Transcription

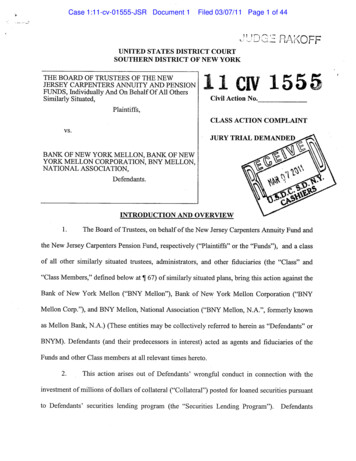

"Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 1 of 44H i r'in!\'fl./-it\1'0 FF.'\.i /,,,.".,,\,., -, UNITED STATESUNITEDSTATES DISTRICTDISTRICT COURTCOURTSOUTHERN DISTRICTDISTRICT OF NEWYORKSOUTHERNNEW YORKTHE BOARDBOAR OFTHEOFTRUSTEESTRUSTEES OFOF THETHE NEWNEWJERSEYCARPENTERSCARENTERSANNUITYANNITY ANDAN PENSIONJERSEYPENSIONFUNS, hidividuallyFUNDS,Individually AndAndOnOnBehalfBehalf OfOf AllAll OthersOthersSimilarlySituated,Similarly Situated,11155511CIVov 1555CivilCivil ActionAction No.Plaintiffs,Plaintiffs,CLASS ACTIONCLASSACTION COMPLAINTCOMPLAINTvs.BANMELLON, BANKBAN OF NEWNEWBANKOFOF NEWNEW YORKYORK MELLON,YORK MELLONMELLON CORPORATION,YORKCORPORATION, BNYBNY MELLON,MELLON,NATIONAL nts.INTRODUCTION ANDAND OVERVIEWOVERVIEWINTRODUCTION1.Boardof Trustees,New JerseyCarpentersAnnuityAhuity FundFund andand1. The TheBoardof Trustees,ononbehalfbehalf ofof thethe NewJersey CarpenterstheNew JerseyJersey CarpentersCarenters Pension("Plaintiffs" oror thethe "Funds"),"Funds"), and a classthe NewPension Fund,Fund, respectivelyrespectively ("Plaintiffs"classofand other(the "Class"of allall otherother similarlysimilarly situatedsituated trustees,trustees, administrators,administrators, andother fiduciariesfiduciaries (the"Class" andand"ClassMembers," defined67) ofof similarlysimilarly situatedplans, bringbring thisthis action"Class Members,"defined belowbelow at ir 67)situated plans,action againstagainst theBankBank of NewNew YorkYork MellonMellon ("BNY("BNY Mellon"),Mellon"), BankBank ofof NewNew YorkYork MellonMellon CorporationCorporation ("BNY("BNYMellonMellon, N.A.",N.A.", formerlyMellon Corp."),Corp."), andand BNYBNY Mellon,Mellon, NationalNational AssociationAssociation ("BNY("BNY Mellon,formerly knownknownas MellonMellon Bank,Bank, N.A.)N.A.) (These(These entitiesentities maymay bebe collectivelycollectively referredreferred toto hereinherein asas "Defendants""Defendants" orBNY).BNYM).DefendantsDefendants (and(andtheirtheirpredecessorspredecessors inin interest)interest) actedacted asas agentsagents andand fiduciariesfiduciaries of thetheFundsFunds and otherother ClassClass membersmembers at all relevantrelevant timestimes hereto.hereto.2.actionarises2. s' wrongfulwrongful conductconduct inin connectionconnection withwith thetheinvestmentof millionsmillions of dollarsdollars of collateralcollateral ("Collateral")("Collateral") postedinvestment ofposted forfor loanedloaned securitiessecurities pursuantpursuanttoto Defendants'Defendants' securitiessecurities lendinglending programprogram (the(the "Securities"Securities LendingLending Program").Program"). DefendantsDefendants

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 2 of 44improperlymanaged accountsaccounts ("Separatelyimproperly createdcreated unreportedunreported andand unauthorizedunauthorized separatelyseparately managed("SeparatelyManagedManaged CollateralCollateral Accounts"Accounts" oror thethe "Separately"Separately ManagedManaged Accounts")Accounts") andand usedused thesethese accountsaccountstoinvest millionsmillions ofof dollarsto improperlyimproperly investdollars ofof thisthis CollateralCollateral in,in, amongamong otherother things,things, high-riskhigh-riskboth theirsecurities and other securities, in breach of boththeir fiduciaryfiduciary dutiesduties and the agreementsagreements enteredenteredsecurties and other securties, in breach ofintowith the Fundsparticipants in the Securitiesinto withFunds and otherother participantsSecurities LendingLending Program.Program.3.violated,otherthings,Lending3. ,amongamongotherthings, thethe SecuritiesSecurities LendingProgram'sthat investmentsinvestments ofof CollateralCollateral bebe heldProgram's requirementsrequirements thatheld andand maintainedmaintained inin aa single,single,commingledaccount ofof relativelysecure investmentsinvestments suchsuch asas cashcommingled accountrelatively securecash equivalentequivalent securitiessecurities (a(a"CommingledAccount"(in(in Plaintiffs'Plaintiffs' case,case, the"Commingled Account"the "BNY"BNY ilstitutionalInstitutional CashCash ReservesReserves Fund"Fund"accountor theaccount orthe "Portfolio,""Portfolio," referencedreferenced belowbelow atat irir 34-35)).34-35)). TheThe combinationcombination ofof highlyhighly liquidliquidsecuritiesin aa commingledby Defendantsas aa structurethat wouldsecurities incommingled accountaccount waswas marketedmarketed byDefendants asstructure thatwouldminimizeand nearlynearly eliminateeliminate thethe riskrisk ofof lossesin that,minimize andlosses onon thethe CollateralCollateral inthat, inin thethe unlikelyunlikely eventeventthatsecurties inthat oneone oror moremore ofof thethe cashcash equivalentequivalent securitiesin thethe accountaccount waswas valuedvalued atat lessless thanthan bookbookvalue,assets inin theaccount, whichwhich werewere notnot "under"under water"water" orvalue, alternativealternative assetsthe CommingledCommingled account,or severelyseverelydeterioratedvalue priorprior to maturity,maturity, couldcould bebe liquidatedliquidated inin orderorder toto meetmeet repaymentrepayment demandsdemands ififdeteriorated in valuealoan werewere tobe terminated.Defendants' unauthorizedunreported Separatelya loanto beterminated. ilstead,Instead, Defendants'unauthorized useuse ofof unreportedSeparatelyManagedAccounts inin whichinvested thethe CollateralCollateral inin otherManaged Accountswhich DefendantsDefendants investedother securities,securities, including,including,intermagnified thethe riskrisk ofinter alia,alia, higher-riskhigher-risk securitiessecurities severelyseverely magnifiedof thethe Funds'Funds' lossloss ofof principalprincipal andandprofitson theprofits onthe CollateralCollateral investments.investments. ilInPlaintiffs'Plaintiffs' case,case,DefendantsDefendants improperlyimproperly placedplaced andandmaintainedin unreportedunreported unauthorizedmaintained aa substantialsubstantial portionportion ofof thisthis CollateralCollateral inunauthorized SeparatelySeparatelyManagedAccounts asabove andand elsewhereherein, andand improperlyimproperly investedManaged Accountsas referencedreferenced aboveelsewhere herein,invested thisthisCollateralin securities,including (among(among others)others) high-riskhigh-risk securities,securities, andand includingincluding 7 7 millionmilionCollateral insecurities, includinginvestedin aa Lehmaninvested inLehman BrothersBrothers Holdings,Holdings, Inc.Inc. BondBond (the(the "Lehman"Lehman Bond"Bond" investment),investment), makingmaking2

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 3 of 44andthis imprudentand improperdespite itsits extremerisk andand maintainingmaintaining thisimprudent andimproper investmentinvestment despiteextreme riskand steadysteadydeterioration,holding itit untiluntil Lehman'sdeterioration, holdingLehman's defaultdefault insteadinstead ofof attemptingattempting toto minimizeminimize losseslosses andandpreservethe Funds'Funds' Collateralvalue byby sellingselling it,it, andand clearclearwarningwarngpreserve theCollateral valuesignsthat itit wasan investmentinvestmentinin distress.distress. Onlyin thethe fallfall ofsigns thatwas anOnly afterafter Lehman'sLehman's collapsecollapse inof 20082008followingthe UnitedUnited StatesTreasury Department'sfollowing theStates TreasuryDepartment's decisiondecision notnot toto bailoutbailout thethe strugglingstrugglinginvestmentban didinvestment bankdidDefendantsDefendants finallyfinally informinform thethe FundsFunds ofof thethe massivemassive CollateralCollateral investmentinvestment intheManaged Accounts,Accounts, andand thethe Funds'Funds' exposurethe SeparatelySeparately Managedexposure toto millionsmillions ofof dollarsdollars inin losseslosses asas aaresultthereof. hicredibly,forresult thereof.Incredibly, DefendantsDefendants nownow claimclaim thatthat thethe FundsFunds shouldshould be solelysolely responsibleresponsible formillionsdollars inin losseslosses inin thesethese surreptitiouslysureptitiously investedmillions of dollarsinvested separateseparate CollateralCollateral investments.investments.4.are arefiduciaresAct4. DefendantsDefendantsfiduciariesunderunderthethe EmployeeEmployee RetirementRetirement hicomeIncome SecuritySecurity Act("ERISA"), 291001, et seq.,seq., andand pursuantpursuant totothethesecuritiessecurities lendinglending programprogram("ERISA"),29 U.S.C.U.S.C. §§§§ e FundsFunds andand otheragreementsother ClassClass members.members. PlaintiffsPlaintiffs allegeallege thatthatDefendants,asas fiduciariesfiduciares ofof the3(21)(A)ofof ERISA,ERISA,2929 U.S.c.U.S.c. §§Defendants,the FundsFunds underunder SectionSection therotherparticipantsparicipants andandbeneficiariesbeneficiares ofof1002(21the Fundsin violationtheFunds (and(and otherother ClassClass members)members) inviolation ofof ERISAERISA §§§§ 404(a)404(a) andand 405,405, 2929 U.S.C.U.S.C. §§§§1104(a) and 1105.1105.5.5.CountI allegesthatthatDefendantsCountI ryfiduciary dutiesduties ofof loyalty,loyalty, carecareand prudenceprudenceby,by,interinter alia:alia: actingandacting beyondbeyond thethe scopescope ofof theirtheir authorityauthority underunder thethe SecuritiesSecuritiesLendingProgram agreementsagreements (defined(defined belowbelow atLending Programat ir 31)31) inin establishingestablishing thethe SeparatelySeparately ManagedManagedAccounts,and inin failingAccounts, andfailing toto prudentlyprudently andand loyallyloyally managemanage FundFund assets,assets, failingfailing toto disclosedisclose allallmaterialinformation concerningconcerning thethe Funds'Funds' assetsmaterial informationassets andand transactionstransactions byby DefendantsDefendants withwith respectrespect totothoseusing Collateralpurchase and maintainthose assets,assets, usingCollateral to purchasemaintain higherhigher risk,risk, longer-termlonger-term securitiessecurities insteadinsteadof cashequivalents, andand failingfailing toto actact withwith the requisitecash equivalents,requisite degreedegree of care andand loyaltyloyalty to the FundsFunds in33

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 4 of 44managingthe assetsAccounts, allall inin violationof ERISAmanaging theassets of the SeparatelySeparately ManagedManaged Accounts,violation ofERlSA § 404404 (29(29U.S.C.U.S.C. § 1104).1104). ilInsum,sum,Defendants'Defendants' failedfailedtotoinvestinvestandandmonitormonitor thetheCollateralCollateral safelysafely andandprudentlyin a commingledprudently incommingled collateralcollateral accountaccount of cashcash equivalentsequivalents as requiredrequired in thethe SecuritiesSecuritiesLendingProgram agreements,ManagedLending Programagreements, insteadinstead placingplacing it in unreported,unreported, unauthorizedunauthorized SeparatelySeparately ManagedAccountsAccounts in directdirect violationviolation of thesethese agreements,agreements, and eveneven investinginvesting in longerlonger term,term, higher-riskhigher-riskinvestmentsand theninvestments andthen failingfailing to monitormonitor thesethese investmentsinvestments andand theirtheir performance,performance, andand failingfailing tosellthose securitiessecurties tosell thoseto minimizeminimize the lossloss ofof principalprincipal in thethe Accounts.Accounts. DefendantsDefendants engagedengaged inthisthis misconductmisconduct all forfor thethe purposepurpose ofof maximizingmaximizing theirtheir ownown profitsprofits andand favoringfavoring Defendants'Defendants'ownmonetar interestsown monetaryinterests overover thosethose ofof theirtheir clients,clients, thethe FundsFunds andand otherother ClassClass members,members, allall inviolation ofERlSA404(a)(1).ERISA § 404(a)(1).violation of6. CountII allegesthatDefendants,fiduciaries6.CountII ingexercismg authorityauthority ororcontrol concerningthe managementmanagement or dispositionthe FundsFunds andand othercontrolconcerning thedisposition of the Collateral,Collateral, assetsassets of theotherClass members,breached dutiesduties toto avoidof interestin violationviolation ofofClassmembers, breachedavoid conflictsconflicts ofinterest andand self-dealingself-dealing inERISA, and placedERISA,placed the CollateralCollateral inin unreportedunreported SeparatelySeparately ManagedManaged AccountsAccounts andand investedinvested it insecurities, includingincluding longer-term,longer-term, higherhigher riskrisk investments,investments, forfor theirtheir ownsecurities,own financialfinancial benefitbenefit andearning profitsprofits andearningand feesfees forfor themselvesthemselves atat thethe expenseexpense of thethe Funds,Funds, constitutingconstituting prohibitedprohibitedtransactions in violationtransactionsviolation of ERISAERISA §§ 406.7. CountIII allegesconduct7.CountIII allegesbreachbreachofofcontractcontract byby Defendants.Defendants. ByByengagingengaging inin thethe conductdescribed herein,describedherein, DefendantsDefendants failedfailed to performperform theirtheir dutiesduties underunder the SecuritiesSecurities LendingLending ProgramProgramagreements andand breachedbreachedthethe agreements'agreements' terms.terms. ilIndoingagreementsdoing so,so,DefendantsDefendants alsoalso breachedbreached thetheimplied term ofthe Funds'Funds' (andimpliedterm of thethe agreementsagreements thatthat requiredrequired it to monitormonitor and prudentlyprudently managemanage the(andother ClassCollateral investmentsinvestments andand theirtheir performance.performance. As aa directotherClass members)members) Collateraldirect andand proximateproximateresult of of Defendants'Defendants' breach ofbreach of thethe materialterms ofresultmaterialterms of theSecurities LendingLending ProgramProgram agreements,agreements,the Securities4

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 5 of 44thethe FundsFunds (and(and otherother ClassClass members)members) diddid notnot receivereceive thethe benefitbenefit ofof theirtheir bargain,bargain, werewere damageddamagedas a result,result, andthreatened withand are threatenedwith additionaladditional harm.harm.8.IV allegesthatand8. CountCountIV liedimpliedcovenantscovenants ofofgoodgoodfaithfaith andfairdealing, imposedimposed uponupon eacheach partyparty toto aa contract.contract. Thefair dealing,The SecurtiesSecurities LendingLending ProgramProgram agreementsagreementsat issuehere betweenbetween thethe FundsFunds (and(and otherother Classmembers) on the oneissue hereClass members)one hand,hand, andand DefendantsDefendants ontheimplied covenantscovenants ofof goodthe otherother hand,hand, werewere bindingbinding contractscontracts containingcontaining impliedgood faithfaith andand fairfairdealing.dealing. DefendantsDefendants breachedbreached thesethese impliedimplied covenantscovenants toto thethe detrimentdetriment ofof PlaintiffsPlaintiffs andand otherotherClassby thethe conductherein thereby:thereby: failingfailing toto makeClass membersmembers byconduct describeddescribed hereinmake goodgood faithfaith effortsefforts totoplace,invest andand monitormonitor theproperly inin aaplace, investthe Funds'Funds' andand otherother ClassClass members'members' CollateralCollateral properlyCommingledCollateral Account,Account, failingfailing toto disclosedisclose thatthat theCommingled Collateralthe Funds'Funds' andand otherother ClassClass members'members'investmentswere improperlyimproperly heldheld withoutinvestments werewithout authorizationauthorization inin SeparatelySeparately ManagedManaged Accounts;Accounts; andandfailingto prudentlyprudently investinvest andfailing toand monitormonitor suchsuch CollateralCollateral investmentsinvestments soso thatthat theythey wouldwould maintainmaintainprincipal value.principalvalue.9.claimspromissory9. CountCountV allegesV allegesclaimsforforpromissory estoppel.estoppel. DefendantsDefendants mademaderepresentationsregarding thethe Securitiesrepresentations regardingSecurities LendingLending Program,Program, thatthat theythey wouldwould investinvest thethe Funds'Funds' (and(andothermembers')Collateral inin aa Commingledother ClassClass members') CollateralCommingled collateralcollateral accountaccount alongalong withwith otherotherinvestmentsand cashcash collateral,and ininvestments andcollateral, andin relativelyrelatively stable,stable, securesecure andand non-riskynon-risky cashcash equivalentequivalentinvestmentsgeared atat gaininggaining smallsmall profitsprofits andand preservingpreserving principalprincipal value,value, soso asinvestments gearedas toto induceinduce thetheFundsto relyFunds andand otherother ClassClass membersmembers torely onon thesethese representationsrepresentations andand taketake actionsactions andand makemake theirtheirpaymentsbased onon thesethese representations.representations. Plaintiffspayments basedPlaintiffs (and(and otherother ClassClass members)members) reliedrelied uponupon thesetheserepresentationsmade byby DefendantsDefendants andand theirtheir agentsrepresentations madeagents andand representatives,representatives, andand reasonablyreasonably so,so, tototheirtheir seriousserious detriment.detriment.55

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 6 of 4410.VI VIallegesstate10. chesbreaches of fiduciarfiduciary duty.duty. Defendants,Defendants, asasfiduciaresand oversightoffiduciaries ofof thethe FundsFunds (and(and otherother ClassClass members)members) andand in positionspositions of controlcontrol andoversight ofsecurtiesand Collateral,Collateral, owedowed toto themthem thethe dutiesto maintainsecurities lendinglending accountsaccounts andduties tomaintain thethe CollateralCollateralassetsin a CommingledCommingled collateralcollateral account,those assetsassets inaccount, and to investinvest thoseassets loyally,loyally, faithfully,faithfully, carefully,carefully,diligentlyand prudentlyprudently inin relativelyrelatively stable,stable, ities. Instead,ilstead, Defendantsdiligently andDefendantsfailedto exercisefailed toexercise duedue carecare inin thatthat theythey placedplaced thethe CollateralCollateral inin unauthorizedunauthorized andand unts,andand investedinvested itit inin securties,Separately Managedsecurities, includingincluding moneymoney inin higher-riskhigher-riskinvestments.investments. TheThe DefendantsDefendants therebythereby breachedbreached theirtheir dutiesduties ofof care,care, loyalty,loyalty, accountabilityaccountability andanddisclosureby failingfailing toto actact as ordinaryordinary prudentprudent personspersons wouldwould havehave actedacted inin a likeposition, to thedisclosure bylike position,the Plaintiffsgreat detriment of thePlaintiffs (and otherother Class members).members).great detriment of11.11. UponUponinformationinformation andand belief,belief, DefendantsDefendants havehave engagedengaged inin identicalidentical ororsubstantiallysimilar misconductsubstantially similarmisconduct with respectrespect toto bothboth thethe FundsFunds andand numerousnumerous otherother ipants (at(at aa minimum),who havethe sameLending Programminimum), whohave sufferedsuffered thesame oror similarsimilar typestypesdamagesasaaresultresult thereof.thereof. Theinvested forfor Classconsisted ofofdamages asThe assetsassets DefendantsDefendants investedClass membersmembers consistedCollateralthat waswas requiredrequired toto beofCollateral thatbe returnedreturned toto borrowersborrowers uponupon demandsdemands forfor repaymentrepayment ofunderlyingsecurities loans.loans. Defendantsunderlying securitiesDefendants werewere chargedcharged underunder thethe securitiessecurities lendinglending agreementsagreementsinvolved(and otherwise)otherwise) with,with, amongthe Collateral'sCollateral's principal,principal,involved herehere (andamong otherother things,things, safeguardingsafeguarding themaintainingsuffcient liquidityliquidity inin themaintaining sufficientthe accountaccount inin whichwhich itit depositeddeposited andand heldheld CollateralCollateral andandCollateralinvestments forfor securitiessecurities loans,loans, andand fulfillingCollateral investmentsfulfilling theirtheir fiduciaryfiduciary dutiesduties (contractual(contractual andotherwise)in investinginvesting thethe Collateraland monitoringthe Collateralinvestments. Defendantsotherwise) inCollateral andmonitoring theCollateral investments.Defendantswereand withwith care,were alsoalso responsibleresponsible forfor investinginvesting CollateralCollateral conservativelyconservatively andcare, skill,skill, prudenceprudence anddiligenceunder thethe circumstances,circumstances, whichwhich a prudentprudent mandiligence underman actingacting in a similarsimilar capacitycapacity familiarfamiliar withwithsuchmatters wouldwould employemploy in conductingsuch mattersconducting an enterpriseenterprise of similarsimilar charactercharacter and goals.6

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 7 of lves12. fof ofthemselves andand thethe ClassClass inorderand otherother appropriaterelief forfor thethe harmorder toto recoverrecover monetarymonetary damagesdamages andappropriate reliefharm causedcaused bybyDefendants'inter alia, restitutionDefendants' misconductmisconduct as outlinedoutlined hereinherein (including,(including, interrestitution andand disgorgementdisgorgement offees collectedcollected byby DefendantsDefendants in connectionwith BNYBNY Mellon'sMellon's securitiesfeesconnection withsecurities lendinglending program).program).JURISDICTION AND ekseekreliefrelief forfor thethe themselves,themselves, thethe Funds,Funds, andandotherother similarlysimilarly situatedsituatedplans underby ERISAplansunder the civilcivil enforcementenforcement remediesremedies providedprovided byERISA againstagainst fiduciariesfiduciaries pursuantpursuant toERISA §§§§ 404,406,409404,406,409 andERISAand 502(a)502(a) (29(29 U.S.c.US.c. §§§§1104,1104, 1106,1106, 1109,1109, 1132),1132), asas wellwell asas thethe lawslawsof the StateofState ofof NewNew York.York. ThisThisCourtCourt hashasjurisdictionjurisdiction overover thisthis actionaction andand thethe DefendantsDefendantspursuant to 28 toU.S.C.1331, 1332, §§and ERISA§§ 502(e)(I)(2) (29U.S.c. §§ §§1pursuant28§§ US.C.1331,1332,andandERISA502(e)(1) and (2) (29 US.c.§§ 1132(e)(1)132(e)(I)and (2)),jurisdiction. Thein controversyin excessofand(2)), asas wellwell asas supplementalsupplemental jurisdiction.The amountamount incontroversy isis inexcess of 5,000,000.00 (exclusive(exclusive ofof interestinterest andand costs),costs), andandthisthis isis aa classclass actionaction inin which 5,000,000.00which atat leastleast oneonemember ofof thethe ClassClass isis aa citizenof aa statefrom anyany Defendant.Defendant. Onemembercitizen ofstate differentdifferent fromOne or moremore of theDefendants mayDistrict, andDefendants transacttransact businessbusiness withinwithin the State,Defendantsmay be foundfound in this District,and DefendantsState, havehavecommitted tortioustortious actsacts withinwithin thethe Statetortious actsacts outsidecommittedState and/orand/or havehave committedcommitted tortiousoutside the StateStatethat havethathave causedcaused injuryinjury toto personspersons andand propertyproperty withinwithin thethe State,State, includingincluding thethe PlaintiffsPlaintiffs andandother Classmembers.Defendants also Defendantsmaintain executive officeswithin the StateofotherClassmembers.also maintainexecutiveoffices within the State of NewYork,New York,Defendants inuouslyhavehavedonedoneandandcontinuecontinuetoto dodo businessin thisDefendantsbusiness inthisDistrict, andat leastleast inin partpart outout of Defendants'conduct withinwithin thisDistrict,and thisthis casecase arisesarises atDefendants' actsacts andand thisCourtVenueis isproperin inCourtunderunder2828U.S.C.US.C. § 1391§ 1391becausebecause DefendantsDefendantsmaintain headquartersheadquarters inin thisthis DistrictDistrict andand engagedengaged thereinthereininin actsacts ofof wrongdoing.wrongdoing. VenuemaintainVenue is alsoalsoproper in thispursuant to Section502(e)(2)properin Districtthis DistrictpursuanttoofSection 502(e)(2) of ERISA,U.S.C. §§ 1132(e)(2),1132(e)(2), becausebecauseERISA, 2929 U.S.C.7

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 8 of 44somesome or all of the actionableactionable conductconduct for whichwhich reliefrelief isis soughtsought occurredoccurred in this District,District, and/orand/oronemore of thethe DefendantsDefendants residereside or mayone or moremay be found in this District.District.THE PARTIESPARTIESTHE15.Pensiona qualified,15. TheThePensionFundFundis isa on planplan underunder ERISAERISA andandthethe AnuityAnnuity FundFund isisa aqualified,qualified, defineddefined contributioncontribution pension/profitpension/profit sharingsharing planplan underunder ERISA.ERISA.Theand areare administeredwith thethe goalgoal ofof providingsecurty forThe FundsFunds werewere establishedestablished andadministered withproviding nters.carenters. Plaintiffsby a jointjoint Boardthousands ofofretiredPlaintiffs areareFundsFunds administeredadministered byBoardTrustees locatedlocated atat Jersey.Jersey. TheThe yof TrusteesofFundwas establishedon MayMay 1,1, 1982,Fund wasestablished on1982, andand thethe NewNew JerseyJersey CarentersCarpenters PensionPension FundFund waswasestablishedon JulyJuly 3,3, 1985.established on1985. TheThe BoardsBoards ofof TrusteesTrustees areare thethe namednamed fiduciariesfiduciaries of thethe FundsFundsunderthe AgreementsAgreements and DeclarationsDeclarations of Trust establishingunder theestablishing those FundsFunds and underunder ERISA.ERISA.16.a Delaware-incorporated16. DefendantDefendantBNYBNYMellonMellonCorp.Corp.is isa Delaware-incorporated holdingholding companycompanyheadquareredheadquartered in NewNew York,York, NewNew York,York, establishedestablished inin 20072007 followingfollowing the mergermerger of wYorkYorkCompany,Company,Inc.BNYMBNY andFinancial CorporationthetheBankInc.and affliatesaffiliates arearereportedlyreportedly leadingleading assetasset managersmanagers andand securitiessecurities servicers,servicers, providingproviding investmentinvestment managementmanagementandfiduciar andand fundfund administration,administration, fiduciaryand porations, institutionsinstitutions andandwealthyindividuals. BNYitself asas aa globalwith officesoffceswealthy individuals.BNY MellonMellon Corp.Corp. advertisesadvertises itselfglobal companycompany withthroughoutthe U.S.,U.S., Europe,Europe,thethe MiddleMiddle East,East, SouthSouth America,America, Africa,Afrca, andthroughout theand Asia,Asia, reportedlyreportedlyoperatingin overover 3636 countriescountries andand overover 100 marketsmarkets worldwide.worldwide. BNYoperating inBNY MellonMellon Corp.Corp. reportedlyreportedlyconsidersitself oneone of the world'sconsiders itselfworld's largestlargest securitiessecurities lendinglending agents,agents, andand managesmanages investmentsinvestmentssuchsuch as thosethose involvedinvolved herehere throughthrough its assetasset servicingservicing divisiondivision (BNY(BNY MellonMellon AssetAsset Servicing).Servicing).AsAs of the thirdthird quarterquarter of 2010,2010, BNYBNY MellonMellon Corp.Corp. claimedclaimed to havehave US 24.4 24.4 trilliontrillion in assetsassets"underadministration," and US 1.14"under custodycustody andand administration," 1.14 trilliontrillion in assetsassets "under"under management."management."88

Case 1:11-cv-01555-JSR Document 1Filed 03/07/11 Page 9 of 4417.17. DefendantDefendantBNYBNYMellonMellon isisa abaningbankingcompanycompanyorganizedorganized underunder thethe lawslaws ofof thethestateof Newand (as(as wellwell asas predecessorentityTheTheBankBan ofstate ofNew York,York, andpredecessor entityof NewNew York)York) actedacted as thetheinvestmentwith respectrespect to the Subscriptioninvestment manager,manager, custodiancustodian and operatingoperating trusteetrustee withSubscription AgreementAgreement(defined below 31)Institutional CashCash ReservesReserves FundFund (defined(defined aboveabove atatirir 34(definedbelow at ir31) andand thethe BNYBNY ilstitutional35).18.Mellon,wholly18. ormerlyknownknownasasMellonMellon Bank,Bank, N.A.,N.A., isis aa whollyownedsubsidiary ofof BNYBNY -chareredbankban whichowned subsidiarywhich houseshouses BNYBNY Mellon'sMellon'sWealthWealth ManagementManagement E ALLEGATIONSBackground - The SecuritiesLending MarketMarketBackgroundSecurities Lendingand Defendants'Defendants' SecuritiesSecurities LendingLending ProgramProgram19.lendingis isgenerallyby oneone party19. asasthethelendinglending ofof securitiessecurities byparty(the "lender")"lender") toanother (the(the "borrower")"borrower") governedThe(theto ano

JERSEY CARPENTERS ANNUITY AND PENSION FUNDS, Individually And OnBehalf OfAll Others Similarly Situated, Civil Action No. _ CLASS ACTION COMPLAINT vs. INTRODUCTION AND OVERVIEW BANK OFNEW YORK MELLON, BANK OFNEW YORK MELLON CORPORATION, BNY MELLON, NATIONAL ASSOCIATION, Defendants. 1. TheBoard ofTrustees, onbehalf oftheNew Jersey Carpenters .