Transcription

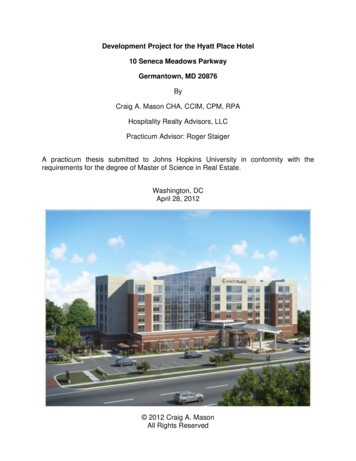

Development Project for the Hyatt Place Hotel10 Seneca Meadows ParkwayGermantown, MD 20876ByCraig A. Mason CHA, CCIM, CPM, RPAHospitality Realty Advisors, LLCPracticum Advisor: Roger StaigerA practicum thesis submitted to Johns Hopkins University in conformity with therequirements for the degree of Master of Science in Real Estate.Washington, DCApril 28, 2012 2012 Craig A. MasonAll Rights Reserved

Table of ContentsExecutive Summary 5Development Program .Project Approach Highest and Best Use Proposed Development Plan 9101214Site and Property Productivity Analysis Market Overview . Subject’s Physical Attributes .Utilities .Site Improvements .Neighborhood Review Legal Use Analysis . Location and Access Vehicular Access . .Visibility .Path of Growth and Relationship to Demand Generators .Linkages to Complimentary and Competitive Developments .Subject’s Physical and Legal Rating Compared to Market Standard Subject’s Locational Attributes .Conclusion .192023262727303132343538394143Regional Market Analysis Introduction Economic and Demographic Indicators Transportation . .Office Market Activity Visitor Volume and Spending . .Conclusion .44454553606469Competitive Market Analysis .Introduction . .National Overview .Regional Overview Competitive Hotel Market . .Competitive Set Historical Supply and Demand .Future Hotel Development . .Projected Performance of the Competitive Set .7071717578101106107Estimated Utilization and ADR . .Projected Market Utilization .Average Daily Rate .Conclusion . .1111121141162

Land Use and Public Policy .Land Use Trends Property Zoning .Parking Standards .Process for Site Approval .Impact Fees .Occupancy Taxes .Property Taxes . .Conclusion .117118129134135139140141143Site Planning and Building Design Site Issues and Constraints .Project Programming . .Project Description . .Floor Plans, Room Layouts and Elevations . .Site Plan .144145146148162169Development/Construction Costs & Schedule Construction Budget Assumptions .Method of Project Delivery Construction Schedule .173174176179Financial Analysis . Fixed and Variable Revenue and Expense Analysis Assumptions .Discounted Cash Flow Analysis Assumptions Investment Ownership Analysis Weighted Average Cost of Capital Participation and Waterfall Structure .Tax Assumptions and Rate of Return Ratio Analysis . .Sensitivity Analysis . .Risk Analysis and Probability of Loss . .Conclusion .186187201213215216219220222222224Project Management Plan .Development Team .Project Team Selection Marketing Strategy . Risk Mitigation Strategy . .225226229238240Conclusions & Recommendations . 246Works Cited . . 2493

Appendices 2591.2.3.4.5.Construction BudgetPro Forma ModelFinancial Analysis ModelHighest and Best Use AnalysisLand Evaluation Chart4

EXECUTIVE SUMMARY

EXECUTIVE SUMMARYEXECUTIVE SUMMARYThis paper summarizes the research and analysis efforts undertaken to assessthe physical, legal, market and financial feasibility of a real estate developmentproject envisioned on the 4.32 acre parcel of land located in the SenecaMeadows Corporate Center located on the eastern side of I-270 between exits15 and 16 in Germantown, MD. The project site was selected as the most viablesite available to pursue the development of a limited service hotel project innorthern Montgomery County. In order to further understand the value of the site,a back of the envelope analysis was completed on an office project, anapartment project and the hotel project. The apartment and office project couldnot offer the highest value for the land and were therefore rejected. However, thisreview provided greater insight into the current land value. Based on this analysisand to generate an appropriate return on the investment, it is recommended thatno more than 35 per square foot be paid for the site or approximately 6.6M.The project is intended to become a joint venture between the existing landowner, Minkoff Development, and Hospitality Reality Advisors with HRAproviding the development support and oversight to complete the transaction.The proposed project consists of a 159-room select service hotel franchisedunder the Hyatt Place brand and managed under a third party managementcontract. A complete site analysis was conducted along with a detailed review ofthe zoning and the analysis shows that the site is suitable for a hoteldevelopment project. Further research was then completed to evaluate themarket and competitive supply and demand. Based on this analysis, a pro formawas created using detailed research on all of the financial assumptions. Theproject construction budget was then prepared using the cost model from HyattDevelopment Corporation and modified to meet the local market conditionsincluding impact fees, construction method and management of the project.6

EXECUTIVE SUMMARYThe project is estimated to start entitlement in June 2012 and take 24 months tocomplete and an additional 18 months to complete construction with anestimated opening date of January 1, 2016.Based on the assumption in this report, the project is estimated to costapproximately 30.56 M ( 192,305 per Room, 312 PSF) to develop including allpre-opening expenses and franchise fees. The project is estimated to have anunleveraged IRR of 12.92 percent based on a ten-year cash flow analysis. Thereversionary value is based on a 9.5 percent capitalization rate, or 50 bps abovethe going in capitalization rate and a 3 percent cost of sales. The IRR on aleveraged basis increases to 18.32 percent and on an after tax basis brings thisreturn down to a 15.17 percent IRR. The project was further evaluated usingsensitivity for changes in net operating income and construction pricing changesin increments of 500,000. Based on a range of NOI going 60 percent above andbelow the pro forma estimate, the IRR range for the project at the project costrange of 27.58 M to 33.58 was between (1.85%) and 24.29 percent. Thisallowed HRA to calculate a probability of loss for return of capital at 3.57 percent.This probability of loss would be greater had other variables been included in thissensitivity such as interest rates, supply and demand changes, or capitalizationrates. The analysis attempted to be conservative on all of these assumptionssuch that the range of results appears reasonable, however, it can be assumedthat the probability of loss for this type of investment is significantly higher had allother variables been included.The sponsor of the project will achieve a greater ROI of 20.93 percent and amultiple of 3.89 times the initial investment based on the proposed waterfallstructure presented in the financial analysis section.Based on the assumptions and analysis used in this report, it is recommendedthat the project be pursued with the next step being to hire an independent7

EXECUTIVE SUMMARYmarket researcher to substantiate the findings in this report. Once completed,HRA and Minkoff Development can evaluate the proposed structure and termspresented herein and formalize a partnership agreement between the parties.8

DEVELOPMENT PROGRAM

DEVELOPMENT PROGRAMDEVELOPMENT PROGRAMPROJECT APPROACHHospitality Realty Advisors LLC is a newly formed entity incorporated in the state ofDelaware and operated out of Germantown, Maryland. The purpose of this entity is tofind desirable locations to develop select service hotel projects. Based upon myknowledge and experience with hotel products throughout the United States, I havebeen looking at the potential for a hotel development project within my home communityas it appears to be a stable and growing market that will need an increase in lodgingsupply given the market’s current growth trends. Consequently, my project type isknown as a use looking for a site.My approach to this project was to first identify available development sites forcommercial use in Montgomery County Maryland, specifically those located on themajor transportation routes. My investigation started by searching for land saleopportunities listed in Costar and talking with brokers form CBRE and Eastdil. I alsospoke to developers who controlled land available for development along the I-270corridor. Since a typical select service project would need 3 or more acres toaccommodate the building and surface parking, my search included land for sale thatexceeded this size requirement but tried to limit the search to sites less than 6 acres, asthis is typically too large to sustain a freestanding select service project and is moresuitable for a mixed use project.My inquiries led me to the following sites.10 Seneca Meadows ParkwayGermantown, MD 208742260 Broadbirch Dr2100 Father Hurley Blvd23310 Frederick RdDino DrWoodfield Rd4111 Sandy Spring RdSilver Spring, MD 20904Germantown, MD 20874Clarksburg, MD 20871Burtonsville, MD 20866Damascus, MD 20872Burtonsville, MD 20866Asking Price 6,591,865 4,800,000 5,500,000 699,000 4,500,000 2,000,000 - Per Acre Land Gross 1,524,592 1,041,215 1,145,833 199,145 818,182 511,509 - Per SF Land Gross 35.00 23.90 26.30 4.57 18.78 11.74 Land Area AcresLand Area SFProperty TypeZoningHotel Conforming UseDays on the MarketFARMaximum Buildable AreaMinimum Hotel AreaMeets Area RequirementsRanking of .50239,5803.91170,3205.12223,027CommercialTMX-2 & al 71097650.00%119,79085,000Yes5

DEVELOPMENT PROGRAMThese sites were then evaluated on the basis of their desirability for a hoteldevelopment, zoning risk and price. Based on the chart presented above, it is clear thatthe site located in the Seneca Meadows Corporate Park is the best option fordevelopment of a new select service property based on the land currently on themarket.The next step in my analysis was to look at recent land sales in the county to bettergage the pricing of the sites available and determine if the asking prices are reasonable.The following sales were recorded over the past 3 years that provide an indicator ofmarket value for land.Land Sales ComparablesMontgomery County MDAddressSales Price Per Acre Land Gross Per SF Land GrossLand Area AcresLand Area SFProposed UseSale DateAddressSales Price Per Acre Land Gross Per SF Land GrossLand Area AcresLand Area SFProposed UseSale DateComparable 17949 Eastern Ave.Silver Spring, MD 20910 7,000,000 3,517,588 80.751.9986,684Hold for Development6/28/2010Comparable 221000 Father Hurley AveGermantown, MD 20874 5,500,000 1,145,833 26.304.80209,088Apartments/SeniorUnder ContractComparable 3960 N Frederick AveGaithersburg, MD 20879 2,327,833 399,285 9.175.83253,955Assemblage6/30/2010Comparable 6500 Olney Sandy Spring Rd.Sandy Spring, MD 20860 1,000,000 555,556 12.751.8078,404Commercial6/9/2011Comparable 716010 Riffle Ford RdGaithersburg, MD 20878 2,750,000 1,037,736 23.82 2.65115,434Hold for Development12/12/2009Comparable 4960 N Frederick RdSilver Spring, MD 20913 3,500,000 1,966,292 45.14 1.7877,537Hotel4/13/2011Comparable 8Comparable 915121 Southlawn Ln13860 Travilah RdRockville, MD 20850Rockville, MD 208501,215,000 1,793,656610,553 896,82814.02 20.591.992.0086,68487,120NAHold for Development2/11/20103/12/2010Comparable 59501 Key West AveRockville, MD 2011Comparable 1019610 Turkey Thicket DrGaithersburg, MD 20879 2,730,300 664,307 15.254.11179,032Office12/1/2010The sales comparables that best reflect the site I have chosen are comparable 2 andcomparable 5. The subject site is slightly superior to both of these sites and is expectedthat the value would be at or above comparable 5. Based on the above, HRA isassuming that 35 per square foot is an appropriate market price for the subjectproperty.The parcel located in the Seneca Meadows Corporate Park is owned by the Minkoffdevelopment Company. The land is currently being held to develop flex office space.11

DEVELOPMENT PROGRAMThe property was rezoned in November 2010 to TMX-2 which allows for higher densitythan the original I-3 zoning. Either zoning may be used for development. In order tosubstantiate the pricing for the sight, a back of the envelope highest and best useanalysis was also conducted.HIGHEST AND BEST USEAccording to the Appraisal Institute, the definition of highe

The proposed project consists of a 159-room select service hotel franchised under the Hyatt Place brand and managed under a third party management contract. A complete site analysis was conducted along with a detailed review of the zoning and the analysis shows that the site is suitable for a hotel development project. Further research was then .