Transcription

1

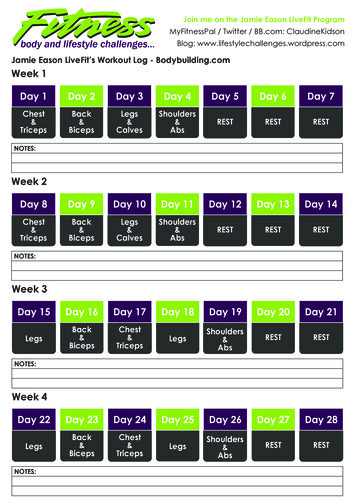

tv reaches27,205,000Canadians every dayweekly reach89%adults (18 )Total Canada Fall-Win-Spr 2020-202178%adults (18-34)80%kids (2-11)2

11587%million hoursCanadians 2 time spentwith tv yesterdaytv’s weeklyreachTotal Canada Fall-Win-Spr 2020-20213

the averagecampaign delivers337million impressions4

tv is powerful because it delivers:reachdemandimpactefficiency5

reach32.6 million Canadians every week

“Marketing activities onlybuild mental availability inthe audience they reach.This makes planning forreach the foundation of anysound media strategy.”Byron SharpAuthor of How Brands Grow7

reaches 87% of Canadians 2 every week8996adults 18 78adults 18-34weekly reachTotal Canada Fall-Win-Spr 2020-2021918089kids 2-11monthly reach8

reaches 75% of Canadian adults dailyADULTS 18 90803583753070246024DAILY REACH%AVERAGE WEEKLY HOURS64252050144035153017201010TVTotal Canada Fall-Win-Spr 2020-202110InternetRadioNewspapers50.30Magazine9

10.5 million Canadian HH’s have a paid TV subscriptionCord cutting has been far overstated: total subs are down less than 1%.The notion that “no millennials subscribe to TV” is also false: 57% of 18-34 year olds subscribe to TV, and they’re alsoaccessing linear TV out-of-home and via streaming (which is how TV is able to reach 78% of A18-34 on a weekly basis).Jan ‘20Total SubscribersBasic/Digital Cable10,548,341 10,483,4365,634,299IndexTV 23,95399.4OtherTotal CanadaJan ‘212021Basic/Digital Cable30%53%DTHTelco/IPTV17%10

Canadians watch a lot of tvAV E R A G E W E E K LY H O U R SADULTS 18 23.7*5.11.7Total okTwitter* Total TV viewing to broadcaster linear TV plus any broadcaster content that is live streamed onother platforms with the linear commercial load intact. Does not include streaming to OTT services.Total Canada Fall-Win-Spr 2020-202111

Canadians watch a lot of tvAV E R A G E W E E K LY H O U R SADULTS 25-54ADULTS 18-3414.5*10.07.26.52.00.70.1Total TV YouTube Facebook Instagram Snapchat0.60.2TikTokTwitter1.41.30.4Total TV YouTube Facebook Instagram Snapchat1.1TikTok0.2Twitter* Total TV viewing to broadcaster linear TV plus any broadcaster content that is live streamed onother platforms with the linear commercial load intact. Does not include streaming to OTT services.Total Canada Fall-Win-Spr 2020-202112

87% of linear tv viewing is liveeven among young adults, 87% of TV viewing is live; 93% is live same day playbackLive TV vs PlaybackT O TA L C A N A D A(% of Total TV Viewing)Live87 Individuals 2 PB Same Day633PB 1 Day87A18-34PB 2-7 Days643* TV viewing to broadcaster linear TV plus any broadcaster content that is live streamed on otherplatforms with the linear commercial load intact. Does not include streaming to OTT services.Source: Numeris PPM, Total Canada, Total TV, All Locations, M-Su 2a-2a, Sept 14, 2020 to May 30, 2021. PB Playback13

“You must have TV inyour consideration set TV continues torepresent a significantmajority slice of video formost demographics.”Mark RitsonMarketing & Branding Expert, Columnist, Consultant and Professor14

impacttv ads are most influential

“Before you canhave a share of themarket, you musthave a share of themind.”16

when it comes to exposure and attention,is kingEach medium delivers some combination of reach (exposure) and consumer attention.TV delivers the highest exposure through its mass reach AND it captures the greatest consumer attention.exposure (reach)Source: Optimizing vs. Minimizing Media17

Canadians pay most attention to ads onQ. Which one of the following media carries video advertising that best captures your attention?51%24%TVOnline Video20%Social Media*Don’t know 4%Total Canada Feb 2020, Adults 18 , TV TV in all its forms; Live, On Demand, Online Attention in Advertising18

ads are the most influentialQ. Which one of the following media carries video advertising that you believe to be the most influential?50%27%18%TVSocial MediaOnline Video*Don’t know 5%Total Canada Feb 2020, Adults 18 , TV TV in all its forms; Live, On Demand, Online Attention in Advertising19

TVis also the most trusted mediumQ. Which one of the following media carries video advertising that you believe to be most trustworthy? Least trustworthy?Least TrustworthyMost Trustworthy70%11%TV12%21%Online Video8%60%Don’t know 7% / Refused 1%Social MediaTotal Canada Feb 2020, Adults 18 , TV TV in all its forms; Live, On Demand, Online Attention in AdvertisingDon’t know 9% / Refused 2%20

is most trusted across all demosQ. Which one of the following media carries video advertising that you believe to be most trustworthy?MOST TRUSTWORTHY70%60%TV12%20%Online Video8%Social Media12%Don’t know/ Refused 18 11% / 18-34 9%Total Canada Feb 2020, TV TV in all its forms; Live, On Demand, Online Attention in AdvertisingAdults 18 Adults 18-34

TV advertising has significant impactQ: In which of the following media are you most likely to find advertising that ?TVDraws your attentionto a product/brandyou hadn't heard ofSticks in your memoryMakes brands/productsmore recognizable%5149%38%9%12%17%Social Media(second highest)22Source: Ad Nation Canada, Ipsos, Fall 2020

TV advertising is the most likely to generateemotion and conversationQ: In which of the following media are you most likely to find advertising that ?TVMakes you laughYou likeMakes you feel emotionalYou talk about it,face to face orover the phone%49%4742%31%13%12%10%14%Social Media(second highest)23Source: Ad Nation Canada, Ipsos, Fall 2020

T ads deliver the biggest impactthe adstock of a TV spot grows the fastest and lasts the longestTV ad stock grows as brandstays in marketGRPsTVPRINTEffect of TVcontinues thelongest44%8%RADIODIGITALEffect of Digital andPrint diminishesafter 2 weeks6%Source: GroupM; “Report: Target the (Whole) Market”24

digital companies knowworks!TV spend by internet-related products & services* is up over 2.7x since 2015YEAR-OVER-YEAR % INCREASETV SPEND BY INTERNET BUSINESSES 28% 37% 17%20152016 30%201720182019Companieslike:*full list available here:Source: Total Canada/Annual/Numerator Canada Full Report Here25

FAANG’sspend continues to growT V s p e n d b y t h e FA A N G c o m p a n i e s h a s d o u b l e d i n 4 y e a r sYEAR-OVER-YEAR % INCREASETV SPENDING-1.5%2015Source: Total Canada/Annual/Numerator Canada Full Report Here2016 21%2017 30% 32% 29%2018201926

online retailer Wayfair usedbusiness to the next levelto drive theirWayfair brand is only a little“ Theover six years old and we’ve beenable to build it as a householdbrand very quickly over just thelast few years. Without usingtelevision, I don’t think we wouldbe where we are today. ”- Niraj Shah, Co-Founder & CEO Wayfair27

demand creationtv ads drive consumer action

TV works throughout the funnelTV is your best store-front windowTop of the Funnel AwarenessBrand buildingInterest / purchase intentBottom of the Funnel Activation via sales promotions messagesTV ads drive website visitsThanks to digital, you can literally buy online while watching the TV commercialSource: ew/How Consumers Buy Brands The new decision journey/29

drives the growth of both established andemerging companies36 ‘Emerging’ DTC Brands*Average Monthly Website Unique Visitors (000)Based Over a Four-Year Time Period: Jan ‘16 – Jan ‘20The VAB tracked 36emerging DTC brands in theUS and found monthlyunique visitors saw animmediate surge upon thelaunch of a TV campaign,and this audience continuedto grow through theduration of these brands’ TVflight. 85% 56%3,4242,9001,853Prior to TV Launch(monthly average)TV Launch MonthMonthly Average(TV launch – January 2020)Source: VAB analysis of Nielsen Ad Intel data, TV spend (national cable TV, national broadcast TV, Spanish language broadcast TV, Spanish language cable TV, spot TV, syndication TV), Feb ‘18 – Jan ‘20 (calendar months). VABanalysis of Comscore mediametrix multiplatform media trend data, total audience (Desktop P2 , Mobile 18 ), Jan ‘16 – Jan ‘20 (calendar months). ‘Prior to TV Launch’ reflects the average monthly unique visitors based on wheneach brand’s website began being measured by Comscore or starting from January 2016 if measurement began before that month. *Reflects the 36 brands that are measured in Comscore and had reported monthly unique visitors inThis information is exclusively provided to VAB members and qualified marketers. Further distribution is prohibited.at least onePAGEmonth 30prior to their campaign launch.

drives the growth of both established andemerging companiesMonthly Website Unique Visitors (000) ComparisonBased Over a Four-Year Time Period: Jan ‘16 – Jan ‘20monthly unique website visitorsquickly skyrocketed for these‘emerging’ new TV advertisersPrior to TV LaunchSource: VAB analysis of Nielsen Ad Intel data, TV spend (national cable TV, national broadcast TV, Spanish language broadcast TV, Spanish language cable TV, spot TV, syndication TV), Feb ‘18 – Jan ‘20 (calendar months).VAB analysis of Comscore mediametrix multiplatform media trend data, total audience (Desktop P2 , Mobile 18 ), Jan ‘16 – Jan ‘20 (calendar months). ‘Prior to TV Launch’ reflects the average monthly unique visitors based onwhen each brand’s website began being measured by Comscore or starting from January 2016 if measurement began before that month.TV Launch - Jan '20

attention drives demand

36

In an Average Ad Second, TV Commands MoreAttentionTV commands 2x as much active watching as YouTube and 14x that of Facebook, highlighting one ofthe key reasons for its ability to have the most impact on salesActive Avoidance2%2%32%Passive Watching40%94%37%Active Watching58%4%31%

38

Key Takeaways Attention and sales are strongly correlated TV commands 2x as much active attention as YouTube and 14x that ofFacebook With the same creative executions tested, TV generates a greater salesimpact Sponsorship in quality programming improves attention and sales All broadcast content has a greater sales impact than other platforms TV screen coverage is about 3x Youtube and 10x Facebook Inventory playing full screen will have a greater sales impact than adsplaying on a smaller proportion of the screen

efficiencyTV is the most efficient channel driving the highest ROI

43

TV HAS THE HIGHEST ROI OF ALL MEDIAATTRIBUTED SALES ROI BY MEDIA CHANNEL (OVER 12 MONTH PERIOD)-2% 14.34-15%-19%-16% 12.71 11.79 13.52 11.45 9.99 13% 6.95OverallMediaSpend:TVDisplay & OtherPaid SearchPaid SocialSFVCOther Media42%18%14%6%2%18%44Source: Canadian Media Attribution Study

4-YR ROI OF MULTIPLATFORM TV IS 77% HIGHERTHAN THE AVERAGE OF ALL OTHER CHANNELSLE GE N D% Change fromST ROI to Total ROI 23.40 25Left Within year oneRight Total ROI 20.21 2063% 1520% 14.34 15.2014% 12.71 10 13.10 11.45 14.3243%49% 13.5237% 9.99 9.49 6.95 5 0Multiplatform TV% of MediaSpending:Display & Other42%Source: Peak Performance: Driving Advertising Effectiveness That Lasts18%SearchSocial14%SFVC6%Other Media2%18%

TV HAS A SIGNIFICANT HALO EFFECT ON DIGITALMEDIA, INCREASING ITS SALES ROI BY 19%Standalone Digital ROILinear TV’s Adjusted ROILinear TV’s HaloOn Digital Advertising-19%Without Linear TV’s halo,digital advertising’s averageROI would decline by 19%Source: Canadian Media Attribution StudyImpact of Linear TVadvertising on Digitalwithin integratedadvertising campaigns 23%Linear TV’s average ROIis understated by 23%

TV REPRESENTS 42% OF SPEND, BUT 57% OF THESALES CONTRIBUTION FROM MEDIAContribution (%) asa proportion ofTotal Sales:17 / 29 57% of the sales contributionfrom all media spend29%17%10%2%Total Net ROI ( ): 16.69 23.40 14.56 9.49All Media ChannelsMultiplatform TVDigital MediaOther Media% of MediaSpending:Source: Peak Performance: Driving Advertising Effectiveness That Lasts42%40%18%

MULTIPLATFORM TV HAS THE LONGEST-LASTINGSALES IMPACT AT 40 MONTHS06120 – 50% RealizationMultiplatform TV189Other Media410Search41064248262423121824Months (Up to 4 years)Source: Peak Performance: Driving Advertising Effectiveness That Lasts483011Display & Other422813503640126SFVC3081 – 98% Realization215Social2451 – 80% Realization3036

“As a company that sells to2 billion plus consumers a day onan annualised basis, we look atTV to provide levels of reach.[TV’s] high levels of reach makeit very cost effective.Richard BrookeGlobal Media Operation Director, Unilever49

in conclusionTV’s winning formula is hard to beat

’s list of great attributes100% viewableRobust measurementFull screenBrand safeSound onShared viewingViewed by humansHigh quality programming51

’s winning formula1TV dominates time spent with media2TV ads produce the biggest impact3TV improves the performance of online advertising4TV works @ both ends of the funnel5TV delivers the strongest ROI of all media52

in case you missed itcheck out these additional research reportsthe 10 key factors driving advertisingeffectivenessad nationIpsos CanadaPeak Performance: AdvertisingEffectiveness that LastsWhat has Mark Ritson, the outspoken marketingconsultant and industry pundit, learned from his reviewof 50 years of Effie winners? In this highly engaging andinformative talk, Mark outlines the 10 key factors thatdrive advertising effectiveness.This new research, conducted by Ipsos andcommissioned by thinktv, identifies how the mediahabits of the advertising and media communities differfrom the rest of Canada, and how those differencesimpact our assumptions of general media usage.Accenture assessed 700M of media spend in Canada,covering 105 brands across four verticals. The researchclearly outlines the ways different advertising channelsimpact sales, what that impact is in the short and longterm, and how TV and digital work together.learn more »learn more »learn more »effectiveness in contexttarget the (whole) marketonline businesses on tvPeter Field’s latest report explores the damage beingdone as companies increasingly cut long-term brandinvestment in favour of short-term sales activation, andhighlights how the “60/40 rule” changes depending onthe context.Byron Sharp famously challenged a number oftraditionally held beliefs in his ground-breaking book'How Brands Grow'. We commissioned MediaComBusiness Science to examine Sharp's best practices andhow they apply in Canada.Digital companies continue to invest heavily in TVadvertising. TV spend by internet-related companies isup 30% from last year.learn more »learn more »learn more »learn more »53

reach us @info@thinktv.ca@thinktvcathinktv.ca

SourcesSlides 2, 3, 6, 8: Numeris, PPM, Total Canada, Consolidated, All Locations, Mo-Su 2a-2a, Sept 14, 2020 to May 30, 2021Slide 4:TV campaign based on a 900 GRP campaign (6 weeks x150 GRPs), Sept 14, 2020 to May 30, 2021, Total Canada, Ind. 2 , Numeris 2020-21 pop est.Slide 9:Television: Numeris PPM, Total Canada, Total TV, Consolidated, All Locations, A18 , M-Su 2a-2a, Sept 14, 2020 to May 30, 2021Internet (Daily Reach), Radio, Daily Newspaper, Magazine: Numeris RTS, Canada, Spring 2021Internet (Weekly Hours): comScore Media Metrix; Multi-Platform; Sept 2020 to April 2021(Note: Numeris pop est. used to calculate average weekly hours per capita).Slide 10:Mediastats, Total Canada, Jan 2020, Jan 2021, BDU Profile Report, CTAM 2020Slide 11-12:Television: Numeris, PPM, Total Canada, Consolidated, All Locations, Mo-Su 2a-2a, Sept 14, 2020 to May 30, 2021 Facebook.com, Instagram.com, Twitter.com,Snapchat, Inc.: Comscore Media Metrix Multi-Platform, Canada, Sept 2020 to Apr 2021 YouTube: comScore Video Metrix MultiPlatform, Canada, Sept 2020 to Apr2021 (Note: Numeris population estimates used to calculate average weekly hours per capita for digital media)Slide 13:Numeris, PPM, Total Canada, Total TV, All Locations, M-Su 2a-2a, Sept 14, 2020 to May 30, 2021. PB PlaybackSlide 14:Mark Ritson on COVID, advertising during a recession, and the impact of TV, webinar, 2020Slide 17:Ipsos Media TIPs Study, Optimizing vs Minimizing Media August 2018Slides 18-21 :thinktv, nlogic, omniVu, National, Feb 2020 (Don’t Know/Refuse not included): Attention in AdvertisingSlides 22-23:Ipsos Ad Nation 2020Slide 24:GroupM Canada, 2016; Marketing Mix models across Consumer Electronics, Retail, Finance, Auto and CPG; Target the (Whole) MarketSlide 25,26:Numerator, Canada, Internet Related Sites and Services Category. Online Businesses on TV. For full list of companies contact thinktv.Slide 30,31:VAB: Direct Effect – Driving Intent for Emerging DTC Brands, 2020Slide 33-41:Karen Nelson-Field, More Proof of the Value of Attention, 2020; Karen Nelson-Field, Visibility: The Attribute That Really MattersSlide 43-48:Accenture, Peak Performance: Driving Advertising Effectiveness That Lasts, 2020; The Moneyball Moment for Marketing in Canada, 2019

Satellite: 1,933,180. 1,786,392: 92.4. Telco/IPTV . (SellOffVacations) Tangerine Mobile Banking SVCS TD Canada Trust MySpend App TD Mobile App Telus Smart Home Security Monitoring SVCS Uber Untuckit Shirts Videotron Club Illico UnLtd Movies & . Mobile 18 ), Jan '16 - Jan '20 (calendar months). 'Prior to TV Launch .

![Welcome [dashdiet.me]](/img/17/30-day-weight-loss-journal.jpg)