Transcription

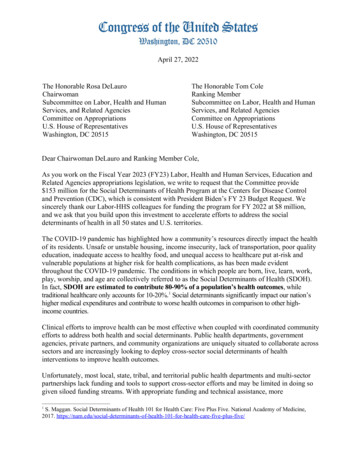

Member Application and Service AgreementVeriCheck, Inc.Member ApplicationThank you for your business!This Member Application form may be filled out using your computer. In order to use thefillable features, please note the following: Use your TAB key, not the RETURN key, to jump forward through the form while filling outthe text boxes. To begin, click on the line you want to fill in, or click the box in yourbrowser window labeled ‘‘Highilight Fields’’ to see where information can be entered into theform. Please complete the application by filling it out on your computer. When done print theapplication to sign and date it. Once completed, please fax to VeriCheck at (404) 665-3465 or you can scan in theapplication and email it to support@vericheck.net as an attachment. The forms available for downloading (printing) from this Web site are the approvedversions. In order to make use of all of the features of our fillable forms, you should use latestaddition of the free Adobe Acrobat Reader, a free download at http://www.adobe.com/ Remember, your agreement needs to be signed and dated.PLEASE INCLUDE 2 MONTHS CURRENT BANK STATEMENTS, COPY OF SIGNORS DRIVER’S LICENSE, AND APRE-PRINTED VOIDED CHECK OR BANK LETTER WITH THE APPLICATION – *THESE ITEMS ARE REQUIRED*ph: 877-885-0622fax: (404) 665-3465web: www.vericheck.comemail: support@vericheck.net

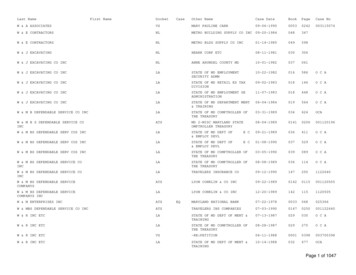

Member ApplicationCheck all that apply:PPDCCDWEBTELBOCARCPOPCheck 21Check GuaranteeISO/Agent Name:COMPANY INFOBUSINESS DATALegal Name:Business Start Date:DBA:Business Type:Contact Person:Goods / Services:Phone Number:Average Ticket: High Ticket:Fax Number:Annual Check Volume:Website URL:Total Sales Volume:E-Mail:Business Tax ID:Business Address:Corporate Structure:City: State: Zip:Non-ProfitSole ProprietorshipPrivate CorpLLCPublic CorpPartnershipOWNER / SIGNER INFORMATIONBUSINESS BANKING RELATIONSHIPFull Name:Bank Name:Home Address:Contact Name & Title:City: State: Zip:Bank Address:Title:City: State: Zip:Social Security #:Phone Number:Driver’s License #: State:Routing Number (ABA):Phone Number:Account Number (DDA):Fax Number:Account Type:CheckingSavingsSUPPLIER REFERENCESReference 1 Name:Contact Name:Phone Number: State Account Number:Reference 2 Name:Contact Name:Phone Number: State Account Number:Reference 3 Name:Contact Name:Phone Number: State Account Number:Application Fee:Statement Fee:Transaction Fee:Discount Rate:PRICINGMonthly Minimum:Gateway Fee:Return Fee:Settlement Fee: 0.15Chargeback Fee: 25.00

Member ApplicationWhat methods will be used to obtain the proper authorizations before payments are initiated? (i.e. signed authorization form, authorization viaWebsite Payment Form) see http://www.vericheck.com/images/VCI Merchant Package.pdf for complete authorization requirements.Do you currently use QuickBooks accounting software?YesNoCUSTOMER acknowledges that he/she has read and understands the Terms and Conditions of this Agreement contained herein andagrees to be bound by the terms and conditions herein.By:CUSTOMER SIGNATUREPRINTED CUSTOMER NAMEBUSINESS NAMEDATEAUTHORIZED VERICHECK SIGNATUREPRINTED VERICHECK NAMEAttach Voided Business Check Here

Member Service AgreementPage 1 of 8This Agreement ("Agreement") is between you (the "CUSTOMER"), and VeriCheck, Inc., ("VCI" or "Processor") (VCI is referred to as “Servicer”).Vericheck Inc, in conjunction with BANK (ODFI) performs authorization, processing and settlement services for CUSTOMERs originatingtransactions through the ACH network (NACHA).In consideration of the mutual covenants and agreements set forth herein, SERVICER and CUSTOMER agree as follows:It is the understanding that CUSTOMER intends to access check verification and/or guarantee services to assist CUSTOMER in determiningwhether to accept or reject checks tendered at the point of sale (POS) in payment for goods and/or services. SERVICER will provide the servicesto CUSTOMER, for the purpose specified herein, but only if the CUSTOMER agrees to abide by the terms and conditions set forth below, whichare required for the protection of CUSTOMER and SERVICER.1. NONDISCLOSURE/LIMITATION ON USE OF DATA:CUSTOMER agrees to limit use to verification/guarantee ofchecks presented at its business locations and agrees toinstruct its employees, representatives and agents to take allreasonable measures to ensure compliance with thisprovision.2. VERIFICATION/GUARANTEE PROCEDURES:CUSTOMER agrees that in order for check data provided byits customer at the Point of Sale (POS), Internet or MailOrderTelephone Order to be accurately compared with dataprovided by SERVICER, CUSTOMER must enter either thecheck Magnetic Ink Character Recognition (“MICR”) numberfrom the check drawn by its customer and/or the customer‟sdriver‟s license number (as applicable). CUSTOMER furtheragrees that if it declines to accept a customer‟s check as aresult of information obtained through SERVICER,CUSTOMER shall immediately advise the customer whosecheck was denied where inquiries concerning the reasons fordenial and requests for assistance can be directed.A. CUSTOMER agrees to acquire and/or print legibly oncheck the following information:1. Checkwriter‟s Home Phone, Work Phone, and DriversLicense Numbers, Street Address (if Post Office Boxis printed on check). POST OFFICE BOXES ARENO ACCEPTABLE.2. Drivers License Number must be obtained andverified.3. All checks must be submitted electronically at time oftransaction occurrenceB. Payroll Checks (Retail ONLY) ‐ CUSTOMER agrees toacquire and print legibly on check the followinginformation.1. Check Writer‟s (Business issuing the check) PhoneNumber, Street Address (if Post Office Box is printedon check)2. Name of the person signing check (if not legible)3. Home Phone, Work Phone, Street Address anddrivers license numberC. CUSTOMER agrees not to accept the following checks.1. Payroll checks (Applies to Internet/MOTO only)2. Starter Checks (checks that do not have printedcheckwriter information)D. GUARANTEE SERVICES: All Checks presented toCUSTOMER that meet criteria established in thisagreement will be paid at face value (GuaranteeServices Only) as outlined.2.1. MOTO/INTERNET MERCHANTS: CUSTOMER agreesto obtain the same information outlined in section 2.A‐D.3.ASSISTANCE IN REMEDYING ERRORS OR CONSUMERISSUES: In the event an error or apparent error exists in theSERVICER data which has been supplied to theCUSTOMER, CUSTOMER agrees to fully cooperate with SERVICERin an effort to clarify and rectify the accuracy of the data of concern.3.1 Disputing Chargeback’s, Debits and SummaryAdjustments In order to quickly resolve disputedChargeback‟s, debits, and summary adjustments, it isextremely important that these issues/items be sent to theaddress below. (If the Summary Adjustment is forunreadable or incorrect checkwriter number, resubmit thecorrected sales record with your next deposit. Also, if thetransaction is over thirty (30) days, you must reauthorize.The following information should be obtained from your files:1) Clear and legible copy of the sales record showing:o Date of sale/credito Checkwriter‟s routing and account numbero Checkwriter‟s nameo Checkwriter‟s addresso Total amount of the saleo Description of goods and serviceso Date and authorization approval codeo Original Check2) A dated cover letter detailing the reasons for requesting areview of the Chargeback, debit, or summary adjustmentand documentation to support your dispute shouldaccompany your sales record. (You should retain a copyof the correspondence and all documentation for yourfiles.) If the inquiry is related to prior correspondence, besure to include the control number we used previously.Immediately submit the sales/credit records, all documentation,and your letter to:VCI Inc. Chargeback Department.P.O. Box 241Young Harris, GA 30582If you have any questions, please call Customer Services. If you areinformed by a Customer Service Representative that additionaldocumentation is required in order to fully review the item;please submit it immediately to the above address.It is strongly recommended that, whenever possible, contact theCheckwriter directly to resolve a Chargeback.4. NO LIABILITY FOR LOSSES: CUSTOMER agrees thatSERVICER is not guaranteeing any consumer salestransactions. It is further agreed that SERVICER has noliability for any loses that CUSTOMER may incur as theresult of a consumer sales transaction that has been authorized bythe CUSTOMER using SERVICER. It is also agreed that SERVICERhas no liability for any losses that CUSTOMER mayincur as a result of any failure of equipment.5. DEFINITION: For the purpose of this agreement, the term“check” shall be defined under Section 3‐104(2)(b) of theUniform Commercial Code.6. GOVERNING LAW: CUSTOMER agrees that thisagreement shall be governed by and construed in allrespects with the laws of the State of Georgia and theparties hereby consent that the sole proper venue andjurisdiction for any disputes arising under this agreementshall be in the federal and state courts situated in the Countyof Fulton, State of Georgia.

Member Service AgreementPage 2 of 87. TERMINATION: CUSTOMER agrees that SERVICER maydiscontinue services to CUSTOMER in the eventCUSTOMER fails to comply with the rules and regulationsset forth herein or otherwise breaches any terms of thisagreement.7.1 Early Termination Fee: The parties further agree andacknowledge that, in addition to any remedies containedherein or otherwise available under applicable law and,If (a) CUSTOMER breaches this Agreement byimproperly terminating it prior to the expiration of theapplicable term of the Agreement, or (b) this Agreementis terminated prior to the expiration of the applicableterm of the Agreement due to an Event of Default, thenSERVICER will suffer a substantial injury that is difficultor impossible to accurately estimate. Accordingly, in aneffort to liquidate in advance the sum that shouldrepresent such damages, the parties have agreed thatthe amount calculated in the manner specified below is areasonable pre‐estimate of SERVICER probable loss.Such amount shall be paid to SERVICER within 15 daysafter CUSTOMER‟s receipt of SERVICERS‟ calculationof the amount due. The amount shall equal the greaterof (A) 175 or (B) 80% of the product of (i) the averagenet monthly fees, and (ii) the number of months,including any pro rata portion of a month, then remainingprior to the date on which CUSTOMER may terminatethis Agreement in accordance with the terms hereof.8. NO ALTERATIONS, ADDITIONS, DELETIONS ORMODIFICATIONS: any Sales Representative may make Noalteration, addition, deletion or modification. This agreementrepresents the entire agreement between SERVICER andthe CUSTOMER. Any previous or extraneous agreements,whether oral or written are void and of no effect.9. TERMS AND FEES:9.1 TERM: THE INITIAL TERM OF THIS AGREEMENTSHALL COMMENCE AND SHALL CONTINUE INFORCE FOR TWELVE (12) MONTHS AFTER ITBECOMES EFFECTIVE. THIS AGREEMENT SHALLRENEW FOR SUCCESSIVE TWELVE‐MONTHPERIODS UNLESS ANY PARTY TERMINATES THISAGREEMENT BY NOTICE TO THE OTHER, INWRITING, AT LEAST 60 DAYS PRIOR TO THEEXPIRATION OF THE TERM, OR THE AGREEMENTRENEWS AUTOMATICALLY.9.2 FEES:a. CUSTOMER agrees that if a check is paid directly toCUSTOMER by check writer that he/she will collectthe service fee of 25.00 or the maximum fees asallowed by the laws of that jurisdiction/state,whichever is the greater of the two.b. CUSTOMER agrees that a fee of 20% of face value ofcheck will be charged on checks received thirty (30)days after Issuance9.3 The fees for Services may be adjusted to reflectIncreases or decreases by Associations in interchange,assessment and other Association fees or to passthrough increases charged by third parties for on‐linecommunications and similar items. All suchadjustments shall be CUSTOMER‟s responsibility topay and shallbecome effective upon the date any such change isimplemented by the applicable Association or otherparty.9.4 The fees for Services are based upon assumptionsassociated with the anticipated annual volume andaverage transaction size for all Services andCUSTOMER‟s method of doing business. If the actualvolume or average transaction size are not as expectedor if CUSTOMER significantly alters its method of doingbusiness, SERVICER may adjust CUSTOMER‟sdiscount fee and transaction fees without prior notice.9.5 CUSTOMER agrees to pay SERVICER any finesimposed on SERVICER by any Association resultingfrom Chargeback‟s and any other fees or fines imposedby an Association with respect to acts or omissions ofCUSTOMER.9.6 If CUSTOMER‟s Chargeback Percentage for any line ofbusiness exceeds the estimated industry chargebackpercentage, CUSTOMER shall, in addition to theChargeback fees and any applicable Chargebackhandling fees or fines, pay SERVICER an excessiveChargeback fee for all Chargeback‟s occurring in suchmonth in such line(s) of business. Each estimatedindustry chargeback percentage is subject to changefrom time to time by SERVICER in order to reflectchanges in the industry chargeback percentagereported by NACHA.9.6.1 If CUSTOMER believes any adjustments should bemade with respect to CUSTOMER‟s SettlementAccount, CUSTOMER shall notify SERVICER inwriting within 45 days after any debit or credit is orshould have been effected. If CUSTOMER notifiesSERVICER after such time period, SERVICER may, intheir discretion, assist CUSTOMER, at CUSTOMER‟sexpense, in investigating whether any adjustments areappropriate and whether any amounts are due to orfrom other parties, but SERVICER shall not have anyobligation to investigate or effect any such adjustments.Any voluntary efforts by SERVICER to assistCUSTOMER in investigating such matters shall notcreate any obligation to continue such investigation orany future investigation.10. APPOINTMENT: Customer wishes to initiate debit andcredit entries pursuant to the terms of this Agreement andthe rules of the National Clearing House Association (the“Rules”). Customer hereby appoints Processor as itsexclusive Processor of Electronic Representment onReturned Checks (“RCK”) ACH transactions. Customerspecifically warrants to Processor that it has taken allnecessary legal action and has authority to enter into thisAgreement with Processor. It further warrants that theperson signing for and on behalf of Customer is specificallyauthorized to do so by Customer. Processor herebyaccepts this appointment and agrees to processCustomer‟s RCK transactions pursuant to the Rules andthe terms and conditions set forth below.11. CUSTOMER’S OBLIGATIONS: Customer OR Customer‟sbanking institution may provide Processor with RCK‟s on adaily basis via U.S. Mail, Courier, or other appropriatedelivery vehicle. Customer shall ensure that RCK‟s havebeen presented once and ONLY ONCE to the appropriatebanking institution for payment.12. PROCESSOR’S OBLIGATIONS: Processor shall createCustomer files and debit said files for the amount of theapplicable transaction. All file information submitted by theCustomer on a given day shall constitute a “batch”.Processor shall transmit the batch to the ODFI forprocessing and shall credit its account for the aggregateamount of the batch transaction information until finalsettlement occurs.

Member Service AgreementPage 3 of 813. TRANSACTIONS UNACCEPTABLE FOR PROCESSING:The Rules set forth those items that are unacceptable forprocessing. They include, but are not limited to thefollowing:- Checks that have been presented to the RDFI threetimes or more for payment in any format.- Checks drafted 180 days or more from the date that thereturned check item is transmitted to the RDFI.- Post‐dated checks.- Checks returned for other than Non‐Sufficient Funds(NSF) or uncollected funds.- Checks not bearing an imprint including:1) “I agree that my account will be debited electronicallyfor both the face amount and the returned check feeif returned unpaid.”2) The check writer‟s signature indicating hisacceptance of the imprint.The Customer is solely and absolutely responsible for all lossesand damages related to unacceptable transactions submitted toProcessor. Processor shall have rights against any account that isheld by Processor to initiate debits to make Processor whole forthe amount of said transactions and any fees associated with thepresentment of such transactions.14. RCK BiWeekly Report and FINAL SETTLEMENTREPORT: Processor shall provide Customer with a Bi‐Weekly Report. This report will itemize the transactionssubmitted and returned in the previous period by the ODFI.Final Settlement for RCK‟s will also be created bi‐weekly. Atthe end of each reporting period, the Processor will providea detailed final settlement report to Customer. This reportshall state the total number of transactions in that period,the aggregate amount of transactions returned in thatperiod and the final net settlement for that period.15. FINAL SETTLEMENT OF RCK: The Final Settlement is thenet of the aggregate amount for items paid in a period lessthe aggregate amount for returned items posted againstthose items by the end of the final settlement day for thatperiod AND Post‐Settlement Returns (PSR‟s). PSR‟s arethose items returned by the RDFI after initial clearance of atransaction by the RDFI. All items debited and credited tothe Customer will be identified with the Customer‟sStatement.16. NETTING OF TRANSACTIONS: Customer acknowledgesthat all transactions between Customer and Processorunder this Agreement, except assessment of fees, shall betreated as a single transaction for purposes of settlementbetween Customer and Processor.17. AMENDMENTS: Each party hereto shall comply with allfederal and state statutes, ordinances, and applicablegovernment regulations in the conduct of its business.From time to time, the parties may amend operationprocedures and processing to conform to updated softwareor to conform to and comply with any federal, state, or localregulation changes. Such amendments to operations orprocedures shall become effective upon receipt of writtennotice to the other party, as provided for herein, or uponsuch date as may be provided in the applicable law orregulation referenced in the written notice, whichever isearlier. Use of the ACH services after receipt of notice ofsuch changes shall constitute evidence of acceptance ofchanges by the parties. No other amendments to thisAgreement will be effective unless such changes arereduced to writing and are signed by the duly authorizedparty or parties to this Agreement and such Amendmentsare incorporated into and made a part of this document.18 PAYMENT: Customer acknowledges that this Agreementprovides for the provisional settlement of Customer‟stransactions, subject to certain terms and conditions, credittransactions, contingent claims for chargeback‟s,adjustments, final settlement, and post‐settlement returnsincluding but not limited to those enumerated herein. Allpayments to Customer for legitimate and authorizedtransactions shall be made to Processor as prescribed inCustomer‟s Check Collection contract with Processor.However, Processor cannot guarantee the timeliness withwhich any transaction may be credited by Customer‟sbanking institution.18.1 Payments to CUSTOMER from VCI, will be made onthe 1st and 16th of each month. It is understood thatpayments from check writers received by VCI.between the 1st and the 15th of the month will be paidthe 1st of the following month. Payments from checkwriters received by VCI, between the 16th and theend of the month will be paid to Customer on the 16thof the following month. All ACH‐Collected items fullyfunded by the 15th of the month will be paid onthe 16th of the same month. All ACH‐Collected itemsfully funded by the end of the month will be paid onthe 1st of the following month.VeriCheck as (Processor), with corporate offices located at:12 A Town SquareBlairsville, GEORGIA 30512.19. CUSTOMER’S WARRANTIES: Customer warrants andagrees to fully comply with all applicable federal, state, andlocal laws, rules and regulations, as amended from time totime. Customer warrants that all legal requirements andregulations have been met for obtaining RCK transactioninformation and for processing same. {Customer representsand warrants that a notice has been provided to checkwriters, which adequately and completely informs each thatany checks returned as “NSF” may be collectedelectronically. Customer warrants that this notice is madeavailable to each check writer through either a sign at thepoint of sale, or on the receipt issued at time of sale or on aseparate piece of paper provided at the time the checkwriter authorizes the transaction.} Customer furtherwarrants that the information procured by the Customer hasnot been altered or tampered with, and is in all wayssufficient and appropriate for ACH processing. Customer shallinform Processor immediately if it believes the transaction dataor any other necessary information has been compromised oraltered. Customer warrants that all transactions submitted toProcessor are acceptable transactions as defined by theterms and conditions of this Agreement, the Rules and theapplicable law. Customer warrants that it has access to all RCKtransaction information so as to be in compliance with anystatutory requirements.20. PROCESSOR’S WARRANTIES: Processor warrants that itis a legal corporation duly organized and authorized toconduct business.21. CONFIDENTIAL INFORMATION: The parties acknowledgethat each shall have access to and shall becomeacquainted with confidential and/or proprietary informationand data relating to each other‟s business. This may includeinformation with respect to operation, sales, marketing,customer lists and other aspects of each other‟s businessand in connection therewith. Each party agrees not todirectly or indirectly disclose such confidential or proprietaryinformation to any firm, person, or company or other entitynot a party to this Agreement.

Member Service AgreementPage 4 of 822. INDEMNIFICATION: Customer agrees to indemnify and tohold harmless Processor for any cost, expense, damage,lost profit and/or attorney‟s fees caused by any breach of itsobligations, representations, or warranties in thisAgreement. IN NO EVENT SHALL PROCESSOR BELIABLE TO PRINCIPAL FOR ANY CONSEQUENTIAL,INCIDENTAL, PUNITIVE, OR SPECIAL DAMAGES WHICHPRINCIPAL OR ITS CUSTOMERS, AFFILIATES, PARENTCOMPANIES, ASSOCIATES, AGENTS, OFFICERS,DIRECTORS, OR EMPLOYEES MAY INCUR OR SUFFERIN CONNECTION WITH THIS AGREEMENT, INCLUDINGLOSS OR DAMAGE FROM SUBSEQUENT WRONGFULDISHONOR RESULTING FROM PROCESSOR‟S ACTSOR OMISSIONS PURSUANT TO THIS AGREEMENT.23. NONWAIVER:The failure or delay on the part ofProcessor to exercise any right, remedy, power, or privilegehereunder shall not operate as a waiver thereof or give riseto an estoppels nor shall it be construed as an agreement tomodify the terms of this Agreement. Nor shall any single orpartial exercise of any right, remedy, power, or privilegewith respect to any occurrence be construed as a waiver ofsuch right, remedy, power, or privilege with respect to otheroccurrence. No waiver by a party hereunder shall beeffective unless it is in writing and signed by the partymaking such waiver, and then such waiver shall apply onlyto the extent specifically stated in such writing.24. LIMITATION OF LIABILITY AND CUSTOMER’S WAIVEROF DAMAGES: Processor shall be responsible fortransmitting data to the ODFI as a third party processor inaccordance with the terms of this Agreement. Processorshall not be responsible for any other person‟s or entity‟serrors, acts, omissions, failures to act, negligence, orintentional conduct, including without limitation entities suchas Processor‟s communication carriers or clearing houses,and no such entity shall be deemed a representative oragent of Processor. IN NO EVENT SHALL PROCESSORBE LIABLE TO CUSTOMER FOR ANY CONSEQUENTIAL,INCIDENTAL, PUNITIVE, OR SPECIAL DAMAGES WHICHCUSTOMER OR ITS CUSTOMERS, AFFILIATES,PARENT COMPANIES, ASSOCIATES, AGENTS,OFFICERS, DIRECTORS, OR EMPLOYEES MAY INCUROR SUFFER IN CONNECTION WITH THIS AGREEMENT,INCLUDING LOSS OR DAMAGE FROM SUBSEQUENTWRONGFUL DISHONOR RESULTING FROMPROCESSOR‟S ACTS OR OMISSIONS PURSUANT TOTHIS AGREEMENT.24.1 Company and/or Company‟s Transactee will have 60days from the transaction date to notify Processor, inwriting, of any discrepancies, errors or problems with atransaction processed. This will include but not belimited to, errors in amounts, erroneous transactions,or other transactions processed. You can telephoneus, but by doing so will not preserve your rights. In aletter, give us the following information:A. Name of company transaction was processedunder with their Fed Tax ID Number.B. The name, account number and ABA number onthe transaction in question.C. The dollar amount of the transaction in question.D. Describe the error and explain why you believe thisis an error. If you need more information, describethe item you are unsure of.We will tell you the results of our investigation within 30 days andwill correct any error promptly. If we need more time, we maytake up to 45 days to investigate your complaint. For transfersinitiated outside the United States or transfers resulting frompoint of sale or debit/access cards, the time periods for resolvingerrors will be 45 days and 90 days respectively.25. CHARGEBACKS / SECURITY INTEREST: Customer shallbear all risk of loss, without warranty or recourse toProcessor for the face amount of any transaction submittedto Processor and any fees or other amounts due Processorassociated with any transaction (including Processor‟sactual costs and expenses). Processor shall have the rightto debit Customer‟s incoming transactions, designatedaccount, or any other funds of Customer in Processor‟sdirect or indirect control by reason of Processor‟s securityinterest granted to Processor by Customer hereunder, andto charge back any transactions returned to Customer forANY reason. *26. CHARGEBACK RESERVE ACCOUNT: Notwithstandingany other language to the contrary in this Agreement,Processor reserves the right to establish (without notice toCustomer) and Customer agrees to fund a non‐ interestbearing RCK Chargeback Reserve Account, or to demandother security and/or to raise any transaction fee hereunder,upon Processor‟s reasonable determination of theoccurrence of the following:A. Customer engages in the processing of chargeswhich creates an overcharge to the customer byduplication of chargesB. Any activity engaged in by Customer, which violatesany applicable law or Rule or the terms andconditions of this AgreementC. Chargeback’s exceed 33% of the total number oftransactions submitted by Customer in any thirty(30) day calendar periodD. Excessive number of requests from customers orbanks for retrieval of documentationE. Customer’s financial stability is in question orCustomer ceases doing business upon notice oftermination of this Agreement.Processor shall disburse any and all funds remaining in thisaccount at the end of one hundred eighty (180) days aftertermination of this Agreement or ninety (90) days from thedate of the last Chargeback activity, whichever is later,unless Processor, in its sole discretion has reason tobelieve that customer Chargeback rights may be longerthan such period of time or that loss is otherwise likely, inwhich event Processor will notify Customer of the date setfor the release of the funds. No monies in the ChargebackReserve Account shall bear interest. Provisions applicableto the designated account are also applicable to thisaccount.

Member Service AgreementPage 5 of 827. COMPLIANCE AND DISCLOSURE OF INFORMATION:The Parties shall provide such information, certifications orlicenses as may reasonably be required from time to time todetermine if Parties are in compliance with the terms andconditions of this Agreement and applicable law. Customerfurther agrees to produce and make available for inspectionby Processor or its officers, agents, accountants, orrepresentatives such books and records of Customer asProcessor may deem reasonably necessary to beadequately informed of the business and financial conditionof Customer, or the ability of Customer to perform itsobligations to Processor pursuant to this Agreement.Customer will not transfer, sell, merge, or liquidate itsbusiness or assets or otherwise transfer control of itsbusiness, change its ownership in any amount or respect,engage in any joint venture partnership or similar businessarrangement, change its basic method of doing businesswithout providing sufficient notice to Processor of suchactions so that if Processor chooses to terminate thisagreement, the Parties can wind down operations in anorderly manner.28. FORCE MAJURE: Processor shall not be responsible fordelays, nonperformance, damages, lost profits, or otherlosses caused directly or indirectly by any Act of god,including without limitation, fires, earthquakes, tornadoes,hurricanes, wars, labor disputes, communication failures,legal constraints, power outages, data transmission loss,failure or interception, incorrect data transmission or anyother event outside the direct control of Processor.29. ATTORNEY’S FEES: In the event that it becomesnecessary for processor to hire an attorney to enforce orinterpret this Agreement, Processor shall be entitled torecover its reasonable attorney‟s fees, costs, anddisbursements from Principal.30. MEDIATION: Any controversy or claim arising out of orconnected with or related to this Agreement, including priorto its execution by the Parties, or the breach or violation ofany of its terms, covenants or conditions contained herein,shall be submitted to Non‐binding Mediation. SuchMediation shall be conducted in good faith and shall resulteither i

whether to accept or reject checks tendered at the point of sale (POS) in payment for goods and/or services. SERVICER will provide the services to CUSTOMER, for the purpose specified herein, but only if the CUSTOMER agrees to abide by the terms and conditions set forth below, which are required for the protection of CUSTOMER and SERVICER. 1.