Transcription

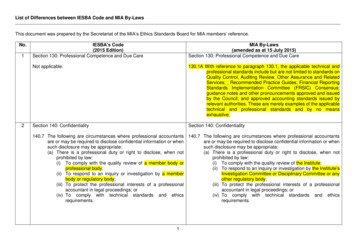

List of Differences between IESBA Code and MIA By-LawsThis document was prepared by the Secretariat of the MIA’s Ethics Standards Board for MIA members’ reference.No.12IESBA’s Code(2015 Edition)Section 130: Professional Competence and Due CareMIA By-Laws(amended as at 15 July 2015)Section 130: Professional Competence and Due CareNot applicable.130.1A With reference to paragraph 130.1, the applicable technical andprofessional standards include but are not limited to standards onQuality Control, Auditing Review, Other Assurance and RelatedServices; , Recommended Practice Guides; Financial ReportingStandards Implementation Committee (FRSIC) Consensus;guidance notes and other pronouncements approved and issuedby the Council; and approved accounting standards issued byrelevant authorities. These are merely examples of the applicabletechnical and professional standards and by no meansexhaustive.Section 140: ConfidentialitySection 140: Confidentiality140.7 The following are circumstances where professional accountants 140.7 The following are circumstances where professional accountantsare or may be required to disclose confidential information or whenare or may be required to disclose confidential information or whensuch disclosure may be appropriate:such disclosure may be appropriate:(a) There is a professional duty or right to disclose, when not(a) There is a professional duty or right to disclose, when notprohibited by law:prohibited by law:(i) To comply with the quality review of a member body or(i) To comply with the quality review of the Institute;professional body;(ii) To respond to an inquiry or investigation by the Institute’s(ii) To respond to an inquiry or investigation by a memberInvestigation Committee or Disciplinary Committee or anybody or regulatory body;other regulatory body;(iii) To protect the professional interests of a professional(iii) To protect the professional interests of a professionalaccountant in legal proceedings; oraccountant in legal proceedings; or(iv) To comply with technical standards and ethics(iv) To comply with technical standards and ethicsrequirements.requirements.1

List of Differences between IESBA Code and MIA By-LawsNo.3IESBA’s Code(2015 Edition)Section 150: Professional BehaviorMIA By-Laws(amended as at 15 July 2015)Section 150: Professional Behavior150.1 In marketing and promoting themselves and their work, 150.2 In advertising, marketing or promoting themselves and their work,professional accountants shall not bring the profession intoprofessional accountants shall not bring the profession intodisrepute. Professional accountants shall be honest and truthfuldisrepute and shall ensure that such advertisement, marketing orand not:promotional material is:(a) make exaggerated claims for the services they are able to(a) professionally dignified and in good taste; andoffer, the qualifications they possess, or experience they have(b) carried out in accordance with the relevant legislation wheregained; orapplicable.(b) make disparaging references or unsubstantiated comparisonsto the work of others.150.3 Professional accountants shall be honest and truthful and shall not:(a) make exaggerated claims for the services they are able tooffer, the qualifications they possess, or experience they havegained; or(b) make disparaging references or unsubstantiated comparisonsto the work of others.4Section 210: Professional AppointmentSection 210: Professional AppointmentChanges in Professional AppointmentChanges in Professional AppointmentNot applicable.210.10A In the case of a financial statement audit engagement, nomember in public practice shall accept nomination for theengagement without enquiring from the existing auditor as towhether there is any professional or other reason for theproposed change of which he should be aware before decidingwhether or not to accept the appointment and, if there are suchreasons, requesting the existing auditor to provide him with allthe details necessary to enable him to come to a decision.2

List of Differences between IESBA Code and MIA By-LawsNo.5IESBA’s Code(2015 Edition)Section 210: Professional AppointmentMIA By-Laws(amended as at 15 July 2015)Section 210: Professional AppointmentChanges in Professional AppointmentChanges in Professional Appointment210.14 A professional accountant in public practice will generally need to 210.14 A professional accountant in public practice will generally need toobtain the client's permission, preferably in writing, to initiateobtain the client’s permission, preferably in writing, to initiatediscussion with an existing accountant. Once that permission isdiscussion with an existing accountant. Where:obtained, the existing accountant shall comply with relevant legal(a) permission is refused, the professional accountant in publicand other regulations governing such requests. Where the existingpractice shall decline the appointment.accountant provides information, it shall be provided honestly and(b) permission is obtained, the existing accountant shall complyunambiguously. If the proposed accountant is unable towith relevant legal and other regulations governing suchcommunicate with the existing accountant, the proposedrequests. Where the existing accountant provides information,accountant shall take reasonable steps to obtain information aboutit shall be provided honestly and unambiguously. If theany possible threats by other means, such as through inquiries ofproposed accountant is unable to communicate with thethird parties or background investigations of senior management orexisting accountant, the proposed accountant shall takethose charged with governance of the client.reasonable steps to obtain information about any possiblethreats by other means, such as through inquiries of thirdparties or background investigations of senior management orthose charged with governance of the client.6Section 240: Fees and Other Types of RemunerationSection 240: Fees and Other Types of RemunerationFees240.2 The existence and significance of any threats created will dependon factors such as the level of fee quoted and the services to whichit applies. The significance of any threat shall be evaluated andsafeguards applied when necessary to eliminate the threat orreduce it to an acceptable level. Examples of such safeguardsinclude: Making the client aware of the terms of the engagement and, inparticular, the basis on which fees are charged and whichservices are covered by the quoted fee; or Assigning appropriate time and qualified staff to the task.3240.2 The existence and significance of any threats will depend onfactors such as the level of fee quoted and the services to which itapplies. The significance of any threat shall be evaluated andsafeguards applied when necessary to eliminate the threat orreduce it to an acceptable level. Examples of such safeguardsinclude:(a) Making the client aware of the terms of the engagement and,in particular, the basis on which fees are charged and whichservices are covered by the quoted fee.

List of Differences between IESBA Code and MIA By-LawsIESBA’s Code(2015 Edition)No.7Section 240: Fees and Other Types of RemunerationMIA By-Laws(amended as at 15 July 2015)(b) Making the client aware of the statutory duties andresponsibilities involved, if any, in respect of the engagement.(c) Assigning appropriate time and qualified staff to the task.Section 240: Fees and Other Types of RemunerationFees8Not applicable.240.2A Fees charged for all engagements should be a fair reflection of thevalue of the work involved and should take into account, amongothers:(a) the skill and knowledge required for the type of work involved;(b) the level of training and experience of the persons necessarilyengaged on the work;(c) the time necessarily occupied by each person engaged onthe work; an(d) the degree of responsibility and urgency that the work entails.Section 250: Marketing Professional ServicesSection 250: Marketing Public Practice ServicesAdvertising or Marketing Services250.2 A professional accountant in public practice shall not bring the 250.2 A professional accountant in public practice shall not bring theprofession into disrepute when marketing professional services.profession into disrepute when advertising or marketing publicThe professional accountant in public practice shall be honest andpractice services. The professional accountant in public practicetruthful, and not:shall be honest and truthful and not:(a) Make exaggerated claims for services offered, qualifications(a) Make exaggerated claims for services offered, qualificationspossessed, or experience gained; orpossessed or experience gained;(b) Make disparaging references or unsubstantiated comparisons(b) Make disparaging references to unsubstantiated comparisonsto the work of another.to the work of another.If the professional accountant in public practice is in doubt aboutwhether a proposed form of advertising or marketing is appropriate,the professional accountant in public practice shall considerconsulting with the relevant professional body.4

List of Differences between IESBA Code and MIA By-LawsNo.9IESBA’s Code(2015 Edition)Section 250: Marketing Professional ServicesMIA By-Laws(amended as at 15 July 2015)Section 250: Marketing Public Practice ServicesAdvertising or Marketing Services10Not applicable.250.3 If the professional accountant in public practice is in doubt whethera proposed form of advertising or marketing is appropriate, theprofessional accountant in public practice shall consider consultingwith the Institute.Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsEmployment with an Audit ClientEmployment with an Audit ClientAudit Clients that are Public Interest EntitiesAudit Clients that are Public Interest Entities290.137 Familiarity or intimidation threats are created when a key audit 290.139 Familiarity or intimidation threats are created when a key auditpartner joins the audit client that is a public interest entity as:partner joins the audit client that is a public interest entity as:(a) A director or officer of the entity; or(a) A director or officer of the entity; or(b) An employee in a position to exert significant influence over(b) An employee in a position to exert significant influence overthe preparation of the client's accounting records or thethe preparation of the client’s accounting records or thefinancial statements on which the firm will express an opinion.financial statements on which the firm will express an opinion.Independence would be deemed to be compromised unless,Independence would be deemed to be compromised unless,subsequent to the partner ceasing to be a key audit partner, thesubsequent to the partner ceasing to be a key audit partner, thepublic interest entity had issued audited financial statementspublic interest entity had issued audited financial statementscovering a period of not less than twelve months and the partnercovering a period of not less than two years and the partner waswas not a member of the audit team with respect to the audit ofnot a member of the audit team with respect to the audit of thosethose financial statements.financial statements.5

List of Differences between IESBA Code and MIA By-LawsNo.11IESBA’s Code(2015 Edition)Section 290: Independence – Audit and Review EngagementsMIA By-Laws(amended as at 15 July 2015)Section 290: Independence – Audit and Review EngagementsEmployment with an Audit ClientEmployment with an Audit ClientAudit Clients that are Public Interest EntitiesAudit Clients that are Public Interest Entities290.138 An intimidation threat is created when the individual who was the 290.140 An intimidation threat is created when the individual who was thefirm's Senior or Managing Partner (Chief Executive or equivalent)firm’s Senior or Managing Partner (Chief Executive or equivalent)joins an audit client that is a public interest entity as:joins an audit client that is a public interest entity as (a) an(a) An employee in a position to exert significant influence overemployee in a position to exert significant influence over thethe preparation of the entity's accounting records or itspreparation of the entity’s accounting records or its financialfinancial statements; orstatements or (b) a director or officer of the entity. Independence(b) A director or officer of the entity.would be deemed to be compromised unless two years haveIndependence would be deemed to be compromised unlesspassed since the individual was the Senior or Managing Partnertwelve months have passed since the individual was the Senior(Chief Executive or equivalent) of the firm.or Managing Partner (Chief Executive or equivalent) of the firm.1213Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsServing as a Director or Officer of an Audit ClientServing as a Director or Officer of an Audit ClientNot applicable.290.149A Company secretary is defined as an officer of a company underSection 4 of the Companies Act 1965. Pursuant to Section 9of the Companies Act 1965, an individual shall not act as anapproved company auditor if he or she is also an officer of acompany.Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsLong Association of Senior Personnel (Including Partner Rotation) with an Long Association of Senior Personnel (Including Partner Rotation) with anAudit ClientAudit ClientAudit Clients that are Public Interest EntitiesAudit Clients that are Public Interest Entities6

List of Differences between IESBA Code and MIA By-LawsNo.IESBA’s Code(2015 Edition)290.149 In respect of an audit of a public interest entity, an individual shallnot be a key audit partner for more than seven years. After suchtime, the individual shall not be a member of the engagementteam or be a key audit partner for the client for two years. Duringthat period, the individual shall not participate in the audit of theentity, provide quality control for the engagement, consult with theengagement team or the client regarding technical or industryspecific issues, transactions or events or otherwise directlyinfluence the outcome of the engagement.MIA By-Laws(amended as at 15 July 2015)290.151 In respect of an audit of a public interest entity, an individual shallnot be a key audit partner for more than five years. After suchtime, the individual shall not be a member of the engagementteam or be a key audit partner for the client for two years. Duringthat period, the individual shall not participate in the audit of theentity, provide quality control for the engagement, consult with theengagement team or the client regarding technical or industryspecific issues transactions or events or otherwise directlyinfluence the outcome of the engagement.14Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsLong Association of Senior Personnel (Including Partner Rotation) with an Long Association of Senior Personnel (Including Partner Rotation) with anAudit ClientAudit ClientAudit Clients that are Public Interest EntitiesAudit Clients that are Public Interest Entities290.152 When an audit client becomes a public interest entity, the lengthof time the individual has served the audit client as a key auditpartner before the client becomes a public interest entity shall betaken into account in determining the timing of the rotation. If theindividual has served the audit client as a key audit partner forfive years or less when the client becomes a public interest entity,the number of years the individual may continue to serve theclient in that capacity before rotating off the engagement is sevenyears less the number of years already served. If the individualhas served the audit client as a key audit partner for six or moreyears when the client becomes a public interest entity, the partnermay continue to serve in that capacity for a maximum of twoadditional years before rotating off the engagement.290.154 When an audit client becomes a public interest entity, the lengthof time the individual has served the audit client as a key auditpartner before the client becomes a public interest entity shall betaken into account in determining the timing of the rotation. If theindividual has served the audit client as a key audit partner forthree (3) years or less when the client becomes a public interestentity, the number of years the individual may continue to servethe client in that capacity before rotating off the engagement isfive (5) years less the number of years already served. If theindividual has served the audit client as a key audit partner forfour (4) or more years when the client becomes a public interestentity, the partner may continue to serve in that capacity for amaximum of two additional years before rotating off theengagement.7

List of Differences between IESBA Code and MIA By-LawsNo.15IESBA’s Code(2015 Edition)Section 290: Independence – Audit and Review EngagementsMIA By-Laws(amended as at 15 July 2015)Section 290: Independence – Audit and Review EngagementsLong Association of Senior Personnel (Including Partner Rotation) with an Long Association of Senior Personnel (Including Partner Rotation) with anAudit ClientAudit Client16Audit Clients that are Public Interest EntitiesAudit Clients that are Public Interest Entities290.153 When a firm has only a few people with the necessary knowledgeand experience to serve as a key audit partner on the audit of apublic interest entity, rotation of key audit partners may not be anavailable safeguard. If an independent regulator in the relevantjurisdiction has provided an exemption from partner rotation insuch circumstances, an individual may remain a key audit partnerfor more than seven years, in accordance with such regulation,provided that the independent regulator has specified alternativesafeguards which are applied, such as a regular independentexternal review.290.155 When a firm has only a few people with the necessary knowledgeand experience to serve as a key audit partner on the audit of apublic interest entity, rotation of key audit partners may not be anavailable safeguard. If an independent regulator in the relevantjurisdiction has provided an exemption from partner rotation insuch circumstances, an individual may remain a key audit partnerfor more than five years, in accordance with such regulation,provided that the independent regulator has specified alternativesafeguards which are applied, such as a regular independentexternal review.Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsPreparing Accounting Records and Financial StatementsPreparing Accounting Records and Financial StatementsAudit clients that are public interest entitiesAudit Clients that are Public Interest Entities290.169 Except in emergency situations, a firm shall not provide to anaudit client that is a public interest entity accounting andbookkeeping services, including payroll services, or preparefinancial statements on which the firm will express an opinion orfinancial information which forms the basis of the financialstatements.290.172 The provision of accounting and bookkeeping services, includingpayroll services and the preparation of financial statements orfinancial information which forms the basis on which the auditreport is provided, on behalf of a financial statement audit clientthat is a public interest entity, impairs the independence of thefirm, or at least give the appearance of impairing independence.Accordingly, no safeguard other than the prohibition of suchservices, could reduce the threat created to an acceptable level.Therefore, a firm shall not, provide such services to a publicinterest entity that is an audit client.8

List of Differences between IESBA Code and MIA By-LawsNo.1718IESBA’s Code(2015 Edition)Section 290: Independence – Audit and Review EngagementsMIA By-Laws(amended as at 15 July 2015)Section 290: Independence – Audit and Review EngagementsPreparing Accounting Records and Financial StatementsPreparing Accounting Records and Financial StatementsAudit clients that are public interest entitiesAudit Clients that are Public Interest Entities290.170 Despite paragraph 290.169, a firm may provide accounting andbookkeeping services, including payroll services and thepreparation of financial statements or other financial information,of a routine or mechanical nature for divisions or related entitiesof an audit client that is a public interest entity if the personnelproviding the services are not members of the audit team and:(a) The divisions or related entities for which the service isprovided are collectively immaterial to the financialstatements on which the firm will express an opinion; or(b) The services relate to matters that are collectively immaterialto the financial statements of the division or related entity.290.173 [This section is intentionally left blank]Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsPreparing Accounting Records and Financial StatementsPreparing Accounting Records and Financial StatementsAudit clients that are public interest entitiesAudit Clients that are Public Interest EntitiesEmergency Situations290.171 Accounting and bookkeeping services, which would otherwise notbe permitted under this section, may be provided to audit clientsin emergency or other unusual situations, when it is impracticalfor the audit client to make other arrangements. This may be thecase when (a) only the firm has the resources and necessaryknowledge of the client's systems and procedures to assist theclient in the timely preparation of its accounting records andfinancial statements, and (b) a restriction on the firm's ability to9290.174 [This section is intentionally left blank]

List of Differences between IESBA Code and MIA By-LawsNo.19IESBA’s Code(2015 Edition)provide the services would result in significant difficulties for theclient (for example, as might result from a failure to meetregulatory reporting requirements). In such situations, thefollowing conditions shall be met:(a) Those who provide the services are not members of the auditteam;(b) The services are provided for only a short period of time andare not expected to recur; and(c) The situation is discussed with those charged withgovernance.MIA By-Laws(amended as at 15 July 2015)Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsTax Calculations for the Purpose of Preparing Accounting EntriesTax Calculations for the Purpose of Preparing Accounting EntriesAudit clients that are public interest entitiesAudit clients that are Public Interest Entities290.182 Except in emergency situations, in the case of an audit client that 290.185 In the case of an audit client that is a public interest entity, a firmis a public interest entity, a firm shall not prepare tax calculationsshall not prepare tax calculations of current and deferred taxof current and deferred tax liabilities (or assets) for the purposeliabilities (or assets) for the purpose of preparing accountingof preparing accounting entries that are material to the financialentries that are material to the financial statements on which thestatements on which the firm will express an opinion.firm will express an opinion.20Section 290: Independence – Audit and Review EngagementsSection 290: Independence – Audit and Review EngagementsTax Calculations for the Purpose of Preparing Accounting EntriesTax Calculations for the Purpose of Preparing Accounting EntriesAudit clients that are public interest entitiesAudit clients that are Public Interest Entities290.183 The preparation of calculations of current and deferred tax 290.186 [This section is intentionally left blank]liabilities (or assets) for an audit client for the purpose of thepreparation of accounting entries, which would otherwise not bepermitted under this section, may be provided to audit clients inemergency or other unusual situations when it is impractical for10

List of Differences between IESBA Code and MIA By-LawsIESBA’s Code(2015 Edition)the audit client to make other arrangements. This may be the casewhen (a) only the firm has the resources and necessaryknowledge of the client's business to assist the client in the timelypreparation of its calculations of current and deferred tax liabilities(or assets), and (b) a restriction on the firm's ability to provide theservices would result in significant difficulties for the client (forexample, as might result from a failure to meet regulatoryreporting requirements). In such situations, the followingconditions shall be met:(a) Those who provide the services are not members of the auditteam;(b) The services are provided for only a short period of time andare not expected to recur; and(c) The situation is discussed with those charged withgovernance.No.21Section 290: Independence – Audit and Review EngagementsMIA By-Laws(amended as at 15 July 2015)Section 290: Independence – Audit and Review EngagementsProvision of Dispute Resolution Services to an Audit ClientNot applicable.290.213A Notwithstanding paragraphs 290.209, 290.210 and 290.213, theprofessional accountants are required to observe the relevantlaws and regulations as provided in the Legal Profession Act1976, Advocate Ordinance Sabah 1953 and AdvocateOrdinance Sarawak 1953 in relation to provision of legalservices in Malaysia.22Section 330: Acting with Sufficient Expertise330.3Section 330: Acting with Sufficient ExpertiseThe significance of the threat will depend on factors such as the 330.3 The significance of the threat will depend on factors such as theextent to which the professional accountant in business is workingextent to which the professional accountant in business is workingwith others, relative seniority in the business, and the level ofwith others, relative seniority in the business, and the level ofsupervision and review applied to the work. The significance ofsupervision and review applied to the work. The significance of thethe threat shall be evaluated and safeguards applied whenthreat shall be evaluated and safeguards applied when necessary11

List of Differences between IESBA Code and MIA By-LawsNo.23IESBA’s Code(2015 Edition)necessary to eliminate the threat or reduce it to an acceptablelevel. Examples of such safeguards include: Obtaining additional advice or training. Ensuring that there is adequate time available for performingthe relevant duties. Obtaining assistance from someone with the necessaryexpertise. Consulting, where appropriate, with:o Superiors within the employing organization;o Independent experts; oro A relevant professional body.MIA By-Laws(amended as at 15 July 2015)to eliminate the threat or reduce it to an acceptable level. Examplesof such safeguards include:(a) Obtaining additional advice or training.(b) Ensuring that there is adequate time available for performingthe relevant duties.(c) Obtaining assistance from someone with the necessaryexpertise.(d) Consulting, where appropriate, with:(i) Superiors within the employing organization;(ii) Independent experts; or(e) To seek guidance from the Institute.DefinitionsDefinitionsDirector or officerThose charged with the governance of an entity, or acting in an equivalentcapacity, regardless of their title, which may vary from jurisdiction tojurisdiction.Director or officerThose charged with the governance of an entity, or acting in an equivalentcapacity, regardless of their title, and include those persons defined inother relevant legislations.12

List of Differences between IESBA Code and MIA By-Laws 4 No. IESBA's Code (2015 Edition) MIA By-Laws (amended as at 15 July 2015) (b) Making the client aware of the statutory duties and responsibilities involved, if any, in respect of the engagement. (c) Assigning appropriate time and qualified staff to the task.