Transcription

NORFOLK STATE UNIVERSITYINTERCOLLEGIATE ATHLETHICS PROGRAMSFOR THE YEAR ENDEDJUNE 30, 2021Auditor of Public AccountsStaci A. Henshaw, CPAwww.apa.virginia.gov(804) 225-3350

–TABLE OF CONTENTS–PagesINDEPENDENT ACCOUNTANT’S REPORT ON APPLYINGAGREED-UPON PROCEDURES1-7SCHEDULESchedule of Revenues and Expenses of Intercollegiate Athletics ProgramsNotes to the Schedule of Revenues and Expenses of IntercollegiateAthletics ProgramsUNIVERSITY OFFICIALS89-1112

February 24, 2022The Honorable Glenn YoungkinGovernor of VirginiaJoint Legislative Auditand Review CommissionJavaune Adams-GastonPresident, Norfolk State UniversityINDEPENDENT ACCOUNTANT’S REPORTON APPLYING AGREED-UPON PROCEDURESWe have performed the procedures enumerated below on the Norfolk State University’sSchedule of Revenues and Expenses of Intercollegiate Athletics Programs (Schedule) for the year endedJune 30, 2021. University management is responsible for the Schedule and its compliance with NationalCollegiate Athletic Association (NCAA) requirements.University management has agreed to and acknowledged that the procedures performed areappropriate to meet the intended purpose of evaluating whether the Schedule is in compliance withNCAA Constitution 3.2.4.17.1, for the year ended June 30, 2021. This report may not be suitable for anyother purpose. The procedures performed may not address all the items of interest to a user of thisreport and may not meet the needs of all users of this report and, as such, users are responsible fordetermining whether the procedures performed are appropriate for their purposes.Agreed-Upon Procedures Related to theSchedule of Revenues and Expenses of Intercollegiate Athletics ProgramsProcedures described below were limited to material items. For the purpose of this report, andas defined in the agreed-upon procedures, items are considered material if they exceed four percent oftotal revenues or total expenses, as applicable. The procedures and associated findings are as follows:Fiscal Year 20211

Internal Controls1.We reviewed the relationship of internal control over intercollegiate athletics programsto internal control reviewed in connection with our audit of the university’s financialstatements. In addition, we identified and reviewed those controls unique to theIntercollegiate Athletics Department, which were not reviewed in connection with ouraudit of the university’s financial statements.2.Intercollegiate Athletics Department management provided a current organizationalchart. We also made certain inquiries of management regarding control consciousness,the use of internal audit in the department, competence of personnel, protection ofrecords and equipment, and controls regarding information systems with the InformationTechnology Department.3.Intercollegiate Athletics Department management provided us with their process forgathering information on the nature and extent of affiliated and outside organizationalactivity for or on behalf of the university’s intercollegiate athletics programs. We testedthese procedures as noted below.Affiliated and Outside Organizations4.Intercollegiate Athletics Department management identified all related affiliated andoutside organizations. The audit of the financial statements of the Norfolk StateUniversity Athletic Foundation was not complete at the time of this engagement and assuch, we were unable to review the results of the audit.5.Intercollegiate Athletics Department management prepared and provided to us asummary of revenues and expenses for or on behalf of the university’s intercollegiateathletics programs by affiliated and outside organizations included in the Schedule.Schedule of Revenues and Expenses of Intercollegiate Athletics Programs6.Intercollegiate Athletics Department management provided to us the Schedule ofRevenues and Expenses of Intercollegiate Athletics Programs for the year endedJune 30, 2021, as prepared by the university and shown in this report. We recalculatedthe addition of the amounts in the Schedule, traced the amounts on the Schedule tomanagement’s trial balance worksheets, and agreed the amounts in management’s trialbalance worksheets to the Intercollegiate Athletics Department’s accounts in theaccounting records. Certain adjustments to the Schedule were necessary to conform toNCAA reporting guidance. We discussed the nature of adjusting journal entries withmanagement and are satisfied that the adjustments are appropriate.7.We compared each major revenue and expense account over ten percent of totalrevenues or total expenses, respectively, to prior period amounts and budget estimates.Fiscal Year 20212

Variances exceeding ten percent of prior period amounts or budget estimates areexplained below:Line ItemExplanationDirect State or OtherGovernment SupportDirect state or other government support revenueincreased by 1,443,514 due to COVID-19 relieffunding provided by the federal government andallocated to the Intercollegiate Athletics Departmentby the university.Student FeesStudent fee revenue declined by 1,920,818 or 22percent over the prior year. The decrease is mainlyattributable to a fee reduction in fall 2020 for remotestudents.Direct Institutional SupportDirect institutional support increased by 1,513,601or 106 percent since the prior year due to impactsfrom the COVID-19 pandemic including a decrease instudent fee revenue.Support Staff/AdministrativeCompensation, Benefits, andBonuses paid by the Universityand related entitiesAdministrative and support staff expenses increased 288,519 or 14 percent due to increases incompensation and a new position in fiscal year 2021.Athletic Administration Revenue:Athletics Fee (Budget)Athletics fee revenue was 779,348 or 11 percent lessthan budgeted due to a reduction in student fees as aresult of the COVID-19 pandemic.Athletic Administration Revenue:NCAA Revenue Distribution(Budget)NSU does not separately budget for NCAA revenuedistributions but includes them as part of its otherincome budget. The other income budget itemincludes an estimate for direct institutional support.With this support included, the object code exceededits budget by 496,466, or 19 percent.Fiscal Year 20213

Revenues8.We compared amounts reported in the Schedule for direct state or other governmentalsupport to state appropriations, institutional authorizations and/or other corroborativesupporting documentation, and noted them to be substantially in agreement.9.We obtained documentation of the university’s methodology for allocating student feesto intercollegiate athletics programs. We compared student fees reported in theSchedule to amounts reported in the accounting records and an expected amount basedon fee rates and enrollment. We found these amounts to be substantially in agreementwith minor differences attributed to the methodology used for projecting student feerevenue.10.We compared amounts reported in the Schedule for direct institutional support toinstitutional budget transfer documentation and/or other corroborative supportingdocumentation and noted them to be substantially in agreement.11.We compared amounts reported in the Schedule for indirect institutional support toexpense payments, cost allocation detail and other corroborative supportingdocumentation and noted them to be substantially in agreement.12.We obtained the amount of guarantee revenue from the Schedule. The amount wasdeemed to be immaterial for detailed testing.13.We obtained the amount of contribution revenue reported in the Schedule. The amountwas deemed to be immaterial for detailed testing.14.We obtained the amount of in-kind revenue reported in the Schedule. The amount wasdeemed to be immaterial for detailed testing.15.Intercollegiate Athletics Department management provided us with copies of allagreements related to participation in revenues from NCAA distributions. We inspectedthe terms of the agreements and agreed selected amounts to proper posting in theaccounting records and supporting documentation.16.We obtained the amount of program, novelty, parking, and concession sales revenuereported in the Schedule. The amount was deemed to be immaterial for detailed testing.17.Intercollegiate Athletics Department management provided us with a listing and copiesof all agreements related to participation in revenues from royalties, licensing,advertisement, and sponsorships. We inspected the terms of the agreements and agreedselected amounts to proper posting in the accounting records and supportingdocumentation.Fiscal Year 20214

18.We obtained the amount of other operating revenue reported in the Schedule. Theamount was deemed to be immaterial for detailed testing.Expenses19.Intercollegiate Athletics Department management provided us a listing of student aidrecipients during the reporting period. Since the university used the NCAA ComplianceAssistant software to prepare athletic aid detail, we selected ten percent of individualstudent-athletes across all sports and obtained the students’ account detail from theuniversity’s student information system. We agreed each student’s information to theinformation reported in the NCAA Membership Financial Reporting System. We alsoensured that the total aid amount for each sport agreed to amounts reported as financialaid in the student accounting system. We performed a check of selected students’information as reported in the NCAA Membership Financial Reporting System to ensureproper calculation of revenue distribution equivalencies.20.We obtained the amount of guarantee expense reported in the Schedule. This amountwas deemed to be immaterial for detailed testing.21.Intercollegiate Athletics Department management provided us with a listing of coaches,support staff, and administrative personnel employed and paid by the university duringthe reporting period. We selected and tested individuals, including football and men’sand women’s basketball coaches, and compared amounts paid during the fiscal year fromthe payroll accounting system to their contract or other employment agreementdocument. We found that recorded expenses equaled amounts paid as salary andbonuses and agreed with approved contracts or other documentation.22.We obtained the Intercollegiate Athletics Department’s written recruiting and teamtravel policies from Intercollegiate Athletics Department management and documentedan understanding of those policies. We compared these policies to existing university andNCAA policies and noted substantial agreement of those policies.23.We selected a sample of disbursements for team travel, sports equipment, uniforms, andsupplies, direct overhead and administrative expenses, and other operating expenses.We compared and agreed the selected operating expenses to adequate supportingdocumentation. We found all reviewed amounts to be properly approved, reasonable tointercollegiate athletics and properly recorded in the accounting records.24.We obtained the amount of athletic facility debt service expense from the Schedule. Theamount was deemed to be immaterial for detailed testing.25.We obtained an understanding of the university’s methodology for charging indirect costto the Intercollegiate Athletics Department. We evaluated indirect cost charges forreasonableness and noted proper reporting of these charges in the Schedule.Fiscal Year 20215

Other Reporting Items26.We obtained repayment schedules for all outstanding intercollegiate athletics debt duringthe reporting period. We recalculated annual maturities reported in the notes to theSchedule and agreed total annual maturities and total outstanding athletic-related debtto supporting documentation.27.We agreed total outstanding institutional debt to supporting debt schedules and theuniversity’s unaudited financial statements and general ledger, as the audited financialstatements were not yet available.28.We agreed the fair value of athletics-dedicated endowments to supportingdocumentation provided by the University and the Norfolk State University AthleticFoundation’s unaudited financial statements.29.We agreed the fair value of institutional endowments to supporting documentation andthe audited financial statements of the University’s Foundation, as applicable.Additional Procedures30.We compared the sports sponsored by the university, as reported in the NCAAMembership Financial Reporting System, to the Calculation of Revenue DistributionEquivalencies Report (CRDE) from the NCAA’s Compliance Assistant software. We notedagreement of the sports reported.31.We compared total current year grants-in-aid revenue distribution equivalencies to totalprior year reported equivalencies per the NCAA Membership Financial Report submissionand noted no variations exceeding four percent when compared to prior year.32.We obtained the university’s Sports Sponsorship and Demographics Forms Report for thereporting year. We validated that the countable sports identified by the institution metthe minimum requirements for number of contests and minimum number of participantsas defined in NCAA Bylaw 20.9.6.3 or qualified for the extraordinary blanket waiver perNCAA guidance due to the COVID-19 pandemic. We ensured that countable sports havebeen properly identified in the NCAA Membership Financial Reporting System for thepurpose of revenue distribution calculations.33.We compared the current number of sports sponsored to the prior year total reported inthe university’s NCAA Membership Financial Report submission and noted no variationswhen compared to prior year.34.We obtained a listing of student-athletes receiving Pell grant awards from the institution’sstudent information system and agreed the total value of these Pell grants to the amountFiscal Year 20216

reported in the NCAA Membership Financial Reporting System. We noted agreement ofthe amounts reported.35.We compared the total number of Pell grant awards in the current year to the numberreported in the prior year NCAA Membership Financial Report submission. We noted novariations greater than 20 grants when compared with the prior year.We were engaged by university management to perform this agreed-upon proceduresengagement and conducted our engagement in accordance with attestation standards established bythe American Institute of Certified Public Accountants. We were not engaged to and did not conduct anaudit, examination, or review engagement, the objective of which would be the expression of an opinionor conclusion, respectively, on the Schedule of Revenues and Expenses of Intercollegiate AthleticsPrograms or any of the accounts or items referred to above. Accordingly, we do not express such anopinion or conclusion. Had we performed additional procedures, other matters might have come to ourattention that would have been reported to you.We are required to be independent of the university and to meet our other ethicalresponsibilities, in accordance with the relevant ethical requirements related to our agreed-uponprocedures engagement.This report is intended solely for the information and use of Norfolk State University and itsPresident and is not intended to be and should not be used by anyone other than these specified parties.However, this report is a matter of public record and its distribution is not limited.Staci A. HenshawAUDITOR OF PUBLIC ACCOUNTSDLR/vksFiscal Year 20217

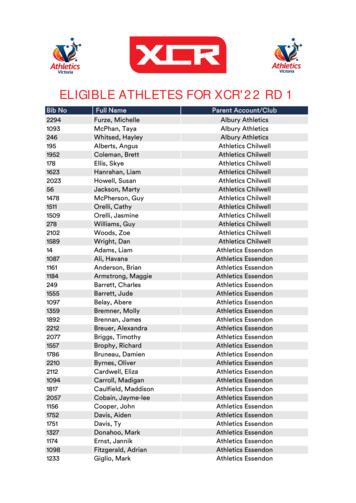

NORFOLK STATE UNIVERSITYSCHEDULE OF REVENUES AND EXPENSES OFINTERCOLLEGIATE ATHLETICS PROGRAMSFor the year ended June 30, 2021FootballOperating revenues:Direct state or other government supportStudent feesDirect institutional supportIndirect institutional supportGuaranteesContributionsIn-KindNCAA distributionsProgram, novelty, parking, and concession salesRoyalties, licensing, advertisement and sponsorshipsOther operating revenueTotal operating revenuesOperating expenses:Athletic student aidGuaranteesCoaching salaries, benefits, and bonuses paid by theuniversity and related entitiesSupport staff/administrative compensation, benefits, andbonuses paid by the University and related entitiesRecruitingTeam travelSports equipment, uniforms, and suppliesGame expensesFundraising, marketing and promotionAthletic facility debt serviceDirect overhead and administrative expensesIndirect cost paid to the institution by athleticsMedical expenses and insuranceMemberships and duesStudent-Athlete Meals (non-travel)Other operating expensesTotal operating expensesExcess (deficiency) of revenues over (under) expenses Men'sBasketballWomen'sBasketballOther Sports207,666 4711,500845,1561,332,254(812,746) 17,552 194,32627,18339,125105,333-Total1,151,404 2,000194,6144,49158,000161,667-2,959,900 (1,387,724) 66,892 353,108,883(798,672) (2,725,364) Other Reporting Items:Total athletics-related debtTotal institutional debtValue of athletics-dedicated endowmentsValue of institutional endowments- 35,339,6345,724,506 13,813,206- 1,278,34989,173,98750,00034,000,715The accompanying Notes to the Schedule of Revenues and Expenses of Intercollegiate Athletics Programs are an integral part of this Schedule.Fiscal Year 20218

NORFOLK STATE UNIVERSITYNOTES TO SCHEDULE OF REVENUES AND EXPENSES OFINTERCOLLEGIATE ATHLETICS PROGRAMSFOR THE YEAR ENDED JUNE 30, 20211.BASIS OF PRESENTATIONThe accompanying Schedule of Revenues and Expenses of Intercollegiate AthleticsPrograms have been prepared on the accrual basis of accounting. The purpose of theSchedule is to present a summary of revenues and expenses of the intercollegiateathletics programs of the university for the year ended June 30, 2021, using theaccounting methods used by the university to monitor intercollegiate athletics programactivities. The Schedule includes both those revenues and expenses for athletic programsunder the direct accounting control of the university and those on behalf of theuniversity’s athletics programs by outside organizations not under the university’saccounting control. Because the Schedule presents only a selected portion of theactivities of the university, it is not intended to and does not present either the financialposition, changes in financial position or changes in cash flows for the year then ended.Revenues and expenses directly identifiable with each category of sport presented arereported accordingly. Revenues and expenses not directly identifiable to a specific sportare reported under the category “Non-program-specific.”2.CONTRIBUTIONSThe university received 70,495 from the Athletics Foundation of Norfolk State Universitywhich was used for academic enhancement. The amounts received are included in theaccompanying Schedule as contribution revenue. The university’s athletics programreceived 58,625 in in-kind contributions from the Mid-Eastern Athletic Conference and 143,321 in other in-kind contributions recorded as in-kind revenue, and 575,009 fromsponsorships and vehicle contracts recorded as royalties, licensing, advertisement andsponsorships revenue.3.DIRECT INSTUTIONAL SUPPORTThe university provided direct funds to support the operations of intercollegiate athleticstotaling 2,935,186 during the fiscal year ending June 30, 2021. This amount includes 89,470 from Federal Work-Study and 2,845,716 from auxiliary reserves to supplementthe athletic program from excess revenues collected in prior years.Fiscal Year 20219

4.CAPITAL ASSETSCapital assets include land, buildings and other improvements, library materials, equipmentand infrastructure assets such as parking lots, sidewalks, campus lighting, and computernetwork cabling systems. The university generally defines capital assets as assets with aninitial cost of 5,000 or more and an estimated useful life in excess of one year. Such assetsare recorded at historical cost or estimated historical cost and donated capital assets arerecorded at the acquisition value at the acquisition date.Expenses for major capital assets and improvements are capitalized (construction-inprogress) as projects are constructed. Interest expense relating to construction iscapitalized net of interest income earned on resources set aside for this purpose. The costsof normal maintenance and repairs that do not add to an asset’s value or materially extendits useful life are not capitalized.Depreciation is computed using the straight-line method over the estimated useful life ofthe asset and is not allocated to the functional expense categories. Useful lives by assetcategories are listed below:BuildingsOther improvements and infrastructureEquipment30 years8-25 years2-20 yearsA summary of capital asset balances for the year ending June 30, 2021 not reflected onthe Schedule are as follows:Ending BalanceJune 30, 2021Depreciable Capital Assets:BuildingsEquipmentTotal depreciable capital assets 37,782,2365,477,55143,259,787Less accumulated depreciation for:BuildingsEquipmentTotal accumulation le capital assets, NetTotal capital assets, Net10,907,801 10,907,801Fiscal Year 202110

5.LONG-TERM DEBTAt June 30, 2021, the intercollegiate athletics program has future obligations under aninstallment purchase consisting of the current and long-term portions of obligationsresulting from a contract used to finance the acquisition of equipment. The length of thepurchase agreement is for four years and the interest rates charged are 1.57 and 2.14percent.Installments payable:Master equipment leaseprogramInterest Rates(%)MaturityFiscal Year EndBalance atJune 30, 20211.57-2.142022-20251,278,349Net installments payable1,278,349Long-term debt matures as follows:6.Year Ending2022202320242025Principal 518,771385,131248,300126,147Interest 22,57313,0396,695 1,350Total 1,278,349 43,657INDIRECT COST PAID TO THE INSTITUTION BY ATHLETICSThe university recovers from each auxiliary enterprise an amount to reimburse for thecost of administrative support. Pursuant to Section 3-4.01.3 of the Appropriations Act,the University did not recover auxiliary support costs from the intercollegiate athleticsdepartment due to significant financial impact on auxiliary enterprises caused by theCOVID-19 pandemic. The value of these indirect costs of 947,854 is reported on theSchedule of Revenues and Expenses in the line titled Indirect institutional Support inoperating revenues and the line titled Indirect Cost Paid to the Institution by Athletics inoperating expenses.Fiscal Year 202111

NORFOLK STATE UNIVERSITYAs of June 30, 2021BOARD OF VISITORSDevon H. HenryRectorMary L. BluntVice RectorKim W. BrownSecretaryHeidi W. AbbottTerri L. BestDwayne B. BlakeDeborah M. DiCroceJames W. Dyke, Jr.B. K. FultonLarry A. GriffithDelbert ParksHarold L. Watkins, IIJoan G. WilmerUNIVERSITY OFFICIALSJavaune Adams-GastonPresidentGerald E. HunterVice President for Finance and AdministrationMelody WebbAthletics DirectorFiscal Year 202112

We have performed the procedures enumerated below on the Norfolk State University's Schedule of Revenues and Expenses of Intercollegiate Athletics Programs (Schedule) for the year ended June 30, 2021. University management is responsible for the Schedule and its compliance with National Collegiate Athletic Association (NCAA) requirements.