Transcription

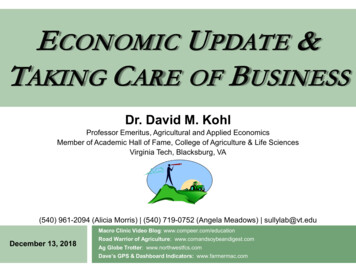

E CONOMIC U PDATE &TAKING C ARE OF B USINESSDr. David M. KohlProfessor Emeritus, Agricultural and Applied EconomicsMember of Academic Hall of Fame, College of Agriculture & Life SciencesVirginia Tech, Blacksburg, VA(540) 961-2094 (Alicia Morris) (540) 719-0752 (Angela Meadows) sullylab@vt.eduMacro Clinic Video Blog: www.compeer.com/educationDecember 13, 2018Road Warrior of Agriculture: www.cornandsoybeandigest.comAg Globe Trotter: www.northwestfcs.comDave’s GPS & Dashboard Indicators: www.farmermac.com

Radar Screen 2019-2020:“Low Beams” international trade USMCA China’s Belt & Road Initiative other slowing of the global economypost mid term electionsbaby boomer, farm land values, “the great bridge”great wall of proteinU.S. economy all time record!interest rates/dollardebt, debt, and debt- Achilles’ heel2

Oil & Energy Economics 911 tragedyU.S. is globe’s major energy producerdrive towards efficiencysolar, wind, and electric2040 Germany & Franceelectric vehicles2025- one fourth of cars in China will be electricCentral Africa will become the new Saudi ArabiaIMPACT: 80% of ag expenses are energy related3

Farm Real Estate Perspectives farm real estate appreciated or stayed level 79%of years from 1910-2017 since WWII (1941) farm real estate appreciatedor stayed level 88% of the years 1910-WWII (1940) farm real estate appreciated57% of the years farm real estate was flat or declined for 13 yearsfrom 1920-1933 farm real estate declined for four years in the1980’s4

Land Value Resilience local or regional vs. state or nationalmarginal land valuescrop insurancehedge fundslow interest ratescycle of refinancingBaby Boomer farmer5

Factors Contributing to DramaticDiscount in Land Values 100 to 200 basis point increase in long terminterest rates more conservative refinance cycle outside investors seeking alternativeinvestments supply and demand in a given area strong value of dollar, higher rates, less exportpotential crash of the U.S. or global economy6

State of U.S. Economy 110-plus months 106 & 120 months urban and coastal economies and the fly overstates central bank driven- U.S. and abroad wealth effect consumer investing consumer spendingIMPACT: killers of economic expansions7

Federal Reserve’sInterest Rate Barometer Three increases in 2019IndicatorCurrent Estimated“Flag” LevelsUnemploymentBelow 5.0% orAbove 6.0%GDP GrowthAbove 3.0% orBelow 2.0%InflationAbove 2.5% orBelow 1.0%Consumer SentimentAbove 90 orBelow 80 trends matter stock market/real estate wealth effect copper prices8

Mega Trends of Agriculture“High Beams” NGO’s technology Smithfield production Monsanto consumers/food industry others dietary trends cultured meat & non-dairy vegans consumer trends Millennials, Gen Z five year itch disconnect vendor and non-traditionalfinancing environmental positioning consumers of the future buy experiences & personalizationvs. commoditization big data9

Median Net Farm Income10

Is the New Normal the OldNormal?Time PeriodApproximateNet Farm IncomeIn Constant DollarsEra Name2013-2017 35,000Agricultural Economic Reset1996-2001 50,000Asian Tigers Boost Commodity Demand2001-2005 54,000Pre Agricultural Super Cycle2007-2012 125,000Agricultural Commodity Super CycleSource: https://finbin.umn.edu/11

Net Farm Income, 201212

Net Farm Income, 201713

Reactive & Passive Managers did not build working capital in the Super Cycle buy lifestyle pleasures with excess profits grow farm size regardless of economics such asby renting more land or purchasing land have solid production but are poor marketingmanagers have capital appreciation vs. earned net worthgain have second or third refinance14

Proactive Managers built working capital reserves in the Super Cycle know cost of production & execute marketingplan understand parameters of financialleverage/working capital have modest living costs/dividends are innovative & adaptive balance production, marketing, finance &operating efficiency15

Why Some Businesses Are MoreProfitable Than Others These businesses are a “little” better at: productionmarketingcost controlasset and capital efficiency utilize the 5% Rule16

Business IQ: Management FactorsProgressive BusinessesCustomer ChecklistGreen (3-4 points*)Yellow (2 points)Red (1 point)1.Knows cost of productionWrittenIn headNo idea2.Knows cost of production by enterpriseWrittenIn headNo idea3.Goals- business, family & personalWrittenIn headNo idea4.Record keeping systemAccrualSchedule F (one & done)No idea5.Projected cash flowWrittenIn headNo idea6.Sensitivity analysisWrittenIn headNo idea7.Understand financial ratios, break evensWrittenIn headNo idea8.Work with advisory team and lenderYesSometimesNever9.Marketing plan written and executedYesSometimesNever10.Risk management plan executedYesSometimesNever11.Modest lifestyle habits, family living budgetYesSometimesNon existent12.Written plan for improvement executedYesSometimesNon existent13.Transition plan/Business Owner planYesWorking on planNon existent/controversy14.Educational seminars/coursesYesSometimesNever a Points: Progressive Business may receive 4points for #2,6,7,8,14 Struggling Business attemptingturnaround may receive 4 points for#3,5,8,11,12ScoreOverall Analysis35-50Strong management rating & viability20-34Moderate risk & viability; will most likely show previous refinancing 20High risk & lack of long term viability

Critical Financial Performance Indexfor Debt & t/Asset RatioTotal Farm LiabilitiesTotal Farm Assets 70%40-70% 40%Term Debt/EBITDATotal Term Debt (non-operating)EBITDA¹ 6:13:1-6:1 3:1WorkingCapital/ExpensesCurrent Assets - Current Liabilities 10%10-33% 33%OperatingExpenses/RevenueOperating Expenses²Total Farm Revenue 85%75-85% 75%Coverage Ratio(Net Farm Income Interest Depreciation Total Non-FarmIncome – Income Tax ExpensesFamily Living Withdrawals) /Total Annual Principal & InterestPayments on Term Debts &Capital Leases 110%110-150% 150%Total Farm Expenses¹ EBITDA Net Farm Income Interest Depreciation² Operating Expenses Excluding Interest and DepreciationCustomer3 YearAverage18

Habits of Successful Businesses 1 goal focused & balanced business family personal core values focused on five to seven key words that means success invest in productive assets land machinery & equipment livestock people modest family living withdrawals from the business develop and monitor income statements and cash flows monthly quarterly19

Habits of Successful Businesses 2 understand macro economics- how it creates opportunities and challengesand complete scenario analysis for: production price cost interest rates follow the management principle of better before bigger 5% rule 60-30-10 rule of profitability and positive economic cycles interdependent vs. independent – know the value of people best crop you will ever raise children grandchildren aspiring agriculturalists20

Staying Positive in the DownCycle network of people self worth net wortholder – mentor and wisdomeducation and developmenttake a look at yourself exercise hear the silence giving back sweat the small stuff position for small accomplishments21

Four “P’s” of Success Purpose: working toward your passion Picture: mapping where you want to go Planning: written business plan & mentalimage detailing your strategy and tactics Partnering: the people you will engage andalign with to accomplish the plan22

Ag Globe Trotter: www.northwestfcs.com. Dave's GPS & Dashboard Indicators: www.farmermac.com. Dr. David M. Kohl. Professor Emeritus, Agricultural and Applied Economics. Member of Academic Hall of Fame, College of Agriculture & Life Sciences. Virginia Tech, Blacksburg, VA (540) 961-2094 (Alicia Morris) (540) 719- 0752 (Angela Meadows .