Transcription

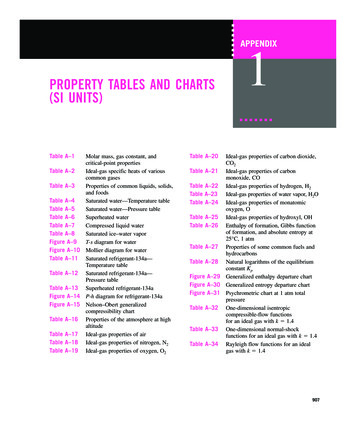

Table of ContentsIntroductionDepartment Officials -------------------------------- 1Organizational Chart -------------------------------- 2Telephone and FAX ---------------------------- 3Comparison of Kansas and Selected States ----- 4Tax Rates --------------------------------------------- 9Distribution of Taxes and Fees ------------------ 10By County, Income, Sales, Vehicle Property and Real Property Taxes and Per Capita-- 12Legislative Summary ----------------------------- 14Total Revenue Collections ----------------------- 17State General Fund Collections ----------------- 20Division of Tax OperationsIndividual Income ------------------------------- 21Corporate Income and Privilege Tax ----------- 28Kansas Department of Revenue Tax Credits -- 31Sales and Use Tax --------------------------------- 35Motor Fuel Tax ------------------------------------ 50Mineral Tax ---------------------------------------- 53Cigarette, Tobacco, and Bingo Taxes ---------- 59Food Sales ------------------------------------------ 62Homestead Refunds ------------------------------- 63Audit Assessments -------------------------------- 66Audit Collections ---------------------------------- 67Recovery of Accounts Receivable by ----------68Recovery of Accounts Receivable by Tax ----69Compliance Enforcement Program Return on Division of Property ValuationStatewide Assessed Values and Taxes --------- 71Real and Personal Property Taxes Levied ----- 74Average Countywide Levies per 1,000 Assessed Valuation -------------------------------- 76Preliminary Property Taxes Levied by County ------------------------------------------------- 78Motor Vehicle Property Tax by County ------- 79Division of VehiclesVehicle and Driver License Fees --------------Total Vehicle Revenue Collections ------------Motor Vehicle Registrations --------------------Driver Licensing n of Alcoholic Beverage ControlGallonage Tax ------------------------------------- 90Liquor Excise Tax --------------------------------- 91Liquor Enforcement Tax ------------------------- 92Total Taxes and Fees and Number of Licenses ------------------------------------------------- 93Liquor-by-the-Drink ------------------------------ 94

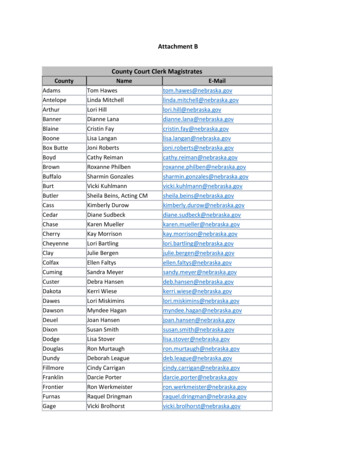

DEPARTMENT OFFICIALSJANUARY 2021Mark A. BurghartSecretary of RevenueSECRETARIAT STAFFDIVISIONS AND SUPPORTING BUREAUSChief of StaffDivision of Alcoholic Beverage ControlMark BeshearsLegal ServicesJay Befort, General CounselOffice of Special InvestigationsJoanna Labastida, DirectorDebbi Beavers, DirectorBart Branyon, Chief Enforcement OfficerAudra Shughart, Licensing ManagerDivision of TaxationLisa Locke, DirectorSteve Stotts, DirectorBusiness Support ServicesAndy Coultis, Business Support Senior ManagerCustomer RelationsJohn Peterson, Customer Relations Senior ManagerFinancial & Document ManagementMonica Becker, Financial & Document Management Senior ManagerRevenue RecoveryDedra Platt, Revenue Recovery Senior ManagerOffice of Policy and ResearchDivision of Property ValuationOffice of Financial Management andAudit ServicesKris Holm, CFO & Director of Audit ServicesOffice of Personnel Services (DOA)Kathleen Smith, DirectorInformation Systems (OITS)Andy Sandberg, Chief Information OfficerPublic Information OfficerZach FletcherLegislative LiaisonEthan SpurlingAnnual ReportDavid Harper, DirectorRoger Hamm, Deputy DirectorDivision of VehiclesDavid Harper, DirectorDeann Williams, Deputy DirectorDriver ServicesKent Selk, Driver Services Senior Manager, Driver License and CDLVehicle Services Senior ManagerLeeAnn Phelps, Titles & Registrations, Dealers Licensing and E-LienComm. Mtr Veh and Veh Financial OfficeDriver ServicesLacey Black, Driver Solutions Manager1Kansas Department of Revenue

KANSAS DEPARTMENT OF REVENUEORGANIZATION CHARTFISCAL YEAR 2020/2021Office of the SecretaryPersonnelServicesAlcoholicBeverage ControlAnnual ReportInformationSystemsLegal ServicesPropertyValuationTaxation2Policy andResearchFinancialManagementVehiclesKansas Department of Revenue

Selected Kansas Department of Revenue Telephone and FAX NumbersAlcoholic Beverage ControlCollectionsHuman ResourcesProperty Valuation DivisionSecretary of Revenue's OfficeTaxationVehicles(785) 296(785) 296(785) 296(785) 296(785) 296(785) 368(785) 296-7015612130772365304282223601Taxpayer Advocate(785) 296- 2473For registration to remit taxes:Sales, Use, Excise, Withholding(785) 368- 8222Billing and tax inquiries:Taxpayer Assistance Center for TopekaRefund Information Line(785) 368- 82221(800) 894- 0318For audit inquiries:Audit Services Bureau(785) 296- 7719For legal inquiries:Legal Services Bureau(785) 296- 2381For revenue collection statistical inquiries:Office of Research and Analysis(785) 296- 3082Department Regional Offices Telephone Numbers:Kansas City Metro Assistance Center(913) 942Wichita Audit Office(316) 337Wichita Collections Office(316) 337Wichita Assistance Center(316) 337-3060616361536132FAX Numbers:Alcoholic Beverage ControlAudit ServicesCommercial Motor Veh Office (CMVO)Commercial Vehicle Central PermitCustomer Relations-Business SegmentCustomer Relations-Liquor/Misc TaxCustomer Relations-Cigarette/TobaccoCustomer Relations-CorporateCustomer Relations-IFTA/Motor Fuel RefCustomer Relations-Motor FuelCustomer Relations-Wage EarnerDriver SolutionsDriver License: MissionDriver License: Topeka, DockingDriver License: Topeka, 89896851019906918277Annual Report(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 296(785) 432(785) 296(785) 296-Information - Department of RevenueBingo TaxCigarette and Tobacco ProductsCommercial Motor Veh Office (CMVO)Commercial Vehicle Central PermitCorporate Income TaxDealer LicensingDriver License ExaminationDriver License Examination, BurlingameDriver Medical/VisionDriver SolutionsDrycleaning Envir Surcharge & Solvent FeeElectronic FilingEnvironmental Assurance FeeEstate TaxFed/State DiscoveryFiduciaryFood Sales Tax Refund UnitHomestead Tax Refund UnitIndividual Income Estimated TaxIndividual Income TaxIntangibles TaxLiquor Enforcement TaxLiquor Drink TaxMineral TaxesMotor Fuel TaxesRevenue Recovery/Legal Case Mgmnt TopekaRevenue Recovery/CAR/Collections TopekaSales and Use TaxSand RoyaltyTax Appeals SectionTire Excise TaxTransient Guest TaxVehicle MSRP amd Class CodesVehicle Rental Excise TaxVehicle Titles and RegistrationWater Protection FeeWithholding Tax(785) 296(785) 368(785) 368(785) 296(785) 368(785) 368(785) 296(785) 296(785) 266(785) 368(785) 296(785) 368(785) 296(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 368(785) 296(785) 296(785) 368(785) 368(785) 296(785) 368(785) 368(785) 368(785) 368(785) 296(785) 368(785) 228222Driver License: Wichita, Twin LakesDriver Medical ReviewHuman ResourcesKansas City Metropolitan Asssistance CenterMineral Tax/Motor Fuel TaxPolicy and ResearchProperty Valuation DivisionSecretary of Revenue & SecretariatTaxation, Director's OfficeTaxpayer AssistanceTitles and RegistrationWichita Assistance CenterWichita Audit OfficeWichita Collections Office(316) 821(785) 296(785) 296(913) 631(785) 296(785) 296(785) 296(785) 368(785) 296(785) 291(785) 296(855) 489(316) 337(316) 69616261623Kansas Department of Revenue

Comparison of Kansas and Selected States, Various Tax Rates - January 1, 2020BeerPer GallonWinePer GallonCigarettePer PackMotor Fuel(Gasoline)Per GallonColorado 0.08 0.28 0.84 0.2200Iowa 0.19 1.75 1.36 0.3050Kansas 0.18 0.30 1.29 0.2403Missouri 0.06 0.42 0.17 0.1740Nebraska 0.31 0.95 0.64 0.3020Oklahoma 0.40 0.72 2.03 0.2000Note: In Missouri, cities and counties may impose an additional tax on a pack of cigarettes.Motor Fuel Rates include any fees that may be added to excise tax.Source: Federation of Tax Administrators January 2020Annual Report4Kansas Department of Revenue

Comparison of Kansas and Selected States, Personal IncomePer Capita Personal ited States2014 50,700 44,799 46,874 41,775 48,948 45,540 47,0582015 52,133 46,224 47,386 43,096 50,588 44,2452016 52,262 46,431 47,510 44,336 49,703 41,8712017 55,335 47,458 48,869 45,744 50,663 43,6342018 58,896 50,175 51,261 47,109 52,890 45,8432017-18% change6.4%5.7%4.9%3.0%4.4%5.1% 48,978 49,870 51,885 54,6065.2%Per Capita Disposable Personal 14 44,493 40,183 42,067 37,341 43,876 41,2792015 45,521 41,309 42,489 38,286 45,386 39,9912016 45,492 41,461 42,636 39,422 44,517 37,8912017 48,341 42,304 43,627 40,653 45,321 39,4712018 51,895 45,086 46,020 42,209 47,663 41,7002017-18% change7.4%6.6%5.5%3.8%5.2%5.6%United States 39,554 41,460 42,941 43,821 escendingRankRank20172018114433552266Disposable Personal Income as Percent of Personal .8%89.6%90.1%91.0%United States84.1%84.7%86.1%84.5%88.3%Source: U. S. Dept of Commerce, Bureau of Economic Analysis, www.bea.govAnnual Report5Kansas Department of Revenue

Comparison of Kansas and Selected States, Individual Income TaxIndividual Income Taxes: Basic Rates, Exemptions and Standard Deductions, Tax Year 2018TaxRatesRangeNumberofBracketsTaxable Income Brackets4.63%1--------Flat .5%-5.9%NebraskaOklahomaColoradoIowaLowestPersonal ExemptionsHighestStandard DeductionsSingleMarriedDependentsSM/Jnanana 12,000 24,000 1,598 71,910 40 80 40 2,030 5,000 15,000 30,000 2,250 4,500 2,250 3,000 7,50010 1,028 9,253 2,100 4,200 1,200 12,000 24,0002.46%-6.84%4 3,150 30,420 134 268 134 6,750 13,5000.5%-5.00%6 1,000 7,200 1,000 2,000 1,000 6,350 12,700#General Notes:Colorado - Uses the personal exemption amount provided in the federal Internal Revenue Code. Uses the federal standard deduction.Iowa - The personal exemption takes the form of a tax credit instead of a deduction and is indexed to the rate of inflation.Kansas - For joint returns, taxes are twice the tax on half the couple's income.Missouri - Deduction or exemption tied to federal tax system. Federal deductions and exemptions are indexed for inflation. Uses the federal standard deduction.Nebraska - For joint returns, taxes are twice the tax on half the couple's income. The personal exemption takes the form of a tax credit instead of a deduction. Usesthe federal standard deduction.Oklahoma - The income brackets reported are for single persons. For married persons filing jointly, the same tax rates apply to income brackets ranging from 2,000 to 12,200. Uses the federal standard deduction.Source: State Individual Income Taxes , Federation of State Tax Administrators. Standard Deduction data from individual state websites.Annual Report6Kansas Department of Revenue

Comparison of Kansas and Selected States, Corporate Tax ComparisonComparison of corporate tax bases, minimum tax, and computation of taxable net income, tax lawseffective July 1, aNo definitionNANo definitionNANoNoNoYes, starts withtaxable income (Line30).Yes, starts withtaxable income (Line30).Yes, starts withtaxable income beforeNOL and currentspecial deductions(Line 28).6.25% 0- 100,0005.58% 100,001 or more:7.81%6%Tax Basebusiness incomeUDITPA definitionsSee Iowa Code§422.32(1)(b)Income fromtransactions andactivities in the regular Abides by MTC andMO regulationscourse of trade orbusiness (K.S.A. 793271(a))Tax Basenonbusiness incomeUDITPA definitionsSee Iowa Code§422.32(1)(i)Any income other thanAny income other thanbusiness income.business income.(K.S.A. 79-3271(e))NoYesIs there aminimum tax?Does statecomputation oftaxable net incomestart with an amountfrom Federal Form1120?NoYes, starts with federaltaxable income (LineYes, starts with28) and allows specialYes, starts withtaxable income (Linetaxable income (Linedeductions (Line30).30).29(b), but not thefederal NOL deduction(Line 29(a)).Tax Rate4.63% 0-25,000:6% 25,001-100,000: 8% Normal tax at 4%; 3% 100,001-250,000: surcharge on income 10% 50,000 250,001 or more:12%NA - Not ApplicableSource: 2020 Multistate Corporate Tax Guide, Volume IAnnual Report7Kansas Department of Revenue

Comparison of Kansas and Selected States, Sales Tax ComparisonComparison of state sales tax rates, filing period, reproduction of returns, option of local sales taxes, localitiesassessing tax, tax laws effective July 1, 2019.ColoradoIowaKansasMissouriNebraskaOklahomaTax Rate-General Salesand Use Tax2.9%6%6.50%4.225%5.5%4.5%State has approved localsales taxYesYesYesYesYesYesState has approved localuse taxYesNoYesYesYesYesItemFiling PeriodDoes state acceptreproductions of thereturns?Monthly:TaxLiability 300/moQuarterly:TaxLiability 300/moAnnually:TaxLiability 15/moMonthly:Tax LiabilityMonthly:Tax Liability 4,000.01 to 40,000/yearMonthly:Tax 25,000 avg sales tax forMonthly:TaxLiability 500 sales(more than 40,000/yrMonthly:Taxmonth remitted for priordue 500/motax/moprepaid monthly)Liability 3,000/yrfiscal yearQuarterly:Tax due 120Quarterly:Tax LiabilityQuarterly:Tax LiabilityQuarterly:TaxSemi-monthly: 25,000and 6,000/yr 400.01 - 4,000 of 500 sales tax/moLiability 900- 3,000/yrAnnually:Taxin sales tax liabilitytax/yearAnnually:TaxAnnually: 900 sales/yrTwice a year: 50/mo inLiability 120/yrAnnually:Tax Liability Liability 45 sales tax/qtrtax liability 400 or less/yrYesYesNoYesYesYesPercent or range of ratesfor local sales 002pdf1% (sls only)0.05% - 3.0%There are over 60different local taxauthorizing statutes.5% - 2.0%2% - 5%Localities assessing taxcity, county, and specialdistrictscity, county (sls only)city, county, communityimprovement andtransportationdevelopment districtscity, county, specialdistrictscity, countycity, county,transportation and hospitalauthoritiesSource: 2020 Multistate Corporate Tax Guide, Volume IIAnnual Report8Kansas Department of Revenue

Selected Kansas Tax Rates with Statutory CitationK.S.A.:Bingo TaxBingo faces 0.002Bingo instant (pull-tabs)1.00%Bingo cards3.00%Car Line Tax/gross earnings2.5%eff. 7/1/15 Package of 20 - 1.29; Package of 25 - 1.61Cigarette Taxeff. 7/1/17 0.05 per milliliter of consumable material for electronic cigarettes3.00% surtax on taxable income over 50,000plusCorporation Taxtotal taxable income @4.00%DrycleaningEnvironmental Surcharge/gross receiptsSolvent Fee (chlorinated)/gallonSolvent Fee (non-chlorinated)/gallonDrug Stamp TaxMarijuana:Processed Wet Plant Dry Plant - 3.50 per gram or portion of gram 0.40 per gram or portion of gram 0.90 per gram or portion of gramEnviron. Fee/gallon petroleum productIndividual Income Tax7.000%75-517679-907; 91779-331079-339979-32,110(TY 11 and thereafter)2.5% 5.50 0.55Controlled Substance:Cont. Substance/gram or portion of gramCont. Substance/50 dose unit or portion of unit-65-34,15065-34,15065-34-15179-5202 200/gram or portion of gram 2,000/50 dose unit or portion of unit 0.01each of two funds has maximum and minimum limitsTax Year 18 and all tax years thereafter65-34,11779-32,110Tax Rates, Resident, married, jointtaxable income 30,000 @ 3.1%taxable income 30,000 but 60,000 @ 930 5.25% 30,000taxable income 60,000 2,505 5.7% 60,000Tax Rates, Resident, otherstaxable income 15,000 @ 3.1%taxable income . 15,000 but 30,000 @ 465 5.25% 15,000taxable income 30,000 1,252.50 5.7% 30,000Liquor Gallonage TaxStrong Beer and CMB/gallon 0.18Alcohol & Sprits/gallon 2.50Light Wine/gallon 0.30Fortified Wine/gallon 0.75Liquor Excise Tax (Drinking Establishments)10.00%Gross receiptsLiquor Enforcement (Liquor Stores)8.00%Gross receiptsMineral TaxOil/gross taxable value8.00%with3.67% property tax creditGas/gross taxable value8.00%with3.67% property tax creditCoal/ton 1.00Motor Fuel Tax/per GallonRegular Motor Fuel/gallon 0.24Gasohol/gallon 0.24Diesel/gallon 0.26LP-Gas/gallon 0.23E-85/gallon 0.17Compress Nat Gas/126.67 CF or 5.66 pounds GGE (gasoline gallon equivalent) 0.24Liquefied Nat Gas/6.06 pounds DGE (diesel gallon equivalent) 0.26 13.00/24 hr; 25.00/72 hr eff. 7/1/2006Trip Permits/eachOil Inspection Fee/barrel (50 gallons) 0.015/barrelPrepaid Wireless 911 Fee2.06% per retail transactionPrivilege TaxBankstotal net income @2.25%plus2.125% surtax on taxable income over 25,000Trusts and S&Lstotal net income @2.25%plus2.25% surtax on taxable income over 25,000Property Tax (State levy) Assessed Valuation1.5 millsState School District Finance Levy20 millsSales and Use TaxState Retailers Sales Tax6.5%eff July 1, 2015State Compensating Use Taxes6.5%eff July 1, 2015Local Retailers Sales Taxup to 1% general & 1% special for counties; up to 2% general & 1% special for citiesLocal Use Sales Taxup to 1% general & 1% special for counties; up to 2% general & 1% special for citiesSand Royalty/per ton 0.15/tonTire Tax/per tire (New Tires) 0.25Tobacco Tax (wholesale price)10.00%Vehicle Rental Excise Tax/gross receipts3.5%for rentals not exceeding 28 daysWater Protection Fee/1,000 gallons 0.032( 0.03 is collected for the Kansas Water Office and .002 is collected for H&E, K.A.R. 28-15-12.)Clean Drinking Water Fee/1,000 gallons 0.030Annual 217, sas Department of Revenue

FY 2020 After-Refund Distribution of Selected State Taxes and Fees Collected by Kansas Department of RevenueAnnual ReportTax or FeeBingo Enforcement TaxRaffle License FeeCigarette & Tobacco TaxesCommercial Vehicle Fee10(Property Tax)Corporate IncomeDrug Stamp Tax*Drycleaning Envir SurchargeDrycleaning Solvent FeesEnvironmental Assurance FeeIndividual Income*Liquor Gallonage Tax (b)*Liquor Enforcement TaxLiquor Excise Tax**Minerals (Severance) Tax*Oil Inspection Fee*Motor Fuel Taxes***Motor Vehicle Property Tax**Motor Veh Rental Excise Tax*Prepaid Wireless 911 FeePrivilege TaxProperty Tax (StatewideAssessed Value)Private Car Line TaxKansas Department of RevenueSand Royalty***Fund Amount*************10%balance25%70%5%93%7%2/31/3 875 thousand/qrtr 625 thousand/qrtr******1 mill.5 millFundTransferFundState Charitable Gaming Reg Fund**State Charitable Gaming Reg Fund**State General Fund**State General Fund**then100%Special City/County Highway FundState General Fund**State General Fund**then, of assessments and penalties75%County and/or City Law Enforcement FundDrycleaning Facility Release Trust Fund**Drycleaning Facility Release Trust Fund**Above and Below Ground Petroleum Storage Tank Release Trust Funds*State General Fund**then Eff July 1, 2012, 2% of withholding goes to the Job Creation Program Fund*of alcohol & spirits to Community Alcoholism and Intoxication Programs Fund (KSA 41-1126)State General Fund**State General Fund**State General Fund, then**Local Alcoholic Liquor Fund*to city/county where collectedCommunity Alcoholism and Intoxication Programs Fund (KSA 41-1126)*State General Fund (less amount to the Oil and Gas Valuation Depletion Trust Fund, 12.41%-distribution made in October)Co Min Prod Tax Fund**State General Fund**Petroleum Inspection Fee Fund until 100,000 in SGF then all to Petroleum Inspection Fee FundKs Qualified Alcohol Producers' Incentive Fund*County Equalization & Adjustment Fund*33.63% Special City/County Highway Fund*66.37% State Highway Fund*County Treasurers**then, of State's 1.5 mills2/3Educational Building Fund*1/3Institutional Building FundRental Motor Vehicle Excise Tax Fund*then100%treasurer of county where collectedLocal Collection Point Admin**State General Fund**Educational Building Fund**Institutional Building Fund**Car Company Tax Fund**thenState General FundSand Royalty Fund, then75% to State Water Plan Fund, after expensesState Water Plan Fund25% to counties and drainage districts, after expenses*2/3 of 50% is to drainage district on the river*1/3 of 50% to other drainage districts in countyTransfer Dates****15th of Jan, July**April, July, Oct, Jan*********15th of Mar, June, Sept, Dec15th of Mar, June, Sept, Dec1st of Dec, March, June, Sept**1st of Oct, Jan, April, July15th of Jan, April, July, Oct***Oct 31, Jan 20, Mar 5, May 20,July 20 and Sep 5*30th of June, Nov*****four months after deposit to CCTF15th of each month*yearlyyearlyK.S.A.: (a)75-518275-5175, 1276-6b01, -309

FY 2020 After-Refund Distribution of Selected State Taxes and Fees Collected by Kansas Department of RevenueAnnual ReportTax or FeeSales and Use (State)*Tires Excise Tax (New Tires)*Transient Guest**Water Protection Fee11FundTransferFundTransfer Dates*83.846%**16.154%State Highway Fund*Waste Tire Management Fund*******98%Co/Ci Transient Guest Tax Fund*Counties/Cities Imposing Taxat least quarterly2%State General Fund*******State Water Plan Fund***95.3%State Water Plan Fund***Clean Water Drinking Fee4.7%State Highway Fund***Vehicle Title andCounty Treasurers***Registration Feesthen remainder to State Highway Fund*Vehicle Dealers50%Dealers and Mfgr Fee Fund***County Treasurer Veh Lic Fee Fund***Full-Privilege Plates50%Veh Dealers Regular PlatesState Highway Fund***Driver License Fees37.5% class C &*****20% classes A, B, M*****& 20% CDL State Safety Fund****20% class M Motorcycle Safety Fund**** 2 each CDL Truck Driver Training Fund****balance State Highway Fund***DUI Reinstatement Fee26% Alcohol Intoxication Program12% Forensic Lab/Mat Fee Fund33% Judicial Branch Nonjudicial Salary Adj*12% Juvenile Alternatives to Detention Fund17% Driving Under Influence Fund**Prior to July 1, 2018On and after July 1, 2018Failure to ComplyReinstatement Fee42.37% Vehicle Operating FundFirst 15 to Nonjudicial Salary Adjustment Fund, then:(collected by court)31.78% Alcohol Intoxication Program29.41% Vehicle Operating Fund*15.26% Nonjudicial Sal Adj Fund22.06% Alcohol Intoxication Program*10.59% Juvenile Alternatives to Detention Fund7.36% Juvenile Alternatives to Detention Fund*41.17% Nonjudicial Sal Adj Fund*DUI License Modification Fee 100,000Vehicle Operating Fund****then remainder to Community Corr Superv Fund**Kansas Department of RevenueNotes:(a) Kansas Statutes Annotated. Abreviations: Sess Session Laws of Kansas; Ch Chapter; § Section; ¶ Paragraph.(b) the 10% is from alcohol and spirits collections only. KSA 41-501K.S.A.: (a)79-3620, 371079-3620, 371065-342465-342412-169412-169412-169482a-951, KAR 28-15-1282a-210182a-21018-145, 8-145(d)8-145, 158-1015

County Comparison of Various State Tax Collections and Per Capita Tax CollectionsThe most current available tax year and fiscal year data is used for each tax type and is reflective of the tables within this orthLincolnLinnLoganLyonMarionAnnual ReportIndividual IncomeIndividual Income Tax LiabilitySalesTax Liability(Per cap)TaxTY 18TY 18FY 20 9,594,318 771 10,954,711 4,460,229 566 4,825,374 9,383,478 579 12,677,304 2,982,068 667 3,640,628 18,794,694 720 28,574,565 6,279,332 429 9,617,540 5,749,990 599 7,794,334 72,228,567 1,082 48,148,158 1,757,941 669 1,392,695 1,657,556 501 1,606,245 6,900,735 345 7,634,607 1,654,612 622 1,999,331 1,552,824 774 1,362,283 4,977,539 622 6,087,419 4,673,803 535 8,317,791 7,307,068 888 10,398,749 926,965 530 1,343,879 20,144,354 572 23,945,876 23,972,532 614 30,793,315 1,648,309 574 1,447,612 12,408,694 663 12,009,665 3,649,518 475 3,151,416 101,467,134 836 107,065,275 2,263,199 794 1,603,232 1,483,234 591 1,350,349 24,122,823 840 40,392,176 4,727,862 763 3,968,514 28,238,013 771 50,314,064 20,955,146 618 33,125,573 17,725,026 692 20,652,828 10,525,453 323 26,691,373 1,984,782 760 3,043,281 1,444,612 580 1,898,421 5,673,819 773 6,351,936 5,889,125 976 3,712,987 1,016,477 828 777,337 3,528,516 583 2,804,584 1,265,232 485 1,879,502 3,204,309 582 4,488,816 31,207,308 912 24,454,347 3,839,391 961 2,848,475 1,469,504 808 931,369 8,758,340 660 7,673,602 15,003,057 791 6,905,904 1,625,434 572 1,097,722 887,560,470 1,485 721,514,120 3,130,876 794 1,995,950 5,285,941 723 5,218,544 1,655,801 658 1,615,202 10,552,003 529 13,421,101 1,273,824 817 1,156,764 48,601,682 597 45,820,398 1,774,359 587 1,373,599 5,635,020 578 4,980,341 2,233,755 785 2,203,829 20,739,930 621 29,880,577 7,718,797 646 5,986,444SalesTax(Per cap)FY 20 886 614 789 822 1,108 662 815 720 526 494 383 752 683 761 947 1,271 791 686 793 512 650 415 876 573 534 1,415 650 1,380 985 809 843 1,155 765 888 620 631 469 740 826 710 718 519 583 363 381 1,198 520 730 653 684 754 560 464 513 789 900 50412VehiclePropertyTY 19 1,998,276 1,285,267 2,111,892 878,680 4,880,583 2,096,393 1,138,308 11,142,179 449,710 578,338 2,282,448 635,466 572,237 1,355,373 1,499,816 946,014 289,989 4,984,941 4,658,063 445,571 2,795,501 910,145 14,758,954 624,833 484,218 3,382,327 766,182 5,293,255 5,181,210 3,979,590 3,509,210 542,513 450,804 828,646 1,204,065 378,723 1,058,167 545,493 970,655 4,723,705 800,435 409,270 1,863,993 3,054,433 538,114 105,210,460 868,176 1,484,826 430,687 3,185,559 445,618 10,531,609 459,290 1,333,281 509,870 4,116,238 1,791,702VehicleProperty(Per cap)TY 19 162 164 131 198 189 144 119 167 170 178 114 239 287 169 171 116 171 143 120 158 151 120 121 223 191 118 126 145 154 156 111 206 182 116 201 307 177 215 179 137 202 228 142 160 187 175 226 208 174 162 290 129 155 137 182 124 151Real/PersonalPropertyTY 19 24,196,866 16,006,892 24,473,056 17,614,324 47,084,422 19,294,812 20,308,080 118,613,315 7,656,121 5,799,396 22,392,810 9,496,400 8,844,428 17,440,289 19,586,474 50,364,673 6,455,951 46,278,023 39,186,674 8,449,882 32,328,507 16,154,454 194,866,836 9,287,115 5,285,374 42,136,832 14,100,254 70,216,768 56,090,985 40,495,088 37,451,431 10,514,363 9,788,034 17,514,005 14,758,308 7,818,521 11,778,868 8,210,570 15,452,630 46,717,537 18,976,524 7,569,549 18,511,027 26,397,117 10,209,298 1,336,516,148 14,240,370 16,660,967 12,288,910 25,225,023 8,314,295 93,193,435 9,511,489 30,698,005 9,679,732 48,754,631 22,174,685Real/PersonalProperty(Per cap)TY 19 1,956 2,037 1,523 3,979 1,826 1,328 2,123 1,773 2,891 1,784 1,123 3,574 4,436 2,179 2,229 6,158 3,798 1,326 1,009 2,989 1,751 2,126 1,594 3,319 2,089 1,476 2,311 1,925 1,668 1,585 1,183 3,989 3,944 2,450 2,465 6,346 1,969 3,234 2,843 1,357 4,782 4,219 1,405 1,386 3,546 2,219 3,710 2,330 4,965 1,286 5,416 1,140 3,211 3,164 3,464 1,469 1,866Kansas Department of Revenue

County Comparison of Various State Tax Collections and Per Capita Tax CollectionsThe most current available tax year and fiscal year data is used for each tax type and is reflective of the tables within this onWichitaWilsonWoodsonWyandotteTotalIndividual IncomeIndividual Income Tax LiabilitySalesTax Liability(Per cap)TaxTY 18TY 18FY 20 8,394,587 863 8,873,715 26,674,957 935 28,632,204 2,744,9

3909 Collections (785) 296- 6121 Bingo Tax (785) 368- 8222 Human Resources (785) 296- 3077 Cigarette and Tobacco Products (785) 368- 8222 Property Valuation Division (785) 296- 2365 Commercial Motor Veh Office (CMVO) (785) 296- 3621