Transcription

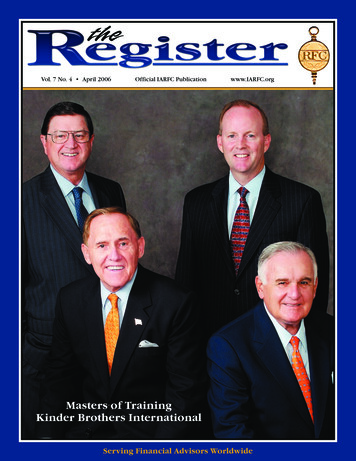

theVol. 7 No. 4 April 2006Official IARFC Publicationwww.IARFC.orgMasters of TrainingKinder Brothers InternationalServing Financial Advisors Worldwide

EXPAND YOURHORIZONS.by starting a foundation at the National Heritage Foundation.Raise tax-deductible funds for the charitable causes you want tosupport. Get involved and make a difference! Apply for a foundation at www.nhf.org or call us today at 1-800-9-TO-GIVE!The National Heritage Foundation is anonprofit 501(c)(3) organization. Ourmission is to undertake charitableprojects whose aim is to restore, maintain,or extend our national heritage of peoplehelping others. We believe thateveryone can make a difference bystarting a foundation. And we makeit easy, affordable, and fun! Wecurrently have about 10,000charitable projects with us.Call us at 800-986-4483, orcheck us out on the webat www.nhf.org.

in this issueFinancial Planning Building2507 North Verity ParkwayP.O. Box 42506Middletown, OH 45042-0506800 532 9060 Fax 513 424 5752www.IARFC.orgBOARD OF DIRECTORSEdwin P. Morrow, Chairman & CEOCLU, ChFC, CFP , CEP, RFC edm@IARFC.orgJudith Fisette-Losz, Executive Directordirector@IARFC.orgH. Stephen Bailey, PresidentLUTCF, CEBA, CEP, CSA, RFC steve@hbfinancial.com2Register Letters3Masters of Training — Kinder Brothers Internationalby Forrest Wallace Cato5IARFC Calendar of Events5From the Chairman’s Deskby Ed Morrow6Tournament of the Century:The King of Commerce vs. The Clown Prince!by Rev. Dr. John Clements8Compliance-Friendly MarketingThe Care and Feeding of Clients or Treat Your Clients Like a Dogby Katherine Vessenes10Resources for Financial Advisors11Financial Advisors Forum Exhibitor and Sponsors12Vernon D. GwynneCFP , RFC fsxfirst@aol.comFinancial Advisors Forum Agenda & RegistrationInterface with Financial Legends and Industry Leadersin the Premier Educational Symposium13Derek D. KlockMBA, RFC ddklock@vt.eduSecrets of Successful Internet Marketingby Syliva Todor15Consumer FocusLife Stage Analysis of Changing Attitudes and Behaviors Part IIby Paul Richard16Avoid Sales Mistakes in the LTC Market!by Wilma G. Anderson17The 7 Simplest Communication Strategiesfor Doubling Your Salesby Teresa Easler18Cato CommentsFinancial Planner’s Introduction to Blogsby Forrest Wallace Cato21Having the Right People On Your BusA New Service for IARFC Membersby Ed Morrow24IARFC Cruise Conference for Financial AdvisorsJoin Other RFCs and Get Your CE at SeaJeffrey ChiewDBA, CLU, ChFC, CFP , RFC JeffreyChiew@yahoo.comJohn E. GrableMBA, Ph.D, CFP , RFC grable@humec.ksu.eduEdward J. LedfordCLU, RFC eledford@marketsharefinancial.comConstance O. LuttrellRFC luttrell@mindspring.comRuth LyttonMS, Ph.D., RFC rlytton@vt.eduJames McCarty, SecretaryCLU, RHU, LUTCF, RFC jimmccarty@icetotheeskimos.comBurnett Marus, TreasurerRFC bmarus@sbcglobal.netWilliam J. NelsonLUTCF, CEP, RFC billn@nelsonfinancial.comRuben RuizChFC, CLU, MSFS, CSA, RFC rruiz@moneyconcepts.comWendy M. Kennedy, EditorEditor@IARFC.orgStephanie Langster, Administrative AssistantStephanie@IARFC.orgThe Register April 2006The Register (ISSN 1556-4045) is published monthly by the International Association of RegisteredFinancial Consultants, Financial Planning Building, 2507 North Verity Parkway, P.O. Box 42506,Middletown, Ohio 45042, 2006. It includes articles and advice on technical subjects, economicevents, regulatory actions and practice management. The IARFC makes no claim as to accuracy anddoes not guarantee or endorse any product or service advertised or featured. Articles, comments andletters are welcomed by e-mail to: Editor@IARFC.org.Application to Mail at Periodicals Postage Rates is Pending at Mansfield, Ohio 44901.POSTMASTER: Send address changes to: The Register, P.O. Box 42506, Middletown, Ohio 45042.Page 1

Register LettersWe welcome your comments, suggestions and ideas.Please direct correspondence to: Editor@IARFC.orgLetters may be edited for length and clarity.What a nice surprise to access the newwebsite, much easier to view andnavigate. Please consider usinghomepage to directly address prospectswhy and how to find us and use anotherpage for why advisors should become aRFC , I think that would be a moreeffective use of search engineoptimization and more profitable for theRFCs. I also think the terminated RFC language may be a bit confusing as to ifsomeone just resigned on their own orthey were terminated for not payingoverdue membership fees. The Profilesection was very easy to update. Iprinted cards to match the ethicsbrochures and stapled them to theback. Monday night a client asked"Why should I trust you?" I pulled outthe brochure and he closed himself. Soits important to me that I am promotinga designation worth promoting. Unlikemy membership in the now devaluedeasily obtained CSA. This Saturday Iwill be attending the Texas NAELAchapter meeting where I will again usethe brochure to promote the RFC designation to the membership. Yourcontinuing restrictive standards andimproved website are as helpful as Ihad hoped and may well be worth the50 dollar increase in membership feesthis year. But let's not get too carriedaway. Look at the churn at CSA and thehuge drop in membership at SFSPwhere I used to be a member.Charles Luedtke, RFC Mesquite, TXHey Ed, a great article, "A New Year —A New You." Very inspiring. Most ofus have a weight problem. Thanksfor sharing!I have spoken to Government ofBotswana. They are very keen to followthe developments of the IARFC.Although there is currently no regulationin Botswana in terms of regulation offinancial advice, they are interested tosee how it can be brought about in duecourse. For now they have encouragedme to see how our industry can selfregulate. Do you have any furtherguidance that you could share with me?Faiz Versey, RFC Gaborone, BotswannaPage 2It has been some time since I haveseen you, and I must confess that inyour article “A New Year — A New You,”I was a bit taken back! Yours is truly anunbelievable transformation and ahearty congratulation is in order.You really have been quite instrumentalin my practice through informationprovided in “The Register,” marketingresources available through the IARFCand through the most excellentPractice Builder Financial software.Thank you for all you have done to helpmove our industry toward everincreasing competence and clarity.As I read your article, I was grateful forchallenge and advice. I am at the frontend of where you were and for me, abariatric intervention would certainlynot be appropriate. But I can see,through your illustration of “grainingfour pounds a year” that by not takingappropriate action now, the need forsuch a procedure could be in my future.I’m certain you would agree thatprevention is far better than the cure!So I thank you Ed, for sharing yourstruggles and successes with us and inso doing , helping me to reevaluate myown health, and begin taking positivesteps to correct incorrect lifestylechoices. Your influence continues toshape not only my practice, but now,me personally.Craig S. Wright, RFC Xenia, OHIARFC Cruise ConferenceI went on this same (fall Foliage) cruise,with my wife last year, it was great!Perfect weather, I highly recommend it!!!Samuel F. Slabaugh, Sr., CFP , RFC Delmar, DEThe IARFC Register is lookingfor articles. You may submitarticles of at least 300 to 1,500words via e-mail, along with anelectronic photo and a short bio ofnot more than 100 words.INTERNATIONALIARFC COORDINATORSJeffrey ChiewAsia ChairDBA, CLU, ChFC, CFP , RFC JeffreyChiew@yahoo.comLiang Tien LungChina Development Organization (IMM)RFC Ralph LiewPhilippines ChairRFC kilhk@myjaring.netJoyce ManaloExecutive Assistantjoycemanalo@iarfcphils.orgJerry TanSingapore ChairCIAM, CMFA, RFC jerry@iarfcsg.orgZhu Xu LongChina Chair, ShanghaiRFC iarfc-cn@immadviser.cnSamuel W. K. Yung, MHChair, Hong Kong and Macao ChairCFP , MFP, FChFP, CMFA, CIAM, RFC chair@iarfc-hk.orgDr. Teresa SoAdvisor, Hong Kong and MacaoPhD, MFP, FChFP, CMFA, CIAM, RFC director@iarfc-hk.orgAllan WanRFC admin@iarfc-hk.orgNg Jyi WeiMalaysia ChairChFC, CFP , RFC iarfcmgt@time.net.myAidil Akbar MadjidIndonesia ChairMBA, RFC akbar@pavillioncapital.comLisa SoemartoMA, RFC lisa@pavillion.comJeffrey ChenTaiwan ChairRFC jeffrey@imm.com.twPreecha SwasdpeeraThailand ChairMPA, MM, RFC Preecha sg@yahoo.comDemetre KatsabekisGreece ChairMBA, Ph.D, RFC vie@otenet.grThe Register April 2006

Masters of Training — Kinder Brothers InternationalJack Kinder, Garry D. Kinder, William L.Moore and David Smith are leaders of theacclaimed Kinder Brothers International,one of the oldest and best-knownfinancial sales and sales managementtraining organizations in the world. Theyhave conducted professional trainingevents in 17 countries and addressedevery professional association. Theirbooks include Building the MasterAgency, Secrets of Successful InsuranceSalespeople, written with W. ClementStone and Winning Strategies in Sellingwritten with Roger Staubach. Other titlesby this veteran group are The Making of aSalesperson, Upward Bound, 21stCentury Positioning and The Selling Heart.Every year the firm delivers over 200presentations and management workshopsto financial planners and insurance agents.Jack, Garry, and Bill all hold the RFC designation, in addition to otherprofessional designations. For this editionof The Register we asked this dynamicgroup the following questions. If you're expected to be there, be there.In other words, show up on time andshow up dressed ready to play,attitudinally and physically. Make good on all commitments. Acommitment made is a debt unpaid. Always strive to do the right thing,regardless of the politics of thesituation.What is most important to the RegisteredFinancial Consultant’s image?Once again, we would say integrity. This issomething that has to be developed overa period of time. Many advisors havedeveloped successful practices fromreferrals of other clients. Client Adevelops a strong relationship with theadvisor, has trust in the advisor, andbelieves that the advisor brought valueadded service and helped solve his/herproblems. Client A refers the advisor toClient B. The integrity of the advisor istransferred by “borrowed perception” fromClient A to Client B.Is image important to success?Image is important to any RFC as well asto our firm. We strive to be the mostprofessional training organization in thefinancial service industry. Our goals havealways been the same, developing salesand sales management professionals by“building confidence through competence.”We feel image is important, but beinggenuine is more important. We see toomany people who are more concernedabout looking good rather than being good.They are more concerned with how they’relooking than how they are doing.How did you build such an impressiveworldwide image?As a consensus, we feel that we haveachieved our reputation by always doingthe best work possible for our customersand clients. One of our greatest assets isbeing consistent with our beliefs andprinciples. When we started working inthe Pacific-Rim countries, leaders of manyAsian companies commented that ourprofessional image had preceded us, andit was important in their decision to useour training and motivation services.The Register April 2006What are prospects looking for infinancial advisors today?We believe prospects are looking foradvisors who: Are trustworthy. Are likeable. Are organized and well prepared. Are a source of knowledge, notjust information. Are direct, confidential and sincere. Stay in touch frequently with the client. Communicate about problems andoffer solutions. Bring in specialists when appropriate. Are reliable, meet deadlines andfulfill promises. Look out for the best interest ofthe client.Can a well-established image bedestroyed or damaged?A well-established image can always bedestroyed. It takes a lifetime to build areputation, but only one act to destroy it.What is your bottom-line advice aboutimage relating to career success?When the advisor continues to treat thenew client with honesty and integrity, thebuilding of a professional image hasbegun. As the recent Register series ofarticles on clowns indicated, it isimportant for advisors to always use theIARFC Code of Ethics as their guide.What can each RFC do to create andestablish a desired image?We suggest the best way to create andestablish a strong image is by havingsatisfied clients. The highly satisfiedclient will tell others and the desiredimage transfer is started. Brochures andmarketing materials can also reflectimage. However, actions are whatdevelop the advisor’s professional image.What is most important about image?That’s easy: the most important factor isintegrity. We teach and try to live by threebasic principles, and they are equally validfor every advisor:presume you know what they want, orwhat their highest priorities are orshould be. You must ask, and confirm —and do so frequently during yourfact-finding interview.What is a key piece of advice forRegister readers?Planners and advisors must know theirclients’ expectations. You cannotAll Register readers must rememberthat they are entrepreneurs and theirimage is as important to the growth ofthe business as is any other element.Because this image is related to service,it is important that the advisor andmanagers all impart the importance ofthese principles to every employee andstaff member.The average client who purchasesyour products or services will usuallyform his or her judgment about youfrom the first contact. If you lackproper manners, if you are disorganizedor inefficient, it will take a lot ofkindness and efficiency to overcome thefirst negative impression. This is true,even if you were highly referred bysomeone they respect.Your image as a RFC is built aroundintegrity and high standards — and youmust work on this as you would any otheraspect of your business. Dr. Michaelcontinued on page 4Page 3

continued from page 3 Masters of TrainingMescon suggests, “Standards ofabsolutely first-class, pristineperformances don’t spontaneouslyemerge. Standards of excellence arecultivated by first-class advisorscommitted to the notion that second bestsimply will not do.”These standards of excellence willbuild your image and your practice.But you must be consistent, providingfirst class service to even your leastprofitable client — who could,nevertheless be very instrumental infurthering your reputation.For over thirty years Kinder BrothersInternational has trained financialadvisors in every state. What have younoticed during this time?Since 1976, from coast to coast, wehave found the same thing: When itcomes to building their images andmarketing, most financial advisors areweak. Most do not work hard at operatingwith the principles we previously listed,which will build a professional image.Some think that advertising, publicrelations, brochures, or the reputation ofan affiliated insurance company or brokerdealer will create image. Image is earnedby acts.Are financial planner’s PR imageexpectations realistic?Today, as we talk with advisors about howthey market themselves, in the U.S.,Europe and in Asia, most don’t even havea basic image brochure. Some have noideas about image building. Most havetotally unrealistic ideas about imagebuilding and media expectations.We encourage advisors to write articles.You don’t just write an article and send itoff to a publication. You must study thetarget magazine’s editorial copy stylerequirement and editorial schedule, thenyou must first have evidence of youraccomplishment, indications ofprofessional recognition, proof of afollowing, tear sheets of your otherpublished work, and a professional presskit, plus at least one professional qualityphoto of yourself.The value of these articles is not just withthe recipients of the publication whomight happen to read that issue. Theadvisor should reproduce every publishedarticle and send it with a simple coverletter to clients, prospects and centersof influence.Page 4What advice do you have for traditionallife insurance agents?The trends we have seen in the U.S. arenow being replicated worldwide. Lifeagents are becoming financial advisors,adding new products and new services.An image change is critical for thisprofession. They must become betterbusiness people, better marketers andunderstand a wider array of products.They must be trained to be advisors,rather than relying on the diversification ofan insurance carrier.your training techniques?That’s a great question, and the answer isboth Yes and No. Naturally as insuranceproducts became more complex and thelife industry embraced securities, we hadto consider additional areas, such ascompliance. But the fundamentalprinciples of management are unchanged.How can a financial servicesorganization assess the reasons whysome persons are successful, and othersare not?This transformation is critical. Theaverage citizen (of the U.S. Canada,Spain, China, Malaysia — wherever) isseeking a relationship with someone theytrust, respect and believe hascompetence. A credential like theRegistered Financial Consultantdesignation is valuable, provided that theadvisor explains to the prospect what itmeans. Everywhere in the world citizensare looking for someone who will helpthem obtain quality products toaccomplish their goals. Doing this on adaily basis is the way you create andmaintain a professional image.We have always said, you need to askthree questions: “Who hired them? Whotrained them? Who managed them?”As organizations grow, are differentskills needed?That’s why we take it very seriously whena firm or an advisor places theirconfidence in KBI to help them acquiremanagement and training skills.Most financial advisors start out alone,and then add staff to expand theircapability. Soon they begin to recruitother advisors, and at this timemanagement and training become amajor issue. The skills that made anadvisor effective with clients are not thesame skills required to manage andmotivate employees and associates. Overthe past 30 years we have developedbooks, courses and training sessions tohelp companies and broker dealersdeliver these skills.How have you delivered this training?We started out as life agents,rising through the management ranks,to the top of a major company. Butit became obvious that our real skillwas in training and motivation ofmanagers, not merely in themanagement of a sales force. Weenjoyed taking the principles we hadbeen using, and the practical tools wedeveloped, and seeing them make adifference in the lives and careers offinancial advisors.Have the changes in the financialservices industry caused you to changeMany persons should never be hired.Others are hired wrong — the disclosure isnot adequate, or they are given theimpression that selling financial productswill be very easy. Many are inadequatelytrained — by the home office or by thelocal firm. The investment in trainingtoday is insufficient in many organizations,and it is responsible for lack of retention.And some do not receive the right caliberof leadership, attention and motivation.What is new on the horizon for KBI?One of our programs, Professional Patternsof Management, was structured as acorrespondence course or employed inhouse by company training staff. It wasused as the basis for the development ofthe 21st Century program by companiesin Asia, and we have been involved in“training the trainer” for prominentinstitutions. Now Bill Moore is in theprocess of adapting this material into anew program for those managing fullservice financial firms. This will becomethe core of the Registered FinancialManager designation program, to beoffered in partnership with the IARFC.Kinder Brothers International is located at17110 Dallas Parkway, Suite 220, Dallas,Texas 75248. Phone: 800 372 7110 andwww.kbigroup.com This article was prepared for the Registerby Forrest Wallace Cato, who regularlyprepares his Cato Comments column,“About Your Image” for the Register.The Register April 2006

From theChairman’s Desk.Hong Kong. I visited with Samuel Yung, Teresa So, Liang Tien Lung and Allan Wan.They are moving ahead in the development of an accelerated course for experiencedproducers which will be quicker and less expensive for the participant. GAMA hasbeen effective in its support of the RFC , and Johnson Wong, Davey Lee and MaggieLee are all helpful GAMA officers and RFC members. We had a well-attended CEsession, and my three-hour presentation was translated by Hugo Chan, JD, RFC .Macau. Allan Wan and I visited the former Portuguese colony of Macau. It is aboutto explode with Las Vegas based casinos moving in. We met with Macau University ofTechnical Services and Dr. John Pontes, the head of the Macau Monetary Authority.While there I spoke to a group of LUA members, hosted by the local AIA office, andthere is definitely interest in our launching RFC in Macau.Where the IARFCwill be represented:Financial Advisors ForumMay 11-13, 2006, Middletown, OhioNAIFA – Ohio ConventionMay 15-16, 2006, Dublin, OhioMillion Dollar Marketing WorkshopMay 22-23, 2006, MinneapolisMDRT Annual MeetingJune 11-14, 2006, San Diego, CAFinancial Planning AssociationJuly 7, 2006, Manila, PhilippinesAdvisors Forum and GraduationJuly 8 & 9, 2006, Manila, PhilippinesInternational Dragon AwardsAugust 11-13, 2006, Chengdu, ChinaIARFC Cruise/ConferenceSeptember 16-23, 2006 “Fall Foliage”Through New England and CanadaMDRT Top of TableOctober 18-21, 2006 Cancun, MexicoHeckerling Estate ConferenceJanuary, 2007, OrlandoAPfinSA ConferenceApril 13-15, 2007, TaipeiFinancial Advisors ForumMay, 15-17, 2007, Las Vegas, NevadaMDRT Annual MeetingJune 10-13, 2007, Denver, COIf you are going to attend any ofthese events, please let us know.Masters Degree. The GAMA of Hong Kong has launched a new MBA program thatinvolves the University of North Alabama. The cost will be 96,000 in Hong Kong,equivalent to 12,400 U.S. They have already granted a credit for RFC toward theirmasters degree of 6 hours. We are investigating various options for an IARFCsponsored Masters Degree.RFM designation. While in Hong Kong I also met with Robert Suen, RFC , about theproposed Registered Financial Manager course being developed by Bill Moore, RFC who is a part of Kinder Brothers International, which will include many of thesuccessful Kinder management principles.Thailand. In Bangkok I spoke at the MDRT Experience, attended by 9,500 Asians.They had five commercial exhibitors, of which IARFC was one — and we were given theprime location on the ground floor closest to the main auditorium. The program wasopened and closed by MDRT President, Stephen Rothschild, RFC . My secondsession, in a room that seated 3,000 was overflowing into the outer area. MDRT staffcounted 197 persons standing or sitting outside listening on their radio translationheadsets. Our exhibit booth was mobbed and we handed out six cartons of materials.The IARFC booth was manned by persons from IARFC Thailand, assisted by membersfrom Indonesia, Malaysia and Philippines. We got a lot of calls later from attendeesinterested in registering for an RFC course. After MDRT we had a graduationceremony for the first 79 RFC recipients and it was a nice affair, with caps andgowns — a good photo opportunity. Everything was well coordinated by the IARFCThailand Chair, Preecha Swasdpeera with the assistance of Ralph Liew and JeffreyChiew. The following day Preecha and I made calls on local insurance leaders.Singapore. We had the graduation ceremony for the first 29 RFC graduates. It wasattended by the General Manager of AIA, Mark O’Dell, RFC who congratulated thestudents. The following day I gave a 2 hour presentation to about 250 AIA agents attheir Alexandra office and it was followed by a number of signups for the RFC course.Philippines. I didn’t stop there on this trip, but many of the attendees of MDRTexperience reported back to the Financial Planning Association of Philippines on mytalk at MDRT and they have invited me to speak July 7th. We’ll combine that withanother Forum in Makati and a graduation ceremony.China. The IMM event, the IDA International Dragon Awards and 6th WorldwideChinese Life Insurance Conference, with 8,000 or more attendees will be held inChengdu on August 11-13. Do you want to attend IDA? Have you ever been toChengdu? Mehdi Fakharzadeh, RFC will be a speaker. We plan to hold aconcurrent RFC session, 3 hours – in English at IDA with Stephen Rothschild as oneof the speakers. There will be a very inexpensive post conference 3-4 day cruise onthe Yangtze River.Are You Traveling to Asia? If so, why not plan to address a group of RegisteredFinancial Consultants. Since this would have publicity value in your home town, youmight consider part of your expenses to be business-related.Contact IARFC — if you’d like to attend IDA in Chengdu or speak abroad. The Register April 2006Page 5

Tournament of the Century:The King of Commerce vs. The Clown Prince!into more than forty categories, and hedoes it with a skill that I can only liken toan entomologist analyzing the antics ofperforming fleas.I am of course familiar with the clowns’substandard stunts; and so are my fellowmembers of the International Associationof Registered Financial Consultants in theUSA and also the British Institute of Salesand Marketing Management. Weconsider the clowns to be the worst adwe’ve ever had. They give us a bad name— and don’t make us laugh either!Rev. Dr. John Clements, Th.D., RFC When we look objectively (that is, withoutvested interest) at the functioning of thecommercial world, we see very little thatwe would genuinely call ‘excellence’ inoperation. Notwithstanding the plethoraof technological resources for training andlearning, the average company’s blueprintfor success seems destined to shortcircuit the best intentions of its designers.Indeed, an impartial systems analystmight well diagnose it as being hard-wiredfor an output of mediocrity!Ambitious individuals seeking to improvepersonal and professional performanceare often pressured, by time or financialconstraints, to settle for quick-fix solutionsto long-term deficiencies. Not surprising,therefore, we have ended up with ageneration of self-styled leaders whoprefer to cultivate a personal power-baserather than promote genuine fulfillmentfor the corporate culture as a whole.Never have so many been managed by solittle wisdom! The culprits? Professionalclowns who consider themselves to haveoutgrown the circus ring!Forrest Wallace Cato (well known to manyin the financial services industry andreaders of this magazine) has taken amicroscope to those minuscule mindedmerchants of mediocrity — blown them toa size, so to speak in his insightful andincisive (perhaps even incendiary) article,“Beware of the Clowns!”Through the power-zoom of his 25 years’experience in finance, selling, andpromotion, Cato analyses the antics of theprofessional amateurs (or amateurprofessionals, which ever is the lesser)Page 6Thus have I arrived at my life-mission (orone of them, anyway): to lend a serioushelping hand to folk desirous of extractingthemselves from the mire of mediocrityinto which the clowns have lured them;and thereafter to help them develop aCato-like power-zoom of experience — sothat they can detect the clowns beforethey roll up, and avoid them by leapinggracefully onto the narrow (and oftenconcealed) pathway of excellence.If you would like further details about thisprocess, you can download a (free!) copyof my e-book Excellence Becomes Youwww.excellence-becomes-you.com — oryou can contact me on my e-mail addressjohn@lifewisecoaching.orgAnyway — enough of clown princes andperforming fleas. Let’s examine theelements necessary to transformourselves into what we really aspire to be:Kings of Commerce. For the individualexecutive operating in a corporatestructure the standard list would generallybe understood to run like this: Mentoring/coaching by immediatesupervisors A specialised department of internaltrainers Visits from external general consultants The academic paper chase (MBAs etc)The school of hard knocks!Does that list ring a bell? Then let’sanalyze the elements individually.Hard knocks may thicken the hide of arhinoceros, but always impair thesensibilities of the human soul. They are,as such, no more useful for improving abusiness than kicking a computer will forimprove the program!The academic paper chase is a very goodindicator of an employee’s ability toexecute further academic paperchases but how far can those be reliedupon to make the executive into aneffective leader? MBA programs containa great deal of theoretical material, someaspects of which may be inapplicable inthe real world, and so singularly fail toaddress the human-related issues ofleadership. Idiosyncratic businesspractices based on paper qualificationsmay sometimes be worse than useless,because they are seldom adapted to newcircumstances. In addition, an overdedicated student can overdose on theinjection of new concepts into an alreadywork-laden psyche.External general consultants havea tendency to act as itinerantmedicine-men: they champion asingle solution for complex ailments,and often don’t wait around longenough to see it fail! Furthermore,they are accustomed to working ingroups rather than ‘one-on-one’ withclients; so the results of theirministrations can be disappointing tomanagers, who see colleagues emergingfrom the seminar room with a sheaf ofpapers and booklets, but no finely-tunedskills or long-lasting encouragement.Internal trainers may possess lowcredibility in the eyes of fast-trackingsenior executives, who have vestedinterests in never revealing theirweaknesses within their ownorganizations. For similar reasons, theycan never ‘let their hair down’ and sharefears, feelings or failings on open coursesrun by external training organizations,because those are often attended bydelegates from competitor companies.Thus superficial issues are the only onesaired,

Wendy M. Kennedy,Editor Editor@IARFC.org Stephanie Langster,Administrative Assistant Stephanie@IARFC.org in this issue 2 Register Letters 3 Masters of Training — Kinder Brothers International by Forrest Wallace Cato 5 IARFC Calendar of Events 5 From the Chairman's Desk by Ed Morrow 6 Tournament of the Century: The King of Commerce vs. The .