World Economic Forum that seeksto catalyse progress on environmental, social and governance (ESG) targets for the crypto ecosystem.Building upon the work of the Forum’s Blockchain and Digital Assets Platform and a global network ofcontributors, the initiative explores emerging topics, such as DAOs, to bridge gaps in understandingbetween the public and private sectors, drive efforts across the space and shape a cohesive narrative thathighlights how crypto can lead in contributions to ESG in web3 and beyond.Decentralized Autonomous Organizations: Beyond the Hype5

1What is a DAO?A “decentralized autonomous organization”(DAO) is a general term for a group that usesblockchains and related technologies tocoordinate its activities.1.1 The emergence of DAOsTraditionally, hierarchical management has offereda means of directing human activity.9 Entities asdiverse as governments, religious institutions andcorporations use centralized methods to governresources, territories and communities. Utilizinginnovations such as joint-stock companies,centralized organizations have become someof the most powerful and economically valuableenterprises ever created.Yet centralization is not without its costs. With asmall minority in charge, centralized entities tend tomake decisions opaquely and consolidate power atthe top. The overheads of centralized managementcan be considerable. Moreover, centralizedorganizations may overemphasize narrow goals,like maximizing shareholder profits, at the expenseof broader considerations such as contributing toefforts to address the climate crisis.10By empoweringtoken-holdingmembers topropose, voteon and enactchanges to anentity, DAOs enablecommunities towork collaborativelytowards achievingshared goals.Recognizing the limitations of centralizedgovernance, internet pioneers use open protocolsand standards to empower participants aroundthe world to collaborate on ambitious projects.Techniques of social production, utilizingopen-source software, online collaborationtools and open interfaces played a key role inthe development of the internet.11 Over time,however, power has become consolidated in ahandful of large corporations occupying strategicintermediation points in the digital world.12Today, entrepreneurs are using web3 technologies,including blockchain, digital assets and DAOs,to create new mechanisms of decentralizedgovernance and coordination. By empoweringtoken-holding members to propose, vote onand enact changes to an entity, DAOs enablecommunities to work collaboratively towardsachieving shared goals. DAOs aspire to operatewithout conventional centralized intermediaries orinstitutional structures for functions such as theallocation of tasks and deployment of resources.13Their open, composable structure makes themsimple to launch and customize with incentivestructures. By locking agreements into automaticallyexecuting computer code, DAOs can foster rapidand transparent decision-making.These features have made the DAO landscapefertile ground for innovation. In recent years, DAOshave mushroomed across sectors, serving a widevariety of functions. DAOs are being leveragedto make investments, network around commoninterests and even advance the ESG agenda.Nonetheless, DAOs are nascent; their operations,utility and functions are still being defined.In practice, DAOs are as numerous and diverse asthe communities that build them. The analytics firmDeepDAO estimated as of early 2022 that therewere 4,228 DAOs in operation, ranging from largecommunities with multiple aims14 to applicationsthat are nothing more than “group chat[s] with ashared bank account”.15 By leveraging social mediaand viral marketing, DAOs have demonstrated theirability to quickly develop and rapidly deploy fundingto launch projects.16Decentralized Autonomous Organizations: Beyond the Hype6

1.2 The history of DAOsThe DAOecosystemacceleratedin 2020 asdecentralizedfinance (DeFi)platforms took offand incorporatedDAOs, awardingearly participantswith governancetokens.Coined in the 1990s by the German computerscientist Werner Dilger, the term “DAO” was takenup two decades later by blockchain enthusiasts anddevelopers, most notably Ethereum’s Vitalik Buterin,who began theorizing in 2014 about DAOs asentities featuring “automation at the centre, humansat the edges”.17 Blockchain-based DAOs takeadvantage of smart contracts, which can immutablyexecute software code on a blockchain network.participants with governance tokens. The growthof non-fungible tokens (NFTs) further expanded theDAO landscape as groups built NFT collections.Most recently, DAOs for rapid single-purposecapital allocation have attracted significant interest.ConstitutionDAO was able to raise approximately 47 million over a few days to bid on a copy of theUS Constitution, and AssangeDAO amassed morethan 50 million in a matter of weeks.23The first functional entity denominated as a DAO,The DAO, was created in 2016. The DAO raisedroughly 150 million in ether in a matter of weeksto create a platform for collective investment inblockchain-based projects.18 Shortly afterwards,a bug in The DAO’s smart contract code wasexploited to siphon off a considerable amount ofthe committed digital assets.19 Given the immutablenature of Ethereum smart contracts, no one hadthe power to return the funds. The end result wasa contentious and disruptive hard fork, or radicalchange, of the entire Ethereum blockchain.20Today, DAOs leverage a wide variety of votingmethods and experiment with different forms ofrepresentation. Some DAOs operate on a “one token,one vote” basis, whereby some if not all collectivedecisions are made through a direct participatorysystem. Some DAOs support the delegation ofvoting or proposal power to other individuals througha representative system. Many DAOs increasinglyprovide greater voting power to individuals who “lockup” or stake their tokens in an escrow smart contractfor a fixed amount of time. Others use weighted votingto provide greater power to individuals with greaterinvestment. While some of these governance modelsresult in broad representation through collectivedecision-making, others risk recreating quasioligarchic dynamics by concentrating governancetokens in the hands of a small number of powerfulplayers like venture capitalists and early insiders.Although some DAOs are attempting to mitigate therisk of co-optation through delegation efforts, thechallenges of power concentration remain.24 ManyDAOs adopt a goal of “progressive decentralization”,25building out structures for participation and movinggreater control to token holders over time.26Seeking to avoid a repeat of this fiasco, innovatorsdeveloped improved DAO tooling and supportinginfrastructure. Platforms for creating DAOs,solutions for facilitating voting and security protocolsfor auditing code were established, and theseinnovations were iterated upon.21 Experimentaluse cases such as collective grants for Ethereumdevelopers provided real-world experience with DAOgovernance.22 The DAO ecosystem acceleratedin 2020 as decentralized finance (DeFi) platformstook off and incorporated DAOs, awarding earlyCASE STUDY 1ConstitutionDAOConstitutionDAO was formed inNovember 2021 to acquire one of the 13remaining original printed copies of theUS Constitution at a Sotheby’s auction. It raised 47 million worth of ether from 17,437 contributorsin under a week. In return for providing ether,contributors to the DAO received the PEOPLEtoken, representing a share of the ConstitutionDAO. PEOPLE token holders would be given the right tovote on what to do with the copy of the Constitutionand what the organization should do in the future.ConstitutionDAO did not have a long-term roadmap.Individuals who contributed financially were soaligned with the purpose, and motivated by thecommunity, that they simply wanted to contributeand spread the word. At the time, Sotheby’s didnot allow DAOs to bid directly, nor did the auctionhouse accept anything other than governmentissued currencies. ConstitutionDAO teamed up witha crypto exchange to convert its ether to dollars,as well as with Endaoment, a non-profit, to makebids on the DAO’s behalf. The group also formed acorporation to help facilitate the transfer.In the end, the DAO failed in its bid. Theartefact was sold for 43.2 million, andContitutionDAO was ultimately limited bySotheby’s to 43 million to factor in taxesand the costs required to protect, insure andmove the Constitution. There was a period ofuncertainty afterwards, but the DAO ultimatelyoffered full refunds to its community minustransaction fees. Although some arguedthe funds collected should be applied toother objectives, the project was eventuallyclosed by the founding team. Several othercommunity-based DAOs have sprung upclaiming to use the PEOPLE token as theirproject’s native token.As this case study illustrates, DAOs can enablecommunities to quickly mobilize to achievea specific aim. While ConstitutionDAO wasfocused on purchasing an artefact, future adhoc DAOs could coordinate to pursue a widevariety of aims, including supporting a politicalcampaign or purchasing a stake in anotherentity in order to determine its strategy.Decentralized Autonomous Organizations: Beyond the Hype7

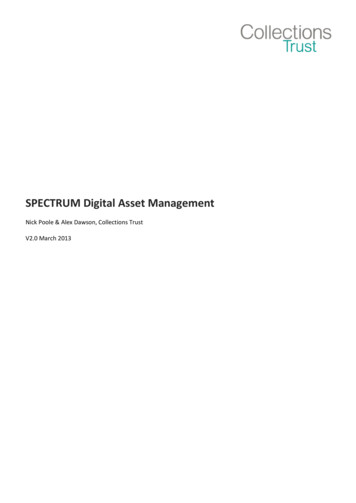

1.3 DAO strengths and weaknessesAlthough it is still early in their development,some key strengths and weaknesses of DAOsare already becoming evident. Relative tocorporations and other traditional organizationalforms, DAOs may achieve greater transparency,trust, adaptability and speed. All token holders ina DAO, not just executives, can have a role in thedecision-making. All DAO participants can viewfinancial and operational information stored onpublic permissionless blockchains in real time,27and anyone with sufficient expertise can checkits smart contract code. The open, composablestructure of DAOs makes it possible forcommunities to establish organizational structuresquickly, with customized incentive structuresdirected at a wide array of goals.28 Using tokenbased governance, DAOs can consider andimplement changes at any time, according to acommunity vote.29 DAOs facilitate experimentationwith innovations such as treasury management,quadratic voting, subsidies for public goodsprovision, streaming payment of salaries andmultifaceted reward structures for contributors.Perhaps thegreatest threatto DAOs todayis uncertainty.Without clearlegal status,DAOs cannot takeadvantage of thesame protectionsas corporations,such as legalpersonhood,limited liabilityand simplified taxarrangements.DAOs also have many limitations and potentialdisadvantages. Defining responsibilities andcompensation structures for contributors,matching them with community needs andcoordinating activity through messaging systemssuch as Discord is not always a smooth process.Some DAOs give central management powerto a small number of individuals for pragmaticreasons or because they established the DAO.Even when engaging in decentralized governance,DAOs have experienced plutocracy, vote buying,manipulation and co-optation, as well as issuesof low voter turnout and voter fatigue.30 Whengovernance votes do pass off-chain, it can oftentake weeks or months of coordination to push aproposal through.Further, the lack of DAO contributor informationor reputable on-chain credentialling can createissues of accountability. Information asymmetriesbetween creators and contributors can open thedoor to fraud and manipulation and make legalrecourse challenging.31 DAOs are also subject tothe security challenges that face all smart contractbased solutions today.32 Hacks and exploits directedat DAOs have resulted in the loss of hundreds ofmillions of dollars in assets.33 DAOs may also violatemembers’ privacy or agency through the transparentrecording of member actions and reputation inblockchain systems.34 DAOs can also be limitedby their foundational infrastructure. The scalabilitychallenges common to blockchain platforms suchas Ethereum could diminish the functionality oflarge-scale DAOs,35 namely, the extent of thedecentralization of many DAOs.Perhaps the greatest threat to DAOs today isuncertainty. Without clear legal status, DAOscannot take advantage of the same protectionsas corporations, such as legal personhood,limited liability and simplified tax arrangements.36Initiatives such as Colorado’s Uniforma LimitedCooperative Association Act and Wyoming’s DAOlegislation provide pathways for DAOs to attain legalrecognition.37 Privately crafted approaches withinexisting law, such as the unincorporated non-profitassociation structure,38 decentralized autonomousassociations under Swiss law and the dYdXframework for non-US trusts, are also emerging.39Fitting global DAOs into varying national legalstructures will be an important challenge.In considering the strengths and weaknesses ofDAOs, it is useful to compare them with traditionalbusiness associations such as corporations,partnerships, foundations and limited liabilitycompanies (LLCs), as well as with communities thatorganize without formal legal protections.Decentralized Autonomous Organizations: Beyond the Hype8

TA B L E 1Strengths and weaknesses of DAOs compared to alternativesCommunityStrengthsWeaknessesNo barriers to entry/exitLack of legal protectionsAdaptabilityMember liabilityStakeholder alignmentAbsence of tax planningGlobal accessSlower decision-makingInclusive participationDifficult to scaleOpaque, informal rulesLack of capital accessFree ridingCollective action challengesBusinessassociationDAOClear legal status/protectionsHigh barriers to entry/exitWell-established legal precedentsOpacityTax planning opportunitiesInflexibilityScalabilityLimited participant in governanceAccess to traditional sources of capitalManagement dominanceClear management powersSeparation of ownership/controlLow barriers to entry/exitLegal uncertaintySpeedLack of clearly defined rolesAdaptabilityDifficult informal coordinationTransparencyLimited toolingComposabilityGovernance challengesDecentralized governanceSecurity vulnerabilitiesToken-based incentivesSurveillance potentialOpportunity to experimentTax uncertaintySmart contract automationFree ridingDAOs are still early in their development, andtheir full potential is not yet known. A forthcomingreport will offer further insight into the advantagesand disadvantages of DAOs relative to otherorganizational forms.Decentralized Autonomous Organizations: Beyond the Hype9

2Practical elementsIn recent years, entrepreneurs havedeveloped a suite of tools to streamlinethe processes of joining, creating andgoverning DAOs.2.1 Launching DAOsMembership in a DAO is generally represented bya digital asset. These “governance tokens” enableholders to propose and vote on changes to theprotocol. Proposals can range from cybersecurityupgrades to overhauls of the organization’s purpose.While some DAOs are private, most are based onfreely-tradable digital assets, enabling any userto obtain governance tokens and become part ofthe DAO. DAOs may also grant initial allocations,including through airdrops – in which tokens areprovided for free for past usage or in exchangefor a service – to founders and other stakeholderswho have demonstrated engagement with arelevant platform.As with any organization, the critical first step inestablishing a DAO is galvanizing a communityunited by a common purpose.40 Often, DAOs arelaunched by peers coordinating on communicationsplatforms such as Discord, Telegram and Twitter.Founders work together to determine the DAO’spurpose, agree on parameters for governance anddevelop a rollout plan. DAO communities oftenleverage iconography, memes, acronyms andother references to organize themselves.41 A DAOmight also be built around an existing community orblockchain-based application.Once the group has attained agreement, thecommunity can then encode their mandate andrules into smart contracts, which will ultimately bindthe group to its decisions. While some DAOs opt tocode their own rules, DAO creation platforms suchas Gnosis, Moloch, Aragon, Colony and DAOStackprovide off-the-shelf tools for developing smartcontract code. Users of DAO creation services canset parameters such as the primary token, proposalvelocity, voting period, voting mechanisms andproposal mechanisms.Decentralized Autonomous Organizations: Beyond the Hype10

CASE STUDY 2MolochDAOMolochDAO v1, launched by Ameen Soleimani in February 2019, isa DAO on the Ethereum blockchain. It was created to provide theEthereum ecosystem and its core developers with a sustainable,distributed source of capital to fund open source development. The DAOwas seeded through a donation of 1,000 ether each from ConsenSysfounder Joseph Lubin and Ethereum co-founder Vitalik Buterin, plus 2,000ether more from individuals at ConsenSys and the Ethereum Foundation.Since 2019, MolochDAO has distributed approximately 1.4 million ingrants to 67 recipients,42 including projects like DApp Node, EthereumCat Herders, Tornado Cash, Lodestar, Lighthouse, clr.fund, Flashbots andmultiple reports – State of Eth2.0 (2019), State of the Mixers (2019), State ofOptimistic Rollup (February 2020) and Eth2.0 Economic Review (July 2020).The DAO prides itself on its speed and efficiency in funding public goods,with funds being distributed more rapidly due

distributed source of capital to fund open source development. The DAO was seeded through a donation of 1,000 ether each from ConsenSys founder Joseph Lubin and Ethereum co-founder Vitalik Buterin, plus 2,000 ether more from individuals at ConsenSys and the Ethereum Foundation. Since 2019, MolochDAO has distributed approximately 1.4 million in