Transcription

Presentment Date & Time: June 11, 2009 at 12:00 P.M. (ET)Objection Deadline: June 11, 2009 at 11:30 A.M. (ET)AKIN GUMP STRAUSS HAUER & FELD LLPOne Bryant ParkNew York, New York 10036(212) 872-1000 (Telephone)(212) 872-1002 (Facsimile)Daniel H. Golden (DG-5624)Philip C. Dublin (PD-4919)Meredith A. Lahaie (ML-1008)Counsel for the Official Committee of Unsecured CreditorsUNITED STATES BANKRUPTCY COURTSOUTHERN DISTRICT OF NEW -----------------x:In re:::Chemtura Corporation, et ---------------------------xChapter 11Case No. 09-11233 (REG)(Jointly Administered)NOTICE OF PRESENTMENT OF THE APPLICATION OF THEOFFICIAL COMMITTEE OF UNSECURED CREDITORS OFCHEMTURA CORPORATION, ET AL., FOR ENTRY OF ANORDER AUTHORIZING THE EMPLOYMENT AND RETENTIONOF THE GARDEN CITY GROUP, INC. AS THE COMMITTEE’SINFORMATION AGENT NUNC PRO TUNC TO MARCH 31, 2009PLEASE TAKE NOTICE that upon the annexed Application of the Official Committeeof Unsecured Creditors (the “Committee”) of Chemtura Corporation, et al. (collectively, the“Debtors”), for entry of an order authorizing the employment and retention of The Garden CityGroup, Inc. as the Committee’s information agent nunc pro tunc to March 31, 2009 (the“Application”), the undersigned will present the attached proposed order to the HonorableRobert E. Gerber, United States Bankruptcy Judge, United States Bankruptcy Court for theSouthern District of New York (the “Court”) for approval and signature on June 11, 2009 at12:00 p.m. (ET).¿0ñ{,A)%;0911233090527000000000006&[½

PLEASE TAKE FURTHER NOTICE that objections, if any, to the relief requested in theApplication must comply with the Bankruptcy Rules and the Local Rules of the United StatesBankruptcy Court for the Southern District of New York, must be set forth in a writingdescribing the basis therefor and must be filed with the Court electronically in accordance withGeneral Orders M-182 and M-193 by registered users of the Court’s electronic case filing system(the User’s Manual for the Electronic Case Filing System can be found athttp://www.nysb.uscourts.gov, the official website of the Court) and, by all other parties ininterest, on a 3 ½ inch disk, preferably in Portable Document Format (PDF), WordPerfect or anyother Windows-based word processing format (with a hard copy delivered directly to Chambers)and served in accordance with General Order M-182 or by first-class mail upon each of thefollowing: (i) counsel to the Committee, Akin Gump Strauss Hauer & Feld LLP, One BryantPark, New York, New York 10036, Attn: Daniel H. Golden, Esq. and Philip C. Dublin, Esq.;(ii) the Office of the United States Trustee for the Southern District of New York, 33 WhitehallStreet, 21st Floor, New York, New York 10004, Attn.: Susan Golden, Esq.; and (iii) counsel forthe Debtors, Kirkland & Ellis LLP, Citigroup Center, 153 East 53rd Street, New York, New York10022, Attn.: M. Natasha Labovitz, Esq.; so as to be received no later than 11:30 a.m. (ET) onJune 11, 2009.PLEASE TAKE FURTHER NOTICE that unless a written objection to the Application,with proof of service, is filed with the Clerk of the Court by 11:30 a.m. (ET) on June 11, 2009,there will not be a hearing and the order may be signed.PLEASE TAKE FURTHER NOTICE that if a written objection is timely filed, the Courtwill hear the Application, along with any written objection timely received, on a date to bedetermined at the United States Bankruptcy Court for the Southern District of New York,2

Honorable Robert E. Gerber, United States Bankruptcy Judge, One Bowling Green, New York,New York 10004-1408, 6th Floor. The moving and objecting parties are required to attend thehearing, and failure to attend in person or by counsel may result in relief being granted or deniedupon default.Dated: May 27, 2009New York, New YorkRespectfully submitted,AKIN GUMP STRAUSS HAUER & FELD LLPBy:/s/ Daniel H. GoldenDaniel H. Golden (DG-5624)Philip C. Dublin (PD-4919)Meredith A. Lahaie (ML-1008)Akin Gump Strauss Hauer & Feld LLPOne Bryant ParkNew York, New York 10036(212) 872-1000 (Telephone)(212) 872-1002 mmlahaie@akingump.comCounsel for the Official Committee of UnsecuredCreditors3

AKIN GUMP STRAUSS HAUER & FELD LLPOne Bryant ParkNew York, New York 10036(212) 872-1000 (Telephone)(212) 872-1002 (Facsimile)Daniel H. GoldenPhilip C. DublinMeredith A. LahaieCounsel for the Official Committee of Unsecured CreditorsUNITED STATES BANKRUPTCY COURTSOUTHERN DISTRICT OF NEW -----------------x:In re:::Chemtura Corporation, et ---------------------------xChapter 11Case No. 09-11233 (REG)(Jointly Administered)APPLICATION OF THE OFFICIALCOMMITTEE OF UNSECURED CREDITORS OF CHEMTURACORPORATION, ET AL. FOR ENTRY OF AN ORDERAUTHORIZING THE EMPLOYMENT AND RETENTION OF THEGARDEN CITY GROUP, INC. AS THE COMMITTEE’SINFORMATION AGENT NUNC PRO TUNC TO MARCH 31, 2009The Official Committee of Unsecured Creditors (the “Committee”) of ChemturaCorporation (“Chemtura”) and its affiliated debtors and debtors in possession (collectively, the“Debtors”), by and through its counsel, Akin Gump Strauss Hauer & Feld LLP (“Akin Gump”),submits this application (the “Application”), pursuant to sections 105(a), 1102(b)(3)(A) and1103(c) of title 11 of the United States Code (the “Bankruptcy Code”) for entry of an order (the“Order”), attached hereto as Exhibit A, authorizing the Committee’s employment and retentionof The Garden City Group, Inc. (“GCG”) as information agent (the “Information Agent”) for theCommittee in connection with the Debtors’ chapter 11 cases nunc pro tunc to March 31, 2009.In support of this Application, the Committee submits the Affidavit of Jeffrey S. Stein, Vice8143853

President of GCG (the “Stein Affidavit”), which is annexed hereto as Exhibit B. In furthersupport of the Application, the Committee respectfully represents as follows:JURISDICTION1.This Court has jurisdiction to consider this Application pursuant to 28 U.S.C. §§157 and 1334. This is a core proceeding pursuant to 28 U.S.C. § 157(b). Venue is proper beforethis Court pursuant to 28 U.S.C. §§ 1408 and 1409.BACKGROUND2.On May 27, 2009, the Committee filed a Stipulation and Agreed Order Betweenthe Committee and the Debtors Regarding Creditor Access to Information Pursuant toBankruptcy Code sections 105(a), 1102(b)(3)(A) and 1103(c) (the “Information ProtocolStipulation”). (Docket No. 451).RELIEF REQUESTEDServices to be Provided3.By this Application, the Committee seeks entry of an order pursuant toBankruptcy Code section 105, 1102(b)(3) and 1103 authorizing the employment and retention ofGCG as its Information Agent.1 The Committee requires the services of GCG in order to complywith its obligations under Bankruptcy Code section 1102(b)(3), which provides that:A committee appointed under subsection (a) shall –(A)provide access to information for creditors who –(i) hold claims of the kind represented by that committee; and(ii) are not appointed to the committee;(B)solicit and receive comments form the creditors describedin subparagraph (A); and111 U.S.C. § 1103 provides, in pertinent part, that “ a committee appointed under section 1102 of this title mayselect and authorize the employment by such committee of agents, to represent or perform services for suchcommittee.” 11 U.S.C. § 1103(a).81438532

(C)be subject to a court order that compels any additionalreport or disclosure to be made to the creditors described insubparagraph (A).11 U.S.C. § 1102(b)(3).4.The Committee believes that the retention of GCG to assist the Committee incomplying with its obligations under Bankruptcy Code section 1102(b)(3) will add to theeffective administration of the chapter 11 cases (the “Chapter 11 Cases”) and reduce the overallexpense of administering these cases. GCG will undertake, inter alia, the following actions andprocedures:(a)Establish and maintain an Internet-accessed website (the“Committee Website”) that provides, without limitation:8143853(1)a link or other form of access to the website maintained bythe Debtors’ notice, claims and balloting agent atwww.kccllc.net/chemtura, which shall include, amongother things, the case docket and claims register;(2)highlights of significant events in the Chapter 11 Cases;(3)a calendar with upcoming significant events in the Chapter11 Cases;(4)a general overview of the chapter 11 process;(5)press releases (if any) issued by the Committee or theDebtors;(6)a registration form for creditors to request “real-time”updates regarding the Chapter 11 Cases via electronic mail;(7)a form to submit creditor questions, comments and requestsfor access to information;(8)responses to creditor questions, comments and requests foraccess to information; provided, that the Committee mayprivately provide such responses in the exercise of itsreasonable discretion, including in the light of the nature ofthe information request and the creditor’s agreement toappropriate confidentiality and trading constraints;(9)answers to frequently asked questions;3

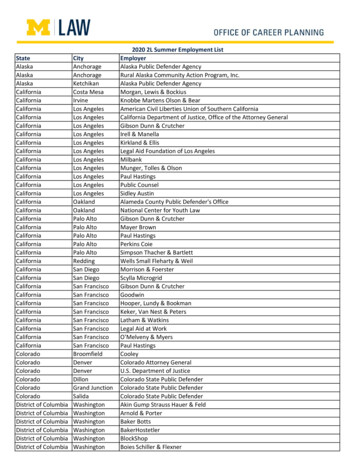

(10)links to other relevant websites;(11)the names and contact information for the Debtors’ counseland restructuring advisor(s); and(12)the names and contact information for the Committee’scounsel and financial advisor(s);(b)Distribute updates regarding the Chapter 11 Cases via electronicmail for creditors that have registered for such service on the Committee website;and(c)Establish and maintain a telephone number and electronic mailaddress for creditors to submit questions and comments.GCG’s Qualifications5.GCG is particularly well suited to perform the foregoing tasks. In the normalcourse of its business, GCG is often called upon to create websites for the purpose of providingaccess to information for creditors. GCG is well qualified to provide unsecured creditors withaccess to information in connection with the Chapter 11 Cases. Large chapter 11 cases in whichGCG has been retained and created websites to provide creditors access to information include: 8143853Calpine Corp., Case No. 05-60200 (BRL) (Bankr. S.D.N.Y.)Bally Total Fitness of Greater New York, Inc., Case No. 08-14814 (BRL) (Bankr.S.D.N.Y.)Kimball Hill, Inc., Case No. 08-10095 (SPS) (Bankr. N.D. Ill.)Leiner Health Products Inc., Case No. 08-10446 (KJC) (Bankr. D. Del.)TOUSA, INC., Case No. 08-10928 (JKO) (Bankr. S.D. FL)Propex Inc., Case No. 08-10249 (JCC) (Bankr. E.D. Tenn.)WCI Communities, Inc., Case No. 08-11643 (KJC) (Bankr. D. DE.)LandAmerica 1031 Exchange Services, Inc., Case No. 08-35995 (KRH) (Bankr. E.D. VA.)Victory Memorial Hospital, Case No. 06-44387 (CEC) (Bankr. E.D.N.Y.)Boyds Collection, Ltd., Case No. 05-43793 (DWK) Bankr. D. Md.)O’Sullivan Industries, Inc., Case No. 05-83049 (CRM) (Bankr. N.D. Ga.)Flintkote Company, Case No. 04-11300 (JFK) (Bankr. D. Del.)Sure Fit, Inc., Case No. 04-11495 (BRL) (Bankr. S.D.N.Y.)Hawaiian Airlines, Case No. 03-00817 (RFJ), (Bankr. D. HI)General Media, Inc. Case No. 03-15078 (SMB) (Bankr. S.D.N.Y.)HQ Global, Case No. 02-10760 (MFW) (Bankr. D. Del.)Federal-Mogul, Case No. 01-10578 (AMW) (Bankr. D. Del.)4

As such, GCG is well qualified to prepare the Committee Website and to assist the Committee inproviding the Debtors’ unsecured creditors with access to information in connection with theChapter 11 Cases as required by the Information Protocol Stipulation.Terms of Retention6.GCG shall be compensated by the Debtors’ estates for professional servicesrendered on behalf of the Committee in connection with the Chapter 11 Cases in accordance withthe provisions of the retention agreement (and pricing schedule annexed thereto) (together, the“Retention Agreement”) by and between the Committee and GCG, a copy of which is annexedhereto as Exhibit C.7.The Committee respectfully submits that the rates charged by GCG are fair andreasonable and have been negotiated with the Committee. The Committee believes thatengaging GCG is the most cost efficient manner for the Committee to comply with therequirements of section 1102(b)(3) in that the billing rates of GCG are considerably less thanthose of the attorneys for the Committee. Since the function served by GCG is administrative innature, the Committee believes there will be a significant cost savings which ultimately inures tothe benefit of the Debtors’ estates and their creditors, thereby eliminating the administrativeburden of maintaining the Committee Website from the attorneys for the Committee.8.As the fees and expenses to be incurred by GCG under the proposed engagementwill be administrative in nature, the Committee submits that (a) GCG should be exempt from theOrder Establishing Procedures for Interim Compensation and Reimbursement of Expenses forProfessionals (Docket No. 112) and (b) this Court should authorize the Debtors to compensateGCG on a monthly basis in accordance with the terms and conditions of the RetentionAgreement, upon GCG’s submission to the Committee, the Debtors and the United States81438535

Trustee of monthly invoices summarizing in reasonable detail the services rendered and expensesincurred in connection therewith.9.In addition, the Committee requests that the Committee, the Debtors and theUnited States Trustee shall have ten (10) days to advise GCG of any objections to the monthlyinvoices. If an objection cannot be resolved, the Committee will schedule a hearing before thisCourt to consider the disputed invoice. Unless advised of an objection, the Debtors shall payeach GCG invoice within thirty (30) days after the receipt of the invoice, in the ordinary courseof business. If an objection is raised to a GCG invoice, the Debtors will remit to GCG only theundisputed portion of the invoice and, if applicable, will pay the remainder to GCG upon theresolution of the dispute or as directed by the Court.GCG’s Disinterestedness10.Based upon the Stein Affidavit, sworn to on May 26, 2009, annexed hereto asExhibit B and incorporated herein by reference, to the best of GCG’s knowledge, except as maybe set forth in the Stein Affidavit, GCG has and represents no interest adverse to the interests ofthe Committee or the Debtors’ estates and the Committee believes that GCG’s employment willbe in the best interests of the unsecured creditors which the Committee represents.11.As set forth in the Stein Affidavit, GCG is a “disinterested person” as defined insection 101(14) of the Bankruptcy Code.12.To the extent that GCG discovers any new relevant facts or relationships bearingon the matters described herein during the period of its retention, GCG will supplement the SteinAffidavit.WAIVER OF MEMORANDUM OF LAW13.Because the relevant facts and law are detailed herein, the Committee respectfullyrequests that the Court waive the requirement that the Committee file a separate memorandum of81438536

law in support of the Application, but the Committee reserves the right to file a brief in reply toany objection to this Application.NOTICE14.No trustee or examiner has been appointed in these Chapter 11 Cases. Notice ofthis Application has been given to: (i) the Office of the United States Trustee for the SouthernDistrict of New York; (ii) counsel to the Debtors; (iii) counsel to the agent for the Debtors’postpetition lenders; (iv) counsel to the agent for the Debtors’ prepetition lenders; (v) theindenture trustee for each of the Debtors’ outstanding note and debenture issuances; (vi) thoseparties that have requested notice pursuant to Bankruptcy Rule 2002; (vii) the Internal RevenueServices; (viii) the Environmental Protection Agency; and (ix) the Securities and ExchangeCommission. Based on the foregoing, the Committee respectfully submits that no further noticeis needed.NO PRIOR REQUEST15.No prior application for the relief sought in this Application has been made to thisor any other court in connection with the Chapter 11 Cases.81438537

WHEREFORE, the Committee respectfully requests that the Court enter the Order,annexed hereto as Exhibit A, and award such other and further relief as this Court deems to bejust, proper and equitable.Dated: New York, NYMay 27, 2009AKIN GUMP STRAUSS HAUER & FELD LLPBy:/s/ Daniel H. GoldenDaniel H. GoldenPhilip C. DublinMeredith A. LahaieAkin Gump Strauss Hauer & Feld LLPOne Bryant ParkNew York, New York 10036(212) 872-1000 (Telephone)(212) 872-1002 mmlahaie@akingump.comCounsel for the Official Committee ofUnsecured Creditors81438538

EXHIBIT A8143853

UNITED STATES BANKRUPTCY COURTSOUTHERN DISTRICT OF NEW -----------------x:In re:::Chemtura Corporation, et ---------------------------xChapter 11Case No. 09-11233 (REG)(Jointly Administered)ORDER AUTHORIZINGEMPLOYMENT AND RETENTION OF THE GARDEN CITYGROUP, INC. AS INFORMATION AGENT FOR THEOFFICIAL COMMITTEE OF UNSECURED CREDITORS CHEMTURACORPORATION, ET AL. NUNC PRO TUNC TO MARCH 31, 2009Upon the application (the “Application”) dated May 27, 2009 of the Official Committeeof Unsecured Creditors (the “Committee”) of Chemtura Corporation, et al. (collectively, the“Debtors”) for entry of an order pursuant to 11 U.S.C. §§ 105(a), 1102(b)(3) and 1103(c)authorizing the employment and retention of The Garden City Group, Inc. (“GCG”), asinformation agent for the Committee, nunc pro tunc to March 31, 2009, to, among other things,create a website for the purpose of providing access to information to creditors; and upon theconsideration of the Affidavit of Jeffrey S. Stein (the “Stein Affidavit”) attached to theApplication as Exhibit B; and pursuant to the retention agreement (and pricing schedule annexedthereto) (together, the “Retention Agreement”) by and between the Committee and GCG, a trueand correct copy of which is attached to the Application as Exhibit C; and it appearing that therelief requested is in the best interests of the Committee, the Debtors’ estates and their creditors;and the Court being satisfied that GCG has the capability and experience to provide suchservices for which it is to be retained by the Committee and that GCG does not hold an interestadverse to the Debtors’ estates respecting the matters upon which GCG is to be engaged; and the

Court having jurisdiction over this matter pursuant to 28 U.S.C. §§ 157 and 1334; andconsideration of the matter being a core proceeding pursuant to 28 U.S.C. § 157(b); and venuebeing proper in this Court pursuant to 28 U.S.C. §§ 1408 and 1409; and the Court being satisfiedbased on representations made in the Stein Affidavit that GCG does not hold or represent aninterest adverse to the Debtors’ estates; and good and sufficient notice of the Application havingbeen given; and no other or further notice being required; and sufficient cause appearingtherefor; it isORDERED, that the Committee is authorized to employ and retain GCG as itsinformation agent in accordance with the terms and conditions set forth herein and in theRetention Agreement; and it is furtherORDERED, that GCG will undertake, inter alia, the following actions and procedures:(a)Establish and maintain an Internet-accessed website (the“Committee Website”) that provides, without limitation:1(1)a link or other form of access to the website maintained bythe Debtors’ notice, claims and balloting agent atwww.kccllc.net/chemtura, which shall include, amongother things, the case docket and claims register;(2)highlights of significant events in the Chapter 11 Cases;1(3)a calendar with upcoming significant events in the Chapter11 Cases;(4)a general overview of the chapter 11 process;(5)press releases (if any) issued by the Committee or theDebtors;(6)a registration form for creditors to request “real-time”updates regarding the Chapter 11 Cases via electronic mail;Capitalized terms not defined herein shall have the meaning ascribed to them in the Application.2

(7)a form to submit creditor questions, comments and requestsfor access to information;(8)responses to creditor questions, comments and requests foraccess to information; provided, that the Committee mayprivately provide such responses in the exercise of itsreasonable discretion, including in the light of the nature ofthe information request and the creditor’s agreement toappropriate confidentiality and trading constraints;(9)answers to frequently asked questions;(10)links to other relevant websites;(11)the names and contact information for the Debtors’ counseland restructuring advisor(s); and(12)the names and contact information for the Committee’scounsel and financial advisor(s);(b)Distribute the updates regarding the Chapter 11 Cases viaelectronic mail for creditors that have registered for such service on theCommittee Website; and(c)Establish and maintain a telephone number and electronic mailaddress for creditors to submit questions and comments; and it is furtherORDERED, that without further order of the Court, the Debtors are authorized anddirected to compensate GCG on a monthly basis in accordance with the terms and conditions ofthe Retention Agreement, upon GCG’s submission to the Committee, the Debtors and the UnitedStates Trustee of monthly invoices summarizing in reasonable detail the services rendered andexpenses incurred in connection therewith; and it is furtherORDERED, that the Committee, the Debtors and the United States Trustee shall haveten (10) days to advise GCG of any objections to the monthly invoices. If an objection is raisedto a GCG invoice, the Debtors will remit to GCG only the undisputed portion of the invoice and,if applicable, will pay the remainder to GCG upon the resolution of the dispute within thirty (30)days of receipt of an invoice. All objections that are not resolved by the parties shall be3

preserved and presented to the Court by the objecting party at the next interim or final feeapplication hearing to be heard by the Court; and it is furtherORDERED, that, the fees and expenses GCG incurs in the performance of its servicesshall be treated as an administrative expense of the Debtors’ chapter 11 estates and be paid by theDebtors in the ordinary course of business without further application to this Court; provided,however, that to the extent that fees and expenses are disallowed by this Court, GCG shall not beentitled to an administrative expense for such disallowed fees and expenses; and it is furtherORDERED, that this Court shall retain jurisdiction with respect to all mattersarising from or related to the implementation of this Order.Dated:, 2009New York, New YorkHONORABLE ROBERT E. GERBERUNITED STATES BANKRUPTCY JUDGE4

EXHIBIT B

UNITED STATES BANKRUPTCY COURTSOUTHERN DISTRICT OF NEW YORK)))CHEMTURA CORPORATION, et al.,))Debtors.))In re:Chapter 11Case No. 09-11233 (REG)(Jointly Administered)AFFIDAVIT OF JEFFREY S. STEIN INSUPPORT OF THE APPLICATION OF THE OFFICIALCOMMITTEE OF UNSECURED CREDITORS FOR AN ORDERAUTHORIZING THE EMPLOYMENT AND RETENTION OF THEGARDEN CITY GROUP, INC. AS THE COMMITTEE’SINFORMATION AGENT NUNC PRO TUNC TO MARCH 31, 2009Jeffrey S. Stein, being duly sworn, deposes and says:1.I am a Vice President of The Garden City Group, Inc. (“GCG”) and I amauthorized to make and submit this affidavit on behalf of GCG. This affidavit issubmitted in support of the application (the “Application”) of the Official Committee ofUnsecured Creditors (the “Committee”) of Chemtura Corporation, et al. (collectively, the“Debtors”) seeking entry of an order authorizing the employment and retention of GCGas the Committee’s information agent (the “Information Agent”) nunc pro tunc to March31, 2009. The statements contained herein are based upon personal knowledge.2.GCG is one of the country’s leading chapter 11 administrators withexpertise in noticing, claims processing, balloting administration and distribution. In thenormal course of its business, GCG is often called upon to create websites for the purposeof providing access to information to creditors. GCG is well qualified and experienced toprovide the Committee and unsecured creditors with access to information in connectionwith these cases, having previously been retained as a communications agent in Bally

Total Fitness of Greater New York, Inc., Case No. 08-14818 (BRL) (Bankr. S.D.N.Y.); Inre Calpine Corporation, Case No. 05-60200 (BRL) (Bankr. S.D.N.Y.); In re Kimball Hill,Inc., Case No. 08-10095 (SPS) (Bankr. N.D. Ill.); In re TOUSA, Inc., Case No. 08-10928(JKO) (Bankr. S.D. Fla); In re Propex Inc., Case No. 08-10249 (JCC) (Bankr. E.D. Tenn.);In re VeraSun Energy Corporation, Case No. 08-12606 (BLS) (Bankr. D. DE.); In re WCICommunities, Inc., Case No. 08-11643 (KJC) (Bankr. D. DE.); In re SemCrude, L.P., CaseNo. 08-11525 (BLS) (Bankr. D. DE.); In re Pierre Foods, Inc., Case No. 08-11480 (KG)(Bankr. D. DE.); In re LandAmerica 1031 Exchange Services, Inc., Case No. 08-35995(KRH) (Bankr. E.D. VA.); and In re Victory Memorial Hospital, Case No. 06-44387(CEC) (Bankr. E.D.N.Y.). In addition, GCG has been retained as the noticing and claimsagent and created websites to provide access to information to creditors in the followingcases: In re Star Tribune Holdings Corporation, Case No. 09-10244 (RDD); In re LenoxSales, Inc., Case No. 08-14679 (ALG); In re Our Lady of Mercy Medical Center, Case No.07-10609 (REG) (Bankr. S.D.N.Y.); In re New York Racing Association Inc., Case No.06-12618 (JMP) (Bankr. S.D.N.Y.); In re Sure Fit, Inc., Case No. 04-11495 (BRL) (Bankr.S.D.N.Y.); In re General Media, Inc., Case No. 03-15078 (SMB) (Bankr. S.D.N.Y.); In reDice Inc., Case No. 03-10877 (BRL) (Bankr. S.D.N.Y.); In re Interbank Funding Corp.,Case No. 02-41590 (BRL) (Bankr. S.D.N.Y.); In re Nations Flooring, Case No. 01-16342(CB) (Bankr. S.D.N.Y.); In re Galey & Lord, Case No. 02-40445 (ALG) (Bankr.S.D.N.Y.); In re PSINet Consulting Solutions Holdings, Case No. 01-14916 (REG)(Bankr. S.D.N.Y.); In re NTL, Case No. 02-41316 (ALG) (Bankr. S.D.N.Y.); In re RegusBusiness Centre Corp., Case No. 03-20026 (ASH) (Bankr. S.D.N.Y.); In re SupplementsLT Inc., Case No. 08-10446 (KJC) (Bankr. D. Del.); In re Diamond Glass, Inc., Case No.3

08-10601 (CSS) (Bankr. D. Del.); In re ProRhythm, Inc., Case No. 07-11861 (KJC)(Bankr. D. Del.); In re Flintkote Company, Case No. 04-11300 (JKF) (Bankr. D. Del.); Inre HQ Global, Case No. 02-10760 (MFW) (Bankr. D. Del.); In re Federal-Mogul, CaseNo. 01-10578 (AMW) (Bankr. D. Del.); In re ACandS, Inc., Case No. 02-12687 (RJN)(Bankr. D. Del.); In re Copperfield Investments LLC, Case No. 07-71327 (JBR) (Bankr.E.D.N.Y.); In re Zurich Depository Corp., Case No. 07-71352 (JBR) (Bankr. E.D.N.Y.);In re Brunswick Hospital Center, Inc., Case No. 05-88168 (MLC) (Bankr. E.D.N.Y.); In rePhotocircuits Corporation, Case No. 05-89022 (SB) (Bankr. E.D.N.Y.); In re MetroTecCommunications, Inc., Case No. 05-20953 (DEM) (Bankr. E.D.N.Y.); In re AllouDistributors Inc., Case No. 03-82321 (MLC) (Bankr. E.D.N.Y.); In re CyberRebate.com,Case No. 01-16534 (CEC) (Bankr. E.D.N.Y.); In re Boyds Collection, Ltd., Case No. 0543793 (DWK) (Bankr. D. Md.); In re O’Sullivan Industries, Inc., Case No. 05-83049(CRM) (Bankr. N.D. Ga.); In re United Producers, Inc., Case No. 05-55272 (CMC)(Bankr. SD. Ohio); In re Automotive Professionals, Inc., Case No. 07-6720 (CAD) (Bankr.N.D. Ill.); In re Gateway HomeCare, Inc., Case No. 03-17457 (JPC) (Bankr. N.D. Ill.); Inre Romacorp, Inc., Case No. 05-86818 (BJH) (Bankr. N.D. Tex.); and In re HawaiianAirlines, Case No. 03-00817 (RJF) (Bankr. D. HI.).3.The Committee selected GCG to serve as the Information Agent for thesecases, as set forth in more detail in the Application filed contemporaneously herewith. Inconnection with its proposed retention by the Committee in these cases, GCG undertookto determine whether it had any conflicts or other relationships that might cause it not tobe disinterested or hold or represent an interest adverse to the Debtors. In connectionwith this inquiry, GCG obtained the names of certain interested parties (the “Conflicts4

List”) from Akin Gump Strauss Hauer & Feld LLP (“Akin Gump”), counsel to theCommittee, and conducted a thorough conflicts analysis based on that Conflicts List,which is attached hereto as Schedule 1.4.To the best of my knowledge, neither GCG, nor any of its professionalpersonnel, have any relationship with the Committee or the Debtors that would impairGCG’s ability to serve as the Information Agent. GCG does have relationships withsome of the Debtors’ creditors, but they are in matters completely unrelated to thesecases, either as vendors or in cases where GCG serves in a neutral capacity as a classaction settlement claims administrator. GCG’s assistance in cases where GCG acts as aclass action settlement claims administrator has been primarily related to the design anddissemination of legal notices and other administrative functions in class actions. GCGhas working relationships with certain of the professionals retained by the Committee orthe Debtors and other parties herein, but such relationships are completely unrelated tothese chapter 11 cases. I have been advised that Angela Ferrante, a Director at GCG, isan attorney formerly associated with Akin Gump. Ms. Ferrante was employed by AkinGump from May 2003 through December 2006. I have also been advised that, whileemployed at Akin Gump, Ms. Ferrante did not work on any matters involving the Debtors(in fact, Ms. Ferrante was no longer employed by Akin Gump when the Debtors filedtheir respective chapter 11 petitions). In addition, GCG personnel may have relationshipswith some of the Debtors’ creditors; however, such relationships are of a personalfinancial nature and completely unrelated to these chapter 11 cases. GCG has and willcontinue to represent clients in matters unrelated to th

AKIN GUMP STRAUSS HAUER & FELD LLP One Bryant Park New York, New York 10036 (212) 872-1000 (Telephone) (212) 872-1002 (Facsimile) Daniel H. Golden (DG-5624) Philip C. Dublin (PD-4919) Meredith A. Lahaie (ML-1008) Counsel for the Official Committee of Unsecured Creditors UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK