Transcription

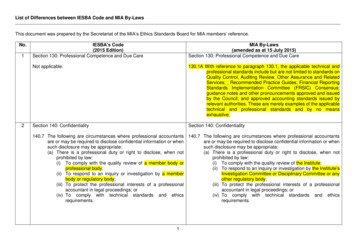

CONTENTSFor ewor d1Th e Or g an is ers2NAC RA Obje c tive s3NAC RA His tory4Awar ds5E l ig ibi lity C rite ria6E n t r y Requ i re ments7Par t i ci pation Fee7NAC RA As s essme nt Criteria8NAC RA 2022 O rga nising Committee13NAC RA 2022 Ad jud ic a tion Committe e13E n t r y For m14NAC RA Pas t W inne rs15

FOREWORDTowards Accountability and ExcellenceThe National Annual Corporate Report Awards (NACRA) is increasinglyrelevant in 2022 as we seek to inspire greater accountability and excellencein corporate reporting. As the world becomes more complex, ambiguous, anduncertain, it is imperative that organisations deliver high-quality fin ancialand non-financial disclosures that tell their unique value creation s tories forthe understanding of investors and stakeholders.To meet the market’s changing expectations of corporate reporting, the N ACRA h as actively tracked andincorporated current d evelopments and best practices into its framework and assessment criteria sinceits inception 32 years ago in 1990 by the Malaysian Institute of Accounta nts ( MIA), The Malaysian Insti tute of Certified Public Accountants (MICPA) and Bursa Malaysia Berhad.For 2022, NACRA continues to raise the bar for corporate reporti ng by encouraging the disclosure ofintegrated financial and non-financial information to effectively communicate enterprise val ue creation.This e nhances compliance with statutory fi nancial statements and Bursa Malaysia’s listi ng require ments, while the provision of non-financial information in the annual r eport meets increasing demand forbusiness sustainability information and its current and projected impacts on enterprise value.To ensure continuing relevance, the NACRA f ramework and assessment criteria which was l ast revised in2020 incorporates value-adding elements that are aligned with l ocal and global devel opments, reporti ngf rameworks and best p ractices. One, N ACRA is aligned with the latest Malaysian Code on CorporateGovernance (MCCG), which was reviewed and updated in April 2021 to strengthen Board governance andintegrate sustainability into business. Two, N ACRA’s emphasis on sustainability el ements in our frame work encourages organisations to integrate ESG considerations into their business models and disclo sure for lasting sustainability. Three, the NACRA framework facilitates investor demands for greateraccountability and transparency on how the COVID-19 pandemic affects enterprise outcomes and pros pects.By curating and balancing the disclosure of fi nancial and non-financial i nformation, a n enterprise candemonstrate how it stayed agile and res ilient to continuously create long-term sta kehol der valueamidst the C OVID-19 and climate crises. This is what the market and investors seek from corporatereporting to support their decision-making processes - a comprehensive yet concise, reliable, balanced,complete, consistent, and comparable account of value creation that clarifies the enterprise’s strategicfocus and future orientation.We trust that N ACRA will inspire you to enhance your corporate reporting in order to present a convinc ing and enthrallin g story of sustainable business and value creati on for investors and the market atlarge. We welcome your participation and support in N ACRA and look forward to learning more aboutyour unique value creation journey to achieve long-term business sustainability.Mr O ng C h ee Wa iChai rma n1

THE ORGANISERSB U R S A M A L AY S I A B E R H A DM A L AY S I A N I N S T I T U T E O F A C C O U N T A N T ST H E M A L AY S I A N I N S T I T U T E O FC E R T I F I E D P U B L I C A C C O U N TA N T S2

NACRA OBJECTIVESTo promote effective communication byTo raise t h e b ar for q u alit y c or p ora t e r ep ortingorganisations through the publication ofin Malaysia.timely, informative, transparent andreader-friendly annual reports.To recognise and encourage excellenceTo create public awareness of the objectivein the presentation of financial andmeasures of an organisation and their valuecorporate information.creation over time, and greater understandingof the fi nancial performance and results againstthe organisation’s strategic objectives.3

NACRA HISTORY2021New NAC R A logo wa s intro duc e d.2019S us ta i na bi l i tySt a t e m e n tim ple mented.In c l u s i ve n e sshasbeen&f u l lyDi ve r s i t y2020New NAC R A f ra m ewor k wa s intro duced.Repo r t i n g Awa r d w h i c h was i n t r od u c e d i n 20 15was r em oved , a s S u st ai n ab i l i t y R e p or t i n g al s oe nco m p a s s es d i s c los u r e s on i n cl u si ve n e s s andd i ve r si ty.2016Co rp o ra t eAwar dSo c i a lhasb eenR e s p on s i b i l i t yR e p or t i ngr e p l ace dthewi t h2017N ACRA intro duc e d the ina ug ura l IntegratedR ep or t in g Awa r d s.n ewSus t a i n a b i l i t y R e p o rt i n g Awa rd .20152013Co rp o ra t eSo c i a lR e s p on s i b i l i t yAwar dwasrenamed a s t h e C or p o ra t e S o c i a l R e s p o n s i b i l i t yN ACRA in pa rtne rs hip with Ta le nt CorporationMa la y s iaBe rha dc a te g o ryfo rintro duc e dIn c lu siven essan&awardD iversityR ep or t in g.R e p o rt i n g Awa rd .2008Envi ron m en t a l R ep or t i n g Awar d was r e n am e d asth e Co r pora te S o c i a l R e s p o n s i b i l i t y Awa rd.1990In rec o gn i t i o n t h at t h e t wo awar d s s h ar e dcomm o nawardso b jec t i ves,totheb ec o m eu n i fi cat i onNationaltheoftheAnnual2012Par t ic ip at ionin t oNAC R Aismadev iaap p lic a t ion a nd no t a uto ma tic e ntry as per theprev io us pro c e s s .2000L a unc hoftheEn vir on m en t alRepo rtingAwar d .Corpora te R epor t Awa rd s (N AC R A ) wh i c h wasjo i ntl yMACPA.s p o n s o r edNAC R AbyK LS E ,con t i n u e dMIA,toMIMbean dj oi n t l yo rganis ed by B u r s a M al ay s i a, M I A an d t h e M I CPAt i l l p r e s e n t.1988The Ma la y s ia n I ns titute o f Ac c o untants (M IA )a nd the Kua la L umpur Sto c k Exc ha n ge (KLSE)c o lla bo ra te d to o rg a nis e the Nat ional Annual1985Launch o f t h e M a l a y s i a nC o rp o ra t eR ep or t Awa r d s (NA R A ).R e p o rtAwards ( M ACR A) w h i c h was j oi n t l y or g an i se d byThe Ma l a y s i a n As s oc i at i on of Ce r t i fi e d Pu b l i cAcco u n t a n t s( MACPA )an dtheM al ay si anIn s t i t u t e of M an ag e m e n t (M I M ).4

AWA R D SNACRA comprises four categories of awards, namely the Excellence Awards, Best SustainabilityReporting Awards, Best Annual Report in Bahasa Malaysia Awards and Best Designed Annual Report.The top award for the most outstanding Annual Report for the year is the Platinum Excellence Award.This Award will be presented to the organisation which displays the highest standard of reporting in itsannual report.Companies with more than RM10 billionin market capitalisationCompanies with RM2 billion to RM10 billionEXCELLENCEAWA R D Sin market capitalisationCompanies with less than RM2 billion in marketcapitalisationNon-listed Organisations[The market capitalisation for NACRA Award 2022 will be based on the market capitalisation as at 4January 2021.]In each category of Excellence Awards (exc ept for the Non-listed Organisations), the number ofwinners (provided the minimum assessment marks are met) are as follows:Platinum1 winnerGoldUp to 3 winnersSilverUp to 3 winnersBest Sustainability ReportingS P E C I A L AWA R D SBest Annual Report in Bahasa MalaysiaBest Designed Annual ReportEach category of Special Awards will have a Platinum, Gold and Silver award.5

ELIGIBILITY CRITERIANACRA is open to all companies incorporated or registered in Malaysia as well as the public sector andother organisations established in Malaysia.Eligible companies including organisations not listed on Bursa Malaysia Securities Berhad (BursaMalaysia), public sector and other organisations established in Malaysia.The annual reports eligible for entry to NACRA 2022 are those with fi nancial years ended in 2021.For companies listed on Bursa Malaysia, the annual reports eligible for entry should fulfi l the followingcriteria:Promptness o f publication i.e. published annual report received by Bursa Malaysia within theprescribed period after year-end.Auditors’ report is not modified, other than due to the true and fair over-ride as permitted undersection 244(3) of the Companies Act 2016.Compliance with all applicable approved Accounting Standards other than due to the true and fairover-ride as permitted under section 244(3) of the Companies Act 2016.No public sanction by Bursa Malaysia or the Securities Commission on the company’s affairs duringthe companies’ financial year of the Award.Companies should not be under a schem e pursuant to section 365 to 368 of the Companies Act 2016or under Bursa Malaysia Practice Note 16 (PN16) / Practice Note 17 (PN17) / Amended Practice Note(Amended PN17)*#.Compliance with the continuing disclosure requirements as set out in Appendix 9C “Contents ofAnnual Report” in Listing Requirements of Bursa Malaysia.*Publ i c l i s t ed c o m pa n i e s l i st e d on t h e ACE M arke t will be re quire d to me e t the re levant ACE Market ListingRequi rem en t s .#These criteria are not applicable to Real Estate Investment Trusts (REITs) and Exchange-Traded Funds(ETFs). REITs and ETFs are also required to comply with the Securities Commission’s Guidelines onListed Real Estate Investment Trusts and E xchange-Traded Funds Guidelines respectively and the relevant Listing Requirements.6

ENTRY REQUIREMENTSNACRA is open to all companies incorporated or registered in Malaysia as well as the public sector andother organisations established in Malaysia.All companies listed on Bursa Malaysia, non-listed companies, public sector and other Malaysianorganisations that wish to participate in NACRA are required to complete an entry form, to be submittedtogether with 5 hard copies and a PDF copy of the published annual report in English, PDF copy of theCorporate Governance Report and 5 hard copies and a PDF copy of the Sustainability Report (if printedseparately) to the NACRA Adjudication Committee by Tuesday, 31 May 2022.Companies that wish to participate in the “Best Annual Report in Bahasa Malaysia” category are alsorequired to submit a PDF copy of the fully translated Bahasa Malaysia Annual Report to the NACRAAdjudication Committee by the deadline stipulated above.PA R T I C I PAT I O N F E EIn line with our efforts to further enhance NACRA 2022 deliverables and to enable the objectives ofNACRA to be fully realised, the following participation fee will apply to participating organisations:*FEECompanies listed on Main MarketRM5,500Companies listed on ACE MarketRM3,500Non-listed companies, Public Sector and other Malaysian OrganisationsRM3,500The participation fee is to be used fully to meet the costs arising from the adjudication process .Through this effort, NACRA is able to enh ance its resources in more effective and meaningful waystowards promoting excellence in annual corporate reporting.ENQUIRIESFor more information about NACRA 2022, please contact the NACRA Secretariat:c/o M alaysian Institute of Accountants (MIA)Dewan AkauntanUnit 33-01, Level 33,Tower A, The Vertical,Avenue 3, Bangsar South City,No. 8, Jalan Kerinchi,59200 Kuala Lump ur.TEL: 03-2722 9000 FAX: 03-2722 9100 EMAIL: nacra@mia.org.my WEBSITE: www.mia.org.my7

NACRA ASSESSMENT CRITERIAE XC E L L E N C E AWA R D SEntrants are asse ssed in the following six (6) areas:A. OverviewPresentation of reliable and relevant information that is fair, balanced and understandable.A clear and meaningful presentation of the organisation’s purpose, mission and vision.Organisations must ensure that there is connectivity of information in presenting the overall viewof the organisation's business. An integrated report should show a holistic picture of thecombination, interrelatedness and dependencies between the factors that affect the organisation’sability to create value over time.Key financial highlights and trends together with financial indicators of the last five years or sincelisting (if it has been listed less than 5 years).B. Detailed information of the organisation’s business, operations and performance (includingfinancial and non-fi nancial performance)Overview of the organisation’s business and operations including its objectives and strategies forachieving the objectives, and how the organisation’s strategies relate to its ability to create value inthe short, medium and long term.Discussion and analysis of the financial results and financial condition including:(i)Commentary on financial and non-financial indicators to measure the organisation’sperformance;(ii) Significant changes in performance, financial position and liquidity as compared with theprevious financial year;(iii) Discussion on the capital expenditure requirements, capital structure and capital resources;and(iv) Known trends and events that are reasonably likely to have a material effect on the organisation’s operations, performance, financial condition, and liquidity, together with the underlyingreasons or implications;Review of operating activities including discussion on the main factors that may affect theoperating activities of each principal business segment of the organisation, impact on futureoperating activities, and the approach or action taken in dealing with the effect or outcome of suchmatters on its business activities;8

Any identified anticipated or known risks that the organisation is exposed to which may have amaterial effect on the organisation’s operations, performance, financial condition, and liquiditytogether with a discussion of the plans or strategies to mitigate such risks; andForward-looking statement providing commentary on:(i)Organisation’s possible trend, outlook and sustainability of each of its principal businesssegment;(ii) Prospects of new businesses or investments; and(iii) Dividend or distribution policy, if any, and factors contributing to the dividend or distributionfor the financial year.C. Fi nancial StatementsThe financial statements should be prepared in compliance with approved accounting standards anddisclosure requirements set out in the Companies Act 2016, the Listing Requirements of BursaMalaysia and other relevant legislation. Organisations are encouraged to provide relevant andreliable financial information which exceeds the mandatory requirements.The financial statements should comprise:A statement of financial position, statement of profit or loss and other comprehensive income,statement of changes in equity and statement of cashflows.Significant accounting policies are identified and described in a clear and entity-specific manner.Quality and clarity of disclosures in the notes to the financial statements. Clear and conciseexplanatory notes covering major or extraordinary events/ transactions during the year.Ensure that key disclosures are clearly set out and avoid compliance box-ticking or boilerplatedisclosures.Appearance and presentation of financial statements and related notes achieve understandabilityand readability.D. Corporate Governance (“CG”) DisclosuresCompanies listed on Bursa Malaysia must make the Corporate Governance disclosure of theapplication of the principles set out in the Malaysian Code on Corporate Governance 2021 (“MCCG”).Non-listed entities and other organisations are encouraged to embrace the code on corporategovernance and should consider applying the practices in the MCCG to enhance their accountability,transparency and sustainability.CG Overview StatementThe annual report should include the CG Overview Statement which provides a summary of theorganisation’s corporate governance practices during the fi nancial year with reference to the threePrinciples:Board leadership and effectiveness;Effective audit and risk management; andIntegrity in corporate reporting and meaningful relationship with stakeholders.9

The company should highlight the key focus areas and future priorities in relation to its corporategovernance practices through CG Overview Statement.In making the CG Overview Statement, the companies must also consider the following:Ensure the CG Overview Statement:(i)contain adequate information to enable an informed assessment by shareholders andpotential investors of its corporate governance practices; and(ii) align with the spirit and Intended Outcome of the MCCG.Ensure that key messages on governance are clearly set out and avoid compliance box-ticking or boilerplate statements.E. Sustainability ReportingThe annual re port should include a narrative statement of the management of material economic,environmental and social risks and opp ortunities (“Sustainability Statement”).The Sustainability Statement should contain information that is balanced, comparable and meaningful by referring to the Sustainability Reporting Guide issued by Bursa Malaysia.The Sustainability Statement must include disclosures as follows:The governance structure in place to manage the economic, environmental and social risks andopportunities;The scope of the Sustainability Statement and basis for the scope;Material sustainability matters:(i)Identification of Material Sustainability Matters: It includes materiality determinationprocess i.e. how and why they are important(ii) How they are managed including details on:- Policies to manage these sustainability matters;- Measures or actions taken to deal with these sustainability matters; and- Indicators relevant to these sustainability matters which demonstrate how the listedissuer has performed in managing these sustainability matters.10

F. Overall Presentation and Additional ConsiderationOrganisations are encouraged to:Enhance the connectivity of information within the corporate reporting.Include other relevant information beyond the statutory requirements which are useful forunderstanding of the annual report, for example, share trading information (e.g. trading volume andprice movements).Include sufficient concise information under the organisation’s strategy, governance, performanceand prospects excluding less relevant information.Include the nature and quality of the organisation’s relationships with its key stakeholdersincluding how and to what extent the organisation understands, takes into account and responds totheir legitimate needs and interests.Marking Criteria Weightage For Excellence AwardsThe general marking criteria weightage for Excellence Awards are as follows:C o r p o ra t e In for m at i on (i n cl u d i n g fi n an ci a l a nd no n-fina nc ia l info rma tio n)45%Fi n a n c i a l St a t e m e n t s (c om p l i an c e wi t h approve d a c c o unting s ta nda rds a nd40%d i s c l o s u r e r equ i r e m e n t s)Su s t a i n a b i l i t y R e p or t i n g10%C o r p o ra t e G ove r n an ce Di sc l os u r e s5%100%11

NACRA ASSESSMENT CRITERIAS P E C I A L AWA R D SBest Sustainability ReportingThe Award for Best Sustainability Reporting will be presented to Sustainability Statement pr epared inaccordance with the Bursa Malaysia’s Sustainability Reporting Guide (2nd Edition). If a listed issuerprepares its Sustainability Statement in accordance with the GRI Sustainability Reporting Guidelines,the Award will be presented to Sustainability Statement prepared pursuant to GRI SustainabilityRepo rting Guidelines.The Sustainability Statement will be assessed based on the following factors:How sustainability facilitates, suppor ts and drives corporate strategic objectives and societalvalue;The risks and opportunities connected to sustainability matters;How your organisation identifies, eva luates and manages material sustainability risks and theopportunities in creating long term value to stakeholders and society at large; andThe quality and depth of sustainability information disclosed to meet the needs and expectationsof users.Best Annual Report in Bahasa MalaysiaIt is the aim of NACRA to promote the use of Bahasa Malaysia in annual reports. The annual reports willbe judged according to the following criteria:Grammar and usage of language.Usage of generally accepted accounting and other fi nancial terminologies.Accuracy and fluency of translation.Spelling and punctuation.Readability and user-friendly presentation.Best Designed Annual ReportPresentation of information in a concise, logical and easy to understand format is a crucial aspect ofannual reporting. The design of the annual report can also play an important role in improving the levelof presentation and readability of an annual report to its various audiences. The Best Designed AnnualReport is intended to recognise creativity and ingenuity in the use of graphics, illustrations, photographs and layout concepts that enhance the communicative effect of the annual report.The following asp ects will be considered:Clear reflection of the organisation’s theme, objective or vision in the cover design.L ogical progression of report and continuity of design.Relevance and effectiveness of the graphs, photographs and graphics used.Overall layout and photography.Overall neatness and readability of the report – effective use of colour, white space, captions,headlines, type styles and size.12

O R G A N I S I N G & A D J U D I C AT I O NCOMMITTEESNACRA 2022 Organising CommitteeMr Ong Chee Wai (Chairman)Mr Soo Hoo Khoon Yean (Alternate Chairman)En Novie TajuddinEn Ahmad Zahirudin Abdul Rahim (Chairman)Mr Irvin Menezes (Alternate Chairman)Ms Low Wai Ky – Official SecretaryEn Mohd Syafi k Afandi Mohd AzharMs Lailatul Fitriyah MatsainiNACRA 2022 Adjudication CommitteeEn Ahmad Zahirudin Abdul Rahim (MIA)(Chairman)Mr Irvin Menezes (MIA)(Alternate Chairman)Mr Ong Chee Wai (MICPA)Mr Soo Hoo Khoon Yean (MICPA)Ms Tan Lay Khoon (Bursa Malaysia)Joint SecretariesMs Low Wai Ky (MIA)Ms Chiam Pei Pei (MICPA)13

NACRA 2022 ENTRY FORMPlease complete the Entry Form details by scanning the QR code below or at this link :https://form.jotform.com/22046200647144 5Once your entry form has been received, an invoice will be prepared and sent to the email addressprovided to us.PAYMENT1. Please take note that Malaysian Institute of Accountants cease to accept payments through cash orcheque beginning January 2022.2. Payment should be made to “Malaysian In stitute of Accountants” by electronic fund transfer (EFT)to the bank account as stated in the invoice.3. Indicate clearly the invoice number in the payment remark.4. Email the payment advice/ bank acknowledgement once payment been made.5 copies of the Annual Report in English and 5 copies of the Sustainability Report (if printed separately)must be sent to the NACRA Secretatariat at the address provided. The PDF copies of the Annual Reportin English, Corporate Governance Report, the Sustainability Report (if printed separately) and the fullytranslated Bahasa Malaysia Annual Report (only for companies participating in the “Best Annual Reportin Bahasa Malaysia” category) must be emailed to the Secretariat at nacra@mia.org.myThe SecretaryNACRA 2022 Adjudication Committeec/o Malaysian Institute Accountants (MIA)Dewan Akauntan, Unit 33-01, Level 33, Tower A, The Vertical, Avenue 3, Bangsar South City, No. 8, JalanKerinchi, 59200 Kuala Lumpur.TEL: 03-2722 9000 FAX: 03-2722 9100 EMAIL: nacra@mia.org.my WEBSITE: www.mia.org.myCLO S IN G DATE F OR S U B M I S S I O N O F E N T R I E S : Tu esd a y, 31 M a y 20 22.Please contact Ms Low Wai Ky of MIA Tel: 03 - 2722 9000 or email nacra@mia.org.myfor further information.14

N A C R A PA ST W I N N E R SW I N N E R S O F E XC E L L E N C E AWA R D 2 0 2 1C om pan i e s w i th more th a n RM1 0 billion in ma rket c a p it a lis a t io nCIMB G R OUP H O L DIN GS B ER H A D( P LAT I N U M )C om pani e s w i th R M2 billion toRM1 0 billion in mar ke t c a p it a lis a t io nSUNWAY B E R H A D( P L ATI N U M )C om pani e s w i th l ess th a n RM2 billion in ma rket c a p it a lis a t io nK UMP ULAN P ER A N GSA N G SEL A N GO R BE RH A D(PLAT I N U M )No n - l i s te d or g an isa tion sP ET R OLIAM N ASI O N A L B ER H A D( P L AT I N U M )W I N N E R S O F E XC E L L E N C E AWA R D 2 0 2 0C om pani e s w i th more th a n RM1 0 billion in ma rket c a p it a lis a t io nP UB LIC B AN K B H D( P L ATIN U M )Co m pani e s w i th RM2 billion toRM1 0 billion in mar ke t c a p it a lis a t io nT ELEKOM M A L AYSI A( P L ATIN U M )C om pani e s w i th l ess th a n RM2 billion in ma rket c a p it a lis a t io nSUNWAY CO N STR U CTIO N GR O U P B H D(PLAT I N U M )No n- l i s te d or g an isa tion sP ET R OLIAM N ASI O N A L B H D( P L ATI N U M )W I N N E R S O F OV E R A L L E XC E L L E N C E AWA R D1990PUBLIC BANK BER HAD2 0 11TELEKOM MALAYSIA BERHAD1991 – 1996AMMB HOLDINGS BER HAD2 0 12MALAYAN BANKING BERHAD1997PUBLIC BANK BER HAD2 0 13TELEKOM MALAYSIA BERHAD1 9 9 8 – 2 001KUMPULAN GUTHR IE BERHAD2 0 14TELEKOM MALAYSIA BERHAD2 002 – 2 005PUBLIC BANK BER HAD2 0 15MALAYAN BANKING BERHAD2 006TELEKOM MALAYSIA BERHAD2 0 16MALAYAN BANKING BERHAD2 007 – 2 01 0PUBLIC BANK BER HAD2 0 17 - 2 0 19CIMB GROUP HOLDINGS BERHADChallenge for the Most Outstanding Annual Report of The YearWe look forward to meeting you at the NACRA 2022 Virtual Awards Presentation Ceremony onDecember 15, 2022.15

incorpor ated current developments and best practices into its framework and asse ssmen t crite ria since its incept ion 32 years ago in 1990 by the Malaysian Institute of Accou ntants (MIA), The Malaysian Inst i- . Corporate Governance Report and 5 hard copies and a PDF copy of the Sustainability Report (if printed separately) to the NACRA .