Transcription

PUBLICACCOUNTING REPORTThe Independent Newsletter of the Accounting Profession Since 1978IN THIS ISSUETransparency Isn’t Negotiable .3Compare “Best Places To Work” .5People, Firms, and Promotions .8& Save 10%Receive your newsletterby email to save time,money and paper. PLUSrenew your subscriptionwith the e version by March 31, 2014,and we will cut the price by 10%!Call 800-248-3248 to renew and save!Firms Compete ForBest In Class Status‘Best’ lists offer firmsprestige and validation.Where in the public accountingrealm are the best internships? Thebest training? The best places to work?Several surveys and researchprojects were recently released thatgive insight into these questions.Elliott Davis (FY13 net revenue: 60.8 million; 60 partners, 532 total staff, eight offices) has the fourthbest overall internship program inthe nation, according to Vault.com’s2014 Best Internship rankings. Theonly better internship programs, according to Vault, are those offeredby BP America, Bain & Co., andBates White Economic Consulting.ED hired 37 interns and brought on77 new hires in 2013.Other accounting firms on Vault’slist of the top 25 internships nationwide are Plante Moran of Southfield,Mich. (No. 7); PricewaterhouseCoopers (No. 12); Deloitte (No.13); Eide Bailly, based in Fargo,N.D. (No. 16); KPMG (No. 17);See BEST, page 2February 2014Associations And Networks Strive ToEnhance Value To MembersOrganizations offer member firms access toskills, resources, and global support.In conjunction with the publicationof CCH’s 2014 Directory of CPA FirmAssociations and Networks (includedwith this issue), Public Accounting Reportcalled upon the leaders of accountingfirm associations and networks to answerthe following pair of questions:In the past year, what action(s)has your network or associationtaken to become more valuableand effective for your members—and more attractive to potentialmembers?What condition(s) in the publicaccounting profession—or in thelarger economic environment—motivated this change?As is evident from the selected repliesthat follow, associations and networksboth in the U.S. and abroad are taking innovative steps to connect their memberswith timely access to technical skills training, business development resources andbroad global access. Some of these connections are made possible by technology,while others are purely the product ofbringing people together in constructivesettings. Following are some of the notable replies PAR received to our inquiry.See ASSOCIATIONS, page 6EY Warns Clients Of Increased Risk OfFraud And Cyber Crimes In 2014EY is advising clients and prospectsto beware of some crucial risks as theyincreasingly move into emerging markets this year.“We see risks gaining tractionwith multinationals, as well as industry-specific risk issues that will persistinto FY14,” said Brian Loughman, EYAmericas Leader for Fraud Investigations and Dispute Services.His practice is advising clients andprospects to be especially alert to thefollowing six trends:Risk associated with cybercrimewill become a bigger part of a generalcounsel's responsibility. Traditionally, chief information security officersfocused on information security attacks and compromises, but increasing threats will require immediate andplanned responses organized by insideand outside counsel. Risks of potentialshareholder impact, state-sponsoredand industrial cyber-espionage, loss ofvaluable IP and compromised clientdata elevates the responsibility of cybersecurity to board-level territory.Growth opportunities in Africamust be balanced with perceived corruption risk. As investment increasesin emerging markets, U.S. authorities’attention to business conduct in theregion is prompting organizations toreassess their controls, testing and compliance programs. An EY survey foundthat 83% of African respondents viewbribery and corruption as widespread.Organizations setting up operations inAfrica must perform robust due diligence to manage these risks.Regulation will impact the financial services industry stronger thanever. Notwithstanding the billions ofSee EY, page 2

Best, continued from page 1PUBLICACCOUNTING REPORTVolume XXXVIII, No. 2Editor: Julie LindyEmail: Julie.lindy@wolterskluwer.comContributing Editor: Bryan PowellProduction Editor: Don TorresManaging Editor: Kurt DiefenbachCoordinating Editor: Jim WalschlagerPUBLIC ACCOUNTING REPORT(ISSN 0161-309X) is publishedmonthly by CCH, a part of Wolters Kluwer, 4025 W. Peterson Ave.,Chicago, Illinois 60646. Subscriptioninquiries should be directed to 4025W. Peterson Ave., Chicago, IL 60646.Phone: (800) 449-8114.Fax: (773) 866-3895.Email: cust serv@cch.com. 2014 CCH Incorporated.All Rights Reserved.Permissions requests: Requests forpermission to reproduce contentshould be directed to CCH,permissions@cch. com.Photocopying or reproducing in anyform in whole or in part is a violationof federal copyright law and is strictlyforbidden without the publisher’sconsent. No claim is made to originalgovernmental works; however, withinthis product or publication, the following are subject to CCH’s copyright:(1) the gathering, compilation, andarrangement of such governmentmaterials; (2) the magnetic translationand digital conversion of data, if applicable; (3) the historical, statutory, andother notes and references; and (4)the commentary and other materials.2Chicago-based Crowe Horwath (No.21); and Seattle-based Moss Adams(No. 23).Vault also breaks down internshipsby certain specialties, and public accounting firms’ internships made thetop 10 in some of those fields. Forconsulting internships, Plante Moranranked No. 3, followed by PwC at No.5, Deloitte at No. 6, KPMG at No. 7and Crowe Horwath at No. 9.For banking and finance, PwC wasranked No. 4, Deloitte ranked No. 6,and KPMG ranked No. 7. For MBAcandidates, PwC was ranked No. 5, followed by Deloitte and KPMG in theNo. 6 and No. 7 spots, respectively. ForIT, PwC was ranked No. 2, and Deloitte took the No. 4 spot. PwC was theonly public accounting firm to appearon Vault’s best marketing and communications internship list, ranking No. 3.Vault surveys more than 7,700 interns in more than 100 internship programs. They are asked to rate their internship experiences based on quality oflife, compensation and benefits, interview process, career development andfull-time employment prospects. Morethan 500 organizations were invited toparticipate in Vault’s Internship Survey.Only organizations that completed bothparts of the survey—the self-reportedprogram description and the internprovided reviews—were eligible forVault’s top internship rankings list.All program descriptions and internreviews are included in Vault’s internship database.Meanwhile, BKD LLP, based inSpringfield, Mo. (FY13 net revenue: 418 million; 250 partners, 2,175 total staff, 34 offices), was the only publicaccounting firm to appear on Trainingmagazine’s 2014 Training Top 125,ranking No. 89 in its debut appearanceon the list and beating out thousands ofother contenders.“BKD’s firmwide performance management and coach training program isdesigned to enhance professional growththroughout one’s career,” the magazinewrote. “The program has two levels(team member and coach) and providestools, techniques and best practices designed to further day-to-day and longterm effectiveness for BKD client serviceand administrative professionals.”The magazine added that both levels“focus on how to purposefully fulfill theorganization’s mission through behavioral competencies associated with successfully demonstrating each UnmatchedClient Service standard, as well as givingSee BEST, page 3EY, continued from page 1dollars in restitution, fines and litigation costs incurred to date by banksand securities firms, regulatory pressure will escalate in 2014. The financial services industry will continue torespond to broad regulatory focus onsystemic risk and react to rulemakingon mortgage loans, student loans andcredit cards. Regulatory enforcementpressure that so far has focused on thelargest institutions may migrate tomid-sized banks.Consumer Financial ProtectionBureau compliance will remain atop priority for life sciences companies operating in emerging markets. Recent enforcement actionsin China demonstrate significantexpansion of exposure that life sciences companies face when operating overseas. Gone are the days whenenforcement was led solely by U.S.authorities. Staying on top of thediffering anti-corruption laws andstandards, particularly in marketswhere the law is unclear, will present challenges and opportunities forcompanies that depend on growthin those markets. Expect greater attention to compliance processes andoverall internal controls.Anti-money laundering andcorruption programs will facegreater scrutiny. Global regulatorsand the U.S. Department of Justicecontinue to press global financial institutions on issues of money laundering, trade sanctions, bribery andcorruption, stressing the need for robust program controls, sophisticatedmonitoring systems and knowledgeable expertise. Regulatory scrutiny ismoving beyond the traditional banking sector into realms such as creditcard issuers, insurance providers andgaming enterprises, prompting theSee EY, page 4Public Accounting Report February 2014

Best, continued from page 2and receiving feedback related to professional development, improvement andgrowth. Since the implementation ofthis program, employee engagement results related to effectiveness of coaching,communication and career opportunities have improved from 68% to 76%.”Training magazine’s Top 125 ranking is determined by assessing a rangeof qualitative and quantitative factors,including financial investment in employee development, the scope of development programs and how closelysuch development efforts are linked tobusiness goals and objectives.It uses benchmarking statistics suchas total training budget, percentage ofpayroll, number of training hours peremployee program, hours of trainingper employee annually and detailed formal programs—as well as goals, evaluation and workplace surveys.“BKD is honored to be amongthese top-tier training organizations,”BKD CEO Ted Dickman said. “Ourfirm is committed to lifelong learning,and we strongly believe that investingin our professionals’ technical expertiseand leadership development skills enhances their career opportunities andallows them to better serve our clients.”Candidates for the Training’s Top125 complete a detailed application,which is scored both quantitatively(70% of total score) by an outsourcedresearch and statistical data company,and qualitatively (30% of total score)by Training magazine editors.The companies with the Top Fivetraining programs are Jiffy Lube International, Keller Williams Realty, CapitalBlue Cross, CHG Healthcare Servicesand Mohawk Industries, according tothe 50-year-old professional developmentmagazine that advocates training andworkforce development as a business tool.But what are the best places to work?According to Fortune, QuikTripand CarMax are better places to workthan most large accounting firms.One exception might be Plante Moran (FY13 net revenue: 382 million;approximately 270 partners, 1,870 total staff, 21 offices), a 16-year perennialveteran on the magazine’s “Best PlacesTo Work” list. Fortune ranked the firmat No. 23 on its 2014 Best Places ToWork list, up from No. 25 in 2013.PAR GUEST COLUMNAccounting FirmsShould EmbraceTransparencyEnhanced disclosure translatesinto healthier business strategy.By Joanne CleaverPresident, Wilson-Taylor Assoc./ChicagoEverybody knows what’s happeningat your firm.They share pay information at Salary.com. They complain and compare workplace culture at Glassdoor.com. Lettingthe world know who does what, whereand when is the entire business modelof LinkedIn.The more that people—clients, prospects, employees, potential employees andthe business community—can see, themore they want to see.That’s why it’s pointless to try tohide how women fare at your firm.The Big Four also appeared on Fortune’s list, but much farther down. Deloitte ranked No. 61, down from No.47 in 2013. PwC was close on its heelsat No. 65, up from No. 81 in 2013.Ernst & Young ranked No. 78, downfrom No. 57 last year, while KPMGwas ranked No. 80 in 2013 after an absence from the 2013 list.(For detailed information about employees, jobs, pay, benefits, health, work/life, diversity and professional training foreach firm on Fortune’s 2013 “Best PlacesTo Work” list, see page 5.)Eligible participants on Fortune’s“Best Places To Work” list generallyhave been in business for at least fiveyears and have at least 1,000 U.S. employees. There is no cost to participate.The Great Place To Work Institute also produces a list of the “50Best Small and Medium Workplaces.”Denver-based Ehrhardt Keefe Steiner& Hottman (net revenue: 70.5 million; 51 partners, 440 total staff, threeoffices) was the only accounting firm tomake the most recent list of Best Medium Workplaces, ranking No. 7 forbusinesses with 251 to 999 employees.Public Accounting Report February 2014Women want toknow if they trulyhave a chance to advance at your firm.Every firm claimsthat its people areits greatest asset.Women want toknow exactly whatthat claim meansJoanne Cleaverfor them, personally. Can you proveit? Will you go on the record about yourresults? And if not what are you hiding?Given the evaporation of women inaccounting firm partnership pipelines,the skepticism of women in the profession is logical. Currently, women are55% of accounting firm employees butonly 19% of firm partners and principals, according to the 2013 AccountingMOVE Project report. (The executivesummary of the MOVE report is anexclusive annual EXTRA! edition inSee PAR GUEST COLUMN, page 4EKS&H was noted for offering employees a standard invitation to adoptan 11-month work year, which half ofits 440 employees opt to take advantageof, as well as other efforts to create anemployee-empowered, lively environment and support for training.The Great Place To Work Instituteproduces Fortune’s “Best CompaniesTo Work For ” lists. The lists are coauthored by Robert Levering andMilton Moskowitz. Every company appearing on the lists is selected primarilyon the basis of their employees’ responses to the Great Place to Work Trust Index Employee Survey, which measuresthe levels of trust, pride and camaraderie in the workplace. The majority of acompany’s overall score—two-thirds—derives from the quantitative and openended responses provided by employees.Additionally, the surveys rate thebenefits, practices and philosophies thatcomprise the companies’ cultures, collected through the institute’s Culture Audit questionnaire. No accounting firmsappear on Fortune’s Best Small Workplaces list. For additional information,visit www.greatplacetowork.com. 3

PAR GUEST COLUMNPAR Guest Column, continued from page 3PAR and features data about women’sadvancement in the profession.)Clients want to know if your firm’svalues are aligned with theirs, becausethey want to work with people whothink like they do.And the business community wantsto know if your firm plays fair by hiringand supporting women and minorityowned businesses. Do you spend money with small businesses owned by yourneighbors? Do your actions line upwith your attitude?Answers to these reasonable questions can be hard to come by. Transparency is ascendant as a key trust factorfor all businesses. The public and business communities already trust publicaccounting firms because CPA firms arein the business of validating what’s true.A credible process yields a reliably credible result: that is the point of auditsand assurance.Clients show their work to demonstrate that they are telling the truth.Accountants verify that the truth is thetruth by reviewing it and showing theirown work. So, it stands to reason thataccounting firms should be the mosttransparent of all businesses when itcomes to “showing their work” in advancing women. Applying the public accounting mindset to advancingwomen validates firms’ claims that theyare investing in women.So why do so few firms publicly report how women fare at their firms?Obfuscation is a dynamic I encounter on a daily basis as my teamand I research, write and fact-checkthe Accounting MOVE Project—anannual research effort that measuresthe advancement of women in theaccounting profession and that myfirm designs and produces. All we really want to know—all that womenin the public accounting professionreally want to know—is this: howmany women partners do you havenow? How many did you have lastyear? And what are you doing to havemore next year?Really, that’s it. What are your results, and what can other firms learnfrom your experience?[P]ublic accounting firms withthe greatest self-disclosurewill set the standard for theentire profession.Telling the simple truth buildstrust—with current employees, potential hires, clients and your community. Seattle-based Moss Adams(founding sponsor of the AccountingMOVE Project) does this right. Everyfall, it publishes on its website a simple,straightforward report about the resultsof its Forum W culture change effortdesigned to retain and advance morewomen to partnership.“We put our goals out there, making us more accountable for what we’dlike to achieve,” says Human ResourcesManager Tricia Bencich, the key strategist for Forum W.“The number of women partners ispretty consistent across the firms in ourindustry. Over the last five years, we’veseen steady growth to 24% womenpartners, which is higher than industryaverage,” Bencich said. “Overall, ournumbers at each level are not too dissimilar from other firms why notput it out there?”Transparency about advancing women actually won accolades from MossAdams’s clients and expanded relationships with them. The firm was so encouraged that in March 2013, it added a corporate responsibility report that outlineshow the firm re-invests in its communityand how it has changed its operations tominimize its environmental impact.Christian Geismann, the seniormanager who leads the team that oversaw the production of the report, saysthat he is contacted a couple of timeseach week by clients or members of thebusiness community who are intriguedby the firm’s open-book approach.“It’s a representation of our values,”he says.We urge other firms to embrace thesame level of transparency through theAccounting MOVE Project, and it’sstarting to happen. PAR’s upcomingEXTRA edition on the MOVE Project for 2014, to be published later thisspring, will include details about severalfirms that are now publishing results oftheir efforts to advance women.“Transparency” is the buzzword ofthis decade. Dodd-Frank and similarregulations set the baseline, but publicaccounting firms with the greatest selfdisclosure will set the standard for theentire profession.In this case, you want people to seeright through you.To learn more about The MOVEProject, visit www.wilson-taylorassoc.com. Contact Joanne Cleaver atjycleaver@wilson-taylorassoc.com or(231) 299-1275. EY, continued from page 2need to seriously review and enforcecompliance programs and controls.The opportunity to leverageBig Data in the context of compliance and anti-corruption willallow companies to ask new ques-4tions. Data analytics, traditionallythe domain of marketing and sales,has migrated into the domain of internal audit, compliance and corporate oversight. Companies now haveopportunities to use forensic dataanalytics for proactive monitoring ofbusiness data. Organizations shoulddevelop a better understanding ofthe risks and rewards of forensic dataanalytics and learn to use these techniques to help detect potential fraudand implement effective risk mitigation programs. Public Accounting Report February 2014

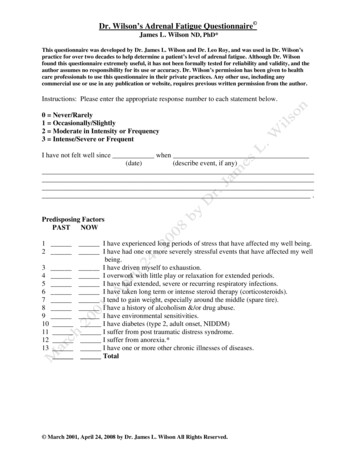

Public Accounting ReportSide-By-Side Analysis: How Firms On Fortune’s “Best Places To Work” ComparePlante MoranDeloitteEYKPMGPwCEmployeesU.S. 504130,391451New Jobs (1 Year)**2812,6732,402-1111,925% Job Growth**18.36.39.1-1.05.7% Voluntary 206,998256,4718912,00016,5006,2004,449Employees Outside the U.S.JobsApplicantsJob Openings as of Jan. 2, 2014Pay***Most Common Job (Salaried)Audit Staff: 76,200Senior/SeniorConsultant: 91,708ClientservingManager: 114,459SeniorAssociate: 86,000Manager/Supervisor: 101,207Most Common Job (Hourly)Admin. Asst.: 48,940Admin. Asst.: 61,393Admin.Asst.: 67,575Sr. Admin.Asst.: 61,000Exec. Asst.: 66,726Fully Paid SabbaticalsYesNoNoNoYesOn-Site Child CareYesNoNoNoNo100% Health Care CoverageNoNoNoNoNoOn-Site Fitness CenterNoYesNoNoYesSubsidized Gym MembershipYesYesNoNoYesJob-Sharing ProgramYesYesYesYesYesCompressed Work ion Policy Includes Sexual OrientationYesYesYesYesYesDomestic Partner Benefits For Same-Sex CouplesYesYesYesYesYesSalaried Employees6454695966Hourly ty% Minorities% WomenProfessional Training (Hours Per Year)*Includes part-time employees **Full-time employees onlyclassification of full-time salaried and hourly employeesNOTE: As of July 2013 and based on U.S. employeesSource: FortunePublic Accounting Report February 2014***Yearly pay rate plus additional cash compensation for the largest5

Associations, continued from page 1Michael Reiss von Filski, CEO, GenevaGroup International (GGI)/Zurich:Over the past year,GGI has begun a“best practices” ormanaging partnerconference in NorthAmerica that is heldjointly with a “developing leaders” eventwhere the risingstars from firms around the region havea chance to interact with and learn fromthe managing partners of today. Theseprograms are held concurrently, but twodistinct programs are offered to accommodate both the managing partners andthe young leaders. In addition, we havestrived to engage our membership by providing a consistent and interactive socialmedia strategy. We have solidified GGI’spresence in social media, which allowsour members access to real-time updatesregarding our organization and encourages their interaction throughout the year.Cornell Rudov, president, CPAsNET.com/Princeton, N.J.:As merger maniaamong accountingfirms continues toprogress, we are providing our memberfirms with specificdemographic information to help identify possible acquisition targets in their marketplaces and thencalling on these prospects to determine theirinterest. Then, we establish meetings andprovide a framework to bring these meetings to a positive conclusion.Maureen Schwartz, executive director,BKR International/New York:We increased thesize of BKR’s annualscholarshipawards, recognizing how crucial itis to help young accounting studentsaround the worldwho will becomeour profession’s future leaders. Further,BKR offered an intensive leadershiptraining program for senior managersand new partners to help them transi6tion from working “in” the firm to “on”the firm. The challenge of finding, training and keeping good people is nowback to the pre-recession days. Associations must assist in this critical endeavor.James Flynn, president, CPA AssociatesInternational/Rutherford, N.J.:During the past year, our association recognized that our members needed furthersupport with firm succession in additionto our leadership development program.Therefore, we introduced new activities that included a workshop on succession planning at our Managing PartnersSeminar. We also conducted a membersurvey regarding succession planning. Thepurpose of the survey was twofold: (1) toassist members in implementing a succession planning process, and (2) to identifymember MPs who have experience andare willing to help fellow members withsuccession planning or firm acquisitions.These acquisitions can be a useful part ofthe leadership succession process.Harvey Bookstein, chairman, boardof directors, JHI/Wayne, N.J., andco-founding partner, RBZ LLP/Los Angeles:We have initiated more teachingof best practicesamong the members by using bothour own membersand outside consultants as moderatorsinstead of speakers.Our members getmore value learning from other members’experiences and roundtable discussions.More networking at conferences hasgiven members the opportunity to get toknow each other better. We’ve becomemore communicative with our membersby including updates from the head office, the international board and all committees now reporting to the membershipon a regular basis.Joe Farrell, executive director, The TAGAlliances/St. Petersburg, Fla.:The words “world” and “economy” arenow used together every day. Whetherdriven by issues related to taxing cloudservices or an international merger, borders are of less consequence, and transactions are increasingly sophisticated, oftenrequiring a multidisciplinary approach.The TAG Alliances have responded tothese developments by adding some ofthe largest independent firms in NorthAmerica and the U.K., by expandingour Asian and African presence and byincreasing the branding of our allianceand that of our individual members. Wehave also deepened the professional andpersonal relationships between our lawfirm and accounting firm members. Withthe increase in size and scale comes an increase in sophistication and in firm ancillary businesses such as actuarial services,offshore trust companies, investmentbanking services and wealth management.We supplement these capabilities with increased education through seminar-stylelearning environments for everyone fromyoung professionals to managing partnersand monthly teleconference calls on marketing, technology and best practices.Mara Ambrose, executive director,INPACT Americas/Frederick, Md.:The “time out ofthe office” factorand high cost oftravel have prompted INPACT tolook more closelyat alternative CPEdelivery methods.While “live” conferences are vital in strengthening partner relationships and networking, webinars are a way to involve more stafflevels and provide learning experiencesat an affordable cost and in a formatthat feels more comfortable to youngerstaff. We’ve started with just a few thatwere well received and plan to expandthe webinar program in the next year.Tony Szczepaniak, managing partner,Firm Foundation/Peoria, Ill.:We continue to strengthen memberto-member relationships throughquarterly videoconference roundtable discussions. Each membersubmits a question to its peer groupand then takes part in a live discussion on this platform. This buildsrelationships without the need fortravel. Additionally, we rolled outpartner- and manager-level leadership programs to strengthen thepipeline of future owners in ourmember firms.See ASSOCIATIONS, page 7Public Accounting Report February 2014

Associations, continued from page 6Michelle Arnold, chief regional officer,North America, PrimeGlobal/Duluth, Ga.:PrimeGlobalhasresponded quicklyto our members’strategic planningsurvey replies andcompleted significant initiatives thisyear that promotedeeper knowledgesharing and cooperation. Technology has made the expansion of delivery channels easier than ever,allowing us to develop creative avenues ofcollaboration. This innovation has produced a significant increase in participation at many levels of our membership.Using video and micro-sites to connectworldwide has promoted greater member communication and expertise, resulting in significant business referrals. Withthe changing workforce demographics,PrimeGlobal is committed to satisfyingour members’ demand for profound vision, immediate relevance and sophisticated access to information.Adelaide Ness, executive director,Enterprise Worldwide/Nashville, Tenn.:We have focused on staff training solutions, certification programs, onlinelearning solutions and increasing the resources available to help members growtheir businesses.Susan Humphry, CEO, IAPA/Farnham, U.K.:In the last year,IAPA strengthenedits offering to members through therecruitment of 16additional firms inAsia, Europe, LatinAmerica and theU.S. Successful regional conferences maximized the opportunity for members to network with eachother and to create new opportunities forbusiness generation. Globally, specialistinterest groups in tax, audit and M&Apromoted exchange of information andideas, and IAPA has plans for new sectoralgroups in Europe and elsewhere. The introduction of “flash fliers”—announcingopportunities for members to work together or announcing new regulation ata national level—has helped to promotecommunication and cooperation between members. The emergence of LatinAmerica and Southeast Asia as economicpowerhouses of the future has promptedefforts to expand the membership in thesecountries, so that IAPA is represented in atotal of 13 Latin American countries and12 Asian countries.Geoff Barnes, CEO and president,Baker Tilly International/London:Due to our memberfirms’ clients becoming more international, we’ve seen arise in cross-bordercollaboration. As aresult, we’ve focusedour energy on crossborder initiatives.These initiatives range from industry- andservice-focused global committees to training aimed at providing a more consistentlevel of client service around the world.Julio Gabay, president and CEO,Abacus Worldwide/Miami:Abacus was createdin October 2012to provide the benefit of an international associationto mid-sized as wellas smaller, nichedfirms that may notqualify in othergroups simply because of size or becauseof geographic exclusivity but which havea need to connect with noncompetingfirms locally and internationally. Abacus has a reduced cost structure and hasadmitted larger and smaller firms, someof which are niched in such areas as theauto industry, employee benefits, community banking and construction/realestate. Abacus is multidisciplinary andhas law firms as members of the association, increasing the possibility of referralinteraction between member firms. Mostassociatio

Public Accounting Report † February 2014 3 and receiving feedback related to profes-sional development, improvement and growth. Since the implementation of this program, employee engagement re-sults related to eff ectiveness of coaching, communication and career opportuni-ties have improved from 68% to 76%."