Transcription

velop mnsial IEAU. S.DE N T o f t heTRRYSUTMAREPniDeionmusFundComtyent FinanctitutNMTC PROGRAMAWARD BOOKCY 2017WWW.CDFIFUND.GOVThe CDFI Fund is an equal oppourtunity provider.

THE NEWMARKETSTAX CREDITPROGRAMThe New Markets Tax Credit Program(NMTC Program) helps economicallydistressed communities attract privateinvestment capital. This federal taxcredit helps to fill project financing gapsby enabling investors to make largerinvestments than would otherwise bepossible. Communities benefit from thejobs associated with theseinvestments, as well as greater accessto public facilities, goods, and servicessuch as manufacturing, food, retail,housing, health, technology,energy, education, and childcare.Through the NMTC Program, the CDFI Fund allocatestax credit authority to Community Development Entities(CDEs) through a competitive application process. CDEs arefinancial intermediaries through which investment capitalflows from an investor to a qualified business located in alow-income community. CDEs use their authority to offertax credits to investors in exchange for equity in the CDE.With these capital investments, CDEs can make loans andinvestments to businesses operating in distressed areasthat have better rates and terms and more flexiblefeatures than the market. The NMTC Program helps tooffset the perceived or real risk of investing in distressedand low-income communities. In exchange for investing inCDEs, investors claim a tax credit worth 39 percent of theiroriginal CDE equity stake, which is claimed over aseven-year period. In addition to receiving a tax benefit,investors have the advantage of entering new, unsaturatedmarkets before their competitors, thereby increasingtheir chances of success. The NMTC Program enablesinvestors to gain recognition for supporting therevitalization of America’s communities.NMTC PROGRAM HISTORY: I n the 14 rounds to date, the CDFI Fund hasmade 1,105 allocation awards totaling 54billion in tax credit authority, including 3 billion in Recovery Act awards and 1 billion that was specifically set aside forrecovery and redevelopment in the wake ofHurricane Katrina. 44 billion in New Markets Tax Credits havebeen invested in low-income communitiessince the program’s inception through FY 2017.NMTC PROGRAM AWARD BOOKIMPACTOF NMTCPROGRAM:For every 1 invested by thefederal government, the NMTCProgram generates over 8of private investment.Since its inception, the NMTCProgram has supported theconstruction of 85 million squarefeet of manufacturing space,63 million square feet of officespace, and 43 million squarefeet of retail space.The IRS’s NMTC Programregulations generally require thatat least 85 percent of QEI proceedsbe invested in Qualified Low-IncomeCommunity Investments (QLICIs).All 73 of the 2017 allocateesindicated that they would invest atleast 95 percent of QEI dollars intoQLICIs. In real dollars, this meansat least 444 million above andbeyond what is minimallyrequired by the NMTC Programwill be invested in low-incomecommunities.

GEOGRAPHIC LOCATIONOF ALLOCATEESTHE 73 ALLOCATEES AREHEADQUARTERED IN 29 DIFFERENTSTATES, THE DISTRICT OF COLUMBIA,AND GUAM3515111235 OF THE ALLOCATEES(OR 47.9 PERCENT) WILL FOCUSINVESTMENT ACTIVITIES ONA NATIONAL SERVICE AREA;15 OF THE ALLOCATEES(OR 20.5 PERCENT) WILLFOCUS ON A MULTI-STATESERVICE AREA;11 OF THE ALLOCATEES(OR 15.1 PERCENT) WILL FOCUSACTIVITIES ON A STATEWIDESERVICE AREA;AND 12 OF THE ALLOCATEES(OR 16.4 PERCENT) WILL FOCUSON LOCAL MARKETS(E.G., A CITYWIDE ORCOUNTYWIDE AREA).NMTC PROGRAM AWARD BOOKURBAN VS. RURAL INVESTMENT AREA*Approximately 2.393 billion(70 percent) of NMTCinvestment proceeds willlikely be used to financeand support loans to orinvestments in operatingbusinesses in low-incomecommunities.APPROXIMATELYApproximately 1.026 billion(30 percent) of NMTCinvestment proceeds will likelybe used to finance and supportreal estate projects inlow-income communities.APPROXIMATELYAPPROXIMATELY 1.981 757.4 680.5BILLION MILLION MILLIONWILL BE INVESTED WILL BE INVESTED WILL BE INVESTEDIN MAJOR URBAN IN MINOR URBANIN RURAL AREASAREASAREAS* Based on initial estimates of 2017 allocateesCDFIs vs. Non-CDFIs73INVESTMENT ACTIVITIES39.7%of the allocatees are certified CommunityDevelopment Financial Institutions (CDFIs)or subsidiaries of certified CDFIs. They receivedallocations totaling 1.435 billion.

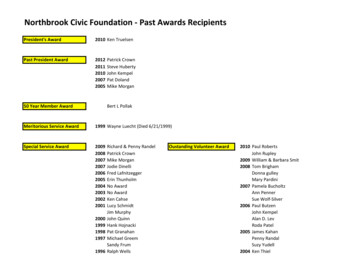

CityStateService AreaAllocatedAmountEmpowermentReinvestment Fund, LLCNew YorkNYNational 40,000,000ESIC New MarketsPartners LPColumbiaMDNational 50,000,000FirstPathway CommunityDevelopment, LLCMilwaukeeWIMulti-state 15,000,000First-Ring IndustrialRedevelopmentEnterprise, Inc.West AllisWILocal 35,000,000Florida Community LoanFund, Inc.OrlandoFLStatewide (orterritory-wide) 45,000,000Fort Wayne New MarketsRevitalization Fund, LLCFt WayneINLocal 55,000,000French LickRedevelopment CDE LLCPaoliINStatewide (orterritory-wide) 15,000,000Guam CommunityDevelopmentEnterprise LLCTamuningGUStatewide (orterritory-wide) 20,000,000Name of AllocateeLIST OF ALLOCATIONRECIPIENTSCityStateService AreaAllocatedAmountKansas CityMOLocal 55,000,000AtlantaGALocal 60,000,000WashingtonDCNational 55,000,000Capital Impact PartnersArlingtonVANational 65,000,000Carver FinancialCorporationSavannahGANational 30,000,000CBKC CDC, L.L.C.Kansas CityMOMulti-state 55,000,000Central StatesDevelopment Partners,Inc.Harbor BanksharesCorporationBaltimoreMDMulti-state 55,000,000Rock IslandILNational 20,000,000HEDC New Markets, IncNew YorkNYNational 50,000,000Hope EnterpriseCorporationJacksonMSMulti-state 30,000,000Los AngelesCALocal 50,000,000Low IncomeInvestment FundSan FranciscoCANational 60,000,000MetaFund Corporation(f.k.a. Oklahoma MetaFundCDC)Oklahoma CityOKMulti-state 30,000,000BostonMAMulti-state 65,000,000Name of AllocateeAltCapAtlanta EmergingMarkets, Inc.Building America CDE, Inc.Central Valley NMTCFund, LLCFresnoCALocal 55,000,000AdaOKNational 30,000,000CincinnatiOHMulti-state 50,000,000LansingMIMulti-state 65,000,000Citibank NMTCCorporationNew YorkNYNational 65,000,000MHIC NE New MarketsCDE II LLCCivic Builders, Inc.New YorkNYNational 40,000,000Community DevelopmentFinance AllianceMDNational 40,000,000UTStatewide (orterritory-wide)BethesdaSalt Lake City 40,000,000Mid-City CommunityCDE, LLCCommunity Health CenterCapital Fund, Inc.GrimesIANational 65,000,000BostonMANational 40,000,000Midwest RenewableCapital, LLCCommunity Loan Fund ofNew Jersey, Inc.MTMulti-state 65,000,000NJStatewide (orterritory-wide)MissoulaNew Brunswick 40,000,000Montana CommunityDevelopment CorporationConsortium America, LLCWashingtonDCNational 55,000,000National CommunityInvestment FundChicagoILNational 55,000,000Corporation for SupportiveHousingNew YorkNYNational 50,000,000National New MarketsFund, LLCLos AngelesCANational 50,000,000Dakotas America, LLCRennerSDNational 75,000,000WashingtonDCNational 60,000,000Dallas Development FundDallasTXLocal 55,000,000National Trust CommunityInvestment CorporationDanville, Virginia CDE, Inc.DanvilleVALocal 35,000,000Nonprofit Finance FundNew YorkNYNational 65,000,000DV CommunityInvestment, LLCPhoenixAZNational 50,000,000Northern CaliforniaCommunity Loan FundSan FranciscoCAStatewide (orterritory-wide) 60,000,000New YorkNYLocal 20,000,000Chickasaw NationCommunity DevelopmentEndeavor LLCCincinnati DevelopmentFund, Inc.Cinnaire New Markets LLCNMTC PROGRAM AWARD BOOKLos AngelesDevelopment FundNYCR-CDE, LLC

Name of AllocateeCityStateService AreaAllocatedAmountName of AllocateeCityStateService AreaAllocatedAmountOpportunity FundNorthern CaliforniaSan JoseCAStatewide (orterritory-wide) 40,000,000Waveland CommunityDevelopment, LLCMilwaukeeWINational 30,000,000WashingtonDCNational 15,000,000WheelingWVMulti-state 40,000,000AustinTXStatewide (orterritory-wide) 30,000,000WesBanco BankCommunityDevelopment Corp.PhiladelphiaPALocal 60,000,000New OrleansLAMulti-state 50,000,000PhoenixAZMulti-state 30,000,000New YorkNYNational 60,000,000Raza DevelopmentFund, Inc.PhoenixAZNational 55,000,000REI Development Corp.DurantOKStatewide (orterritory-wide) 60,000,000PhiladelphiaPANational 70,000,000Mason CityIANational 75,000,000San FranciscoCALocal 30,000,000Southside CommunityOptimal RedevelopmentEnterprise, LLCChicagoILMulti-state 45,000,000St. Louis DevelopmentCorporationSt. LouisMOLocal 35,000,000Baton RougeLANational 35,000,000SunTrust CommunityDevelopment Enterprises,LLCAtlantaGANational 70,000,000TD CommunityDevelopment CorporationGreenvilleSCNational 60,000,000The Community BuildersCDE LLCBostonMANational 50,000,000The Housing PartnershipNetwork, Inc.BostonMANational 30,000,000The Innovate Fund, LLCGreenvilleSCStatewide (orterritory-wide) 55,000,000The Rose Urban GreenFund, LLCDenverCONational 45,000,000San AntonioTXStatewide (orterritory-wide) 65,000,000UB CommunityDevelopment LLCAtmoreALMulti-state 55,000,000USBCDE, LLCSt. LouisMONational 70,000,000Vermont RuralVentures, Inc.BurlingtonVTMulti-state 60,000,000Partners for theCommon GoodPeopleFund NMTC LLCPIDC Community CapitalPrestamos, CDFI, LLCPrimary CareDevelopment CorporationReinvestment Fund, Inc.,TheRural DevelopmentPartners LLCSan Francisco CommunityInvestment FundStonehenge CommunityDevelopment, LLCTransPecos DevelopmentCorpNMTC PROGRAM AWARD BOOKWhitney New MarketsFund, LLC

KEYHIGHLIGHTS:230 7313 32APPLICANTS VS. ALLOCATEESECONOMICALLY DISTRESSED COMMUNITIES230 CDEs applied for allocations,requesting a total of approximately 16.2 billion in allocations. The CDFIFund made allocation awards totaling 3.5 billion, or about 21.6 percent of thetotal amount requested by applicants, to73 CDEs (or 32 percent of the totalapplicant pool).All 73 of the allocatees committed toproviding at least 75 percent of theirinvestments in areas characterizedby: 1) multiple indicia of distress; 2)significantly greater indicia ofdistress than required by NMTCProgram rules; or 3) highunemployment rates.MINORITY- OR NATIVE-OWNED ORCONTROLLED ENTITIESRURAL COMMUNITIES*13 of the allocatees (or 17.8 percent)are minority- or Native-owned orcontrolled entities. They receivedallocations totaling 555 million.NMTC PROGRAM AWARD BOOK*For further information, see the 2017 Notice of Allocation Authority.14 allocatees met the criteria for“Rural CDE” designation. These 14Rural CDEs received allocationstotaling 685 million. 32 allocatees(or about 44 percent) will berequired to deploy some or all of theirinvestments in non-metropolitancounties; totaling approximately 685million, or 20 percent of the QLICIs tobe made with this allocation round.

DE N T o f t heTREAU. S.TMRYSUAREPniDeionmusFundComtyvelop mIent Financialn stit utADDITIONALRESOURCESLearn more about the New Markets TaxCredit Program: www.cdfifund.gov/nmtcExplore where in the country New MarketsTax Credit Program awardees are serving:www.cdfifund.gov/statesservedView previous award rounds of the CDFI Fund’sprograms: www.cdfifund.gov/awardsVisit www.cdfifund.gov to learn about otherCDFI Fund programs and how to apply.Photo Credits: Revolution Mill, Greensboro, North Carolina, financed by Self-Help Credit UnionWalnut Way and Wellness Commons, Milwaukee, Wisconsin, financed by Forward Community Investments

Missoula MT Multi-state 65,000,000 National Community Investment Fund Chicago IL National 55,000,000 National New Markets Fund, LLC Los Angeles CA National 50,000,000 National Trust Community Investment Corporation Washington DC National 60,000,000 Nonprofit Finance Fund New York NY National 65,000,000 Northern California