Transcription

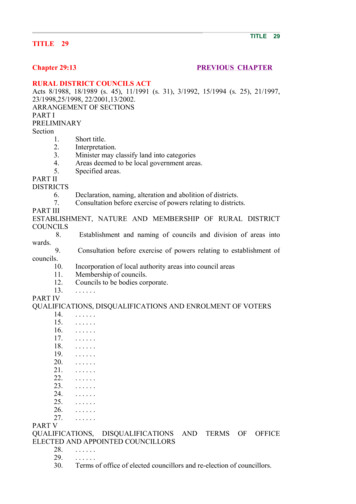

PROFESSIONAL PROGRAMMEMODULE 1, PAPER 2PRACTICE QUESTIONSAdvanced Tax Laws(Relevant for June 2021 examination)Part IIndirect Taxes[Goods and Services Tax (GST) andCustoms Law]1

March, 2021 THE INSTITUTE OF COMPANY SECRETARIES OF INDIANo part of this publication may be translated or copied in any form or by any means withoutthe prior written permission of The Institute of Company Secretaries of India.DISCLAIMER:The PRACTICE QUESTIONS have been prepared by competent persons and theInstitute hopes that it will facilitate the students in preparing for the Institute'sexaminations. It is, however, to be noted that the answers are to be treated as modelanswers and not as exhaustive and there can be alternative solutions available for thequestions. The Institute is not in any way responsible for the correctness or otherwise ofthe answers. Students are expected to be well versed with the amendments in the Laws/Rules made upto six months prior to the date of examination.2

CONTENTSS. No.ChapterPage No.Goods and Services Tax ‘GST’ (60 Marks)1.An Overview on Goods and Services Tax (GST)42.Supply123.Input Tax Credit & Computation of GST Liability264.Procedural Compliance under GST395.Assessment, Audit, Scrutiny, Demand and Recovery, Advance53Ruling, Appeals and Revision6.Inspection, search, seizure, offences & penalties597.GST practitioners, authorized representative, professional73opportunities8.Integrated Goods and Service Tax (IGST)799.Union Territory Goods and Service tax (UTGST)8510.GST Compensation to States8811.Industry/ Sector Specific Analysis91Customs Law (10 Marks)394

Chapter 1An Overview on Goods and Services Tax ‘GST’Historical Background of Indirect Tax in India; International Perspective of GST/VAT;International Scenario of GST/VAT; Need for GST in India; GST Journey; Provisionsunder the Indian Constitution; Goods & Service Tax Council; Introduction of GST in India;Taxes Pre GST Regime, Concept of GST, Legislative framework of GST; Advantages ofGST; Composition Scheme; Reverse Charge Mechanism; Exemption from GSTQuestion 1What is Goods and Services Tax (GST) and what exactly is the concept of destinationbased tax on consumption?AnswerGoods and Services Tax (GST) is an Indirect Tax which has replaced many Indirect Taxes inIndia. The Goods and Service Tax Act was passed in the Parliament on March 29, 2017. TheAct came into effect on July 01, 2017. GST is a destination based tax on consumption of goodsand services. It is levied at all stages right from manufacture to final consumption with creditof taxes paid at previous stages available as set-off. In a nutshell, only value addition will betaxed and burden of tax is to be borne by the final consumer.Destination based tax on consumption means the tax would accrue to the taxing authoritywhich has jurisdiction over the place of consumption which is also termed as place of supply.Question 2What are the basic features of Indirect Taxes?AnswerThe following are the basic features of Indirect Taxes:1. Taxable Event: The indirect taxes are levied on purchase/sale/manufacture of goodsand provision of services.2. Incidence & Impact: In case of indirect taxes, the incidence and impact fall on twodifferent persons. It means the tax burden is shifted by the supplier to the buyer orrecipient of goods or services.3. Regressive Taxation: The indirect taxes do not depend on paying capacity as taxpayable on commodity is same whether it is purchased by a poor man or rich person.Therefore, indirect taxes are regressive in nature. There are exceptions to this argumentas higher taxes may be imposed on luxury goods.4

4. Impact of Indirect Tax: The indirect tax on goods and services increases its price.This leads to inflationary trend.5. Promotes Welfare: The harmful or sin products like alcohol, tobacco, etc. may betaxed at higher rate. This practice not only discourages consumption of such goods butalso increases the revenue of the State.6. Major Source of Revenue: In India, the contribution of indirect taxes to total taxrevenue is more than 50%. Therefore, it is a major source of tax revenue for theGovernment.Question 3What is cascading effect of Tax?AnswerThe cascading effect implies charging tax on tax. In other words, at the time of levy of tax, thetotal value is considered which is inclusive of all taxes paid up to that point. In this manner, ifthe tax is always charged on the selling price of the product, the burden of tax keeps onincreasing at each point of sales. In this process, the effect of taxation magnifies as at eachlevel tax is calculated on value, which includes taxes already levied and paid. The charging oftax on tax is called as ‘Cascading Effect of tax’.Question 4State the necessary pre-conditions for levy of Goods and Services Tax (GST) on goodsand services.AnswerThe following conditions are required to be satisfied for a transaction to be chargeable to Goodsand Services Tax, i.e.a) it involves supply of goods or services or both in terms of Section 7 of the CGST Act,2017;b) the supply is a taxable supply; andc) the supply is made by a taxable person.Question 5ACD Sweets Ltd., registered in Kerala dealing in supply of sweets from its shop in city“X". It has shops (units) in City “Y” and City “Z” in Kerala and City “W” in Tamil Nadu. Ittransfers some of its stock from its shop in City “X” to its other units in Kerala(intra-state)and Tamil Nadu(inter-state).Whether such self-supplies are taxable under Goods and ServicesTax?AnswerThe definition of supply given under section 7 of CGST Act, 2017 is an inclusive one. It doesnot specify that supply is to be made by one person to another. So, self-supplies are to be treatedas supply in terms of section 7 of CGST Act.Establishment of same person in different states to be treated as establishment of distinct5

person [Section 25(5) of CGST Act, 2017]Further, section 25(5) of CGST Act, 2017 provides that where a person who has obtained or isrequired to obtain registration in a State or Union territory in respect of an establishment, hasan establishment in another State or Union territory or in the same state or Union territoryprovided such establishment is separately registered in GST, then such establishments shall betreated as establishments of distinct persons.Clause (2) of Schedule I of CGST Act, 2017 inter alia provides that supply of goods & servicesbetween distinct persons as specified in section 25 made in the course or furtherance ofbusiness is to be treated as supply even if made without consideration.The legal position is thus crystalized that Inter-state self-supplies such as stock transfers,branch transfers or consignment sales shall be taxable under IGST even though suchtransactions may not involve payment of consideration and Intra-state self-supplies shall alsobe taxable provided the recipient is separately registered as business vertical.In view of the above discussed legal position, Inter State transfer of stock made by ACDSweets Ltd. i.e. to its shop located in City “W” in Tamil Nadu are taxable under GST.Assuming that the shops of ACD Sweets Ltd. Located in City “Y” and City “Z” in Kerala arenot separately registered, self-supplies made to such shops are not taxable under GST.Question 6What is GST Composition Scheme? What is the GST Composition Scheme Limit?AnswerGST Composition scheme is a tax paying mechanism offered to small businesses. Whencompared to normal GST filing, the composite scheme offers two main benefits: reducedpaperwork and compliance, and lower tax liability.For instance, normal tax payers need to submit 3 monthly GST returns (GST-1, GST-2, andGST-3) and one annual return (GST 9). However, if a taxpayer has applied for the compositionscheme GST, filing gets easier as they need to file just one quarterly return (GSTR 4), and oneannual return (GSTR 9A).The composition scheme limit under GST varies depending on the type of business: For manufacturers and traders: As a newly registered business, the turnover shouldnot exceed Rs.1.5 crores in the current financial year. If a taxpayer has alreadyregistered, then the turnover must not exceed Rs.1.5 crores in the previous financialyear. For restaurants not serving alcohol: The above terms apply here as well. For service providers: As a newly registered business, the turnover should not exceedRs.50 lakhs in the current financial year. If a taxpayer had already registered, then theturnover must not exceed Rs.50 lakhs in the previous financial year. Additionally, Rs.1.5 crores cap is further limited in Special Category States to Rs.75 lakhs.Further, in the event that the turnover exceeds the specified composition scheme limit in afinancial year, they will have to convert to the regular GST payment mechanism in order tocomply with the GST Composition Scheme Rules.6

Question 7Mrs. X has opted for composition scheme at the time of registration and purchased a plantand machinery Rs. 30,00,000 and paid input tax at a rate of 18% and tax credit was not allowedbut after a period of 9 month and 10 days the dealer has opted for payment u/s 9 i.e. normalscheme. Compute amount of tax credit allowed to Mrs. X.AnswerTotal Input Tax (Rs. 30,00,000 x 18%) Rs. 5,40,000Asset already used for 9 months and 10 days 4 QuartersLess: Tax credit not allowed (Rs. 5,40,000 x (4 x 5%)) (Rs. 1,08,000)Amount of Tax credit allowed Rs. 4,32,000Question 8From the following details pertaining to Ash, a registered dealer engaged in purchaseand sale of goods, ascertain the GST liability (SGST/CGST/IGST) for the month of September,2020:ParticularsAmount (Rs.)Sale price charged to customers within State (excluding GST)12,50,000Commission charged to buyers12,000Packing and forwarding expenses incidental to sale18,000Weighment charges, shown separately in invoices9,500Prompt payment discount, indicated in invoice 1%, if payment made within 1 month. Allbuyers of goods have availed the discount.The rates of taxes for the goods supplied are as rmination of GST Liability of Ash for the month of September, 2020:ParticularsAmount (Rs.)Sale price charged to customers within State (excluding GST)12,50,000Add : Commission charged to buyers [See Note 1]12,000Packing and forwarding expenses incidental to sale [See Note 1]18,000Weighment charges, shown separately in invoices [See Note 1]9,5007

12,89,500Less : Prompt payment discount, indicated in invoice 1%12,500[See Note 2]Value of taxable supply12,77,000SGST at 9%1,14,930CGST at 9%1,14,930Total GST Payable (SGST CGST)2,29,860Notes:As per Section 15(2)(c) of the CGST Act, 2017, all incidental expenses like commission,packing & forwarding, weighment charges form part of the taxable supply.1. Prompt payment discount is deductible in the tax invoice, if payment is being madebefore or at the time of supply. However, if the payment is made post supply, theamount of discount along with tax paid thereon can be adjusted by way of a creditnote. Here, it is assumed that all the buyers paid whole of the amount before the supplyis made. In the event of buyers making payment post the date of supply but within 1month, the amount of Rs. 12500/- along with CGST and SGST can be repaid to thecustomer by way of credit note.2. It is also assumed that the transaction is an intra-state supply. Hence CGST andSGST has been charged.Question 9Mrs. XYZ acts as a referee in a Basketball match organized by Sports Authority of India. Shehas also acted as a referee in another charity Basketball organized by a local sports club, in lieuof a lump sum payment. Discuss whether she is required to pay any GST?AnswerServices provided to a recognized sports body by an individual inter alia as a referee in asporting event organized by a recognized sports body is exempt from GST.Since in the first case, the Basketball match is organized by Sports Authority of India, which isa recognized sports body, services provided by Mrs. XYZ as a referee in such Basketball matchwill be exempt.However, when she acts as a referee in a charity Basketball match organized by a local sportsclub, she would not be entitled to afore-mentioned exemption as a local sports club is not arecognized sports body and thus, GST will be payable in that case.Question 10Comment on the applicability of GST in the following independent casesi) Religious pilgrimage organized by Ganjumal Charitable Trust.ii) Transportation of Milk8

iii) Transportation of books on a consignment transported in a single goods carriage forRs. 7,000.iv) Transportation of chairs for a single consignee in the goods carriage for Rs. 900.v) Services provided by way of vehicle parking to general public in a shopping mall.vi) Services provided by a business facilitator to an insurance company in an urban area.vii) Milling of paddy into rice.viii) Services provided by the State Governments and Private Service Providers by way oftransportation of patients in ambulance.ix) Services by way of Slaughtering of animals .x) Transportation of passengers by non-air-conditioned railways.Answeri) GST is payable as Religious pilgrimage organized by Ganjumal Charitable Trust istaxable.ii) GST is not payable as the transportation of milk by goods transport agency is exempt.iii) GST is payable as the exemption is available for transportation of goods only where theconsideration for transportation of goods on a consignment transported in a single goodscarriage does not exceed Rs. 1,500.iv) GST is payable as the transportation of goods where consideration for transportation ofall goods for a single consignee does not exceed Rs. 750 is exempt.v) GST is payable as the services provided by way of vehicle parking to general public arenot exempt from GST.vi) GST is payable as the services provided by a business facilitator to an insurancecompany in an urban area is not exempt from GST.vii) GST is payable as the milling of paddy into rice on job work basis, is liable to GST at the rateof 5% on the processing charges (and not on the entire value of rice).viii) GST is not payable as the services provided by the State Governments and Private ServiceProviders by way of transportation of patients in ambulance is exempt from GST.[Entry 74 of Notification No. 12/2017-CT (Rate)]ix) GST is not payable as the services by way of Slaughtering of animals are exempt under GST.[Entry 56 of Notification No. 12/2017-CT (Rate)]x) GST is not payable as Transportation of passengers by non-air-conditioned railways is exemptunder GST.Question 11Mr. Hemant Kumar, a registered supplier of Chandigarh, has received an amount of Rs.50,000 for providing services of a selector of national team to recognized sports body in Delhi.Will he be liable to charge GST on the same. What will be the status if Mr. Hement Kumar donot have any other income except Rs. 50,000 as mentioned above.Answer9

Services provided to a recognized sports body by an individual only as a player, referee,umpire, coach or team manager for participation in a sporting event organized by a recognizedsports body are exempt from GST vide Exemption Notification No. 9/2017 IT(R) dated28.06.2017. Thus, service provided as selector of team is not covered in the above referrednotification, Mr. Hemant Kumar is liable to charge GST on Rs. 50,000/-.In case the turnover of Mr. Hemant Kumar falls below the minimum threshold of Rs. 20 lakhs,he is not required to charge any tax.Question 12Mr. Bhudev, an unregistered person receives commission of Rs. 21,00,000/-as an insuranceagent from insurance company. Will he be required to charge GST on the same?AnswerThough commission for providing insurance agent’s services is liable to GST, the tax payablethereon is to be paid by the recipient of service i.e., insurance company, under reverse chargein terms of Notification No. 13/2017 CT(R) dated 28.06.2017. Thus, Mr. Bhudev will not beliable to pay GST on such commission. Instead, the insurance company will pay tax underreverse charge on this particular transaction.Question 13Can we call GST a game changer in long run?AnswerGST is based on the concept of One Nation One Tax which has been implemented after 70years of independence. In Pre-GST regime there were multiple taxes that would be levied byCentre and States on the goods and services consumed. Consumers were burdened with thecascading effect of taxes. To reduce the negative impact of cumbersome Indirect Tax systemand multiple administrative authorities, Indian legislature first introduced an Uniform VATsystem in 2004-05. Still multiple taxes were prevailing, and Centre and State continued to levyseparate taxes on goods and services, like Excise, Service Tax, VAT, Entry Tax, Octroi etc.After 53 years of India’s independence, Legislature started realizing that Indian Businessestruly needed a free market to operate which would be free from state boundaries, entry barriers,multiple tax systems and cost of doing business in India. By introduction of GST by Mr. AtalBihari Vajpayee, Prime Minister of India in 2000, the concept of One India-One Nation-Onemarket was expected to be truly implemented by which Indian businesses would achievefreedom in doing business pan India without any boundaries and restrictions. It took almost 16years since the year 2000 to implement GST.The heart of GST system is the seamless input credit availability which helps to reduce the costand cascading effect. The simplified procedure for smaller taxpayers, like composition schemeand quarterly return filing, and mandatory registration and compliance for taxpayers with aturnover of minimum threshold limit is always exciting for small tax payers and unorganisedsector. Considering the improvement in ease of doing business and the significant socioeconomic impact, GST can be called a game changer in long run.Question 14Prepare a list of most common goods which are exempt under GST?AnswerThe List of most common goods exempt under GST is as follows:10

Types of GoodsExamplesFresh VegetablesCauliflower, Potatoes, Onion, Garlic, carrot etc.Fresh FruitsCoconut, Apples, Cheries, Bananas, Peaches etc.Fresh NutsAlmonds, Kola Nuts, Pistachios, Walnuts etc.Natural ProductsFresh Milk, Honey, Paneer, Eggs etc.Live AnimalsAsses, mules and hinnies, Bovine animals,Swine, Sheep, Goats, Poultry etc.MeatFresh and frozen meat of sheep, cows, goats, pigs, horses, etc.FishFresh or frozen fishTea, Coffee and SpicesCoffee beans, tea leaves, turmeric, ginger, etc.Live Trees and PlantsBulbs, roots, flowers, foliage, etc.GrainsWheat, rice, oats, barley, etc.SugarSugar, jaggery, etc.WaterMineral water, tender coconut water, etc.SeedsFlower seeds, oil seeds, cereal husks, etc.Products of the milingFlours of different typesindustryBaked GoodsBread, Pizza base, puffed rice etc.Fossil FuelsElectrical energyDrugs and pharmaceuticalsHuman blood, contraceptives etc.FertilisersGood and Organic ManureWasteMunicipal Waste, Sewage sludge etc.Beauty ProductsKumkum, Bindi, Sindur and AltaOrnamentsPlastic and glass bangles bangles, etc.NewsprintJudicial stamp paper, envelopes, rupee notes, etc.Printed ItemsPrinted books, newspapers, maps, etc.FabricsRaw silk, silkworm cocoon, khadi, etc.Hand ToolsSpade, hammer, etc.PotteryEarthen pots, clay lamps, etc.***11

Chapter 2SupplySupply under GST, Time of Supply, Value of Supply, Other Provisions -Job Work, PureAgent, E-Commerce, TCS and Anti-Profiteering MeasuresQuestion 1Discuss in brief the ‘taxable event’ and the scope of the term ‘supply’ under GST law.AnswerThe ‘taxable event’ under GST shall be the supply of goods or services or both in terms ofSection 7 of the CGST Act, 2017. The taxable events under the existing indirect tax laws suchas manufacture, sale, or provision of services shall stand subsumed in the taxable event knownas ‘supply’.The term ‘supply’ is wide in its import covers all forms of supply of goods or services or boththat includes sale, transfer, barter, exchange, license, rental, lease or disposal made or agreedto be made for a consideration by a person in the course or furtherance of business. It alsoincludes import of service for consideration whether or not in the course or furtherance ofbusiness. It also includes transactions specified in Schedule I made without consideration.Question 2What are the necessary elements that constitute supply under CGST/SGST Act, 2017?AnswerIn order to constitute a ‘supply’, the following elements are required to be satisfied, i.e.i.the activity involves supply of goods or services or both;ii.the supply is for a consideration unless the transaction is covered by Schedule I tothe CGST Act.iii.the supply is made in the course or furtherance of business except in case ofimport of services;iv.the supply is a taxable supply; andv.the supply is made by a taxable person.Question 3How to calculate Goods and Services Tax (GST)?AnswerGST can be calculated simply by multiplying the Taxable amount by GST rate. If CGST &SGST/UTGST is to be applied then CGST and SGST both amounts are half of the total GSTamount.Goods and Services Tax Taxable Amount x GST RateIf you have the amount which is already including the GST then you can calculate the GST12

excluding amount by below formulaGST excluding amount GST including amount/(1 GST rate/100)For example, GST including amount is Rs. 525 and GST rate is 5%.GST excluding amount 525/(1 5/100) 525/1.05 500GST is calculated on the transaction amount and not on the MRP.Question 4Distinguish between composite supply and mixed supply. Explain in the context of CGSTAct, the liability on composite and mixed supplies.AnswerIn terms of Section 2(30) of the CGST Act, 2017, composite supply means a supply made bya taxable person to a recipient consisting of two or more taxable supplies of goods or servicesor both, or any combination thereof, which are naturally bundled and supplied in conjunctionwith each other in the ordinary course of business, one of which is a principal supply. Theillustration of composite supply appended to Section 2(30) is as follows:Where goods are packed and transported with insurance, the supply of goods, packingmaterials, transport and insurance is a composite supply and supply of goods is a principalsupply.In terms of Section 2(74) of the CGST Act, 2017 mixed supply means two or more individualsupplies of goods or services or any combination thereof, made in conjunction with each otherby a taxable person for a single price where such supply does not constitute a composite supply.The illustration of mixed supply appended to Section 2(74) of the CGST Act, 2017 is asfollows:A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerateddrink and fruit juices when supplied for a single price is a mixed supply. Each of these itemscan be supplied separately and is not dependent on any other. It shall not be a mixed supply ifthese items are supplied separately.The tax liability on a composite or a mixed supply shall be determined in the followingmanner:(i) a composite supply comprising two or more supplies, one of which is a principal supply,shall be treated as a supply of such principal supply. Hence, in case of composite supply,tax rate as applicable to principal supply would apply to entire supply; and(ii) A mixed supply comprising two or more supplies shall be treated as a supply of thatparticular supply which attracts the highest rate of tax. Hence, in case of mixed supply,highest tax rate as applicable to any single supply would apply to all supplies forming partof mixed supply.13

Question 5State which of the following is composite supply or mixed supply under the GST law :(i) Sale of car with warranty coverage.(ii) Gift pack with chocolates and books.(iii) Sale of Refrigerator with power stabilizer.(iv) Hotel Funtoosh providing accommodation with complimentary breakfast.AnswerComposite Supply or Mixed Supply(i) Composite Supply: Sale of car with warranty coverage is a composite supply as bothsupplies are naturally bundled and sale of car is a principal supply.(ii) Mixed Supply: Gift pack with chocolates and books are not bundled due to naturalnecessities and hence they are mixed supply.(iii) Mixed Supply: Refrigerator and power stabilizer are not inseparable and are not bundleddue to natural necessities. They are mixed supply.(iv) Composite Supply: Hotel Funtoosh providing accommodation with complimentarybreakfast is a composite supply as the principal supply is supply of service i.e.accommodation.Question 6What is Deemed Supply? Explain with examples.AnswerDeemed Supply means event or transaction where no or inadequate consideration is receivedfor the supply of goods or services.Schedule I to CGST Act 2017:Activities to be treated as Supply even if made Without Consideration1.Permanent transfer or disposal of business assets where input tax credit has beenavailed on such assets.For Example:i.) Mr. A who sells Air Conditioner (AC). He transfers 1 AC from stock in trade to his homefor personal use would constitute as Supply.14

ii) Scrap of machinery destroyed by fire handed over to insurance company for settlement ofclaim. Since, ITC has been availed So, when the machinery destroyed by fire is handed over toinsurance company in return for insurance compensation, it is a supply of goods.2. Supply of goods or services or both between related persons or between distinct persons asspecified in section 25, when made in the course or furtherance of business:Provided that gifts not exceeding fifty thousand rupees in value in a financial year by anemployer to an employee shall not be treated as supply of goods or services or both.3. Supply of goods—(a) by a principal to his agent where the agent undertakes to supply such goods on behalf of theprincipal; or(b) by an agent to his principal where the agent undertakes to receive such goods on behalf ofthe principal.As per section 2(88) “Principal” means a person on whose behalf an agent carries on thebusiness of supply or receipt of goods or services or both.As per 2(5) of CGST Act, 2017 “Agent” means a person including a factor, broker, commissionagent, arhatia, del-credre agent, an auctioneer or any other mercantile agent by whatever namecalled who carries on supply or receipt of goods or services or both on behalf of another.4. Import of services by a person from a related person or from any of his other establishmentsoutside India, in the course or furtherance of business.For example: X ltd USA is the holding company of Y Ltd. India. Y Ltd. imports businessconsultancy services from A Ltd. in the course or furtherance of business then the aforesaidimportation of service shall fall within the ambit of term “Supply” and Y Ltd. shall be liableto pay IGST.Question 7XYZ Ltd. is a manufacturer of Overhead Power Transmission Line Hardware andAccessories. He has entered into two separate contracts with M/s Power Grid Corporation ofIndia – one for supply of materials at ex-factory price (hereinafter referred to as “the FirstContract”), and the other for supply of allied services like transportation, insurance,loading/unloading etc. for delivery of materials at the contractee’s site (hereinafter referredto as “the Second Contract”).The two contracts are linked by a cross fall breach clause that specifies that breach of onecontract will be deemed to be a breach of the other contract.As per XYZ Ltd., since they are not a Goods Transport Agency, for the Second Contract they15

arrange for the supply and delivery of materials through various other suppliers of theseservices. The Contractee is charged for these services at a pre-fixed rate, irrespective of theactual cost incurred. However, the Contractee is unwilling to bear the cost of GST on suchservices provided to them by XYZ Ltd through various Service Suppliers.In their opinion transportation services provided by non GTA is exempt from tax. XYZ Ltd.hence, wants your opinion regarding the taxability of these services supplied by them.AnswerThe question above is similar to the one decided by West Bengal Authority for Advance Rulingin the case of IAC Electricals Pvt. Ltd. The Authority has held that here the supplier has beenawarded a package for supply of hardware fittings and accessories at different projects undertwo separate contracts. It is immediately apparent that the First Contract cannot be executedindependent of the Second Contract. There cannot be any ‘supply of goods’ without a place ofsupply. As the goods to be supplied under the First Contract involve movement and/orinstallation at the site, the place of supply shall be the location of the goods at the time whenmovement of the goods terminates for delivery to the recipient, or moved to the site forassembly or installation [refer to Section 10(1)(a) & (d) of the IGST Act, 2017]. The FirstContract, however, does not include the provision and cost of such transportation and delivery.It, therefore, does not amount to a contract for ‘supply of goods’ unless tied up with the SecondContract.Therefore, services of transportation, in-transit insurance and loading/unloading, beingancillary to the principal supply of goods, shall be treated to taxation under Section 8 (a) of theGST Act , 2017 as Composite Supply, and the consideration receivable on that account betaxed at the rate at principal supply is taxed.Question 8Discuss whether GST would be payable in following independent cases:a) A Company Secretary makes payment of LLP Registration fees of Rs. 3,000/- on behalfof their clients and charges the client his professional fee of Rs. 15,000/-along withexpenses of Rs. 3,000/- incurred in form of payment to Registrar of Companies.b) A company provides Subsidized Meal facility to employees. It pays Rs. 70/- per plateto the caterer and deducts Rs. 10/- per plate from the employee’s salary.c) A pharmaceutical company supplies free samples to doctors.16

d) Raghunath Temple Charitable trust, registered under section 10(23C)(v) of theIncome-

3. Input Tax Credit & Computation of GST Liability 26 4. Procedural Compliance under GST 39 5. Assessment, Audit, Scrutiny, Demand and Recovery, Advance Ruling, Appeals and Revision 53 6. Inspection, search, seizure, offences & penalties 59 7. GST practitioners, authorized representative, professional opportunities 73 8.