Transcription

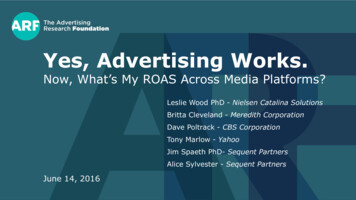

Yes, Advertising Works.Now, What’s My ROAS Across Media Platforms?Leslie Wood PhD - Nielsen Catalina SolutionsBritta Cleveland - Meredith CorporationDave Poltrack - CBS CorporationTony Marlow - YahooJim Spaeth PhD- Sequent PartnersAlice Sylvester - Sequent PartnersJune 14, 2016

How do themediaplatformscompare?How doesthe cost ofthe mediaaffect it?What Sales & Returnshould I expect frommy Advertising?Doescreativetype varythe results?Are theredifferences bycategory?How do brandcharacteristicsaffect the return?Is this changingover time?

Meet the Cross-Industry Project TeamStep 1: Assembled a group of experts:Leslie Wood PhD,Britta Cleveland,Chief Research officer,Senior Vice President, ResearchNielsen Catalina Solutions-Solutions, Meredith CorporationStep 2: Dug into thedata and looked at:Dave Poltrack, Correlations,Chief Research Officer, CBS Graphs,project leadJim Spaeth PhD,Partner, Sequent PartnersAlice Sylvester,Partner, Sequent PartnersCorporation and President ofCBS VISION, CBSTony Marlow, Distributions InsightsHead of Field Marketing,Yahoo3

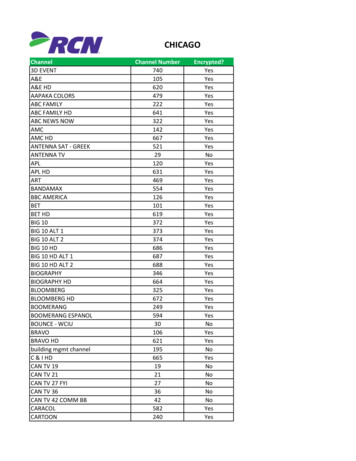

Meet the Dataset Nearly 1,400 studies with complete data Media: TV, Online Display & Video, Mobile,Cross-Platform, Magazines 450 CPG brands in the U.S.11 years of tracking, though not all mediatracked over all yearsAll reported values with less than 10 studiesare removed and all values with between10-20 studies are shown with faded color4

Meet the MediaLinear TV since 2009 – TV networks & cable networksMagazines since 2012 – Major publishing companies, largecampaignsOnline Display since 2004/Video since 2008 – major publishers &portals; typically premium inventory. Little to no programmatic.Wide variety in size of campaigns and size of brandsMobile since 2013 – In-App measurementCross Media since 2013 – Includes more than one media5

ObjectivesDetermine theROAS (Return onAd Spend) figuresfor each mediathat reflect theactual differencesin the mediaDetermine salesproductivitymetrics thatremove mediacosts from theequationWhat factorsdrive salesresults?

Norms Across Media are Challenging:Changes inmedia landscape– no clearcategorization Media costs andIncremental Sales varyby year, size of brand,category & mediabudget Each media has adifferent mix of years,of brands, categoriesand budgetsRecessionaryperiodMany of thedrivers ofdifferencesbetween mediaare not beingcontrolled for7

How Do We Measure theIncremental SalesAttributed to Advertising?8

NCS Connects the Media People Consumewith the Products they BuyExposure DataBuy DataNielsen Media &Partner DataCatalina FrequentShopper Card DataSet Top Box Data4.3 MM HHNielsen NPMDigital100 MM HHMobile80 MM HHClient ProprietaryPrint50 MM HHRadio29K HH90 MM HHAnonymousSingle SourceHouseholds Nielsen HomescanAll-Outlet Data Client ProprietarySales Data

How we Measure the Sales Impact of AdvertisingTest Design andTreatment ExecutionExposed & Unexposed HHsmatched on hundreds ofvariables to isolate ad impactMeasure & Interpret SalesImpact by focusing onpurchasing patterns 14%ExposedTest HouseholdsExposed householdsisolated in ntrol Households10

The Result: Incremental SalesCampaignStartCampaignEndYour Ad DroveIncremental posed and Unexposed Comparison Accountsfor 52 Weeks Purchase History & Demographics11

Key Metrics:ROASIncremental Salesper Exposed or“Reached” HHIncremental Salesper thousandImpressions IncrementalSales LiftCampaignCostsIncrementalSales LiftExposedHHIncrementalSales LiftImpressions (000)sdeliveredAn ROAS of 3.00 meansthat for every 1.00 spenton advertising, 3.00 isdriven in incremental sales.These metricsremove thecost of themedia tomeasure “salesproductivity”12

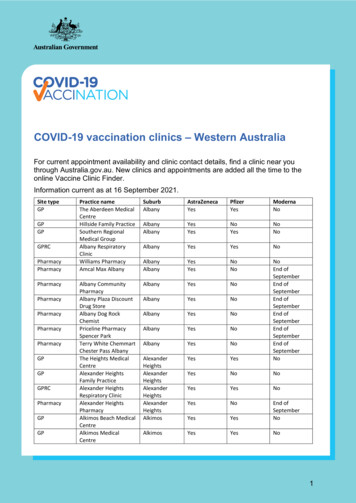

ROAS: All Studies – Across MediaROAS 4.50 3.94 4.00 3.50 3.00 2.63 2.55 2.50 2.62 2.45 2.00 1.53 1.50 1.00 0.50 DisplayLinear TVMobileDigital VideoMagazinesCross MediaSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions13

Incremental Sales per Reached HH:All Studies – Across MediaIncremental per Reached HH 0.33 0.23 0.23MobileDigital Video 0.26 0.25MagazinesCross Media 0.19DisplayLinear TVSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions14

Incremental Sales per Impression (000):All Studies – Across MediaIncremental per Impression (000) 26.52 23.48 20.56 20.30 16.95DisplayLinear TVMobileDigital VideoCross MediaNote: Magazine Impressions not currently included in the databaseSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions15

All Studies – Across MediaDifferent Metrics Paint a Different PictureMagazines ROASLinear TVMobileIncremental Sales perReached HHIncremental Salesper thousand impressionsSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions16

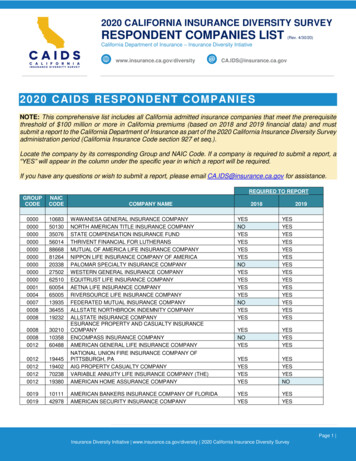

ROAS: Category – All StudiesROAS 4.00 3.71 3.50 3.06 3.00 2.82 2.78 2.67 2.60 2.59Health & BeautyGeneralMerchandiseFoodBeverageOver-the Counter 2.50 2.00 1.50 1.00 0.50 BabyPetSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions17

ROAS: Category – Across MediaROAS 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 DisplayBabyPetLinear TVHealth & BeautyMobileDigital VideoGeneral MerchandiseFoodMagazinesBeverageCross MediaOver-the -CounterSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions18

Incremental Sales per Reached HH:Category – Across MediaIncremental per Reached HH 0.45 0.40 0.35 0.30 0.25 0.20 0.15 0.10 0.05 DisplayBabyPetLinear TVHealth & BeautyMobileDigital VideoGeneral MerchandiseFoodMagazinesBeverageCross MediaOver-the -CounterSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions19

Incremental Sales per Impression (000):Category – Across MediaIncremental per Impression (000) 45.00 40.00 35.00 30.00 25.00 20.00 15.00 10.00 5.00 DisplayBabyPetLinear TVHealth & BeautyMobileGeneral MerchandiseDigital VideoFoodBeverageCross MediaOver-the -CounterNote: Magazine Impressions not currently included in the databaseSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions20

What we do know: Brand Characteristics MatterCluster Analysis: clustered brands into groups based on their purchase cycle,dollars per week and penetrationMarquee BrandsBigger Brands, shorterpurchase cycleMid-sizedBrandsInfrequent UseSmaller brands, longer purchase cycles,fixed level of purchasing across timeFROZENAverage Penetration(1 year)Average PurchaseCycle (days)Average Brand Share47%15%10%69719631%16%11%21

Across Clusters:Very Different Average PerformanceIncremental perReached HHROAS 4.00 3.63 3.50 0.35 3.00 0.30 2.78 2.50 2.18 0.25 2.00 0.20 1.50 0.15 1.00 0.10 0.50 0.05 - 0.31 0.22 0.14 dsMidsizeBrandsInfrequentUseSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions22

ROAS: Clusters – Across MediaValues with 10-20 studiesROASValues with 10-20 studiesMarquee BrandsMidsize BrandsInfrequent Use 5.94 3.82 3.80 3.70 2.95 2.74 2.65 2.70 1.96DisplayLinear TV 2.69 2.57 2.10 1.75Mobile 1.44Digital VideoMagazinesCross MediaSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions23

Incremental Sales per Reached HH:Clusters – Across MediaValues with 10-20 studiesIncremental per Reached HHValues with 10-20 studiesMarquee BrandsMidsize BrandsInfrequent Use 0.73 0.53 0.30 0.29 0.33 0.25 0.25 0.23 0.19 0.26 0.13 0.12Display 0.24 0.24Linear TVMobileDigital VideoMagazinesCross MediaSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions24

Incremental per Impression (000):Clusters – Across MediaValues with 10-20 studiesIncremental per Impression (000)Values with 10-20 studiesMarquee BrandsMidsize BrandsInfrequent Use 31.97 28.13 25.36 22.38 21.92 18.17 11.58Display 20.68 20.68Digital VideoCross Media 17.83 13.14Linear TVMobileNote: Magazine Impressions not currently included in the databaseSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions25

ROAS: All Studies – Across YearsROAS 6.00 5.28 5.00 4.22 4.20 4.00 3.30 3.05 3.27 2.80 3.00 2.23 2.2020072008 2.33 2.31 2.00 1.00 200520062009201020112012201320142015Source: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions26

Summary/Findings It was much harder than we thought to isolate the variables to create a pure “apples to apples” comparison betweenmedia For example, we could not control for creative – and weknow from other studies that creative is a primary driver ofall lift measures: ROI, ROAS and Incremental SalesWhile we need to use with caution, advertisers can comparetheir results to these normso By Media Platform, Category, Brand Cluster & other filters Brand Clusters are better indicators of incremental sales thancategory27

Implications There is no “best” media – strategy & messagedrive the choice These are averages.Be accountable to sales:Know Your Numbers! Make sure that your creative is as strong as it canbe, and is driving sales Leverage data and measurement to inform mediadecisions28

Summary: Three Key MetricsAll Studies – Across MediaROASIncremental Sales perReached HH Incremental Salesper thousand impressions 0.33 26.52 3.94 0.26 0.23 2.63 2.55 2.62 2.45 0.23 23.48 0.25 20.56 20.30 16.95 0.19 1.53DisplayLinearTVMobileDigital Magazines CrossVideoMediaDisplayLinearTVMobileDigital Magazines CrossVideoMediaDisplayLinearTVMobile DigitalVideoCrossMediaSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions29

Appendix

How Does the Same BrandPerform Across Media?

Brand A:Very Different Results for the Same Medium, Same Period of TimeBrand A – Same Time PeriodThree Digital Portals - Nine Different Tactics1.401.201.000.800.600.400.200.00ROASSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions32

Brand B:Consistently High Results for Different Years and Different MediaBrand BDifferent Media & e: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions33

Media Type by Year NCS Began 320142015Online DisplayOnline VideoCross MediaTVMobileMagazinesRadioSource: Nielsen Catalina Solutions, Multi-Media Norms & Benchmarks: 2004 -Q4 2015. Copyright 2016 Nielsen Catalina Solutions34

ROAS: All Studies – Creative TypeValues with 10-20 studies 4.00ROAS 3.62 3.27 3.50 3.18 3.00 2.62 2.51 2.50 2.43 2.35 2.06 2.00 1.50 1.00 0.50 Reward/Sweepstakes *Promotion/CouponNutritional *OtherInteractiveEquity BrandingUsageRecipeSource: Nielsen Catalina Solutions, Multi-Media Sales Effect Studies from 2004 – Q4 2015. Copyright 2016 Nielsen Catalina Solutions35

Online Display since 2004/Video since 2008 -major publishers & portals; typically premium inventory. Little to no programmatic. Wide variety in size of campaigns and size of brands Mobile since 2013 -In-App measurement Cross Media since 2013 -Includes more than one media 5