Transcription

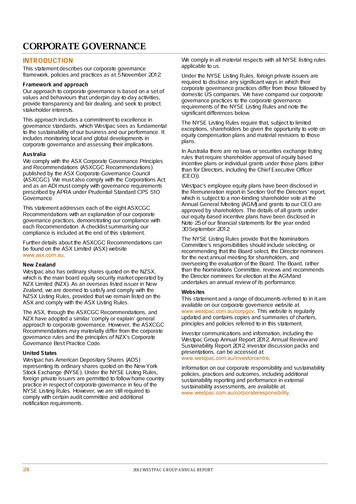

CORPORATE GOVERNANCEINTRODUCTIONThis statement describes our corporate governanceframework, policies and practices as at 5 November 2012.Framework and approachOur approach to corporate governance is based on a set ofvalues and behaviours that underpin day-to-day activities,provide transparency and fair dealing, and seek to protectstakeholder interests.This approach includes a commitment to excellence ingovernance standards, which Westpac sees as fundamentalto the sustainability of our business and our performance. Itincludes monitoring local and global developments incorporate governance and assessing their implications.AustraliaWe comply with the ASX Corporate Governance Principlesand Recommendations (ASXCGC Recommendations)published by the ASX Corporate Governance Council(ASXCGC). We must also comply with the Corporations Actand as an ADI must comply with governance requirementsprescribed by APRA under Prudential Standard CPS 510Governance.This statement addresses each of the eight ASXCGCRecommendations with an explanation of our corporategovernance practices, demonstrating our compliance witheach Recommendation. A checklist summarising ourcompliance is included at the end of this statement.Further details about the ASXCGC Recommendations canbe found on the ASX Limited (ASX) website.New ZealandWestpac also has ordinary shares quoted on the NZSX,which is the main board equity security market operated byNZX Limited (NZX). As an overseas listed issuer in NewZealand, we are deemed to satisfy and comply with theNZSX Listing Rules, provided that we remain listed on theASX and comply with the ASX Listing Rules.The ASX, through the ASXCGC Recommendations, andNZX have adopted a similar ‘comply or explain’ generalapproach to corporate governance. However, the ASXCGCRecommendations may materially differ from the corporategovernance rules and the principles of NZX’s CorporateGovernance Best Practice Code.United StatesWestpac has American Depositary Shares (ADS)representing its ordinary shares quoted on the New YorkStock Exchange (NYSE). Under the NYSE Listing Rules,foreign private issuers are permitted to follow home countrypractice in respect of corporate governance in lieu of theNYSE Listing Rules. However, we are still required tocomply with certain audit committee and additionalnotification requirements.24We comply in all material respects with all NYSE listing rulesapplicable to us.Under the NYSE Listing Rules, foreign private issuers arerequired to disclose any significant ways in which theircorporate governance practices differ from those followed bydomestic US companies. We have compared our corporategovernance practices to the corporate governancerequirements of the NYSE Listing Rules and note thesignificant differences below.The NYSE Listing Rules require that, subject to limitedexceptions, shareholders be given the opportunity to vote onequity compensation plans and material revisions to thoseplans.In Australia there are no laws or securities exchange listingrules that require shareholder approval of equity basedincentive plans or individual grants under those plans (otherthan for Directors, including the Chief Executive Officer(CEO)).Westpac’s employee equity plans have been disclosed inthe Remuneration report in Section 9 of the Directors’ report,which is subject to a non-binding shareholder vote at theAnnual General Meeting (AGM) and grants to our CEO areapproved by shareholders. The details of all grants underour equity-based incentive plans have been disclosed inNote 25 of our financial statements for the year ended30 September 2012.The NYSE Listing Rules provide that the NominationsCommittee’s responsibilities should include selecting, orrecommending that the Board select, the Director nomineesfor the next annual meeting for shareholders, andoverseeing the evaluation of the Board. The Board, ratherthan the Nominations Committee, reviews and recommendsthe Director nominees for election at the AGM andundertakes an annual review of its performance.WebsitesThis statement and a range of documents referred to in it areavailable on our corporate governance website at. This website is regularlyupdated and contains copies and summaries of charters,principles and policies referred to in this statement.Investor communications and information, including theWestpac Group Annual Report 2012, Annual Review andSustainability Report 2012, investor discussion packs andpresentations, can be accessed at.Information on our corporate responsibility and sustainabilitypolicies, practices and outcomes, including additionalsustainability reporting and performance in externalsustainability assessments, are available at.2012 WESTPAC GROUP ANNUAL REPORT

CORPORATE GOVERNANCEGOVERNANCE ees Independent legal orother ementProvide assuranceon risk componentsof financialstatements1Chief ExecutiveOfficerAssurance,Oversight throughReportingExternal auditors Group Assurance DelegationIndependentAssuranceAuditTechnologyFrom time to time the Board may form other Committees or request Directors to undertake specific extra duties. In 2010, theBoard introduced a temporary Committee to provide specific focus on Health, Safety and Wellbeing (HS&W) across the Group.By late 2011 the HS&W Committee considered the improvement program sufficiently implemented to warrant arecommendation to the Board that the committee be dissolved as of 1 January 2012. That recommendation was accepted andthe Board is again responsible for the overall monitoring of HS&W across the Westpac Group.Further, on 6 March 2012 the Board re-assumed responsibility for the oversight and monitoring of sustainability and dissolvedthe Sustainability Committee. This decision reflects that the Westpac Group’s sustainability agenda is well embedded acrossthe organisation, and with sustainability playing a core part in our overall approach to doing business, it is now appropriate forthe Board to more directly play a larger role.In addition, from time to time the Board participates (either directly or through representatives) in due diligence committees inrelation to strategic decisions, capital and funding activities.The Executive Team, Disclosure Committee and Executive Risk Committees are not Board Committees (that is, they have nodelegation of authority from the Board) but sit beneath the CEO and the Board Committees to implement Board-approvedstrategies, policies and management of risk across the Group.The key functions of the Board and each of the Board Committees are outlined in this corporate governance statement. AllBoard Committee Charters are available on our corporate governance website at.2012 WESTPAC GROUP ANNUAL REPORT25

BOARD, COMMITTEES AND OVERSIGHT OF MANAGEMENTBoard of DirectorsRoles and responsibilitiesThe Board Charter outlines the roles and responsibilities ofthe Board. Key responsibilities in summary are: approving the strategic direction of Westpac Group; evaluating Board performance and determining Boardsize and composition; considering and approving the Westpac Board RenewalPolicy; appointing and determining the duration, remunerationand other terms of appointment of the CEO and ChiefFinancial Officer (CFO); evaluating the performance of the CEO, and monitoringthe performance of other senior executives; succession planning for the Board, CEO and GroupExecutives; approving the appointment of Group Executives, GeneralManager Group Assurance and Group General Counseland monitoring the performance of senior management; approving the annual targets and financial statementsand monitoring performance against forecast and priorperiods; determining our dividend policy; determining our capital structure; approving our risk management strategy and frameworks,and monitoring their effectiveness; considering the social, ethical and environmental impactof our activities and monitoring compliance with oursustainability policies and practices; monitoring Workplace Health and Safety (WH&S) issuesin Westpac Group and considering appropriate WH&Sreports and information; maintaining an ongoing dialogue with Westpac’s auditorsand, where appropriate, principal regulators; and internal governance including delegated authorities,policies for appointments to our controlled entity Boardsand monitoring resources available to senior executives.Delegated authorityThe Constitution and the Board Charter enable the Board todelegate to Committees and management.The roles and responsibilities delegated to the BoardCommittees are captured in the Charters of each of the fiveestablished Committees, namely: Audit; Risk Management; Nominations; Remuneration; and Technology.26The Board Charter, Board Committee Charters and theConstitution are available on our corporate governancewebsiteThe Delegated Authority Policy Framework outlinesprinciples to govern decision-making within the WestpacGroup, including appropriate escalation and reporting to theBoard. The Board has also delegated to the CEO, andthrough the CEO to other executives, responsibility for theday-to-day management of our business. The scope of, andlimitations to, management delegated authority is clearlydocumented and covers areas such as operating and capitalexpenditure, funding and securitisation, and lending. Thesedelegations balance effective oversight with appropriateempowerment and accountability of management.IndependenceTogether, the Board members have a broad range ofrelevant financial and other skills and knowledge, combinedwith the extensive experience necessary to guide ourbusiness. Details are set out in Section 1 of the Directors’report.All of our Non-executive Directors satisfy our criteria forindependence, which align with the guidance provided in theASXCGC Recommendations and the criteria applied by theNYSE.The Board assesses the independence of our Directors onappointment and annually. Each Director provides an annualattestation of his or her interests and independence.Directors are considered independent if they areindependent of management and free from any business orother relationship that could materially interfere with, orreasonably be perceived to materially interfere with, theexercise of their unfettered and independent judgment.Materiality is assessed on a case by case basis by referenceto each Director’s individual circumstances rather than byapplying general materiality thresholds. The assessment hasregard to the criteria applied by the NYSE and US Securitiesand Exchange Commission (SEC).Each Director is expected to disclose any business or otherrelationship that he or she has directly, or as a partner,shareholder or officer of a company or other entity that hasan interest with Westpac or a related entity. The Boardconsiders information about any such interests orrelationships, including any related financial or other details,when it assesses the Director’s independence.2012 WESTPAC GROUP ANNUAL REPORT

Size and membership of Board Committees as at 30 September yMaxstedBoard AuditCommittee9Deputy Chairman,John Curtis Non-executive,IndependentBoard RiskManagementCommitteeBoard Nominations Board RemunerationCommitteeCommittee9Chair99Gail KellyCEO, ir999Ann Pickard Non-executive,IndependentPeter Wilson Non-executive,IndependentCORPORATE GOVERNANCE99999Chair99Chair9999This table shows membership of standing Committees of the Board.The charts below demonstrate that our Board comprises a majority of independent Directors and show the tenure of ourcurrent Non-executive Directors.Length of tenure of Non-executive Directors8–9years25%5–6years12.5%4–5 years12.5%Balance of Non-executive and Executive Directors0–1 –4years25%2012 WESTPAC GROUP ANNUAL REPORT27

ChairmanThe Board elects one of the independent Non-executiveDirectors as Chairman. Our current Chairman is LindsayMaxsted, who became Chairman on 14 December 2011following the retirement of Ted Evans at the AGM held onthat day. The Chairman’s role includes: providing effective leadership to the Board in relation toall Board matters; guiding the agenda and conducting all Board meetings; in conjunction with the Company Secretaries, arrangingregular Board meetings throughout the year, confirmingthat minutes of meetings accurately record decisionstaken and, where appropriate, the views of individualDirectors; overseeing the process for appraising Directors and theBoard as a whole; overseeing Board succession; acting as a conduit between management and Board, andbeing the primary point of communication between theBoard and CEO; representing the views of the Board to the public; and taking a leading role in creating and maintaining aneffective corporate governance system.Deputy ChairmanOur Deputy Chairman is John Curtis. The DeputyChairman’s role includes: chairing Board and shareholder meetings when theChairman is unable to do so; and undertaking additional matters on the Chairman’s behalf,as requested by the Chairman.CEOOur CEO is Gail Kelly. The CEO’s role includes: leadership of the management team; developing strategic objectives for the business; and the day-to-day management of the Westpac Group’soperations.Board meetingsThe Board had nine scheduled meetings for the financialyear ended 30 September 2012, with additional meetingsheld as required. In July each year the Board discusses ourstrategic plan and approves our overall strategic direction.The Board also conducts a half year review of our strategy.The Board conducts workshops on specific subjects relevantto our business throughout the year. Board meetings arecharacterised by robust exchanges of views, with Directorsbringing their experience and independent judgment to bearon the issues and decisions at hand.Non-executive Directors regularly meet without managementpresent, so that they can discuss issues appropriate to sucha forum. In all other respects, senior executives are invited,where considered appropriate, to participate in Boardmeetings. They also are available to be contacted byDirectors between meetings.Meetings attended by Directors for the financial year ended30 September 2012 are reported in Section 8 of theDirectors’ report.28Nomination and appointmentThe Board Nominations Committee is responsible for: developing and reviewing policies on Board composition,strategic function and size; reviewing and making recommendations to the Boardannually on diversity generally within the Westpac Group,measurable objectives for achieving diversity andprogress in achieving those objectives; planning succession of the Non-executive Directors; developing and implementing induction programs for newDirectors and ongoing education for existing Directors; developing eligibility criteria for the appointment ofDirectors; recommending appointment of Directors to the Board;and considering and recommending candidates forappointment to the Boards of relevant subsidiaries.Westpac seeks to maintain a Board of Directors with a broadrange of financial and other skills, experience andknowledge necessary to guide the business of theWestpac Group.The Board Nominations Committee considers and makesrecommendations to the Board on candidates forappointment as Directors. Such recommendations payparticular attention to the mix of skills, experience, expertise,diversity and other qualities of existing Directors, and howthe candidate’s attributes will balance and complementthose qualities. External consultants are used to access awide base of potential Directors.New Directors receive an induction pack which includes aletter of appointment setting out the expectations of the role,conditions of appointment including the expected term ofappointment, and remuneration. This letter conforms to theASXCGC Recommendations.The attendance of Board Nominations Committee membersat the Committee’s meetings is set out in Section 8 of theDirectors’ report.Term of officeThe Board may appoint a new Director, either to fill a casualvacancy or as an addition to the existing Directors, providedthe total number of Directors does not exceed 15 Nonexecutive Directors and three Executive Directors. Exceptfor the Managing Director, a Director appointed by the Boardholds office only until the close of the next AGM but iseligible for election by shareholders at that meeting.Our constitution states that at each AGM, one-third ofeligible Directors, and any other Director who has held officefor three or more years since their last election, must retire.In determining the number of Directors to retire by rotation,no account is to be taken of Directors holding casualvacancy positions or of the CEO. The Directors to retire byrotation are those who have been the longest in office. Aretiring Director holds office until the conclusion of themeeting at which he or she retires but is eligible forre-election by shareholders at that meeting.2012 WESTPAC GROUP ANNUAL REPORT

CORPORATE GOVERNANCEThe Board makes recommendations concerning the electionor re-election of any Director by shareholders. In consideringwhether to support a candidate, the Board takes intoaccount the results of the Board performance evaluationconducted during the year. In addition to information on thecandidates provided to shareholders in the Notice ofMeeting, the candidates are invited to give a shortpresentation at the AGM.The Board has a Tenure Policy, which limits the maximumtenure of office that any Non-executive Director other thanthe Chairman may serve to nine years, from the date of firstelection by shareholders. The maximum tenure for theChairman is 12 years (inclusive of any term as a Directorprior to being elected as Chairman), from the date of firstelection by shareholders. The Board, on its initiative and onan exceptional basis, may exercise discretion to extend themaximum terms specified above where it considers thatsuch an extension would benefit the Group. Such discretionwill be exercised on an annual basis and the Directorconcerned will be required to stand for re-election annually.EducationOn appointment, all Directors are offered an inductionprogram appropriate to their experience to familiarise themwith our business, strategy and any current issues beforethe Board. The induction program includes meetings with theChairman, the CEO, the Board Committee Chairs and eachGroup Executive.The Board encourages Directors to continue their educationby participating in workshops held throughout the year,attending relevant site visits and undertaking relevantexternal education.Access to information and adviceAll Directors have unrestricted access to company recordsand information, and receive regular detailed financial andoperational reports from executive management. EachDirector also enters into an access and indemnity agreementwhich, among other things, provides for access todocuments for up to seven years after his or her retirementas a Director.The Chairman and other Non-executive Directors regularlyconsult with the CEO, CFO and other senior executives, andmay consult with, and request additional information from,any of our employees.All Directors have access to advice from senior internal legaladvisors including the Group General Counsel.In addition, the Board collectively, and all Directorsindividually, have the right to seek independent professionaladvice, at our expense, to help them carry out theirresponsibilities. While the Chairman’s prior approval isneeded, it may not be unreasonably withheld.Company SecretariesWe have two Company Secretaries appointed by the Board.The Senior Company Secretary, who is also Legal Counselto the Board, attends Board and Board Committee meetingsand is responsible for providing Directors with advice onlegal and corporate governance issues together with theGroup General Counsel. The Group Company Secretaryattends Board and Board Committee meetings and isresponsible for the operation of the secretariat function,including implementing our governance framework and, inconjunction with management, giving practical effect to theBoard’s decisions.Profiles of our Company Secretaries are set out in Section 1of the Directors’ report.Board CommitteesComposition and independenceBoard Committee members are chosen for the skills andexperience they can contribute to the respective BoardCommittees. All of the Board Committees are comprised ofindependent Non-executive Directors. The CEO is also amember of the Board Technology Committee.Operation and reportingScheduled meetings of the Board Committees occurquarterly, with the exception of the Board TechnologyCommittee which has scheduled meetings three times ayear. All Board Committees are able to meet more frequentlyas necessary. Each Board Committee is entitled to theresources and information it requires and has direct accessto our employees and advisers. The CEO attends all BoardCommittee meetings, except where she has a materialpersonal interest in a matter being considered. Seniorexecutives and other selected employees are invited toattend Board Committee meetings as required. All Directorscan receive all Board Committee papers and can attend anyBoard Committee meeting, provided there is no conflict ofinterest.PerformanceBoard, Board Committees and DirectorsThe Board undertakes ongoing self-assessment as well ascommissioning an annual performance review by anindependent consultant.The review process includes an assessment of theperformance of the Board, the Board Committees and eachDirector.The performance review process conducted in 2012included interviews by an independent consultant withDirectors and certain senior executives. The review waswide-ranging, with outputs collected and analysed andpresented to the Board. The Board discussed the resultsand agreed follow-up action on matters relating to Boardcomposition, process and priorities.The Chairman also discusses the results with individualDirectors and Board Committee Chairs. The full Board(excluding the Chairman) reviews the results of theperformance review of the Chairman and results are thenprivately discussed between the Chairman andDeputy Chairman.2012 WESTPAC GROUP ANNUAL REPORT291

ManagementThe Board, in conjunction with its Board RemunerationCommittee, is responsible for approving the performanceobjectives and measures for the CEO and other seniorexecutives, and providing input into the evaluation ofperformance against these objectives. The Board RiskManagement Committee also refers to the BoardRemuneration Committee any matters that come to itsattention that are relevant with respect to remunerationpolicy or practices.Management performance evaluations for the financial yearended 30 September 2012 will be conducted following theend of the financial year.There is a further discussion on performance objectives andperformance achieved in the Remuneration report in theDirectors’ report.All new senior executives are provided with extensivebriefing on our strategies and operations, and the respectiveroles and responsibilities of the Board and seniormanagement.Advisory BoardsEach brand in our portfolio has its own unique identity andmarket position. Westpac maintains an Advisory Board foreach of BankSA and Bank of Melbourne. Each assists inpreserving the unique identity of these brands within theoverall multi-brand strategy of the Westpac Group throughoversight of management reports in relation to their brandhealth and positioning.In particular, the Advisory Boards are responsible for: overseeing management’s strategies and initiatives tocontinue to strengthen the unique brand position andidentity; overseeing the management of the relevant brand so asto promote and preserve its distinct position and identityand align brand values with those of the relevantcommunities served; considering and assessing reports provided bymanagement on the health of the relevant brand; acting as ambassadors for the relevant bank, includingthrough supporting community and major corporatepromotional events to assist in building relationships withthe bank’s customers, local communities and thebusiness and government sector, and advising seniormanagement on community matters relevant to theprovision of financial services in the community it serves;and alerting management to local market opportunities andissues of which Advisory Board members are aware thatwould enhance the provision of services to customersand potential customers and the position of the bank in itslocal communities.30ETHICAL AND RESPONSIBLEDECISION-MAKINGCode of Conduct and Principles for Doing BusinessOur ‘Code of Conduct’ sets out six principles that we believewill maintain the trust and confidence placed in us by ourcustomers, shareholders, suppliers and the community atlarge. We recognise that this trust can only be retained byacting ethically and responsibly in all our dealings and byseeking to continually improve in all that we do. The Code ofConduct applies to all of our employees and contractors andis supported by the Board. The six principles are: we act with honesty and integrity; we comply with laws and with our policies; we respect confidentiality and do not misuse information; we value and maintain our professionalism; we work as a team; and we manage conflicts of interest responsibly.Our ‘Principles for Doing Business’ (the Principles) set outhow we aim to conduct ourselves across our business in theareas of: governance and ethical practices; customers; employees; environment; community; and suppliers.The Principles are also aligned with significant globalinitiatives that promote responsible business practices. OurPrinciples apply to all Directors and employees.We also have a range of internal guidelines,communications and training processes and tools, includingan online learning module entitled ‘Doing the Right Thing’,which apply to and support our Code of Conduct and thePrinciples.Key policiesIn addition to our Code of Conduct and the Principles, wehave a number of key policies to manage our complianceand human resource requirements. We also voluntarilysubscribe to a range of external industry codes, such as theCode of Banking Practice and the Electronic Funds TransferCode of Conduct.2012 WESTPAC GROUP ANNUAL REPORT

CORPORATE GOVERNANCECode of Ethics for Senior Finance OfficersThe Code of Accounting Practice and Financial Reporting(the Code) complements our Code of Conduct. The Code isdesigned to assist the CEO, CFO and other principalfinancial officers in applying the highest ethical standards tothe performance of their duties and responsibilities withrespect to accounting practice and financial reporting. TheCode requires that those officers: act honestly and ethically, particularly with respect toconflicts of interest; provide full, fair, accurate and timely disclosure inreporting and other communications; comply with applicable laws, rules and regulations; promptly report violations of the Code; and be accountable for adherence to the Code.Conflicts of interestWestpac Group has a conflicts of interest framework, whichincludes a Group policy supported by more specific policiesand guidelines aimed at recognising and managing potentialconflicts.The BoardAll Directors are required to disclose any actual or potentialconflict of interest upon appointment and are required tokeep these disclosures to the Board up to date.Any Director with a material personal interest in a matterbeing considered by the Board must declare their interestand, unless the Board resolves otherwise, may not bepresent during the boardroom discussions or vote on therelevant matter.Our employeesOur employees are not permitted to participate in activitiesthat involve a conflict with their duties and responsibilities orwhich are prejudicial to our business. We expect ouremployees to: manage conflicts of interest; obtain consent from senior management before acceptinga directorship on the board of a non Westpac Groupcompany; disclose any material interests they have with ourcustomers or suppliers to their manager and not beinvolved with customer relationships where they havesuch an interest; not participate in business activities outside theiremployment with us (whether as a principal, partner,director, agent, guarantor, investor or employee) withoutapproval or when it could adversely affect their ability tocarry out their duties and responsibilities; and not solicit, provide facilitation payments, accept or offermoney, gifts, favours or entertainment which mightinfluence, or might appear to influence, their businessjudgment.Fit and Proper Person assessmentsOur Fit and Proper Policy complies with the related APRAPrudential Standards and ASIC guidelines. In accordancewith that policy, we assess the fitness and propriety of ourDirectors and also of employees who perform specifiedroles. The Chairman of the Board (and in the case of theChairman, the Board) is responsible for assessing the mainBoard Directors, Non-executive Directors on subsidiaryBoards and Group Executives. An executive Fit and ProperCommittee assesses other employees. In all cases theindividual is asked to provide a detailed declaration andbackground checks are undertaken. Assessments areperformed upon appointment to the relevant position and arere-assessed annually.Concern reporting and whistleblower protectionUnder our Whistleblower Protection Policy, our employeesare encouraged to raise any concerns about activities orbehaviour that may be unlawful or unethical withmanagement, the human resources team, the complianceteam or the Financial Crime

CORPORATE GOVERNANCE 24 2012 WESTPAC GROUP ANNUAL REPORT INTRODUCTION This statement describes our corporate governance framework, policies and practices as at 5 November 2012. . All of our Non-executive Directors satisfy our crite ria for independence, which align with the guidance provide d in the ASXCGC Recommendations and the criteria .