Transcription

Plumbing SegmentRichard O’Reagan / Group President, Global Plumbing

AgendaThe Business TodayGrowth Plan2

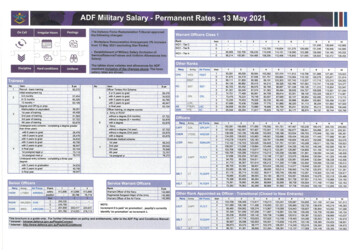

Plumbing Products Segment Overview12/31/2014Masco Corp.(Breakdown of 2014 Revenue)Rest ofMasco61%39%PlumbingSegmentRevenue 3.3BMargin as Adjusted*15.6%% of Masco EBITas adjusted*61%% Revenue outsideN. America41%% Repair &Remodel Sales82%Currency ExposureCommodity ExposureUSD / EUR/ CADCopper/ Zinc*Operating profit, as adjusted excludes 5M of rationalization charges for Plumbing Products and 63M of netrationalization changes for Masco.3

Strong Brands with Industry Leading PositionsBrizo Delta BrassCraft (US DIY faucet brand)(NA plumber brand)#1(Recommended premiumfaucet showroom brand)#1#1Hot Spring / Caldera (Leading global brands inportable spa market)#1Hansgrohe (Global shower brand)Bristan / Heritage#1(UK faucet market)#1Axor (Global designerfaucet brand)Mirolin #1#1(Acrylic bath-waremanufacturer inCanada)4

Broad Product Range with MultipleOpportunities for GrowthNorth AmericaInt’l - 40% RevenuesFaucets& ShowersBathSystemsSanitaryWaresRoughPlumbingBath Acc. /WellnessMarkets5

Diversified Portfolio Delivers a SolidPerformance RecordAdjusted Operating Profit( M)15% 517CAGR 418 338 3322011201220132014*Excludes business rationalization charges for 2014, 2013, 2012, and 2011 of 5 million, 24 million, 25 million and 15 million,respectively. Excludes 2011 other intangible asset impairment charge of 1 million.6

AgendaThe Business TodayGrowth Plan7

Strategic Priorities1 Extend leadership inNorth American plumbing2 Pursue category expansion3 Growth in priority international markets,both organically and inorganically8

STRATEGY #1 EXTEND LEADERSHIP IN NORTH AMERICAN PLUMBINGTarget and Grow in Under-Penetrated ChannelsChannel Breakdownof Addressable OpportunityBig Box, Trade / Showroom,All Other RetailCommercial, Builder,Trade / Showroom Urban 3.6B 2.8BMascoopportunity 1.0B 0.3BAddressable US Plumbing Industry SizeNotes: Industry includes Faucets, Rough Plumbing Supplies and Portable SpasSource: Company Estimates for Masco Addressable OpportunitiesMasco Sales9

STRATEGY #1 EXTEND LEADERSHIP IN NORTH AMERICAN PLUMBINGOur Strengths are Key Enablers for SuccessBrandsDelta Faucet Company share#1BrassCraft products preferred choice byProfessional Plumber#1Hot Spring portable spa brand#1InnovationKBIS – Brizo articulating arm kitchen faucetWinnerThe Home Depot InnovationTop 10U.S. patent filings for faucets & fittings forthe past 20 years vs. the competitionVitality Index2XBrizo Articulating ArmKitchen Faucet 30%10

STRATEGY #1 EXTEND LEADERSHIP IN NORTH AMERICAN PLUMBINGKey Execution InitiativesPreserve the core Grow commercial salesEstimatedSales Opportunity: 175- 250MCapitalize on new homeconstruction with key buildersover the nextthree years Grow urban showroom sales11

STRATEGY #2 PURSUE CATEGORY EXPANSIONAdjacent Categories Represent SignificantGrowth PotentialProduct Breakdownof Addressable OpportunityFaucets & Mixers,Portable Spas / Bath AccessoriesRough Plumbing, Bath Systems,Sanitary Wares 48BMascoopportunity 28B 2.7BGlobal Plumbing Industry SalesNotes: Industry includes Faucets, Rough Plumbing Supplies and Portable SpasSource: Company Estimates for Masco Addressable Opportunities 0.6BMasco Plumbing Sales12

STRATEGY #2 PURSUE CATEGORY EXPANSIONBrand Recognition Drives Our Right to WinStrong Consumer Association with Delta Brandand Adjacent Bathing ProductsDelta Brand Awareness 71237125Attachment Rates Adjacent categories with highestattachment rate to existing products1. Toilet with purchase of bothvanity sink / faucet2. Vanity sink with purchaseof a faucet69284724DeltaAverageSource: DFC Brand Extension Study (Invoke). Aided awareness %.13

STRATEGY #2 PURSUE CATEGORY EXPANSIONKey Execution InitiativesExpand into sanitary wares Grow bath systems sales Extend rough plumbing categoriesEstimatedSales Opportunity: 75- 125Mover the nextthree years Pursue inorganic growth14

STRATEGY #3 GROW IN PRIORITY INTERNATIONAL MARKETSLeverage our Leadership Position in Global Faucetsand Mixers for Greater GrowthGlobal Faucet Industry 22BCompetitorsales88%12%Masco globalfaucet salesMasco is the #1 global faucet player withsignificant opportunity to growNotes:All figures based on Wholesale PricingSource: BRG, Fredonia and Company estimates for 201415

STRATEGY #3 GROW IN PRIORITY INTERNATIONAL MARKETSMasco Plumbing – Competitive Global FootprintMultiple Business Units in N. America Delta Faucet Hansgrohe BrassCraft (USA, Canada) Brasstech (USA) Masco Canada (Canada) Mirolin (Canada) WatkinsSource: MascoDelta Faucet ( 60 Countries)#1Hansgrohe ( 140 Countries)globally in faucets and mixers16

STRATEGY #3 GROW IN PRIORITY INTERNATIONAL MARKETSGrowth in Priority International 17

STRATEGY #3 GROW IN PRIORITY INTERNATIONAL MARKETSKey Execution InitiativesFocus international growthin key markets Leverage Hansgrohe’sdistribution capabilities Leverage Delta andHansgrohe’s innovationEstimatedSales Opportunity: 125- 225Mover the nextthree years Pursue inorganic growth18

Plumbing Segment 3 Year Outlook 175M- 250M 75M- 125M 3,100MExtend NAplumbing2014 PlumbingNet Sales*Pursuecategoryexpansion 125M- 225M 3,500M 3,700MGrow priorityinternationalmarkets2017 PlumbingNet SalesPlumbing segment is expected to generate 16-17% operating marginsin 2017 with sales growing at 4%-6% CAGR during the next 3 years*2014 Plumbing net sales as reported was 3.3B. Using a 1.10 euro to USD foreign exchange rate, net sales would have been reduced byapproximately 200M19

IN SUMMARYMasco’s Plumbing Segment is a Powerhouse ofGlobal Industry Leading Brands Masco’s Plumbing segment has a strong trackrecord of execution– which has consistently delivered above industry growth and margins Portfolio has broad product depth and leadershippositions in the industries served– represent tremendous opportunities for growth Plumbing segment has identified clear strategies– to leverage the portfolio’s brand strengths, innovation, and globalcapabilities to achieve its growth targets20

2014 Plumbing Net Sales* 2017 Plumbing Net Sales 3,100M Extend NA plumbing Pursue category expansion Grow priority international markets 175M- 250M 75M- 125M 125M- 225M 3,500M- 3,700M *2014 Plumbing net sales as reported was 3.3B. Using a 1.10 euro to USD foreign exchange rate, net sales would have been reduced by approximately 200M

![WELCOME [ montclair.edu]](/img/31/commencement-program-2022.jpg)