Transcription

TIAA-CREF Self-Directed BrokerageOverview and Account SetupYour quick guide to the brokerage program

For investors with specializedinvesting needs, more choicemeans more opportunity todirect retirement investmentsacross markets and assetclasses — using an array ofoptions outside of your Plan’score lineup.The TIAA-CREF self-directed brokerage account is an optional featuremade available by the University of Colorado. Together with yourRetirement Plan investments, the brokerage account offers you moreoptions to meet your investing needs.For investors with more specialized needs, a self-directed brokerageaccount lets you allocate your assets to a wide range of investmentoptions beyond those in the University of Colorado Retirement Plan corelineup. This includes over 7,000 funds from over 150 well-known mutualfund families, stocks and exchange-traded funds (ETF).1Investors who may benefit from a self-directed brokerage accountgenerally have financial knowledge and the time to research, trade andmanage their accounts independently, or work with their investmentadvisor to discuss their account. You must be enrolled in the Universityof Colorado 401(a) Retirement Plan and/or the University of Colorado403(b) Voluntary Retirement Plan to be eligible to establish a TIAA-CREFbrokerage account.2 It is important to note that the investments inthe brokerage account are not monitored by the University ofColorado.12The University of Colorado 403(b) Plan can only transact mutual funds within the brokerage account.TIAA-CREF’s Brokerage Services is available only to enrolled Plan participants with a permanent U.S. residential and mailing address.2TIAA-Cref Brokerage Services

How the self-directed brokerageaccount worksThe University of Colorado permits you to invest 100% of your Retirement Plan assetsin a brokerage account. There is an initial minimum investment of 1,000 required inorder to activate the brokerage account and certain minimums exist for each fund.There is no minimum balance requirement, no annual fee, and there are nomaintenance fees.3Flexibility and simplicityTIAA-CREF Brokerage Services keeps things simple. You can get information on youraccount and place orders to buy, sell, or transfer investments by: Logging in to your account at www.tiaa-cref.org/cu. You can also call TIAA-CREF’s Automated Telephone Service at 1-800-842-2252,24 hours a day, seven days a week for information about your account. If you prefer, you can place orders with a TIAA-CREF financial consultant bycalling 1-800-927-3059. Consultants at this number can also answer anyquestions you have about your brokerage account.Fund investment minimums must be met for the mutual funds purchased through the account. Other fees and expenses,including those that apply to a continued investment in a fund, are described in the fund’s current prospectus.3TIAA-CREF Brokerage Services3

Opening a self-directed brokerage accountStep 1: Verify your University of Colorado Retirement Plan account has been opened.You must have established a retirement account before you can open aself-directed brokerage account.Step 2:You need to have a Retirement Plan balance of at least 1,000 to open andfund a brokerage account. Once you have the necessary balance in your Plan,you will need to log in to your online account.Step 3: From your home page,find the account whereyou want to add a selfdirected brokerageaccount, click theActions arrow andselect Change myinvestments from thedrop-down menu.Step 4: The Change MyInvestments screenwill allow you to selectan effective date andsource of funds.4TIAA-Cref Brokerage Services

Step 5: Decide if you want totransfer a percentage ordollar value from yoursource fund. Then inputthe amount with whichyou wish to initiallyestablish your brokerageaccount.Note: The minimumis 1,000.Step 6: Next, designate thosefunds to the brokerageaccount. Then, selectPreview Changes at thebottom of the screen.Note: The amountyou transfer to thebrokerage account willautomatically beinvested in the moneymarket sweep account,which is where assetsare initially transferred toawait your finalinvestment instructions.TIAA-CREF Brokerage Services5

STEP 7: You will then bedirected to the Open aBrokerage Accountscreen. The first step inthe process is to readthe waiver of releaseand liability, and acceptthe terms andconditions. Once youhave done so, check the“I have read and acceptthe terms andconditions” box andselect Continue.Note: You will need toscroll to the bottom ofthe waiver to accept theterms and conditions.STEP 8:6The next requirementis to consent toelectronic delivery ofyour importantdocuments. You willneed to check that youhave read andaccepted the terms andconditions, then selectContinue.TIAA-Cref Brokerage Services

Step 9: It is now time tocomplete your personalinformation. Pleaseenter your employmentdata, affiliations andinvestment profile.When all the data isentered and verified,select Continue.Step 10: At this point in theprocess, you will needto review thebrokerage accountagreement, and acceptthe terms andconditions. After youhave done so, check “Ihave read these termsand conditions” andselect I Agree.TIAA-CREF Brokerage Services7

Step 11: You are now finishedwith the account-openingprocess. A message willappear that yourbrokerage accountapplication has beenreceived and is beingprocessed. It typicallytakes two business days.Once completed, you willbe able to begin tradingwithin your brokerageaccount.You will need to confirmthe transfer of assets,which was requested toinitially fund thebrokerage account(Step 5), then review andselect Submit tocomplete thetransaction. A screen willappear that verifies yourchange of investmentshasbeen submitted.8TIAA-Cref Brokerage Services

How to access your brokerage accountStep 1: Go to www.tiaa-cref.org/cuand select Log In. Enter youruser ID and password.Step 2: This brings you to thehome page and yourRetirement Plan accounts.The brokerage account isseparated out, and you willsee “ xxx of this accountis held in a TIAA-CREFBrokerage Account.”Step 3: To the right of that is anActions drop-down menu thatwill allow you to: View account details.Trade.Check your order status.View account activity.Review statementsand reports.Click the arrow and select theaction that you wish to initiate.TIAA-CREF Brokerage Services9

How to buy/sell in your brokerage accountIn addition to the investment options available directly through the University of Colorado,the self-directed brokerage option offers access to powerful tools and research, andexpands the range of investments available to you. Please note: All funds/ETF aresubject to their specific prospectus, which may indicate, for example, various minimuminvestment requirements.Trading equities and ETFsStep 1: From the home page, findyour brokerage accountand use the Actionsarrow to select Trade.Step 2: Near the top of the tradingscreen you will see “ForAccount.” Please makesure this is the correctaccount in which youwish to transact thetrade. There are tabs forstocks, mutual funds,order status, recurringmutual fund orders andaccount details.O n the Stocks tab, enterthe requested information: B uy or sell Number of shares Ticker symbol T ype of order (market,limit or stop) T ime in force (good forthe day, kill or fill, etc.) Qualifier When you are readyand all the informationis complete, clickPreview Order.10 TIAA-Cref Brokerage Services

Step 3: Confirm the informationis correct and clickPlace Order to initiatethe transaction.Step 4: A trade acknowledgementwill then appear. Atthis point, your orderhas been submittedfor execution. If youdesire, you can view theorder status or placeanother order.TIAA-CREF Brokerage Services11

Trading mutual fundsStep 1: F rom the home page, findyour brokerage accountand use the Actions arrowto select Trade.Step 2: Near the top of the tradingscreen you will see “ForAccount.” Please makesure this is the correctaccount in which you wishto transact the trade.There are tabs for stocks,mutual funds, order status,recurring mutual fundorders and account details.On the Mutual Funds tab,enter the requestedinformation for your desiredaction (purchase, redeem,exchange or systematicinvestment). Once theaction is determined, theappropriate data needed forthe transaction will appear.When the necessaryinformation is completeand you are ready toplace the trade, selectPreview Order.12 TIAA-Cref Brokerage Services

Step 3: Confirm the informationis correct and clickPlace Order to initiatethe transaction.Step 4: A trade acknowledgementwill then appear. Atthis point, your orderhas been submittedfor execution. If youdesire, you can view theorder status or placeanother order.TIAA-CREF Brokerage Services13

Mutual fund automatic investment/redemption plans Once you own a mutual fund you have the ability to make ongoing automaticpurchases to add additional shares to your account.Step 1: F rom the home page, findyour brokerage account anduse the Actions arrow toselect Trade.Step 2: Select the Recurring MutualFund Orders tab. You willthen need to identify if youare creating a recurringpurchase or redemption.Select the appropriate box.14 TIAA-Cref Brokerage Services

Step 3: I f you want to create arecurring purchase,choose the fund inwhich you wish to doso using the radio buttonand enter the requestedinformation: Dollar amount ofrecurring purchasesFrequency of purchasesStart dateEnd dateWhen you are ready andall the information iscomplete, select Next.Step 4: Y ou now will have thechance to preview yourpurchase. Confirm theinformation is correct,check the authorizationbox and click Submit Planto initiate the transaction.Step 5: A screen will then appearthat verifies yourautomatic purchase setupis complete.TIAA-CREF Brokerage Services15

View transaction historyConfirmations are sent for every trade. You can view your entire transaction history bylogging in to your account at www.tiaa-cref.org/cu or through your monthly brokerageand quarterly combined retirement account statements.Note: Trades placed before the investment trade cut-off time (2 p.m. MST) will beexecuted that business day. Transfers between the brokerage account and anotheraccount or fund available through retirement plan(s) are subject to brokeragesettlement periods and can take several days to complete.16TIAA-Cref Brokerage Services

Frequently asked questionsQ: H ow do I move the money out of my brokerage account back to other investment optionsavailable through the core menu?A: To transfer between the brokerage account and another investment option availablethrough the core menu, you must call a TIAA-CREF financial services consultant at1-800-927-3059. Moving funds from the brokerage account to the core menu cannot bedone online.Q: How can I take a distribution or withdrawal from my brokerage account?A: You cannot receive a distribution or a withdrawal from your brokerage account directly. Toreceive distributions or withdrawals from the funds in your brokerage account, you first musttransfer the amount you wish to withdraw from your brokerage account to the core menu andthen request a withdrawal. You will need to call a TIAA-CREF financial services consultant at1-800-927-3059.Q: Are there any fees associated with my brokerage account?A: I f you open a brokerage account, you will be charged a commission on all transactionsand other account-related fees in accordance with the TIAA-CREF Commission and FeeSchedule. Please see page 18 for more detailed information.Q: Will I receive confirmations of my trades?A: Yes, a confirmation for every trade is sent according to your delivery preference. You canalways view your transaction history or trade confirmations in the secure portion ofwww.tiaa-cref.org/cu or on your monthly brokerage account statements.TIAA-CREF Brokerage Services17

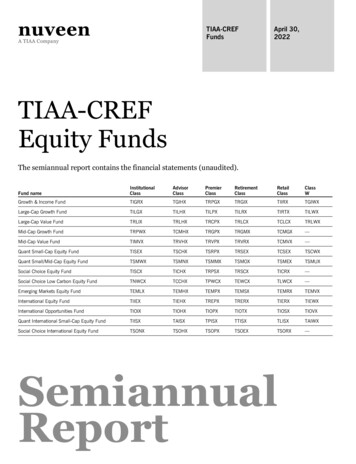

Transaction feesTransaction fees are charged in accordance with the TIAA-CREF Commission and Fee Schedule shown below.For complete information about the brokerage account, read the TIAA-CREF Self-Directed Brokerage AccountCustomer Account Agreement or visit TIAA-CREF Brokerage Services forms. Additional fees and expensesapply to a continued investment in the funds and are described in the fund’s current prospectus.18 TIAA-Cref Brokerage Services

For questions about your self-directed brokerageaccount, please contact us at 1-800-927-3059.TIAA-CREF Brokerage Services19

You should consider the investment objectives, risks, charges and expenses carefully before investing.Please call 1-877-518-9161 for a prospectus that contains this and other information. Please read theprospectus carefully before investing.Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are notbank deposits, are not insured by any federal government agency, are not a condition to any bankingservice or activity, and may lose value.Self-Directed Brokerage Services are provided by TIAA-Cref Brokerage Services, a division of TIAA-Cref Individual &Institutional Services, LLC, member fINrA and SIPC.Brokerage accounts are carried by Pershing, LLC, a subsidiary of The Bank of New York Company, Inc. Member fINrA, NYSe,SIPC. TIAA-Cref Brokerage Services reserves the right to change its fee and commission schedule at its discretion, subjectto notification in accordance with applicable laws and regulations.Certain securities may not be suitable for all investors.TIAA-Cref Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC,members fINrA and SIPC, distribute securities products. 2015 Teachers Insurance and Annuity Association of America-College retirement equities fund (TIAA-Cref), 730 ThirdAvenue, New York, NY 10017C24561402821 550002 6/2015

A: To transfer between the brokerage account and another investment option available through the core menu, you must call a TIAA-CREF financial services consultant at 1-800-927-3059. Moving funds from the brokerage account to the core menu cannot be done online. Q: How can I take a distribution or withdrawal from my brokerage account?