Transcription

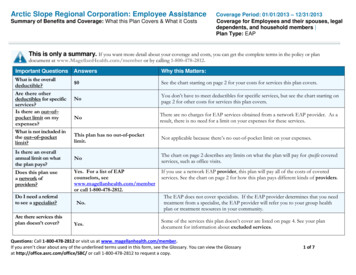

Arctic Slope Regional Corporation: Employee AssistanceSummary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage Period: 01/01/2013 – 12/31/2013Coverage for Employees and their spouses, legaldependents, and household members Plan Type: EAPThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at www.MagellanHealth.com/member or by calling 1-800-478-2812.Important QuestionsWhat is the overalldeductible?Are there otherdeductibles for specificservices?Is there an out–of–pocket limit on myexpenses?What is not included inthe out–of–pocketlimit?Is there an overallannual limit on whatthe plan pays?Does this plan usea network ofproviders?Do I need a referralto see a specialist?Are there services thisplan doesn’t cover?AnswersWhy this Matters: 0See the chart starting on page 2 for your costs for services this plan covers.NoYou don’t have to meet deductibles for specific services, but see the chart starting onpage 2 for other costs for services this plan covers.NoThere are no charges for EAP services obtained from a network EAP provider. As aresult, there is no need for a limit on your expenses for these services.This plan has no out-of-pocketlimit.Not applicable because there’s no out-of-pocket limit on your expenses.NoThe chart on page 2 describes any limits on what the plan will pay for specific coveredservices, such as office visits.Yes. For a list of EAPcounselors, seewww.magellanhealth.com/memberor call 1-800-478-2812.No.Yes.If you use a network EAP provider, this plan will pay all of the costs of coveredservices. See the chart on page 2 for how this plan pays different kinds of providers.The EAP does not cover specialists. If the EAP provider determines that you needtreatment from a specialist, the EAP provider will refer you to your group healthplan or treatment resources in your community.Some of the services this plan doesn’t cover are listed on page 4. See your plandocument for information about excluded services.Questions: Call 1-800-478-2812 or visit us at www. magellanhealth.com/member.If you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossaryat http://office.asrc.com/office/SBC/ or call 1-800-478-2812 to request a copy.1 of 7

Copayments are fixed dollar amounts (for example, 15) you pay for covered health care, usually when you receive the service.Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, ifthe plan’s allowed amount for an overnight hospital stay is 1,000, your coinsurance payment of 20% would be 200. This may change ifyou haven’t met your deductibleThe amount the plan pays for covered services is based on the allowed amount If an out-of-network provider charges more than theallowed amount you may have to pay the difference. For example, if an out-of-network hospital charges 1,500 for an overnight stay andthe allowed amount is 1,000, you may have to pay the 500 difference. (This is called balance billing.)This plan may encourage you to use network providers by charging you lower deductibles copayments and coinsuranceamounts. ., ,Primary care visit to treat an injury or illnessSpecialist visitOther practitioner office visitPreventive care/screening/immunizationYour Cost IfYou Use anIn-networkEAP ProviderNot coveredNot coveredNot covered 0Your Cost IfYou Use anOut-of-networkProviderNot coveredNot coveredNot covered 0Diagnostic test (x-ray, blood work)Imaging (CT/PET scans, MRIs)Generic drugsPreferred brand drugsNon-preferred brand drugsNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNoneNoneNoneNoneNoneMore informationabout prescriptiondrug coverage isavailable atwww.premera.comSpecialty drugsNot coveredNot coveredNoneIf you haveoutpatient surgeryFacility fee (e.g., ambulatory surgery center)Physician/surgeon feesNot coveredNot coveredNot coveredNot coveredNoneNoneCommonMedical EventServices You May NeedIf you visit a healthcare provider’s officeor clinicIf you have a testIf you need drugs totreat your illness orconditionLimitations & ExceptionsNoneNoneNoneBrief counseling, limited to six faceto-face sessions per problem, permember per year individually2 of 7

CommonMedical EventIf you needimmediate medicalattentionIf you have ahospital stayIf you have mentalhealth, behavioralhealth, or substanceabuse needsIf you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careEmergency room servicesEmergency medical transportationUrgent careFacility fee (e.g., hospital room)Physician/surgeon feeYour Cost IfYou Use anIn-networkProviderNot coveredNot coveredNot coveredNot coveredNot coveredYour Cost IfYou Use anOut-of-networkProviderNot coveredNot coveredNot coveredNot coveredNot coveredMental/Behavioral health outpatient servicesMental/Behavioral health inpatient servicesSubstance use disorder outpatient servicesSubstance use disorder inpatient servicesPrenatal and postnatal careDelivery and all inpatient servicesHome health careRehabilitation servicesHabilitation servicesSkilled nursing careDurable medical equipmentHospice serviceEye examGlassesDental check-upNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredNot coveredServices You May NeedLimitations & NoneNoneNoneNoneNoneNoneNoneNoneNoneNone3 of 7

Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) Acupuncture Dental care (adult) Long-term care Routine eye care (Adult) Bariatric surgery Emergency care whentraveling outside the US Routine foot care Chiropractic care Hearing aids Non-emergency carewhen traveling outside the U.S. Cosmetic surgery Infertility treatment Private-duty nursing Weight loss programsOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.) Financial services consultation Legal consultation Magellan self-screening system4 of 7

Your Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep healthcoverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you paywhile covered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-478-2812. You may also contact your state insurance department, theU.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of Health andHuman Services at 1-877267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. Forquestions about your rights, this notice, or assistance, you can contact: the plan at 1-800-478-2812, or the Department of Labor’s EmployeeBenefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa/healthreform.Language Access Services:Para obtener ayuda en español, llámenos al número de teléfono que se lista al final de la página.Sa pagtamo ng tulong sa Tagalog, tawagan kami sa nakalistang numero ng telepono sa bandang ilalim ng ��頁底部的電話號碼聯繫我們。to see examples of how this plan might cover costs for a sample medical situation, see the next page.Questions: Call 1-800-478-2812 or visit us at www. magellanhealth.com/member.5 of 7

Arctic Slope Regional Corporation: Employee AssistanceAbout these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from theseexamples, and the cost ofthat care will also bedifferent.See the next page forimportant information aboutthese examples.N/AHaving a babyManaging type 2 diabetes(normal delivery)(routine maintenance ofa well-controlled condition) Amount owed to providers: 7,540 Plan pays 0Patient pays This condition is not covered bythis plan, so the patient pays 100%. Amount owed to providers: 5,400 Plan pays 0Patient pays This condition is not covered bythis plan, so the patient pays 100%.Sample care costs:Hospital charges (mother)Routine obstetric careHospital charges (baby)AnesthesiaLaboratory testsPrescriptionsRadiologyVaccines, other preventiveTotalSample care costs:PrescriptionsMedical Equipment and SuppliesOffice Visits and ProceduresEducationLaboratory testsVaccines, other preventiveTotal 2,700 2,100 900 900 500 200 200 40 7,540Patient pays: This condition is not covered, sothe patient pays 100%.Deductibles Copays Coinsurance Limits or exclusions Total 2,900 1,300 700 300 100 100 5,400Patient pays: This condition is not covered, sothe patient pays 100%.Deductibles Copays Coinsurance Limits or exclusions Total 6 of 7

Arctic Slope Regional Corporation: Employee AssistanceN/AQuestions and answers about the Coverage Examples:What are some of theassumptions behind theCoverage Examples? What does a Coverage Exampleshow?Costs don’t include premiumsSample care costs are based on nationalaverages supplied by the U.S.Department of Health and HumanServices, and aren’t specific to aparticular geographic area or health plan.The patient’s condition was not anexcluded or preexisting condition.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based only ontreating the condition in the example.The patient received all care from in-networkproviders If the patient had received carefrom out-of-network providers costs wouldhave been higher.For each treatment situation, the CoverageExample helps you see how deductiblescopayments and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited.,,Does the Coverage Examplepredict my own care needs? No. Treatments shown are just examples.The care you would receive for this conditioncould be different based on your doctor’sadvice, your age, how serious your condition is,and many other factors. Can I use Coverage Examplesto compare plans? Yes. When you look at the Summary ofBenefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides. Are there other costs I shouldconsider when comparingplans? Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium the more you’ll pay in out-ofpocket costs, such as copayments,deductibles, and coinsurance Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.,Does the Coverage Examplepredict my future expenses?, No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. They arefor comparative purposes only. Your owncosts will be different depending on the careyou receive, the prices your providers charge,and the reimbursement your health planallows.,. Page 7 of 7

Arctic Slope Regional Corporation: Employee Assistance Coverage Period: 01/01/2013 - 12/31/2013 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for Employees and their spouses, legal