Transcription

Creation of the world’s leadingbroadband communications companyFebruary 6, 2013

Safe HarborThis presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the transaction andthe anticipated consequences and benefits of the transaction, the targeted close date for the transaction, our estimate of Virgin Media’s 2013 OCF, the intended financing, ourestimate of synergies and the value of certain tax assets, our expectation regarding combined leverage and liquidity, our expectations with respect to free cash flow and shareholderreturns, our expectations with respect to future growth prospects and the impact of the transaction on our operations and financial performance, and other information and statementsthat are not historical fact. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or impliedby these statements. These risks and uncertainties include the receipt and timing of necessary regulatory approval, the ability to finance the transaction (including the completion ofthe debt financing), Virgin Media’s ability to continue financial and operational growth at historic levels, the ability to successfully operate and integrate the Virgin Media operation andrealize estimated synergies, continued use by subscribers and potential subscribers of Virgin Media’s services, the ability to achieve expected operational efficiencies and economiesof scale, as well as other factors detailed from time to time in Liberty Global’s and Virgin Media’s filings with the Securities and Exchange Commission (“SEC”) including our mostrecently filed Forms 10-K and 10-Q. These forward-looking statements speak only as of the date of this presentation. We expressly disclaim any obligation or undertaking todisseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in the our expectations with regard thereto or any change in events,conditions or circumstances on which any such statement is based.Nothing in this presentation shall constitute a solicitation to buy or subscribe for or an offer to sell any securities of Liberty Global, Virgin Media or the new Liberty Global holdingcompany. In connection with the proposed transaction, Liberty Global and Virgin Media will file a joint proxy statement/prospectus with the SEC, and the new Liberty Global holdingcompany will file a Registration Statement on Form S-4 with the SEC. STOCKHOLDERS OF EACH COMPANY AND OTHER INVESTORS ARE URGED TO READ THEREGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) REGARDING THEPROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy ofthe registration statement and joint proxy statement/prospectus, as well as other filings containing information about Liberty Global, Virgin Media and the new Liberty Global holdingcompany, without charge, at the SEC's Internet site (http://www.sec.gov). Copies of the registration statement and joint proxy statement/prospectus and the filings with the SEC thatwill be incorporated by reference therein can also be obtained, without charge, by directing a request to Liberty Global, Inc., 12300 Liberty Boulevard, Englewood, Colorado, 80112,USA, Attention: Investor Relations, Telephone: 1 303 220 6600, or to Virgin Media Limited, Communications House, Bartley Wood Business Park, Bartley Way, Hook, RG27 9UP,United Kingdom, Attn: Investor Relations Department, Telephone 44 (0) 1256 753037.The respective directors and executive officers of Liberty Global and Virgin Media and other persons may be deemed to be participants in the solicitation of proxies in respect of theproposed transaction. Information regarding Liberty Global's directors and executive officers is available in its proxy statement filed with the SEC by Liberty Global on April 27, 2012,and information regarding Virgin Media's directors and executive officers is available in its proxy statement filed with the SEC by Virgin Media on April 30, 2012. Other informationregarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxystatement/prospectus and other relevant materials to be filed with the SEC when they become available. These documents can be obtained free of charge from the sources indicatedabove.Operating Cash Flow (“OCF”), Free Cash Flow (“FCF”) and Adjusted Free Cash Flow (“Adjusted FCF”) are non-GAAP measures. Definitions and GAAP reconciliations for these nonGAAP measures are included in the Appendices.The following may be used throughout the presentation: Liberty Global, Inc. (“Liberty Global,” “LGI,” or the “Company”) and Virgin Media Inc. (“Virgin Media” or “VMED”).Liberty Global & Virgin Media February 6, 20132

PresentersMichael T. FriesNeil A. BerkettPresident & Chief Executive OfficerChief Executive OfficerLiberty Global & Virgin Media February 6, 20133

Agenda Transaction Rationale Virgin Media Highlights Liberty Global Highlights Transaction Summary

A Powerful Combination Creation of the world’s leading broadband communications company Complementary strengths across video, voice & broadband products Significant potential to monetize customer base Substantial synergy opportunity Accretive to free cash flow Strengthened commitment to shareholder returnsLiberty Global & Virgin Media February 6, 20135

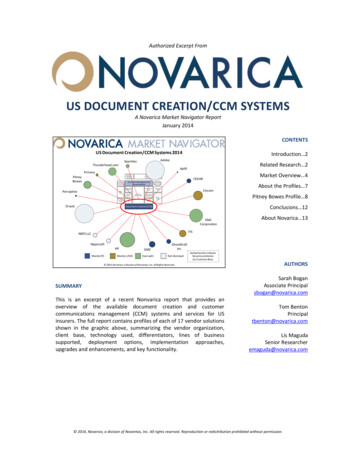

World’s Leading Cable OperatorScale advantage drives innovation & operating leverage# of customers (mm)2520Liberty Global & Virgin Media February 6, 2013OnoZiggoCablevisionVirgin MediaCharterKDGTWCLiberty GlobalComcastLGI VMED56

Focus on Europe’s Strongest MarketsStable economic & regulatory climates, healthy growth profileNearly 80% of revenuesfrom 5 marketsLiberty Global & Virgin Media February 6, 2013Largest Cable Operatorin 9 of 12 European countries7

Complementary Core StrengthsAligned triple-play product suite, roadmap & expertiseLeading thedigital TV experienceLiberty Global & Virgin Media February 6, 2013Delivering thefastest broadband speedsGreat success withcompelling bundles8

(1)Meaningful Upside from Sub Growth(2)Combined(In millions)Homes Passed341347Customers20525Cable 1.9x134Bundling RatioMobile(1) Statistics as of December 31, 2012 based on each entity’s subscriber counting policies. Total customers excludes mobile-only customers. Virgin Media statistics exclude non-cablecustomers and RGUs.(2) Totals may not summate due to rounding.Liberty Global & Virgin Media February 6, 20139

Additional Growth OpportunitiesMobility & B2B offer growth potential beyond traditional triple-playMobile cross-selling expertisePan-European B2B potentialMobile revenue as % of total revenueB2B revenues as % of total revenue16%14%6%2%Virgin Media(1)(2)Liberty Global(1)Virgin MediaLiberty Global(2)This calculation only includes countries where Liberty Global generates mobile revenues. Mobile revenue as defined by each company.Results for Liberty Global reflect only the results for our UPC/Unity Division, which is our European broadband communications and direct-to-home satellite operations of UPC Holding andthe broadband communications operations in Germany of Unitymedia KabelBW GmbH.Liberty Global & Virgin Media February 6, 201310

Substantial Cost SynergiesTargeting 180 million of annual synergies(1) Cost synergies of 110 million between LGI & VMED operations CapEx savings of 70 million Driven across core functional areas including network, IT support & procurementEfficiencies derived from increased scaleStrong track record of integration & of achieving synergy targetsVMEDLGI(1) To be realized after full integration. Based on GBP/USD foreign exchange spot rate as of February 1, 2013 as per Bloomberg.Liberty Global & Virgin Media February 6, 201311

(1)Focused on Shareholder ReturnsVMED RepurchasesLGI RepurchasesCombined repurchases(in billions)(in billions) 10 bn since ’05 1.1 1.0 1.0 1.0Target leverage(2)4x to 5x 0.52-year target upon close 0.32010(1)(2) 3.5 bn20112012201020112012Please see Appendix for the definition of LGI Repurchases. Virgin Media’s amounts are translated at the respective average annual GBP/USD foreign exchange rates.As customarily defined by Liberty Global. Leverage refers to gross debt divided by last quarter annualized OCF.Liberty Global & Virgin Media February 6, 201312

Agenda Transaction Rationale Virgin Media Highlights Liberty Global Highlights Transaction Summary

Proven Leader in Attractive UK MarketThe UK MarketVirgin Media 26 mm total homes in footprintVirgin passes 50% of homes Stable, rational competitive landscapeTriple-play leader – industry leading ARPU Favorable pricing environmentAnnual history of price increases Strong demand for broadbandSuperfast(1) broadband leader – 63% share Underpenetrated pay TVConnected TV leader – 1.3 mm TiVo subs Significant B2B opportunityLeading challenger in business telecoms Undeveloped quad-play marketLeading MVNO player in UK(1)Superfast is defined as RGUs that are receiving 30 Mb or higher broadband speeds.Liberty Global & Virgin Media February 6, 201314

Multiple Drivers of Operating GrowthFive Key Drivers12345BEST TV - TiVoFASTESTBROADBANDMOBILEQUAD PLAYADVANTAGEDB2BBEST BRAND:VIRGINLiberty Global & Virgin Media February 6, 2013Q4 ResultsCustomerGrowthPricingTier MixProductCross-SellBusinessDataDecliningHeadwinds Strong net customer adds of 43k Disconnects down 22k, with churn at 1.1% Pricing underpinned by product differentiation Price inflation is occurring in UK Telecoms Fibre & content investment underpins competitor price actions Over 40% of broadband gross adds take 60Mb Paying TV mix improved to 87% TiVo penetration up to 35%, with 1.3m subscribers Improved triple play to 65% and quad play to 16% Contract mobile revenue up 5% despite MTR headwind Data revenue grew 10% in 2012 Total revenue growth of 5% in 2012 Telephony usage15

Strong Momentum Looking Ahead2013 brandFixed/mobileconvergenceImprovedcustomer serviceB2BopportunityLiberty Global & Virgin Media February 6, 2013 Revenue: Growth should improve through 2013 Customer growth: Sustainable part of revenue mix Price: Increased by 5% from February 1 B2B: Underlying revenue growth continues CapEx: Declining capital intensity FCF: Return to free cash flow growth16

Opportunity for VMED ShareholdersAttractive value now; exposure to compelling growth equity story Multiple driversof revenue growth Operational leverage Disciplined approachto CapEx & costs Focus on driving FCF Proven track record ofreturning capital to equityinvestorsLiberty Global & Virgin Media February 6, 2013A sharedcommitment tovalue creationAn enhanced& compellingplatform Greater diversity of revenuedrivers across multiplegeographies & categories Exposure to less mature,growing markets Enhanced potential forFCF expansion Greater buyback capacity Redomicile in UK17

Agenda Transaction Rationale Virgin Media Highlights Liberty Global Highlights Transaction Summary

Building Scale in Western EuropeTwo-thirds of revenue from four strategic countries Germany, Belgium, Switzerland & the Netherlands Industrial heartland of Europe; strong demographics Additional M&A consolidation opportunitiesLiberty Global Revenue“Big Four” driving growth(1)Rational competitive environments Telco operators struggling on multiple fronts Stable pricing environment with upside potentialSupportive regulatory framework Cable driving EU broadband agenda National regulators control access & consolidation issues(1) Based on Q4 2012 revenue.Liberty Global & Virgin Media February 6, 201319

Track Record of Performance(1)Since 2009 Organic RGU additions of 3.6 mm Over 50% increase in reported OCF to 4.9 bn in 2012 2.5-fold expansion in reported Adj. FCF since 2009Organic RGU AdditionsBundling driving record results1,594(000s)Q4 2012 Results Record quarter with 465,000 organic RGU adds Rebased growth: revenue 7%; OCF 6% Adj. FCF up 62% to 594 mm1,192837577465380317235FY 2012 Results(1) Highest-ever annual organic RGU adds of 1.6 mm Rebased growth: revenue 6%; OCF 4% Adj. FCF growth of 31% - brings 2012 total to over 1 bn2009201020112012Q4 Organic RGU AdditionsYTD September Organic RGU AdditionsPlease see Appendix for the definition and information on organic RGU additions and rebased growth.Liberty Global & Virgin Media February 6, 201320

Sustainable Operating MomentumSubstantial RGU (subscriber) growth opportunity Digital upside with over 8 mm analog RGUs Significant runway with low broadband & voice penetrationsVideo Opportunity(1)Innovation driving growthStable pricing Continued ARPU/customer growth with bundling success Brand power & price/value proposition improvingOther 0.8 mmInnovation drives volume/ARPU Broadband superiority a proven growth driver Emerging opportunities with Horizon, mobile & B2BAttractive OCF and FCF profile(1) OCF margin up 200 bps over last 3 years Declining capital intensity Strong cash from ops & vendor financing driving FCF18.3 mmSubsAnalogCable8.4 mmDigitalCable9.1 mmStatistics as of December 31, 2012.Liberty Global & Virgin Media February 6, 201321

Agenda Transaction Rationale Virgin Media Highlights Liberty Global Highlights Transaction Summary

Key Transaction Terms & Valuation(1)(2)(3)Structure & ConsiderationValuation Liberty Global to acquire VirginMedia in cash & stock merger 47.87 per Virgin Media share(2) Virgin Media shareholders receivefor each share: Implied Virgin Media equity value of 16.0 bn & enterprise value of 23.3 bn(2) 24% premium to closing price(3) 17.50 in cash Represents 8.8x 2012 OCF multiple 0.2582 shares of Liberty Global(1)Series A common stock Represents 7.0x 2013E OCF multiple,(3)after adjusting for synergies & taxes 0.1928 shares of Liberty Global(1)Series C common stock Accretive to Free Cash FlowIn the transaction, Liberty Global will create a new holding company, a UK public limited company (plc), listed on NASDAQ. The shares delivered therefore will be shares of the plc entity with substantiallysimilar rights as the current Liberty Global shares of common stock.Based on Liberty Global’s & Virgin Media’s closing prices at February 4, 2013.OCF adjusted to conform to Liberty Global’s OCF definition. 2013 multiple is calculated after taking into consideration the expected annual impact of approximately 110 million of operating synergies thatmay be realized following full integration and after adjusting the consideration to be paid for certain tax assets. Assumptions underlying forward purchase multiple as estimated by Liberty Global.Liberty Global & Virgin Media February 6, 201323

Key Transaction Terms (Cont.)Pro Forma OwnershipParent Company LGI shareholders expected to own 64% Redomicile to the UK VMED shareholders expected to own 36% Remain listed on NASDAQGovernancePath to Completion One Virgin Media Board member to joinLiberty Global Board Transaction subject to majority LGI & VirginMedia shareholder votes, regulatoryapprovals & customary closing conditions One Virgin Media Board member to joinnewly-formed UK Advisory BoardLiberty Global & Virgin Media February 6, 2013 Expected to close in Q2 201324

Pro Forma CapitalizationCombined PF fully-diluted equity market capitalization of 27.9 bn PF Series A common stock: 16.1 bn market cap (231 mm shares outstanding)Series B common stock: 0.7 bn market cap (10 mm shares outstanding)PF Series C common stock: 11.2 bn market cap (173 mm shares outstanding)Purchase of Virgin Media’s equity totaling 16.0 bn (1)Equity issuance of 10.2 bn (86 mm LBTYA shares & 65 mm LBTYK shares)Total cash outlay of 5.9 bn,(2) funded by a combination of debt financing & availableliquidity of both Liberty Global and Virgin Media Includes more than 3.0 bn of incremental debt at Virgin MediaCombined PF total debt of 39 bn(1)(2) Equates to 5x leverage; deleveraging event for LGI shareholders Target mid-4s leverage by year-end 2014Based on Virgin Media’s fully-diluted shares outstanding of approximately 335 mm and based on closing prices on February 4, 2013.Before taking into account transaction fees, expenses, and the pre-closing carrying cost of the debt, which combined total approximately 500 million.Liberty Global & Virgin Media February 6, 201325

(1)Financial Strength Across Key Metrics2012 Results(unaudited)(2)Combined(In billions, unless %)Revenue 10.3 6.5 16.8OCF 4.9 2.7 7.547.2%41.0%44.8% 1.9 1.2 3.118.3%19.1%18.6% 1.0 0.5 1.5OCF marginCapExCapEx/RevenueAdjusted FCF(1)(2)LGI amounts are on an as reported basis. Please see Appendix for the definitions. The Virgin Media amounts are on a reported basis, as adjusted to conform to the OCF andAdjusted FCF definitions of LGI (see Appendix). Figures are for the year ended December 31, 2012.Reported Virgin Media numbers have been converted at the average 2012 GBP/USD foreign exchange spot rate as per Bloomberg. Totals may not summate due to rounding.Liberty Global & Virgin Media February 6, 201326

Combination Delivers Strong OutlookMid-single digit rebased revenue growthMid-single digit rebased OCF growthCapital intensity to declineMid-teens free cash flow growthLiberty Global & Virgin Media February 6, 201327

Powerful CombinationThe world’s leading broadbandcommunications companyComplementary strengthsacross video, voice & dataSignificant potential tomonetize customer baseSubstantial synergy opportunityAccretive to free cash flowLiberty Global & Virgin Media February 6, 2013Strengthened commitmentto shareholder returns28

Appendix

Liberty Global’s AppendixDefinitions and Additional InformationRevenue Generating Unit (“RGU”) is separatelyan Analog Cable Subscriber, Digital CableSubscriber, DTH Subscriber, MMDS Subscriber,Internet Subscriber or Telephony Subscriber. Ahome, residential multiple dwelling unit, orcommercial unit may contain one or more RGUs.For example, if a residential customer in ourAustrian system subscribed to our digital cableservice, telephony service and broadband internetservice, the customer would constitute threeRGUs. Total RGUs is the sum of Analog Cable,Digital Cable, DTH, MMDS, Internet andTelephony Subscribers. RGUs generally arecounted on a unique premises basis such that agiven premises does not count as more than oneRGU for any given service. On the other hand, ifan individual receives one of our services in twopremises (e.g. a primary home and a vacationhome), that individual will count as two RGUs forthat service. Each bundled cable, internet ortelephony service is counted as a separate RGUregardless of the nature of any bundling discountor promotion.Non-paying subscribers are counted assubscribers during their free promotional serviceperiod. Some of these subscribers may choose todisconnect after their free service period. Servicesoffered without charge on a long-term basis (e.g.,VIP subscribers, free service to employees)generally are not counted as RGUs. We do notinclude subscriptions to mobile services in ourexternally reported RGU counts. In this regard, ourDecember 31, 2012 RGU counts exclude 743,100Liberty Global & Virgin Media February 6, 2013postpaid subscriber identification module (“SIM”)cards in service in Belgium, Germany, Chile,Poland, the Netherlands and Hungary and 89,900prepaid SIM cards in service in Chile.Average Revenue Per Unit (“ARPU”) refers to theaverage monthly subscription revenue per averagecustomer relationship and is calculated by dividingthe average monthly subscription revenue(excluding installation, late fees and mobileservices revenue) for the indicated period, by theaverage of the opening and closing balances forcustomer relationships for the period. Customerrelationships of entities acquired during the periodare normalized. Unless otherwise indicated, ARPUper customer relationship for the UPC/UnityDivision and LGI Consolidated are not adjusted forcurrency impacts. ARPU per customer relationshipamounts reported for periods prior to January 1,2012 have not been restated to reflect the January1, 2012 change in our reporting of SOHO RGUs.Organic RGU additions exclude RGUs ofacquired entities at the date of acquisition, butinclude the impact of changes in RGUs from thedate of acquisition. All subscriber/RGU additions orlosses refer to net organic changes, unlessotherwise noted.Small office home office (“SOHO”); Certain ofour business-to-business (“B2B”) revenue isderived from small or home office subscribers thatpay a premium price to receive enhanced servicelevels along with video, internet or telephonyservices that are the same or similar to the massmarketed products offered to our residentialsubscribers. Effective January 1, 2012, werecorded non-organic adjustments to beginincluding the SOHO subscribers of our UPC/UnityDivision in our RGU and customer counts. As aresult, all mass marketed products provided toSOHOs, whether or not accompanied by enhancedservice levels and/or premium prices, are nowincluded in the respective RGU and customercounts of our broadband communicationsoperations, with only those services provided atpremium prices considered to be “SOHO RGUs” or“SOHO customers.” With the exception of our B2BSOHO subscribers, we generally do not countcustomers of B2B services as customers or RGUsfor external reporting purposes. All RGU,customer, bundling and ARPU amounts presentedfor periods prior to January 1, 2012 have not beenrestated to reflect this change.OCF margin is calculated by dividing OCF by totalrevenue for the applicable period.LGI Repurchases include approximately 90million to repurchase UGC Convertible Notesduring 2010 and 187 million of paymentsassociated with the exchange of LGI’s ConvertibleNotes during 2011.30

Liberty Global’s AppendixDefinitions and Additional InformationInformation on Rebased Growth: For purposesof calculating rebased growth rates on acomparable basis for all businesses that we ownedduring 2012, we have adjusted our historicalrevenue and OCF for the three months and yearended December 31, 2011 to (i) include the preacquisition revenue and OCF of certain entitiesacquired during 2011 and 2012 in our rebasedamounts for the three months and year endedDecember 31, 2011 to the same extent that therevenue and OCF of such entities are included inour results for the three months and year endedDecember 31, 2012, (ii) exclude the pre-dispositionrevenue and OCF of a small studio business thatwas disposed of at the beginning of 2012 from ourrebased amounts for the three months and yearended December 31, 2011 and (iii) reflect thetranslation of our rebased amounts for the threemonths and year ended December 31, 2011 at theapplicable average foreign currency exchangerates that were used to translate our results for thethree months and year ended December 31, 2012.The acquired entities that have been included inwhole or in part in the determination of our rebasedLiberty Global & Virgin Media February 6, 2013revenue and OCF for the three months endedDecember 31, 2011 include KBW, OneLink andfive small entities in Europe. The acquired entitiesthat have been included in whole or in part in thedetermination of our rebased revenue and OCF forthe year ended December 31, 2011 include KBW,Aster, OneLink and seven small entities in Europe.We have reflected the revenue and OCF of theacquired entities in our 2011 rebased amountsbased on what we believe to be the most reliableinformation that is currently available to us(generally pre-acquisition financial statements), asadjusted for the estimated effects of (i) anysignificant differences between GAAP and localgenerally accepted accounting principles, (ii) anysignificant effects of acquisition accountingadjustments, (iii) any significant differencesbetween our accounting policies and those of theacquired entities and (iv) other items we deemappropriate. We do not adjust pre-acquisitionperiods to eliminate non-recurring items or to giveretroactive effect to any changes in estimates thatmight be implemented during post-acquisitionperiods. As we did not own or operate the acquiredbusinesses during the pre-acquisition periods, noassurance can be given that we have identified alladjustments necessary to present the revenue andOCF of these entities on a basis that is comparableto the corresponding post-acquisition amounts thatare included in our historical results or that the preacquisition financial statements we have reliedupon do not contain undetected errors. Theadjustments reflected in our rebased amounts havenot been prepared with a view towards complyingwith Article 11 of Regulation S-X. In addition, therebased growth percentages are not necessarilyindicative of the revenue and OCF that would haveoccurred if these transactions had occurred on thedates assumed for purposes of calculating ourrebased amounts or the revenue and OCF that willoccur in the future. The rebased growthpercentages have been presented as a basis forassessing growth rates on a comparable basis,and are not presented as a measure of our proforma financial performance. Therefore, we believeour rebased data is not a non-GAAP financialmeasure as contemplated by Regulation G or Item10 of Regulation S-K.31

Liberty Global’s Appendix (Cont.)Liberty Global’s Operating Cash Flow Definition and ReconciliationOperating cash flow is the primary measure usedby our chief operating decision maker to evaluatesegment operating performance. Operating cashflow is also a key factor that is used by ourinternal decision makers to (i) determine how toallocate resources to segments and (ii) evaluatethe effectiveness of our management forpurposes of annual and other incentivecompensation plans. As we use the term,operating cash flow is defined as revenue lessoperating and selling, general and administrativeexpenses (excluding stock-based compensation,depreciation and amortization, provisions forlitigation and impairment, restructuring and otheroperating items). Other operating items include (i)gains and losses on the disposition of long-livedto investors because it is one of the bases forcomparing our performance with the performanceof other companies in the same or similarindustries, although our measure may not bedirectly comparable to similar measures used byother public companies. Operating cash flowshould be viewed as a measure of operatingperformance that is a supplement to, and not asubstitute for, operating income, net earnings(loss), cash flow from operating activities andother GAAP measures of income or cash flows. Areconciliation of total segment operating cash flowto our operating income is presented below.assets, (ii) direct acquisition costs, such as thirdparty due diligence, legal and advisory costs, and(iii) other acquisition-related items, such as gainsand losses on the settlement of contingentconsideration. Our internal decision makersbelieve operating cash flow is a meaningfulmeasure and is superior to available GAAPmeasures because it represents a transparentview of our recurring operating performance thatis unaffected by our capital structure and allowsmanagement to (i) readily view operating trends,(ii) perform analytical comparisons andbenchmarking between segments and (iii) identifystrategies to improve operating performance inthe different countries in which we operate. Webelieve our operating cash flow measure is usefulThree months endedDecember 31,2012Year endedDecember 31,201120122011in millionsTotal segment operating cash flow from continuing operations. Stock-based compensation expense .Depreciation and amortization.Impairment, restructuring and other operating items, net .Operating income . Liberty Global & Virgin Media February 6, 20131,254.4(21.9)(681.4)(50.4)500.7 1,099.5(25.6)(618.7)(47.1)408.1 4,869.6(112.4)(2,691.1)(83.0)1,983.1 4,482.3(131.3)(2,457.0)(75.6)1,818.432

Liberty Global’s Appendix (Cont.)Liberty Global’s Free Cash Flow and Adjusted Free Cash Flow Definitionsand Reconciliations(*)We define free cash flow as net cash provided byour operating activities, plus (i) excess taxbenefits related to the exercise of stock incentiveawards and (ii) cash payments for directacquisition costs, less (a) capital expenditures, asreported in our consolidated cash flowstatements, (b) principal payments on vendorfinancing obligations and (c) principal paymentson capital leases (exclusive of the portions of thenetwork lease in Belgium and the duct leases inGermany that we assumed in connection withcertain acquisitions), with each item excluding anycash provided or used by our discontinuedoperations.operations’ net cash provided by operatingactivities to FCF and Adjusted FCF for theindicated periods:We believe that our presentation of free cash flowprovides useful information to our investorsbecause this measure can be used to gauge ourability to service debt and fund new investmentopportunities. Free cash flow should not beunderstood to represent our ability to funddiscretionary amounts, as we have variousmandatory and contractual obligations, includingdebt repayments, which are not deducted to arriveat this amount. Investors should view free cashflow as a supplement to, and not a substitute for,GAAP measures of liquidity included in ourconsolidated cash flow statements.The followingtable provides the reconcilia

LGI VMED Comcast Liberty Global TWC KDG Charter Virgin Media Cablevision Ziggo Ono 6 . compelling bundles Liberty Global & Virgin Media February 6, 2013. 47 25 47 22 14 11 1.9x 4 Homes Passed 34 13 . Leading challenger in business telecoms Leading MVNO player in UK Liberty Global & Virgin Media February 6, 2013 .