Transcription

Introduction of the NewRegistry of ScriplessSecurities (nRoSS)Bureau of the Treasury

Background The Bureau currently uses two systems for theissuance of Government Securities (GS)—Automated Debt Auction Processing System (ADAPS)—Registry of Scripless Securities (RoSS) Both systems have been in operation for 20 years. These systems lack the robustness andfunctionality to address current and foreseenbusiness requirements to support the expandingcapital market.22

Objectives Modernize the auction platform and registry of securitieseradicating possible operational and reputation risks. Meet existing and future liability management programsand capital market development inititiaves of the Bureau. Conform to industry best practices and internationalstandards:— Bank for International Settlements (BIS)— Committee on Payment and Settlement Systems- InternationalOrganization Commissions (CPSS-IOSCO)— ISO20022 Consolidate auction and registry information for data miningand analytics to support policy-making.33

nRoSS at a glanceProvides full management of Primary MarketActivities for various types of financialinstrumentsMaintains an online centralized electronic registryfor dematerialized fixed income securitiesImproves the efficiency by implementing Deliveryversus Payment (DvP) and Straight-ThroughProcessing (STP)Facilitates the electronic transfer of securities fortrade and non-trade transactions44

nRoSS at a glanceCalculates and executes automatically interest andcoupon payment events and early or totalredemptionAllows participants to monitor the cash leg ofsecurities transactions (Primary and Secondary)settled on PhilPaSSProvides online query facilities to all the participantsCalculates and collects securities accountmaintenance fees55

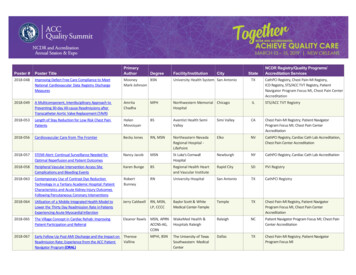

Core OperationsPrimary MarketOperationsSecondaryMarketOperationsPayment Events& CorporateActionsAuctionResultsProcessing &AwardingDelivery versusPayment &Free ofPaymentPayment ofInterestDvP Settlementof AuctionResultsPledge andother non-tradetransactionsTotal, Early orOptionalRedemptions66

THE BIG PICTUREnRoSSCashSettlementSystem(PhilPaSS)Registry BookExternal InterfacesnRoSSParticipantsReportingBilling & etTradingplatform(PDS)DMFASVPNDatabase77

nRoSS in Contrast (1)AUCTION OPERATIONSBusiness ProcessExistingNew1. Auction AccessUsing ADAPS via Reuters Web-based nRoSSterminalbrowser using VPN2. Settlement ofauctionSemi-automatedDvP3. Auction rules andconventionsCurrent ConventionGenerally no change4. SecurityLogin authenticationLogin authentication withsecurity token5. ISO 20022Non-compliantCompliant88

nRoSS in Contrast (2)REGISTRY OPERATIONSBusiness ProcessExistingNew1. Primary MarketRoSSnRoSS2. SecondaryMarketOne Registry Book, TwoRegistry SystemsnRoSS3. Tax calculationvia PDSnRoSS tax module4. SecurityLogin authenticationLogin authentication withsecurity token5. Account SetupRoSS Principal SecuritiesAccount; SATT/BPID/PICnRoSS account number6. ReportsBTr-generatedParticipant-generated7. Portfolio accessNot availableOn-line query facility8. Payment eventRequires manual processAutomated99

High Level Process ModelCLEARINGTRADE SellerPDS Gateway1.0BTrnRoSS5PREREQUISITE: Buyer and Seller must have nRoSS account.2.0 Buyer and Seller input trade details using PDEx platform including nRoSSaccount number.PhilPaSS3.0 Bilaterally cleared/authorized trade for settlement in PDS Gateway.1nRoSSAccount4.0 PDS Gateway sends settlement details to nRoSS.5.0 nRoSS checks securities balance and (if sufficient) proceeds to cash legsettlement via BSP PhilPass thru message exchange. nRoSS employs atax tracking module similar to NRT convention.6.0 Provide transaction confirmation message to PDS.CashSettlementnRoSS-PhilPaSS DvPSystem1010

Technical Requirements

Participant Access ModelBSP PhilPaSSVPNParticipantsPDS GatewayFirewallFirewallTape DriveTape DriveDatabasePRIMARY SITEDatabaseDR SITE1212

System RequirementsHARDWAREPC with the following minimumconfiguration: 1 dual core Intel/AMD CPU64 bit 4 GB RAM 300 GB HDD 17 inch monitor SafeNet eToken 5100SOFTWARE Internet Explorer, Firefox, Google Chrome(2 versions behind the latest currentversion are supported) Java Runtime Environment 8.0(optional if digital signature is required inthe web interface) SafeNet Authentication Client(for SSL client authentication usinghardware tokens and digital signature) Adobe PDF Reader(for viewing PDF reports)1313

terminal Web-based nRoSS browser using VPN 2. Settlement of auction Semi-automated DvP 3. Auction rules and conventions Current Convention Generally no change 4. Security Login authentication Login authentication with security token 5. ISO 20022 Non-compliant Compliant nRoSS in Contrast (1) AUCTION OPERATIONS