Transcription

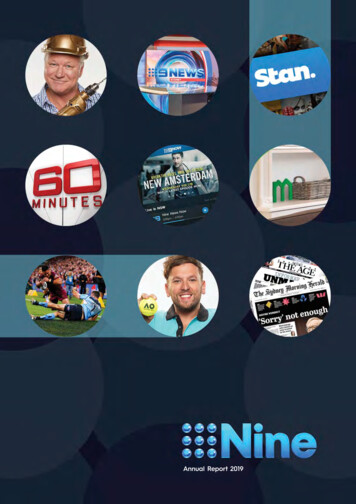

Annual Report 2019

OVERVIEWDuring FY19, Nine completed the merger with Fairfax Media, creating Australia’s leading integrated media business. Ninetoday has a clearly diversified earnings base, with four key operational pillars — Broadcasting, Digital and Publishing, Stanas well as a 59% stake in Domain. These businesses are all at different stages of their evolution, and are all scale businessesin their own right. In FY19, on a Pro Forma basis, the traditional Broadcasting business contributed just over half of Grouprevenue, down from 84% in FY18, marking a real change in the drivers of Nine for the future.Result in briefIn FY19, Nine reported Group EBITDA of 350 million, up 36% on FY18, driven by a 40% increase in Group Revenues to 1.8 billion, reflecting the impact of the merger with Fairfax from 7 December. On a continuing business basis, Statutory NetProfit after Tax and Specific Items, which were predominately accounting led non-cash items, was 217 million, up 3%.On a Pro Forma basis, NEC reported Group EBITDA of 424 million, up 10% on FY18, on revenue of 2.3 billion. Net Profitafter Tax and minority interests increased by 16% to 198 million compared to the FY18 result. Earnings per share was11.6 cents, ( 16%) and a full-year dividend of 10c per share, fully franked, was declared.Revenue1 split FY1910% Pro Forma EBITDA growth driven by3009%7%-11%25020015054%30% 56%100-17%500 48%-50-100BroadcastingDigital & PublishingFY18DomainStanBroadcastingYr to June, m, continuing business basisRevenue2Group EBITDA2NPAT, before Specific Items and minorities2NPAT, before Specific Items2Statutory Net Profit After Tax, after Specific ItemsEarnings per Share, before Specific Items — centsDividend per Share — cents2 56%2 48%FY19Digital & IANCE2,341.72,364.0-1%423.8385.1 10%224.8205.9 9%198.3170.6 16%216.6209.7 3%11.610.0 16%10.09.0 11%Operating Free Cash Flow for the year, ex the cash impact of the final Warner-related Specific Item, was 269 million.Net Debt on a wholly-owned basis at 30 June 2019 was 121 million, unchanged from 12 months earlier. During the year, 170 million was returned to shareholders through dividends, 130 million cash was paid as part of the consideration forFairfax, including transaction costs, 166 million was received from the sale of non-core assets and nearly 110 million wasinvested in the business, in terms of both CapEx and acquisitions.Reported, wholly owned basis30 JUNE 201930 JUNE 2018VARIANCENet Debt, m120.7121.3 0.6mNet Leverage0.4x0.5x-0.1xInterest Cover21.8x114.5xnm1. Split on an economic share basis.2. Pro Forma — Consolidates the results of the former Nine and Fairfax for the full 12 months, including the consolidation of Stan. Resultsinclude synergies realised since the transaction was completed. Interest costs associated with the transaction are also for the periodfrom completion. Pro Forma results are presented on a Continuing Business basis, and exclude Australian Community Media andPrinting (ACM), Stuff New Zealand and Events.

RETURNINGUSING THE CORE OF BROADCASTTO POWER GROWTH BUSINESSESSTRONG CASH FLOWSAND DIVIDENDS TOSHAREHOLDERSBroadcasting andMetro Mediafocusing on theefficient delivery ofpremium contentLeading playerin a fast-growingsegment, newrevenue streamsfrom existingcontent spendGrown brandto 1.7m-plussubscribers in4 years in a newmarket segmentLeveragingNine’s reachto grow yieldand geographicshareStrong cash flow conversionCHAIRMAN’S ADDRESSBUILDINGINVESTING IN THE PREMIUMCONTENT THAT DRIVESPROFITABILITYOPERATIONAL HIGHLIGHTSTRANSFORMINGCOMPANY OVERVIEWCreate Great ContentDistribute it BroadlyEngage Audiencesand Advertisers10 fully franked dividendin FY19, equatesto a yield of 5%CEO’S ADDRESSChairman’s AddressChief Executive Officer’s AddressOperational ReviewCorporate ResponsibilityNine CaresBoard of DirectorsFinancial ReportDirectors’ Report2461820222425Auditor’s Independence DeclarationRemuneration ReportOperating and Financial ReviewFinancial StatementsDirectors’ DeclarationIndependent Auditor’s ReportShareholder InformationCorporate Directory31325359121122129ibcN I N E A N N UA L R E P O RT 2 0 1 91

OPERATIONAL HIGHLIGHTS 2019Australia’s leadingbroadcast brands,across televisionand radioOne of Australia’sleading digitalpublishers, and mostwatched commercialBVOD operatorReaches 19mReaches 14mAustralians nationallyeach weekAustralians nationallyeach monthBroadcastingDigital and Publishing#1 FTA RATINGSSHARE3%METRO MEDIAREVENUE GROWTH12 months to June 2019, 25-54s, primetime, main channel, OzTAM data#1Free To Airrevenue share12 months to June 2019, ThinkTV dataFTA costsdown 4%NEWS-TALKAUDIENCE ATMACQUARIE UP 5%GfK Mon-Sun Average Audience.All People 10 , survey 52018-survey 4 2019 vs pcpAFTER THREE YEARSOF DECLINES65%growth in MetroMedia EBITDA87%GROWTH IN EBITDAFROM 9NOW TO 36M

Australia’s leadinglocal SVOD business 1.7m-plusactive subscribersEvolving Australianproperty marketplacewith core upside fromrelationship with Nine6.9mtotal audience reachemma conducted by Ipsos,people 14 for 12 months endingMarch 2019. Nielsen DigitalContent Ratings (Monthly),people 14 March 2019StanDomain(59.2%)62%12%GROWTH INSUBSCRIPTIONREVENUELAUNCH OF 63 NEWEXCLUSIVES ACROSSTHE YEAR, SOURCEDFROM 16 DIFFERENTSTUDIOSEBITDA andcash flowbreak-evenin H2INCREASE INRESIDENTIAL YIELD,OFFSETTING WEAKNESSIN KEY PROPERTYMARKETSDISCIPLINED COSTMANAGEMENT WITHUNDERLYING COSTSDOWN5%Realignment of Groupoperating structureDevelopment of productsto further enrichagent experience

CHAIRMAN’SADDRESS2019 has been a transformational yearfor Nine.The merger with Fairfax, which completedin early December, has changed the scaleof our business, creating one of the largestmulti-platform media companies in Australia.It has allowed us to bring together premiumassets that are complementary. It has givenus diversified sources of revenue that overall,reduce our exposure to adverse cycles. It isa big development for our business that willprovide greater opportunities in the digital age.And we retain a balance sheet that providesfurther flexibility into the future.From a results perspective, the benefit of thediversification is clear. During the year, growthin our Video on Demand platforms and MetroMedia has more than offset the short termcyclical issues facing our Broadcasting andDomain businesses. On a Pro Forma basis, thisresulted in a 10% increase in combined GroupEBITDA for the year, on broadly flat revenues.But the essence of the merger was basedaround more than just short term profitconsiderations. Whilst the Nine businessalone was doing well, and had strong profitmomentum, the pace of change in themedia market remains unabated, and weare determined to ensure that Nine is at theforefront of the future landscape in Australia.“We are determinedto ensure that Nineis at the forefrontof the future medialandscape inAustralia”2The fragmentation of traditional media hasbeen occurring for some time. There is morecompetition for audience, and more competitionfor revenue. The merger with Fairfax ensures usa strong future within that environment. We nowhave premium assets across multiple platforms,and therefore a greater ability to invest inthe content that drives audiences and in thedata, research and technology that ensuresour relevance to advertisers. Through Nine,advertising can now be offered across thefull spectrum of audiences, from mass-marketbrand-building to truly addressable advertising.

There remain legitimate concernsabout how they use their marketpower to commercially engage withmedia businesses with their take itor leave it' terms.In this transformational year, wehave completed one of the mostsignificant mergers in Australian mediahistory and have emerged a strongercompany. We have continued toimprove the relative performanceof the traditional businesses, whilecontaining costs, and we havedelivered on our longer-term goal ofbroadening the base of our revenuestreams with new and growing digitalassets. We will continue to execute onthis strategy.CEO’S ADDRESSOur advertising businesses arenow in competition with globalplayers like Facebook and Google.The Australian Competition andConsumer Commission (ACCC)has recently reported on the nearmonopoly these players have in theareas of search, content aggregationand social media. They sell advertisingon the basis of reach and targetingand distribute news and videocontent, yet they do not have theobligations of broadcasters andpublishers. We are highly regulated,including content, viewing hours,advertising standards, defamationand public-decency. They are not.In a fast-moving and competitiveworld, we will continue to focus ongenerating superior returns for ourshareholders. We believe the mergedGroup enhances our prospects.We are excited by what the futurehas to offer the new Nine, and lookforward to sharing the rewards ofthat future with all of our stakeholders.CHAIRMAN’S ADDRESSThe merger with Fairfax has alsoresulted in the combining of ourrespective Boards. As a result,David Gyngell and Janette Kendallretired from the Nine board inearly December. I would like toacknowledge the contributions ofboth David and Janette over theyears, particularly through the mergerprocess, and thank them for theircommitment. Additionally, I’d liketo welcome the appointment ofNick Falloon, Patrick Allaway andMickie Rosen to the Nine boardas Non-Executive Directors. It hasbeen something of a transitionyear but your Board settled quickly,and has been a great support tothe management team throughoutthis process.The second is Domain. Domainis principally a Digital business.Although it has been buffeted by theshort term correction in the housingmarket, it has a proven model andtrack record and will clearly benefitfrom a close association with Nine.Both of these, Stan and Domain,are growth businesses.The ACCC has rightly acknowledgedthat these businesses need regulatoryoversight in areas includingtheir commercial dealings withmedia businesses, the spread ofdisinformation on their platformsand copyright. The ACCC has alsorecommended regulatory changesto level the playing field. We welcomethe steps the ACCC has outlinedto deal with these issues in thepublic interest and look forwardto the Government's response tothis well-considered review of theDigital Platforms.OPERATIONAL HIGHLIGHTSThe merger process has gone verysmoothly. This is a testament to allof our people and their willingnessto accept change and the challengesthat change brings. A merging ofcultures is never easy, but this one hasbeen successful, and the underlyingbusiness has not missed a beat.I would like to highlight two businessesthat are increasingly important toour future. The first is Stan – oursubscription streaming business.With the merger, we now have fullcontrol of Stan. This business turnedprofitable in the second half of theyear, which is an exceptional result.In the digital world, start-ups canattract huge market valuations withoutever turning a profit. With more than1.7m subscribers, coupled with positivecash flow, Stan has a strong future.COMPANY OVERVIEWNine’s portfolio of complementaryand inter-related assets places usin a unique position in Australia.At the core of our content creationabilities, Nine boasts a leadingFree To Air TV business and thetraditional mastheads that makeup the Metro Media business. Eachof them creates content, reachingaudiences and generating revenueacross multiple platforms including thedigital platforms 9Now and our DigitalPublishing mastheads. Together, thesecreate a powerful platform for thepromotion and development of ourother digital assets, namely Stan andDomain. We have an enviable mixof assets which together, provide usgreat opportunities into the future.PETER COSTELLO, ACChairmanN I N E A N N UA L R E P O RT 2 0 1 93

CHIEF EXECUTIVEOFFICER’S ADDRESSIn 2019, Nine has laid the clearfoundations for its long term growth.The merger with Fairfax has created a businesswith four key operational pillars — the traditionalBroadcasting business, predominantly Australia’sleading Free to Air broadcaster in terms of ratings,revenue and profitability; Digital & Publishing —one of Australia’s most read digital publishers andleading commercial BVOD operator; 100% of Stan— Australia’s leading local SVOD business as wellas our strategic 59.2% stake in Domain.This combination gives Nine an increasingly digitalearnings profile, which will underpin the growth ofthe business for years to come.In terms of the result for the year, a year in whichthe cyclical nature of advertising and propertyworked heavily against us, we were very pleased toreport 10% growth in Group EBITDA to 424 million.Net Profit After Tax and before Specific Items was 198 million, up 16%. We retained our dividend at 10cper share fully franked which, at the average of theshare price across the year, equated to a yield ofmore than 5%. These results are reported on a ProForma basis — so incorporating a full period of theFairfax acquisition and excluding the assets that wehave either already sold, or earmarked for sale inthe near future. And so are therefore reflective ofNine going forward.“Nine has greatmomentum, and wehave used this periodto invest in our future”The merger came at a time when Nine’s ownbusiness was in great shape. The cost structureand focus of our Free to Air business had beensignificantly reworked and we had positive ratingsand revenue share momentum. Momentum thatcontinues today. And we had substantially completedthe investments that we needed for the future ofNine — Stan and 9Now as well as our innovativesales platform technology, 9 Galaxy. Our balancesheet was, and remains, strong.The merger with Fairfax brought operational diversity,but more importantly, it substantially changedthe growth profile of the Nine business. And withbusinesses that were complemented by Nine’s coreFree to Air business either in terms of cross-platformcontent or from the tremendous marketing machinethat is Free to Air television. In FY19, on a reportedPro Forma, ownership-weighted basis, 7% of Nine’srevenue was sourced from Stan; 9% from Domainand 30% from our newly formed Digital & Publishingdivision which includes the high growth business of9Now. We will see the mix of both our revenues andour profitability change even further in the comingfinancial year.Operationally, there were a number of highlightsin FY19.4

the associated fixed cost base, of printassets.Stan has had a fabulous 12 months,consistently surpassing expectationsacross all key metrics. The achievement ofpositive cash flow in the second half, withmore than 1.7 million increasingly activeand loyal subscribers, is a testamentboth to the team involved and Nine’swillingness four years ago to invest ina market segment that didn’t really existin Australia at the time. Stan’s positionas an aggregator of the best contentfrom around the world, most specificallythe US and UK, has enabled it to builda strong and profitable position in thisfast-growing segment.Our unique suite of assets has broughtwith it vast amounts of first-party datathrough 9Now, Stan, nine.com.au aswell as the major metro mastheadsand Domain — data which will enableus to not only provide better platformsand products for our advertisers, butalso target potential new customers forIn summary, the new Nine is at avery exciting stage. The turnaround atStan, continued growth at 9Now andthe already implemented synergieswill underpin profit growth for FY20 —and that is before we see any cyclicalimprovement in broadcast or the propertymarkets. Our balance sheet is strong andthe business is generating significant cash.It leaves us in a great position to focuson maximising the performance of ourbusiness, and consolidating our positionas one of Australia’s leading digitalmedia companies.It’s been a big year. A big year for Nine,our staff and the Board who have beenunwavering in their commitment andsupport as we continue to redefine ourbusiness. Nine has great momentum andwe have used this period to invest inour future. These past twelve months havebeen both challenging and rewardingand I thank all my colleagues for thespeed and effectiveness at which theyhave approached the opportunity.CEO’S ADDRESSDomain has operated in a cyclicallychallenging property market across theyear, particularly in its core marketsof Sydney and Melbourne. Despitethis backdrop, underlying depth andyield improvements have continued.During the year, Domain completed thereorganisation of its operating structure,allowing more focus on its core businessof residential and commercial realestate, and reducing its exposure tolow margin adjacencies. Overlaid withthe opportunities presented by a NineDomain partnership, we remain excitedabout our investment in Domain andbelieve the leverage will be stronglypositive when the cycle returns to normal.our subscription products. Our substantialfirst-party database and the way thatwill merge with our existing technologyand improved audience measurement,will start to really take shape in the latterhalf of calendar 2019 and creates anotherexciting opportunity for Nine to continueto grow our revenues.CHAIRMAN’S ADDRESSThe other key component of our Digital& Publishing division, Metro Media, hasoutperformed our own expectations onacquisition. This is a business which hascompletely reworked its operating modelover the past three years. A renewedfocus on profitable subscriptions andon our core print advertising basehas coupled with the growth in digitaladvertising and ongoing cost focus tounderpin the division’s first period ofgrowth in four years. And growth acrossboth key components — subscriptionand advertising. It is a testament tothe business which has now reachedan interesting juncture — subscriptionrevenues which exceed advertisingrevenues, and print advertising revenueswhich have stabilised at around 30% oftotal group revenues. And it is a business,which by virtue of the recent sale ofACM, no longer has ownership, andFrom 2020, Nine isrelocating its Sydneypremises with allbusinesses relocatingfrom the current 4locations to a purposebuilt, state of the artfacility at 1 DenisonStreet.OPERATIONAL HIGHLIGHTSSpurred by the broad success ofNine’s schedule, 9Now continued itsdominance of the strongly growingBroadcast Video On Demand (BVOD)market. 9Now’s revenue growth of nearly70% outperformed the overall marketand with much of the associated costalready expensed through television,around 80c of each incremental ofrevenue flowed through to profit. We alsoincorporated 9Now inventory into the9Galaxy sales platform from early 2019,and were the first local broadcaster tointroduce true addressable advertisingat scale, commencing with 9Now’s livestreaming of the Australian Open. Drivenby further increases in active users, 9Nowwill continue to be a strong contributorto growth into the future.Denison StreetCOMPANY OVERVIEWIn a difficult FTA television advertisingmarket, Nine strongly outperformed.Our primary channel ratings were almost6 points clear of the competition inour targeted 25-54 demographics andthis underpinned a #1 revenue sharefor the year of 39.6%, up 1% point onFY18. This ratings success stemmed notonly from Nine’s consistent favourites ofnews, current affairs and entertainmentproducts like The Block and Married AtFirst Sight, but also some new contentlike Lego Masters. And extraordinarily,this gain in share was achieved on a4% decline in operating costs, with thedifficult decision to migrate Nine’s summersports allegiances from cricket to tennisvindicated on every measure.I and my team are equally excited aboutour future.HUGH MARKSCEON I N E A N N UA L R E P O RT 2 0 1 95

Broadcasting6

BROADCASTINGFree to Air TelevisionThis growth in share was achieved on a4% decline in Nine’s television cost base.A combination of the change in sportsrights, coupled with continued ongoingfocus on cost management, resulted ina reduction in overall television costs ofnearly 40 million.25-54s38.2% 1.9pts#116-39s38.4% 2.5pts#1GB CH40.5% 2.6ptsOzTAM data, 12 months to end of June 2019,6am–midnight.The most significant change in FY19 was thereplacement of Nine’s summer sport froma longstanding relationship with cricket totennis. The decision was made with manyconsiderations, not the least of whichwas the expectation of markedly superioreconomics of tennis at the prevailing rightsprices. On all levels, Nine’s decision hasbeen vindicated.From an audience perspective, Nine’sSummer of Tennis attracted a cumulativeaudience reach of nearly 14.5 million peoplenationally, with the Australian Open Men’sFinal the highest rating session, attractingan average audience on Nine of morethan 2 million. Across the Summer, 9Nowrecorded more than 6.2 million streamstotalling 121 million minutes.Broadcasting results2 m1,4003001,2002501,00055%200BOARD OF DIRECTORSEBITDA1 contribution — FY19#1NINE CARESThe overall Metro FTA TV market waschallenging in FY19, with the decline of morethan 5% marked by softness in a numberof key advertising categories, includingFinancials and Automotive, as well asthe interruptive impact of both State andFederal elections. Conversely, Nine’s shareof Metro revenues for the year was strongat 39.6%, up one share point from 38.6%in FY18, marking Nine’s highest sharesince 2000.Network ratingsCORPORATE GOVERNANCEThe positive operating momentum of Nine’sFree to Air business continued into FY19 withgrowth in both ratings and revenue shareacross the year. Coupled with a furtherreduction in operating costs, Nine mitigatedmuch of the impact of a weak Free to Air(FTA) Television market.For the year to June 2019, Nine was the #1Free to Air Network in all of the key buyingdemographics1.OPERATIONAL REVIEWNine’s Broadcasting division, whichcomprises Nine Network as well as theconsolidated results of Macquarie Media(of which Nine currently owns a 54.4%stake), reported EBITDA of 241 millionon revenues of 1,222 million for the year.These results are reported on a Pro Formabasis, which reflects the operations ofboth businesses for a full 12 month period.800150600100400502000BroadcastingDigital & PublishingDomainFY18TVFY19Radio0EBITDA1. On an economic interest adjusted and Pro Forma basis.2. Pro Forma basis.N I N E A N N UA L R E P O RT 2 0 1 97

OPERATIONAL REVIEWBROADCASTING continuedThe more female skew of tennis enabledNine to start calendar 2019 with significantmomentum. The lead-in and demographicalignment of tennis to Nine’s top-rating showof the year, Married At First Sight, gaveNine its strongest start to a calendar yearsince OzTAM became the measurementsystem in 2001.And thirdly, the move to tennis enabled Nineto further refine its cost base — both reducingoverall costs, with limited impact on revenue,but also reducing the portion of Nine’s 650 million programming cost base that iscontracted, creating increased future flexibility.Sport remains a key pillar for Nine. In FY19,Nine broadcast more than 750 hours ofpremium sport across the year, in additionto around 350 hours of other sports-relatedcontent.Coupled with tennis in summer, NRL is Nine’score winter sport. For the first 24 rounds ofseason 2019, Nine’s regular NRL broadcastsattracted an average audience of around3.4 million of league supporters each week,a fertile audience for advertisers chasing thattight demographic. The State of Origin seriesreached a massive 9.9m people nationally —one of the few events in Australia to reachsuch a big audience and accounted for threeof the top ten shows on Australian televisionin the year to June 2019.News is the other key pillar, underpinninga consistency to both audiences andadvertisers that is crucial. Nine’s commitmentto news is unwavering, and the mergerwith Fairfax highlights this commitment —to be the primary supplier of news to allAustralians, across all demographics, anddistribution platforms.In FY19, Nine broadcast around 65 hours oftelevision news and current affairs each week.Nine’s 6pm news service is almost always oneof the top five shows, attracting a nationalFree to Air audience of almost 1.2m peopleeach night. In addition, Nine’s regional newscoverage sourced directly from 13 differentregional market hubs is broadcast throughthe affiliation with Southern Cross. TheNine news and current affairs brands haveextended their reach through Nine’s digitalpublishing platforms, 9.com.au and 9News.comwhile Nine’s video content reaches audiencesvia FaceBook, Twitter and Instagram as wellas the Metro Media mastheads.8Nine’s entertainment schedule continues toperform well. Across the year, Nine has anenviable depth and breadth of content thatentertains Australians. Australian Ninja Warriorreturned for season 2 in July 2018 and wasclosely followed by Season 14 of The Block.Average audiences for The Block of around1.2 million and 1.7 million people on a 5-citymetro and national basis respectively againdemonstrated Australians' obsession with theirhomes and renovations, and the enduringlysuccessful formula of The Block. Moreover,it remains the best example of what can beachieved with original content and an integratedsales effort that brought more than 30premium advertising relationships to the show.The return of Married At First Sight at thestart of calendar 2019, with the lead-in of theAustralian Open Tennis, resulted in 5% growthin overnight audiences on the previous seasonand an average audience, including 9Now, ofalmost 2.4 million per episode.Lego Masters, which launched in April, wasan instant success, with families tuning in towatch the most extraordinary Lego creationsbeing imagined and built. In its first season,Lego Masters averaged an audience of morethan 2 million nationally (including 9Now),winning all of its time slots and guaranteeingits return in 2020.Nine now has a strong and consistentschedule of premium entertainment contentacross the full calendar year. Married at FirstSight, Lego Masters, The Voice, AustralianNinja Warrior and The Block which hascreated an unrivalled proposition for ouradvertisers. Moreover, Nine has furtherincreased its depth around these core titles— Travel Guides, This Time Next Year, DoctorDoctor and Hamish and Andy to name a few. Doctor Doctorcontinues to be aconsistent timeslot winnerfor Nine — series 3delivered a nationalaverage audience of1.2m per episodeOver the past year,60 Minutes has cementeditself as the nation’s mostwatched weekly publicaffairs program

Macquarie Media (54.4%)Travel Guides enjoyed its bestseason to date, with a nationalseries average audience forseason 3 of 1.1m per episode,up 15% on season 2BOARD OF DIRECTORS NINE CARESIn August 2019, Nine announced anoff-market takeover offer for all ofthe outstanding shares in MacquarieMedia. Successful completion will furtherconsolidate Nine’s position as a leadingsupplier of news and current affairscontent across all the key platforms— Television, Digital, Print and Radio.The offer is expected to close laterin 2019.CORPORATE GOVERNANCEIn FY19, Macquarie’s top-ratingNews Talk stations 2GB in Sydney and3AW in Melbourne, combined with thegrowing 4BC in Brisbane and 6PR inPerth for average audience growthacross the network of 5%. Despite thisstrong audience performance, revenuesdeclined by 3%, in a subdued advertisingmarket. Costs were up by 1%, partiallyreflecting the increased investment inthe Macquarie Sports Radio Networkwhich resulted in a 16% decline inEBITDA to 27 million.OPERATIONAL REVIEWFY19 was a difficult year for MacquarieMedia. While audience performance wasstrong, this performance did not translatethrough to revenues.N I N E A N N UA L R E P O RT 2 0 1 99

Digital & Publishing10

DIGITAL & PUBLISHINGMetro MediaThere was growth in both advertising andsubscription/circulation revenues across theyear. This result marks an interesting juncturein the evolution of this business. Not onlyhave the previous sharp declines in printrevenues stabilised, but the combinedcirculation and subscription revenues ofthe mastheads now comfortably exceedadvertising, marking a real change indynamics of a business that traditionallyrelied on advertising for the bulk of itsrevenue.31%Digital & Publishing results2 ngDigital & PublishingDomainFY18Metro Media9Now9DigitalFY19BOARD OF DIRECTORSEBITDA1 contribution — FY19Metro Media’s strong history on costscontinued in FY19, with total costs decliningby 5%. A key driver to this decline was theprint deal announced with News Ltd in July2018, which resulted in increased capacityutilisation at a smaller number of printfacilities owned between the two groups,with surplus facilities closed. The subsequentsale by Nine of ACM in June took this onestep further from Nine’s perspective, withthere now being no residual ownership ofprint facilities, creating further flexibility in thebusiness’s cost base longer term.NINE CARESThe focus is now clearly on reader revenue,which will continue to be driven bydistinctive journalism and engaging products.This has resulted in strong and growingreadership of the Group’s mastheads whilea tightening of the paywall and a focus onThere was strong growth in advertising indigital ( 17%) and a real stabilisation in print.The business attracted an increased shareof digital revenues, while print advertisinghas benefited from a renewed appreciationof the value of the medium to certainadvertising categories, most specificallyTravel and Homewares. Additionally, thebenefit of being part of the larger NineGroup has been reflected in enhancedagency relationships across the MetroMedia business.CORPORATE GOVERNANCEMetro Media performed strongly in FY19,with revenue growth of 3% coupling with a5% cost decline, for an EBITDA increase of65% to 83 million.targeted marketing has driven subscriptionrevenue growth across each of the key titles— the SMH, the Age and most significantly,the AFR. Nine’s commitment to contentand

revenue, down from 84% in FY18, marking a real change in the drivers of Nine for the future. Result in brief In FY19, Nine reported Group EBITDA of 350 million, up 36% on FY18, driven by a 40% increase in Group Revenues to 1.8 billion, reflecting the impact of the merger with Fairfax from 7 December. On a continuing business basis, Statutory Net