Transcription

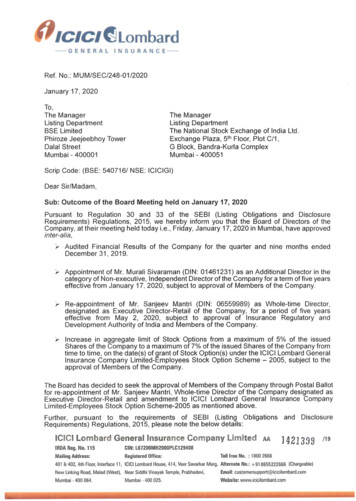

ICICI fJ LombardGENERALINSURANCE-Ref. No.: MUM/SEC/248-01/2020January 17, 2020To ,The ManagerListing DepartmentBSE LimitedPhiroze Jeejeebhoy TowerDalal StreetMumbai - 400001The ManagerListing DepartmentThe National Stock Exchange of India Ltd .Exchange Plaza, 5th Floor, Plot C/1,G Block, Bandra-Kurla ComplexMumbai - 400051Scrip Code: (BSE: 540716/ NSE: ICICIGI)Dear Sir/Madam,Sub: Outcome of the Board Meeting held on January 17, 2020Pursuant to Regulation 30 and 33 of the SEBI (Listing Obligations and DisclosureRequirements) Regulations, 2015, we hereby inform you that the Board of Directors of theCompany, at their meeting held today i.e., Friday, January 17, 2020 in Mumbai, have approvedinter-alia ,'r Audited Financial Results of the Company for the quarter and nine months endedDecember 31, 2019., Appointment of Mr. Murali Sivaraman (DIN: 01461231) as an Additional Director in thecategory of Non-executive, Independent Director of the Company for a term of five yearseffective from January 17, 2020, subject to approval of Members of the Company.,- Re-appointment of Mr. Sanjeev Mantri (DIN: 06559989) as Whole-time Director,designated as Executive Director-Retail of the Company, for a period of five yearseffective from May 2, 2020, subject to approval of Insurance Regulatory andDevelopment Authority of India and Members of the Company.,- Increase in aggregate limit of Stock Options from a maximum of 5% of the issuedShares of the Company to a maximum of 7% of the issued Shares of the Company fromtime to time, on the date(s) of grant of Stock Option(s) under the ICICI Lombard GeneralInsurance Company Limited-Employees Stock Option Scheme - 2005, subject to theapproval of Members of the Company.The Board has decided to seek the approval of Members of the Company through Postal Ballotfor re-appointment of Mr. Sanjeev Mantri, Whole-time Director of the Company designated asExecutive Director-Retail and amendment to ICICI Lombard General Insurance CompanyLimited-Employees Stock Option Scheme-2005 as mentioned above.Further, pursuant to the requirements of SEBI (Listing Obligations andRequirements) Regulations, 2015 , please note the below details:ICICI Lombard General Insurance Company limit edIRDA Reg. No. 115CIN: L67200MH2000PLC129408Mailing Address:Registered Office:AADisclosure] 4213 9Toll free No. : 1800 2666401 & 402, 4th Floor, lntertace 11, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate No.: 918655222666 (Chargeable)New Linking Road, Malad (West), Near Siddhi Vinayak Temple, Prabhadevi,Email: customersupport@icicilombard.comMumbai - 400 064.Website: www.icicilombard.comMumbai - 400 025./19

/CIC/ ANCE -Mr. Murali Sivaraman (DIN: 01461231)Mr. Sanjeev Mantri (DIN: 06559989)Appointment of Additional Director inthecategory of Non-executive,IndependentDirector of theCompanyEffective from January 17, 2020Re-appointment of Whole-timeDirector of the Company·-------1--- -------------t---.,. -- --------- -- --DateofappointmentBrief Profileof DirectorsEffective from May 2, 20201--''-'-- --- ---------------- ---------------·--Mr. Murali Sivaraman, aged 58 years ,is a Fellow Member of the Institute ofChartered Accountants of India,InstituteofCostandWorksAccountants of India and holds a PostGraduate Diploma in ManagementfromtheIndianInstituteofManagement, Ahmedabad. He hasalsocompletedAdvancedManagement Program from lishedbusiness leader, who has worked inIndia, Singapore, China, Canada , andLondon . He is presently a NonExecutive Chairman and IndependentDirector of Huhtamaki PPL Ltd .(formerly known as Paper ProductsLimited) and an Independent Directorin Bharat Forge Limited .In his previous role, he served asPresident of Philips Lig hting GrowthMarkets and Executive Vice PresidentofPhilipsLighting,basedinSingapore . During his tenure atPhilips,hehassuccessfullycompleted and integrated largeacquisitions in India, China andMiddle East and has worked withMarketing, Innovations and SupplyTeams spread across the globe . Healso worked with Akzo Nobel(formerly ICI) for appx. 20 years inglobal positions .Mr. Sanjeev Mantri holds abachelor's degree in commercefromSydenhamCollegeofCommerce and Economics and is amember of theInstituteofChartered Accountants of India andGrad. CWA.He had held key leadershippositions with BNP Paribas andICICI Bank Limited ("the Bank")during a career spanning more than20 years. He joined the Bank in2003, where he led variousbusinesses including Bank's Small& Medium Enterprises Group. Hewas a Senior General Manager atthe Bank and led Bank's Rural andInclusive Banking Group . Under hisleadership, the Bank was awardedthe Asian Banker Award for theBest SME Bank-Asia Pacific 1n2010.He joined ICICI Lombard GeneralInsurance Company Limited ("theCompany") on May 2, 2015, asExecutive Director- Retail. Hespearheads the retail businessdivision of the Company. He is alsoin charge of marketing andcorporate communication verticalsat the Company. --------- -- ----------- ----------------- C C Lombard Genera! nsurra nc e Com pany lim itedIRDA Reg. No. 115CIN: L67200MH2000PLC129408Mailing Address:Registered Office:AA1421456/19Toll free No. : 1800 2666No.: 91 8655222666 (Chargeable)40 1 &402, 4th Floor, Interface 11, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate-------New Linking Road, Malad (West). Near Siddhi Vinayak Temple, Prabhadevi,Email: customersupport@icicilombard.comMumbai - 400 064.Website: www.icicilombard.com------ ----., . .--Mumbai - 400 025 . ------ T'· --,------ -- --

/CIC/ LombardGENERALDisclosure ofrelationshipbetweenDirectorsINSURANCE-Mr. Murali Sivaraman is not related toany Director of the Company.Mr. Sanjeev Mantri is not related toany Director of the Company.Further, we affirm that Mr. Murali Sivaraman (DIN: 01461231) and Mr. Sanjeev Mantri (DIN :06559989) have not been debarred from holding the office of director by virtue of any SEBIorder or any other such authority.The meeting of the Board of Directors of the Company commenced at 2:15 p.m. andconcluded at 4:20 p.m.Thanking you,Yours Sincerely,For ICICI Lombard General Insurance Company Limited0yVikas MehraCompany SecretaryEncl: As above C I C Lombard General lnsura 01ce Company limitedIRDA Reg. No. 115CIN : L67200MH2000PLC129408Mailing Address:Registered Office:AA]4213 89Toll free No. : 1800 2666401 & 402, 4th Floor, Interface 11 , ICICI Lombard House, 414, Veer Savarkar Marg, Alternate No.: 918655222666 (Chargeable)New Linki ng Road, Malad (West), Near Siddhi Vinayak Temple, Prabhadevi,Email: customersupport@icicilombard.comMumbai - 400 06 4.Website: www.icicilombard.comMumbai - 400 025./19

ICICI Lombard General Insurance Company LimitedCIN : L67200MH2000PLC129408Registered Office Address : ICICI Lombard House, 414, Veer Savarkar Marg,Near Siddhivinayak Temple, Prabhadevi Mumbai-400025, MaharashtraIRDAI Registration No. 115 dated August 3, 2001[Pursuant to the Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with IRDAI Circular reference : IRDN F&A/CIR/LFTD/027/01/2017dated 30 .01 .2017)Annexure-1Statement of Audited Results for the Quarter and year to date ended December 31, 2019( i nSI.No.Year to date ended I As at3 months ended I As atParticularsOPERA TING RESULTS1 Gross Premiums written2 Net Premium written '3 Premium Earned (Net)4 Income from investments (net) 'Other incomeCallForeian exchanae aain I Closs\5(bl Investment income from oaol ITerrorism I Nuclear)Cc) Miscellaneous Income6 Total income (3 to 5)& Brokeraoe ln et\ JCommissions78 Net commission JOperatina Expenses related to insurance business (a b) :(a) Employees' remuneration and welfare expenses(bl Other ooeratina exoenses (i ii iiil9i. Advertisement and oublicitvii. Sales oromotioniii. Other expenses10 Premium DeficiencyIncurred Claims11Cal l Claims Paid(b) Chance in Outstandina Claims (Incl . IBNR/IBNER)12 Total Expense (8 9 10 11)13 Underwritina Profit/ Closs) (3-12)14 Provisions for doubtful debts (including bad debts written off)15 Provisions for diminution in value of investments16 Operatin 1 Profit/(Loss) (6-121Appropriations17Cal Transfer to Profit and Loss AleCb) Transfer to ReservesNON-OPERATING RESULTSIncome in shareholders' account (a b c):(al Transfer from Policyh olde rs' Fund18Cbl Income from investments(cl Other in come19 Expenses other than those related to insu rance business20 Provisions for doubtful debts (including bad debts written off)21 Provisions for diminution in value of investments22 Total Expense (19 20 21123 Profit I Closs I before extraordinary items (18-22)24 Extraordinary Items25 Profit/ Closs) before tax 123-24)26 Provisio n for tax27 Profit I (Loss I after tax (PAT)Dividend per share f') (Nominal Value 10 per share) 928(a Interim Dividend(b Final Divid end29 Profrt I (Loss) ca rried to Balance Sh eetPaidup equity capital3031 Reserve & Surplus (Excluding Revaluation Reserve)ShareApplication Money Pending All otment3233 Fair Value Change Account and Revaluation Reserve34 BorrowinasTotal Assets:la) Investm ents:35- Shareholders' Fund- Policyh olders' Fundlb) Other Assets INet of cu rrent lia bilities and provisions)Anal11ical Ratios 4 :(i) Solvencv R t;n R tin 4 b(ii) vnAnOAOliiil Incurred Claim Ratio(IV) Net Retention Ratio(vl Combined Ratio:fvil Earnina per share (il')(a) Basic and diluted EPS before extraordinary items (net oftax exoonco\ for fhA nA,;nn 5(b) Basic and diluted EPS after extraordinary items (net oftax exooncA\ for the oeriod 536lviil NPA ratios:lal Gross and Net NPAs(bl % of Gross & Net NPAs(viii) Yield on Investments 5·6"lix)la) With out unrealized aains8(bl With unrealised aainsPublic shareholdinaal No. of shares'b) Percentaoe of shareholdinacl % of Government holdinalin case of public sector insu rance companies\lakhs)Year ended I As atDecember 31 , 2019AuditedSe ptember 30, 2019AuditedDecember 31, 2018AuditedDecember 31 2019AuditedDecember 31, 2018Audited376.946265.758245,6 1633,636303,067216.656235,69237 ,793376.900259 6912 11 ,09730,1931.036 079720.916705.797112,4131.126,132707 .754617.788102.2531.478 921953 856837.535133,552356 174279,89077057,7057824386273,8926 .1856 ,185(506)694161241,6399.2119,211521.622313820 19719.36119,3615742 .323313723 ,25115 97515,9757372.973426975 22322.29122,29116,84416 ,46514.23050 75044.05857 .1 881.95029.64715.6315.52619 28213.3993,79117 04716,79114 82865 29941 .96711 ,86043 60640.93818 56170.64052 .589137 24 64528,241213,956(2,859)378,261142.904713,370(7 573)367.503105,843629,783(11 995)485.466145,346852,081 14,546)32,07037,32427 683106 82793 468123,14232,07037 32427,683106 82793 46812314232 07010 0641.5352.1002.57727 6839,5071.1122.0292064,67738 99237 32411 .92762.348776273,151461062 23536 067106 82734,6791,5466.1774,2232710,427132 62593 46834,9361.1145.804(1 ,655)774 226125 2921231 4246 0011,43010.11 55397710 731159,84238,9929.58129,41146,10615.31530 79136,06712.15323,914132,62541,44291183125 29243.13982153159,84254.915104 9272 .50366 10245.443529.40130 153.50376,33345 .444539,685March 31 2019Audited25251019.34048,50010.12348.50030.86948 .50019.34048.50030.86948,50033.84248,500571 .5611.912,965(1 .831.533)562,0421.837,888(1 ,766 453)509,7971.534,748(1 456.174)571.5611.912 965(1 7511.608.694)2.1826.9%71 .7%70.5%98.7%2.2627.4%74 .6%71.5%102.6%2.1222.4%72.4%68.9%95.9%2.1826.1%73 .8%69.6%100.5%2.1220.2%76.6%62 .8%98.7%Basic:Diluted:Basic:Diluted: 6.47 6.456.476.45Basic:Diluted:Basic:Diluted: t6.786.766.786.76Basic:Diluted:Basic:Diluted: 5.275.265.275.26Basic:Diluted:Basic:Diluted: t20.0720.0120.0720 .01Basic:Diluted:Basic:Diluted· 18.1018.0618.1018.062.2421 .4%75.3%64.5%98 .5%Basic:Diluted:Basic:Diluted: 23.1 123.06 23 .11 23.061.77%2.33%2.07%1.87%1.99%4.13%6 .28%7.23%4.49%9.40%6.99%200,592 14844.14%200.584 71844.14%200 .220.63844 .10%200.592 .14844 .14%200 ,220,63844 .10%200.466.1 3844.13%Footnotes:1 Net of reinsurance (Including Excess of Loss Reinsu rance) .2 Including capital gains, net of amortisatio n and losses.3 Commission is net of commission re ceived on reinsu rance cession.4 Analytical ratios have been calculated as per definition given in IRDAI analytical ratios disclosures.4a The Solve ncy has been computed at the last day of the period .4b The Expenses of Management has been computed on the basis of Gross Direct Premium5 Not annualised6 Excludes unrealised gains or losses on real estate and unlisted equity7 Yie ld on investments with unrealised gains is computed using the modified Dietz method8 The computati on is based on time weighted average book value.9Dividend is recoQnised in the period it is approved as prescribed by MCA7.28%

Annexure-11(Pursuant to the Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with IRDAI Circular reference : IRDA/F&A/CIR/LFTD/027/01/2017 dated 30.01 .2017]Segment1 Reporting for the Quarter and year to date ended December 31, 2019('(in lakhs)Year to date ended I As atYear ended I As at3 months ended I As atParticularsSI. No.December 31 2019December31 2018March 31, 2019September 30, 2019December 31 2018December 31 eament Income:(Al FireNet Premium EarnedIncome from InvestmentsOther Income(Bl MarineNet Premium EarnedIncome from InvestmentsOther Income(Cl Health includina Personal Accident*Ci) Health RetailNet Premium EarnedIncome from InvestmentsOther Income(ii) Health Grouo, ComorateNet Premium EarnedIncome from InvestmentsOther Income(iii) Health Government BusinessNet Premium EarnedIncome from InvestmentsOther IncomeI CD) MiscellaneousIi) Miscellaneous RetailNet Premium EarnedIncome from InvestmentsOther IncomeIii\ Miscellaneous Grouo ComorateNet Premium EarnedIncome from InvestmentsOther IncomeCEl Crop InsuranceNet Premium EarnedIncome from InvestmentsOther Income/Fl MotorNet Premium EarnedIncome from InvestmentsOther IncomePremium Deficiency1A) Fire(Bl MarineCC) Health includina Personal Accident*Ii) Health Retail(ii) Health Group, Coroorateliiil Health Government BusinessI ID) Miscellaneous(i) Miscellaneous Retailliil Miscellaneous Groun CornoratellE) Crop Insurancel Fl MotorSeament Underwritina Profit I llossl:(Al Fire(6) MarineIC) Health includina Personal Accident*Ii) Health Retail(ii) Health Group. Coroorate(iii) Health Government BusinessI CD) MiscellaneousCil Miscellaneous RetailIii\ Miscellaneous Grouo CoroorateICE) Crop Insurance(Fl Motor8,0538272596,1929811733.937606319190152 8281 06111 3742142140315,7882,7651,7796 415420(50)6,391581(16\6,80944443186481,675(18)17 8941 ,91310521325 5142049,8337,0912166,7229,0993041 9262 95.4727 3876371296139 2731,81991214)104 3832 5622616.3793.486511 3631,31229510 9011,538111\10,0271 99634532 5634 52647729 9007 02484033.8345 4941 21046911881 2401,5201104121 285111,6064,382144 3475 5402656 8137 14430158 29824,90176151,95526,81355128,68821839. 101458 81880744217366 96970935192503 56593 2815.814)(93)7.2815944274 3613647,615(223)(132)3,8251429694025 097(15,360)(87)31 ,860(15.476)(819)4,9281 385(92)(19.432)1.1563 520(800\110,210181256(3,970)(9,034)6,3374 ,502(1 020)(39 058)191319)(9,662)(8 259)1 6364 252(7,504)123 808)

I SI. No.45ParticularsSegment Ooeratino Profit I fLossl:!Al Fire(Bl Marine(C) Health includina Personal Accident lil Health Retail(ii) Health Group, Corporatefiiil Health Government Business(Dl Miscellaneous(i} Miscellaneous Retail(iil Miscellaneous Group, Corporate(E) Crop Insurance(Fl MotorSeament Technical Liabilities:Unexoired Risk Reserve - Net(A) FireIBl MarineICl Health includino Personal Accident*{i) Health Retailliil Health Grouo. Corporate(iii) Health Government Business!Dl Miscellaneous(i) Miscellaneous Retail!iil Miscellaneous Grouo. Coroorate'El Croo InsuranceIF) MotorOutstanding Claims Reserves Including IBNR &IBNER - Gross.!Al FireIBl Marine(Cl Health includina Personal Accident (i) Health Retail{ii) Health Group Coroorateliiil Health Government Business(0) Miscellaneousfil Miscellaneous Retailliil Miscellaneous Group, CoroorateI(E) Crop InsurancefFI Motor3 months ended I As atYear to date ended I As atin lakhslYear ended I As atDecember31, 2019AuditedSeotember 30 2019AuditedDecember 31 2018AuditedDecember 31 2019Audited38398411,0111,0142 4875465 7442 4065 28213363)5,671(3,626)1 448100626872 3188 0024899 5401304{28)9,35824,3411 30632 210(7 336)33940,989(5,34811280)5.5592 9931 0975,5442,0645,04772016 65983,594(2,674)12,9078.9009 5063 36341 ,903207 79,14211,7727,51522,501769011 7727 51512,018596054 92011482455 283117 96067 78783,07354 920114,824677878307371 ,15088 38033 51625 7441358,8633630301 0913351625,744316 0211358 8633630301 09138,34421 720316.02138 00626,0781285.939322 526184 87858441174 92256 456177 93855 426184 87858,441177 93855,426173,57256,26933,27264 79711 09433,86362 5291213544,23751 09912 77133 27264 79711 09444 23751 09912 77142 50444 63012,6303,948123 509265,6641,020,7083 420126 485279,477980 1301116 777316 560847 7903,948123 509265,66410207081116 777316 560847,7903,597115,407305 226888,725December31 2018AuditedMarch 31, 2019AuditedFootnote:1Segments include : (A} Fire, (B) Marine, (C} Health including Personal Accident - (i) Health Retail, (ii) Health Group, and (iii) Health Government Schemes, (D) Miscellaneous - (i) Retail, (ii)Group I Corporate, (E) Crop Insurance, (F) Motor2 includes Travel Insurance

Notes forming part of Annexure I and Annexure IIThe above financial results of the Company for the quarter and year to date ended December 31, 2019 were reviewed and recommended by the Audit Committee and subsequently approvedby the Board of Directors at its meeting held on January 17, 20202The above financial results were audited by the joint statutory auditors, Chaturvedi & Co., Chartered Accountants and PKF Sridhar & Santhanam LLP, Chartered Accountants who have issuedunmodified opinion on these financial results.In view of the seasonality of Industry, the financial results for the quarter and year to date ended are not indicative of full year's expected performance4During the quarter ended December 31, 2019, the Company has alloted 7,430 equity shares of facevalue 10 each, pursuant to exercise of employee stock options granted earlier.In accordance with requirements of IRDAI master circular on preperation of financial statements and filing of returns, the Company will publish the financials on the company's website latest byFebruary 14, 2020.6The Company has during the 02 2020, changed the annual premium allocation for Long Term Motor Own Damage policies issued on or after September 01, 2018 up to March 31, 2019 for newcars and new two wheelers in line with IRDAl's letter no. IRDA/NUMISC/32/2019-20 dated May 21, 2019. This change has the impact of decreasing the operating profit I profit before tax by 104 lakhs for FY2019 & by 349 Lakhs thousand for 01 FY2020. These adjustments have been effected in 02 2020.7The Board has declared an interim dividendcurrent quarter ended December 31, 2019.8The Taxation Laws {Amendment) Act, 2019 has amended the Income Tax Act, 1961, and the Finance (No. 2) Act, 2019 by inserting section 115BAA which provides domestic companies withan option to opt for lower tax rates, provided they do not claim certain deductions. The Company has elected to exercise the option and has accordingly recognized Provision for Income Tax forthe year to date ended December 31, 2019 and re-measured the opening balance of Deferred Tax Assets as at April 01, 2019 at the tower tax rate prescribed in the said section. This changewhich has been recognized in the Profit & Loss account of the current quarter and year to date has reduced provision for taxation by Z 4,397 lakhs (net of one time charge of 8,428 lakhs onaccount of reversal of deferred tax assets as on April 1, 2019).9Other income (non operating results) includes interest on income tax refund of 1,509 lakhs received during the quarter ended and year to date ended December 31, 2019 (for the quarter andyear to date ended December 31, 2018 1, 107 lakhs and for the year ended March 31, 2019 1,391 lakhs).10The Company during the current quarter, has entered into a business transfer agreement to acquire proprietary software, platforms and underlying intellectual property assets developed byUnbox Technologies Private Limited along with ancillary movable assets for housing the Software and employees for operation, maintenance and development of the Software for an aggregatenet consideration of 22,440 lakhs on a slump sate basis.of 3.50 per equity share of face valueof 10 each at it's meeting held on October 18, 2019. The same has been accounted and paid during the11For and on behalf of the BoardICAI UDIN: 20040479AAAAA07889MumbaiJanua 17 2020ICAI UDIN: 20201402AAAAAC4910

Other Oisclosuros Status of Shareholders Complaints for the nine months ended December 31, 2019Sr No Particulars1No. of Investor complaints pending at the beginning of periodNo. of Investor complaints during the period23No. of Investor complaints disposed o ff during the period4No. of Investor comolaints remaininn. unresolved at the end of the neriod The above disclosure is no! reouired to be audited.Number0330

ICICI Lombard General Insurance Company LimitedCIN: L67200MH2000PLC129408Registered Office Address: ICICI Lombard House. 414, Veer Savarkar Marg,Near Siddhivinayak Temple, Prabhadevi Mumbai-400025, MaharashtraIRDAI Registration No. 115 dated August 3, 2001Balance SheetAt December 31, 2019( inAtDecember 31, 2019OOO's)AtMarch 31, 2019Sources of fundsShare capitalReserves and SurplusShare applicat ion money-pending 89Fair value change accountShareholders fundsPolicyholders funds442,0151,491 ,977798,9842,585.229Borrowings4,850,0004,850,00065 877,458Fixed assets6,945.9194,652,318Deferred tax asset3,725,8413,012,597Current assetsCash and bank balancesAdvances and other tal (A)106,354,990104 053,077Current liabilities242,411,720216,228,356Provi sionsSub-Total (B)57,768,324300180 04456,359,032272 587 388(193,825,054)( 168,534,311 65 299 32161 438 819TotalApplication of fundsInvestments - ShareholdersInvestments - PolicyholdersLoansNet current assets (C) (A - BlMiscellaneous expenditure (to the extent not written off or adjusted)Debit balance in profit and loss accountTotalFor and on behalf of the BoardMumbaiJanuary 17, 2020

Chaturvedi & Co.PKF Sridhar & Santhanam LLPChartered AccountantsChartered Accountants81, Mittal Chambers,228, Nariman Point,Mumbai-400021201, 2nd Floor, Center Point Building,Dr. BR Ambedkar Road,Pare I, Mumbai - 400012Independent Auditors' Report on Quarterly and Year to Date Financial Results ofICICI Lombard General Insurance Company Limited pursuant to the Regulation 33of the Securities and Exchange Board of India (Listing Obligations and DisclosureRequirements} Regulations, 2015 read with Insurance Regulatory andDevelopment Authority of India circular reference number IRDA /F&A /CIR/LFTD/027/01/2017 dated January 30, 2017To The Board of Directors ofICICI Lombard General Insurance Company LimitedReport on the audit of the Financial ResultsOpinion1.We have audited the accompanying quarterly financial results of ICICI Lombard General InsuranceCompany Limited (the "Com pany") for the quarter ended 31st December 2019 and the year to date51results for the period from 11t April 2019 to 31 December 2019 attached herewith, being submitted bythe Company pursuant to the requirements of Regulation 33 of the Securities and Exchange Board ofIndia (" SEBI" } (Listing Obligations and Disclosure Requirements} Regulations, 2015, as amended (" SEBIListing Regulations" ) and Insurance Regulatory and Development Authority ('IRDAI" or "Authority")circu lar reference number IRDA / F&A /CIR/ LFTD/ 027 I 01/ 2017 dated January 30, 2017.2.In our opinion and to the best of our information and according to the explanations given to us thesefinancial results:(i}are presented in accordance with the requirements of Regu lation 33 of the SEBI ListingRegulations and IRDAI Circular reference number IRDA / F&A /CIR/ LFTD/ 027 I 01/ 2017 datedJanuary 30, 2017; and(ii}give a true and fair view in conformity wit h the recognition and measu rement principles laiddown in Accounting Standard ("AS") 25, "Interim Financial Reporting" ("AS 25"}, prescribedunder Section 133 of the Companies Act (the "Act"), including relevant provisions of theInsurance Act, 1938 (the " Insurance Act"), the Insurance Regulatory and Development Authorityof India Act, 1999 (the "IRDAI Act") and other accounting principles generally accepted in India,to the extent considered relevant and appropriate for the purpose of these financial results andwhich are not inconsistent with the accounting principles as prescribed in the InsuranceRegulatory and Development Authority of India (Preparation of Financial Statements andAuditors' Report of Insurance Companies) Regulations, 2002 (t he "IRDAI AccountingRegulations" ) and orders/directions/circulars issued by the IRDAI, to the extent applicable, ofthe net profit and other financial info rmation for the quarter ended 31 December 2019 as wellas the year to date period from 1 April 2019 to 31 December2019 .

Chaturvedi & Co.PKF Sridhar & Santhanam LLPChartered AccountantsChartered AccountantsBasis for Opinion3. We conducted our audit in accordance with the Standards on Auditing ("SAs") specified under section143(10) of the Companies Act, 2013 (the Act). Our responsibilities under those Standards are furtherdescribed in the Auditor's Responsibilities for the Audit of the Interim Financial Results section of ourreport. We are independent of the Company in accordance with the Code of Ethics issued by theInstitute of Chartered Accountants of India together with the ethical requirements that are relevant toour audit of the financial results under the provisions of the Companies Act, 2013 and the Rulesthereunder, and we have fulfilled our other ethical responsibilities In accordance with theserequirements and the Code of Ethics. We believe that the audit evidence we have obtained is sufficientand appropriate to provide a basis for our opinion.Management's Responsibilities for the Interim Financial Results4. These financial results have been prepared on the basis of the interim condensed financial statements.The Company's Board of Directors are responsible for the preparation of these financial results thatgive a true and fair view of the net profit and other financial information in accordance with therecognition and measurement principles laid down in AS 25, 'Interim Financial Reporting' prescribedunder Section 133 of the Act read with relevant rules issued thereunder, the Insurance Act, the IRDAIAct, the IRDAI Accounting Regulations and orders I directions prescribed by the IRDAI in thisbehalf, current practices prevailing within the insurance industry in India and other accountingprinciples generally accepted in India and in compliance with Regulation 33 of the SEBI listingRegulations. This responsibility also includes maintenance of adequate accounting records inaccordance with the provisions of the Act for safeguarding of the assets of the Company and forpreventing and detecting frauds and other irregularities; selection and application of appropriateaccounting policies; making judgments and estimates that are reasonable and prudent; and design,implementation and maintenance of adequate internal financial controls that were operatingeffectively for ensuring the accuracy and completeness of the accounting records, relevant to thepreparation and presentation of the financial results that give a true and fair view and are free frommaterial misstatement, whether due to fraud or error.5. In preparing the financial results, the Board of Directors are responsible for assessing the Company'sability to continue as a going concern, disclosing, as applicable, matters related to going concern andusing the going concern basis of accounting unless the Board of Directors either intends to liquidate theCompany or to cease operations, or has no realistic alternative but to do so.6. The Board of Directors are also responsible for overseeing the Company' s financial reporting process.Auditor's Responsibilities for the Audit of the Interim Financial Results7. Our objectives are to obtain reasonable assurance about whether the financial results as a whole arefree from material misstatement, whether due to fraud or error, and to issue an auditor's report thatincludes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that anaudit conducted in accordance with SAs will always detect a material misstatement when it exists.Misstatements can arise from fraud or error and are considered material if, individually or in theaggregate, they could reasonably be expected to influence the economic decisions of users taken onthe basis of these financial results.

Chaturvedi & Co.PKF Sridhar & Santhanam LLPChartered AccountantsChartered Accountants8.As part of an audit in accordance with SAs, we exercise professional judgment and maintainprofessional skepticism t hroughout the audit. We also: Identify and assess the risks of material misstatement of the financial results, whether due tofraud or error, design and perform audit procedures responsive to those risks, and obtain auditevidence that

Scrip Code: (BSE: 540716/ NSE: ICICIGI) Dear Sir/Madam, . 0 For ICICI Lombard General Insurance Company Limited y Vikas Mehra Company Secretary Encl: As above CI C Lombard General lnsura01ce Company limited AA ] 4 213 8 9 /19 IRDA Reg. No. 115 CIN: L67200MH2000PLC129408