Transcription

GE TransportationMorningstarthSeptember 17 , 2014Forward-Looking Statements:This document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future businessand financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” or “would.” Forward-looking statements by theirnature address matters that are, to different degrees, uncertain. For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-lookingstatements include: current economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets; potential marketdisruptions or other impacts arising in the United States or Europe from developments in sovereign debt situations; the impact of conditions in the financial and credit markets on the availability andcost of General Electric Capital Corporation’s (GECC) funding and on our ability to reduce GECC’s asset levels as planned; the impact of conditions in the housing market and unemployment rates on thelevel of commercial and consumer credit defaults; pending and future mortgage securitization claims and litigation in connection with WMC, which may affect our estimates of liability, includingpossible loss estimates; our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; the adequacy of our cash flows and earningsand other conditions which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; GECC’s ability to pay dividends to GE at the planned level,which may be affected by GECC's cash flows and earnings, financial services regulation and oversight, and other factors; our ability to convert pre-order commitments/wins into orders; the price werealize on orders since commitments/wins are stated at list prices; the level of demand and financial performance of the major industries we serve, including, without limitation, air and railtransportation, power generation, oil and gas production, real estate and healthcare; the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, includingthe impact of financial services regulation; our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures,dispositions and other strategic actions; our success in completing announced transactions and integrating acquired businesses; adverse market conditions, timing of and ability to obtain requiredbank regulatory approvals, or other factors relating to us or Synchrony Financial could prevent us from completing the Synchrony IPO and split-off as planned; our ability to complete the proposedtransactions and alliances with Alstom and realize anticipated earnings and savings; the impact of potential information technology or data security breaches; and numerous other matters of national,regional and global scale, including those of a political, economic, business and competitive nature. These uncertainties may cause our actual future results to be materially different than thoseexpressed in our forward-looking statements. We do not undertake to update our forward-looking statements.This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.“This document may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative toinvestors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measurespresented in this document, see the accompanying supplemental information posted to the investor relations section of our website at www.ge.com.”“In this document, “GE” refers to the Industrial businesses of the Company including GECC on an equity basis. “GE (ex-GECC)” and/or “Industrial” refer to GE excluding Financial Services.”GE’s Investor Relations website at www.ge.com/investor and our corporate blog at www.gereports.com, as well as GE’s Facebook page and Twitter accounts, contain a significant amount of informationabout GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.1 2014 General Electric Company - All rights reserved

100 years of manufacturing excellence Established 100 years ago Headquartered in Chicago, IL Operating in 40 countries 12,000 employees worldwide 6.0B revenues in ‘13 54%domestic, 46% international Operating in 6 different industriesGlobal Infrastructure business strong synergies with rest of GE 2014 General Electric Company - All rights reserved2

Business overview(‘13 Revenue in billions/percent of total Revenues)Locomotive & engine adjacenciesMining-a) A leading diesel locomotive producer Newly established GE vertical Engine, propulsion & controls Wheel drive systems 1.2-3MW diesel generators Parts & upgrades AC & DC drill motors Underground equipment 2.5B/ 42% 1.0B/ 16%Services and Software SolutionsIntelligent Transportation Solutions Parts & services Fuel & velocity efficiency Diagnostics and monitoring(Industrial Internet) Railroad safety & compliance (GlobalSignaling) Transportation management &planning optimization 0.6B/ 10% 1.9B/ 32% 2014 General Electric Company - All rights reserved3(a- excludes revenue recognized in other GE segmentsfor products provided to mining customers

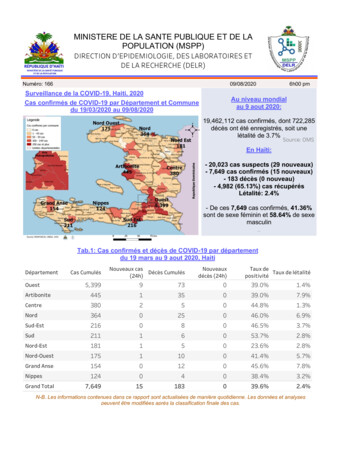

Rail environmentN. America Parked locos15%2,80010%9305%4603320%BN2012 2013 1Q14 ty D rop (YoY)N. America’13’14 YTDPrior 4 wks (vs.’13)Carloads 0.2% 2.4%5.6%Intermodal 4.4% 5.9%7.7%Total 2.1% 4.0%6.6%International locos 1.2%1Q’14avs 10%forecastALL RailOps 1.3%FY 2014a(0.4)%FY 2013a vs 4%vs 8% forecastforecastMRSLogisticaLATAMTransnetS. AfricaSources: Earnings reports,AAR & FTR 14.0%1H FY14abeatforecast 10.4%FY 2013abeatforecast(1.0)%1H’14a YoYvs 2%forecastKTZRZDRUCIS 7.8%9mo FY’14ametforecastAurizonAscianoAUS44 2014 General Electric Company - All rights reserved

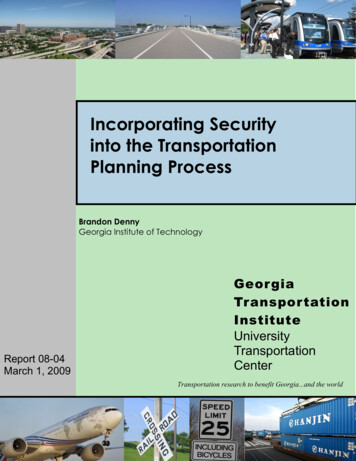

Mining environmentCapex spending 1102012-a)(12)%CAGR 982013 85 B 742014E2015EMining capexcontinues to decline1Q14 survey-b)61%24%15%0%2014201520162017 Consensus regardingglobal recovery in ’16(a- Source: ThomsonOne, Company financial reports for top 13 miners(b- Source: Citi Research, 1Q14 Global Mining Survey 2014 General Electric Company - All rights reserved5

Our strategy remains consistentWin with technology & quality invest through the cycles have agreat Tier 4 productContinue globalizing the locomotive platformImprove customer outcomes through service & software solutionsContinue to build a meaningful Mining businessSimplify maintain solid marginStay nimble, be decisive and executein volatile environment 2014 General Electric Company - All rights reserved6

Strategic technologies Scaled from CoreCritical trol/PowerElectronicsLocomotive platforms Heavy Haul, Intermodal,Passenger, Shunter & Propulsion DrillStationaryMarineInstalled Base Upgrades,Prognostics, Asset MgtDrive Systemsfor Mining TrucksMotors forDrillEngines forPower GenEngines forBoatsTractionMotorUtilize core to build adjacencies 2014 General Electric Company - All rights reserved7GE Title or job number79/16/2014

Tier 4 locomotive rolloutTier 4 requires 70% emissions reduction GE solution does not require after treatment Fuel efficiency will be maintainedInvested and won Over 200MM investment in product development Committed to delivering product on time with highreliabilityOn track for 2015 delivery 1000 units on order for 2015 Building backlog for deliveries out through 2017Being there for customers in a tough environment8GE Title or job number89/16/2014 2014 General Electric Company - All rights reserved

Heavy-haulMedium-weightLight-weight25 20-25 22N. Am, Australia, Brazil,Africa miningE. Aus, China, CIS, EU, India,MENA, S. Am, N. Am, S. AfricaSEA, Sub-Saharan AfricaPartnerships& LocalContentGlobal PlatformsPrimaryRegionsAxleWtWinning in the global segments66% local35% local55% local25-35% local20% local43% localPT Inka9 2014 General Electric Company - All rights reserved

: A connected suite of solutionsDid you know that systeminefficiency that lowersrailroad velocity by 1mph, cancost a railroad 200MM? -a)Standard APIsStandard APIsCustomer IT SystemsOnboard andWayside Assets(a– NS 2010sustainability report 2014 General Electric Company - All rights reserved10

Using data & software to create valueAsset optimizationAdditional software solutionsOperations management15,000 installed baseCondition based maintTargeted repair& replacementIntelligent workscopesPlanning &tooling alignmentTechnical expertiseExpertise atrepair sitesMonitoring & diagnosisSensors tomonitor healthBilling, crew and dispatch optimization addressing inefficiencyNetwork managementYard & movement planning addressingvelocity pressureSupply chain managementFleet, shipping & inventory addressingdwell pressuresAddressing customers’ headwinds 2014 General Electric Company - All rights reserved11GE Title or job number1119/16/20141

GE MiningMining overviewMining objectivesGET revenue 1.0B 50% OEM Transform with existing GE technologyMotors2013Battery poweredshield hauler2014FMining SolutionsOff-highway vehicles Bringing together thecapabilities of “One GE” A leader in propulsionsystems technologySystemintegration Advanced drivesEnergy storageDiesel poweredscoopSolutions Expand geographically new servicemodelsO&G Nuevo PignonePump Luftkin GearEnergy Mgt Digital EnergyControlGreat fit with GE capabilities 2014 General Electric Company - All rights reservedTrans Engine AccessoryRack3rd Party Skid, Misc. Packaging12

Transportation outlook( in billions)Summary 4.9Revenue 5.6 5.9-Strong locomotive shipments offsettingMining headwind 1.2-Continue to drive cost out Product cost &SG&A down 3.4 1.0 0.8Op. profitInvesting in future R&D spend up Strategic execution 0.3 Developing next-generationtechnology paying off in T4 ordersMarginRate'109.3%'11'12'1315.5% 18.4% 19.8%'14F-% Creating value for our customers withsoftware & optimization Expanding global footprintAttractive financial outlook 2014 General Electric Company - All rights reserved13

Intermodal 4.4% 5.9% 7.7% Total 2.1% 4.0% 6.6% International locos 4 Sources: Earnings reports, . Asset optimization Additional software solutions 15,000 installed base Addressing customers' headwinds Billing, crew and dispatch optimization addressing inefficiency Operations management Yard & movement planning addressing