Transcription

WHITE PAPERAcquire With Retentionin MindIdentify the right prospects at the outset togrow profitably.APRIL 2018

ACQUIRE WITH RETENTION IN MINDTable of ContentsExecutive Summary. 02A Common Problem—Capturing and Keeping the Right Customers. 03What Carriers are Doing and Why it Does Not Always Work. 04Indicators That Can Point You to the Right Prospects. 05Identity Verification. 06Analytical Models. 07Real-time Lead Assessment. 09Identify and Attract the Right Prospects. 10Conclusion. 11

ACQUIRE WITH RETENTION IN MINDExecutive SummaryThe U.S. insurance marketplace continues to be highly competitive. As carriers vie foran increased share of the market, the pressure to implement effective acquisition andretention efforts escalates—and with good reason. Policyholder attrition can significantlyaffect carrier profitability.When policyholders switch companies after only being on the books for a short period oftime, carriers scramble to recoup their original acquisition cost. Industry-wide researchcarried out by LexisNexis Risk Solutions confirmed that carriers are well aware of the impactof eroding retention rates. It’s much more profitable to retain and defend existing clientsthan to acquire new ones. In fact, the research suggests it can take as many as seven newpolicies to cover the value of one tenured policy.Acquiring with retention in mind is the solution to fortifying retention rates and avoidingunnecessary policyholder churn that can eat away at profits. But, how can carriersaccomplish this? By gleaning and applying key insights and intelligence that lead toidentifying—and keeping—the right prospects, carriers can eliminate unnecessaryacquisition costs and create a more stable and profitable book of business.Acquire with Retention in Mind2

ACQUIRE WITH RETENTION IN MINDA Common Problem—Capturing and Keeping theRight CustomersIn today’s highly competitive insurance marketplace, carriers in every line of business are faced withthe ongoing problem of attracting and retaining the right customers. These days, customers havemore choices than ever before, and it’s not unusual for them to switch carriers several times in theirlifetime—a behavior that can seriously erode profitability.US Insurance Industry Trends – Quarterly Retention RatesEVEN SMALLPERCENTAGECHANGES INRETENTION CANHAVE A rce: LexisNexis Proprietary Data)Not only do carriers lose profits when they lose revenue from policyholders who change carriers, but theexpense of acquiring new customers can represent a big hit to the bottom line. It is much more costly tocapture a new customer than it is to keep an existing one. Carriers are continually challenged to developcampaigns and programs that are effective at identifying, attracting and retaining the right customersfor their business—customers that represent a higher lifetime value.Acquire with Retention in Mind – Identify andattract prospects who are more likely to belonger-term customers with high lifetime value and aremore likely to be retained.Acquire with Retention in Mind3

ACQUIRE WITH RETENTION IN MINDWhat Carriers are Doing and Why it Does NotAlways WorkCarriers address this challenge in a number ofways, ranging from rudimentary lead vettingthrough the home office to employing highlysophisticated predictive models. Some carriersleverage third-party data to supplement in-houseinformation and use that data to aid in targetingand segmentation. Then there are carriers thatsolely rely on their agents to determine leadprioritization and routing.Whatever the methodology, there are inherentproblems. For example, third party data maynot be insurance-specific, and so it lacks thenecessary relevance and detail that insurancecarriers need to really gain an edge on thecompetition. Agents may employ a variety ofmethods to determine lead value. Some may relyon their intuition, experience or in-house modelsto determine lead potential. It could result inagents overlooking, under-servicing or failing toconvert high value leads. Conversely, low valueleads could be over-serviced or prioritized andshould they convert into customers, may lapse atthe first renewal.In the era of Big Data, when a plethora ofinformation about customers and prospectsis literally at a carrier’s fingertips, identificationand evaluation can seem so difficult.However, in carriers’ defense, identifying,attracting and retaining quality policyholdersis a justifiable challenge that exists across theindustry. Because of our unique insight intothe insurance market and advanced analyticcapabilities, LexisNexis Risk Solutions hasestablished that the road to acquiring withretention in mind is sign posted. We haveidentified three key indicators that can helpcarriers predict who is a good and potentiallong-term customer and who is not. Focus onthose indicators, and watch your acquisition andretention efforts pay off.Acquire with Retention in Mind4

ACQUIRE WITH RETENTION IN MINDIndicators That Can Point You to the Right ProspectsThe critical factor in effective acquisition and retention efforts is engaging highly predictive, insurancespecific intelligence at the point of prospecting. Doing so allows you to more accurately determine aprospect’s retention potential. LexisNexis Risk Solutions has identified the following three key indicatorsthat measure this potential:1Identityverification2Analytical models thatpredict potential riskand attrition3Real-time leadassessment andevaluationAcquire with Retention in Mind5

ACQUIRE WITH RETENTION IN MINDIdentity verification affirms the integrity of the prospect’sidentity-related data.More complete and accurate identities are indicative of higher-scoring prospects who are more likelyto convert and remain with the company as long-term policyholders. Identity verification confirms thefollowing criteria:1Is the prospect anactual person?Is the prospect anexisting customer?Are all the contact pointsfactual and reliable?Acquire with Retention in Mind6

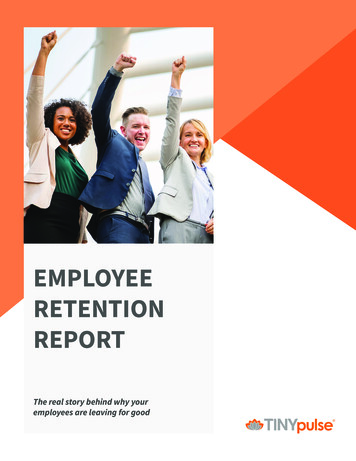

ACQUIRE WITH RETENTION IN MINDAdvanced analytical models that predict risk and thelikelihood of attrition have proven to be highly predictivein terms of identifying prospects who are more likely to beretained beyond the first renewal period.Insurance-specific analytic models are proprietary models based on demographic data such as gender,home ownership, length of residence and the number of moves in recent years, combined with financialdata such as wealth, income, bankruptcy and number of open trades.2Attrition Score Quintiles for Life PoliciesPolicies identified as high risk were 3X more likely to lapse than low risk policies35%30%25%20%3X MORELIKELYTO LAPSE15%10%5%0%1Low Attrition Risk2345High Attrition Risk(Source: LexisNexis Proprietary Data)Acquire with Retention in Mind7

ACQUIRE WITH RETENTION IN MINDFirst Term Attrition Score for Auto Policies18%identified as low risk were more likely to be retained beyond the first renewal periodPolicies16%14%12%10%8%6%4%2%0%1Lowest Risk2345678910Highest Risk(Source: LexisNexis Proprietary Data)Auto Risk Score is highly predictive of claims loss1Lowest Risk23(Source: LexisNexis Proprietary Data)45678910Highest RiskAlmost 50% claims lossdeciles 8-10Acquire with Retention in Mind8

ACQUIRE WITH RETENTION IN MINDReal-time lead assessment and evaluation provides awindow into a prospect’s policy-related behavior inreal time.The immediate identification of a high-scoring lead enables a carrier to prioritize and route the leadaccordingly. The result is a higher degree of customer satisfaction from the outset, which can translateinto long-term customer rceLeadSourceLeadSourceFraudulent leadsDuplicate leadsExisting customersGood leadsOptimize lead sourcesOptimize scoringTrack quotes and conversionsAcquire with Retention in Mind9

ACQUIRE WITH RETENTION IN MINDIdentify and Attract the Right ProspectsLexisNexis Risk Solutions offers a suite ofacquisition and retention solutions built aroundthese three key principles: Identity verification A nalytical models that predict potential riskand attrition Real-time lead assessment and evaluationThese principles enable carriers to identify,attract and retain the most valuable policyholdersthrough compelling, data-driven marketingprograms.Insurance-specific and advanced analyticalmodels enable insurance marketers to makemore informed, data-driven decisions that alignwith market opportunities and organizationalrisk appetite: Having insight of an individual’s risk profile canhelp identify and eliminate prospects who donot align with carriers’ risk appetite so youcan focus your marketing efforts and resourceson those prospects who do align with yourrisk profile. Insight of the relative ranking of an individual’sattrition profile for the relevant line of businesscan be a powerful predictor of a prospect’slikelihood of being retained beyond the initialrenewal period.Lead evaluation and assessment tools, whichassess and score insurance leads in real-timebased on the propensity for prospects torequest a quote and purchase insurance, canprove indispensable for the well-informedinsurance marketer.Lead evaluation and assessment tools, which assessand score insurance leads in real-time based on thepropensity for prospects to request a quote andpurchase insurance, can prove indispensable for thewell-informed insurance marketer.Acquire with Retention in Mind10

ACQUIRE WITH RETENTION IN MINDConclusion: The Right Data and Robust Analytics CanMake the DifferenceCurrent market conditions continue to bechallenging. While insurance shopping rates havestabilized, recent LexisNexis Risk Solutions datareveals that the percentage of policyholders thathave not shopped their auto insurance in thelast five years has fallen to just one in four. Theproliferation of channels and the ease with whichconsumers can comparison shop puts pressureon retention rates. On average, nearly one thirdof policyholders will switch before the end of thefirst term, well in advance of a carrier’s abilityto recoup the acquisition cost.1 Meanwhile, lifeinsurance carriers are confronted with challengesunique to their market. The Insurance BarometerStudy, jointly conducted by the Life Insurance andMarket Research Association and Life Happens,tracks the perceptions and attitudes of USconsumers in regard to life insurance.Highlights of the 2017 study included a call fromconsumers for easy-to-understand products(83%) and a ‘faster sign-up process’ (51%). Manyconsumers overestimate the cost of life insurance,which leads to insufficient coverage. While 85%of respondents agree that most people need lifeinsurance, the reality is much fewer, only 59%have coverage.Acquisition with retention in mind is a criticalbusiness imperative. LexisNexis Risk Solutionsendorses a longer-term, qualitative approachat the point of marketing. This philosophy,incorporating the right data and robust analytics,complementary to the insurance-specificapproach at the point of underwriting, can deliverimproved business outcomes for the organization.1. Source: 2018 LexisNexis Proprietary DataAcquire with Retention in Mind11

Sandeep KharidhiVP Product Management, Acquisition & Retention SolutionsSandeep Kharidhi leads Product Management for Acquisition and Retention products atLexisNexis Risk Solutions. In this role, he is responsible for managing solutions that enableinsurance carriers to acquire new customers and retain and grow existing policy holderrelationships. Previously, Kharidhi served in executive roles for over 18 years with several firmsincluding ChoicePoint, Acxiom, Merkle and Harland Clarke. Kharidhi’s expertise is in marketingstrategies, analytics, campaign attribution and optimization. He is a frequent speaker at industryconferences and has previously been a member of several trade groups. Kharidhi completedhis graduate studies at the University of North Carolina in Charlotte with a master’s degreein Computer Science with a focus on data mining and artificial intelligence. Kharidhi activelyvolunteers in the local community and is a board member of The Empty Stocking Fund.For more information, call 877.719.8805, or emailinsurance.sales@lexisnexisrisk.comAbout LexisNexis Risk SolutionsLexisNexis Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmentalentities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide rangeof industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have officesthroughout the world and are part of RELX Group (LSE: REL/NYSE: RELX), a global provider of information and analytics for professionaland business customers across industries. RELX is a FTSE 100 company and is based in London. For more information, please visitwww.risk.lexisnexis.com, and www.relx.com.LexisNexis and the Knowledge Burst logo are registered trademarks of RELX Inc. Other products and services may be trademarks or registered trademarks of theirrespective companies. Copyright 2018 LexisNexis. NXR12304-00-0418-EN-US

For more information, call 877.719.8805, or email insurance.sales@lexisnexisrisk.com About LexisNexis Risk Solutions LexisNexis Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe.